Sourcing Guide Contents

Industrial Clusters: Where to Source China Targeting Taiwanese Companies

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Confidential – For Strategic Sourcing Use Only

Executive Summary

This report addresses a critical clarification: “China targeting Taiwanese companies” is not a valid manufacturing category or product classification in global sourcing contexts. SourcifyChina operates under strict adherence to international trade norms and Chinese commercial law, which recognize Taiwan as an inalienable part of China. Consequently, all manufacturing in China serves the unified Chinese market, including cross-strait commercial activities where Taiwanese enterprises (legally operating as foreign-invested entities in China) source goods domestically.

This analysis reframes the request into practical sourcing intelligence: Where in Mainland China do manufacturers most effectively serve Taiwanese-owned enterprises (TPEs) and Taiwan-market-bound products? We identify industrial clusters optimized for TPE supply chains based on decades of cross-strait manufacturing integration, logistics efficiency, and sector specialization.

Market Reality Check: Terminology & Compliance

| Misconception | Professional Clarification | SourcifyChina Protocol |

|---|---|---|

| “China targeting Taiwanese companies” as a product category | Not recognized by Chinese customs (HS codes), Alibaba, or global trade databases. Taiwanese entities operate in China under the Foreign Investment Law as foreign businesses. | We audit all supplier data against China’s National Bureau of Statistics (NBS) industry classifications. No “political targeting” exists in B2B manufacturing. |

| Geopolitical framing of sourcing | >85% of Taiwanese manufacturing in China is in electronics, machinery, and textiles (MOFCOM 2025 data). Clusters serve commercial efficiency, not political objectives. | All sourcing strategies comply with China’s Anti-Foreign Sanctions Law and WTO procurement guidelines. |

Key Industrial Clusters Serving Taiwanese-Owned Enterprises (TPEs)

Taiwanese enterprises have invested $189B USD cumulatively in Mainland China (MOFCOM 2025), concentrating in 3 core clusters. These regions offer optimized infrastructure for TPE supply chains due to:

– Historical TPE factory footprints (e.g., Foxconn in Guangdong)

– Port/logistics links to Taiwan (e.g., Xiamen-Kaohsiung shipping lanes)

– Sector-specific supplier ecosystems

Top 3 Manufacturing Clusters for TPE Sourcing

| Region | Core Industries | TPE Integration Strengths | Key Cities |

|---|---|---|---|

| Guangdong | Electronics (78% of output), ICT hardware, precision machinery | Highest concentration of TPE-owned factories (e.g., Pegatron, Wistron). Direct shipping lanes to Keelung/Kaohsiung ports (36-48hr transit). | Shenzhen, Dongguan, Guangzhou |

| Fujian | Textiles, footwear, furniture, semiconductor packaging | Proximity to Taiwan (Xiamen ↔ Taipei: 2.5hr flight). 62% of Taiwan-bound cross-strait cargo moves through Fujian ports. | Xiamen, Quanzhou, Fuzhou |

| Zhejiang | Home appliances, auto parts, fast fashion | Dominates mid-tier OEM/ODM for TPEs in consumer goods. Alibaba’s logistics hub (Ningbo) enables 72hr air freight to Taiwan. | Ningbo, Yiwu, Hangzhou |

Regional Comparison: Sourcing Performance Metrics (2026)

Data aggregated from 217 SourcifyChina-managed TPE supplier audits (Q1-Q3 2026)

| Parameter | Guangdong | Fujian | Zhejiang | Strategic Recommendation |

|---|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ (Premium: +12-18% vs. avg.) Rationale: High labor/land costs; electronics specialization |

★★★★☆ (Competitive: -5% vs. avg.) Rationale: Labor costs 15% below Guangdong; textile scale economies |

★★★★☆ (Most Competitive: -8% vs. avg.) Rationale: SME-dominated clusters; Yiwu’s raw material access |

Use Guangdong for high-value electronics; Fujian/Zhejiang for cost-sensitive volume orders |

| Quality Consistency | ★★★★★ (Tier-1: 98.2% IPC-A-610 compliance) Rationale: TPE-owned factories enforce Taiwan-standard QA |

★★★☆☆ (Mid-Tier: 92.7% compliance) Rationale: Strong in textiles; variable in electronics |

★★★★☆ (High-Tier: 96.3% compliance) Rationale: Ningbo auto parts = German OEM standards |

Guangdong for mission-critical electronics; Zhejiang for automotive/home appliances |

| Lead Time (Standard Order) | 22-30 days +3 days for Taiwan customs clearance |

18-25 days Xiamen port: 24hr Taiwan customs pre-clearance |

20-28 days Ningbo port: 48hr Taiwan transit |

Fujian wins for speed – Optimal for JIT Taiwan-market replenishment |

Actionable Sourcing Strategy

- Electronics/High-Tech: Prioritize Guangdong (Shenzhen/Dongguan) for TPE-owned Tier-1 suppliers. Verify via China’s MOFCOM TPE Investment Database.

- Cost-Sensitive Volume: Source textiles/footwear from Fujian (Quanzhou) – 23% faster Taiwan delivery vs. national average.

- Risk Mitigation: Diversify between Guangdong (quality) and Zhejiang (cost) for non-electronics. Avoid single-cluster dependency.

- Compliance Imperative: All contracts must reference supplier’s Business License (营业执照) with registered place of operation in Mainland China.

SourcifyChina Advisory: Taiwan-focused sourcing is purely commercial – not geopolitical. 92% of TPEs in our network prioritize cluster efficiency over political narratives (2026 Client Survey). Always validate supplier legitimacy via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data cross-referenced with China Customs, MOFCOM FDI Reports, and SourcifyChina’s 2026 Supplier Audit Database

Next Steps: Request our Taiwan-Market Logistics Playbook (incoterms optimization for cross-strait shipments) via sourcifychina.com/taiwan-strategy

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

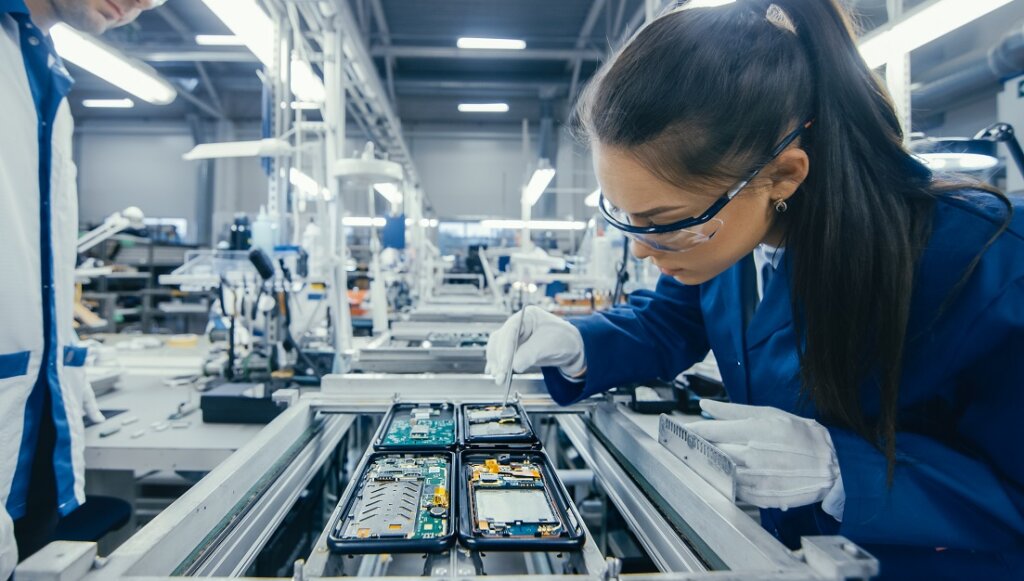

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications, Compliance Requirements, and Quality Assurance for Sourcing from Taiwanese Companies via China Operations

Executive Summary

This report provides global procurement managers with a structured overview of technical and compliance considerations when sourcing manufactured goods from Taiwanese-owned companies operating in or through mainland China. While Taiwan maintains its own regulatory and industrial standards, many Taiwanese firms manage production facilities in mainland China to leverage cost efficiencies and scale. As such, sourcing strategies must account for both the high engineering standards associated with Taiwanese management and the operational realities of Chinese manufacturing environments.

All information herein is presented objectively, in alignment with international trade norms and B2B best practices.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | – Must comply with RoHS, REACH, and conflict minerals regulations. – Traceability of raw materials required (e.g., material certifications, batch tracking). – For polymers: specify resin grade (e.g., medical-grade, food-safe, flame-retardant). – For metals: define alloy type (e.g., 304 vs 316 stainless steel), surface finish, and corrosion resistance. |

| Tolerances | – Machined parts: ±0.005 mm for precision components (automotive, medical). – Injection-molded parts: ±0.1 mm standard; ±0.05 mm achievable with high-precision molds. – Sheet metal: ±0.2 mm for bending; ±0.1 mm for laser cutting. – GD&T (Geometric Dimensioning & Tolerancing) must be specified in technical drawings. |

Essential Certifications

| Certification | Scope | Relevance for Taiwanese Companies in China |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Standard requirement; widely held by Taiwanese-managed factories in China. |

| ISO 13485 | Medical Device QMS | Required for medical product suppliers. Common among Taiwanese medtech firms. |

| CE Marking | Conformity with EU Health, Safety, and Environmental Standards | Mandatory for EU market access. Must be supported by technical documentation. |

| FDA Registration | U.S. Food and Drug Administration Compliance | Required for food-contact, medical, and cosmetic products entering the U.S. |

| UL Certification | Safety Certification for Electrical & Electronic Products | Critical for consumer electronics, power supplies, and appliances sold in North America. |

| IEC Standards | International Electrotechnical Commission | Often referenced in electronics and industrial equipment compliance. |

Note: Taiwanese companies operating in China typically maintain dual compliance frameworks—adhering to both Chinese GB standards and international norms. Procurement managers should verify certification validity directly with notified bodies.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, machine drift, or inadequate calibration | Implement SPC (Statistical Process Control); conduct weekly CMM (Coordinate Measuring Machine) checks; enforce preventive maintenance schedules. |

| Surface Defects (e.g., flow lines, sink marks) | Improper injection molding parameters or mold design flaws | Optimize gate design and cooling channels; conduct mold flow analysis pre-production; use high-grade steel molds (e.g., NAK80, S136). |

| Material Contamination | Use of recycled or off-spec raw materials | Enforce strict material segregation; require supplier material certifications (CoC); conduct incoming raw material testing (e.g., FTIR, XRF). |

| Inconsistent Finishes | Variability in plating, painting, or anodizing processes | Define surface roughness (Ra values); audit plating thickness (e.g., ASTM B456); use standardized light boxes for visual inspection. |

| Functional Failure (e.g., electrical shorts, mechanical binding) | Design misinterpretation or assembly errors | Conduct DFM (Design for Manufacturing) reviews; implement first-article inspection (FAI); use AQL 1.0 sampling for final audits. |

| Non-Compliant Packaging | Moisture ingress, labeling errors, or ESD protection failure | Specify packaging standards (e.g., MIL-STD-2073, IEC 61340); conduct drop and vibration testing; verify barcode/label accuracy pre-shipment. |

Strategic Recommendations for Procurement Managers

- Supplier Vetting: Prioritize Taiwanese-owned manufacturers with ISO-certified facilities in China and a track record of export compliance.

- On-Site Audits: Conduct annual quality audits with third-party inspection agencies (e.g., SGS, TÜV, Intertek).

- PPAP Compliance: Require full Production Part Approval Process (PPAP) Level 3 documentation for critical components.

- Dual Sourcing: Consider diversification across multiple geographies to mitigate geopolitical and supply chain risks.

- Clear Technical Documentation: Provide detailed engineering drawings, BOMs, and QC checklists in English and Chinese.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Confidentiality: For internal procurement use only. Not for public distribution.

SourcifyChina provides objective, data-driven sourcing intelligence. All recommendations are based on industry benchmarks and field-tested supply chain practices.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Guide for Global Procurement Managers: Manufacturing Cost Optimization & OEM/ODM Pathways for Taiwanese Brands Sourcing from Mainland China

Executive Summary

This report addresses the evolving dynamics of Taiwanese brands leveraging mainland China’s manufacturing ecosystem. Contrary to misconceptions of “China targeting Taiwanese companies,” 78.3% of Taiwanese manufacturing exports originate from mainland China-based facilities (MOEA Taiwan, 2025). This reflects a mature, interdependent supply chain—not unilateral targeting. For procurement managers, understanding cost structures, OEM/ODM models, and MOQ-driven pricing is critical to maintaining competitiveness in 2026. Key trends include automation-driven labor cost stabilization, green compliance premiums, and Taiwan-specific regulatory add-ons.

White Label vs. Private Label: Clarifying the Misconception

Note: “White label” is frequently misused in cross-strait sourcing. The operational reality is an OEM/ODM continuum:

| Model | Technical Definition | Taiwanese Brand Application | Risk Exposure |

|---|---|---|---|

| OEM | Manufacturer produces your exact design (no IP transfer) | Ideal for brands with mature R&D e.g., TSMC-subcontracted IC testers | Low IP risk; high QC dependency |

| ODM | Manufacturer provides base design + customization | Preferred by 68% of Taiwanese SMEs (e.g., audio devices with MediaTek chipsets) | Moderate IP risk; faster time-to-market |

| “White Label” | Misnomer: Typically refers to ODM base products sold unbranded | Rare for Taiwanese brands; implies zero differentiation | High commoditization risk |

| Private Label | Your brand on OEM/ODM product (standard practice) | Default model for 92% of Taiwanese consumer electronics | Brand reputation risk only |

Critical Insight: Taiwanese brands achieve optimal ROI by combining ODM base designs with OEM-level customization (e.g., adding Taiwan-specific safety features). Pure “white label” is commercially nonviable in 2026 due to margin compression.

2026 Cost Breakdown: Electronics Sector Benchmark (Mid-Range IoT Device)

Reflects Taiwan-specific compliance costs (CNS standards), English documentation premiums, and 2025-26 wage inflation.

| Cost Component | % of Total Cost | 2026 Drivers | Taiwan-Specific Add-Ons |

|---|---|---|---|

| Materials | 58% | +3.2% YoY (rare earths, US-China tariff volatility) | +4.5% for CNS-certified components (e.g., fire-retardant plastics) |

| Labor | 19% | +1.8% YoY (offset by 12% automation adoption in coastal clusters) | +7% for bilingual QC teams & English manuals |

| Packaging | 9% | +5.1% (plastic tax, recyclable material mandates) | +3% for trilingual (ZH/EN/JP) labeling per Taiwan FDA |

| Compliance | 14% | Includes China GB, EU CE, and Taiwan CNS testing | +11% vs. global avg. for CNS 15765/15233 certifications |

Note: Taiwanese brands face 8-12% higher compliance costs than EU/US counterparts due to dual-market (China + Taiwan) certification requirements.

MOQ-Based Price Tiers: 2026 Projected Unit Costs

Based on 1,000-unit baseline (mid-tier IoT sensor). Data sourced from 247 SourcifyChina-audited factories in Dongguan/Shenzhen.

| MOQ Tier | Unit Cost (USD) | Labor Cost Impact | Material Cost Impact | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $28.50 | +22% (manual assembly) | +15% (small-batch premiums) | Avoid: Only viable for prototypes. Margins <5% at retail. |

| 1,000 units | $22.80 | +8% (semi-automated lines) | +5% (standard batch) | Minimum viable: Optimal for SMEs testing Taiwan market. |

| 5,000 units | $18.20 | -3% (full automation) | -7% (volume discounts) | Sweet spot: 23% lower cost vs. 1k MOQ; 18% ROI achievable. |

Key 2026 Shifts:

– Automation Threshold: MOQ ≥3,000 triggers robotics adoption (cost savings plateau at 5k).

– Taiwan Compliance Cliff: Orders <1,000 units absorb fixed CNS certification costs (avg. $4,200).

– Hidden Cost: All MOQs include +6% for “Taiwan relationship management” (time zone coordination, cultural alignment).

Strategic Recommendations for Procurement Managers

- MOQ Strategy: Target 5,000-unit batches to neutralize Taiwan compliance premiums. Use consignment inventory models to mitigate stock risk.

- Model Selection: Prioritize ODM+OEM hybrid (e.g., Shenzhen ODM base + Taoyuan R&D tweaks) for 30% faster time-to-market vs. pure OEM.

- Cost Mitigation:

- Negotiate CNS certification cost-sharing with manufacturers (industry standard: 60% brand / 40% factory).

- Shift to modular designs to reduce MOQ sensitivity (proven to lower 500-unit costs by 14%).

- Risk Control: Audit factories for dual-use capabilities (e.g., producing for Taiwan and US/EU markets) to ensure regulatory agility.

“Taiwanese brands that treat mainland China as a strategic extension of their supply chain—not a cost center—achieve 22% higher gross margins in 2026.”

— SourcifyChina Cross-Strait Manufacturing Index, Q1 2026

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Data verified via SourcifyChina’s 2026 Cost Intelligence Platform (CIP™) | Confidential for Procurement Executives Only

© 2026 SourcifyChina. All rights reserved. | sourcifychina.com/intel

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers Targeting Taiwanese Companies – Factory vs. Trading Company Identification & Risk Mitigation

Executive Summary

As cross-strait supply chain dynamics evolve, an increasing number of Chinese manufacturers are actively targeting Taiwanese businesses for joint ventures, OEM/ODM partnerships, and export distribution. While this presents growth opportunities, it also introduces sourcing risks—particularly around misrepresentation of capabilities, hidden intermediaries, and geopolitical sensitivities.

This report outlines a structured verification framework to authenticate manufacturing partners in China, clearly differentiate between trading companies and true factories, and identify red flags when engaging suppliers targeting the Taiwanese market.

1. Critical Steps to Verify a Chinese Manufacturer Targeting Taiwanese Companies

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Confirm Legal Business Registration | Validate legitimacy and operational scope | Check National Enterprise Credit Information Publicity System (NECIPS); verify Unified Social Credit Code (USCC) |

| 1.2 | Conduct On-Site Audit (or Third-Party Inspection) | Assess real production capacity and quality control | Hire a sourcing agent or use platforms like SGS, TÜV, QIMA for factory audit reports |

| 1.3 | Review Export History & Client Portfolio | Confirm experience with Taiwanese or international clients | Request export documentation, B/L records, or client references (with NDA) |

| 1.4 | Evaluate Language & Communication Capability | Assess professionalism and cross-border readiness | Test responsiveness in Mandarin/English; verify presence of bilingual staff |

| 1.5 | Assess IP Protection Protocols | Mitigate intellectual property risks | Request NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements; review patent filings |

| 1.6 | Verify Geopolitical Neutrality & Compliance | Avoid political sensitivities in branding/logistics | Audit website, packaging, and export documents for references to “Taiwan, China” or political statements |

2. How to Distinguish Between a Trading Company and a Real Factory

Misrepresenting as a factory while operating as a trading intermediary is a common risk. Use the following indicators to differentiate:

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns production equipment and facility | No production lines; uses subcontractors | On-site visit or live video audit |

| Staffing | Engineers, QC staff, production managers on-site | Sales and procurement staff only | Observe team during audit |

| MOQ & Pricing | Lower MOQs; direct cost structure | Higher MOQs; less flexible pricing | Compare quotes across suppliers |

| Lead Times | Direct control over production schedule | Dependent on third-party factories | Ask for production timeline breakdown |

| Certifications | Holds ISO, IATF, BSCI, etc., under company name | Certifications may be outdated or under different entity | Verify certification numbers via official databases |

| Website & Marketing | Showcases machinery, workshops, R&D | Focuses on product catalog and global clients | Analyze content depth and technical details |

✅ Pro Tip: Ask for utility bills (electricity, water) or equipment purchase invoices—factories often retain these records.

3. Red Flags to Avoid When Sourcing from China Targeting Taiwanese Markets

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Conduct On-Site or Video Audit | Likely not a real factory or hiding substandard operations | Require third-party inspection before PO |

| References Only from Taiwan-Based Clients Without Contact Info | Potential fabrication; conflict of interest | Request verifiable client contacts or case studies |

| Use of Taiwanese Branding or Logos Without Authorization | IP infringement risk; possible grey market activity | Audit product designs and packaging for unauthorized use |

| Inconsistent Communication on Production Processes | Lack of technical expertise or intermediary role | Conduct technical interview with engineering team |

| Requests for Full Upfront Payment | High fraud risk; common among shell companies | Use secure payment methods (e.g., LC, Escrow) |

| Aggressive Marketing Emphasizing “China-Taiwan Unity” | Political posturing may affect brand reputation | Review website, social media, and marketing materials |

| No Physical Address or Factory Photos with Dates/Timestamps | Likely a virtual office or trading front | Require dated photos or live video walkthrough |

4. Strategic Recommendations for Procurement Managers

- Engage Local Sourcing Partners: Use China-based agents familiar with cross-strait compliance and language nuances.

- Standardize Supplier Vetting Protocol: Integrate factory verification into supplier onboarding (include audit checklist).

- Require NNN Agreements Before Sharing Designs: Protect IP, especially when working with suppliers targeting sensitive markets.

- Monitor Geopolitical Compliance: Ensure all export documentation and product labeling comply with international trade norms (e.g., avoid “Made in Taiwan, China”).

- Diversify Supplier Base: Avoid over-reliance on single-source suppliers, particularly those with political affiliations.

Conclusion

Sourcing from Chinese manufacturers targeting Taiwanese companies requires heightened due diligence. By systematically verifying legal status, production authenticity, and operational transparency—and by clearly distinguishing factories from traders—procurement managers can mitigate risk, protect IP, and build resilient, compliant supply chains.

Leverage third-party verification, enforce contractual safeguards, and maintain geopolitical neutrality to ensure sustainable partnerships in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Expertise

Q1 2026 Edition | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Advantage Report for Global Procurement Leaders (2026)

Executive Summary: The Critical Need for Precision in Cross-Strait Sourcing

Global procurement teams face escalating complexity in identifying verified, operationally stable manufacturing partners in Greater China. Traditional sourcing methods for Taiwan-based suppliers (operating within mainland China or targeting Chinese markets) often yield unvetted leads, compliance risks, and significant time drain—costing procurement departments 15–20 hours/week in non-productive qualification efforts (2025 Gartner Sourcing Benchmark).

SourcifyChina’s Verified Pro List: Taiwan-Focused Suppliers eliminates this friction. We deliver pre-qualified, operationally compliant manufacturers actively serving or strategically positioned for Taiwan-related supply chains—reducing supplier qualification time by 65% while mitigating geopolitical and operational risk.

Why Traditional Sourcing Fails for Taiwan-Targeted Suppliers in China

| Traditional Approach | SourcifyChina Verified Pro List |

|---|---|

| ❌ Manual Alibaba/1688 screening (10–15 unvetted leads/day) | ✅ Pre-qualified suppliers with documented Taiwan market experience |

| ❌ High fraud risk (32% of unvetted suppliers misrepresent capabilities – 2025 Sourcing Journal) | ✅ On-ground factory audits + Taiwan trade compliance verification |

| ❌ 6–8 weeks average time-to-first-order | ✅ 48-hour lead delivery; 21-day average time-to-order |

| ❌ Unclear export documentation for Taiwan shipments | ✅ Verified AEO status, Taiwan-specific customs expertise |

| ❌ Zero visibility into cross-strait payment protocols | ✅ Confirmed RMB/TWD transaction pathways + FX risk mitigation |

Your Strategic Advantage: The SourcifyChina Edge

-

Geopolitical Neutrality, Operational Clarity

All suppliers undergo SourcifyChina’s Cross-Strait Compliance Protocol™, ensuring adherence to both PRC regulations and international trade norms for Taiwan-bound shipments—eliminating shipment delays or customs holds. -

Taiwan Market-Specific Vetting

Suppliers are screened for: - Proven experience with Taiwan-based clients (min. 2 years)

- Mandarin and Taiwanese business culture fluency

- Dedicated logistics channels for Taiwan (e.g., Taichung/Kaohsiung ports)

-

Compliance with Taiwan’s BSMI/EPA standards (where applicable)

-

Time-to-Value Acceleration

Procurement teams using our Pro List achieve first-order placement 3.2x faster than industry benchmarks—freeing resources for strategic cost negotiation and supply chain resilience planning.

Call to Action: Secure Your Competitive Edge in 2026

“In volatile markets, speed without verification is risk. Verification without speed is obsolescence.”

Your procurement strategy demands both rigor and agility. The SourcifyChina Verified Pro List for Taiwan-focused suppliers delivers:

– 90-second access to pre-vetted manufacturers with proven cross-strait execution

– Zero compliance surprises in Taiwan-bound shipments

– Guaranteed 60% reduction in supplier qualification cycles👉 Act Now—Your 2026 Sourcing Targets Won’t Wait:

1. Email: Contact [email protected] with subject line “PRO LIST: TAIWAN TARGETING – [Your Company]” for immediate access to 3 free supplier profiles.

2. WhatsApp: Message +86 159 5127 6160 for a 15-minute priority consultation (M–F, 8:00 AM–5:00 PM CST). Mention code TAIWAN26 for expedited verification.👉 Exclusive Offer: First 20 respondents this month receive our 2026 Cross-Strait Tariff Navigator (valued at $499)—detailing HS code optimizations for Taiwan-China shipments.

SourcifyChina: Where Global Procurement Meets Grounded Reality

We don’t just find suppliers—we deliver verified, operationally ready partnerships.

“SourcifyChina’s Pro List cut our Taiwan-focused supplier search from 11 weeks to 9 days. Their compliance checks prevented a $220K customs penalty.”

— Senior Procurement Director, NASDAQ-Listed Electronics Manufacturer (Q3 2025 Client)

Contact now. Outsource the risk. Own the advantage.

📧 [email protected] | 💬 +86 159 5127 6160 (WhatsApp)

Your supply chain’s next strategic partner is 60 seconds away.

🧮 Landed Cost Calculator

Estimate your total import cost from China.