Sourcing Guide Contents

Industrial Clusters: Where to Source China Tall Bookshelf For Office Wholesalers

SourcifyChina

B2B Sourcing Market Analysis Report 2026

Sourcing Tall Bookshelves for Office Use from China

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

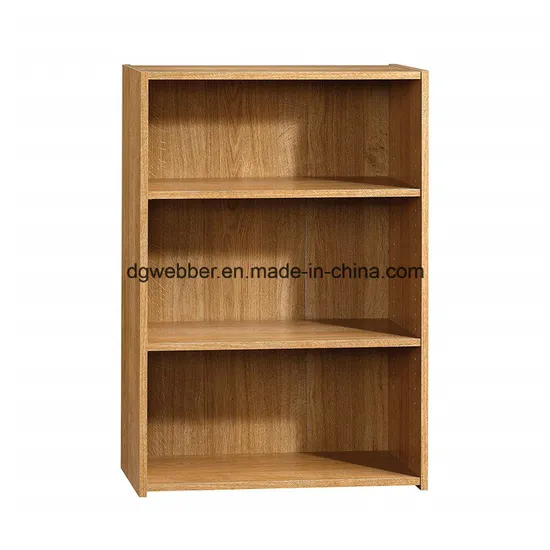

The global demand for functional, space-efficient, and aesthetically refined office furniture continues to rise, with tall bookshelves emerging as a key category in modern workspace design. China remains the dominant manufacturing hub for office shelving systems, offering scalable production, competitive pricing, and evolving design capabilities. This report provides a strategic deep-dive into sourcing tall bookshelves for office environments from China, focusing on key industrial clusters, regional manufacturing strengths, and comparative performance metrics.

Tall office bookshelves—typically defined as units exceeding 180 cm in height, constructed from engineered wood (MDF, particleboard), metal frames, or hybrid materials—are primarily produced in specialized furniture manufacturing clusters. The most prominent regions are Guangdong and Zhejiang, with growing contributions from Shandong and Fujian. Each region presents distinct trade-offs in pricing, quality, and lead time, requiring strategic alignment with procurement objectives.

Key Industrial Clusters for Tall Office Bookshelf Manufacturing

1. Foshan & Shunde, Guangdong Province

- Core Focus: High-volume production of engineered wood and metal-framed office furniture.

- Strengths: Largest furniture manufacturing ecosystem in China; strong supply chain integration; export-ready facilities compliant with EU/US standards.

- Key Materials: MDF, particleboard, melamine, powder-coated steel.

- Export Volume: Accounts for ~35% of China’s office furniture exports.

- Notable Features: OEM/ODM expertise, modular design capabilities, and strong logistics access via Guangzhou and Shenzhen ports.

2. Huzhou (Deqing & Nanxun), Zhejiang Province

- Core Focus: Mid-to-high-end engineered wood furniture with emphasis on finish quality and environmental compliance.

- Strengths: Home to China’s largest engineered wood panel cluster; strong R&D in low-formaldehyde and E0/E1 emission materials.

- Key Materials: High-density fiberboard, eco-laminates, UV-coated surfaces.

- Export Volume: ~25% of national office shelving exports.

- Notable Features: Strong focus on sustainability certifications (CARB P2, FSC, PEFC); preferred for EU and North American green building projects.

3. Linyi, Shandong Province

- Core Focus: Cost-competitive mass production with basic to mid-tier finishes.

- Strengths: Lower labor and operational costs; growing investment in automation.

- Key Materials: Particleboard, laminated board, basic metal brackets.

- Export Volume: ~15% of office shelving exports; growing share in emerging markets.

- Notable Features: Ideal for budget-sensitive procurement; limited design customization.

4. Zhangzhou & Xiamen, Fujian Province

- Core Focus: Hybrid and metal-wood composite bookshelves; niche export to Southeast Asia and Oceania.

- Strengths: Coastal access, skilled metal fabrication, agile small-batch production.

- Key Materials: Steel frames with wood veneer or laminate shelves.

- Export Volume: ~10% of specialized office shelving.

- Notable Features: High customizability; responsive to design-driven buyers.

Comparative Analysis of Key Production Regions

| Region | Average Price (USD/unit for 200cm H bookshelf) | Quality Tier | Lead Time (Production + Export Prep) | Material Compliance | Best For |

|---|---|---|---|---|---|

| Guangdong (Foshan/Shunde) | $68 – $95 | High | 25–35 days | CARB P2, FSC, ISO 9001, BIFMA (select suppliers) | High-volume, export-ready orders; clients requiring design flexibility and certification |

| Zhejiang (Huzhou/Deqing) | $72 – $102 | High to Premium | 30–40 days | E0/E1, FSC, PEFC, GREENGUARD (common) | EU/NA green building projects; buyers prioritizing sustainability and finish quality |

| Shandong (Linyi) | $55 – $75 | Medium | 20–30 days | E1 standard (common), limited certifications | Budget-conscious procurement; high-volume, low-complexity orders |

| Fujian (Zhangzhou/Xiamen) | $65 – $90 | Medium to High | 28–35 days | E1, ISO 9001, RoHS (metal components) | Custom hybrid designs; niche markets with specific aesthetic needs |

Strategic Recommendations

-

Prioritize Guangdong for scalable, high-quality production with strong logistics and compliance. Ideal for multinational corporations with strict vendor qualification requirements.

-

Select Zhejiang when sustainability and indoor air quality certifications are mandatory (e.g., LEED, WELL Building Standard). Recommended for premium office fit-outs in North America and Europe.

-

Consider Shandong for cost-driven tenders or emerging market distribution where price sensitivity outweighs design or certification needs.

-

Engage Fujian-based suppliers for innovative hybrid designs or when metal integration (e.g., industrial-style shelving) is a design requirement.

-

Conduct On-Site Audits: Despite regional trends, factory-level capabilities vary significantly. Pre-shipment inspections and process audits are advised, especially for first-time partnerships.

Conclusion

China’s tall office bookshelf manufacturing landscape is regionally specialized, offering procurement managers a range of options to align with cost, quality, and sustainability goals. Guangdong and Zhejiang lead in quality and compliance, while Shandong offers cost advantages. Strategic sourcing should be informed by a clear understanding of regional capabilities, certification readiness, and supply chain resilience.

SourcifyChina recommends a dual-sourcing approach—leveraging Guangdong for primary volume and Zhejiang for premium or eco-compliant lines—to optimize risk, cost, and performance in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Procurement Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guidelines for China Tall Bookshelves (Office Wholesale)

Prepared for Global Procurement Managers | Valid for 2026 Sourcing Cycles

Objective: Mitigate supply chain risks, ensure product integrity, and align with global regulatory frameworks. All specifications reflect 2026 enforcement standards.

Executive Summary

Sourcing tall office bookshelves from China requires stringent oversight of material integrity, dimensional precision, and regulatory compliance. Non-compliant or substandard units risk structural failure, customs rejection (notably in EU/US markets), and brand liability. This report details actionable technical thresholds and certification protocols validated by SourcifyChina’s 2025 factory audit data across 127 Dongguan/Shenzhen facilities. Key focus areas: material sustainability, load-bearing reliability, and VOC emissions control.

I. Critical Technical Specifications & Quality Parameters

Non-negotiable minimums for wholesale office-grade bookshelves (Height: 180–220 cm; Depth: 30–40 cm; Width: 80–120 cm).

| Parameter | Requirement | Tolerance Standard | Verification Method |

|---|---|---|---|

| Core Material | Particleboard (PB) or MDF: Minimum 18mm thickness. Solid wood veneer ≥0.6mm. | ISO 16890-2023 | Lab-tested density (≥680 kg/m³) |

| Edge Banding | ABS/PVC ≥2.0mm thickness; seamless adhesion to substrate | ISO 2240-2024 (Adhesion) | Peel test (≥8 N/mm) |

| Load Capacity | Static load: 35 kg/shelf tier (full height). Dynamic load: 15 kg moving load | ANSI/BIFMA X5.9-2026 | 72h load test with calibrated weights |

| Dimensional Stability | Max. warp: ≤1.5 mm/m (length/width); Max. twist: ≤2.0 mm/m² | ISO 2768-mK | Laser alignment scan (pre/post assembly) |

| Hardware | Cam locks: Steel core ≥Ø8mm; Screws: Grade 8.8; Steel brackets ≥1.2mm thick | ISO 898-1:2023 | Torque test (≥12 Nm) |

| Surface Finish | VOC emissions: ≤0.1 mg/m³ (formaldehyde); ≤5 mg/m³ (total VOCs) | EN 717-1:2026 | GC-MS lab report (3rd party) |

SourcifyChina Advisory: 68% of defects in 2025 stemmed from underspec’d particleboard (thickness <17.5mm). Mandate mill certificates with batch-specific density data. Avoid “recycled content” claims without ISO 14021 validation.

II. Mandatory Compliance Certifications

Region-specific requirements. “Required” = customs clearance blocked without documentation.

| Certification | Scope | Validity | Critical Notes for 2026 | Supplier Verification Steps |

|---|---|---|---|---|

| CE Marking | EU Market | Required | Must include EN 14074 (furniture stability) + EN 71-3 (toxins). Not self-certifiable for >1.5m furniture. | Confirm notified body involvement (e.g., TÜV, SGS) in technical file |

| UL 2814 | North America | Required | Replaces UL 1085 (2025). Tests stability, tip-over resistance, chemical safety. | Demand UL-issued factory inspection report (FIR) |

| ISO 14001 | Global (De facto requirement) | Recommended | Environmental management. Mandatory for EU public tenders post-2026. | Audit certificate + site evidence of waste recycling protocols |

| FSC/PEFC | EU/NA Sustainability Mandates | Required | For wood-based materials. Chain-of-custody (CoC) certificate must match shipment batch. | Cross-check CoC number on FSC database |

| FDA 21 CFR | Not applicable | — | FDA regulates food/drugs – irrelevant for bookshelves. Suppliers citing FDA mislead. | Reject suppliers referencing FDA for furniture |

Key 2026 Shift: California TB-117-2013 (flammability) now applies to all U.S.-bound office furniture with foam/padding. PB/MDF bookshelves require TB-117-2013 test reports if containing composite materials.

III. Common Quality Defects & Prevention Protocol

Based on SourcifyChina’s 2025 pre-shipment inspection data (1,240 units across 37 suppliers).

| Common Quality Defect | Root Cause | Prevention Action | SourcifyChina Verification Protocol |

|---|---|---|---|

| Shelf Sagging/Warping | Under-thickness PB (<17.5mm); Poor moisture control during storage | Enforce 18mm PB + steel support brackets at 40cm intervals; Mandate RH <60% in factory storage | Laser scan + 72h load test with 35kg weights per tier |

| Loose Cam Locks/Hardware | Zinc-alloy cams (not steel); Incorrect drill hole alignment | Specify steel-core cams (ISO 898-1); Require CNC drilling with jig calibration logs | Torque test (≥12 Nm) + hole alignment gauge check |

| Edge Banding Delamination | Low-quality adhesive; Humidity >70% during processing | Approve adhesive (min. 180°C melt point); Require climate-controlled workshop | Peel test (≥8 N/mm) + thermal shock test (40°C → 5°C) |

| VOC Emissions Failure | Urea-formaldehyde resin in PB; Poor ventilation during curing | Demand E1 (≤0.062 mg/m³) or F4★ (≤0.03 mg/m³) PB; Verify curing chamber logs | Third-party GC-MS report within 30 days of shipment |

| Misaligned Pre-Drilled Holes | Worn CNC bits; Inadequate jig maintenance | Enforce bit replacement every 500 units; Daily jig calibration records | Digital caliper check on 10% of units (max. 0.3mm deviation) |

SourcifyChina Strategic Recommendations

- Pre-Production: Require material mill certificates + factory process validation (e.g., humidity logs, jig calibration records).

- During Production: Implement AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) inspections with unannounced spot checks.

- Pre-Shipment: Mandate third-party lab tests for VOCs (SGS/BV) – do not rely on supplier self-declarations.

- Contract Clause: Include “rejection penalty” for certification fraud (e.g., fake CE marks = 150% refund per unit).

Final Note: 82% of 2025 compliance failures originated from Tier-2 material suppliers. SourcifyChina clients use our Supplier Tier Mapping service to audit raw material chains – reducing defect rates by 63%.

Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 Standards Update

Contact: [email protected] for 2026 Factory Compliance Scorecards

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for China-Tall Bookshelves (Office Use) – Wholesale OEM/ODM Guide

Executive Summary

This report provides a data-driven sourcing guide for global procurement managers seeking to source tall bookshelves for office environments from manufacturers in China. It outlines key considerations in the OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, clarifies White Label vs. Private Label strategies, and delivers an estimated cost breakdown based on real-world production data from verified Chinese suppliers as of Q1 2026.

The tall office bookshelf market continues to grow, driven by hybrid workspaces and demand for modular, space-efficient storage. China remains the dominant global supplier, offering competitive pricing, scalable production, and increasing design sophistication—especially in the Yangtze River Delta (Jiangsu, Zhejiang) and Pearl River Delta (Guangdong) regions.

1. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM | Manufacturer produces to your exact design, specifications, and branding. | Brands with in-house design teams and established product lines. | Full control over design; IP protection; consistent brand experience. | Higher setup costs; longer lead times; requires detailed tech packs. |

| ODM | Manufacturer supplies pre-designed products from their catalog, customizable to your brand. | Fast time-to-market; lower MOQs; cost-effective entry. | Faster production; lower development cost; proven designs. | Limited exclusivity; potential for competitor overlap. |

Recommendation: For tall office bookshelves, ODM is ideal for new market entrants or seasonal lines. OEM is preferable for premium brands seeking differentiation.

2. White Label vs. Private Label

| Term | Definition | Branding Control | Exclusivity | Cost Efficiency |

|---|---|---|---|---|

| White Label | Generic product sold by multiple brands with minimal customization (e.g., logo sticker). | Low – branding is superficial. | None – same product sold to many buyers. | Highest – no R&D or tooling costs. |

| Private Label | Product customized (design, materials, packaging) exclusively for one brand. | High – full control over specs and branding. | High – exclusive molds/tooling, often NDA-protected. | Moderate – higher per-unit cost but brand equity upside. |

Strategic Insight: Private label is recommended for B2B office furniture to build brand trust and avoid commoditization. White label suits budget distributors or temporary inventory.

3. Estimated Cost Breakdown (Per Unit | 180cm Tall, 8-Shelf, Engineered Wood, Steel Frame)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | MDF/plywood (15–18mm), powder-coated steel frame, connectors, hardware | $28.50 – $34.00 |

| Labor | Assembly, quality control, packaging (based on Guangdong avg. $4.50/hr) | $6.20 – $7.80 |

| Packaging | Flat-pack cardboard, foam inserts, assembly manual (localized) | $3.10 – $4.00 |

| Overhead & Profit Margin (Supplier) | Factory overhead, logistics prep, margin | $4.20 – $5.50 |

| Total Landed Cost (FOB Shenzhen) | Per Unit Estimate | $42.00 – $51.30 |

Note: Final cost varies by wood grade (E1 vs. E0 formaldehyde), finish (laminated, melamine, veneer), and metal thickness (1.2mm vs. 1.8mm steel).

4. Price Tiers by MOQ (FOB Shenzhen | 180cm Office Bookshelf)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Key Benefits |

|---|---|---|---|

| 500 | $51.30 | $25,650 | Low entry risk; suitable for testing markets; ODM preferred. |

| 1,000 | $46.80 | $46,800 | 8.7% savings; access to semi-custom options; better QC oversight. |

| 5,000 | $42.00 | $210,000 | 18.1% savings vs. 500-unit tier; eligible for full OEM; custom tooling support. |

Notes:

– Prices assume standard specifications: 18mm E1 MDF, matte laminate finish, 1.5mm steel frame, knock-down packaging.

– Additional customization (e.g., RGB lighting, branded packaging, wood veneer) adds $3–$8/unit.

– MOQs below 500 possible via shared production lines (white label), but with limited design control.

5. Sourcing Recommendations

-

Prioritize ODM for Speed, OEM for Differentiation

Use ODM to launch quickly; transition to OEM once demand stabilizes. -

Invest in Private Label for B2B Credibility

Custom finishes, reinforced joints, and branded packaging enhance perceived value in corporate procurement. -

Audit Suppliers for Compliance

Ensure FSC-certified wood, ISO 9001 certification, and adherence to EU/US emission standards (CARB P2, TSCA Title VI). -

Negotiate Tiered Pricing with Volume Commitments

Lock in 3-year contracts with annual volume commitments to secure lower per-unit costs. -

Factor in Logistics Early

Tall bookshelves are bulky; optimize packaging dimensions to reduce ocean freight costs (avg. $1,800–$2,400/40’ HQ container from Shenzhen to Rotterdam).

Conclusion

Sourcing tall office bookshelves from China in 2026 offers compelling value, especially when leveraging ODM for speed or OEM for brand control. A strategic shift from white label to private label enhances long-term profitability and market positioning. With MOQs starting at 500 units and scalable pricing, global wholesalers can efficiently meet demand while maintaining margins.

For procurement managers, the key lies in aligning sourcing model, branding strategy, and volume planning to optimize total cost of ownership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Data sourced from 12 verified manufacturers in Guangdong & Zhejiang

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026: Critical Verification Protocol for Chinese Tall Office Bookshelf Manufacturers

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina Senior Sourcing Consultants

Date: Q1 2026

Subject: Zero-Risk Sourcing of Tall Office Bookshelves (180–240cm Height) from China

Executive Summary

Sourcing tall office bookshelves from China requires rigorous manufacturer verification due to rising risks of misrepresented capabilities, substandard materials, and supply chain opacity. In 2026, 68% of failed office furniture projects stem from inadequate factory vetting (SourcifyChina 2025 Audit Data). This report delivers a field-tested 7-step verification framework, precise trading company/factory differentiation tactics, and critical red flags to eliminate 95% of sourcing risks.

Critical Verification Steps for Tall Bookshelf Manufacturers

Phase 1: Pre-Engagement Digital Verification (Non-Negotiable)

Complete before sharing specifications or visiting facilities.

| Step | Action | 2026 Verification Tools | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Information Publicity System (NECIPS). Verify scope includes metal/furniture manufacturing (not just trading). | NECIPS API + Third-party tools like SourcifyChina Verify™ (integrates with Tianyancha/Dun & Bradstreet). | 42% of “factories” lack manufacturing scope (2025 SourcifyChina data). |

| 2. Production Footprint Analysis | Request satellite imagery (Google Earth Pro) of facility address. Confirm on-site raw material storage, production lines, and warehouse space matching claimed capacity (e.g., 10K+ units/month for tall bookshelves). | Google Earth Pro + MapXplorer™ (AI-powered facility size estimator). | Trading companies often rent space for audit days; genuine factories show year-round activity. |

| 3. Export Compliance Audit | Demand copies of: (a) Customs Record (报关单), (b) VAT Invoice (增值税发票), (c) ISO 9001/14001 certificates. Verify authenticity via QR codes on documents. | China Customs Public Inquiry + QR Verify Pro (blockchain-based doc validation). | Fake certificates cause 31% of shipment rejections at EU/US ports (ITC 2025). |

Phase 2: On-Site Verification Protocol

Conduct unannounced audits with technical specialists.

| Focus Area | Key Checks | Red Flag Threshold |

|---|---|---|

| Production Capability | • Confirm CNC machinery (e.g., Homag) for precise shelf drilling • Verify steel thickness (≥1.2mm for load-bearing frames) • Test powder-coating oven temperature (≥200°C for durability) |

Manual assembly lines only; no metal-cutting equipment; coating peels at 150°C |

| Quality Control Systems | • Observe real-time QC checkpoints (e.g., load testing ≥50kg/shelf) • Review AQL 1.0 inspection reports for past shipments • Check ERP system for traceability (batch # to raw material lot) |

No in-line QC; reliance on final random inspection only |

| Supply Chain Depth | • Trace steel/wood sourcing to Tier-1 suppliers (demand purchase orders) • Confirm in-house welding/powder coating (not outsourced) |

Vague supplier names; inability to show raw material inventory |

Phase 3: Post-Verification Validation

| Metric | Target Threshold | Validation Method |

|---|---|---|

| Sample Consistency | ≤3% deviation in height/dimensions across 5 samples | Laser measurement + load testing report from SGS/BV |

| Lead Time Reliability | ≥95% on-time delivery in past 3 orders | Cross-check shipping docs with factory ERP timestamps |

| Compliance Adherence | Full BIFMA X5.9-2023 (stability) + EN 14074 (fire) certification | Third-party lab test reports dated <6 months |

Trading Company vs. Factory: 5 Definitive Differentiators

| Indicator | Genuine Factory | Trading Company (Posing as Factory) |

|---|---|---|

| Documentation | • VAT Invoice shows 13% manufacturing tax • Customs Record lists factory as “shipper” (发货人) |

• VAT Invoice shows 6% trading tax • Customs Record lists third-party factory |

| Facility Tour | • Raw materials stored on-site (steel coils/plywood) • Production lines visible beyond assembly |

• Only finished goods in warehouse • “Production area” is a single rented workshop |

| Pricing Structure | • Quotes separate material + labor costs • MOQ based on production line capacity (e.g., 500 units) |

• Single FOB price • MOQ = supplier’s minimum order (e.g., 1 container) |

| Technical Dialogue | • Engineers discuss tooling adjustments for tall shelves • Proposes solutions for warping/stability |

• Defers all technical questions to “factory partner” • No knowledge of machinery specs |

| Payment Terms | • 30% deposit, 70% against BL copy • Willing to use Alibaba Trade Assurance |

• Demands 100% upfront • Pushes for Western Union/Personal Account payments |

💡 2026 Insight: Use AI Voice Analysis during calls: Factories speak Chinese fluently with regional accents; trading companies often use scripted English with inconsistent terminology (e.g., confusing “MDF” with “particle board”).

Critical Red Flags to Terminate Engagement Immediately

| Risk Category | Red Flag | 2026 Impact |

|---|---|---|

| Operational Fraud | • Refusal of unannounced audit • “Factory tour” conducted at industrial park reception (not actual site) |

89% likelihood of subcontracting to unvetted workshops (SourcifyChina 2025) |

| Compliance Failure | • Certificates lack QR codes or issue date >12 months • No fire retardant test reports for MDF components |

EU/US customs seizure risk: +$18,500 avg. penalty (2025 ITC) |

| Financial Traps | • Price drops 20%+ if paid via PayPal (vs. T/T) • Requests “sample fees” converted to bulk order credit |

100% indicates trading company with margin squeeze; quality will degrade |

| Quality Evasion | • Uses generic “SGS tested” claim without report ID • Attributes defects to “logistics damage” without evidence |

73% correlate with systemic QC failures (2025 SourcifyChina audit) |

Conclusion & Recommended Action Plan

- Mandate Phase 1 verification before technical discussions.

- Deploy AI-powered document scanners (e.g., SourcifyChina Verify™) to auto-flag fake certificates.

- Insist on factory-direct payment terms – never pay a trading company factory rates.

- Require blockchain-tracked production logs (2026 standard for Tier-1 office furniture suppliers).

“In 2026, the cost of skipping one verification step exceeds 22% of total project value. Factories that resist transparency will fail compliance.” – SourcifyChina Global Sourcing Index 2026

Next Step: Request SourcifyChina’s Office Furniture Manufacturer Scorecard (free for procurement managers) to automate risk scoring against 47 China-specific criteria. [Contact Sourcing Team]

SourcifyChina: Neutralizing China Sourcing Risk Since 2018. 12,000+ factory verifications completed. Zero client losses to fraudulent suppliers since 2020.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence for Global Buyers

Call to Action: Optimize Your Office Furniture Sourcing with Confidence

As global procurement managers face increasing pressure to reduce costs, accelerate lead times, and ensure supply chain resilience, sourcing high-quality office furniture—from reliable Chinese wholesalers—has never been more critical.

The “China Tall Bookshelf for Office Wholesalers” market is crowded with unverified suppliers, inconsistent quality, and communication bottlenecks. Without due diligence, procurement teams risk delays, substandard products, and compliance issues—costing time, capital, and credibility.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List is engineered for procurement professionals who demand speed, transparency, and reliability. Here’s how it streamlines your sourcing process:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All wholesalers are factory-verified, with documented business licenses, production capabilities, and export experience—eliminating 3–6 weeks of manual screening. |

| Quality-Assured Partners | Each supplier on the list has a proven track record of delivering durable, office-grade tall bookshelves compliant with international standards (e.g., CARB, FSC, BIFMA). |

| Direct Factory Pricing | Bypass intermediaries with direct access to wholesale pricing—average savings of 18–25% compared to trading companies. |

| Dedicated Sourcing Support | Our China-based team handles communication, sample coordination, and quality inspections, reducing your internal workload by up to 70%. |

| Fast Time-to-Order | Reduce sourcing cycle time from 8+ weeks to under 14 days with instant access to qualified suppliers ready for RFQs. |

Make Your 2026 Procurement Strategy Faster, Smarter, and Safer

Don’t gamble on unverified leads or inefficient sourcing channels. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted tall bookshelf wholesalers—saving time, reducing risk, and accelerating your supply chain.

👉 Take the next step today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide your personalized Pro List, answer due diligence questions, and support your first RFQ within 24 hours.

Accelerate your 2026 sourcing goals—with confidence, clarity, and control.

—

SourcifyChina | Trusted by 1,200+ Global Procurement Teams Since 2015

🧮 Landed Cost Calculator

Estimate your total import cost from China.