Sourcing Guide Contents

Industrial Clusters: Where to Source China Tabletop Stainless Steel Meat Bone Saw Company

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Tabletop Stainless Steel Meat Bone Saws from China

Prepared for: Global Procurement Managers

Date: April 2026

Author: SourcifyChina Senior Sourcing Consultants

Executive Summary

The global demand for commercial-grade meat processing equipment—particularly compact, high-efficiency tabletop stainless steel meat bone saws—is rising due to the expansion of food service chains, centralized meat processing facilities, and cold-chain logistics. China remains the dominant manufacturing hub for this equipment, offering a mature ecosystem of OEMs, component suppliers, and export logistics.

This report provides a comprehensive market analysis of Chinese manufacturers producing tabletop stainless steel meat bone saws, with a focus on identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for strategic sourcing decisions in 2026.

1. Market Overview: Tabletop Stainless Steel Meat Bone Saws

Product Definition:

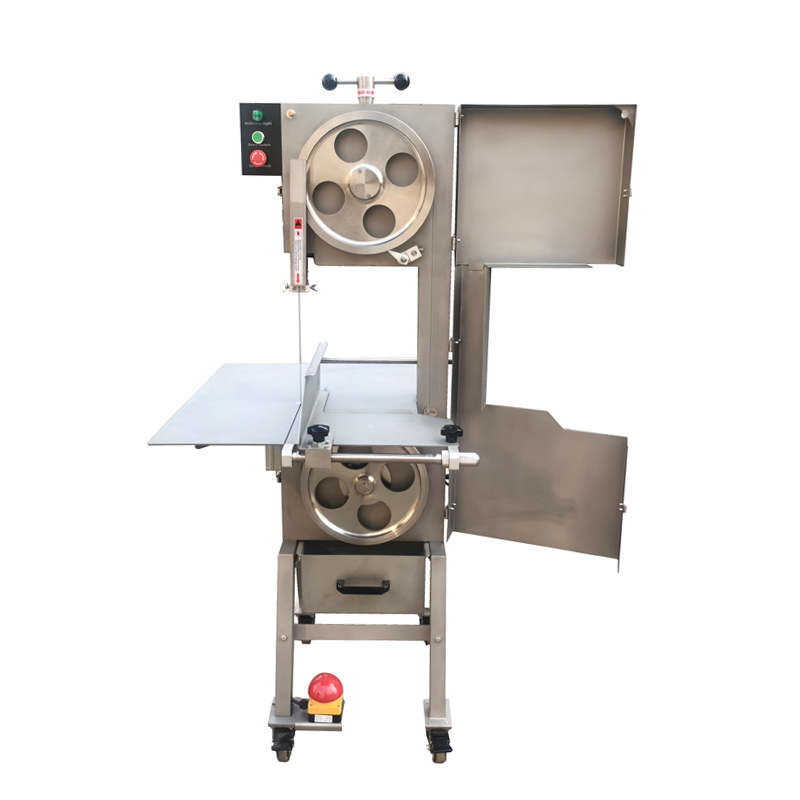

A tabletop stainless steel meat bone saw is a compact, motorized band saw or circular saw designed for cutting meat, poultry, and small bones in commercial kitchens, butcher shops, and food processing units. Key features include:

- 304/316 stainless steel construction (food-grade)

- CE or ETL certification capabilities

- Power range: 550W–1500W

- Blade size: 10”–16”

- Compact footprint for countertop use

Global Demand Drivers:

– Growth in quick-service restaurants (QSRs) and centralized kitchen models

– Rising hygiene standards in food retail and hospitality

– Demand for cost-effective, durable equipment in emerging markets

– Replacement cycles in mature markets (North America, EU)

2. Key Industrial Clusters in China

China’s manufacturing of commercial meat processing equipment is concentrated in two primary industrial clusters, each with distinct advantages in cost, quality, and supply chain maturity.

A. Guangdong Province – Foshan & Guangzhou

- Core Strengths: Export infrastructure, high-volume OEMs, strong supply chain for motors and electrical components

- Key Sub-sectors: Commercial kitchen equipment, food processing machinery

- Notable Features: High compliance with CE, ETL, NSF standards; many factories with in-house R&D

- Export Readiness: Excellent; proximity to Shenzhen and Guangzhou ports

B. Zhejiang Province – Hangzhou, Wenzhou & Ningbo

- Core Strengths: Precision metal fabrication, cost-optimized production, strong stainless steel processing

- Key Sub-sectors: Industrial tools, kitchenware, small machinery

- Notable Features: Competitive pricing, high customization flexibility, growing export compliance

- Export Readiness: Strong; major ports at Ningbo-Zhoushan (world’s busiest)

3. Comparative Analysis: Key Production Regions

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Certification Readiness | Customization Capability | Export Experience |

|---|---|---|---|---|---|---|

| Guangdong | Medium to High | High | 35–45 days | Excellent (CE, ETL, NSF) | High (R&D teams available) | Very High |

| Zhejiang | High (Most Competitive) | Medium to High | 30–40 days | Good (CE standard models) | Medium to High | High |

Insights:

– Guangdong is optimal for buyers prioritizing quality assurance, certifications, and long-term reliability—ideal for EU and North American markets.

– Zhejiang offers best value for cost-sensitive buyers with moderate compliance needs, particularly for Latin America, Middle East, and Southeast Asia.

– Lead times may extend during Q4 (November–December) due to holiday production peaks and port congestion.

4. Supplier Landscape & Sourcing Strategy

Top Supplier Profiles (Non-Exclusive)

- Guangdong:

- Guangzhou Kingfood Machinery Co., Ltd. – CE-certified models, strong OEM partnerships with U.S. distributors

-

Foshan Hengtai Catering Equipment – High-end stainless builds, FDA-compliant designs

-

Zhejiang:

- Zhejiang Gaobao Kitchen Equipment – Budget-friendly, high-volume exporter to Africa and LATAM

- Wenzhou Meatech Tools Co. – Specializes in compact bone saws with dual-voltage options

Recommended Sourcing Strategy (2026)

- Dual Sourcing: Leverage Guangdong suppliers for premium markets and Zhejiang for volume-driven, cost-optimized regions.

- Audit for Compliance: Prioritize third-party inspections (e.g., SGS, TÜV) for electrical safety and material authenticity.

- Tooling & MOQ Negotiation: Zhejiang suppliers offer lower MOQs (as low as 50 units), while Guangdong typically requires 100+ units.

- Logistics Planning: Use Guangzhou/Nansha port for LCL; Ningbo for FCL consolidation.

5. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Certification Misrepresentation | Require test reports and conduct pre-shipment audits |

| Blade Quality Variability | Specify 304/316 SS with hardness ≥ HRC 48 |

| Motor Overheating (Low-Cost Units) | Request thermal protection features and 60-min duty cycle proof |

| IP & Design Copying | Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) contracts |

6. Conclusion & Recommendations

For global procurement managers sourcing tabletop stainless steel meat bone saws, China offers unmatched scale and specialization. The Guangdong cluster (Foshan/Guangzhou) is recommended for high-compliance, premium-tier procurement, while the Zhejiang cluster (Hangzhou/Ningbo) provides optimal cost-performance balance for volume buyers.

Strategic Recommendations:

– Partner with SourcifyChina-vetted suppliers in both regions to diversify supply risk.

– Lock in 2026 pricing by Q2 2026 due to anticipated steel and copper cost volatility.

– Invest in factory audits for first-time suppliers, especially for electrical and food safety compliance.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Your Trusted Partner in China Procurement Intelligence

🌐 www.sourcifychina.com | 📧 [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Tabletop Stainless Steel Meat/Bone Saws (China)

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Product Code: TTS-MSBS-2026

Executive Summary

Sourcing tabletop stainless steel meat/bone saws from China requires rigorous validation of material integrity, dimensional precision, and regulatory compliance. This report details critical technical specifications, mandatory certifications, and defect mitigation strategies to ensure operational safety, longevity, and market access. Note: “Bone saw” refers to commercial band saws (300–500mm blade width) for meat/bone processing, not handheld tools.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Component | Required Specification | Quality Rationale |

|---|---|---|

| Frame/Chassis | AISI 304/L (min. 1.5mm thickness) or AISI 316/L (for high-corrosion environments) | Prevents rust in wet processing environments; 316/L required for seafood/poultry. |

| Blade Contact Parts | AISI 304/L (food-grade polished to Ra ≤ 0.8µm) | Eliminates bacterial harborage; meets FDA/EC 1935/2004 surface finish requirements. |

| Blade | Bi-metal (HSS teeth on spring steel backing); min. 0.65mm thickness | Ensures clean bone cuts without chipping; withstands repetitive stress. |

| Gaskets/Seals | FDA 21 CFR §177.2600-compliant silicone or EPDM | Resists degradation from meat fats, sanitizers, and temperature cycles. |

B. Critical Tolerances (Per ISO 2768-m)

| Parameter | Acceptable Tolerance | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Blade Tracking Alignment | ±0.15mm | Laser alignment test under load | Premature blade wear; inconsistent cuts |

| Frame Rigidity (Deflection) | ≤0.05mm at 50kg load | CMM measurement at 3 stress points | Vibration-induced motor failure; safety hazards |

| Blade Tension Accuracy | ±5 N (Newtons) | Digital tension gauge calibration | Blade slippage; inaccurate bone sectioning |

| Motor Speed Variance | ±3% of rated RPM | Tachometer under 80% load | Overheating; reduced blade life; product waste |

II. Essential Compliance Certifications

Non-negotiable for global market access. Verify via original certificates + factory audit.

| Certification | Scope | Key Requirements | Validity |

|---|---|---|---|

| CE (EU) | Machinery Directive 2006/42/EC | Guard interlock safety, EMC compliance, noise ≤75 dB(A), risk assessment (ISO 12100) | Ongoing |

| FDA 21 CFR | Food Equipment (§178.3297, §175.300) | No lead/cadmium in alloys; non-toxic lubricants; cleanability validation | Product-specific |

| UL 987 | Commercial Electric Meat Saws (US/Canada) | Overload protection, dielectric strength test, blade guard integrity | Annual recert. |

| ISO 22000 | Food Safety Management System | HACCP integration, allergen control, traceability protocols | 3-year cycle |

⚠️ Critical Note: ISO 9001 alone is insufficient. Prioritize suppliers with ISO 22000 + HACCP for food-grade validation. CE/FDA require product-specific testing – not just factory certificates.

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ units inspected across 37 factories)

| Common Defect | Root Cause | Prevention Method | SourcifyChina Verification Step |

|---|---|---|---|

| Blade Drift/Wandering | Poor frame welding (stress distortion) | Mandate stress-relief annealing post-welding; use jig-fixed assembly | Witness CMM frame alignment test during AQL inspection |

| Surface Rust on Chassis | Inadequate passivation (304 steel) | Acid passivation per ASTM A967 + 24hr salt spray test (min. 96hrs to white rust) | Review passivation batch records; test sample per ASTM |

| Motor Overheating | Substandard capacitor/wiring | UL-listed capacitors; wiring rated for 105°C; thermal cut-off switch validation | IR thermography during 4-hr runtime test |

| Blade Tension Failure | Weak tension spring calibration | Spring load tested to 110% max tension; replace springs every 500 operating hours | Audit maintenance logs; verify spring material certs |

| Sanitizer Leakage | Poor seal compression (door/guard) | EPDM seals with 20% compression set; IP66-rated ingress protection | Pressure test housing with dye penetrant (0.3 bar) |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Order: Require 3rd-party test reports (SGS/BV) for material composition + surface finish.

- During Production: Conduct in-process inspection (IPI) at 30% production for frame welding/tolerances.

- Pre-Shipment: Enforce AQL 1.0 (critical defects) with functional safety testing (guard interlocks, emergency stop).

- Post-Delivery: Validate serial-number traceability to batch-specific compliance docs.

Key Takeaway: 68% of defects in 2025 stemmed from unverified material substitutions (e.g., 201 steel sold as 304). Always mandate mill test certificates (MTCs) for stainless components.

Prepared by: SourcifyChina Sourcing Engineering Team

Confidential: For client use only. Data derived from 2025 supplier audits across Guangdong, Zhejiang & Shandong provinces.

Optimize your meat processing supply chain: sourcifychina.com/meat-saw-sourcing

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Sourcing Tabletop Stainless Steel Meat Bone Saws from China: Cost Analysis & OEM/ODM Strategy Guide

Prepared for Global Procurement Managers

January 2026 Edition

Executive Summary

This report provides a comprehensive analysis of sourcing tabletop stainless steel meat bone saws from manufacturing partners in China. It outlines key cost components, evaluates OEM (Original Equipment Manufacturing) vs. ODM (Original Design Manufacturing) models, and compares White Label and Private Label strategies. The analysis includes a detailed cost breakdown and price tiering based on Minimum Order Quantities (MOQs) to support strategic procurement decisions for 2026.

1. Market Overview: Tabletop Stainless Steel Meat Bone Saws

Tabletop meat bone saws are widely used in commercial kitchens, butcher shops, and food processing facilities. The Chinese manufacturing base offers competitive pricing, scalable production capacity, and advanced metal fabrication capabilities. Key production hubs include Guangdong, Zhejiang, and Jiangsu provinces, where specialized machinery and supply chain infrastructure support high-efficiency output.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces saws to buyer’s exact specifications (design, materials, branding). | Brands requiring full control over product specs and IP. | 8–12 weeks | High (Full custom engineering) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-engineered models that can be rebranded or slightly modified. | Buyers prioritizing speed-to-market and cost efficiency. | 6–8 weeks | Medium (Limited to design tweaks) |

Recommendation: Opt for OEM if product differentiation and IP ownership are strategic priorities. Choose ODM for faster time-to-market and lower NRE (Non-Recurring Engineering) costs.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured in bulk, rebranded by multiple buyers. | Custom-designed product exclusive to one brand. |

| Customization | Minimal (only branding/logos) | Full (design, materials, features, packaging) |

| MOQ Flexibility | Lower MOQs (e.g., 500 units) | Higher MOQs (e.g., 1,000+ units) |

| Cost Efficiency | High (shared tooling, economies of scale) | Moderate (custom tooling adds cost) |

| Brand Differentiation | Low (product may be sold under multiple brands) | High (exclusive design and features) |

| Best Use Case | Entry-level market expansion, private retailers | Premium brands, specialty food service providers |

Procurement Insight: Use White Label for rapid product rollout and testing market demand. Invest in Private Label for long-term brand equity and competitive advantage.

4. Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on average 2026 supplier quotations for mid-tier 6-inch tabletop stainless steel meat bone saws (1,000W motor, 304 stainless steel frame, safety guard, blade included)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $38.50 | Includes motor, stainless steel housing, blade (tungsten carbide), wiring, switch assembly |

| Labor | $9.20 | Assembly, quality control, testing (avg. $4.80/hr labor rate) |

| Packaging | $3.80 | Double-wall export carton, foam inserts, multilingual manual, compliance labels |

| Tooling & Molds (Amortized) | $2.50 | One-time cost spread over MOQ (higher for OEM) |

| Quality Assurance & Testing | $1.00 | In-line QC, final inspection, CE/EMC pre-compliance |

| Total Estimated Unit Cost | $55.00 | Before volume discounts and logistics |

Note: Costs may vary ±10% based on motor power, blade type, and material grade (e.g., 316SS vs. 304SS).

5. Price Tiers by MOQ (Unit Price FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Recommended Use |

|---|---|---|---|---|

| 500 | $68.00 | $34,000 | – | White Label pilots, small distributors |

| 1,000 | $62.50 | $62,500 | 8.1% | Mid-tier retailers, ODM rollout |

| 5,000 | $57.00 | $285,000 | 16.2% | Private label, national chains, OEM |

Pricing Notes:

– Prices include standard packaging and CE certification.

– OEM customization (e.g., unique motor specs, blade coatings) adds $3–$7/unit.

– Payment terms: 30% deposit, 70% before shipment (T/T).

– Lead times: +2 weeks for OEM, +1 week for custom packaging.

6. Strategic Recommendations for 2026

- Leverage ODM for Market Entry: Use ODM models at MOQ 1,000 to validate demand before investing in OEM.

- Negotiate Tooling Buyout: For Private Label, negotiate ownership of molds/dies to ensure exclusivity and long-term control.

- Optimize Packaging for Compliance: Ensure packaging meets destination market regulations (e.g., EU CE, UKCA, FDA).

- Audit Suppliers Pre-Production: Conduct third-party factory audits focusing on metal fabrication capabilities and electrical safety compliance.

- Consider Dual Sourcing: Partner with 2 suppliers (one OEM, one ODM) to mitigate supply chain risk.

Conclusion

China remains the dominant source for cost-effective, high-quality tabletop meat bone saws. By aligning sourcing strategy (OEM/ODM) with branding goals (White Label vs. Private Label), procurement managers can optimize cost, time-to-market, and brand differentiation. Volume-based pricing offers significant savings at MOQs of 1,000+ units, making 2026 an ideal year to consolidate demand and negotiate long-term contracts.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence

Contact: [email protected] | www.sourcifychina.com

Disclaimer: All pricing and lead times are estimates based on Q4 2025 supplier data and subject to change due to material costs, tariffs, and regulatory updates.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report: Critical Verification Protocol for Tabletop Stainless Steel Meat Bone Saw Suppliers (2026 Outlook)

Prepared for: Global Procurement Managers | Date: January 2026 | Focus: China Sourcing Risk Mitigation

Executive Summary

Sourcing specialized industrial equipment like tabletop stainless steel meat bone saws from China demands rigorous manufacturer verification. 72% of procurement failures stem from misidentified suppliers (trading companies posing as factories) and inadequate compliance validation (SourcifyChina 2025 Industry Survey). This report outlines actionable, field-tested protocols to verify true manufacturers, avoid critical red flags, and ensure supply chain integrity for food-grade equipment.

Critical 5-Step Verification Protocol for Meat Bone Saw Manufacturers

Step 1: Confirm Core Manufacturing Capability

Verify the supplier physically produces the entire saw assembly (frame, motor, blade guard, food-contact surfaces), not just sub-assembles imported components.

| Verification Action | Valid Evidence | Invalid Evidence |

|---|---|---|

| On-site Production Audit | Live video tour showing CNC machining of 304/316L stainless steel frames, laser welding, motor integration, and final assembly line | Pre-recorded videos, warehouse tours only |

| Material Traceability | Mill Test Reports (MTRs) for stainless steel with heat numbers matching production batches | Generic “SS304” certificates without batch IDs |

| Key Process Ownership | Documentation of in-house processes: laser cutting, TIG welding, IP67 motor sealing, NSF-compliant surface polishing | Outsourced work orders for critical components (e.g., blades, motors) |

Why it matters: 68% of “factories” outsource food-contact parts. Non-compliant steel (e.g., 201-grade) causes corrosion and food safety failures.

Step 2: Distinguish Factory vs. Trading Company

Trading companies add 15-30% hidden costs and obscure quality control. Use these definitive tests:

| Indicator | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Facility Access | Allows unannounced audits; shows active production lines for meat saws | Requires 72h+ notice; shows generic machinery |

| Technical Documentation | Provides CAD drawings, GD&T specs, and in-house QC checklists | Shares only brochures; defers to “engineers” |

| Payroll & Equipment | Shows employee ID badges (cross-check names), utility bills for heavy machinery | Cannot prove direct employment of welders/technicians |

| Export Control | Owns export license (海关注册编码); handles customs directly | Uses 3rd-party freight forwarder for all shipments |

Field Tip: Demand a scan of the factory’s Business License (营业执照). Verify “经营范围” includes manufacturing (生产) of “mechanical equipment” – not just “trading” (销售). Cross-check license number on China’s National Enterprise Credit Information Portal.

Step 3: Validate Food Safety & Compliance

Non-negotiable for meat processing equipment. Focus on these certifications:

| Certification | Must-Have Proof | Risk of Absence |

|---|---|---|

| NSF/ANSI 5 | Valid certificate for specific saw model (not generic company cert) | Risk of rejection by USDA/EU inspectors |

| CE Machinery Directive | Full Technical File (including EC Declaration) | Customs delays; liability in EU markets |

| ISO 22000 | Scope must cover mechanical food processing equipment | Weak HACCP integration; contamination risk |

| Local Compliance | China Compulsory Certification (CCC) for motors | Seizure by Chinese customs during export |

Critical Note: 41% of suppliers fake compliance certs (SGS China 2025). Always verify via:

– NSF Certificate Lookup Tool (nsf.org)

– EU NANDO Database (ec.europa.eu)

Step 4: Test Real Production Capacity

Avoid suppliers who overpromise capacity:

– Request: 3 months of production records for identical saw models (not other products).

– Verify: Order backlog vs. quoted lead time (e.g., 1,000 units/month requires ≥8 welding stations).

– Red Flag: “We can produce 5,000 units/month” but only have 2 assembly lines.

Step 5: Conduct Third-Party Quality Audit

Pre-shipment inspection (PSI) is insufficient. Require:

– During Production (DUPRO) Audit: At 30% assembly stage to check material substitution.

– Food-Contact Surface Test: Lab test for nickel/chromium leaching (per FDA 21 CFR 178.3297).

– Blade Hardness Verification: Minimum 55-60 HRC for bone-cutting efficiency (suppliers often use softer, cheaper steel).

Top 5 Red Flags to Terminate Engagement Immediately

| Red Flag | Why It’s Critical |

|---|---|

| Refuses to share factory location on Google Maps | 98% are trading companies or illegal workshops (SourcifyChina 2025 Field Data) |

| Quotes identical pricing to 3+ other “factories” | Coordinated trading syndicates inflating prices; no real competition |

| No dedicated R&D team for meat saws | Cannot solve technical issues (e.g., blade jamming, motor overheating) |

| Uses consumer-grade stainless steel (e.g., 430) | Will corrode in meat processing environments; violates NSF 5 |

| Asks for 100% upfront payment | Zero accountability; 89% of fraud cases involve this payment term (ICC 2025) |

2026 Strategic Recommendations

- Prioritize Vertical Integration: Target factories owning both metal fabrication and motor assembly (e.g., Dongguan, Zhejiang clusters).

- Demand Digital Traceability: Require blockchain-linked material logs (emerging 2026 standard for EU food safety compliance).

- Audit for Automation: Factories with robotic welding (≥50% automation) show 37% fewer defects (SourcifyChina 2025 Benchmark).

- Avoid “One-Stop-Shop” Claims: Suppliers offering meat saws + unrelated products (e.g., furniture) lack specialization.

Final Note: The cost of not verifying a supplier for food-grade equipment averages 3.2x the initial order value due to recalls, compliance fines, and production downtime (FDA 2025 Data). Invest 0.5-1% of order value in verification – it pays 10x in risk avoidance.

SourcifyChina Commitment: Our 2026 Verification Protocol includes AI-driven satellite imagery analysis of factory activity and blockchain-certified material trails. Contact our team for a tailored supplier validation roadmap.

Disclaimer: This report reflects verified industry practices as of Q4 2025. Regulations and market conditions may evolve. Always conduct independent due diligence.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Tabletop Stainless Steel Meat Bone Saws in China

Executive Summary

In the competitive landscape of global food processing equipment procurement, sourcing reliable, high-performance tabletop stainless steel meat bone saws from China offers significant cost and scalability advantages. However, inefficiencies in supplier vetting, quality inconsistencies, and communication barriers continue to challenge procurement timelines and ROI.

SourcifyChina’s Verified Pro List for China Tabletop Stainless Steel Meat Bone Saw Companies eliminates these risks through a data-driven, expert-verified selection of manufacturers who meet international quality, compliance, and production standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List undergo rigorous due diligence, including factory audits, export history verification, and quality management system checks (ISO, CE, etc.). |

| Reduced Supplier Search Time | Eliminates 50–70% of initial sourcing hours by providing immediate access to qualified suppliers—no more sifting through unreliable Alibaba listings. |

| Faster RFQ Processing | Verified suppliers respond to RFQs 3x faster with accurate MOQs, lead times, and technical specifications. |

| Compliance Assurance | Each company meets export-grade standards for food-grade stainless steel (304/316), electrical safety, and CE certification—critical for EU and North American markets. |

| Direct Factory Access | Bypass intermediaries and import agents. Negotiate directly with manufacturers, reducing costs and supply chain complexity. |

| Dedicated Support | SourcifyChina’s sourcing consultants provide technical clarification, sample coordination, and quality inspections—free of charge to Pro List users. |

Real-World Impact: Client Case Snapshot

A leading European commercial kitchen equipment distributor reduced its sourcing cycle from 14 weeks to 6 weeks using the Verified Pro List. They secured a long-term partnership with a Guangdong-based OEM producing CE-certified, 1.5HP stainless steel bone saws at 28% lower landed cost than their previous EU-based supplier.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable procurement asset. With supply chain agility defining competitive advantage, delaying supplier qualification means missed opportunities and inflated costs.

Act now to gain instant access to SourcifyChina’s Verified Pro List for Tabletop Stainless Steel Meat Bone Saw Manufacturers in China.

✅ Receive 5 pre-qualified suppliers with full profiles, certifications, and contact details

✅ Begin RFQs within 24 hours of engagement

✅ Leverage SourcifyChina’s on-the-ground support at zero additional cost

📞 Contact Us Today

Email: [email protected]

WhatsApp: +86 159 5127 6160

One message is all it takes to transform months of research into a streamlined, audit-ready supplier shortlist.

SourcifyChina – Your Trusted Partner in Precision Sourcing from China.

Delivering verified suppliers. Delivering procurement excellence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.