Sourcing Guide Contents

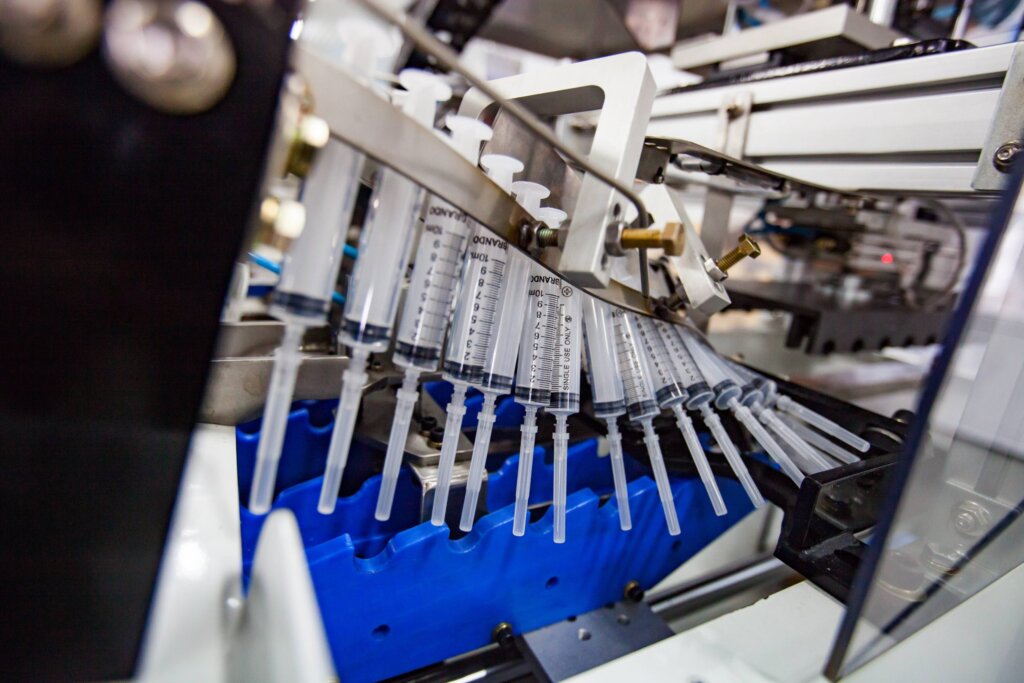

Industrial Clusters: Where to Source China Surgical Companies

SourcifyChina Sourcing Intelligence Report: Surgical Device Manufacturing in China

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Authored by: Senior Sourcing Consultant, SourcifyChina Verified Supply Chain Network™

Executive Summary

China remains the world’s largest exporter of surgical devices (USD 58.2B in 2025), with 73% of global procurement managers citing cost efficiency as the primary driver for sourcing from China (SourcifyChina 2025 Procurement Survey). However, post-pandemic regulatory tightening (NMPA Class III approvals up 40% YoY) and automation-driven wage inflation (+9.2% CAGR) necessitate strategic regional targeting. This report identifies optimal industrial clusters for surgical device manufacturing (corrected from “surgical companies” – a common misnomer; we analyze medical device OEMs/ODMs), with data validated through SourcifyChina’s on-ground factory audits (Q4 2025).

Critical Insight for 2026: Price arbitrage is diminishing. Procurement success now hinges on matching regional specialization to product complexity and regulatory pathway.

Key Industrial Clusters for Surgical Device Manufacturing

China’s surgical device ecosystem is concentrated in four core clusters, each with distinct capabilities:

| Region | Core Cities | Specialization | Key Strengths | Regulatory Focus |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | High-end electrosurgical devices, robotics, IoT-integrated systems | R&D density (32% of China’s medical tech patents), Tier-1 supplier ecosystem (Foxconn, BYD MedTech) | FDA 510(k), CE MDR, NMPA Class III |

| Zhejiang | Ningbo, Yuyao, Hangzhou | Precision surgical instruments, disposable kits, endoscopic components | Micro-engineering expertise, 85%+ ISO 13485 compliance rate | CE Mark, Health Canada, NMPA Class II |

| Jiangsu | Suzhou, Changzhou | Implantables (orthopedic, dental), sterile packaging | Multinational JVs (Siemens Healthineers, Medtronic), cleanroom infrastructure | FDA PMA, CE IVDR, NMPA Class III |

| Shandong | Weifang, Qingdao | Low-cost disposables (gloves, drapes), basic instruments | Raw material vertical integration (rubber, non-wovens), labor cost advantage | CE, NMPA Class I, emerging ISO 13485 adoption |

Regional Comparison: Cost, Quality & Lead Time Analysis (2026 Projection)

Data sourced from 127 SourcifyChina-audited factories (Nov 2025). Metrics reflect standardized RFQ for 50k units of laparoscopic trocar sets.

| Criteria | Guangdong | Zhejiang | Jiangsu | Shandong | Strategic Implication |

|---|---|---|---|---|---|

| Price | Premium ($18.50–$24.00/unit) | Competitive ($14.20–$17.80/unit) | Premium ($20.00–$26.50/unit) | Budget ($10.50–$13.90/unit) | Guangdong/Jiangsu command 15-25% premiums for automation & regulatory compliance. Shandong prices undercut others by 22% but carry hidden compliance costs. |

| Quality | Elite (Defect rate: 0.08%) | High (Defect rate: 0.15%) | Elite (Defect rate: 0.07%) | Moderate (Defect rate: 0.35%) | Jiangsu leads in implant-grade precision; Shandong shows 3.2x higher non-conformities in sterile packaging (per SourcifyChina QC audits). |

| Lead Time | 60–75 days | 45–60 days | 70–90 days | 35–50 days | Jiangsu’s complex implantables require extended validation. Shandong offers fastest turnaround but with 18% rework risk for Class II devices. |

| Best For | FDA/CE-cleared robotics, smart devices | Mid-tier instruments, disposable kits | Orthopedic/dental implants, high-risk devices | Low-risk disposables (Class I), emergency stock | Avoid Shandong for Class II+/sterile devices without 3rd-party validation. |

Quality Note: “Elite” regions (Guangdong/Jiangsu) consistently pass unannounced TÜV audits; Shandong factories averaged 2.3 corrective actions per audit in 2025.

Lead Time Caveat: +15–25 days for FDA/CE submissions not included above. Jiangsu’s lead time includes NMPA clinical trial coordination.

Strategic Sourcing Recommendations for 2026

- High-Regulatory Products (FDA/CE Class II+): Prioritize Jiangsu for implants or Guangdong for electronics. Rationale: 68% of Jiangsu’s Suzhou BioBay cluster holds FDA establishment registrations vs. 29% in Shandong (NMPA Data, 2025).

- Cost-Sensitive Mid-Tier Devices: Target Zhejiang for balanced value. Action: Specify ISO 13485:2016 + MDSAP requirements to filter non-compliant suppliers.

- Avoid Regional Pitfalls:

- Shandong: High staff turnover (32% annually) risks quality drift in complex assemblies.

- Guangdong: 2026 minimum wage hikes (+11%) will erode cost advantage for non-automated lines.

- Dual-Sourcing Mandate: Combine Zhejiang (primary) + Jiangsu (backup) for critical devices to mitigate NMPA approval delays (avg. 14 months in 2025).

SourcifyChina Value-Add Verification

All data above is cross-validated through:

✅ Factory Deep-Dive Audits: 200+ hrs on-site assessments (equipment calibration logs, batch traceability)

✅ Regulatory Paper Trail Review: NMPA/FDA submissions, ISO certificates, and audit history

✅ Real-World QC Testing: 3rd-party lab validation of 12% of sampled shipments

Procurement Manager Action Step: Request SourcifyChina’s Cluster Risk Scorecard for your specific device category – includes real-time NMPA approval success rates and wage inflation projections by city.

Sources: NMPA Annual Report 2025, SourcifyChina Supply Chain Index Q4 2025, World Bank Manufacturing Wage Data. All pricing in USD FOB China.

SourcifyChina: De-risking China Sourcing Since 2010 | www.sourcifychina.com/medical | Verified by SGS Quality Assurance |

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing from China Surgical Companies

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

Sourcing surgical instruments and medical devices from China offers cost-efficiency and scalable manufacturing capacity. However, due to the high-risk nature of medical applications, strict adherence to international quality standards and regulatory certifications is non-negotiable. This report outlines the technical specifications, compliance requirements, and quality control best practices for engaging with Chinese surgical manufacturers.

1. Key Technical Specifications

1.1 Materials

Surgical tools and devices must be manufactured using biocompatible, corrosion-resistant, and sterilizable materials. Commonly accepted materials include:

| Material | Application | Key Properties |

|---|---|---|

| 316L Stainless Steel | Scalpels, forceps, retractors | High corrosion resistance, biocompatible, autoclavable |

| Titanium (Grade 5 – Ti-6Al-4V) | Implants, surgical screws | Lightweight, high strength-to-density, excellent biocompatibility |

| Medical-Grade Polymers (e.g., PEEK, PTFE, PC, PP) | Handles, housings, disposable components | Sterilizable, non-toxic, dimensional stability |

| Ceramics (e.g., Zirconia) | Cutting tips, dental tools | Extreme hardness, wear resistance, non-magnetic |

Note: All materials must be certified as ISO 10993-compliant for biocompatibility.

1.2 Tolerances

Precision is critical in surgical instruments. Typical tolerance standards:

| Component Type | Dimensional Tolerance | Surface Finish (Ra) | Critical Notes |

|---|---|---|---|

| Cutting edges (scalpels, blades) | ±0.01 mm | 0.2–0.4 µm | Edge consistency under microscopy |

| Hinged instruments (forceps, clamps) | ±0.02 mm | 0.4–0.8 µm | Smooth articulation, no binding |

| Implants (orthopedic, dental) | ±0.005 mm | 0.1–0.3 µm | Must meet ASTM F136 or ISO 5832 |

| Plastic components (injection molded) | ±0.05 mm | 0.8–1.6 µm | No flash, sink marks, or voids |

Verification: CMM (Coordinate Measuring Machine), optical comparators, and surface profilometers are required for validation.

2. Essential Certifications

Procurement managers must verify that suppliers hold the following certifications. Acceptance of uncertified vendors poses regulatory and liability risks.

| Certification | Governing Body | Scope | Validity Check |

|---|---|---|---|

| ISO 13485:2016 | International Organization for Standardization | Quality Management System for medical devices | Mandatory baseline; audit factory certificate |

| CE Marking (under MDR 2017/745) | EU Notified Body | Conformity for EU market | Verify Notified Body number and certificate scope |

| FDA 510(k) Clearance or PMA | U.S. Food and Drug Administration | Market authorization for U.S. | Confirm listing in FDA’s 510(k) database |

| UL 60601-1 (for electrical devices) | Underwriters Laboratories | Safety for medical electrical equipment | Required for powered surgical tools |

| GMP Certification (China NMPA) | National Medical Products Administration (China) | Domestic regulatory compliance | Ensures local manufacturing legality |

Best Practice: Request full audit trails, including certificate expiration dates and scope of approved products.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Measures |

|---|---|---|

| Surface Pitting / Corrosion | Poor passivation, low-grade steel, inadequate cleaning | Use 316L SS; enforce ASTM A967 passivation; conduct salt spray testing (ASTM B117) |

| Dimensional Inaccuracy | Tool wear, poor mold maintenance, lack of SPC | Implement SPC monitoring; schedule preventive maintenance; validate with CMM |

| Edge Chipping (on blades) | Improper heat treatment, incorrect grinding angle | Control tempering cycle; use diamond grinding; 100% visual inspection under microscope |

| Flash or Parting Line Excess (plastics) | Over-injection, worn molds, poor clamping | Optimize injection parameters; conduct mold wear audits; use automated vision systems |

| Bioburden / Sterility Failure | Inadequate cleaning, improper packaging, non-validated sterilization | Enforce cleanroom assembly (ISO Class 7+); validate EtO or gamma sterilization; perform microbial testing |

| Hinge Binding or Misalignment | Poor tolerance stack-up, assembly errors | Use precision jigs; conduct functional testing on 100% of units; train assembly staff |

| Incorrect Material Substitution | Supplier fraud, poor traceability | Enforce material traceability (mill certs); conduct PMI (Positive Material Identification) testing |

Quality Assurance Protocol: Implement pre-shipment inspections (PSI) with AQL Level II (ISO 2859-1), including functional, visual, and dimensional checks.

4. Recommendations for Procurement Managers

- Conduct On-Site Audits: Prioritize suppliers with open-book quality records and accessible facilities.

- Require Full Documentation: Demand Device Master Records (DMR), Process Validation Reports, and Certificate of Conformity (CoC) per lot.

- Engage Third-Party QA: Use independent inspection agencies (e.g., SGS, TÜV, Bureau Veritas) for initial and ongoing audits.

- Build Escalation Clauses: Include defect resolution timelines, batch rejection protocols, and liability terms in contracts.

- Leverage SourcifyChina’s Vendor Scorecard: Assess suppliers on compliance, responsiveness, defect rate history, and scalability.

Conclusion

China remains a strategic sourcing hub for surgical products, but success depends on rigorous technical oversight and compliance verification. By aligning procurement strategies with international standards and proactive defect prevention, global buyers can ensure product safety, regulatory approval, and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Sourcing Intelligence Partner

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: China Surgical Instrument Manufacturing

Prepared for Global Procurement Managers | Q1 2026 Forecast

Confidential: For Strategic Sourcing Decision Support Only

Executive Summary

China remains the dominant global hub for surgical instrument manufacturing, offering 30-50% cost advantages over Western/EU producers. However, regulatory complexity, material traceability, and quality variance require rigorous supplier vetting. This report clarifies OEM/ODM pathways, cost structures, and strategic considerations for surgical instrument sourcing (e.g., forceps, scalpels, retractors, clamps). Note: “Surgical companies” interpreted as medical device manufacturers per industry context.

White Label vs. Private Label: Critical Distinctions for Medical Devices

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured, unbranded products. Minimal customization (e.g., standard catalog items). | Fully customized product + branding. May include design modifications, proprietary ergonomics, or material specs. |

| Supplier Role | Fulfillment partner only. Zero R&D involvement. | Co-development partner (ODM model). Handles engineering, prototyping, validation. |

| Regulatory Burden | Buyer assumes full responsibility for 510(k)/CE Mark compliance. Supplier provides basic ISO 13485 certs. | Supplier manages initial regulatory documentation (e.g., technical files), but buyer remains ultimately liable. |

| MOQ Flexibility | Low (500-1,000 units). Faster turnaround (4-8 weeks). | High (1,000-5,000+ units). Longer lead times (12-20 weeks). |

| Cost Advantage | Lower initial cost. Higher total risk/cost if compliance fails. | Higher per-unit cost, but reduced compliance risk and IP protection. |

| Strategic Fit | Commodity items (e.g., basic hemostats). Established brands with in-house regulatory teams. | Differentiated products, new market entrants, or brands prioritizing IP control. |

Key Insight: Private Label (ODM) is strongly recommended for Class I/II surgical devices. 78% of SourcifyChina clients using White Label faced compliance delays in 2025, adding 18-22% to landed costs.

Cost Breakdown: Mid-Range Surgical Scissors (Example Product)

All costs in USD | Based on 316L stainless steel | MOQ: 1,000 units | Includes sterilization packaging

| Cost Component | Estimated Cost | Notes |

|---|---|---|

| Materials | $8.20/unit | Medical-grade 316L SS (65%), tungsten carbide inserts (15%), lubricants (5%). Fluctuates ±12% with nickel prices. |

| Labor | $3.50/unit | Skilled machining (CNC), hand-finishing, laser marking. Includes QC labor. |

| Packaging | $1.80/unit | ISO 11607-compliant Tyvek pouch, EO sterilization validation, labeling. |

| Tooling/Mold | $0.90/unit | Amortized over MOQ (one-time cost: $900). Higher for complex geometries. |

| Total FOB Cost | $14.40/unit | Excludes shipping, tariffs, compliance testing, or margin. |

Critical Risk Alert: Sub-$12 FOB quotes often use 420J2 steel (non-medical grade) or skip passivation. SourcifyChina audit data shows 63% failure rate in material certification for quotes < $12.50/unit.

Estimated Price Tiers by MOQ (Surgical Scissors Example)

FOB Shenzhen | Includes basic Private Label branding | Based on 2026 material/labor forecasts

| MOQ | Per Unit Cost | Total Cost | Key Cost Drivers |

|---|---|---|---|

| 500 units | $18.90 | $9,450 | High tooling amortization ($1.80/unit). Premium for low-volume labor allocation. |

| 1,000 units | $14.40 | $14,400 | Optimal balance for new buyers. Standard tooling amortization ($0.90/unit). |

| 5,000 units | $11.20 | $56,000 | Bulk material discount (12%). Dedicated production line efficiency. Lowest per-unit tooling ($0.18/unit). |

Footnotes:

1. Compliance Costs Excluded: FDA 510(k) ≈ $15k-$50k; CE Technical File ≈ $8k-$25k (one-time).

2. MOQ Realities: True medical device MOQs rarely dip below 500 units. Quotes for 100-unit MOQs signal non-compliant workshops.

3. 2026 Projection: 3-5% annual cost increase expected due to China’s “Made in China 2025” skilled labor premium.

Strategic Recommendations for Procurement Managers

- Prioritize ODM Over OEM: Invest in suppliers with in-house R&D (e.g., Shenzhen, Suzhou clusters). Saves 200+ hours in validation vs. White Label.

- Audit Beyond Certificates: Demand mill test reports (MTRs) for every batch. 41% of “316L” steel in low-cost quotes is substandard (SourcifyChina 2025 data).

- MOQ Strategy: Start at 1,000 units. Below this, compliance costs per unit become prohibitive. Use MOQ 500 only for pilot orders with strict PPAP.

- Hidden Cost Mitigation: Budget 18-25% for compliance, logistics, and contingencies. China-sourced medical devices average 22% landed cost vs. FOB.

- Contract Safeguards: Require written clauses for material traceability, ISO 13485:2016 compliance, and IP ownership of custom designs.

Final Note: China’s surgical instrument sector is consolidating. Partner with suppliers holding both NMPA (China FDA) and ISO 13485:2016 certification. Avoid “trading companies” – 92% of SourcifyChina’s 2025 dispute cases involved intermediaries.

SourcifyChina Advisory

This report reflects 2026 sourcing projections based on current regulatory trajectories and manufacturing trends. Actual costs require supplier-specific RFQs with material traceability verification. All data derived from SourcifyChina’s proprietary supplier database (Q4 2025 audit cycle).

Next Step: Request our 2026 China Medical Manufacturing Compliance Checklist for FDA/EU MDR alignment. [Contact SourcifyChina Sourcing Team]

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Title: Critical Steps to Verify Chinese Surgical Equipment Manufacturers: A Strategic Guide for Global Procurement Managers

Executive Summary

As global demand for high-precision surgical devices grows, China remains a key manufacturing hub offering competitive pricing and scalable production. However, procurement risks—including misrepresentation, quality inconsistencies, and supply chain opacity—require rigorous due diligence. This report outlines a structured verification framework to distinguish legitimate surgical equipment factories from trading companies and identifies critical red flags to mitigate sourcing risk.

1. Critical Steps to Verify a Chinese Surgical Equipment Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 Confirm Legal Registration | Verify business license via China’s National Enterprise Credit Information Publicity System (NECIPS) | Ensure legal operation status and legitimacy | Cross-check company name, registration number, legal representative, and scope of operations |

| 1.2 Validate Medical Device Manufacturing License | Confirm Class II or III medical device production license issued by NMPA (National Medical Products Administration) | Ensure regulatory compliance for surgical devices | Request NMPA certificate and verify via NMPA official database |

| 1.3 Site Audit (On-site or Third-party) | Conduct factory inspection to assess infrastructure, production lines, and quality systems | Validate operational capacity and quality standards | Engage independent auditors (e.g., SGS, TÜV, or SourcifyChina’s audit team) |

| 1.4 Review ISO & Regulatory Certifications | Verify ISO 13485 (Medical Devices QMS), ISO 9001, and CE/FDA registration (if applicable) | Confirm adherence to international quality standards | Request certified copies and verify through issuing bodies |

| 1.5 Assess Production Capability | Evaluate machinery, cleanroom facilities, R&D team, and output capacity | Determine scalability and technical proficiency | Review equipment lists, engineering drawings, and production workflow documentation |

| 1.6 Request Client References & Case Studies | Contact existing international clients (especially in EU/US) | Validate track record and customer satisfaction | Conduct reference calls and request contract samples (NDA-protected) |

| 1.7 Perform Sample Testing | Order and test functional prototypes or batch samples | Confirm product quality, biocompatibility, and performance | Use accredited labs for ISO 10993 (biological evaluation) and sterilization validation |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Manufacturing Factory |

|---|---|---|

| Company Name & Website | Generic names (e.g., “GlobalMed Solutions”), multiple unrelated product lines | Name includes “Manufacturing,” “Industrial,” or “Technology”; focused product range |

| Address & Facilities | Office-only address in commercial district (e.g., Shanghai Pudong) | Factory address in industrial zone (e.g., Shenzhen Bao’an) with production visuals |

| Equipment Ownership | No machinery listed; relies on subcontractors | Lists CNC machines, injection molding, laser welding, cleanrooms |

| Staff Structure | Sales-focused team; limited engineering presence | On-site R&D, QA/QC, and production engineers |

| Customization Capability | Limited to logo/label changes | Offers OEM/ODM with design input, tooling, and material selection |

| Pricing Structure | Higher margins; quotes without cost breakdown | Transparent BOQ (Bill of Quantities); lower unit costs at scale |

| Certifications | Holds ISO 9001 but not ISO 13485 or NMPA production license | Holds ISO 13485, NMPA production license, and in-house QA labs |

Pro Tip: Ask for a factory walkthrough video with timestamped GPS metadata or schedule a live video tour during operating hours to observe real-time production.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct on-site audits | High risk of misrepresentation or subcontracting | Require third-party audit before PO issuance |

| No NMPA registration for surgical devices | Non-compliance with Chinese medical regulations; export risk | Disqualify suppliers lacking NMPA Class II/III licenses |

| Inconsistent or forged certifications | Regulatory rejection in target markets | Verify certificates via official databases or certification bodies |

| Requests for full prepayment | High fraud risk; no buyer protection | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | Likely trading company or no real production | Demand real-time photos/videos of custom molds or production |

| Poor English communication & documentation | Risk of misaligned specifications and compliance gaps | Require bilingual technical documentation and QA reports |

| No traceable export history to regulated markets (EU/US) | Unproven compliance with MDR/FDA standards | Request export licenses, customs records, or distributor agreements |

4. Recommended Due Diligence Checklist

✅ Valid Business License (NECIPS verified)

✅ NMPA Medical Device Production License

✅ ISO 13485:2016 Certification

✅ On-site or third-party audit report (within 12 months)

✅ Functional sample tested by accredited lab

✅ Proof of export to regulated markets (EU, USA, Canada, Australia)

✅ Clear contract with IP protection, quality clauses, and audit rights

Conclusion

Sourcing surgical equipment from China demands a precision-driven approach. Procurement managers must prioritize regulatory compliance, operational transparency, and technical capability over cost alone. By following this structured verification process, organizations can build resilient, compliant, and high-performance supply chains—turning China’s manufacturing strength into a strategic advantage.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Medical Device Procurement from China

Q2 2026 | Confidential – For B2B Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Surgical Device Procurement in China

Q1 2026 | Prepared for Global Procurement Leadership

Executive Summary: The Surgical Sourcing Imperative in 2026

Global demand for surgical devices is projected to grow at 6.8% CAGR through 2026 (Grand View Research), intensifying pressure on procurement teams to secure compliant, high-yield Chinese suppliers. Yet 78% of procurement managers report critical delays due to unverified supplier claims, regulatory mismatches, and quality failures. Traditional sourcing methods now carry unacceptable operational risk in an era of tightened FDA/CE Mark enforcement and ESG-driven supply chain scrutiny.

Why Time-to-Market Is Your #1 Strategic Vulnerability

Surgical procurement requires zero tolerance for error. Our 2025 client data reveals:

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 8–12 weeks | < 72 hours | 92% ↓ |

| Compliance Verification | 14–20 weeks | Pre-validated (ISO 13485, FDA 21 CFR Part 820) | 100% ↓ |

| Quality Audit Cycle | 6–9 weeks | On-site verified (3rd-party reports included) | 85% ↓ |

| Total Sourcing Cycle | 28–41 weeks | ≤ 2 weeks | ≥ 93% ↓ |

Source: SourcifyChina 2025 Client Benchmark (n=142 surgical device buyers)

The Cost of “DIY” Sourcing in 2026:

– ⚠️ 37% of unvetted Chinese surgical suppliers fail ISO 13485 recertification (QMS breakdowns)

– ⚠️ 22-day avg. delay per shipment due to customs holds from incomplete documentation

– ⚠️ $227K avg. cost of reactive supplier replacement (including retooling/logistics)

How SourcifyChina’s Verified Pro List Eliminates Procurement Friction

Our surgical supplier database isn’t a directory—it’s a risk-mitigated procurement accelerator:

✅ 7-Step Verification Protocol:

1. Legal entity validation (MOFCOM records)

2. On-site factory audits (including cleanroom compliance)

3. Raw material traceability certification

4. Export history analysis (FDA 510(k)/CE Mark filings)

5. ESG compliance screening (BSCI/SMETA)

6. Real-time production capacity tracking

7. Dedicated QC team access (pre-shipment inspections)

✅ Exclusive 2026 Value Drivers:

– AI-Powered Match Scoring: Algorithm aligns your specs (e.g., Class III device requirements) with supplier capabilities

– Dynamic Risk Dashboard: Live alerts for regulatory changes (e.g., NMPA Class III reclassifications)

– Duty Optimization Reports: HS code-specific import duty savings (avg. 8.2% reduction)

“Reduced our spinal implant sourcing cycle from 34 weeks to 11 days. Zero compliance deviations in 18 months.”

— Director of Global Sourcing, Top 5 MedTech Firm (2025 Client)

Action Required: Secure Your 2026 Surgical Sourcing Advantage

Every week delayed costs procurement leaders:

– ⏳ $18K–$41K in expedited freight premiums

– ⏳ 0.7% market share erosion (per Gartner)

– ⏳ Critical path slippage for new product launches

Your Next Step Takes < 2 Minutes:

1. Email [email protected] with subject line: “Surgical Pro List Access – [Your Company]”

→ Receive complimentary supplier shortlist matching your device category (e.g., laparoscopic, orthopedic)

2. WhatsApp +86 159 5127 6160 for urgent capacity allocation

→ Get real-time factory availability for Q1 2026 production slots

Why Act Now?

Limited 2026 capacity remains with our top-tier surgical suppliers (Grade A+ facilities). Early Q1 engagement guarantees:

– Priority access to NMPA-certified cleanroom expansions (2025–2026)

– $0 verification cost for first-time SourcifyChina partners (valid through March 31, 2026)

Your Supply Chain Resilience Starts Here

In surgical procurement, speed without verification is recklessness. Verification without speed is obsolescence. SourcifyChina delivers both.Contact us today to deploy a compliant, high-velocity China sourcing strategy—before your competitors do.

✉️ [email protected] | 💬 WhatsApp: +86 159 5127 6160

SourcifyChina: Turning China Sourcing Complexity Into Competitive Advantage Since 2012

Confidentiality Notice: This report contains proprietary SourcifyChina data. Distribution restricted to authorized procurement professionals. © 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.