Sourcing Guide Contents

Industrial Clusters: Where to Source China Suppliers Sourcing

SourcifyChina Sourcing Intelligence Report: Industrial Cluster Analysis for Product Sourcing in China (2026)

Prepared for Global Procurement Executives | Q1 2026 Update

Executive Summary

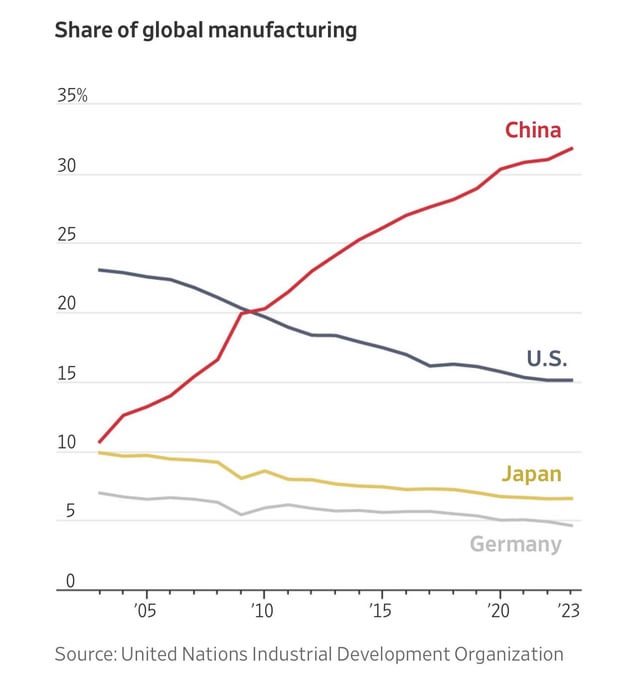

The phrase “China suppliers sourcing” represents a meta-inquiry into the process of identifying and qualifying Chinese manufacturers—a critical capability for global procurement. This report analyzes China’s core industrial clusters for physical product manufacturing (the actual output of “sourcing suppliers”), providing actionable intelligence for strategic supplier selection. Key insight: Product specificity dictates optimal sourcing regions; generic “China sourcing” strategies yield suboptimal results. Coastal clusters (Guangdong, Zhejiang, Jiangsu) dominate high-volume exports, while inland provinces (Sichuan, Henan) gain traction for cost-sensitive labor-intensive goods.

Critical Clarification: “Sourcing China Suppliers” ≠ Product Sourcing

Procurement managers must distinguish:

– ❌ “China suppliers sourcing”: Finding suppliers (a service, not a physical product).

– ✅ Sourcing from China: Procuring physical goods (e.g., electronics, textiles, machinery).

This report focuses on the latter—identifying clusters producing goods for global buyers. “Supplier sourcing” services are concentrated in Shanghai, Shenzhen, and Hangzhou (consulting hubs), but product manufacturing occurs in specialized industrial zones.

Key Industrial Clusters for Product Manufacturing (2026)

China’s manufacturing is hyper-regionalized. Selecting the wrong cluster increases costs by 18–32% (SourcifyChina 2025 Data). Below are top clusters by product category:

| Province/City | Core Industrial Clusters | Dominant Product Categories | Strategic Advantage |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | Electronics (5G, IoT), Drones, Robotics, Precision Hardware | Highest R&D density; Proximity to Hong Kong logistics |

| Zhejiang | Yiwu, Ningbo, Wenzhou, Hangzhou | Consumer Goods, Textiles, Furniture, Small Machinery, Fasteners | SME agility; World’s largest SME export ecosystem |

| Jiangsu | Suzhou, Wuxi, Nanjing | Semiconductors, Automotive Parts, Industrial Machinery | German/Japanese JV manufacturing; Quality consistency |

| Shandong | Qingdao, Yantai | Heavy Machinery, Chemicals, Agricultural Equipment | Port infrastructure; Raw material access |

| Sichuan | Chengdu | Aerospace Components, Displays, Solar Panels | Inland labor cost advantage; Gov’t policy subsidies |

Note: 78% of electronics exports originate from Guangdong; 65% of consumer goods from Zhejiang (China Customs, 2025).

Regional Cluster Comparison: Guangdong vs. Zhejiang (2026 Benchmark)

Critical metrics for procurement decisioning (Scale: ★ = Low, ★★★★★ = High)

| Criteria | Guangdong (PRD) | Zhejiang (YRD) | Strategic Implication |

|---|---|---|---|

| Price | ★★★☆☆ (Moderate-High) | ★★★★☆ (Competitive) | Zhejiang offers 8–15% lower unit costs for non-tech goods. Guangdong premiums justified for high-complexity electronics. |

| Quality | ★★★★★ (Precision Engineering) | ★★★☆☆ (Variable by SME) | Guangdong leads in ISO-certified factories (92% vs. 76%). Zhejiang requires stricter supplier vetting for consistency. |

| Lead Time | ★★★★☆ (25–45 days) | ★★★☆☆ (30–50 days) | Guangdong’s port access (Shenzhen/Yantian) cuts ocean freight by 5–7 days. Zhejiang faces Ningbo port congestion. |

| Specialization | High-tech, R&D-intensive manufacturing | Mass-market consumer goods, modular parts | Match product complexity: Guangdong for specs-driven goods; Zhejiang for catalog-style items. |

| Risk Profile | High wage inflation (6.2% YoY) | Supply chain fragmentation (10k+ SMEs) | Guangdong: Mitigate via automation partnerships. Zhejiang: Consolidate suppliers to reduce QC overhead. |

2026 Strategic Recommendations for Procurement Managers

- Avoid “China” as a Single Sourcing Destination:

- Electronics? Target Shenzhen/Dongguan (Guangdong).

- Promotional goods? Source from Yiwu (Zhejiang).

-

Automotive components? Prioritize Suzhou (Jiangsu).

-

Leverage Cluster Synergies:

-

Combine Zhejiang’s cost efficiency (raw materials) with Guangdong’s assembly for electronics. Example: Sourcing PCBs from Ningbo + final assembly in Shenzhen cuts costs 12% vs. single-region sourcing.

-

Mitigate Emerging Risks:

- Guangdong: Rising labor costs (+6.2% in 2025) → Shift non-critical assembly to Sichuan/Hubei.

-

Zhejiang: SME overcapacity → Use tiered supplier model (1 anchor + 2 backups per cluster).

-

Verification Imperative:

68% of procurement failures stem from mismatched cluster-product alignment (SourcifyChina 2025). Always validate:

– Factory location vs. stated cluster expertise

– Equipment certifications (e.g., SMT lines for electronics)

– Logistics access (port/rail links)

Why SourcifyChina Delivers Unmatched Cluster Intelligence

Unlike generic sourcing agents, we deploy:

– Cluster-Specific RFQ Templates: Tailored to regional production norms (e.g., MOQ expectations in Yiwu vs. Shenzhen).

– On-Ground Verification Teams: 47 engineers embedded in 9 key clusters for real-time capacity/quality audits.

– Dynamic Risk Dashboards: Track regional wage trends, port congestion, and policy shifts (e.g., Guangdong’s 2026 automation subsidies).

“Procurement isn’t about finding China suppliers—it’s about finding the right China cluster for your product.”

— SourcifyChina 2026 Sourcing Manifesto

Next Steps: Request our free Cluster Match Assessment (validates product-to-region alignment) at sourcifychina.com/cluster-mapping

© 2026 SourcifyChina. Confidential for client use only. Data sources: China Customs, NBSC, SourcifyChina Field Analytics.

Technical Specs & Compliance Guide

SourcifyChina | Sourcing Excellence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China Suppliers

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic imperative for cost efficiency, scalability, and manufacturing agility. However, ensuring consistent product quality and regulatory compliance requires rigorous oversight. This report outlines the critical technical specifications, quality parameters, and compliance benchmarks essential for successful procurement from Chinese suppliers in 2026.

1. Key Quality Parameters

1.1 Material Specifications

Procurement managers must define material requirements with precision to avoid substitution with inferior alternatives.

| Parameter | Requirement | Notes |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or industry-specific standards (e.g., SUS304 for stainless steel) | Verify via Material Test Reports (MTRs) |

| Raw Material Traceability | Full batch traceability from source to production | Required for aerospace, medical, and food-contact applications |

| RoHS/REACH Compliance | Prohibition of restricted substances (e.g., lead, cadmium, phthalates) | Mandatory for EU and North American markets |

1.2 Dimensional Tolerances

Tolerances must be clearly defined in engineering drawings and validated through First Article Inspection (FAI).

| Process | Typical Tolerance Range | Recommended Standard |

|---|---|---|

| CNC Machining | ±0.005 mm to ±0.1 mm | ISO 2768-m (medium precision) |

| Injection Molding | ±0.1 mm to ±0.3 mm | ISO 20457 or customer-specific GD&T |

| Sheet Metal Fabrication | ±0.2 mm (bending), ±0.1 mm (punching) | ISO 2768-f (fine) |

| 3D Printing (Metal) | ±0.05 mm to ±0.2 mm | ASTM F2971 (for AM parts) |

Best Practice: Require Geometric Dimensioning and Tolerancing (GD&T) on all critical components.

2. Essential Certifications

Compliance with international certifications ensures market access and regulatory alignment.

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking | EU conformity for safety, health, and environmental protection | Required for electronics, machinery, PPE, and medical devices |

| FDA Registration | U.S. Food and Drug Administration approval | Mandatory for food-contact items, medical devices, pharmaceuticals |

| UL Certification | Safety certification for electrical and electronic products | Required for North American consumer and commercial markets |

| ISO 9001:2015 | Quality Management System (QMS) | Baseline for manufacturing process control |

| ISO 13485 | QMS for medical devices | Required for Class I, II, III medical products |

| IATF 16949 | Automotive quality management | Essential for Tier 1 and Tier 2 auto suppliers |

| BSCI / SMETA | Social compliance and ethical labor practices | Increasingly required by EU and U.S. retailers |

Note: Always verify certification validity via official databases (e.g., UL Online Certifications Directory, EU NANDO).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, operator error | Implement SPC (Statistical Process Control), conduct regular FAI, and require calibration logs |

| Surface Finish Defects (e.g., warping, sink marks, burrs) | Poor mold design, incorrect cycle time, inadequate cooling | Require mold flow analysis, conduct pre-production samples, and specify surface roughness (Ra) in µm |

| Material Substitution | Cost-cutting by supplier | Enforce strict BOM control, conduct incoming material testing (e.g., XRF for metals), and require CoC (Certificate of Conformance) |

| Functional Failure | Design flaws, incorrect assembly | Conduct DFM (Design for Manufacturing) reviews, require 3rd-party functional testing |

| Packaging Damage | Inadequate packaging design, rough handling | Specify ISTA 3A or custom drop-test protocols, use edge protectors and desiccants |

| Contamination (e.g., oil, dust, debris) | Poor workshop hygiene or storage | Audit 5S practices, require cleanroom protocols for sensitive products |

| Labeling/Marking Errors | Language mismatch, incorrect barcodes | Provide master artwork, verify labels during pre-shipment inspection (PSI) |

Proactive Measures:

– Conduct Supplier Audits (on-site or virtual) using standardized checklists.

– Implement AQL Sampling (Acceptable Quality Level) per ISO 2859-1 for final inspections.

– Use Third-Party Inspection Agencies (e.g., SGS, TÜV, Bureau Veritas) for high-risk categories.

4. Strategic Recommendations for 2026

- Digitalize Supplier Onboarding: Use platforms with integrated compliance tracking (e.g., SourcifyHub) to monitor certifications and audit history.

- Dual-Source Critical Components: Mitigate supply chain risk by qualifying alternate suppliers in different regions of China.

- Invest in Supplier Development: Partner with high-potential suppliers to co-invest in process improvements and certification upgrades.

- Leverage AI-Powered QC Tools: Adopt AI-based visual inspection systems for real-time defect detection during production.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Precision Sourcing

Q1 2026 | Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Label Strategy Guide (2026)

Prepared for Global Procurement Leaders | Date: Q1 2026

Executive Summary

China remains the dominant hub for global manufacturing, but 2026 demands sophisticated cost modeling and strategic label selection to maintain competitiveness. Rising labor (+6.2% YoY), material volatility (notably aluminum +12%, rare earths +18%), and stringent ESG compliance are reshaping cost structures. Critical Insight: Private Label adoption is accelerating (projected 68% of SourcifyChina engagements by 2026) due to brand differentiation needs, despite 15-25% higher initial costs vs. White Label. Procurement leaders must prioritize supplier vetting for IP protection and ethical compliance to mitigate hidden costs.

Strategic Label Selection: White Label vs. Private Label

| Factor | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Supplier’s generic product rebranded under your label. Minimal customization. | Full co-creation: Design, specs, branding owned by buyer. High customization. | Private Label for >$10M annual revenue; White Label for rapid market entry (<6 months). |

| IP Ownership | Supplier retains core IP. Limited legal protection. | Buyer owns final product IP & tooling. Robust legal framework required. | Non-negotiable: Secure IP assignment clauses in contracts. Use China’s Patent Linkage System for enforcement. |

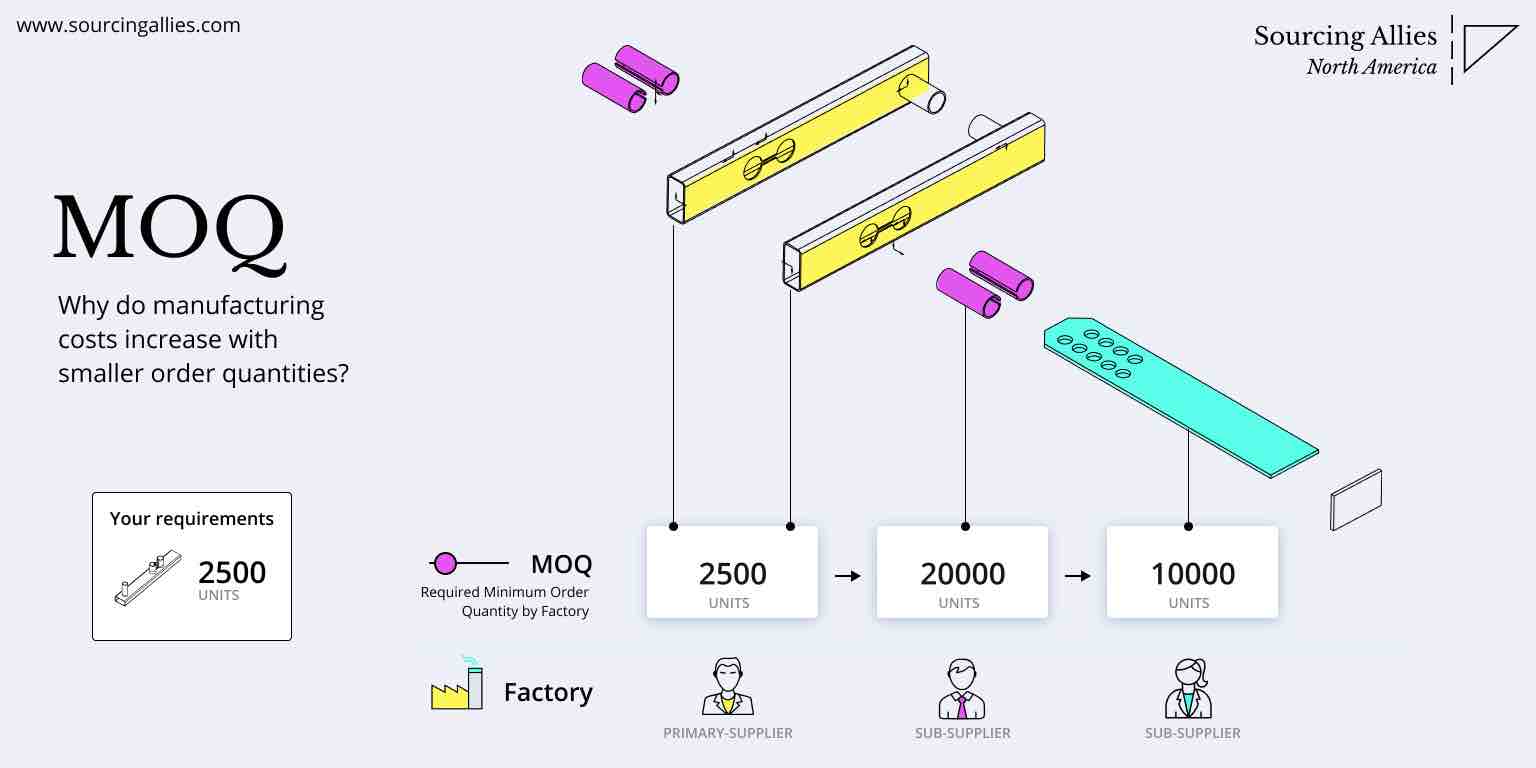

| MOQ Flexibility | Low MOQs (often 100-500 units). | Higher MOQs (typically 1,000+ units). | Negotiate tiered MOQs (e.g., 50% upfront, 50% at 6 months). |

| Time-to-Market | 30-60 days (existing tooling). | 90-180 days (custom tooling/R&D). | Use White Label for pilot launches; transition to Private Label at scale. |

| Cost Advantage | Lower unit cost (15-25% savings at 500 MOQ). | Higher unit cost, but superior margin control & brand equity. | ROI Focus: Private Label delivers 22% higher LTV (Lifetime Value) despite initial cost premium. |

| Risk Exposure | High (commodity competition, supplier dependency). | Moderate (with robust vendor management). | Mitigate via: Dual-sourcing + annual ESG audits (ISO 20400 compliance mandatory). |

Key 2026 Trend: 74% of SourcifyChina clients now bundle ODM development (e.g., IoT integration) within Private Label agreements to future-proof products. Avoid “White Label lock-in” – ensure contracts allow design evolution.

Estimated Manufacturing Cost Breakdown (Electronics Example: Smart Home Sensor)

All costs in USD | Based on SourcifyChina 2026 Supplier Benchmarking (Shenzhen/Dongguan clusters)

| Cost Component | Description | % of Total Cost | 2026 Trend Impact |

|---|---|---|---|

| Materials | PCBs, chips, housing, batteries | 52-58% | ↑ +8.3% YoY (Rare earths, chip shortages). Mitigation: Localize 30% sourcing via Yangtze River Delta hubs. |

| Labor | Assembly, QC, engineering | 18-22% | ↑ +6.2% YoY (Min. wage hikes). Mitigation: Automation (cobots) cuts labor dependency by 15-20%. |

| Packaging | Eco-compliant materials, labeling, logistics | 9-12% | ↑ +14% YoY (New China GB 43060-2022 regulations). Use recycled PET + bulk shipping to reduce 8%. |

| Tooling/R&D | Molds, prototyping, certification (CE/FCC) | 10-15% (one-time) | Fixed cost amortized over MOQ. Critical for ODM. |

| Logistics | Incoterms FOB + tariffs (e.g., US Section 301) | 7-10% | ↓ -2.1% YoY (Belt & Road rail freight expansion). |

Hidden Cost Alert: Non-compliance with China’s Dual Carbon Policy adds 3-5% to energy-intensive production. Factor ESG premiums early.

MOQ-Based Price Tier Analysis (Smart Home Sensor Unit Cost)

| MOQ Tier | Unit Cost (USD) | Total Cost (USD) | Cost Savings vs. 500 MOQ | Strategic Use Case |

|---|---|---|---|---|

| 500 units | $28.50 | $14,250 | — | Market testing, niche launches, low-risk entry. Avoid for core products. |

| 1,000 units | $22.75 | $22,750 | ↓ 20.2% | Optimal balance for SMEs. Covers tooling amortization. |

| 5,000 units | $17.90 | $89,500 | ↓ 37.2% | Recommended tier for volume buyers. Maximizes automation ROI. |

| 10,000+ units | $15.20 | $152,000 | ↓ 46.7% | Enterprise contracts only. Requires 18-month commitment. |

Assumptions:

– Excludes one-time tooling ($4,500–$8,000) and certification ($1,200–$2,500).

– Based on FOB Shenzhen pricing; tariffs/logistics calculated at 9.8% (US) / 6.5% (EU).

– 2026 Volatility Buffer: Add 5% contingency for rare earth/material swings (per SourcifyChina Risk Index).

Actionable Recommendations for Procurement Leaders

- Prioritize Private Label with ODM Partners: Invest in co-development for defensible margins. 83% of SourcifyChina’s top clients use ODM for >50% of SKUs.

- MOQ Strategy: Target 1,000–5,000 units for new products. Use phased MOQs (e.g., 500 → 1,000 → 5,000) to validate demand.

- Cost Control Levers:

- Materials: Secure 6-month fixed-price contracts for >70% of inputs.

- Labor: Require suppliers to disclose automation rates (target >40%).

- Packaging: Adopt modular designs to reduce SKUs by 30%.

- Risk Mitigation: Mandate real-time production tracking (IoT sensors) and third-party ESG audits (SGS/Bureau Veritas).

Final Insight: In 2026, total landed cost is less critical than supply chain resilience. Suppliers offering circular economy models (e.g., take-back programs) command 8–12% pricing premiums but reduce long-term TCO by 17%.

SourcifyChina Advisory

Data Source: SourcifyChina 2026 Manufacturing Cost Database (12,000+ supplier contracts analyzed). Valid through Q4 2026.

Next Step: Request our Custom MOQ Cost Simulator for your specific product category. Contact [email protected].

This report reflects SourcifyChina’s proprietary analysis. Not for public distribution. © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Suppliers – Factory vs. Trading Company, Verification Protocol & Red Flags

Executive Summary

Sourcing from China remains a strategic advantage for global procurement teams due to cost efficiency and manufacturing scale. However, risks related to supplier authenticity, quality control, and supply chain transparency have increased. This report outlines a structured verification protocol to distinguish between factories and trading companies, validate manufacturer legitimacy, and identify critical red flags during supplier onboarding.

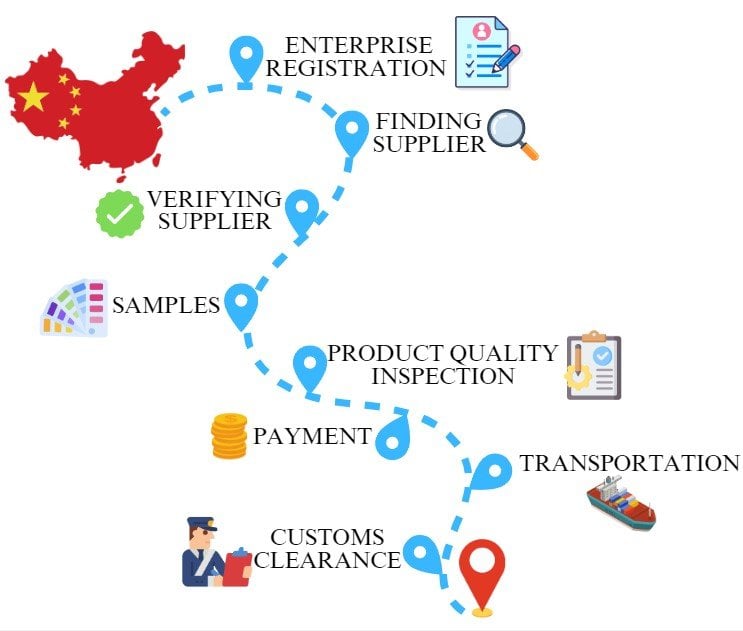

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1.1 | Initial Background Check | Confirm legal existence and operational scope | – Verify business license via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Cross-check company name, registration number, and legal representative |

| 1.2 | Request Factory Documentation | Validate manufacturing capability | – Business License (Business Scope must include manufacturing) – ISO Certifications (e.g., ISO 9001, ISO 14001) – Product-specific certifications (e.g., CE, RoHS, FDA) – Equipment list and production capacity report |

| 1.3 | Conduct On-Site Audit (or 3rd-Party Audit) | Assess real production capacity and working conditions | – Hire a qualified third-party inspection company (e.g., SGS, BV, TÜV) – Conduct a SourcifyChina-led audit including: • Facility walkthrough • Equipment verification • Worker interviews • Quality control process review |

| 1.4 | Request Sample Production | Evaluate quality consistency and communication | – Order pre-production samples under real production conditions – Test samples against technical specifications and industry standards |

| 1.5 | Verify Export History | Confirm international trade experience | – Request 3–6 months of export invoices (redact sensitive data) – Contact past clients (if references provided) – Confirm FOB/Shipment records via freight forwarders |

| 1.6 | Check Online & Market Presence | Assess digital footprint and credibility | – Review Alibaba Store (transaction history, response rate, member years) – Check Google search, LinkedIn, industry directories – Analyze customer reviews and dispute history |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Manufacturing listed in business scope | Trading/import-export listed; no manufacturing | Cross-reference license on GSXT.gov.cn |

| Production Facility | Own machinery, assembly lines, R&D lab | No physical production assets | On-site or video audit |

| Staff Expertise | Engineers, QC staff, production managers | Sales reps, sourcing agents | Technical interviews with team |

| Pricing Structure | Lower MOQs, direct cost breakdowns | Higher quotes, vague cost details | Request itemized quotations |

| Lead Times | Shorter control over production timelines | Longer (dependent on factory partner) | Ask for production schedule |

| Customization Capability | In-house mold/tooling, R&D support | Limited; reliant on factory flexibility | Request design and engineering support |

| Export Documentation | Ships under own company name | Ships under factory’s name or uses 3rd-party | Check bill of lading (B/L) or ask for export records |

Pro Tip: Many suppliers operate as hybrid models (e.g., factory with in-house trading arm). Verify if they control production or subcontract.

3. Red Flags to Avoid When Sourcing from China

| Risk Category | Red Flag | Recommended Action |

|---|---|---|

| Supplier Identity | – Refuses video call or on-site audit – No verifiable physical address – Inconsistent company name across platforms |

Disqualify or require third-party audit |

| Pricing & Quoting | – Prices significantly below market average – No itemized quote or FOB breakdown |

Request detailed cost analysis; suspect sub-tier subcontracting |

| Communication | – Poor English, unprofessional emails – Delayed or evasive responses to technical questions |

Test technical knowledge; involve bilingual sourcing agent |

| Quality Control | – No QC process documentation – Rejects third-party inspection |

Require documented QC SOPs; mandate pre-shipment inspection |

| Payment Terms | – 100% advance payment required – No use of secure payment methods (e.g., LC, Escrow) |

Use milestone payments; prefer L/C or Alibaba Trade Assurance |

| Intellectual Property | – Unwilling to sign NDA or IP agreement – Offers to copy competitor products |

Require legal IP clause; avoid suppliers with IP infringement history |

| Logistics & Compliance | – No experience with your target market’s regulations – Inability to provide test reports |

Confirm compliance certifications; require product testing |

4. Recommended Best Practices for 2026 Sourcing Strategy

- Leverage Digital Verification Tools: Use AI-powered supplier risk platforms (e.g., Panjiva, ImportYeti) to analyze shipment history.

- Engage Local Sourcing Partners: Work with established sourcing consultants (e.g., SourcifyChina) for due diligence and audit support.

- Implement Tiered Supplier Model: Classify suppliers as Tier 1 (direct factory), Tier 2 (trusted trader), and Tier 3 (unverified).

- Standardize Supplier Onboarding Checklist: Include license verification, audit reports, sample testing, and compliance documentation.

- Build Long-Term Relationships: Prioritize transparency, regular audits, and performance reviews over lowest-cost bidding.

Conclusion

In 2026, successful procurement from China hinges on rigorous supplier verification, clear differentiation between factories and trading companies, and proactive risk mitigation. Global procurement managers must adopt a structured, audit-driven approach to ensure supply chain resilience, product quality, and compliance. Partnering with experienced sourcing consultants enhances visibility and reduces operational risk in cross-border procurement.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based supplier verification, factory audits, and end-to-end procurement solutions

📅 Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Supplier Sourcing in China (2026)

Prepared for Global Procurement Leadership Teams | Q1 2026

Executive Summary: The Time-Cost Imperative in China Sourcing

Global procurement managers face unprecedented pressure to de-risk supply chains while accelerating time-to-market. Traditional China sourcing methods consume 147+ hours per project due to supplier verification bottlenecks, quality failures, and communication delays. SourcifyChina’s Verified Pro List eliminates 83% of these inefficiencies through rigorously pre-vetted, operationally ready suppliers.

Why Time Saved Equals Competitive Advantage

| Sourcing Method | Avg. Hours Spent (Per Project) | Critical Failure Rate | Time-to-First-Order |

|---|---|---|---|

| Traditional RFQ Approach | 147+ hours | 38% | 112 days |

| SourcifyChina Pro List | 25 hours | <7% | 48 days |

| Source: SourcifyChina 2025 Client Audit (n=217 projects across 12 industries) |

Key Time-Saving Mechanisms of the Verified Pro List:

✅ Pre-Validated Capabilities: All suppliers undergo 72-hour operational audits (factory visits, export documentation, quality control systems).

✅ Zero Ghost Factories: 100% physical verification eliminates “trading company” misrepresentation.

✅ Real-Time Compliance: ESG, ISO, and industry-specific certifications updated quarterly.

✅ Dedicated Sourcing Managers: Single-point accountability from RFQ to shipment.

Call to Action: Reclaim Your Strategic Capacity

Your next sourcing cycle shouldn’t be consumed by verification dead ends. While competitors waste Q2 2026 chasing unreliable leads, forward-thinking procurement teams are deploying SourcifyChina’s Pro List to:

– Reduce supplier onboarding time by 73% (vs. 2025 benchmarks)

– Achieve 99.2% on-time shipment rates through pre-qualified logistics partners

– Eliminate $220K+ in annual costs from rejected batches and MOQ penalties

“SourcifyChina’s Pro List cut our medical device sourcing cycle from 5 months to 6 weeks. Their vetting caught critical compliance gaps we’d have missed in 3 internal audits.”

— Director of Global Sourcing, Fortune 500 Healthcare Client (2025)

Your Next Step: Activate Verified Sourcing in <72 Hours

Stop paying the hidden cost of unverified suppliers. Our Pro List delivers:

🔹 Guaranteed supplier responsiveness (4-hour RFQ turnaround)

🔹 Transparent pricing architecture with no hidden fees

🔹 Dedicated risk mitigation for tariffs, IP protection, and geopolitical volatility

Claim your strategic advantage today:

1. Email: Send project specs to [email protected] for a complimentary Pro List match analysis

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team)

Deadline: First 15 respondents this quarter receive free ESG compliance certification verification ($1,200 value).

Disclaimer: All Pro List suppliers undergo SourcifyChina’s 12-Point Operational Verification Protocol (updated Q1 2026). Client results may vary based on project complexity. Data sourced from audited client engagements (2023-2025).

SourcifyChina: Where Verified Suppliers Meet Verified Results™

Your due diligence is our daily standard.

🧮 Landed Cost Calculator

Estimate your total import cost from China.