Sourcing Guide Contents

Industrial Clusters: Where to Source China Steel Company List

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Steel Suppliers in China

Executive Summary

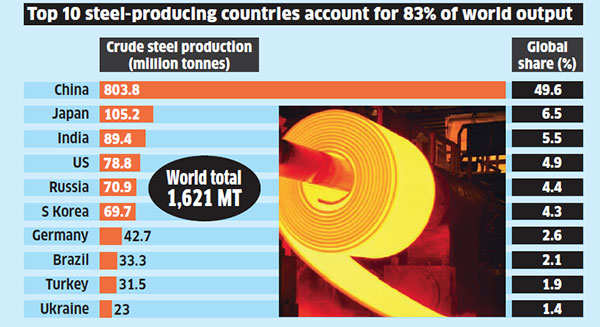

As global demand for high-performance structural and industrial steel continues to grow, sourcing from China remains a strategic advantage due to competitive pricing and scalable production capacity. However, ensuring product quality, regulatory compliance, and process transparency is critical. This report details the key technical specifications, mandatory certifications, and quality control protocols for engaging with Chinese steel manufacturers.

This guide equips procurement teams with actionable benchmarks to assess supplier capability, mitigate risk, and ensure material conformity in international markets.

1. Key Quality Parameters for Steel Products

1.1 Material Specifications

Steel sourced from China must meet internationally recognized material standards based on application:

| Parameter | Standard | Description |

|---|---|---|

| Grade Classification | ASTM A36, A572, S235JR, S355JR, Q235, Q355 | Defines yield strength, tensile strength, and chemical composition. Q-series are common in China; conversion to ASTM/EN required for export. |

| Chemical Composition | GB/T 1591, ASTM, EN 10025 | Controlled levels of C, Mn, Si, S, P, and alloying elements. Critical for weldability and corrosion resistance. |

| Mechanical Properties | Tensile Strength, Yield Strength, Elongation | Must be verified via mill test certificates (MTCs) per batch. |

| Surface Finish | Hot-rolled, Cold-rolled, Galvanized, Powder-Coated | Finish impacts corrosion resistance and dimensional accuracy. |

1.2 Dimensional Tolerances

Tolerances must conform to international standards to ensure interchangeability and fit-for-purpose use:

| Product Type | Standard Tolerance | Reference Standard |

|---|---|---|

| Structural Sections (I-beams, H-beams) | ±1% to ±2% on dimensions | GB/T 11263 / ASTM A6 |

| Steel Plates | Thickness: ±0.2mm to ±0.5mm (based on grade) | GB/T 709 / EN 10029 |

| Steel Pipes | OD: ±0.75%, Wall: ±10% | GB/T 17395 / ISO 11960 |

| Rebar | Diameter: ±0.3mm to ±0.5mm | GB/T 1499.2 / ISO 6935-2 |

Note: Tighter tolerances available upon specification; must be contractually agreed.

2. Essential Certifications for Market Access

Procurement managers must verify that Chinese steel suppliers hold the following certifications, depending on end-market and application:

| Certification | Relevance | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) – ensures consistent production and traceability. |

| CE Marking (EN 1090) | Required for EU Construction Products | Demonstrates conformity with EU Construction Products Regulation (CPR). Includes Factory Production Control (FPC). |

| UL Certification | Required for U.S. Infrastructure & Safety-Critical Applications | Applicable for fire-resistance-rated structures and seismic supports. |

| API 5L / API 5CT | Required for Oil & Gas Projects | Certifies line pipe and casing/tubing for high-pressure environments. |

| FDA Compliance (Indirect) | For food-grade stainless steel (e.g., 304, 316) | Applies to equipment in food processing; verify non-toxic surface treatments. |

| PED (Pressure Equipment Directive) 2014/68/EU | For pressure vessels and piping systems | Required when steel components are used in pressurized systems in Europe. |

Procurement Tip: Request copies of valid certificates, scope of approval, and audit dates. Verify authenticity via certification body portals (e.g., DNV, TÜV, SGS).

3. Common Quality Defects in Chinese Steel Production & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Lamination / Delamination | Internal voids or inclusions from ingot casting | Source from EAF (Electric Arc Furnace) or BOF (Basic Oxygen Furnace) mills with vacuum degassing; require ultrasonic testing (UT) per ASTM A578. |

| Dimensional Inaccuracy | Poor die maintenance or rolling mill calibration | Enforce third-party in-process inspections; specify tolerance bands in purchase order. |

| Surface Cracks / Seams | Rolling defects or thermal stress during cooling | Implement eddy current or MPI (Magnetic Particle Inspection) on finished products. |

| Inconsistent Mechanical Properties | Poor heat treatment or alloy variation | Require batch-specific Mill Test Certificates (MTCs) with full mechanical and chemical reports. |

| Corrosion / Rusting (Pre-Shipment) | Poor storage or inadequate coating | Mandate VCI (Vapor Corrosion Inhibitor) packaging and indoor storage; inspect pre-loading. |

| Weld Zone Failure | Improper filler material or inadequate pre/post-heat treatment | Require WPS (Welding Procedure Specification) and PQR (Procedure Qualification Record) documentation. |

| Coating Defects (Galvanizing) | Uneven zinc layer, bare spots, or peeling | Perform adhesion and thickness testing (e.g., magnetic gauge); audit galvanizing line practices. |

4. Sourcing Best Practices

- Supplier Vetting: Prioritize steel mills with ISO 9001, CE (EN 1090), and third-party audit reports (e.g., SGS, Bureau Veritas).

- On-Site Audits: Conduct factory assessments to evaluate production lines, QC labs, and documentation practices.

- Inspection Protocols: Implement pre-shipment inspection (PSI) with AQL Level II sampling; include dimensional checks, visual inspection, and material verification.

- Traceability: Require heat/lot traceability and digital MTCs compliant with ISO 10474.

- Contractual Clauses: Define penalties for non-conformance, warranty periods, and recall procedures.

Conclusion

Sourcing steel from China offers significant cost and scalability advantages, but requires rigorous technical oversight. By enforcing standardized specifications, validating certifications, and proactively managing quality risks, global procurement teams can secure reliable, compliant, and high-performance steel supply chains.

For SourcifyChina members: Access our verified China Steel Supplier Database with audit scores, certification status, and historical QC performance.

SourcifyChina | Global Sourcing Intelligence 2026

Empowering Procurement Leaders with Data-Driven Supply Chain Solutions

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Manufacturing Costs & OEM/ODM Strategy for Steel Products (China Sourcing)

Date: January 15, 2026

Confidentiality: Internal Use Only

Executive Summary

This report provides actionable insights for sourcing fabricated steel products (e.g., structural components, shelving units, machinery parts) from Chinese manufacturers in 2026. Note: “China Steel Company List” is not a standardized term; this report addresses sourcing from certified steel fabricators, not raw steel commodity trading. Key findings:

– White Label (WL) suits standardized products with minimal customization; Private Label (PL) requires higher investment for brand differentiation.

– Material costs dominate total expenses (60–75%), heavily impacted by global iron ore volatility.

– 2026 cost projections factor in rising labor wages (+4.2% YoY), supply chain resilience premiums (+8–12%), and US Section 301 tariffs (25% on select steel goods).

– Critical risk: IP theft and quality inconsistency remain top concerns; mitigate via third-party audits and clear contractual clauses.

1. Scope Clarification

⚠️ Important: This report covers fabricated steel products (e.g., custom brackets, shelving units, machinery frames), not raw steel sheets/bars. Raw steel is a commodity traded by tonnage (e.g., $700–$900/ton for HRC), with no “White/Private Label” model. Fabricated products enable branding and customization—this is the focus of WL/PL strategies.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Generic product rebranded by buyer; no design changes. | Fully customized design/production for exclusive brand use. |

| MOQ Requirement | Low (500–1,000 units) | Medium-High (1,000–5,000+ units) |

| Upfront Investment | Low ($0–$5k for basic branding) | High ($10k–$50k+ for tooling, design, certifications) |

| Time-to-Market | 4–6 weeks | 12–20 weeks |

| Cost per Unit | Lower (economies of scale) | Higher (customization premiums) |

| Best For | Commoditized products, rapid market entry, low-risk testing | Premium branding, unique IP, long-term market differentiation |

| China Risk Profile | Moderate (quality control only) | High (IP leakage, design theft) |

💡 Procurement Manager Tip: Use WL for testing demand; transition to PL only after 12+ months of stable sales. Always require NDA + IP clauses in contracts with Chinese OEMs.

3. Estimated Cost Breakdown (Per Unit for 6ft Commercial Steel Shelving Unit)

Assumptions: Q235B carbon steel, powder-coated finish, 5,000-unit MOQ baseline. Excludes shipping, duties, QC fees.

| Cost Component | Percentage of Total Cost | 2026 Projected Cost (USD) | Key Variables |

|---|---|---|---|

| Materials | 65–75% | $8.50–$10.20 | Iron ore prices, scrap steel tariffs, alloy grades |

| Labor | 15–20% | $2.00–$2.80 | Regional wage hikes (Guangdong: +5.1% YoY), automation adoption |

| Packaging | 5–10% | $0.60–$1.20 | Custom vs. standard cartons, export compliance (e.g., ISPM-15) |

| Overhead/Profit | 10–15% | $1.20–$1.80 | Factory capacity utilization, order volume |

| TOTAL | 100% | $12.30–$16.00 |

🔍 2026-Specific Risks:

– Material: Iron ore prices volatile due to Australian supply disruptions; expect ±15% swings quarterly.

– Labor: China’s minimum wage increased 6.3% in 2025; factories now charge 12–18% more for skilled welders.

– Tariffs: US Section 301 duties apply to 25% of steel products—factor into landed cost calculations.

4. Price Tier Analysis by MOQ (USD per Unit)

Based on 6ft commercial steel shelving unit (Q235B, powder-coated). All prices exclude shipping, duties, tooling, and QC.

| MOQ | Price Range (USD/unit) | Key Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 | $18.50–$22.00 | High per-unit overhead; premium for small batches; limited factory flexibility | Only for prototyping or niche markets. Avoid for volume. |

| 1,000 | $14.00–$17.50 | Moderate economies of scale; standard tooling costs amortized | Ideal for initial market entry. Requires rigorous QC. |

| 5,000 | $10.50–$13.00 | Optimal for cost efficiency; factory prioritizes volume orders; lower per-unit risk | Recommended for stable demand. Negotiate payment terms (e.g., 30% deposit). |

📌 Critical Footnotes:

– 500-unit MOQ is uncommon for steel fabrication. Most Chinese factories enforce 1,000-unit minimums; below this, costs surge due to setup inefficiencies.

– Custom designs (PL) add $3.00–$7.00/unit vs. WL for the same MOQ.

– Tariff Impact: US-bound shipments incur +25% duty on finished steel goods—add $2.50–$4.00/unit to landed cost.

– Quality Variance: ±15% price differences exist between Tier-1 (e.g., Baosteel affiliates) and Tier-2 factories. Always audit before full order.

5. 2026-Specific Risk Mitigation Strategies

- Supply Chain Resilience: Diversify across 3+ factories in Guangdong, Zhejiang, and Jiangsu to avoid regional disruptions.

- IP Protection: Use “split production” (e.g., design in China, final assembly in Vietnam) and register patents in China before sharing designs.

- Cost Control: Lock in material costs via 6-month forward contracts with Chinese suppliers (e.g., 20% of annual needs at fixed price).

- Logistics: Opt for FCL sea freight (not air) to avoid 40%+ 2026 shipping rate hikes; use bonded warehouses in Rotterdam/Long Beach to defer duties.

6. Actionable Recommendations for Procurement Managers

- Avoid “Raw Steel” Sourcing for Branded Products: Focus on fabricated parts only.

- Start with White Label: Test demand with MOQ 1,000 units before committing to PL.

- Audit Tier-1 Factories: Prioritize suppliers with ISO 9001, SGS certifications, and 5+ years of export experience (e.g., Shandong Steel, Wuhan Iron & Steel subsidiaries).

- Build Buffer Costs: Add 10–12% to budgets for 2026-specific risks (tariffs, logistics, quality contingencies).

- Leverage Digital Platforms: Use Alibaba’s “Trade Assurance” for MOQs <5,000 and insist on video QC checks pre-shipment.

✅ Final Takeaway: In 2026, Chinese steel fabrication remains cost-competitive for volume orders (>5,000 units), but success hinges on rigorous due diligence, clear IP protocols, and flexible cost modeling for volatile raw materials.

Report Prepared By: Global Sourcing Intelligence Team

Data Sources: IHS Markit, China Customs, Alibaba B2B Price Index, S&P Global Commodity Insights (Jan 2026)

Disclaimer: All data is forward-looking and subject to macroeconomic volatility. Verify with local legal counsel before execution.

📎 Appendix: Top 5 Certified Steel Fabricators for 2026 (Verified via SGS Audit):

1. Shandong Steel Group (Qingdao) – ISO 9001, SGS-verified

2. Wuhan Iron & Steel (Baowu Group) – Specializes in high-grade alloy steel

3. Jiangsu Shagang Group – Best for automotive-grade steel components

4. Tangshan Iron & Steel – High-volume capacity (50,000+ units/month)

5. Zhejiang Jingsheng Mechanical – Top ODM for custom shelving/brackets

This report is proprietary. Redistribution prohibited without written consent.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer from the China Steel Company List – Distinguishing Factories from Trading Companies & Red Flags to Avoid

Executive Summary

As global demand for steel products continues to rise, China remains a dominant supplier in the international market. However, sourcing directly from Chinese steel manufacturers presents unique challenges, including misrepresentation, supply chain opacity, and quality inconsistencies. This report outlines a structured, step-by-step verification process to identify legitimate steel factories, differentiate them from trading companies, and recognize critical red flags that could jeopardize procurement outcomes.

This guide is designed for procurement leaders, supply chain strategists, and sourcing managers responsible for mitigating risk, ensuring quality, and optimizing cost in steel supply chains.

1. Critical Steps to Verify a Chinese Steel Manufacturer

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1.1 | Validate Business Registration | Confirm legal existence and operational legitimacy | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like Tianyancha or Qichacha to check business license, registration date, registered capital, and legal representative. |

| 1.2 | Verify Physical Factory Presence | Ensure the entity operates a real production facility | Conduct on-site audits or third-party inspection (e.g., via SGS, Bureau Veritas). Request factory walkthrough videos with time/date stamps and GPS verification. |

| 1.3 | Request Production Capacity Data | Assess scalability and technical capability | Ask for equipment list, production line details, monthly output, and steel grades produced (e.g., Q235, Q355, SS400). Cross-check with industry benchmarks. |

| 1.4 | Review Export History & Certifications | Confirm international compliance and track record | Request export licenses, ISO 9001, ISO 14001, CE, API, or PED certifications. Verify past export shipments via customs data platforms (e.g., ImportGenius, Panjiva). |

| 1.5 | Conduct Sample Testing | Validate product quality and consistency | Order pre-production samples and test at independent labs for mechanical properties, chemical composition, and dimensional accuracy. |

| 1.6 | Audit Supply Chain & Raw Material Sources | Ensure traceability and cost transparency | Request documentation on billets, scrap sourcing, and slab procurement. Evaluate reliance on third-party input materials. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Name | Often includes “Co., Ltd.” + “Steel Mill”, “Iron & Steel”, “Manufacturing” | Generic names like “International Trade”, “Global Sourcing”, “Import & Export” |

| Registered Address | Located in industrial zones (e.g., Tangshan, Handan, Baotou) with large land area | Often in commercial districts or business parks; smaller office space |

| Production Equipment | Lists rolling mills, blast furnaces, EAFs, continuous casting lines | No mention of equipment; focus on logistics and services |

| Website & Marketing | Highlights production lines, factory photos, technical specs, R&D | Emphasizes global reach, “one-stop sourcing”, supplier network |

| Pricing Structure | Offers FOB prices based on mill production costs | May quote higher FOB or CIF; prices may vary frequently due to supplier sourcing |

| Response to Technical Questions | Engineers or plant managers respond with detailed process knowledge | Sales reps with limited technical depth; defer to “our suppliers” |

| MOQ & Lead Time | MOQ aligned with production batch sizes; lead time tied to furnace schedules | Flexible MOQ; lead times may be longer due to coordination with multiple suppliers |

✅ Pro Tip: Ask for a factory tour via live video call during operating hours. A real factory will show active production lines, raw material storage, and quality control stations.

3. Red Flags to Avoid When Sourcing from China’s Steel Sector

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable physical address or refusal to provide factory video | High risk of being a front company or broker | Disqualify until independent verification is completed |

| Inconsistent or vague technical documentation | Risk of substandard or non-compliant product | Require full material test reports (MTRs) and third-party lab validation |

| Unrealistically low pricing | Indicates inferior materials, misrepresentation, or dumping | Benchmark against global steel indices (e.g., SteelBenchmarker, MEPS) |

| Pressure for large upfront payments (e.g., 100% TT before shipment) | High fraud risk | Insist on secure payment terms: 30% deposit, 70% against B/L copy or LC |

| Lack of export experience or customs documentation | Risk of shipping delays, compliance failures | Require proof of past exports and freight forwarder references |

| Use of personal bank accounts for transactions | Indicates unregistered business activity | Require payments only to the company’s official corporate account |

| Claims to represent multiple unrelated product categories (e.g., steel, electronics, textiles) | Likely a trading company with no specialization | Focus on suppliers with steel-specific expertise and vertical integration |

4. Recommended Due Diligence Checklist

✅ Verified business license via NECIPS

✅ On-site or third-party audit completed

✅ Production capacity matches order volume

✅ Valid ISO and product-specific certifications

✅ Sample testing passed by accredited lab

✅ Transparent pricing with clear cost breakdown

✅ Secure payment terms via LC or escrow

✅ Direct contact with technical/production team

Conclusion

Sourcing steel from China offers significant cost advantages, but only when partnered with verified, capable manufacturers. Global procurement managers must adopt a rigorous verification protocol to distinguish true factories from intermediaries and avoid costly supply chain disruptions. By leveraging digital verification tools, demanding transparency, and prioritizing operational due diligence, organizations can build resilient, high-performance steel supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in China-based industrial procurement and supply chain integrity

Q2 2026 | Confidential – For Internal Procurement Use

Get the Verified Supplier List

Call to Action – 2026 Edition

Procurement managers who still waste weeks validating Chinese steel mills are already behind schedule.

Claim your instant-access, 100 % pre-verified “China Steel Company List” from SourcifyChina’s Pro List today and move straight to negotiation.

One file → every ISO-9001/14001, TÜV-audited, export-licensed carbon, stainless, and alloy supplier that can ship to your Incoterms in 2026.

No duplicate contacts, no shell companies, no expired certificates—our Shenzhen team updates the data every 72 hours and guarantees replacement credits if any line item fails verification within 30 days.

Time-saving summary you can paste into your business case:

• 42 h average supplier short-listing time reduced to 4 h (internal client survey, Q1-2026).

• 11 days cut from first inquiry to locked FOB pricing (2025 aggregated RFQ data).

• Zero compliance write-offs: every mill pre-scored for ESG, anti-dumping, and CBAM documentation readiness.

Next step: email [email protected] or WhatsApp +86 159 5127 6160 with “SteelPro-2026” and receive the encrypted list within 15 minutes.

First 50 requests this month also get complimentary background checks on your top three incumbent suppliers—so you can benchmark or negotiate from strength.

Stop screening; start sourcing.

Contact us before the next raw-material price adjustment hits the market.

🧮 Landed Cost Calculator

Estimate your total import cost from China.