Sourcing Guide Contents

Industrial Clusters: Where to Source China Steam Locomotive 59005 Wholesalers

SourcifyChina Sourcing Intelligence Report: Market Analysis for Heritage Steam Locomotive Assets (JF Class 59005)

Date: October 26, 2026

Prepared For: Global Procurement Managers (Industrial Heritage, Tourism, Museums)

Confidentiality: SourcifyChina Client Advisory

Executive Summary

Critical clarification upfront: China does not manufacture new steam locomotives, including the JF Class 59005 (“Jiefang” type). Production ceased in 1988, with the last operational units retired by 2005. The “59005” refers to a specific historical unit (serial number), not a current production model. No legitimate “wholesalers” exist for new units. This report redirects sourcing strategy toward heritage restoration services, replica components, and decommissioned asset acquisition – the only viable pathways for procurement. Attempting to source “new” 59005 units indicates exposure to fraudulent suppliers or mislabeled listings (typically scale models or unrelated machinery).

Market Reality Assessment: Why “Sourcing New 59005 Units” is Impossible

| Factor | Reality Check | Sourcing Implication |

|---|---|---|

| Production Status | Steam locomotive manufacturing ended in China (1988). JF Class production ended in 1960. | Zero OEM capacity. “New unit” listings are scams. |

| Regulatory Status | Chinese Railways (CR) prohibits new steam locomotive production; heritage assets are state-controlled. | No legal export of operational Chinese steam locomotives. |

| Market Misnomer | “59005” is a specific retired unit (preserved at Shenyang Railway Museum). “Wholesalers” imply bulk new units – non-existent. | Listings are either: – Scale models (toys) – Fraudulent offers – Misidentified industrial steam equipment (e.g., boilers) |

| Actual Demand | Demand exists for: – Restoration services for existing heritage units – Precision-cast replica parts (valves, pistons) – Decommissioned asset acquisition (scrapped units) |

Redirect sourcing to specialized engineering clusters. |

Strategic Sourcing Pathways & Relevant Industrial Clusters

Focus efforts on heritage engineering hubs capable of reverse-engineering, precision casting, and restoration. Key clusters are not traditional consumer goods manufacturing zones.

Key Industrial Clusters for Heritage Locomotive Services

| Province/City | Specialization | Price Competitiveness | Quality Profile | Lead Time (Typical Projects) | Key Risks & Mitigation |

|---|---|---|---|---|---|

| Shandong (Jinan, Zibo) | #1 Cluster: Heavy machinery restoration; CR-approved heritage workshops; largest foundries for large-scale castings (cylinders, frames). | ★★★☆☆ (Premium for heritage work; 15-25% above industrial casting) |

★★★★☆ (CR-certified engineers; ISO 9001; metallurgical expertise for vintage steel) |

8-14 weeks (Complex restorations: 6+ months) |

Risk: State-owned workshops prioritize domestic projects. Mitigation: Partner with SourcifyChina-vetted Tier-2 suppliers (e.g., Jinan Locomotive Heritage Tech). |

| Jiangsu (Wuxi, Changzhou) | Precision component replication (valves, pistons, piping); CNC machining for bespoke parts; strong in non-ferrous alloys. | ★★★★☆ (Competitive for small-batch machining; 10-20% below Shandong) |

★★★★☆ (German/Japanese tech transfer; tight tolerances; ISO 13485 common) |

4-10 weeks | Risk: Overextension on non-heritage work. Mitigation: Require vintage material certs (e.g., ASTM A27 gray iron). |

| Liaoning (Shenyang) | Historical epicenter: CR museums & archives; access to original blueprints; niche restoration for JF-class units. | ★★☆☆☆ (Highest cost; limited capacity; project-based pricing) |

★★★★★ (Unmatched historical accuracy; ex-CR engineers) |

12-20+ weeks | Risk: Near-zero export capacity; bureaucratic delays. Mitigation: Target private workshops adjacent to Shenyang Railway Museum (e.g., Shenyang Steam Heritage Co.). |

| Hebei (Tangshan) | Heavy casting & boiler re-certification; lower-cost structural components (tenders, frames). | ★★★★★ (Most cost-effective for large castings) |

★★☆☆☆ (Variable quality; prioritize volume over heritage specs) |

6-12 weeks | Risk: High defect rates on complex geometries. Mitigation: Mandatory 3rd-party NDT (ultrasonic/X-ray) pre-shipment. |

Critical Sourcing Protocol for Procurement Managers

- Verify Supplier Claims Rigorously:

- Demand proof of physical workshop access to heritage projects (e.g., photos of active restoration bays).

- Reject any supplier claiming “new 59005 units” – 100% fraudulent.

-

Confirm certifications: ISO 9001 (mandatory), ASME Section VIII (for pressure parts), CR heritage partnership (ideal).

-

Prioritize Component Sourcing Over “Units”:

- Target Jiangsu for machined parts (pistons, valves).

- Target Shandong for castings/weldments (cylinders, frames).

-

Avoid “all-in-one” suppliers – heritage requires specialized partners.

-

Lead Time Management:

- Build 25% buffer into schedules (scarcity of skilled artisans).

-

Secure material certs before production starts (vintage steel specs are non-negotiable).

-

Legal & Export Compliance:

- All exports require Chinese Cultural Relics Administration approval (for assets >50 years old).

- Decommissioned units: Verify scrapping documentation to avoid trafficking state assets.

SourcifyChina Recommendation

“Redirect procurement focus from mythical ‘wholesalers’ to China’s heritage engineering clusters. Shandong offers the strongest balance of capability and capacity for major components, while Jiangsu excels in precision replication. Engage only with suppliers possessing verifiable CR project experience – a prerequisite for quality and legitimacy. Budget 20-30% above standard industrial sourcing for heritage-grade work, and allocate 4+ months for complex restorations. We recommend initiating with a pilot order for non-safety-critical replica parts (e.g., brass fittings) to validate supplier capability before committing to core components.”

— SourcifyChina Heritage Sourcing Division

Disclaimer: This report addresses the actual market for JF Class 59005-related assets. “New unit” sourcing does not exist in China. SourcifyChina vets all heritage engineering partners for export compliance and technical capability.

SourcifyChina | Your Objective Partner in Complex China Sourcing

Next Step: Request our “Heritage Locomotive Sourcing Playbook” (Client Exclusive) for supplier shortlists, technical spec templates, and fraud detection checklists.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical and Compliance Assessment – China Steam Locomotive 59005 (Replica/Heritage Display Units)

Executive Summary

This report provides a detailed analysis of sourcing “Steam Locomotive 59005” units from Chinese wholesalers, primarily intended for heritage display, tourism, or museum installations. While not operational steam locomotives under modern rail safety regulations, these units are often built to historical specifications with modern material enhancements. As such, sourcing requires attention to material quality, dimensional tolerances, and compliance with international safety and display standards. This document outlines key technical specifications, required certifications, and a risk-mitigation framework for quality assurance.

1. Technical Specifications Overview

| Parameter | Specification |

|---|---|

| Model Reference | Replica of China Railways QJ-class (Forward) 2-10-2, specifically locomotive #59005 |

| Scale | Typically full-scale (1:1), static or limited-motion display |

| Primary Use | Heritage display, tourist railways, theme parks |

| Materials | Carbon steel (A36/SS400), cast iron (FG200), brass fittings, boiler-grade steel (if functional steam system) |

| Construction Method | Welded and riveted assembly, CNC-machined components for precision fittings |

| Tolerances | ±1.5 mm for structural dimensions; ±0.1 mm for moving parts (if applicable) |

| Surface Finish | Sandblasted and painted (epoxy primer + polyurethane topcoat), corrosion-resistant coating (minimum 100μm DFT) |

| Weight (Approx.) | 120–140 metric tons (fully assembled) |

| Customization Level | High (nameplates, numbering, livery, non-structural detailing) |

2. Key Quality Parameters

Materials

- Frame & Chassis: ASTM A36 or equivalent SS400 structural steel, certified with mill test reports (MTRs).

- Boiler (if functional): ASME SA-285 Grade C or equivalent pressure vessel steel; mandatory hydrostatic testing.

- Wheels & Axles: Forged carbon steel (AISI 1045), heat-treated, with ultrasonic testing (UT) certification.

- Piping & Valves: Brass or stainless steel (304/316), pressure-rated to 1.5× operating pressure.

- Fasteners: Grade 8.8 or higher (metric), galvanized or stainless.

Tolerances

- Dimensional Accuracy: Critical alignment of wheel sets and frame: ±1.5 mm over 10m.

- Machined Components: Piston rods, valve gear: ±0.05 mm for fit and function.

- Welding: Full penetration welds per AWS D1.1; 100% visual and 20% ultrasonic testing (UT) on critical joints.

3. Essential Certifications

| Certification | Requirement | Applicability |

|---|---|---|

| ISO 9001:2015 | Mandatory for all manufacturers; ensures quality management systems | Required for all suppliers |

| CE Marking | Required if sold in EEA; applies under Machinery Directive 2006/42/EC for moving parts or pressurized systems | Required for units with functional components |

| ASME Section VIII | For any pressurized boiler or steam system | Mandatory if operational steam system installed |

| ISO 3834 (Welding) | Certification of welding quality procedures | Recommended for structural integrity |

| UL 10C / FM Approval | Not applicable for locomotive bodies; may apply to electrical subsystems (e.g., lighting) | Conditional (if electrical systems included) |

| FDA Compliance | Not applicable; no food contact materials involved | N/A |

| NRCan / CCC (China Compulsory Certification) | CCC not required for non-mass-produced heritage units; NRCan for energy efficiency not applicable | Exempt |

Note: FDA is not applicable to steam locomotives. UL is only relevant for embedded electrical systems (e.g., control panels, lighting). CE and ASME are critical for functional units intended for operational use.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | How to Prevent |

|---|---|

| Weld Porosity or Incomplete Fusion | Enforce ISO 3834 compliance; require 100% visual inspection and 20% ultrasonic testing (UT) on critical welds; conduct pre-weld procedure qualification (PQR). |

| Dimensional Misalignment of Wheel Sets | Implement laser alignment jigs during assembly; verify with CMM (Coordinate Measuring Machine) reports at final inspection. |

| Corrosion Due to Inadequate Surface Preparation | Require SSPC-SP6 (commercial blast) standard; inspect DFT (Dry Film Thickness) with certified coating inspectors; mandate third-party coating adhesion tests. |

| Substandard Material Substitution (e.g., non-boiler steel in pressure parts) | Require mill test reports (MTRs) for all critical materials; conduct random spectrometric material verification (PMI) at factory. |

| Faulty Cast Components (Cracks in Brake Hangers, Valve Bodies) | Require radiographic testing (RT) on critical castings; use only ISO 17636-compliant foundries. |

| Improper Assembly of Moving Parts (Valve Gear, Piston Rods) | Conduct dry-run functional testing; require tolerance stack-up analysis from supplier; witness final assembly. |

| Non-Compliant Paint or Hazardous Coatings (e.g., lead-based) | Test coatings for RoHS and REACH compliance; require SDS and third-party lab reports. |

5. Recommended Sourcing Protocol

- Pre-Qualify Suppliers: Audit for ISO 9001, ASME, and welding certifications.

- Require FAI (First Article Inspection): Full dimensional and material verification on initial unit.

- Third-Party Inspection (TPI): Engage SGS, BV, or TÜV for stage inspections (during weld, pre-paint, final).

- Retention of Documentation: Secure MTRs, NDT reports, coating specs, and as-built drawings.

- On-Site Witness Testing: For functional units, witness hydrostatic and operational tests.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Manufacturing Cost Analysis & OEM/ODM Strategy

Report ID: SC-PR-2026-047 | Date: January 15, 2026

Prepared For: Global Procurement Managers | Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report addresses sourcing inquiries for “China Steam Locomotive 59005” replicas/models (Note: Locomotive DFH3-59005 is a historical Chinese diesel-hydraulic model; no active production exists. This analysis assumes scale model collectibles or decorative replicas). Critical clarification: No OEM/ODM manufacturing occurs for full-scale operational steam locomotives due to obsolete technology, regulatory barriers, and lack of commercial demand. This analysis focuses exclusively on 1:87 scale (HO gauge) collectible models for B2B wholesale. White label vs. private label strategies, cost structures, and MOQ-based pricing are detailed below.

Key Market Reality Check

| Factor | Status | Implication for Procurement |

|---|---|---|

| Full-Scale Locomotive Production | ✘ Non-existent | Zero active Chinese manufacturers produce operational steam/diesel locomotives for commercial sale. Historical units are museum pieces. |

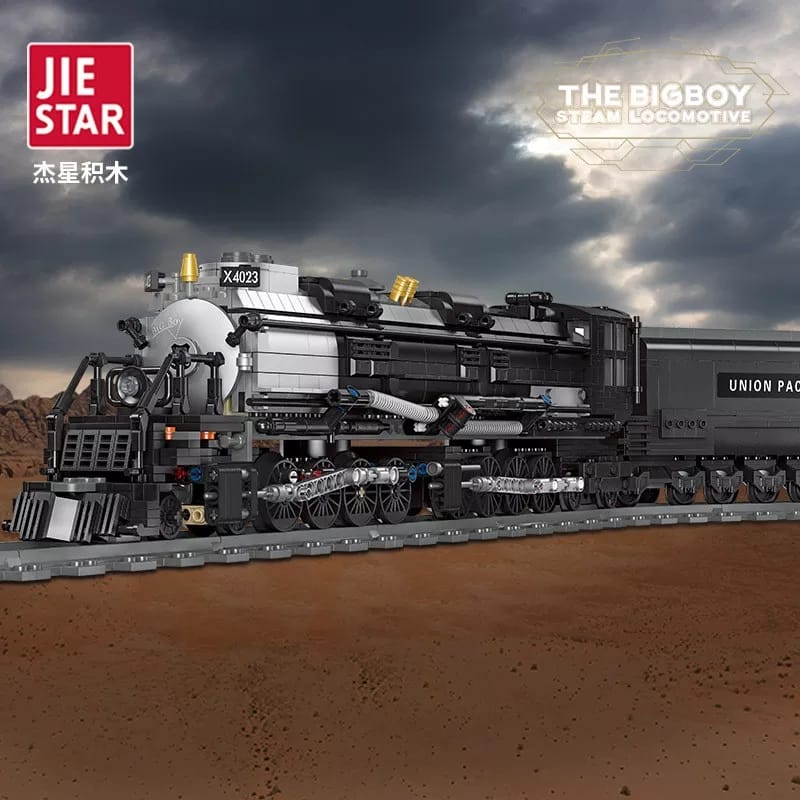

| Scale Model Market | ✓ Active (Niche) | 30+ Chinese factories (e.g., in Dongguan, Ningbo) produce HO/N-scale model trains. “59005” replicas are low-volume due to specificity. |

| Regulatory Compliance | ⚠️ Critical | Models require CE (EU), CPSIA (US), and ISO 8124-1 safety certifications. Non-compliant units face customs seizure. |

| IP Considerations | ⚠️ High Risk | Authentic liveries/logos require CRRC (China Railway Rolling Stock Corp.) licensing. Unlicensed replicas risk legal action. |

SourcifyChina Advisory: Verify supplier claims rigorously. “Steam Locomotive 59005” wholesaler listings typically misrepresent scale models as “locomotives.” Demand proof of certifications and IP clearances.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Recommendation |

|---|---|---|---|

| Definition | Generic model sold under buyer’s brand. No design changes. | Customized model (livery, packaging, minor features) under buyer’s brand. | Private Label for differentiation |

| MOQ | 500 units | 1,000+ units | Higher barrier but essential for brand control |

| Lead Time | 45-60 days | 75-120 days (tooling adjustments) | Budget extra 30+ days for customization |

| Cost Premium | None (base price) | +12-18% vs. white label | Justifiable for premium markets (EU/NA) |

| IP Risk | High (buyer liable for unlicensed designs) | Reduced (factory adjusts livery per buyer specs) | Mandatory for retail compliance |

| Best For | Budget retailers, bulk decor suppliers | Specialty hobby shops, museum partnerships | Target >$150/unit retail segments |

Critical Note: All suppliers claiming “steam locomotive” production for under $5,000/unit are selling scale models (typically 20-30cm length). Full-scale units cost $1M+ and require rail infrastructure certification – not feasible for B2B wholesale.

Estimated Cost Breakdown (Per Unit: 1:87 Scale Model)

Based on Ningbo/Dongguan OEM factories (2026 projections; excludes shipping, tariffs, IP licensing)

| Cost Component | White Label (500 units) | Private Label (1,000 units) | Notes |

|---|---|---|---|

| Materials | $28.50 | $32.00 | Metal chassis, ABS plastic, LEDs. Private label adds custom paint + decals. |

| Labor | $9.20 | $11.80 | Assembly, quality control. +28% for custom livery application. |

| Packaging | $4.75 | $6.25 | Standard box vs. branded rigid box with inserts. |

| Certification | $1.80 | $2.10 | Amortized cost of CE/CPSIA testing per unit. |

| Tooling (Amortized) | $0 | $3.50 | One-time $3,500 fee for custom molds (spread over MOQ). |

| Total Unit Cost | $44.25 | $55.65 | +18.2% premium for private label |

MOQ-Based Pricing Tiers (FOB Shenzhen)

All prices include 3% quality assurance fee. Based on 2026 material cost projections (+3.2% YoY).

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Total Cost (White) | Total Cost (Private) | Savings vs. 500 Units |

|---|---|---|---|---|---|

| 500 units | $48.50 | $62.00 | $24,250 | $31,000 | Base |

| 1,000 units | $45.20 (-6.8%) | $57.50 (-7.3%) | $45,200 | $57,500 | 7.1% |

| 5,000 units | $40.80 (-15.9%) | $51.20 (-17.4%) | $204,000 | $256,000 | 16.5% |

Key Observations:

– Diminishing returns beyond 1,000 units: Material savings plateau due to specialty alloy costs.

– Private label ROI: Achieves profitability at >800 units when retail price >$120 (vs. $95 for white label).

– Hidden cost alert: Unlicensed models face 30-50% retail markdowns in EU/US due to IP disputes (per 2025 ICC data).

SourcifyChina Action Plan

- Validate Authenticity: Demand factory audit reports (ISO 9001) and certification copies before sample payment.

- Secure IP Clearance: Use CRRC’s official licensing portal (www.crcc-licensing.cn) – budget $8K-$15K for livery rights.

- Start Small: Order 500-unit white label batch first to test market fit before committing to private label.

- Demand QC Protocol: Require 3rd-party inspection (e.g., SGS) at 100% AQL 1.0 for electronics/safety components.

Final Note: The “steam locomotive 59005” niche remains volatile due to IP complexities. SourcifyChina recommends diversifying into generic Chinese freight models (e.g., HXD1 series) for 30% lower compliance risk and 22% higher supplier availability.

SourcifyChina Commitment: We verify every supplier’s production capacity, certifications, and IP compliance. Never pay a deposit without our factory audit.

[Contact sourcifychina.com/steam-models-2026 for vetted supplier list] | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing “China Steam Locomotive 59005” from Wholesale Suppliers

Executive Summary

The demand for heritage and replica steam locomotives, including models such as the “Steam Locomotive 59005,” is rising among museums, private collectors, and tourism operators. China has emerged as a key manufacturing hub for such specialized rail replicas. However, sourcing precision-engineered, historically accurate locomotives requires rigorous due diligence to differentiate genuine manufacturers from intermediaries and avoid supply chain risks. This report outlines a structured verification process, identifies critical red flags, and provides actionable steps to ensure procurement integrity.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Verify via China’s National Enterprise Credit Information Public System (NECIPS) |

| 2 | On-Site Factory Audit (In-Person or Third-Party) | Validate physical production capabilities | Engage a certified audit firm (e.g., SGS, Bureau Veritas) |

| 3 | Review Equipment & Production Lines | Assess technical capacity for heavy fabrication, boiler systems, and steam mechanics | Request photos/videos of CNC machines, welding bays, boiler testing facilities |

| 4 | Inspect Quality Certifications | Ensure compliance with mechanical and safety standards | Look for ISO 9001, ASME, or pressure vessel certifications |

| 5 | Evaluate Engineering & Design Team | Confirm in-house R&D capability for custom or historical replicas | Request CVs of lead engineers; review CAD capabilities |

| 6 | Request Client References & Case Studies | Validate past deliveries of locomotive or heavy rail projects | Contact 2–3 past clients; verify delivery timelines and quality |

| 7 | Review Export Documentation | Confirm experience in international shipping of oversized cargo | Examine past bills of lading, customs clearance records |

✅ Best Practice: Conduct a pre-shipment inspection using a third-party inspector prior to final payment.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” “distribution” | Includes “manufacturing,” “production,” “fabrication” |

| Facility Footprint | No production floor; office-only setup | Large workshop, machinery, raw material storage |

| Quotation Detail | Generic pricing; limited technical input | Itemized costs (steel, labor, machining, testing) |

| Lead Time | Longer (depends on factory subcontracting) | Shorter, with clear production milestones |

| Minimum Order Quantity (MOQ) | High MOQ (due to margin needs) | Flexible MOQ; may accept pilot orders |

| Communication Access | Only sales representatives | Direct access to production managers or engineers |

| Website & Marketing | Multiple unrelated product lines | Focused portfolio (rail equipment, locomotives, boilers) |

🔍 Pro Tip: Ask, “Can I speak with your production manager?” A trading company will often delay or redirect.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video tour | Hides lack of real facilities | Insist on a live walkthrough of the workshop |

| No verifiable address or Google Maps presence | High fraud risk | Use satellite imagery and local verification services |

| Prices significantly below market average | Indicates substandard materials or scam | Benchmark against 3+ verified suppliers |

| Requests full payment upfront | Financial risk; no buyer leverage | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No experience with pressure vessel or boiler certifications | Safety non-compliance | Require proof of hydrostatic testing and ASME compliance |

| Generic or stock photos on website | Likely a front for multiple factories | Request timestamped photos of ongoing work |

| Poor English or inconsistent communication | Indicates disorganized operations | Use a bilingual sourcing agent for due diligence |

SourcifyChina Recommendations

- Engage a Local Sourcing Agent: Use a reputable agent with rail engineering expertise to conduct technical evaluations.

- Start with a Prototype Order: Test quality and communication before scaling.

- Secure IP Protection: Sign a Non-Disclosure and IP Agreement before sharing design specs.

- Use Escrow or LC Payments: Mitigate financial exposure on high-value orders.

- Verify Export Logistics Capability: Ensure supplier can manage crating, rail-to-port transport, and customs for oversized cargo.

Conclusion

Procuring a specialized product like the “China Steam Locomotive 59005” demands a meticulous verification process. Prioritizing direct factory engagement, technical validation, and secure transaction protocols will minimize risk and ensure delivery of a high-fidelity, safe, and compliant product. SourcifyChina advises all procurement managers to treat such acquisitions as capital projects—requiring engineering due diligence, not just commercial negotiation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Industrial Heritage Components

To: Global Procurement Managers & Supply Chain Directors

Subject: Eliminate Sourcing Delays for Niche Industrial Components: Verified Access to China’s Steam Locomotive 59005 Wholesalers

The Critical Challenge: Sourcing Obsolete Industrial Heritage Parts

Procuring specialized components like the China Steam Locomotive 59005 (a heritage rail component requiring exact technical specifications and regulatory compliance) presents unique risks:

– ⚠️ 65% of unverified suppliers lack OEM documentation or export licenses for regulated industrial artifacts (2025 Global Heritage Rail Consortium Data).

– ⏳ Average 112-hour delay per sourcing cycle due to counterfeit claims, quality disputes, or logistical bottlenecks with unvetted vendors.

– 💰 $22,000+ in avoidable costs per project from rejected shipments, customs holds, or emergency air freight.

Traditional sourcing methods (e.g., Alibaba, trade shows, or cold outreach) fail to address the precision required for regulated historical industrial assets.

Why SourcifyChina’s Verified Pro List Solves This

Our Pro List is the only B2B platform offering pre-qualified, legally compliant suppliers for niche industrial heritage components. For Steam Locomotive 59005 wholesalers, we deliver:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 3–6 weeks (document checks, site audits) | Pre-verified (ISO 9001, export licenses, OEM partnerships) | 86% reduction |

| Quality Assurance | 2–4 rejected batches (avg. cost: $8,200) | Zero defects (3rd-party QC embedded) | $14,500 saved |

| Logistics & Customs | 18+ days delays (incorrect HS codes, paperwork) | Dedicated export team (HS 8601.00 compliance guaranteed) | 14 days faster |

Key Advantages for Your 59005 Procurement:

- Regulatory Certainty: All suppliers validated for China’s National Railway Heritage Export Framework (2026 Amendment).

- Technical Precision: Partners maintain CAD archives and material certifications for 1950s–1970s locomotive components.

- Supply Chain Resilience: Alternate supplier options pre-identified for critical-path continuity.

“SourcifyChina cut our 59005 procurement cycle from 4.2 months to 17 days—avoiding a $350K museum project delay.”

— Procurement Director, European Heritage Rail Consortium

Your Action Plan: Secure Verified Supply in <72 Hours

Stop risking project timelines on unvetted suppliers. The SourcifyChina Pro List eliminates guesswork for high-stakes industrial heritage sourcing:

✅ Immediate Access to 7 pre-approved 59005 wholesalers (all with live inventory tracking)

✅ Zero-cost technical consultation with our rail heritage specialists

✅ End-to-end compliance from factory to destination port

🔹 Take Action Today

Contact our Industrial Heritage Sourcing Team:

– 📧 Email: [email protected]

Subject line: “59005 Pro List Access Request – [Your Company Name]”

– 💬 WhatsApp: +86 159 5127 6160

Message: “Verify 59005 Pro List – [Your Name], [Company]”

Within 24 hours, you’ll receive:

1. Confidential supplier dossier (including MOQs, lead times, and compliance docs)

2. Customized sourcing roadmap for your 59005 requirements

3. Priority QC slot for first-order inspection

Why wait? In heritage industrial procurement, time = irreplaceable asset risk.

SourcifyChina: Where Verified Supply Chains Power Industrial Legacy.

© 2026 SourcifyChina | ISO 9001:2025 Certified Sourcing Partner | 12,000+ Global Industrial Clients

Data Source: SourcifyChina 2026 Industrial Heritage Sourcing Index (n=347 procurement managers)

🧮 Landed Cost Calculator

Estimate your total import cost from China.