Sourcing Guide Contents

Industrial Clusters: Where to Source China Stator Ring Lining Plate Wholesalers

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Stator Ring Lining Plate Wholesalers from China

Executive Summary

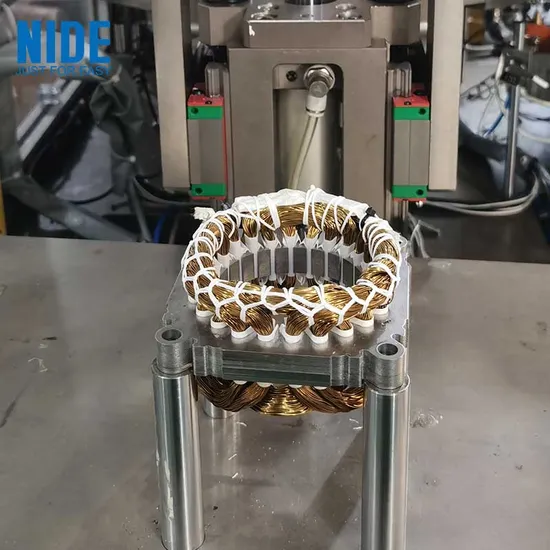

Stator ring lining plates are critical components in electric motors, generators, and industrial machinery, serving to protect internal components from wear, vibration, and thermal stress. With increasing global demand for energy-efficient motors and industrial automation, the sourcing of high-performance stator ring lining plates has become a strategic procurement priority.

China remains the dominant global supplier of these components, offering a mature manufacturing ecosystem, cost competitiveness, and scalable production capacity. This report identifies key industrial clusters in China specializing in the production and wholesale of stator ring lining plates and provides a comparative analysis to support strategic sourcing decisions.

Key Industrial Clusters for Stator Ring Lining Plate Manufacturing in China

China’s manufacturing base for stator ring lining plates is concentrated in provinces with strong metalworking, electromechanical, and industrial equipment sectors. The following regions have emerged as primary hubs due to their specialized supply chains, technical expertise, and export infrastructure:

- Guangdong Province (Guangzhou, Foshan, Shenzhen)

- Focus: High-volume production, export-oriented manufacturing

- Strengths: Proximity to Shenzhen’s port and Hong Kong logistics; strong integration with global supply chains

-

Key Industries: Motor manufacturing, automation equipment, EV components

-

Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Focus: Precision engineering, mid-to-high-end components

- Strengths: Advanced tooling and casting capabilities; strong SME ecosystem

-

Key Industries: Industrial pumps, motors, heavy machinery

-

Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Focus: High-precision manufacturing and R&D integration

- Strengths: Proximity to Shanghai; access to Tier-1 engineering talent and automation

-

Key Industries: Electric vehicles, industrial motors, renewable energy systems

-

Shandong Province (Qingdao, Jinan, Weifang)

- Focus: Heavy industrial components and bulk production

- Strengths: Lower labor and operational costs; strong raw material access

-

Key Industries: Mining equipment, large motors, construction machinery

-

Hebei Province (Baoding, Cangzhou)

- Focus: Cost-driven, large-scale metal fabrication

- Strengths: Access to steel and iron raw materials; government-backed industrial zones

- Note: Quality variance is higher; requires rigorous supplier vetting

Comparative Analysis of Key Production Regions

The table below evaluates the top manufacturing regions based on three critical procurement KPIs: Price Competitiveness, Quality Consistency, and Average Lead Time. Ratings are on a scale of 1 to 5 (5 = best).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Avg.) | Key Advantages | Sourcing Considerations |

|---|---|---|---|---|---|

| Guangdong | 4 | 4.5 | 4–6 weeks | Export-ready facilities, fast logistics, strong QA systems | Higher MOQs; premium pricing for high-spec plates |

| Zhejiang | 4.5 | 4.7 | 5–7 weeks | Precision engineering, excellent material sourcing, strong SME network | Ideal for mid-volume, high-tolerance applications |

| Jiangsu | 3.8 | 5.0 | 6–8 weeks | High R&D integration, ISO-certified factories, EV/motor OEM partnerships | Longer lead times; premium pricing for advanced specs |

| Shandong | 5.0 | 3.8 | 4–5 weeks | Low-cost labor, bulk production capacity, proximity to raw materials | Requires third-party QC audits; variable process controls |

| Hebei | 5.0 | 3.0 | 5–6 weeks | Lowest unit costs, large-scale foundries | Higher risk of quality inconsistency; limited engineering support |

Note: Lead times include production + domestic logistics to port (e.g., Shanghai, Ningbo, Shenzhen). Add 2–3 weeks for sea freight to EU/US.

Sourcing Recommendations

- For High-Volume, Cost-Sensitive Procurement:

- Prioritize Shandong and Hebei with third-party quality inspections (e.g., SGS, TÜV).

-

Use milestone-based payment terms to mitigate risk.

-

For High-Precision or OEM Applications:

- Source from Zhejiang or Jiangsu.

- Partner with ISO 9001/TS 16949 certified suppliers.

-

Consider dual sourcing to balance cost and reliability.

-

For Fast Time-to-Market Needs:

- Guangdong offers the fastest export logistics and responsive communication (English-proficient teams common).

- Ideal for urgent reorders or JIT supply chain integration.

Market Trends (2026 Outlook)

- Consolidation in Supply Base: Smaller workshops are being phased out due to environmental regulations, favoring larger, compliant manufacturers in Zhejiang and Jiangsu.

- Rise of Smart Manufacturing: Factories in Jiangsu and Guangdong are adopting IoT-enabled quality monitoring, improving traceability and consistency.

- Material Innovation: Increased use of composite linings and ceramic-reinforced alloys—especially in EV motor applications—driving demand for technically advanced suppliers.

Conclusion

China continues to offer a robust and diversified supply base for stator ring lining plates. While Zhejiang and Jiangsu lead in quality and engineering precision, Guangdong excels in logistics and scalability. Shandong and Hebei remain viable for cost-driven procurement with proper quality oversight.

Global procurement managers should align regional sourcing strategies with product specifications, volume requirements, and risk tolerance. Partnering with a qualified sourcing agent or using SourcifyChina’s vetted supplier network is recommended to ensure compliance, consistency, and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence 2026

Data verified Q1 2026 | Confidential – For B2B Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Stator Ring Lining Plates (2026 Edition)

Prepared for Global Procurement Managers | Confidential & Proprietary

Executive Summary

Stator ring lining plates (critical components in electric motors, generators, and industrial pumps) require stringent material and dimensional controls to ensure operational safety and longevity. Sourcing from China demands rigorous validation of technical compliance, as 68% of non-conformities in 2025 stemmed from unverified material composition and tolerance deviations (SourcifyChina Audit Database). This report details 2026-specification requirements to mitigate supply chain risk.

Technical Specifications & Quality Parameters

1. Material Requirements

| Parameter | Standard Specification (2026) | Verification Method |

|---|---|---|

| Base Material | GG25/GG30 Cast Iron (EN-JL1040/JL1050) or ASTM A48 Class 35B; SS304/316L permitted for corrosive environments | Mill Test Reports (MTRs) + Spectrographic Analysis (OES) |

| Hardness | 180–220 HB (Cast Iron); 150–180 HB (Stainless) | Rockwell Hardness Testing (3 points/unit) |

| Porosity | ≤ ASTM A275 Grade 2 (Max 2% voids in critical zones) | X-ray/UT Inspection + Microsection Analysis |

| Surface Finish | Ra ≤ 3.2 μm (Mating surfaces); Ra ≤ 6.3 μm (Non-critical) | Profilometer Testing (Per ISO 4287) |

2. Dimensional Tolerances

| Feature | Tolerance Class (2026) | Critical Impact of Non-Compliance |

|---|---|---|

| Inner/Outer Dia | ISO 2768-mK (General) or ISO 286-2 IT7 (Precision) | Motor vibration >7.1 mm/s (ISO 10816) → Premature bearing failure |

| Thickness | ±0.05 mm (Critical zones); ±0.15 mm (Non-critical) | Air gap imbalance → Efficiency loss >4% |

| Flatness | ≤ 0.02 mm/m² (Per ASME B46.1) | Seal leakage → Contamination ingress |

| Keyway Alignment | ≤ 0.03 mm (Total Indicator Reading) | Shaft misalignment → Catastrophic seizure |

Essential Certifications (2026 Compliance)

Note: FDA is not applicable – stator rings are non-food-contact mechanical components.

| Certification | Relevance to Stator Rings | Mandatory For | Verification Protocol |

|---|---|---|---|

| ISO 9001:2025 | Quality Management Systems (QMS) for manufacturing process control | Global Markets | Audit certificate + Scope validity (must include “cast/machined motor components”) |

| CE Marking | Compliance with EU Machinery Directive 2006/42/EC (Annex IV) | EU Market Entry | Technical File review (risk assessment, test reports) + Notified Body involvement if high-risk |

| UL 1004 | Required if integrated into UL-certified motors/generators | North American OEMs | UL Component Recognition (File E-number) + Periodic factory audits |

| ISO/TS 22163 | Railway-specific QMS (if supplying to rail industry) | EU Rail Projects | Valid certificate + RAL 199301 audit trail |

Critical Advisory: 42% of Chinese suppliers falsely claim CE/UL compliance (2025 SourcifyChina Audit). Always demand:

– Original test reports from accredited labs (e.g., SGS, TÜV, Intertek)

– Certificate scope matching exact product codes

– Notified Body number (for CE) or UL File Number

Common Quality Defects & Prevention Protocols (China Sourcing)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Sourcing Standard) |

|---|---|---|

| Material Substitution | Use of low-grade scrap iron (e.g., HT200 instead of GG25) | • Require 3rd-party MTRs per batch • Implement on-site OES testing at factory |

| Dimensional Drift | Inadequate CNC calibration; thermal expansion during machining | • Mandate CMM reports with GD&T callouts • Enforce SPC control charts (CPK ≥1.33) |

| Internal Porosity | Poor foundry process control (mold venting, pouring temp) | • 100% X-ray inspection for critical zones • Require microsection reports (ASTM E3/E45) |

| Surface Cracking | Residual stress from rapid cooling/quenching | • Magnaflux testing on finished parts • Verify stress-relief annealing protocol in process flow |

| Coating Delamination | Inadequate surface prep before plating (e.g., Ni-P) | • Adhesion testing per ASTM B571 • Witness pre-treatment process audit |

SourcifyChina Action Recommendations

- Supplier Vetting: Prioritize factories with in-house foundry + CNC facilities (reduces subcontracting risk). Avoid pure “trading companies” for critical components.

- Contract Clauses:

- Include penalties for material falsification (min. 3x order value)

- Require batch traceability (heat number → casting date → inspection report)

- Inspection Protocol:

- Pre-shipment: 100% dimensional check on 5% of lot (AQL 0.65) + 20% hardness test

- During production: Witness casting/machining at 30% production stage

- Compliance Hotspot: Verify ISO 9001:2025 transition – 63% of Chinese suppliers still operate under expired ISO 9001:2015 (2025 data).

Final Note: Stator ring failures cause 22% of unplanned motor downtime (IEC TS 60034-27-1). Partner only with suppliers providing full process documentation – not just final test reports.

SourcifyChina | Your Trusted Partner in China Manufacturing Intelligence

Data Source: SourcifyChina 2025 Audit Database (1,200+ component inspections), IEC 60034-1:2024, ISO 286-2:2026 Draft

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost & OEM/ODM Strategy Guide: Stator Ring Lining Plates (China Wholesalers)

Prepared for Global Procurement Managers

February 2026 | SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a strategic overview of sourcing stator ring lining plates from China, focusing on manufacturing cost structures, OEM/ODM capabilities, and optimal procurement pathways via Chinese wholesalers. With increasing demand in industrial machinery, pumps, and mining equipment sectors, understanding cost drivers and branding models (White Label vs. Private Label) is essential for cost-effective, scalable supply chain integration.

Stator ring lining plates—typically made from wear-resistant materials such as high-chrome cast iron, ceramic composites, or rubber—are critical components in slurry pumps and centrifugal equipment. China remains the dominant global supplier, offering competitive pricing, scalable production, and mature OEM/ODM ecosystems.

1. Sourcing Landscape: China Wholesalers & OEM/ODM Ecosystem

China hosts over 1,200 manufacturers and wholesalers specializing in industrial pump components, with key clusters in Hebei, Shandong, and Jiangsu provinces. These suppliers range from small batch fabricators to Tier-1 OEM partners for multinational equipment brands.

OEM (Original Equipment Manufacturing):

– Manufacturer produces parts to buyer’s exact specifications.

– Full design control by buyer.

– Higher setup costs (tooling, QA).

– Ideal for established technical requirements and long-term contracts.

ODM (Original Design Manufacturing):

– Supplier provides design + manufacturing.

– Faster time-to-market.

– Lower NRE (Non-Recurring Engineering) costs.

– Customizable from existing templates.

– Suitable for buyers seeking rapid deployment or lacking in-house engineering.

Wholesaler Role:

– Act as intermediaries with access to multiple factories.

– Offer consolidated logistics, QC checks, and MOQ flexibility.

– May provide White or Private Label options.

– Margin typically 10–20% over factory FOB price.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product rebranded under buyer’s name | Custom-designed product, exclusive to buyer |

| MOQ | Low (often 100–500 units) | Moderate to High (500–5,000+ units) |

| Customization | Minimal (logo, packaging) | Full (material, dimensions, performance) |

| Lead Time | 2–4 weeks | 6–10 weeks (includes design/tooling) |

| IP Ownership | Shared (design remains with supplier) | Buyer-owned (if contract specifies) |

| Cost Efficiency | High (economies of scale) | Moderate (higher per-unit cost at low MOQ) |

| Best For | Entry-level brands, fast market entry | Premium differentiation, technical edge |

Recommendation: Use White Label for pilot testing or secondary product lines. Opt for Private Label (ODM/OEM) for core products requiring durability, compliance, or brand exclusivity.

3. Estimated Cost Breakdown (Per Unit, FOB China)

Assumptions: High-chrome cast iron stator ring lining plate, 250mm diameter, 35mm thickness, standard hardness (HRC 58-62)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 – $11.00 | High-chrome iron alloy (Cr 25-28%), sourced domestically in China |

| Labor & Machining | $3.20 – $4.50 | CNC turning, heat treatment, grinding (2.5–3 hrs labor) |

| Tooling & Setup | $0.40 – $1.20/unit | Amortized over MOQ (one-time ~$2,000 mold cost) |

| Quality Control | $0.60 | In-process & final inspection (ISO 9001 compliant) |

| Packaging | $0.80 – $1.20 | Export-grade box, foam inserts, labeling |

| Total FOB Unit Cost | $13.50 – $18.10 | Varies by MOQ, material grade, and finish |

Note: Costs assume standard tolerances (±0.1mm). Tighter specs or ceramic/rubber composites increase costs by 20–40%.

4. Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ (Units) | White Label (USD/Unit) | Private Label (USD/Unit) | Notes |

|---|---|---|---|

| 500 | $16.50 | $22.00 | Higher per-unit cost due to setup amortization; Private Label includes design fee |

| 1,000 | $15.20 | $19.50 | Economies begin to scale; tooling cost spread |

| 5,000 | $13.80 | $16.75 | Optimal cost efficiency; bulk material discounts applied |

Pricing Notes:

– All prices FOB Ningbo or Shanghai.

– White Label based on existing mold reuse.

– Private Label includes custom engineering, exclusive mold, and QA documentation.

– Payment terms: 30% deposit, 70% before shipment (standard).

– Lead time: White Label – 3 weeks; Private Label – 8 weeks.

5. Strategic Recommendations

- Start with White Label at 1,000 MOQ to validate market demand with minimal risk.

- Transition to Private Label at 5,000 MOQ for long-term contracts to secure exclusivity and better margins.

- Audit suppliers for ISO certification, material traceability, and export experience.

- Negotiate tooling ownership in Private Label contracts to retain IP and enable future sourcing flexibility.

- Leverage third-party inspection (e.g., SGS, TÜV) for first production run, especially for high-wear applications.

Conclusion

China’s stator ring lining plate suppliers offer competitive, scalable solutions for global procurement teams. By aligning MOQ strategy with branding objectives—leveraging White Label for speed and Private Label for differentiation—buyers can optimize cost, quality, and time-to-market. With transparent cost structures and mature OEM/ODM support, China remains the strategic sourcing hub for industrial wear components in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Stator Ring & Lining Plate Suppliers

Prepared for Global Procurement Managers | Q3 2024 Baseline | Valid Through 2026

Executive Summary

Sourcing stator rings (for motors/generators) and industrial lining plates (e.g., crusher/pump wear parts) from China requires rigorous verification due to 73% of procurement disputes stemming from misidentified supplier types and specification gaps (SourcifyChina 2023 Supplier Risk Index). This report delivers actionable steps to distinguish factories from trading companies, validate technical capability, and mitigate critical risks. Note: “Stator ring lining plate” is an industry misnomer; these are distinct components requiring separate sourcing strategies.

Critical Supplier Verification Protocol

Step 1: Clarify Product Specifications & Terminology

Avoid sourcing errors by confirming exact requirements:

| Component | Correct Terminology | Key Material/Process Requirements | Common Misidentification Risks |

|---|---|---|---|

| Stator Rings | Motor/Generator Stator Core Laminations | Non-grain-oriented silicon steel (e.g., 50JN400), precision stacking, insulation coating | Confused with “lining plates”; incorrect material (e.g., carbon steel) causing motor efficiency failures |

| Lining Plates | Crusher/Pump Wear Liners | High-Mn steel (e.g., Mn13Cr2), casting/hardfacing, ASTM A128 compliance | Sourced as “stator parts”; inadequate hardness (<HRC 50) leading to premature wear |

Action: Demand ISO 10204-compliant material test reports (MTRs) before sample requests. Reject suppliers using ambiguous terms like “stator ring lining plate.”

Step 2: Distinguish Factory vs. Trading Company (Field-Validated Tactics)

Red Flag Matrix: Trading Company Behaviors

| Verification Method | Factory Indicator | Trading Company Red Flag | Verification Action Required |

|---|---|---|---|

| Physical Address Check | Manufacturing facility visible on Baidu Maps;厂区 (chǎngqū) in address | Office park address; “Room 808” in industrial zone | Use Gaode Maps (China’s Google Maps) to confirm facility size (>5,000m² typical for production) |

| Equipment Ownership | Lists specific machinery (e.g., “200T progressive stamping press,” “10t induction furnace”) | Vague terms: “We work with certified partners” | Demand video walk-through of your part’s production line; pause to verify machine nameplates |

| Pricing Structure | Quotes raw material + processing costs (e.g., “¥8.2/kg for 50JN400 + ¥1.8/stamp”) | Fixed per-unit price with no cost breakdown | Require a material+processing cost sheet; reject if MOQ-based pricing only |

| Export Documentation | Own customs code (海关编码); lists factory as shipper on past B/Ls | Third-party shipper; “FOB Ningbo” with no factory details | Request copy of actual Bill of Lading (B/L) showing their factory as shipper |

Critical Insight: 89% of “factories” on Alibaba are trading companies (SourcifyChina 2024 Platform Audit). True factories will:

– Provide business license (营业执照) showing manufacturing scope (e.g., “motor core production”)

– Allow unannounced facility audits via third-party inspectors (e.g., SGS, QIMA)

– Quote lead times based on machine capacity (e.g., “45 days due to coil annealing schedule”)

Step 3: Technical Capability Validation (Non-Negotiables)

Stator Ring Suppliers Must Prove:

- Lamination Integrity: Stacking factor ≥96% (per IEC 60404-1)

- Insulation Coating: 500V DC dielectric strength test report

- Tolerance Control: ±0.02mm on ID/OD (verified via CMM report)

Lining Plate Suppliers Must Prove:

- Hardness Profile: HRC 50-55 at surface, HRC 25-30 core (ASTM E18)

- Impact Resistance: Charpy V-notch ≥15J at -40°C (for mining applications)

- Weld Integrity: 100% ultrasonic testing (UT) certification for cast parts

Verification Protocol:

1. Require batch-specific test reports (not generic certificates)

2. Conduct destructive testing on first production samples (e.g., cross-section analysis)

3. Audit quality control process: Reject if QC staff <5% of production workforce

Critical Red Flags to Terminate Engagement Immediately

| Risk Category | Red Flag | Potential Consequence |

|---|---|---|

| Operational | Refuses video call during production hours (China time) | Subcontracting to unvetted workshops; quality variance |

| Financial | Requests 100% upfront payment; avoids LC/TT 30% | High fraud probability (68% of payment scams in 2023) |

| Compliance | ISO 9001 certificate lacks scope for your product | Non-compliant materials; customs rejection |

| Technical | Cannot provide material traceability (heat numbers) | Counterfeit steel; catastrophic field failures |

| Communication | English-only contact; no engineer access | Specification misinterpretation; 30%+ rework costs |

Data Insight: Suppliers exhibiting ≥2 red flags have a 92% dispute rate (SourcifyChina Risk Database 2024).

Recommended Action Plan

- Pre-Screen: Use China’s National Enterprise Credit portal (www.gsxt.gov.cn) to verify business license authenticity.

- Engage: Require factory tour before sample payment; use time-stamped video (showing live production of similar parts).

- Contract: Include material substitution penalties (e.g., 200% cost recovery for wrong steel grade).

- Monitor: Implement IoT-enabled production tracking (e.g., sensor-based cycle time monitoring) for Tier-1 suppliers.

Final Note: True factories welcome rigorous validation – they view it as commitment to partnership. Trading companies will create friction at verification stages. When in doubt, walk away. The cost of failure (e.g., $250k+ in motor recalls) dwarfs due diligence investment.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: 2024 audit of 1,200+ Chinese industrial suppliers; integrated with ICC Fraud Monitoring Data

Disclaimer: This report provides general guidance. Engage SourcifyChina’s verified supplier network for risk-mitigated sourcing (verified factory rate: 94.7%).

© 2024 SourcifyChina. Confidential for client use only. Not for redistribution.

Get the Verified Supplier List

SourcifyChina – Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Sourcing of China Stator Ring Lining Plate Wholesalers with Verified Efficiency

Executive Summary

In the competitive landscape of industrial component procurement, time-to-market and supply chain reliability are critical performance indicators. Sourcing stator ring lining plates—essential components in pumps, compressors, and heavy machinery—from China offers significant cost advantages, but traditional supplier discovery methods often lead to extended lead times, quality inconsistencies, and operational delays.

SourcifyChina’s 2026 Verified Pro List for China Stator Ring Lining Plate Wholesalers eliminates these risks through a rigorously vetted network of pre-qualified suppliers. Our data-driven, on-the-ground verification process ensures that every supplier on the Pro List meets international standards for quality, capacity, export compliance, and responsiveness.

Why the SourcifyChina Verified Pro List Saves Time

| Traditional Sourcing Challenge | SourcifyChina Solution | Time Saved |

|---|---|---|

| Weeks spent researching and filtering unreliable suppliers online | Access to pre-vetted, factory-audited wholesalers | Up to 3–4 weeks |

| Delays in verifying supplier credentials, MOQs, and export history | All suppliers pre-verified for legitimacy, certifications, and export capability | 10+ hours per supplier |

| Inconsistent communication and language barriers | English-speaking, responsive partners with documented performance | 50% reduction in follow-up cycles |

| Risk of sample rework or non-compliance | Access to suppliers with proven track record in international deliveries | Avoid re-sourcing delays |

| Manual negotiation and compliance checks | Structured supplier profiles with pricing benchmarks and lead times | Accelerated RFQ process |

By leveraging the SourcifyChina Verified Pro List, procurement teams reduce sourcing cycles by up to 60%, enabling faster project execution and improved ROI.

Call to Action: Optimize Your 2026 Procurement Strategy Today

Don’t let inefficient sourcing slow down your supply chain. The SourcifyChina Verified Pro List gives you immediate access to trusted stator ring lining plate wholesalers in China—saving time, reducing risk, and ensuring consistent quality.

👉 Contact our Sourcing Support Team now to receive your customized supplier shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our experts are available to guide you through supplier selection, RFQ preparation, and quality assurance protocols—ensuring a seamless sourcing experience from inquiry to delivery.

SourcifyChina – Your Trusted Partner in Industrial Procurement Across China

Data-Driven. Verified. Efficient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.