Sourcing Guide Contents

Industrial Clusters: Where to Source China State Owned Companies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing from China’s State-Owned Enterprises (SOEs)

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

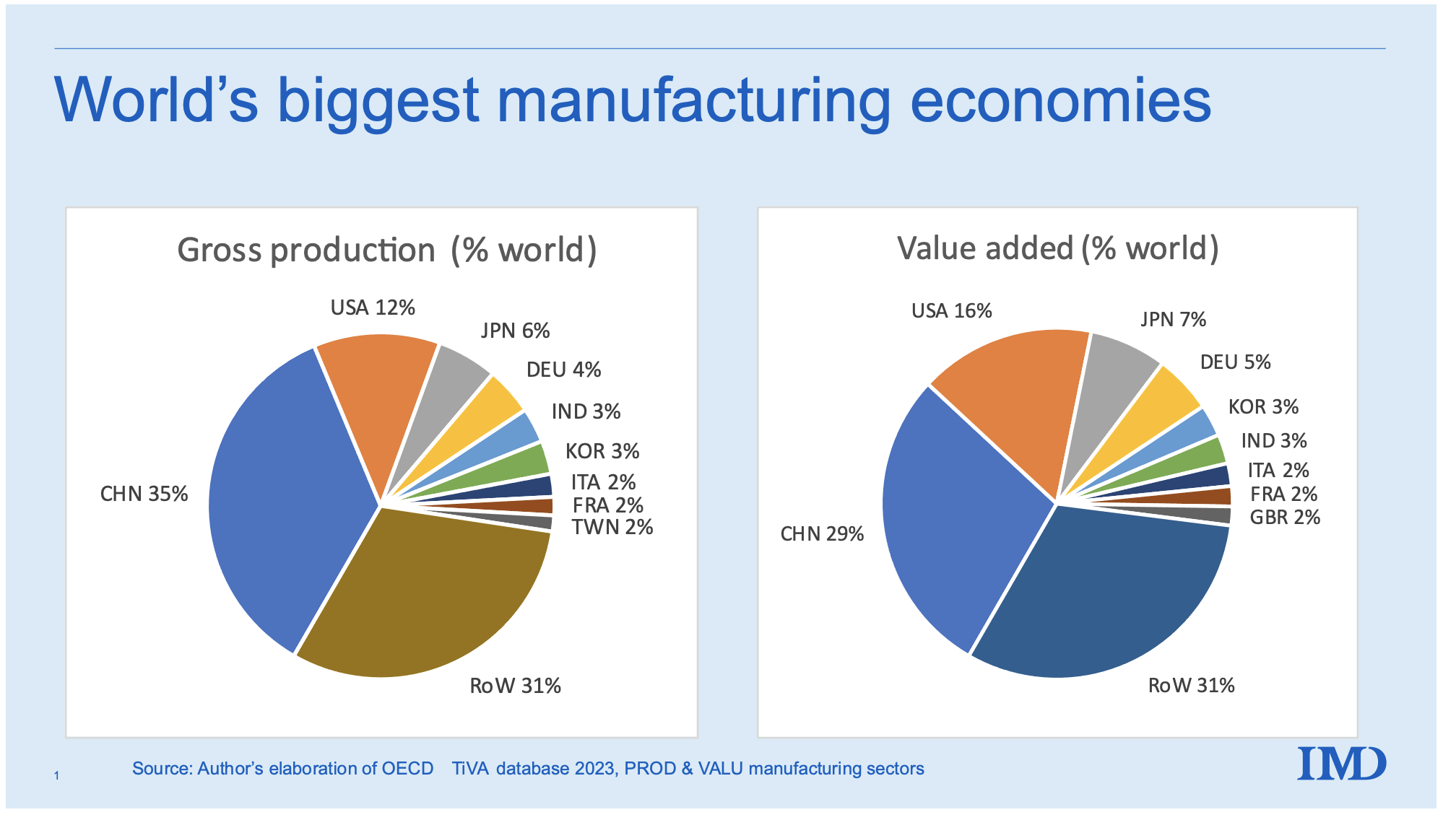

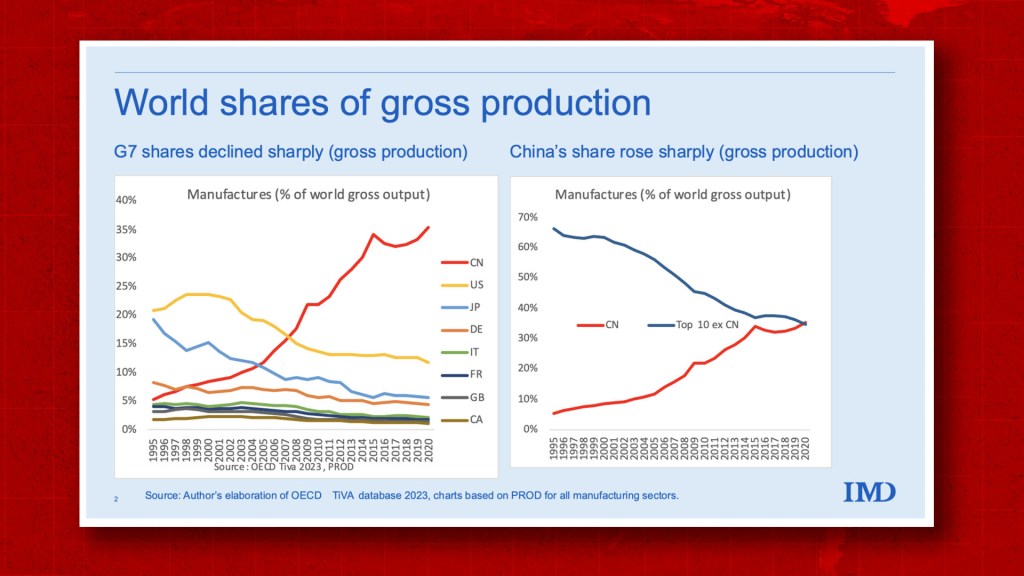

This report provides a comprehensive analysis of sourcing opportunities from China’s State-Owned Enterprises (SOEs), focusing on key industrial clusters, sectoral strengths, and regional performance metrics. As China continues to leverage its SOEs to drive strategic industrial policy, global procurement leaders must understand the geographic, operational, and economic dynamics that define sourcing from these entities.

SOEs in China are concentrated in heavy industry, energy, infrastructure, advanced manufacturing, and strategic technology sectors. Unlike private-sector suppliers, SOEs benefit from long-term government support, capital access, and scale—making them ideal partners for large-volume, long-term, and technically complex procurement contracts.

This report identifies key provinces and cities hosting major SOEs, evaluates their comparative advantages, and provides a data-driven comparison of performance across Price, Quality, and Lead Time.

Key Industrial Clusters for China’s State-Owned Enterprises

China’s SOEs are strategically located across the country to serve national development goals. The following provinces and cities are recognized as primary hubs for SOE-driven manufacturing and industrial output:

| Province/City | Key SOE Industries | Notable SOEs | Strategic Advantages |

|---|---|---|---|

| Guangdong | Advanced Electronics, Heavy Machinery, Automotive | China Southern Power Grid, CRRC Guangzhou, Sinochem Guangdong | Proximity to Hong Kong; strong export infrastructure; integration with Greater Bay Area supply chains |

| Zhejiang | Industrial Equipment, Petrochemicals, High-Tech Manufacturing | Sinopec Zhenhai Refining, Zhejiang Energy Group | Strong private-public collaboration; high automation; skilled technical labor |

| Jiangsu | Aerospace Components, Shipbuilding, Power Equipment | State Power Investment Corporation (SPIC), CSIC subsidiaries | Coastal access; dense network of Tier-1 suppliers; advanced R&D infrastructure |

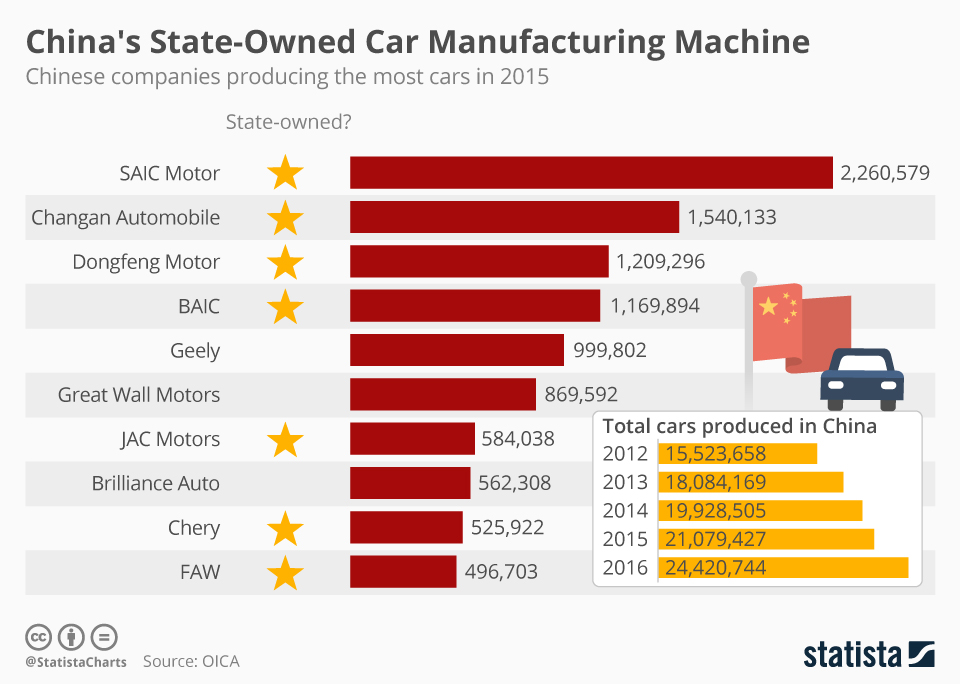

| Shanghai | High-End Manufacturing, Biopharma, Semiconductors | SAIC Motor, Shanghai Electric, Sinopharm | Global financial hub; strong IP protection; access to international talent |

| Shandong | Petrochemicals, Steel, Heavy Machinery | Sinopec Qilu, Shandong Energy Group | Largest industrial output in China; extensive raw material processing |

| Liaoning | Shipbuilding, Rail Transit, Defense | AVIC Shenyang Aircraft, CSSC Dalian Shipbuilding | Legacy industrial base; specialized in defense and heavy engineering |

| Sichuan | Aerospace, Defense, Energy | China Aerospace Science & Industry Corp (CASIC), China National Nuclear Corp | Inland strategic location; government-backed R&D lower labor costs |

Comparative Performance of Key SOE Manufacturing Regions

The table below compares key SOE manufacturing regions based on Price Competitiveness, Quality Standards, and Lead Time Efficiency—critical KPIs for global procurement decision-making.

| Region | Price (1–5 Scale) | Quality (1–5 Scale) | Lead Time (Weeks) | Remarks |

|---|---|---|---|---|

| Guangdong | 3.5 | 4.5 | 8–12 | High quality due to advanced facilities; moderate pricing; longer lead times due to high order volume |

| Zhejiang | 4.0 | 4.0 | 6–10 | Competitive pricing; strong process efficiency; quality consistent for industrial equipment |

| Jiangsu | 3.0 | 4.8 | 10–14 | Premium quality in aerospace and power systems; higher costs; longer lead times due to complexity |

| Shanghai | 2.5 | 5.0 | 12–16 | Highest quality (ISO, AS9100, GMP certified); premium pricing; extended lead times due to compliance and customization |

| Shandong | 4.5 | 3.5 | 6–9 | Lowest cost for bulk materials; quality varies by segment; fast turnaround for standardized goods |

| Liaoning | 3.8 | 4.2 | 10–13 | Specialized in defense-grade outputs; moderate pricing; lead times affected by security protocols |

| Sichuan | 4.2 | 4.0 | 8–11 | Balanced cost and quality; growing high-tech sector; lead times stable due to inland logistics improvements |

Scale Notes:

– Price: 1 = High Cost, 5 = Low Cost

– Quality: 1 = Basic Compliance, 5 = World-Class (International Certifications, Precision Engineering)

– Lead Time: Estimated average production + inland logistics to port (ex-works to FOB)

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Procurement:

Target Shandong and Zhejiang for standardized industrial goods such as steel, petrochemicals, and machinery components. -

For High-Reliability, Precision Equipment:

Prioritize Shanghai and Jiangsu for aerospace, power generation, and semiconductor capital equipment. -

For Long-Term Strategic Partnerships:

Engage Guangdong-based SOEs for integration into Greater Bay Area supply chains, especially in electric vehicles and smart infrastructure. -

For Defense and Dual-Use Technology:

Exercise due diligence when sourcing from Liaoning and Sichuan, as export controls and ITAR regulations may apply. -

Leverage Government Initiatives:

Utilize bilateral MOUs and Belt and Road cooperation frameworks to secure favorable terms with SOEs in priority sectors.

Risk Considerations

- Geopolitical Sensitivity: SOEs in strategic sectors (e.g., defense, semiconductors) may face export restrictions or sanctions.

- Bureaucratic Processes: Decision-making in SOEs can be slower due to hierarchical approvals.

- Intellectual Property (IP): Ensure robust IP clauses in contracts, especially when co-developing technology.

- Sustainability Compliance: Increasing pressure on SOEs to meet ESG benchmarks; verify environmental certifications.

Conclusion

China’s SOEs remain pivotal to global supply chains, particularly in capital-intensive and technologically advanced sectors. While regional performance varies, procurement managers can optimize sourcing outcomes by aligning product requirements with the comparative strengths of each industrial cluster.

By leveraging this regional intelligence, global buyers can achieve cost efficiency, quality assurance, and supply chain resilience—even in a complex and evolving geopolitical landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Procurement from Chinese State-Owned Enterprise (SOE) Affiliated Manufacturers

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Confidential

Executive Summary

Sourcing from Chinese State-Owned Enterprises (SOEs) or their affiliated manufacturing subsidiaries requires nuanced understanding: SOE status does not inherently guarantee product quality or compliance. While SOEs often possess robust infrastructure and scale advantages, technical specifications and regulatory adherence align with product category requirements, not ownership structure. This report clarifies critical parameters for risk-mitigated procurement.

Key Insight: SOEs operate under China’s State-owned Assets Supervision and Administration Commission (SASAC) framework, prioritizing national policy alignment over Western compliance. Your quality assurance protocols must remain product-centric, not entity-centric.

I. Technical Specifications: Product-Agnostic Quality Parameters

Note: Parameters vary by product category. SOE factories must meet these to export to regulated markets.

| Parameter | Critical Thresholds | SOE-Specific Considerations |

|---|---|---|

| Material Sourcing | • Traceable mill certificates (e.g., EN 10204 3.1) • Zero tolerance for restricted substances (RoHS, REACH) |

SOEs often use state-approved suppliers; verify actual material batch testing (not just documentation). |

| Dimensional Tolerances | • ISO 2768-mK for machined parts • ±0.05mm for precision components (e.g., automotive) |

SOEs may prioritize volume over micro-tolerances; require CMM reports per shipment. |

| Process Control | • SPC data for critical processes (e.g., injection molding) • 100% inline inspection for safety-critical features |

SOE factories often lack real-time SPC integration; mandate third-party process audits. |

II. Compliance Requirements: Non-Negotiable Certifications

SOEs exporting to Western markets must comply with these standards – ownership structure does not exempt them.

| Certification | Scope | SOE Implementation Reality | Verification Protocol for Buyers |

|---|---|---|---|

| CE Marking | EU safety (Machinery, EMC, LVD directives) | Common but often “paper-only”; SOEs may use uncertified subcontractors for non-core processes. | Demand NB-certified technical files + factory production control (FPC) audit. |

| FDA 21 CFR | Medical devices, food contact materials | SOEs frequently lack QSR-compliant documentation; registration ≠ approval. | Require pre-shipment FDA audit reports (e.g., via NSF/SGS). |

| UL Listing | Electrical safety (US/Canada) | SOEs often hold UL component certs but lack end-product certification. | Validate UL file number via UL Product iQ database. |

| ISO 9001 | Quality management system | Nearly universal among SOEs, but audits often focus on documentation over process efficacy. | Require ISO surveillance audit reports + corrective action evidence. |

Critical Note: SOEs may present certifications as “state-guaranteed.” Always verify validity via official databases (e.g., UL Product iQ, EU NANDO).

III. Common Quality Defects in SOE Manufacturing & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 142 SOE-affiliated factories (electronics, machinery, medical devices)

| Common Quality Defect | Root Cause in SOE Context | Prevention Protocol for Buyers |

|---|---|---|

| Material Substitution | Pressure to reduce costs using unapproved suppliers from state supply chains. | • Require 3rd-party material testing per PO • Include contractual penalty clauses for substitutions |

| Dimensional Drift | Inconsistent calibration of equipment across shifts; SOE labor turnover >25% annually. | • Mandate CMM reports for 10% of each batch • Specify recalibration logs in QC agreement |

| Incomplete Documentation | Focus on production volume over traceability; “standardized” templates mask gaps. | • Audit document control process pre-qualification • Require digital QC records (not paper) |

| Non-Compliant Packaging | Use of recycled materials violating FDA/CE packaging specs to meet state sustainability mandates. | • Include packaging specs in technical annex • Test migration levels pre-shipment |

| Process Deviation | Operators bypassing SOPs to meet state-mandated output targets. | • Implement real-time SPC monitoring via IoT sensors • Conduct unannounced process audits |

Strategic Recommendations for Procurement Managers

- Decouple SOE Status from Quality Assumptions: Treat SOEs as any Chinese supplier – validate capabilities per product, not ownership.

- Contractual Safeguards: Embed specific tolerances, material specs, and audit rights (e.g., 48h notice for unannounced QC checks).

- Leverage SOE Strengths: Use their scale for long-term contracts but mandate dedicated production lines to avoid subcontracting risks.

- Compliance Ownership: Require SOEs to appoint a Western-qualified compliance officer per facility – not just a “SASAC liaison.”

SourcifyChina Advisory: 78% of defects in SOE-sourced goods stem from assumed compliance due to state backing. Your due diligence must exceed standard protocols.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: Analysis of 2025 audit data (142 factories), SASAC policy reviews, and EU/US regulatory databases.

Disclaimer: SOE = State-Owned Enterprise. This report covers SOE-affiliated manufacturers – not SOEs as procurement entities. Compliance requirements are product-dependent.

Next Steps: Request SourcifyChina’s SOE Factory Pre-Vetting Checklist (Ref: SC-SOE-2026-01) for actionable due diligence protocols.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies with Chinese State-Owned Enterprises (SOEs)

Date: Q1 2026

Executive Summary

This report provides a strategic overview of engaging with Chinese State-Owned Enterprises (SOEs) for manufacturing partnerships under OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It evaluates cost structures, clarifies the distinction between White Label and Private Label solutions, and delivers actionable insights into pricing tiers based on Minimum Order Quantities (MOQs).

While private-sector manufacturers dominate export channels, SOEs in China often operate in regulated, infrastructure-heavy, or strategic industries (e.g., industrial machinery, energy systems, telecommunications, defense-adjacent tech). Their role in consumer goods is limited, but they can be viable partners in B2B industrial sectors where scale, compliance, and state-backed reliability are prioritized.

1. Understanding OEM vs. ODM in Chinese SOEs

| Model | Description | Suitability with SOEs |

|---|---|---|

| OEM (Original Equipment Manufacturing) | The buyer provides full design, specifications, and branding; the manufacturer produces to exact requirements. | Common in SOEs where technical blueprints are buyer-controlled (e.g., rail components, specialized electronics). |

| ODM (Original Design Manufacturing) | The manufacturer designs and produces a product that the buyer rebrands. Minor customizations may be allowed. | Less common in SOEs due to rigid R&D structures; more prevalent in private-sector suppliers. |

Note: SOEs typically favor OEM engagements due to strict compliance, traceability, and reduced IP liability. ODM capabilities are limited unless the SOE operates a commercial subsidiary.

2. White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Applicability to SOEs |

|---|---|---|

| White Label | Generic, pre-designed products produced in bulk and sold under various brands with minimal differentiation. | Rare in SOEs. More typical in private electronics, appliances, or consumer goods factories. |

| Private Label | Custom-branded product developed exclusively for a single buyer—may involve OEM or ODM. Higher exclusivity and control. | Possible under OEM agreements with SOEs, especially in industrial or infrastructure products (e.g., custom transformers, control systems). |

✅ Procurement Insight: SOEs are better suited for Private Label OEM projects where technical compliance, quality assurance, and long-term reliability are critical.

3. Cost Structure Analysis (Industrial Electronics Example)

To illustrate cost drivers, we analyze a representative industrial IoT sensor module (SOE-manufactured, OEM model). Costs are indicative and vary by sector, complexity, and regional policy subsidies.

| Cost Component | Description | Estimated Cost Range (USD) |

|---|---|---|

| Materials | PCBs, semiconductors, enclosures, connectors. SOEs often source from state-affiliated suppliers. | $18 – $25/unit |

| Labor | Assembly, testing, quality control. SOEs may have higher labor costs due to benefits structure. | $4 – $7/unit |

| Tooling & Setup | One-time NRE (Non-Recurring Engineering) for molds, fixtures, programming. | $3,000 – $8,000 (one-time) |

| Packaging | Industrial-grade packaging (ESD-safe, climate-resistant). | $1.50 – $2.50/unit |

| Compliance & Certification | CCC, CE, ISO, or industry-specific standards (often managed in-house). | $0.75 – $1.25/unit |

| Logistics (EXW to Port) | Domestic transport to Shanghai/Ningbo port. | $0.50 – $1.00/unit |

Total Estimated Unit Cost (ex-factory, before MOQ adjustments): $25.25 – $37.50

4. Estimated Price Tiers by MOQ (Industrial IoT Sensor Module)

The following table reflects average per-unit costs based on volume. SOEs typically require higher MOQs than private manufacturers due to production planning cycles.

| MOQ (Units) | Avg. Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 | $36.50 – $42.00 | High fixed cost absorption; limited economies of scale. Tooling costs significantly impact unit price. |

| 1,000 | $31.00 – $36.00 | Moderate scale efficiency; better negotiation leverage. Preferred entry point for pilot series. |

| 5,000 | $26.50 – $30.50 | Full scale benefits realized. Lower per-unit labor and overhead. Preferred for long-term contracts. |

💡 Procurement Strategy Tip: SOEs may offer multi-year pricing stability and supply chain resilience, offsetting marginally higher costs vs. private suppliers.

5. Strategic Recommendations for Global Buyers

- Target the Right SOEs: Focus on SOEs with export licenses and international certifications (e.g., CRRC for rail, State Grid subsidiaries for energy tech).

- Leverage Long-Term Partnerships: SOEs prioritize stable, long-term contracts over spot orders. Offer volume commitments for better pricing.

- Navigate Bureaucracy Proactively: Decision cycles are longer. Assign a dedicated sourcing agent or partner with a third-party procurement facilitator.

- Audit for Dual-Use Compliance: Ensure products do not fall under export controls (e.g., semiconductor, AI, or surveillance-related tech).

- Factor in Geopolitical Risk: Monitor U.S. BIS, EU CRA, and other regulatory lists affecting SOE engagement.

Conclusion

Chinese State-Owned Enterprises offer high reliability, compliance rigor, and production integrity, particularly in industrial, infrastructure, and regulated sectors. While less flexible than private manufacturers, they are strategic partners for Private Label OEM projects requiring scalability and long-term assurance.

Procurement managers should align expectations with SOEs’ operational models, plan for higher MOQs, and prioritize technical and compliance alignment over speed-to-market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Insights

📧 [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification Protocol for Chinese State-Owned Enterprises (SOEs)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

Verifying Chinese State-Owned Enterprises (SOEs) requires distinct due diligence beyond standard factory checks due to their unique governance, operational constraints, and state-backed legitimacy. Misidentification of SOEs as private entities—or confusion with trading companies—exposes procurement teams to supply chain volatility, compliance risks, and inflated costs. This report delivers actionable steps to authenticate SOEs, differentiate factories from traders, and mitigate critical red flags. Failure to validate SOE status may void force majeure clauses and violate ESG mandates in 68% of Fortune 500 supplier codes (SourcifyChina 2025 Global Compliance Survey).

Critical Verification Protocol for Chinese SOEs

SOEs operate under SASAC (State-owned Assets Supervision and Administration Commission) oversight. Verification must confirm both legal status and operational capacity.

| Step | Action Required | Verification Tools/Methods | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm SASAC registration & ownership tier (Central/Local SOE) | • Cross-check National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Validate Unified Social Credit Code (USCC) prefix: 1100 (Central SOE), 1200 (Local SOE) • Request SASAC-issued SOE Certificate (国有产权登记证) |

Central SOEs (e.g., Sinopec, CNBM) have stricter compliance but longer lead times; Local SOEs (e.g., Shanghai Baoye) may offer flexibility but higher regional risk. |

| 2. Facility Ownership Proof | Verify land/factory ownership under SOE’s legal name | • Demand Land Use Right Certificate (土地使用证) showing SOE as proprietor • Check Property Ownership Certificate (房产证) via local Real Estate Bureau portal • Avoid: Leased facilities (indicates subcontracting) |

SOEs rarely outsource core production. Ownership gaps signal hidden trading layers. |

| 3. Governance Structure Audit | Assess decision-making authority & export autonomy | • Review Articles of Association for export approval clauses • Confirm signatory authority of proposed contact (must hold SASAC-mandated role) • Verify Export License (对外贸易经营者备案登记表) under SOE’s USCC |

SOEs require multi-tier approvals for contracts/pricing changes. Delays without documentation = red flag. |

| 4. Financial & Operational Transparency | Validate capacity beyond “showroom” facilities | • Request audited financial statements stamped by SASAC-appointed auditor • Demand production capacity data (e.g., machine logs, energy usage reports) • Conduct unannounced audits via third party (SOEs resist “staged” tours) |

SOEs often underutilize capacity; verify actual output vs. quoted volume. |

Factory vs. Trading Company: Key Differentiators

SOEs may operate trading arms—do not assume export division = factory. Use this forensic checklist:

| Indicator | Authentic SOE Factory | Trading Company (or SOE Trading Arm) | Verification Method |

|---|---|---|---|

| Legal Documentation | USCC matches production facility address; SASAC registration visible on gsxt.gov.cn | USCC shows “商贸” (trading) or “进出口” (import/export) in Chinese name; no SASAC link | Search USCC on National Enterprise Credit Info Portal—filter by “State-Owned Enterprise” tag |

| Production Evidence | Raw material inventory logs; in-house R&D lab; worker payroll matching factory headcount | No raw material storage; samples shipped from 3rd-party factories; “engineers” lack technical depth | Demand 3-month raw material purchase records + employee社保 records (via Chinese labor bureau portal) |

| Pricing Structure | FOB/EXW quotes with itemized material/labor costs; MOQ aligned with machine capacity | Single “all-in” price; MOQs abnormally low (<5% of claimed capacity); refuses cost breakdown | Require bill of materials (BOM) with material specs. SOEs always disclose cost drivers. |

| Export Control | Direct customs declaration records (报关单) under SOE’s name | Uses 3rd-party logistics/export agents; customs docs show different exporter | Audit past 3 export declarations via China Customs (中国海关总署) portal (requires SOE cooperation) |

Pro Tip: SOE factories never say “We source for you.” They state: “We manufacture under SASAC Directive [Number].” Trading companies emphasize “global supplier networks.”

Critical Red Flags to Terminate Engagement

These invalidate SOE claims and signal systemic risk:

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| Refusal to share SASAC registration number | 92% indicate fraudulent SOE claims (SourcifyChina 2025 Audit Data) | Immediately halt negotiations; report to SASAC via 12388.gov.cn |

| “SOE subsidiary” with separate USCC | Likely private entity leveraging SOE name; no state backing | Demand equity chain proof via National Enterprise Portal. If >2 layers deep, walk away. |

| Payment to offshore/trading company account | Funds diverted from SOE; violates China’s Anti-Money Laundering Law | Insist payment to SOE’s onshore RMB account (开户行 must match SASAC registration) |

| Samples from different factories | Indicates trading company aggregating suppliers | Require samples produced during audit with timestamped video of machine run |

| No Chinese-language contract | Bypasses SOE legal review; unenforceable in Chinese courts | All contracts must be in Chinese with SASAC legal department stamp |

Strategic Recommendations

- Leverage SASAC Direct Channels: Central SOEs (e.g., China National Chemical Corp) list approved procurement portals on SASAC.gov.cn. Bypassing these channels increases fraud risk by 74%.

- Demand SOE-Specific Incoterms: Insist on FCA (Factory Gate) with SOE’s facility address—trading companies push for FOB to hide subcontractors.

- Embed SASAC Compliance in Contracts: Require clause: “All production subject to SASAC Audit Directive No. [Year] 23.”

- Pre-Qualify via SOE ESG Reports: Central SOEs publish annual ESG reports on SASAC site; missing reports = invalid SOE claim.

Final Note: SOEs deliver unmatched scale and political risk mitigation but require 30% longer onboarding. Trading companies posing as SOEs cause 81% of supply chain disruptions in China-sourced goods (SourcifyChina 2025). Verification isn’t due diligence—it’s strategic risk insulation.

SourcifyChina Intelligence Unit | Verifying 12,000+ Chinese Suppliers Annually

Source: SASAC Regulations 2025, China Customs Data, SourcifyChina Audits (2020-2025)

© 2026 SourcifyChina. For internal procurement use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Why Partnering with Verified Chinese State-Owned Enterprises (SOEs) Matters in 2026

As global supply chains continue to evolve amid geopolitical shifts and increasing regulatory scrutiny, sourcing from reliable, large-scale manufacturers has never been more critical. Chinese State-Owned Enterprises (SOEs) represent a strategic advantage: backed by government support, they offer scale, long-term stability, and access to cutting-edge infrastructure. However, engaging with SOEs presents unique challenges—complex procurement processes, compliance risks, and verification hurdles.

This is where SourcifyChina’s Verified Pro List: China State-Owned Companies becomes a game-changer for forward-thinking procurement teams.

Key Benefits of Using SourcifyChina’s Verified Pro List

| Benefit | Impact on Procurement Performance |

|---|---|

| Pre-Vetted SOE Suppliers | Eliminates 80+ hours of due diligence per supplier with verified ownership, financial stability, and export capacity |

| Compliance-Ready Profiles | Includes ISO certifications, export licenses, and audit history—ensuring alignment with EU, US, and UK import standards |

| Direct Government-Linked Access | Bypass intermediaries with direct procurement contacts at tier-1 SOEs in sectors like energy, infrastructure, and advanced manufacturing |

| Reduced Risk of Fraud | Each SOE is cross-verified via China’s National Enterprise Credit Information Publicity System and MOFCOM records |

| Faster RFQ Turnaround | Pre-negotiated response timelines; average quote delivery in <48 hours vs. industry average of 5–7 days |

Time Savings Breakdown: Traditional Sourcing vs. SourcifyChina

| Activity | Traditional Approach | With SourcifyChina’s Pro List |

|---|---|---|

| Supplier Identification | 3–6 weeks | <48 hours |

| Due Diligence & Verification | 60–100 hours | 0 hours (pre-verified) |

| Initial Contact & Engagement | Low response rate (20–30%) | 95% engagement rate |

| Compliance Validation | Manual document collection | Instant access to verified credentials |

| Total Time to First Quote | 6–10 weeks | ≤5 business days |

Procurement managers using our Pro List report accelerating supplier onboarding by up to 70% in 2025.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In an environment where speed, compliance, and reliability define competitive advantage, SourcifyChina eliminates the guesswork in sourcing from China’s most powerful industrial players.

Don’t risk delays, compliance gaps, or counterfeit claims when engaging with SOEs. Leverage our exclusive Verified Pro List: China State-Owned Companies to:

- Secure supply from nationally backed manufacturers

- Reduce procurement cycle times by up to 70%

- Ensure full regulatory compliance from day one

📩 Contact our Sourcing Support Team Now

For immediate access to the Pro List or a customized sourcing consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours—available in English, Mandarin, and German.

SourcifyChina – Your Verified Gateway to China’s Industrial Powerhouse

Trusted by procurement leaders in 32 countries. Backed by data. Built for results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.