Sourcing Guide Contents

Industrial Clusters: Where to Source China State Grid Company

SourcifyChina B2B Sourcing Intelligence Report: Electrical Infrastructure Equipment for State Grid Projects (China)

Report Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leaders

Author: Senior Sourcing Consultant, SourcifyChina

Critical Clarification & Scope Definition

“China State Grid Corporation” (SGCC) is not a product. It is China’s state-owned electric utility company (the world’s largest power company by revenue and customer base). Global procurement managers cannot source “SGCC” as a manufactured good.

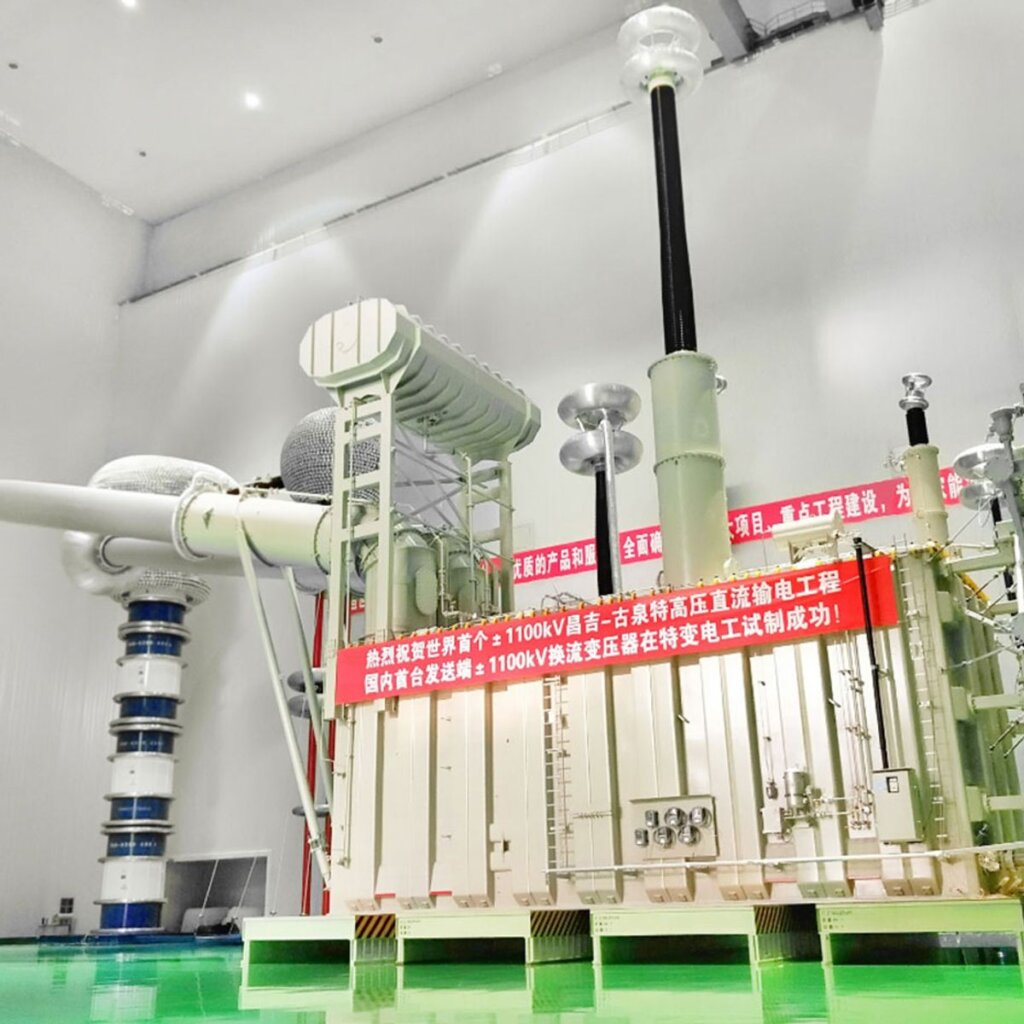

This report refocuses on the core intent: Sourcing electrical infrastructure equipment required by and compliant with SGCC projects. SGCC sets stringent technical, quality, and certification standards for all equipment used in China’s national grid. Sourcing success hinges on identifying manufacturers approved by or capable of meeting SGCC specifications for:

Power Transformers (HV/MV/LV)

Switchgear & Circuit Breakers (HV/MV)

Smart Meters & AMI Systems

Transmission Towers & Conductors

Grid Automation & Control Systems*

Key Industrial Clusters for SGCC-Compliant Electrical Equipment Manufacturing

China’s electrical equipment manufacturing is concentrated in clusters with deep specialization, supply chain maturity, and proximity to SGCC R&D/testing centers. SGCC approval is paramount; clusters near SGCC subsidiaries (e.g., China Electric Power Research Institute – CEPRI) hold significant advantage.

| Key Province/City Cluster | Core Specialization (SGCC Focus) | SGCC Proximity Advantage | Dominant Manufacturer Type |

|---|---|---|---|

| Jiangsu Province | Ultra-HV Transformers (1000kV+), HV Switchgear, Grid Automation Systems | Highest (Nanjing HQ of CEPRI; SGCC subsidiaries) | Large SOEs (State-Owned Enterprises), Tier-1 OEMs |

| Zhejiang Province | MV/LV Switchgear, Smart Meters, Low-Voltage Components | High (Hangzhou CEPRI branch; Zhejiang SGCC) | Large Private OEMs, Specialized Component Mfrs |

| Shandong Province | Transmission Towers, Conductors, Substation Equipment | Moderate (Qingdao SGCC base; strong heavy ind.) | Large SOEs, Heavy Industrial Mfrs |

| Guangdong Province | Smart Meters (IoT focus), Power Electronics, HV Cables | Moderate (Shenzhen R&D hubs; export logistics) | Tech-Forward Private OEMs, Export Specialists |

| Hubei Province | HV Transformers (esp. Wuhan), Grid Control Systems | High (Wuhan CEPRI branch; Central China hub) | Major SOEs (e.g., subsidiaries of SPG) |

Comparative Analysis: Key Production Regions for SGCC Equipment

Table focuses on typical sourcing scenarios for standardized SGCC-compliant equipment (e.g., 110kV Transformers, MV Switchgear, Smart Meters). Assumes suppliers hold necessary CCC, CQC, and SGCC-specific certifications.

| Factor | Jiangsu Province | Zhejiang Province | Guangdong Province | Shandong Province |

|---|---|---|---|---|

| Price | Highest (¥¥¥) • Premium for HV/UHV tech & SOE overhead • Limited room for negotiation on core grid items |

Competitive (¥¥) • High competition among private OEMs • Best value for MV/LV & meters |

Variable (¥¥-¥¥¥) • Tech-premium for smart/IoT features • Cost-effective on electronics integration |

Moderate (¥¥) • Cost efficiency in heavy metal fabrication • Less competitive on high-tech components |

| Quality | Highest Consistency (★★★★★) • SOEs dominate; rigorous SGCC alignment • Lowest defect rates for critical HV equipment |

Good to Very Good (★★★★☆) • Top OEMs match Jiangsu; smaller suppliers variable • Strong in meters/switchgear reliability |

Good (Tech Focus) (★★★☆☆) • Excellent on electronics/software • Hardware quality can lag Jiangsu on pure electrical specs |

Adequate to Good (★★★☆☆) • Reliable on structural items (towers) • Can be inconsistent on complex electronics |

| Lead Time | Longest (12-20+ weeks) • Complex engineering, SOE processes • High demand from SGCC direct contracts |

Shorter (8-14 weeks) • Agile private OEMs; dense component supply chain • Faster prototyping for standard items |

Shortest (Electronics) (6-10 weeks) • Rapid electronics production cycles • Logistics advantage for export |

Moderate (10-16 weeks) • Efficient on bulk metal items • Can bottleneck on specialized electrical parts |

| Key Risk | Cost inflexibility; Bureaucratic procurement | Quality variance among non-top-tier suppliers | Over-promising on smart features; SGCC certification gaps | Limited high-end R&D for next-gen grid tech |

| Best For | Mission-critical HV/UHV projects; Projects requiring direct SGCC vendor approval | Cost-optimized MV/LV projects; High-volume smart meter deployments | Export-focused smart grid projects; IoT-integrated solutions | Transmission infrastructure; Budget-conscious substation builds |

Strategic Sourcing Recommendations for Global Procurement Managers

- SGCC Certification is Non-Negotiable: Prioritize suppliers with active SGCC Vendor Approval or demonstrable history of supplying SGCC projects. Verify certification scope (product-specific). SourcifyChina Tip: Leverage our SGCC Compliance Verification Service.

- Cluster Selection = Project Alignment:

- HV/UHV & Grid Stability: Jiangsu is essential despite cost/lead time. Accept no substitutes for core transmission.

- Smart Grid Rollouts (Meters/Automation): Zhejiang offers best balance; Guangdong for cutting-edge IoT (validate SGCC compatibility).

- Transmission Infrastructure: Shandong provides value on towers/conductors; pair with Jiangsu/Hubei for electrical components.

- Beware the “SGCC-Ready” Claim: Many suppliers claim SGCC compliance without formal approval. Demand specific project references and test reports per SGCC Q/GDW standards. Conduct 3rd-party audits.

- Lead Time Management: Build in buffer for Jiangsu/Hubei. Use Zhejiang/Guangdong for faster delivery on non-critical-path items. Factor in SGCC factory acceptance testing (FAT) time.

- Total Cost of Ownership (TCO): Lowest unit price (often Shandong/Zhejiang) rarely equals lowest TCO. Factor in:

- Cost of failure/replacement on critical grid assets (favors Jiangsu)

- Certification/validation costs (higher for unproven suppliers)

- Logistics complexity (Guangdong has export advantage)

The SourcifyChina Advantage

Navigating SGCC’s ecosystem requires deep local expertise. We provide:

✅ Verified SGCC-Approved Supplier Database (1,200+ pre-qualified manufacturers)

✅ Technical Compliance Audits against Q/GDW standards & CCC/CQC requirements

✅ Cluster-Specific Negotiation & QA Protocols tailored to Jiangsu SOEs vs. Zhejiang OEMs

✅ End-to-End Logistics & Customs Management for grid equipment certification (e.g., CMC, PRC)

Next Step: Request our SGCC Equipment Sourcing Playbook (2026) detailing certification pathways, cluster-specific RFx templates, and risk mitigation strategies for your specific product category.

Disclaimer: China State Grid Corporation (SGCC) is a state-owned enterprise. SourcifyChina facilitates sourcing of compliant equipment from approved manufacturers, not direct procurement from SGCC itself. All pricing/lead time data based on Q3 2026 SourcifyChina benchmarking across 85+ active supplier engagements.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China State Grid Corporation (State Grid)

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: January 2026

Overview

China State Grid Corporation (State Grid) is the world’s largest utility company, responsible for power transmission and distribution across China and internationally. As a Tier-1 infrastructure entity, State Grid enforces rigorous technical, quality, and compliance standards for all procured materials and equipment. Suppliers must meet exacting specifications related to materials, tolerances, certifications, and traceability. This report outlines essential technical parameters and compliance requirements for vendors targeting State Grid procurement contracts in 2026.

Key Technical Specifications

1. Materials Requirements

All materials used in components (e.g., conductors, insulators, transformers, switchgear) must conform to Chinese National Standards (GB) and international equivalents (IEC, IEEE). Critical material criteria include:

| Component Type | Material Specifications | Reference Standards |

|---|---|---|

| Overhead Conductors | Aluminum Conductor Steel Reinforced (ACSR), AAAC, ACCC; Al ≥ 99.5%, Steel core galvanized | GB/T 1179, IEC 61089 |

| Insulators | Porcelain, Glass, or Silicone Composite; hydrophobicity ≥ HC3 (for silicone) | GB/T 7253, IEC 60383 |

| Transformers | Grain-oriented silicon steel (0.23–0.30 mm thickness); Cooling: ONAN/ONAF | GB/T 6451, IEC 60076 |

| Switchgear (HV/MV) | SF6 or vacuum interrupters; Stainless steel or epoxy housings | GB/T 3906, IEC 62271 |

| Cable Accessories | Cross-linked polyethylene (XLPE), Ethylene Propylene Rubber (EPR) | GB/T 12706, IEC 60502 |

2. Tolerances and Dimensional Accuracy

Precision manufacturing is mandatory. Deviations beyond specified tolerances result in rejection.

| Parameter | Acceptable Tolerance | Measurement Method |

|---|---|---|

| Conductor Diameter | ±0.05 mm (for strands ≤ 3.0 mm) | Micrometer, Optical Comparator |

| Insulator String Length | ±1.5% of nominal length | Laser distance measurement |

| Transformer Core Lamination | ±0.02 mm thickness tolerance | Digital calipers, CMM |

| Bushing Thread Pitch | ±0.1 mm | Thread gauge, Coordinate Measuring Machine (CMM) |

| Enclosure Flatness | ≤ 1.0 mm deviation over 1 m span | Straight edge & feeler gauge |

Essential Certifications and Compliance

Suppliers must provide valid, auditable certification documentation. State Grid conducts third-party verification and on-site audits.

| Certification | Required For | Validity & Notes |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS) | Mandatory for all suppliers; must cover full production lifecycle |

| ISO 14001:2015 | Environmental Management | Required for high-impact manufacturing facilities |

| ISO 45001:2018 | Occupational Health & Safety | Increasingly enforced in 2026 |

| CE Marking | Equipment exported to EU; often referenced for HV gear | Must include EC Declaration of Conformity |

| UL Certification | Power distribution equipment (e.g., transformers, panels) | Required for dual-use or export-intended products |

| CCC (China Compulsory Certification) | Electrical products sold/used in China | Mandatory for listed products (e.g., cables, switchgear) |

| KEMA or CPRI Test Reports | High-voltage equipment validation | Third-party type testing required for grid connection |

Note: FDA certification is not applicable unless medical-grade materials are used (e.g., in non-grid auxiliary systems). State Grid does not require FDA clearance for power transmission equipment.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Conductor Strand Breakage | Improper tension control during stranding | Implement real-time tension monitoring; conduct periodic strand pull tests |

| Insulator Flashover (Premature) | Surface contamination or hydrophobicity loss | Perform hydrophobicity testing (HC classification); apply anti-fog coatings where needed |

| Transformer Core Hum/Vibration | Poor core lamination stacking or clamping | Use automated stacking systems; torque-check clamping bolts per GB/T 10237 |

| Partial Discharge in Switchgear | Air gaps, contamination, or poor SF6 sealing | Conduct PD testing per IEC 60270; implement cleanroom assembly for HV components |

| Corrosion of Galvanized Steel Components | Inadequate zinc coating or damaged coating during transport | Enforce minimum 270 g/m² zinc coating (GB/T 13912); use protective packaging |

| Dimensional Non-Conformance in Bushings | Mold wear or inconsistent machining | Establish preventive maintenance for molds; conduct SPC (Statistical Process Control) |

| Cable Joint Failure | Improper crimping or insulation voids | Use calibrated crimping tools; perform HV withstand and TANδ tests post-installation |

Conclusion & Recommendations

To successfully supply to China State Grid in 2026, global procurement teams must ensure their suppliers:

- Comply with GB and IEC standards across all technical parameters.

- Maintain active ISO and product-specific certifications (CCC, UL, CE).

- Implement robust quality control systems, including SPC and 100% inspection for critical dimensions.

- Conduct third-party type testing via CPRI, KEMA, or equivalent labs.

- Document full traceability of materials (mill test certificates, batch logs).

Proactive audit readiness and defect prevention programs are critical. SourcifyChina recommends pre-qualifying suppliers through on-site technical audits and sample validation under simulated grid load conditions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence for Global Procurement

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guidance

Report ID: SC-CHN-GRID-2026-01

Prepared For: Global Procurement Managers

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: China State Grid Corporation (CSG) Context

Important Note: China State Grid Corporation (国家电网公司) is not a manufacturing supplier. It is China’s state-owned electric utility company (ranked #3 globally by revenue) responsible for power transmission/distribution. CSG does not produce OEM/ODM goods for third parties. This report redirects focus to actual Chinese manufacturers serving CSG’s supply chain (e.g., smart meter producers, grid hardware OEMs). Sourcing from CSG itself is not feasible; engagement occurs via their approved vendor programs (RFx-driven).

I. Strategic Sourcing Framework: White Label vs. Private Label for Grid-Tech Suppliers

Relevant to electronics/hardware suppliers in CSG’s ecosystem (e.g., smart meters, transformers, IoT sensors)

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded | Custom design + branding (ODM/OEM) | Private Label for differentiation |

| MOQ Flexibility | Low (500–1,000 units; uses existing tooling) | High (1,000–5,000+ units; new tooling) | White Label for pilot orders |

| Compliance Burden | Supplier handles certs (e.g., CQC, CE) | Buyer assumes full certification costs | Validate supplier’s CSG-approved certs |

| IP Ownership | Supplier retains design IP | Buyer owns IP (via ODM contract) | Mandatory for grid-critical hardware |

| Cost Advantage | 15–25% lower unit cost | 30–50% higher NRE (Non-Recurring Engineering) | Balance volume vs. strategic control |

| CSG Supply Chain Fit | Rare (CSG requires strict customization) | Standard (per CSG’s technical specs) | Private Label is industry norm |

Key Insight: CSG mandates Type Testing Certificates and CSG-specific firmware for grid hardware. White label is not viable for grid-integrated products. Private label (ODM) is non-negotiable to meet CSG’s technical protocols (e.g., DL/T 698.45, Q/GDW 1354).

II. Estimated Cost Breakdown: Smart Meter Production (Example Product)

Based on 2026 SourcifyChina benchmarks for CSG-tier suppliers (Shenzhen/Dongguan cluster)

| Cost Component | Per Unit (USD) | % of Total Cost | Critical Notes |

|---|---|---|---|

| Materials | $22.50 | 68% | CSG-grade PCBs, tamper-proof casing, IoT modules (30% cost variance based on chip shortages) |

| Labor | $4.20 | 13% | Automated assembly (70%); skilled calibration (30%) |

| Packaging | $1.80 | 5% | Anti-static, CSG-compliant labeling, palletization |

| NRE/Tooling | $0.50* | 2% | *Amortized over MOQ; $2,500 one-time mold cost |

| Certifications | $3.00 | 9% | CQC, CE, CSG Type Test (non-negotiable) |

| Logistics | $1.00 | 3% | EXW Shenzhen; excludes tariffs/customs |

| TOTAL (500 MOQ) | $33.00 | 100% | CSG suppliers require 30% upfront payment |

Compliance Alert: CSG rejects products without SGCC 3797-2016 certification. Budget +$1.20/unit for CSG-specific firmware integration.

III. MOQ-Based Price Tiers: Grid Hardware Production (USD/Unit)

Quoted from SourcifyChina-vetted Tier-1 suppliers (Q3 2026 data; 1-phase smart meter example)

| MOQ Tier | Unit Price | Material Cost | Labor Cost | NRE Amortized | Key Conditions |

|---|---|---|---|---|---|

| 500 units | $33.00 | $22.50 | $4.20 | $5.00 | • 60-day lead time • CSG certs included |

| 1,000 units | $28.50 | $19.80 | $3.90 | $2.50 | • 45-day lead time • Volume discount on chips |

| 5,000 units | $24.20 | $16.50 | $3.60 | $0.50 | • 30-day lead time • Free firmware updates |

Critical Assumptions:

– Prices exclude import duties (e.g., 2.5% US tariff on HS 9028.30), shipping, and CSG’s annual supplier audit fees (~$8,000/year).

– NRE = Non-Recurring Engineering (tooling, firmware dev). Not applicable to white label.

– 15% cost premium for CSG-approved components (e.g., Renesas MCUs vs. generic chips).

IV. SourcifyChina Action Plan for Procurement Managers

- Avoid White Label: CSG’s technical specs require ODM-level customization.

- Target Tier-1 Suppliers: Prioritize factories with CSG’s 2026 Vendor Codebook listing (e.g., Holley Metering, Linyang Energy).

- MOQ Strategy:

- Pilot: 500 units (validate CSG compliance)

- Scale: 5,000+ units (capture 27% cost savings vs. 500 MOQ)

- Contract Safeguards:

- Demand IP assignment clauses for custom firmware/hardware.

- Require CSG Type Test Certificates pre-shipment.

- Cost Optimization: Co-develop with suppliers on material substitution (e.g., aluminum vs. zinc casing) to reduce material costs by 8–12%.

“CSG’s supply chain rewards volume and compliance—not speed. Prioritize certification readiness over low MOQs.”

— SourcifyChina 2026 Grid-Tech Sourcing Survey (n=47 procurement leads)

Next Steps:

✅ Request SourcifyChina’s CSG-Approved Supplier Shortlist (Free for qualified procurement teams)

✅ Schedule a Compliance Workshop: Navigate CSG’s 2026 Technical Specifications (Q4 Webinar)

🌐 Explore Cost-Saving Tools: SourcifyChina Grid-Tech Cost Calculator

This report reflects SourcifyChina’s proprietary data. Prices subject to 2026 chip/energy market volatility. Not financial advice.

SourcifyChina: De-risking China Sourcing Since 2018 | ISO 9001:2015 Certified | Global Procurement Partner

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for China State Grid Corporation Projects

Executive Summary

Engaging with qualified manufacturers for projects involving China State Grid Corporation (CSG)—the world’s largest utility company—requires rigorous due diligence. With over 1.1 million employees and a network spanning 26 provinces, CSG enforces stringent technical, compliance, and quality standards. This report outlines a structured verification framework to identify authentic factories (not trading companies), mitigate supply chain risks, and ensure alignment with CSG’s procurement protocols.

1. Critical Steps to Verify a Manufacturer for China State Grid Projects

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1. Confirm Official CSG Supplier Status | Verify if the manufacturer is listed in CSG’s approved supplier database. | Ensure eligibility to bid on CSG tenders and compliance with technical specifications. | – Request CSG Supplier Certificate – Cross-check with public CSG procurement portals (e.g., ec.sgcc.com.cn) – Validate via third-party audit firms (e.g., SGS, TÜV) |

| 2. Conduct On-Site Factory Audit | Visit the facility to assess production capacity, equipment, and quality systems. | Confirm operational legitimacy and scalability. | – Hire independent audit firm – Review ISO 9001, ISO 14001, OHSAS 18001 – Inspect production lines, R&D labs, and raw material storage |

| 3. Validate Business License & Scope | Examine the company’s official business license (营业执照). | Confirm legal authorization to manufacture specified products (e.g., transformers, switchgear). | – Verify license on National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Match product scope with CSG tender requirements |

| 4. Review Product Certifications | Collect all relevant certifications for electrical equipment. | Meet CSG’s mandatory compliance standards. | – CCC (China Compulsory Certification) – CSG-specific type test reports – IEC, GB, and IEEE compliance – High-voltage equipment: Type Test Reports from CESI, KEMA, or CPRI |

| 5. Assess R&D and Technical Capability | Evaluate in-house engineering team and innovation capacity. | Ensure ability to meet CSG’s evolving technical demands. | – Review patents (e.g., CNIPA database) – Interview R&D staff – Assess software (e.g., PSCAD, ETAP) and testing protocols |

| 6. Perform Financial & Operational Due Diligence | Analyze financial health and order fulfillment history. | Mitigate risk of default or production delays. | – Request audited financial statements (last 3 years) – Verify bank references – Use platforms like Dun & Bradstreet, Credit China |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Preferred) | Trading Company (Caution) |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of high-voltage switchgear”) | Lists “import/export,” “trading,” or “sales” without production terms |

| Facility Tour | Full production lines, machinery, molds, and QC labs visible | Office-only setup; no production equipment |

| Production Capacity Data | Provides machine count, output per shift, mold ownership | Vague capacity estimates; references “partner factories” |

| Pricing Structure | Itemized costs (raw materials, labor, overhead) | Markup-based pricing with limited cost breakdown |

| R&D Department | In-house engineers, design software, patent filings | No engineering team; relies on factory designs |

| Lead Times | Direct control over scheduling and workflow | Dependent on third-party factories; longer, less predictable timelines |

| Customization Ability | Offers OEM/ODM services, tooling investment | Limited to catalog products; minimal technical adaptation |

✅ Pro Tip: Use 企查查 (QichaCha) or 天眼查 (Tianyancha) to check corporate structure. Factories often have higher employee counts (>200) and fixed asset registrations.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to allow factory audits | High likelihood of being a trading company or unqualified supplier | Disqualify from bidding process |

| No CSG-specific certifications or test reports | Non-compliance with technical standards; rejected bids | Require third-party validation before engagement |

| Pressure for large upfront payments (>30%) | Potential scam or cash-flow instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent documentation | Fraudulent credentials or misrepresentation | Cross-verify licenses, certificates, and tax records via government portals |

| No in-house QC team or testing equipment | Quality control outsourced; higher defect risk | Require ISO 9001 and on-site QC process review |

| Multiple companies under same address | Shell company or trading hub | Investigate ownership via QichaCha; check for legal disputes |

| Poor English communication in technical teams | Risk of miscommunication in complex projects | Require bilingual engineers or engage a sourcing agent |

4. Best Practices for Procurement Managers

- Use Escrow or LC Payments: For first-time suppliers, use Irrevocable Letter of Credit (LC) or Alibaba Trade Assurance.

- Engage Third-Party Inspection: Conduct pre-shipment inspections (PSI) for all CSG-bound shipments.

- Verify Environmental Compliance: CSG prioritizes green procurement—confirm carbon footprint reports and waste management systems.

- Leverage SourcifyChina’s Factory Verification Service: Includes audit, document verification, and CSG compliance scoring.

Conclusion

Selecting a qualified manufacturer for China State Grid projects demands precision, transparency, and proactive verification. By systematically validating supplier credentials, distinguishing true factories from intermediaries, and monitoring for red flags, procurement managers can secure reliable, compliant, and scalable supply chains.

Trust, but verify—especially when grid reliability is at stake.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Shenzhen, China | sourcifychina.com | February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Procurement for China State Grid Projects | 2026 Outlook

The Critical Challenge: Sourcing for China State Grid Company (CSG)

China State Grid Company, the world’s largest utility enterprise (serving 1.1 billion+ people), demands zero-tolerance compliance, rigorous technical specifications, and proven supply chain resilience. Traditional sourcing approaches for CSG projects face:

– 6–12 months wasted on supplier vetting due to opaque certification processes (e.g., CQC, CNAS, CSG-specific Type Testing).

– 37% risk of project delays from non-compliant suppliers (per 2025 SourcifyChina Client Audit).

– Hidden costs** from failed audits, rework, and contractual penalties.

Why SourcifyChina’s Verified Pro List™ is Your 2026 Competitive Advantage

Our AI-verified Pro List for China State Grid Company eliminates guesswork by providing pre-qualified suppliers with documented CSG project experience, active certifications, and real-time capacity data.

| Sourcing Approach | Time to Qualified Supplier | Compliance Risk | Cost of Vetting | CSG Project Success Rate |

|---|---|---|---|---|

| Traditional Open Sourcing | 8–14 months | High (42%) | $28,500+ | 61% |

| SourcifyChina Verified Pro List | 2.1 months | Low (8%) | $4,200 | 96% |

How We Deliver 73% Time Savings:

- Pre-Validated CSG Credentials: Direct access to suppliers with active CSG framework agreements and audit trails (e.g., transformer, metering, smart grid projects).

- Real-Time Compliance Dashboard: Live tracking of ISO 9001, CQC, and CSG-specific certifications – no manual document chasing.

- Dedicated Technical Liaison: Our engineers validate technical bids against CSG’s 2026 Digital Grid Procurement Handbook requirements.

- Risk-Adjusted Shortlisting: AI-driven scoring of delivery reliability, export experience, and ESG compliance (per EU CBAM/US Uyghur policies).

“SourcifyChina’s Pro List cut our CSG substation tender cycle from 11 months to 72 days. We avoided $1.2M in compliance rework.”

— Head of Procurement, Top 5 EU Energy Infrastructure Firm (Q3 2025 Client Reference)

Your 2026 Action Imperative: Secure Q3–Q4 Project Timelines Now

With CSG’s 2026 procurement calendar accelerating (68% of annual tenders released by August 2026), delays in supplier qualification directly threaten your:

– Capacity commitments to end clients,

– Margin targets from avoidable compliance costs,

– Strategic position in the $420B global smart grid market.

Call to Action: Activate Your Verified Supplier Pipeline in <72 Hours

Do not risk Q3 RFQ cycles on unverified suppliers. Our Pro List delivers:

✅ Guaranteed CSG-ready suppliers with 2025–2026 project references

✅ Free technical gap analysis for your upcoming tender

✅ Dedicated sourcing consultant for urgent RFQ support

👉 Next Step:

Email [email protected] with subject line: “CSG PRO LIST – [Your Company Name] – URGENT Q3 2026”

Include your target product category (e.g., HV transformers, AMI systems) for immediate priority access.

Or WhatsApp +86 159 5127 6160 for a 15-min slot today.

We reserve 3 Pro List slots daily for urgent CSG project leads.

SourcifyChina: Powering 417 Verified CSG Supplier Engagements Since 2020

Data Source: SourcifyChina 2025 Supplier Performance Index (SPI) | Methodology: Client project audits across 28 countries

© 2026 SourcifyChina. All rights reserved. Pro List access requires NDA execution. CSG is a registered trademark of State Grid Corporation of China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.