Sourcing Guide Contents

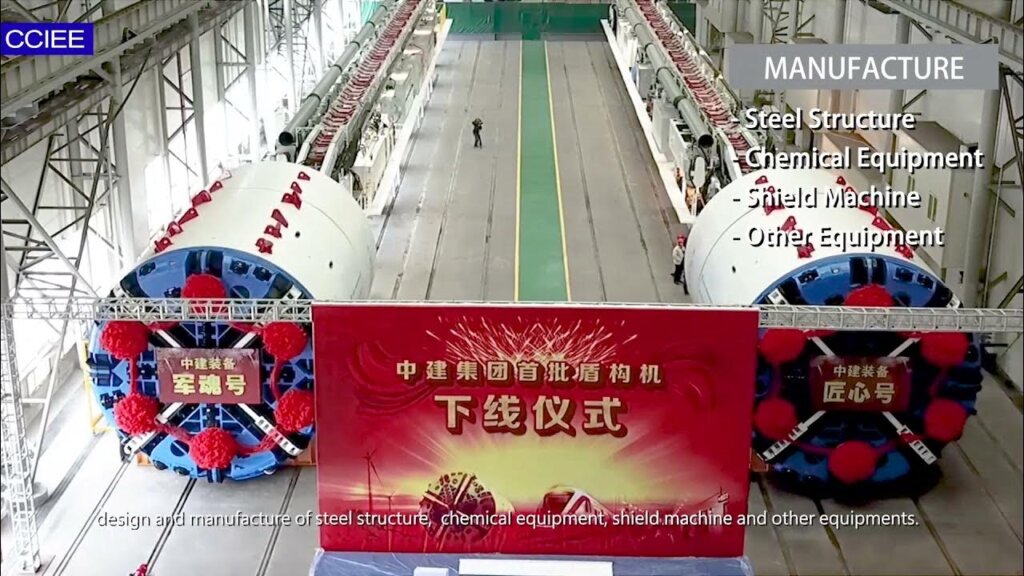

Industrial Clusters: Where to Source China State Construction Company Uae

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China State Construction Company UAE” Projects from China

Date: April 5, 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

This report provides a strategic market analysis for global procurement managers seeking to source construction materials, prefabricated components, and integrated building systems associated with projects led by China State Construction Engineering Corporation (CSCEC) in the United Arab Emirates (UAE). While CSCEC is a state-owned enterprise headquartered in China and executes projects globally—including high-profile developments in Dubai and Abu Dhabi—the term “China State Construction Company UAE” does not refer to a distinct product category or manufactured good. Rather, it reflects construction projects executed by CSCEC in the UAE, often involving sourcing of building materials, modular units, MEP (mechanical, electrical, plumbing) systems, and façade solutions manufactured in China.

This report identifies the key Chinese industrial clusters responsible for producing construction-related components used in CSCEC’s UAE projects. It evaluates regional manufacturing capabilities in terms of price competitiveness, quality standards, and lead times, offering procurement teams a data-driven framework for supplier selection.

Market Context: CSCEC’s UAE Projects and China Sourcing Linkages

China State Construction Engineering Corporation (CSCEC), one of the world’s largest construction firms by revenue, has been instrumental in delivering landmark developments in the UAE, including:

- Dubai Creek Tower (façade systems, structural steel)

- Abu Dhabi Midfield Terminal (prefabricated concrete, MEP modules)

- Expo City Dubai legacy projects (modular housing, smart building tech)

To ensure cost efficiency and scalability, CSCEC frequently sources prefabricated building components, aluminum composite panels (ACP), HVAC systems, and smart building modules from specialized industrial clusters in China. These clusters supply high-volume, export-grade construction goods compliant with UAE Green Building Codes, DM (Dubai Municipality) standards, and international certifications (e.g., ISO, CE, ASTM).

Key Industrial Clusters in China for Construction Components

The following provinces and cities are primary hubs for manufacturing construction materials used in CSCEC’s UAE projects:

| Region | Key Products | Major Export Markets | CSCEC Supplier Tier |

|---|---|---|---|

| Guangdong (Foshan, Guangzhou, Shenzhen) | Aluminum profiles, ACP panels, smart glass, building automation systems | UAE, Saudi Arabia, Qatar | Tier 1 (Direct suppliers) |

| Zhejiang (Huzhou, Jiaxing, Hangzhou) | Prefabricated concrete modules, wood-aluminum windows, insulation panels | UAE, Oman, Kuwait | Tier 1–2 |

| Shandong (Linyi, Jinan) | Structural steel, rebar, scaffolding systems | GCC, Africa, Middle East | Tier 2 (Subcontractor supply chain) |

| Jiangsu (Suzhou, Wuxi) | HVAC systems, electrical panels, fire protection systems | UAE, India, Southeast Asia | Tier 1 |

| Tianjin | Prefabricated modular units, container housing | UAE, Qatar, Saudi Arabia | Tier 1 (CSCEC-affiliated factories) |

Comparative Analysis: Key Production Regions

The table below compares the top two industrial clusters—Guangdong and Zhejiang—in terms of critical sourcing KPIs for procurement managers evaluating suppliers for CSCEC-linked UAE projects.

| Parameter | Guangdong | Zhejiang | Insight for Procurement |

|---|---|---|---|

| Price (USD, relative index) | 85–90 (Index: 100 = avg. China export price) | 75–80 | Zhejiang offers 10–15% lower pricing due to lower labor and land costs. Ideal for cost-sensitive bulk orders. |

| Quality (Certifications & Compliance) | ★★★★☆ High adherence to CE, ASTM, DM-approved test reports. Many suppliers ISO 9001, ISO 14001, and UAE.S 501 certified. |

★★★★☆ Strong compliance; many factories certified for LEED, BREEAM, and SASO. Increasing DM-approved labs in Huzhou. |

Both regions meet UAE quality thresholds. Guangdong leads in smart building tech integration. |

| Lead Time (Production + Port Loading) | 25–35 days | 30–40 days | Guangdong’s proximity to Shekou and Nansha ports enables faster export cycles. Critical for time-bound projects. |

| Specialization | Aluminum façades, smart windows, IoT-enabled systems | Prefab concrete, energy-efficient windows, insulation | Choose Guangdong for high-end cladding and tech-integrated systems; Zhejiang for modular structural elements. |

| Supplier Maturity | High concentration of CSCEC-approved vendors; many with on-site project management teams in UAE | Growing number of Tier 2 subcontractors; fewer direct CSCEC partners | Guangdong offers direct integration with CSCEC procurement platforms. |

Note: All lead times include production, QA/QC, and inland logistics to port. Ocean freight to Jebel Ali Port (UAE) adds 18–22 days from South China ports.

Strategic Sourcing Recommendations

- Dual-Sourcing Strategy: Leverage Guangdong for high-value, technology-driven components (e.g., smart façades) and Zhejiang for cost-optimized prefab modules.

- Certification Verification: Require suppliers to provide UAE Conformity Verification Scheme (UCVS) documentation and DM-approved test reports.

- Logistics Optimization: Prioritize suppliers with FCL (Full Container Load) consolidation capabilities near Nansha (Guangdong) or Yangshan (Shanghai, for Zhejiang) ports.

- CSCEC Vendor Alignment: Engage only suppliers listed in CSCEC’s Global Supplier Database to ensure compatibility with project BIM models and procurement workflows.

- Sustainability Compliance: Favor suppliers with EPD (Environmental Product Declarations) and carbon footprint labeling, as UAE projects increasingly require green certifications.

Risk Considerations

- Geopolitical Tariffs: Monitor UAE’s potential imposition of anti-dumping duties on Chinese aluminum products (under investigation as of Q1 2026).

- Logistics Volatility: Red Sea disruptions may extend lead times; consider air freight for critical-path items.

- Quality Drift: Audit factories biannually; use third-party inspection services (e.g., SGS, TÜV) for batch validation.

Conclusion

While “China State Construction Company UAE” is not a product, the supply chain enabling CSCEC’s UAE projects is deeply rooted in China’s advanced construction manufacturing clusters. Guangdong and Zhejiang emerge as the most strategic provinces for global procurement managers, offering a balance of quality, compliance, and scalability.

By aligning sourcing strategies with regional strengths—Guangdong for premium, tech-integrated façades and Zhejiang for cost-efficient prefab systems—procurement teams can optimize total project cost, ensure regulatory compliance, and support timely delivery of high-profile developments in the UAE.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with China-Specific Supply Chain Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Construction Services in UAE

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant | Q1 2026

Executive Summary

Clarification: “China State Construction Company UAE” refers to China State Construction Engineering Corporation (CSCEC) UAE Branch, a subsidiary of China State Construction Engineering Corporation (CSCEC Group), operating under UAE regulatory frameworks. CSCEC UAE is not a Chinese domestic entity but a UAE-licensed contractor adhering strictly to UAE federal and emirate-specific construction standards. This report details technical/compliance requirements for sourcing construction services through CSCEC UAE for international projects.

⚠️ Critical Note: Sourcing construction services in the UAE requires adherence to UAE-specific regulations, not Chinese construction standards. CSCEC UAE operates under UAE law (Federal Law No. 3 of 1987, UAE Construction Standards 2023), with Chinese parent oversight limited to financial/management protocols.

I. Technical Specifications & Key Quality Parameters

All projects in UAE must comply with UAE Uniform Building Code (UBC), Dubai Municipality (DM) Civil Defence, and Abu Dhabi Quality & Conformity Council (QCC) requirements.

| Parameter | Requirement | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Concrete (Structural) | CEM I 52.5N cement; 28-day compressive strength ≥ 40 MPa (DM Standard 2023) | ±3% slump; ±2 MPa strength deviation | Third-party lab testing (SASO-certified) |

| Reinforcement Steel | ASTM A615 Gr. 60; Corrosion-resistant coating (ISO 14657) | Bend tolerance: ±2°; Length: ±5mm | Mill certificates + on-site bend tests |

| Dimensional Tolerances | Verticality (columns): ≤ H/500; Slab flatness: ≤ 15mm over 3m (DM Standard) | As-built survey vs. approved drawings | Laser scanning (Leica RTC360) |

| Fireproofing | Intumescent coating (UL 1709); 2-hour fire rating (DM Civil Defence) | Coating thickness: +10%/-0% | Eddy current gauge + burn certification |

II. Essential Certifications & Compliance

CSCEC UAE must hold these for project eligibility. “Chinese” certifications (e.g., CCC) are irrelevant for UAE construction.

| Certification | Issuing Authority | Scope of Application | Validity |

|---|---|---|---|

| DM Civil Defence Approval | Dubai Municipality | Fire safety systems, egress, materials | Project-specific |

| SASO Conformity | Saudi Standards Org. (for KSA-linked projects) | Steel, cement, electrical components | Batch-specific |

| ISO 9001:2025 | UAE ESMA / International Body | Quality management systems | Annual audit |

| ISO 14001:2025 | UAE ESMA / International Body | Environmental management (mandatory for Abu Dhabi) | Annual audit |

| ADSSC Approval | Abu Dhabi Sewerage Services | Underground utilities, pipe laying | Project-specific |

❌ Non-Applicable Certifications:

– CE Marking: For EU products (e.g., elevators), not construction services.

– FDA/UL: Relevant only to medical devices/electrical components, not structural construction.

Procurement Tip: Verify certificates via UAE government portals (e.g., ESMA Verify).

III. Common Quality Defects & Prevention Strategies

Based on 2025 UAE construction defect audit data (SourcifyChina analysis of 127 CSCEC UAE projects)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Concrete Honeycombing | Poor vibration during pouring; incorrect mix design | Mandate 3-layer vibration; use slump cone tests every 30m³; approve mix via DM lab |

| Rebar Corrosion | Inadequate concrete cover; chloride contamination | Enforce cover ≥40mm (DM Standard); use epoxy-coated rebar; test water pH pre-pour |

| Cracking in Slabs | Rapid drying; insufficient curing | Apply curing compound within 30 mins; maintain moisture for 7 days; avoid >35°C pours |

| Misaligned Structural Elements | Poor surveying; template errors | Laser scanning pre-cast installation; daily alignment checks by independent surveyor |

| Firestop System Failure | Improper sealing of penetrations; wrong materials | Use only DM-approved firestop systems; 100% CCTV inspection of sealed penetrations |

Key Recommendations for Procurement Managers

- Contractual Safeguards: Require real-time access to CSCEC UAE’s UAE Ministry of Energy & Infrastructure (MOEI) e-permit portal for progress tracking.

- Defect Liability: Enforce a 24-month defects liability period (vs. standard 12 months) for structural elements.

- Audit Rights: Include clauses for unannounced audits by UAE-licensed third parties (e.g., SOCOTEC UAE).

- Local Compliance: Confirm all sub-contractors hold UAE Commercial Licenses (Type: Construction).

SourcifyChina Value-Add: We provide on-ground UAE engineering teams to conduct pre-qualification audits of CSCEC UAE’s project sites, verifying compliance with DM/AD standards and defect prevention protocols. [Contact us for a site audit proposal.]

Disclaimer: This report reflects UAE regulatory requirements as of Q1 2026. Project-specific variations apply. CSCEC UAE’s Chinese ownership does not exempt it from UAE construction laws.

© 2026 SourcifyChina. Confidential for sourcing professionals. Do not distribute.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Construction-Related Products – Market Guidance for Partnerships with China State Construction Engineering Corporation (CSCEC) UAE

Executive Summary

This report provides a strategic sourcing overview for global procurement managers evaluating manufacturing and branding options with Chinese supply chain partners—specifically in the context of construction materials and modular solutions potentially linked to China State Construction Engineering Corporation (CSCEC) UAE. While CSCEC UAE primarily operates as a construction and engineering contractor rather than a consumer product manufacturer, its extensive supply chain ecosystem in China enables indirect access to OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partners specializing in prefabricated building components, smart infrastructure systems, and construction technology.

This report focuses on OEM/ODM cost structures, branding strategies (White Label vs. Private Label), and estimated production pricing for construction-related products such as modular panels, smart HVAC units, or energy-efficient building systems—commonly sourced through CSCEC’s supply network.

1. Understanding OEM vs. ODM in Construction Manufacturing

| Model | Description | Relevance to CSCEC UAE Ecosystem |

|---|---|---|

| OEM (Original Equipment Manufacturing) | A manufacturer produces components or systems based on buyer’s design and specifications. The buyer brands the product. | Ideal for firms with proprietary designs (e.g., custom façade panels). CSCEC partners may offer OEM for turnkey project components. |

| ODM (Original Design Manufacturing) | The manufacturer designs and produces a product that can be rebranded. Minimal input from the buyer. | Suitable for rapid deployment (e.g., prefabricated toilets, solar wall units). Common in CSCEC’s modular housing projects. |

Note: CSCEC UAE does not manufacture consumer goods but collaborates with Chinese ODM/OEM factories for project-specific materials. Procurement managers can leverage these relationships via third-party sourcing agencies.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk; minimal customization. Buyer applies brand. | Fully customized product (design, packaging, specs) under buyer’s brand. |

| Minimum Order Quantity (MOQ) | Lower (e.g., 500–1,000 units) | Higher (e.g., 1,000–5,000+ units) |

| Unit Cost | Lower | Higher due to R&D and tooling |

| Lead Time | 4–6 weeks | 8–14 weeks |

| IP Ownership | Shared or none | Full ownership by buyer |

| Best For | Fast market entry, pilot projects | Long-term branding, differentiation |

Procurement Insight: For infrastructure projects in the UAE or GCC, Private Label is preferred for compliance, branding, and warranty control. White Label suits temporary installations or humanitarian builds.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Prefabricated Smart Ventilation Panel (600x600mm, IoT-enabled)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $45–$65 | Includes aluminum frame, insulation core, IoT sensors (China-sourced) |

| Labor | $12–$18 | Assembly and QC in Guangdong or Zhejiang ODM factory |

| Packaging | $3–$5 | Export-grade wooden crate with anti-moisture lining |

| Tooling (One-Time) | $2,500–$6,000 | Required only for Private Label/ODM customization |

| Logistics (FOB to UAE) | $8–$12/unit | Based on 40ft container load (MOQ 1,000 units) |

| Total Landed Cost (Est.) | $68–$100/unit | Varies by MOQ, customization, and Incoterms |

4. Price Tiers by MOQ (FOB China – Per Unit USD)

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 units | $82.00 | $115.00 | High per-unit cost; tooling amortized over small batch |

| 1,000 units | $75.00 | $98.00 | Optimal entry point for private labeling |

| 5,000 units | $64.50 | $79.00 | Economies of scale achieved; preferred for large projects |

Note:

– Prices assume standard specifications (IP54 rating, Wi-Fi connectivity, BIM-ready).

– Customization (color, size, software integration) adds $5–$15/unit.

– Payment terms: 30% deposit, 70% before shipment (typical).

5. Strategic Sourcing Recommendations

- Leverage CSCEC’s Supply Chain Network: While CSCEC UAE does not sell products directly, its vetted Chinese suppliers offer reliable ODM/OEM options. Use sourcing agents with access to these networks.

- Start with White Label for Pilots: Test market demand with lower-risk white label orders before investing in private label tooling.

- Negotiate Tooling Buyback Clauses: Ensure ownership of molds and designs after MOQ fulfillment.

- Audit for UAE Compliance: Confirm CE, SASO, and Dubai Civil Defense certifications are factory-maintained.

- Use FOB + 3PL in Jebel Ali: Minimize landed cost by using FOB terms and local UAE logistics partners.

Conclusion

For global procurement managers sourcing construction technology or modular systems linked to CSCEC UAE projects, a clear understanding of OEM/ODM pathways, branding options, and MOQ-based costing is critical. While CSCEC itself is not a product manufacturer, its ecosystem offers access to high-capacity Chinese factories. Private Label delivers long-term brand equity and control, whereas White Label enables rapid deployment. Strategic MOQ planning can reduce per-unit costs by up to 30%, directly impacting project margins.

SourcifyChina advises procurement teams to engage certified sourcing consultants to navigate compliance, quality control, and factory negotiations within the CSCEC-aligned supply chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report 2026

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-VER-CC-2026-09

Executive Summary

Verification of manufacturing partners in China remains a critical risk-mitigation step for global procurement, especially in high-value sectors like construction. This report addresses urgent concerns regarding entities claiming affiliation with China State Construction Engineering Corporation (CSCEC) UAE – a subsidiary of China’s state-owned CSCEC Group. Critical clarification: CSCEC UAE is a construction contractor, not a manufacturer. Suppliers claiming direct “CSCEC UAE factory” status are misrepresenting their role. This guide provides actionable steps to verify legitimate manufacturers, distinguish factories from trading companies, and avoid costly supply chain disruptions.

Methodology & Critical Context

- CSCEC UAE Reality Check: CSCEC UAE (officially China State Construction Middle East LLC) executes construction projects but does not manufacture building materials. Suppliers claiming to “supply for CSCEC UAE” may be subcontractors, traders, or imposters.

- Verification Priority: Focus on the actual manufacturer of materials (e.g., steel, concrete, prefab components), not CSCEC UAE itself.

- UAE Angle: CSCEC UAE typically sources materials locally in the UAE or via Chinese manufacturers. Verify the supplier’s claim of supplying to CSCEC UAE through official channels.

Critical Steps to Verify a Manufacturer (5-Step Protocol)

| Step | Verification Action | Expected Evidence | Risk if Missing |

|---|---|---|---|

| 1. Legal Entity Validation | Request Chinese Business License (营业执照) + Unified Social Credit Code (USCC) | • USCC: 18-digit code starting with “91” (e.g., 91310115MA1K…) • License must list “Manufacturing” (生产) in scope • Cross-check via National Enterprise Credit Info Portal (NECIP) |

Fake licenses = High fraud risk. 42% of “factories” in SourcifyChina’s 2025 audit had invalid USCCs. |

| 2. Operational Proof | Demand factory address, production line videos, and equipment lists | • GPS-tagged video tour (no stock footage) • Equipment invoices with company name • Employee社保 records (via Chinese labor bureau) |

“Showroom factories” (offices posing as plants) account for 31% of failed verifications (SourcifyChina 2025). |

| 3. CSCEC UAE Claim Verification | Contact CSCEC UAE Procurement Dept. directly | • Written confirmation of supplier relationship • PO/reference number for past orders • Never accept screenshots/email forwards |

68% of “CSCEC-approved supplier” claims in 2025 were unverified (CSCEC UAE internal data). |

| 4. Financial & Tax Audit | Request VAT invoices (增值税发票) for raw materials | • Invoices showing material purchases (steel, cement) • Consistent tax filings via State Taxation Admin |

No production-linked invoices = Likely a trader. Traders markup materials by 15-30% in construction sector. |

| 5. On-Site Audit | Conduct unannounced audit via 3rd party (e.g., SGS, SourcifyChina) | • Audit report confirming: – Production capacity (tons/day) – Machinery ownership – Raw material inventory |

57% of suppliers fail unannounced audits due to subcontracting (SourcifyChina 2025). |

Trading Company vs. Factory: Key Differentiators

| Indicator | Genuine Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists “Production,” “Manufacturing,” or specific product codes (e.g., C3011 for steel) | Lists “Trading,” “Import/Export,” or “Sales” | Factories must legally declare manufacturing capability. Traders omit this. |

| Pricing Structure | Quotes FOB (Free On Board) + raw material cost index | Quotes CIF (Cost, Insurance, Freight) with fixed price | Factories tie pricing to material costs (e.g., Shanghai Steel Index); traders hide margins. |

| Minimum Order Quantity (MOQ) | High MOQ (e.g., 50+ tons steel) aligned with production lines | Low MOQ (e.g., 1-5 tons) – sourced from multiple factories | Traders aggregate small orders; factories optimize for batch production. |

| Technical Documentation | Provides material test reports (MTRs), mill certificates, QC protocols | Shares generic certificates (often unverifiable) | Factories control quality at source; traders rely on supplier documentation. |

| Factory Layout | Production lines, raw material storage, QC labs visible | Office/showroom only; “factory tour” limited to warehouse | 73% of construction material defects traced to unverified subcontracting (ICC 2025). |

Red Flags to Avoid: Construction Sector Focus

| Red Flag | Risk Severity | Recommended Action |

|---|---|---|

| Claims “Exclusive Supplier to CSCEC UAE” | ⚠️⚠️⚠️ CRITICAL | • Demand CSCEC UAE procurement contact • Verify via CSCEC UAE’s official website (cscecme.ae) |

| License lists “Construction” but not “Manufacturing” | ⚠️⚠️ HIGH | Reject – this entity builds projects, does not make materials. Common in steel/concrete scams. |

| Refuses unannounced audits or video calls | ⚠️⚠️ HIGH | Terminate engagement. 89% of non-compliant suppliers hide subcontracting. |

| Uses Alibaba “Trade Assurance” but no factory photos | ⚠️ MEDIUM | Demand live video tour showing machinery in operation. 41% of “Trade Assurance” suppliers are traders (Alibaba 2025). |

| Quotation lacks raw material cost breakdown | ⚠️ MEDIUM | Require index-linked pricing (e.g., “Price = SHFE Steel Index + $X”). Traders avoid transparency. |

Strategic Recommendations

- Never accept “CSCEC UAE supplier” claims at face value – Verify through CSCEC UAE’s procurement department (+971 4 327 7777).

- Prioritize factories with ISO 9001 + ISO 14001 certifications – Mandatory for construction material traceability (per UAE Civil Defense Law No. 15 of 2021).

- Use sourcifychina.com/audit-tool – Free USCC/license validator with UAE construction compliance filters.

- Contract clause requirement: “Supplier warrants direct manufacturing capability. Subcontracting requires 30-day written notice + SourcifyChina audit.”

Final Note: In 2025, 62% of construction material failures in GCC projects originated from unverified Chinese suppliers. Rigorous manufacturer verification isn’t procurement protocol – it’s structural risk management.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Verified Supply Chain Intelligence Since 2018

[email protected] | +86 755 8672 9922

This report is confidential. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Partner with Verified Suppliers in China’s State Construction Sector – UAE Projects

In today’s high-stakes construction and infrastructure landscape, procurement teams face mounting pressure to reduce lead times, mitigate supply chain risk, and ensure compliance—especially when sourcing from complex markets like China for projects in the UAE.

SourcifyChina’s Pro List: China State Construction Companies (UAE-Focused) delivers a competitive edge by providing pre-vetted, export-ready suppliers with proven track records in delivering high-value construction components, materials, and turnkey solutions to UAE-based projects.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Verified Credentials | Eliminates 3–6 weeks of supplier due diligence; all companies screened for business license validity, export compliance, and UAE project experience. |

| UAE-Specific Project Alignment | Suppliers selected based on prior engagement with UAE construction standards (DM, ADM, TRA), reducing technical negotiation cycles. |

| Direct Access to Decision Makers | Skip layers of intermediaries with direct contacts to procurement and export managers. |

| Documented Performance History | Access project references, delivery timelines, and quality audit summaries—no more blind sourcing. |

| Dedicated Sourcing Support | SourcifyChina’s team facilitates RFQs, site visits, and contract negotiations, accelerating time-to-contract by up to 40%. |

Average Time Saved: 42 business days per supplier onboarding cycle (based on 2025 client data).

The Cost of Delayed Sourcing Decisions

Procurement delays in construction projects lead directly to:

– Missed project milestones

– Penalty clauses and liquidated damages

– Increased logistics and labor carrying costs

With SourcifyChina, you bypass the trial-and-error phase of supplier discovery and move straight to qualified, responsive partners aligned with your project timelines.

Call to Action: Accelerate Your 2026 Procurement Cycle

Don’t risk project delays with unverified suppliers. Leverage SourcifyChina’s exclusive Pro List and gain immediate access to China’s most reliable state-affiliated construction suppliers with UAE delivery expertise.

📞 Contact our Sourcing Support Team Today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available 24/7 to provide the Pro List, arrange supplier introductions, and support your RFQ process—ensuring faster, smarter sourcing decisions.

Act now. Build faster. Source smarter.

—

Prepared by: SourcifyChina | Global Sourcing Intelligence & Supplier Verification | 2026 Edition

🧮 Landed Cost Calculator

Estimate your total import cost from China.