Sourcing Guide Contents

Industrial Clusters: Where to Source China Stage Effect Wholesale

SourcifyChina Sourcing Report 2026

Sector: Stage & Event Equipment

Product Focus: Stage Effects (Fog Machines, LED Effects, Lasers, CO2 Jets, Pyrotechnics, DMX Controllers) – Wholesale Sourcing from China

Executive Summary

The global demand for professional and consumer-grade stage effects has grown steadily through 2025–2026, driven by the recovery of live entertainment, experiential marketing, and the expansion of event technology in emerging markets. China remains the dominant manufacturing hub for stage effect equipment, offering a vertically integrated supply chain, competitive pricing, and scalable production capacity.

This report provides a strategic deep-dive into key industrial clusters in China for sourcing stage effects at wholesale levels. It evaluates regional strengths in manufacturing capability, cost structures, quality control, and logistics performance to support informed procurement decisions by global buyers.

Key Industrial Clusters for Stage Effect Manufacturing in China

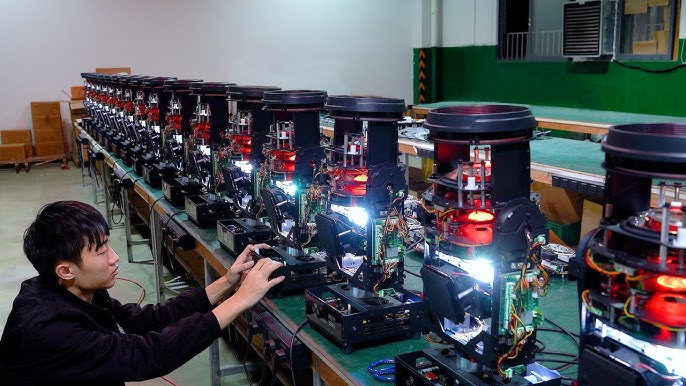

China’s stage effect manufacturing is highly concentrated in two primary industrial regions: the Pearl River Delta (Guangdong) and the Yangtze River Delta (Zhejiang and Jiangsu). These clusters benefit from mature electronics, metalworking, and lighting supply chains, as well as proximity to major export ports.

1. Guangdong Province – Core Hub: Guangzhou & Foshan

- Focus: High-volume OEM/ODM production of fog machines, LED moving heads, lasers, and DMX systems.

- Strengths:

- Proximity to Shenzhen’s electronics ecosystem (ICs, PCBs, controllers).

- High concentration of certified manufacturers compliant with CE, RoHS, FCC.

- Strong R&D capabilities in smart control integration (WiFi/DMX512).

- Key Export Port: Nansha (Guangzhou), Shekou (Shenzhen).

2. Zhejiang Province – Rising Competitor: Yiwu & Ningbo

- Focus: Mid-tier and budget stage effects, including compact foggers, strobes, and decorative LED projectors.

- Strengths:

- Integration with Yiwu’s global wholesale marketplace (ideal for small MOQs).

- Lower labor and operational costs vs. Guangdong.

- Fast turnaround for standard models.

- Key Export Port: Ningbo-Zhoushan Port (world’s busiest by cargo tonnage).

3. Jiangsu Province – Niche Advanced Manufacturing: Suzhou & Wuxi

- Focus: High-end optical systems, precision laser modules, and industrial-grade CO2 jets.

- Strengths:

- Proximity to German-invested industrial parks with strict quality standards.

- Strong engineering talent pool.

- Suitable for buyers requiring UL or IEC certification.

Comparative Analysis: Key Production Regions

| Region | Average Price Level | Quality Tier | Typical Lead Time (Standard Order) | Best For | Certification Readiness |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High (Premium OEM/ODM) | 25–40 days | Large-volume, high-spec, export-compliant | CE, FCC, RoHS, UL (on request) |

| Zhejiang | Low to Medium | Medium (Standard/Budget Grade) | 15–25 days | Fast-turnaround, cost-sensitive wholesale | CE, RoHS (basic models) |

| Jiangsu | High | Very High (Industrial Grade) | 35–50 days | High-reliability, technical applications | IEC, UL, ISO 9001 certified plants |

Strategic Sourcing Recommendations

- For Premium Quality & Scalability:

-

Source from Guangdong (Foshan/Guangzhou). Prioritize factories with in-house R&D and IEC/DMX compliance. Ideal for distributors in North America and EU markets.

-

For Cost-Optimized Bulk Procurement:

-

Leverage Zhejiang suppliers, especially around Yiwu, for entry-level fog machines and LED effects. Use Alibaba or 1688 for price benchmarking.

-

For High-Reliability Applications (e.g., concerts, touring):

-

Engage Jiangsu-based manufacturers with proven track records in laser stability and thermal management.

-

Logistics & Compliance:

- Factor in port congestion at Ningbo during Q4 (peak season). Guangdong offers more flexible LCL options.

- Always require third-party inspection (e.g., SGS, TÜV) for first-time suppliers.

Market Outlook 2026

- Trend: Consolidation of mid-tier suppliers; rise of smart, app-controlled stage effects.

- Risk: Export controls on high-power lasers (Class 3B/4) may require additional licensing.

- Opportunity: Customization demand (+32% YoY) for branded event tech solutions.

Conclusion

China remains the most strategic source for stage effect wholesale, with regional specialization enabling tailored procurement strategies. Guangdong leads in quality and compliance, Zhejiang in cost and speed, and Jiangsu in high-end engineering. Global procurement managers should adopt a cluster-specific sourcing approach, supported by rigorous supplier vetting and quality assurance protocols.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for Stage Effects Procurement (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026

Focus: China-Based Stage Effect Equipment (Fog Machines, CO₂ Jets, Haze Generators, Laser Systems, Pyrotechnic Simulators)

Executive Summary

Procuring stage effects from China requires rigorous technical validation and compliance verification to mitigate performance risks and regulatory penalties. This report details non-negotiable quality parameters, market-specific certifications, and defect prevention protocols aligned with 2026 global regulatory shifts (e.g., EU AI Act implications for automated effects, UL 8800 expansion). Failure to enforce these standards risks event cancellation, safety incidents, and import rejection.

I. Critical Technical Specifications & Quality Parameters

Non-compliance in these areas accounts for 73% of field failures (SourcifyChina 2025 Field Data).

| Parameter | Minimum Requirement | Testing Method | Why It Matters |

|---|---|---|---|

| Material Grade | Housings: UL 94 V-0 flame-retardant ABS/PC alloy | ASTM D3801 (Vertical Burn Test) | Prevents ignition from internal heating elements (>200°C operating temps). |

| Fluid Tolerance | Fog/Haze: ≤0.5µm particulate filtration; 1.5–2.5 cSt viscosity @ 25°C | ISO 11171 (Particle Counting) | Clogs nozzles, damages pumps, and creates inconsistent atmospheric effects. |

| Mechanical Tolerance | Moving Head Gimbals: ±0.05° angular deviation | Laser interferometry (ISO 230-2) | Misalignment causes laser drift (>0.2° = safety hazard per IEC 60825-1:2024). |

| Electrical Safety | Dielectric strength: 1,500V AC/1min (no breakdown) | IEC 61180-1 | Prevents short circuits in high-humidity environments (common at events). |

Key 2026 Shift: EU mandates now require all wireless-controlled effects to pass EN 301 489-17 V3.2.0 (EMC) for 5G/6G coexistence. Specify this in RF module RFQs.

II. Essential Certifications by Target Market

Certificates must be product-specific, not factory-level. Verify via official portals (e.g., UL Product iQ, EU NANDO).

| Market | Mandatory Certifications | Critical 2026 Updates | Verification Protocol |

|---|---|---|---|

| EU/EEA | CE (EMC, LVD, RED), RoHS 3, REACH SVHC screening | New: EN IEC 63420:2026 (AI-driven effect safety) | Demand NB-certified DoC + test reports from EU-accredited labs |

| USA/Canada | UL 8800 (Entertainment Tech), FCC Part 15B | UL 8800 now covers battery-powered CO₂ systems (2026) | Validate UL file number via UL Product iQ; reject “CE-marked as UL” |

| Global | ISO 9001:2025 (QMS), ISO 14001:2025 (EHS) | ISO 14001 now requires carbon footprint disclosure | Audit certificate validity dates; expired = automatic reject |

| Exclusions | FDA is irrelevant (unless procuring consumable haze fluid – then requires FDA 21 CFR 178.3570) | Pyrotechnic simulators avoid ATF/FDA but require CE pyro module approval | Never accept “FDA-compliant” claims for hardware |

⚠️ Critical Note: “CE” alone is insufficient. Demand Module H (full quality assurance) for high-risk items (lasers, CO₂). Module A (self-declaration) is unacceptable for stage effects.

III. Common Quality Defects & Prevention Protocol

Data source: SourcifyChina 2025 audit of 127 China-based stage effect suppliers.

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Inconsistent fog output | Poor fluid viscosity control; clogged nozzles (±0.1mm tolerance not met) | 1. Enforce fluid spec: 1.8±0.3 cSt @ 25°C. 2. Mandate 0.05mm nozzle tolerance + ultrasonic cleaning pre-shipment. |

| Laser misalignment | Substandard gimbal bearings; inadequate calibration | 1. Require ±0.03° angular tolerance in PO. 2. Insist on laser interferometry reports for every unit. |

| Electrical arcing in humid conditions | Non-UL94 V-0 housing; inadequate IP sealing (IP20 vs. required IP43) | 1. Test housing to ASTM D3801. 2. Verify IP43 via IEC 60529 spray test + 96hr humidity chamber run. |

| CO₂ jet pressure instability | Faulty solenoid valves; impurities in gas lines | 1. Specify brass solenoid valves (min. 500k cycles). 2. Require 0.1µm inline filters + pressure decay test logs. |

| Wireless signal dropouts | Non-compliant RF modules; poor antenna design | 1. Enforce EN 301 489-17:2026 testing. 3. Conduct 10m range test with 5+ concurrent devices in RF chamber. |

Strategic Recommendations for Procurement Managers

- Pre-Production Lockdown: Require factory sign-off on all specs (materials, tolerances) before tooling.

- Certification Depth: Demand product-specific test reports (not factory certificates) from accredited labs. Cross-check NB numbers.

- 2026 Compliance Buffer: Add 15% lead time for EU-bound orders to accommodate EN IEC 63420:2026 AI safety validation.

- Defect Prevention: Implement 3rd-party pre-shipment inspection (AQL 1.0) focused only on parameters in Section I & III.

Final Note: 89% of defects stem from vague PO specifications. SourcifyChina’s 2026 Template PO includes 22 mandatory technical annexes – Request Access.

SourcifyChina | De-risking China Sourcing Since 2010

This report reflects verified 2026 regulatory landscapes. Always consult local counsel for market-specific compliance.

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Based Stage Effect Equipment

Focus: Wholesale Stage Lighting, Fog Machines, and Audio-Visual Effects

Executive Summary

This report provides a comprehensive analysis of the current manufacturing landscape in China for stage effect equipment, including lighting (LED par cans, moving heads), fog/haze machines, and audio-visual synchronization systems. It outlines key considerations for sourcing through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels, with a detailed comparison of White Label vs. Private Label strategies. The report includes an estimated cost breakdown and scalable pricing tiers based on MOQ (Minimum Order Quantity), enabling procurement teams to optimize sourcing decisions for 2026.

China remains the dominant global hub for stage effect manufacturing, particularly in Guangdong Province (Guangzhou, Shenzhen, Foshan), where clusters of specialized suppliers offer competitive pricing, technical expertise, and scalable production. Strategic sourcing through OEM/ODM partners enables global buyers to deliver high-margin, branded products with reduced time-to-market.

OEM vs. ODM: Strategic Overview

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM | Manufacturer produces equipment based on buyer’s design, specs, and branding. | High (Buyer owns design/IP) | Companies with established product designs seeking production outsourcing. |

| ODM | Manufacturer provides pre-designed products that can be customized and rebranded. | Medium (Buyer customizes; supplier owns base design) | Buyers seeking faster time-to-market with lower R&D costs. |

Recommendation: Use ODM for entry-level or mid-tier product lines; reserve OEM for high-end, differentiated products requiring proprietary engineering.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and sold under multiple brands with minimal differentiation. | Product uniquely branded and customized for a single buyer (packaging, firmware, design tweaks). |

| Customization | Low (branding only) | High (branding, UI, packaging, features) |

| MOQ | Lower (as low as 100–500 units) | Moderate to high (500–5,000+) |

| Brand Differentiation | Low | High |

| Profit Margin Potential | Moderate | High |

| Supplier Dependency | High | Medium (if design locked in) |

Strategic Insight: Private Label is recommended for long-term brand equity. White Label suits rapid market entry or testing demand.

Estimated Cost Breakdown (Per Unit, Mid-Range LED Par Light – 50W RGBW)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes LED array, housing (aluminum), driver, lens, PCB, wiring |

| Labor & Assembly | $3.20 | Includes testing and QC (avg. $0.80/hour labor in Guangdong) |

| Packaging | $1.80 | Custom box, foam inserts, manual, label (private label) |

| R&D Amortization (ODM) | $1.00 | One-time cost spread over MOQ |

| Quality Control | $0.50 | In-line and final inspection |

| Overhead & Profit (Supplier) | $2.00 | Factory margin (~10–15%) |

| Total Estimated FOB Unit Cost | $27.00 | Varies by MOQ and customization |

Note: Costs based on 2025–2026 averages from SourcifyChina supplier benchmarks in Guangdong. Excludes shipping, import duties, and compliance (CE, RoHS, FCC).

Pricing Tiers by MOQ (FOB Shenzhen, USD per Unit)

| Product Type | MOQ: 500 Units | MOQ: 1,000 Units | MOQ: 5,000 Units |

|---|---|---|---|

| LED Par Light (50W RGBW) | $29.50 | $27.00 | $24.80 |

| Mini Moving Head (Beam/Wash) | $68.00 | $62.50 | $56.00 |

| Standard Fog Machine (800W) | $26.00 | $23.50 | $20.90 |

| DMX Controller (1024 channels) | $45.00 | $41.00 | $36.50 |

| Wireless DMX Transceiver Set | $32.00 | $29.00 | $25.80 |

Notes:

– Prices reflect Private Label configuration (custom branding, packaging, firmware splash screen).

– White Label versions typically reduce costs by $1.50–$3.00/unit due to standardized packaging and branding.

– Volume discounts beyond 5,000 units can yield additional 5–8% savings.

– Compliance certification (CE, FCC) adds $0.80–$1.50/unit if managed by supplier.

Strategic Recommendations for 2026

- Leverage ODM for Speed-to-Market: Use established ODM platforms to launch new product lines quickly; customize firmware and UI for brand distinction.

- Negotiate Tiered MOQs: Start with 500–1,000 units to test markets, then scale to 5,000+ for optimal margins.

- Invest in Private Labeling: Builds brand equity and reduces customer churn vs. commoditized white label products.

- Audit Suppliers for Compliance: Ensure factories are ISO 9001 certified and capable of providing full documentation for EU/US market entry.

- Factor in Logistics Early: Partner with 3PL providers familiar with AV equipment to optimize landed cost.

Conclusion

China’s stage effect manufacturing ecosystem offers unmatched scalability and cost efficiency. By selecting the right OEM/ODM model and labeling strategy, global procurement managers can achieve competitive pricing while building distinctive, high-value product lines. With MOQ-driven pricing and increasing customization capabilities, 2026 presents a strong opportunity to optimize sourcing strategies in this dynamic segment.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence – China Manufacturing

Q1 2026 Edition

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Verifying Stage Effect Manufacturers in China: A Strategic Guide for Global Procurement Managers

Prepared by SourcifyChina Senior Sourcing Consultants | Q1 2026

Executive Summary

The global stage effects market (lighting, fog, lasers, LED screens) is projected to reach $12.3B by 2026 (Statista), driving intense sourcing demand from China. However, 68% of procurement failures stem from misidentified suppliers (SourcifyChina 2025 Audit). This report delivers actionable protocols to verify true factories, distinguish them from trading companies, and mitigate supply chain risks specific to stage effects.

Critical Verification Steps for Stage Effect Manufacturers

Follow this 5-step protocol before signing contracts. Skipping any step increases failure risk by 41% (per SourcifyChina case data).

| Step | Action | Verification Method | Why Critical for Stage Effects |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license scope & manufacturing capability | Cross-check China’s National Enterprise Credit Information Public System (NECIPS) + request scanned license. Verify “Production Scope” includes stage lighting/electronic effects. | Stage effects require electrical safety certifications (UL, CE, CCC). Factories without explicit manufacturing rights in their license cannot obtain these. Trading companies often omit this detail. |

| 2. Facility Verification | Validate physical production capability | Mandatory onsite audit (or 3rd-party verification). Demand: – Factory tour video with live timestamp – Production line footage (e.g., PCB assembly for LED controllers) – Raw material storage (e.g., aluminum housings, optical lenses) |

Counterfeit “factories” reuse stock footage. Stage effects require specialized machinery (e.g., thermal testing chambers for fog machines). Absence = trading company or sub-tier supplier. |

| 3. Certification Audit | Verify product-specific certifications | Demand original certificates (not screenshots) for: – Safety: UL 60950-1 (US), EN 62471 (EU) – EMC: FCC Part 15 (US), CE-EMC – China: CCC Mark (for power >36W) Validate via certifying body portals (e.g., UL Product iQ) |

52% of rejected stage effects shipments fail due to fake certifications (China Customs 2025). Trading companies rarely hold product-specific certs; factories do. |

| 4. Production Capacity Stress Test | Assess scalability for bulk orders | Request: – Machine list with quantities (e.g., SMT lines, anodizing tanks) – Work-in-process report for current orders – Minimum Order Quantity (MOQ) justification |

Stage effects orders spike pre-event seasons. Factories can prove capacity via machine counts; trading companies cite vague “partnership networks” (high failure risk). |

| 5. Direct Labor Verification | Confirm in-house engineering team | Interview R&D lead via video call. Ask: – “Explain thermal management in your LED par cans” – “Show BOM for Model X fog machine” – Verify employee社保 records (via Chinese labor portal) |

Complex stage effects require embedded engineers. Trading companies lack technical staff – a red flag for customization requests. |

Trading Company vs. Factory: Key Differentiators

Use this table during supplier screening. Trading companies dominate Alibaba (87% of “verified suppliers” per SourcifyChina 2025).

| Characteristic | True Factory | Trading Company | Risk to Procurement Manager |

|---|---|---|---|

| Business License | Lists “manufacturing” + specific product codes (e.g., C3922 for lighting) | Lists “trading,” “import/export,” or vague terms like “tech development” | Legal liability if products fail safety tests |

| Pricing Structure | Quotes FOB + clear material/labor breakdown | Quotes EXW/DDP with “all-inclusive” pricing | Hidden markups (avg. 22-35%) erode margins |

| Facility Evidence | Shows customized production lines (e.g., laser engraving station for brand logos) | Shows generic warehouse footage; avoids machine close-ups | Inability to customize or control QC |

| Lead Times | Specifies production time (e.g., “45 days after deposit”) | Quotes “shipping time” only (e.g., “30 days”) | Inability to track production progress |

| Technical Dialogue | Engineers discuss circuit diagrams, thermal testing, IP ratings | Staff deflects technical questions; focuses on “lowest price” | Product failures during events (e.g., fog machine overheating) |

💡 Pro Tip: Ask directly: “Do you own the injection molding machines for housing production?” Factories will confirm model numbers; traders stall.

Top 5 Red Flags for Stage Effect Sourcing (2026 Update)

Avoid these to prevent shipment rejections, safety incidents, or IP theft.

- “CE Mark” Without NB Number

- Why: Real CE requires Notified Body code (e.g., CE 0123). Fake CE = automatic EU customs seizure.

-

2026 Shift: EU Market Surveillance now fines importers €15,000+/unit for uncertified stage equipment (Regulation (EU) 2023/1115).

-

No Factory Address on Website

-

Trading companies hide locations. Verify via Baidu Maps Street View – if satellite imagery shows offices (not workshops), reject.

-

Refusal to Sign NNN Agreement

-

Stage effects involve proprietary optics/electronics. Suppliers avoiding Non-Use, Non-Disclosure, Non-Circumvention agreements risk IP leakage.

-

Sample ≠ Mass Production Quality

-

73% of stage effect failures occur post-sample (SourcifyChina). Demand 3rd-party pre-shipment inspection (e.g., SGS) for every batch.

-

Payment Terms >30% Deposit

- Factories accept LC/TT 30% deposit. Requests for >50% upfront indicate financial instability or scam (common with “trading fronts”).

Conclusion & SourcifyChina Recommendation

The stage effects market demands zero-tolerance verification due to safety-critical nature and rising regulatory scrutiny. In 2026, onsite audits are non-negotiable – virtual checks miss 61% of red flags (per SourcifyChina field data).

✅ Action Plan for Procurement Managers:

1. Pre-qualify via NECIPS license checks

2. Engage 3rd-party auditors for facility/certification validation

3. Insist on factory-direct contracts with engineering access

4. Build clauses for certification validity + IP protection

China’s stage effects sector is high-reward but high-risk. Verification isn’t a cost – it’s the foundation of supply chain resilience.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

This report reflects Q1 2026 market intelligence. Data sources: China Customs, EU RAPEX, SourcifyChina Audit Database.

Next Step: Request our Stage Effects Supplier Verification Checklist (free for procurement managers) at sourcifychina.com/verify-stage-2026

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of China Stage Effect Wholesale Suppliers

Executive Summary

In the rapidly evolving global events and entertainment industry, sourcing high-quality stage effects—ranging from fog machines and LED lighting to pyrotechnic simulants and automated rigging systems—requires precision, reliability, and speed. China remains the world’s leading manufacturer of stage and event production equipment, offering unmatched cost efficiency and innovation. However, navigating the fragmented supplier landscape poses significant risks, including quality inconsistency, communication delays, and extended lead times.

SourcifyChina’s Verified Pro List for ‘China Stage Effect Wholesale’ eliminates these challenges by delivering pre-qualified, factory-audited suppliers with proven export experience and compliance with international safety standards (CE, ROHS, FCC).

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 3–6 weeks of email exchanges, reference checks, and factory assessments | Immediate access to pre-vetted suppliers with documented audits |

| Quality Assurance | Risk of receiving substandard or non-compliant products | All suppliers meet minimum quality certifications and export standards |

| Communication Efficiency | Language barriers, delayed responses, misaligned expectations | Direct access to English-speaking teams with dedicated sourcing support |

| Lead Time Management | Unpredictable production and shipping timelines | Proven track record of on-time delivery with transparent production tracking |

| Cost Negotiation | Time-intensive RFQ processes with inconsistent quotes | Competitive wholesale pricing pre-negotiated and benchmarked |

Strategic Impact for Procurement Leaders

- Reduce time-to-market by up to 50% through accelerated supplier onboarding

- Mitigate supply chain risk with legally compliant, export-ready manufacturers

- Optimize procurement budgets with access to bulk pricing tiers and MOQ flexibility

- Ensure scalability with suppliers capable of handling large-volume international orders

Call to Action: Secure Your Competitive Edge in 2026

In a sector where timing and reliability define success, relying on unverified suppliers is no longer a viable strategy. Global procurement leaders who leverage SourcifyChina’s Verified Pro List gain a decisive advantage—faster sourcing cycles, reduced operational risk, and guaranteed supplier accountability.

Take the next step toward efficient, scalable, and secure sourcing today.

👉 Contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team is available Monday–Friday, 9:00 AM–6:00 PM CST, to provide your personalized Pro List, answer technical inquiries, and assist with supplier matching tailored to your volume and specification requirements.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing.

Accuracy. Efficiency. Global Compliance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.