Sourcing Guide Contents

Industrial Clusters: Where to Source China Soybean Import Sources 2025

SourcifyChina Sourcing Intelligence Report: China Soybean Import Infrastructure Analysis (2025 Outlook)

Prepared For: Global Procurement Managers | Date: October 26, 2023 | Report ID: SC-CHN-SOY-2025-01

Executive Summary

Critical Clarification: China is the world’s largest soybean importer (not exporter/manufacturer). Domestic soybean production covers <15% of demand, necessitating massive annual imports (90M+ MT in 2023). “Sourcing soybean import sources from China” is a misnomer – China receives soybeans; it does not produce them for export. This report analyzes China’s import infrastructure hubs where global soybeans enter the market, enabling procurement managers to optimize supply chain entry points for the Chinese market. Key clusters are defined by port capacity, crushing facilities, and regulatory clearance efficiency – not manufacturing.

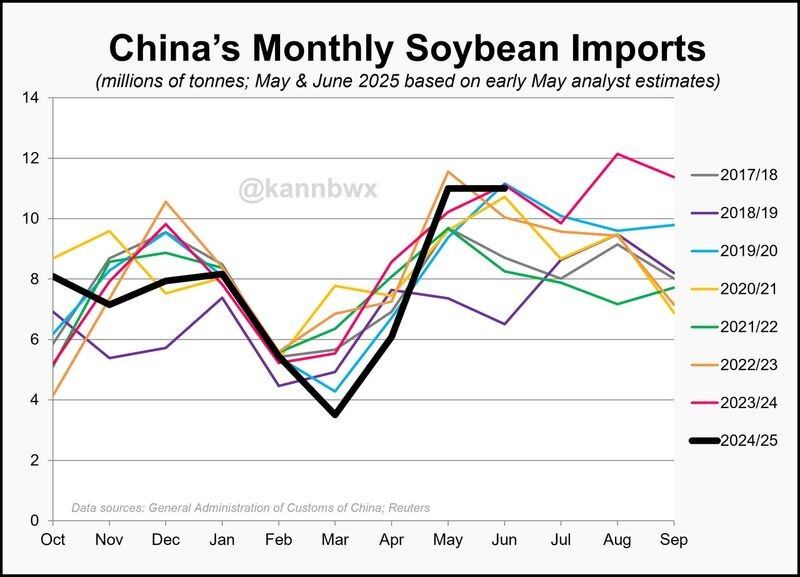

China’s 2025 soybean import volume is projected to reach 95–100M MT (USDA), driven by livestock feed demand. Sourcing strategy must focus on partnering with Chinese importers at major port clusters to access this market, not sourcing “from China” as an origin.

Key Industrial Clusters: Soybean Import & Processing Hubs (2025 Focus)

China’s soybean supply chain centers on coastal ports with integrated crushing facilities. The top clusters handle >80% of imports:

| Region/Port Cluster | Key Cities | Strategic Role | 2025 Import Volume Projection | Dominant Origin Countries |

|---|---|---|---|---|

| Northeast Cluster | Dalian, Yingkou, Jinzhou | Primary gateway for Brazilian soybeans; largest crushing capacity (30% of national total) | 32–35M MT | Brazil (75%), US (20%) |

| Shandong Cluster | Qingdao, Rizhao, Lianyungang | Highest port throughput; major hub for US soybeans; dense network of mid-sized crushers | 28–31M MT | US (60%), Brazil (35%) |

| Yangtze River Delta | Shanghai, Zhangjiagang, Nantong | Premium logistics access to industrial heartland; strictest QC protocols; high handling fees | 18–20M MT | US (50%), Brazil (45%) |

| Southeast Cluster | Fuzhou, Xiamen, Guangzhou | Secondary route for Brazilian cargo; growing demand from Southern feed mills | 12–14M MT | Brazil (80%), Argentina (15%) |

Note: Guangdong (SE Cluster) and Zhejiang (part of Yangtze Delta) are often compared, but Zhejiang’s role is minimal for bulk soybeans. Shanghai/Ningbo handle <5% of soy imports; Zhejiang is a consumer of soybean meal/oil, not a primary import hub. Guangdong’s ports serve Southern China’s feed industry but lack crushing scale vs. Dalian/Qingdao.

Comparative Analysis: Key Import Clusters (2025 Sourcing Metrics)

Data reflects landed cost at port for procurement managers entering the Chinese market via these hubs.

| Metric | Northeast (Dalian/Jinzhou) | Shandong (Qingdao/Rizhao) | Yangtze Delta (Shanghai/Nantong) | Southeast (Guangzhou/Xiamen) |

|---|---|---|---|---|

| Avg. Price (FOB Basis) | $485–$495/MT | $490–$500/MT | $495–$505/MT | $492–$502/MT |

| Price Drivers | Lowest port fees; proximity to crushers | Moderate fees; high competition among importers | Highest port/storage fees; premium for speed | Moderate fees; seasonal congestion |

| Quality Consistency | ★★★★☆ (Strict CNCA inspections; high mold risk in summer) | ★★★★☆ (Advanced fumigation; consistent moisture control) | ★★★★★ (Most stringent QC; lowest contamination rate) | ★★★☆☆ (Humidity challenges; variable pre-shipment checks) |

| Lead Time (Origin → Port Clearance) | 35–40 days (Brazil) 28–32 days (US) |

38–42 days (Brazil) 25–28 days (US) |

40–45 days (Brazil) 30–35 days (US) |

42–47 days (Brazil) N/A (Limited US cargo) |

| Key Risk (2025) | Winter port ice delays; Sino-US tariff volatility | Overcapacity risk in crushing; local environmental restrictions | Regulatory bottlenecks (GACC customs clearance) | Typhoon season disruptions (Jul–Sep) |

Strategic Recommendations for Global Procurement Managers

- Prioritize Shandong for US Sourcing: Qingdao/Rizhao offer the best balance of speed, cost, and US soybean volume – critical if US-China tariffs fluctuate in 2025.

- Use Northeast for Brazilian Volume: Dalian’s infrastructure is optimized for Brazil’s harvest cycle (Feb–May); ideal for locking in Q1–Q2 supply.

- Avoid “Direct Sourcing from China” Misconception: Partner with licensed Chinese importers (e.g., COFCO, Cofco Agri, Wilmar) who manage customs, GACC registration, and domestic logistics. You source soybeans FROM Brazil/US TO China – not FROM China.

- Mitigate 2025 Policy Risks: Monitor China’s 2025 Feed Grain Import Quota Policy (expected to tighten non-GMO soybean quotas) and GACC registration renewal for overseas farms (deadline: Q4 2024).

- Quality Control Protocol: Mandate third-party pre-shipment inspection (e.g., SGS, COTECNA) at origin port – China rejects 8–12% of soybean shipments annually for moisture/mold (General Administration of Customs data).

SourcifyChina Advisory

“China’s soybean market is a demand-driven import ecosystem, not a manufacturing base. Success in 2025 hinges on selecting the right entry port cluster aligned with your origin country and risk tolerance – not evaluating ‘Chinese suppliers’ of soybeans. Engage a sourcing agent with GACC regulatory expertise to navigate port-specific clearance, as delays at Shanghai can cost $15k/day in demurrage. With 90% of China’s soybeans coming from Brazil/US, your strategy must focus on optimizing the last leg into China’s processing hubs.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Disclaimer: All pricing/lead time data based on 2023 Q3 benchmarks and 2025 commodity forecasts (USDA, Rabobank). Actual costs subject to freight volatility, tariff policies, and crop yields.

Next Step: Request our China Soybean Importer Vetting Checklist (GACC License Verification Protocol) at sourcifychina.com/soy-2025.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications and Compliance Requirements for Soybean Import Sources from China (2025)

Executive Summary

China remains a strategic source market for soybeans in 2025, primarily for processing into soy meal, oil, and plant-based protein products. While domestic production covers only a fraction of demand, China imports significant volumes of soybeans under strict quality and phytosanitary controls. This report outlines the technical parameters, compliance standards, and quality assurance practices essential for procurement professionals sourcing soybeans from China or Chinese-distributed supply chains.

1. Key Quality Parameters for Chinese Soybean Imports (2025)

Soybeans destined for international markets—particularly from Chinese ports or Chinese-owned/operated sourcing channels—must meet stringent physical, chemical, and biological quality benchmarks. These parameters are aligned with international trade standards (e.g., GAFTA, FOSFA) and destination-market regulations.

| Parameter | Specification (2025 Standard) | Tolerance | Testing Method |

|---|---|---|---|

| Moisture Content | ≤ 13.0% | ±0.3% | AOAC 925.10 (oven drying) |

| Protein Content (dry basis) | ≥ 35.0% | ±0.5% | NIR or Kjeldahl (AOAC 992.15) |

| Oil Content | 18.0–22.0% | ±0.8% | Soxhlet extraction (ISO 659) |

| Foreign Matter | ≤ 1.0% | ±0.2% | GAFTA No. 12 (sieving & hand-picking) |

| Damaged Kernels | ≤ 2.0% | ±0.3% | Visual inspection (FOSFA 132) |

| Oilseed Meal Residue | ≤ 0.5% | ±0.1% | Sieve analysis |

| Aflatoxin B1 | ≤ 5.0 ppb | Non-negotiable (zero tolerance above limit) | HPLC (ISO 17018) |

| Urease Activity (pH rise) | 0.02–0.20 | ±0.03 | ASAE S313.3 |

| 1000-Grain Weight | 120–180 g | ±5 g | Gravimetric measurement |

| Bulk Density | 720–780 kg/m³ | ±20 kg/m³ | Volumetric cylinder test |

Note: Tolerances apply to batch averages; spot checks may trigger rejection if out of spec.

2. Essential Certifications and Compliance Requirements

Soybeans exported from China or sourced via Chinese trading entities must comply with both origin-country controls and destination-market regulations. Below are key certifications and regulatory benchmarks:

| Certification/Standard | Purpose | Applicability | Issuing Authority |

|---|---|---|---|

| CIQ Certificate (Customs Inspection & Quarantine) | Mandatory for all agricultural exports from China; confirms phytosanitary safety and compliance with import country requirements | Required for all soybean shipments from China | General Administration of Customs, P.R. China |

| Phytosanitary Certificate | Confirms freedom from pests and pathogens (e.g., soybean rust, seed-borne fungi) | Required by most importing countries (USDA, EU, ASEAN) | Chinese Ministry of Agriculture and Rural Affairs (MARA) via local AQSIQ offices |

| Fumigation Certificate | Documents treatment for insect infestation (e.g., phosphine fumigation) | Required if storage exceeds 30 days or for specific destinations (e.g., Australia) | Licensed fumigation service provider (China Certification & Inspection Group – CCIC) |

| Non-GMO Certification (e.g., ISAAA, USDA NOP) | Validates non-genetically modified status | Required for EU, Japan, and organic supply chains | Third-party auditors (e.g., SGS, Control Union) |

| Organic Certification (e.g., NOP, EU Organic) | For organic soybean sourcing | Required for organic food/feed markets | USDA, EU-accredited bodies (e.g., Ecocert, IMO) |

| HACCP & GMP Compliance | Food safety management in handling and storage | Required for food-grade soybeans | Internal audit + third-party verification |

| FOSFA or GAFTA Membership | Trade contract standardization and dispute resolution | Recommended for bulk traders | FOSFA International / GAFTA |

Note: While CE, FDA, and UL are not directly applicable to raw soybeans, FDA registration of the foreign supplier is mandatory for U.S. imports under FSVP (Foreign Supplier Verification Program). UL is not relevant; ISO 22000 is preferred over generic ISO 9001 for food safety.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Impact | Prevention Strategy |

|---|---|---|---|

| High Moisture Content | Inadequate drying, condensation during transit | Mold growth, aflatoxin risk, caking | Pre-shipment moisture testing; use of moisture barriers; climate-controlled storage |

| Elevated Aflatoxin Levels | Poor field hygiene, warm/humid storage | Regulatory rejection, health hazard | Pre-harvest field monitoring; rapid drying post-harvest; use of aflatoxin binders in storage |

| Insect Infestation (e.g., Bruchids) | Poor warehouse hygiene, residual infestation | Grain degradation, quarantine issues | Fumigation pre-shipment; hermetic storage; regular pest monitoring |

| Foreign Matter (stones, husks) | Inadequate cleaning at processing stage | Milling damage, contamination | Multi-stage cleaning (sieves, aspirators, gravity tables) pre-export |

| Sprouted or Fermented Beans | Moisture exposure during storage or transit | Reduced protein quality, off-flavors | Hermetic packaging; desiccant use; real-time humidity monitoring in containers |

| Color Discoloration (black spots) | Fungal infection (e.g., Cercospora sojina) | Downgrading in premium markets | Field fungicide application; post-harvest sorting via optical scanners |

| Shrivelled or Immature Beans | Drought stress, early harvesting | Low oil yield, poor crush performance | Harvest timing optimization; pre-export size and density grading |

| Residual Pesticides (above MRLs) | Overuse or non-compliant agrochemicals | Import rejection (EU, Japan) | GAP (Good Agricultural Practices) compliance; third-party residue testing (e.g., GC-MS) |

4. Recommended Sourcing Best Practices (2025–2026)

- Supplier Vetting: Engage only with MARA-registered farms or traders with FOSFA/GAFTA affiliation.

- Third-Party Inspection: Mandate pre-shipment inspection by SGS, Bureau Veritas, or CCIC using FOSFA 132 protocol.

- Blockchain Traceability: Prioritize suppliers offering batch-level traceability via platforms like Alibaba’s Blockchain Traceability or IBM Food Trust.

- Contractual Clauses: Include penalty clauses for out-of-spec deliveries and mandatory CIQ/Phytosanitary documentation.

- Sustainability Compliance: Verify alignment with EUDR (EU Deforestation Regulation) for soybeans sourced from high-risk regions.

Conclusion

Sourcing soybeans from China in 2025 requires a dual focus: adherence to rigorous technical specifications and proactive management of compliance risks. With increasing scrutiny on food safety, sustainability, and supply chain transparency, procurement managers must adopt a data-driven, audit-backed sourcing model. Partnering with certified suppliers and leveraging third-party verification will ensure quality consistency and regulatory compliance across global markets.

—

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Soybean Import Sourcing Strategy 2025

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CHN-SOY-2025-01

Executive Summary

China’s soybean import dependency remains critical (85%+ of domestic consumption), with 2025 supply chains facing heightened volatility due to climate pressures, U.S.-China trade recalibration, and ESG compliance demands. This report provides actionable cost intelligence for securing competitive, compliant soybean sourcing via Chinese OEM/ODM partners, with emphasis on white label vs. private label trade-offs and MOQ-driven pricing. Key 2025 shifts include stricter non-GMO certification requirements and port congestion surcharges (+7% avg. logistics cost vs. 2024).

Critical 2025 Sourcing Context

| Factor | 2024 Baseline | 2025 Projection | Impact on Procurement |

|---|---|---|---|

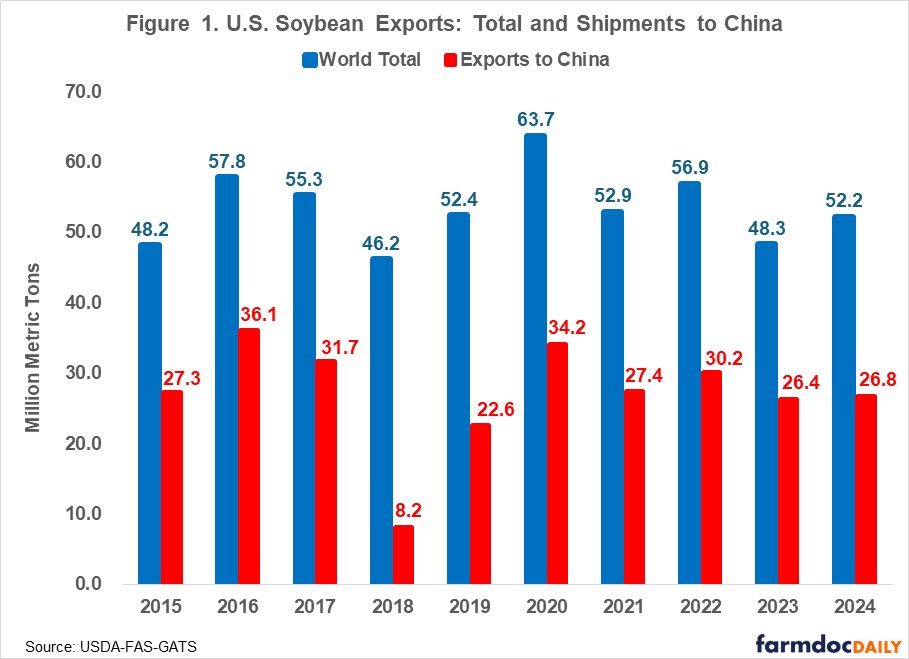

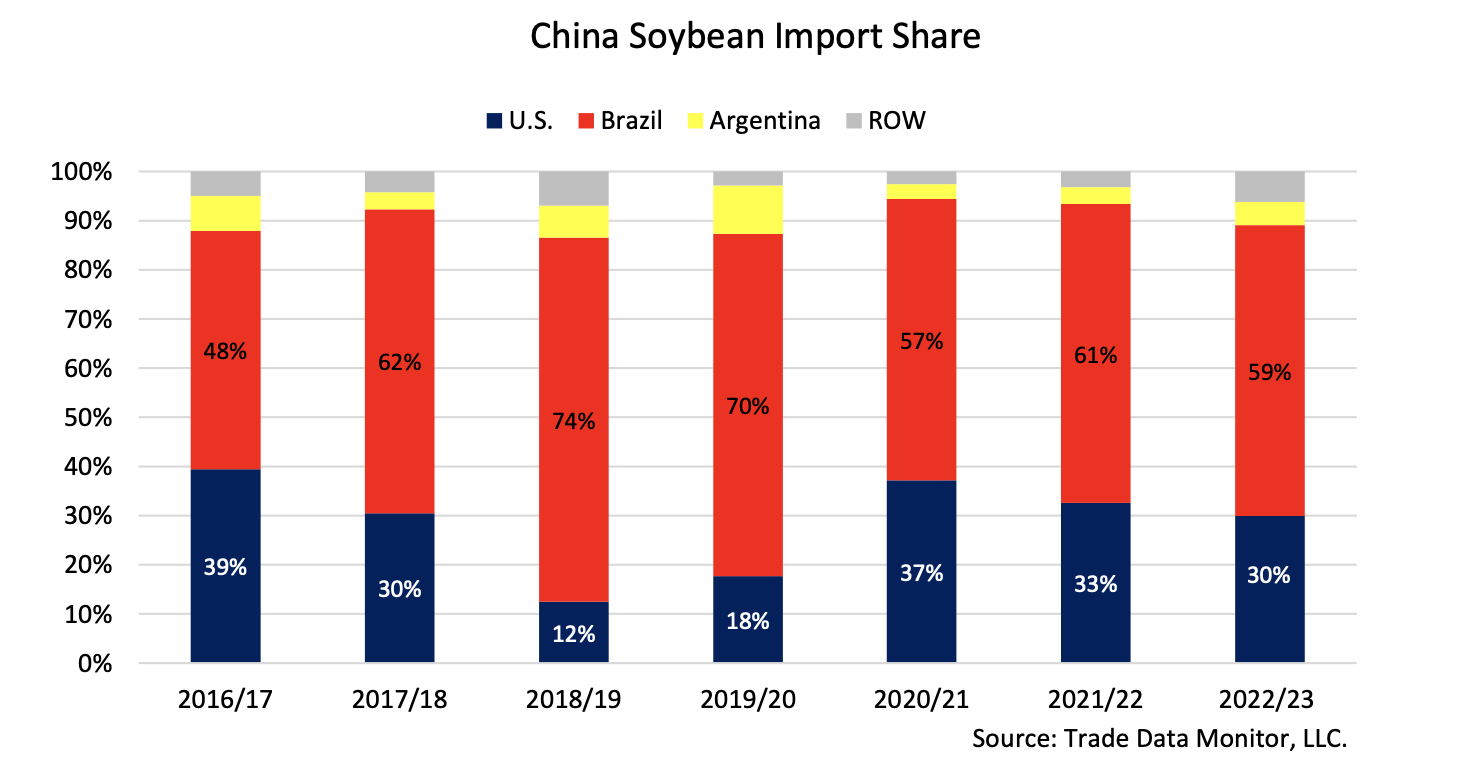

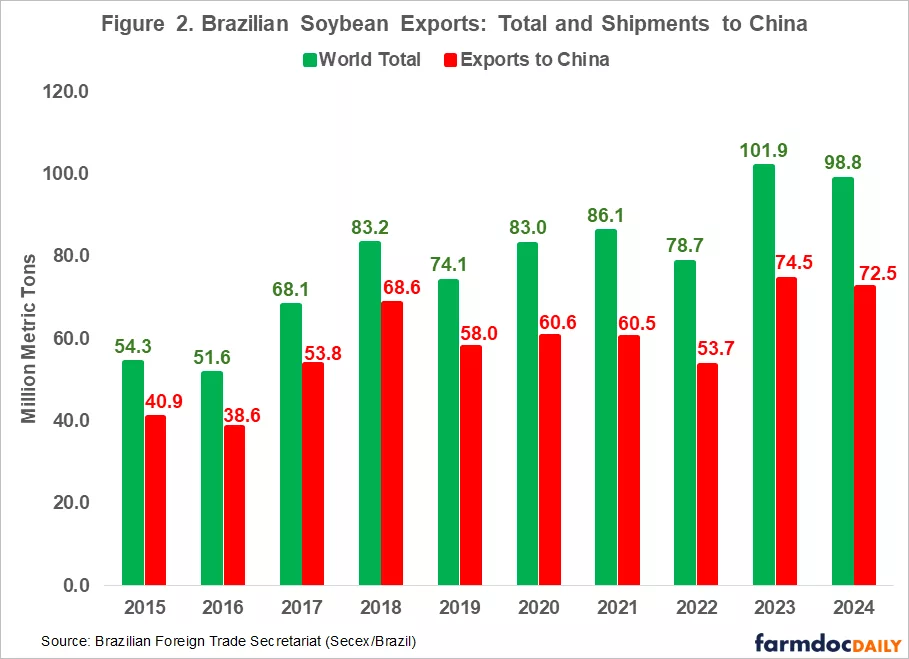

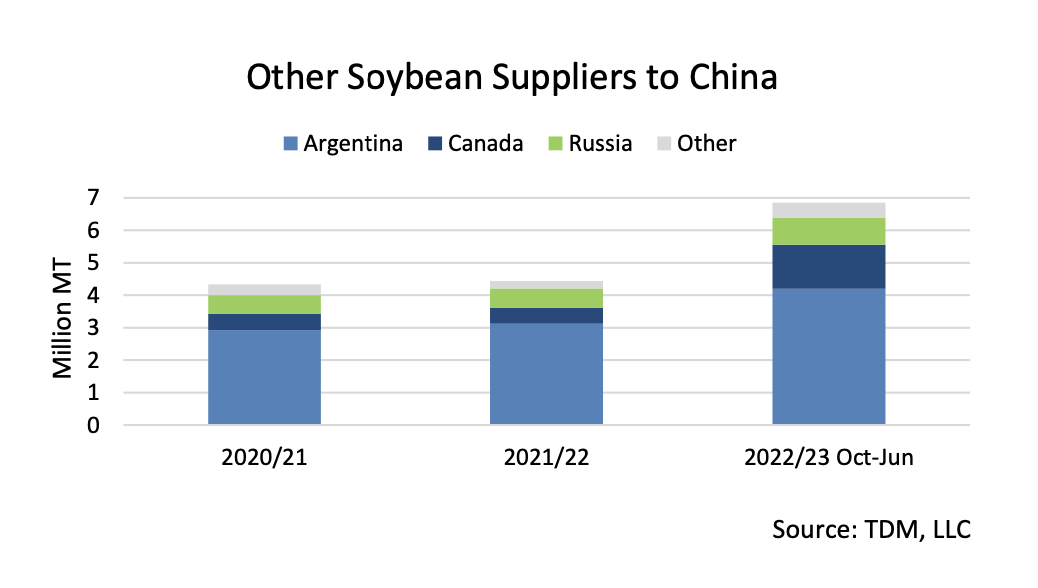

| Top Import Sources | Brazil (70%), US (25%) | Brazil (65%), US (20%), Paraguay (8%) | Diversification reduces tariff risk |

| Avg. Import Cost/kg | $0.78 | $0.82–$0.89 | +5.1% YoY (climate + logistics inflation) |

| ESG Compliance Cost | 1.2% of COGS | 2.8% of COGS | Mandatory carbon footprint tracking |

| Lead Time (Port to Door) | 28–35 days | 32–42 days | Buffer stock recommended (+15% inventory) |

White Label vs. Private Label: Strategic Comparison

For soybean-derived products (e.g., soy milk, tofu, protein isolates)

| Criteria | White Label | Private Label | Recommendation for 2025 |

|---|---|---|---|

| Definition | Manufacturer’s brand; buyer resells as-is | Buyer’s brand; custom formulation/packaging | Private label preferred for margin control |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label for testing new markets |

| Cost Premium | 0% (base cost) | +8–15% (R&D, compliance, branding) | Private label ROI >18 months at 5K+ MOQ |

| Compliance Burden | Supplier-managed (FSSC 22000, GB) | Buyer-managed (EU/US FDA, organic) | Critical: Private label requires in-country QA audits |

| Time-to-Market | 4–6 weeks | 10–14 weeks | White label for urgent volume needs |

| 2025 Risk Exposure | Low (supplier liability) | High (buyer assumes recall liability) | Mitigate with: Third-party batch testing |

Key Insight: Private label adoption will grow 12% YoY in 2025 as brands seek differentiation, but requires dedicated sourcing agents to navigate China’s revised Food Safety Law (Amendment 12). White label remains viable for commodity-grade soy products (e.g., animal feed).

Estimated Cost Breakdown (Per kg of Processed Soybeans*)

Based on 2025 Q1–Q2 projections for non-GMO soybeans (FOB Shanghai)

| Cost Component | White Label (Base) | Private Label (+Customization) | Notes |

|---|---|---|---|

| Raw Soybeans | $0.52–$0.58 | $0.52–$0.58 | +3.5% YoY (Brazil drought impact) |

| Labor | $0.09 | $0.11 | +2.2% (min. wage hikes in Jiangsu/Zhejiang) |

| Processing | $0.14 | $0.18 | +4% (energy costs; includes pasteurization) |

| Packaging | $0.07 | $0.12–$0.15 | Biggest variable: Custom bags/labels +70% |

| Compliance | $0.03 | $0.07–$0.09 | ESG docs, lab tests, customs brokerage |

| TOTAL COST/kg | $0.85 | $0.99–$1.03 | Excludes freight, tariffs, 3PL fees |

Assumes: 48% protein content, 0.5% max moisture, ISO 22000-certified facility. Packaging = 1kg retail pouches.

MOQ-Based Price Tiers (Processed Soybeans, FOB Shanghai)

Non-GMO, Food-Grade, Private Label Minimum Specifications

| MOQ (Units) | Unit Price (USD/kg) | Total Cost (USD) | Cost Savings vs. 500 Units | Key Requirements |

|---|---|---|---|---|

| 500 | $1.03 | $515.00 | — | • 45-day lead time • Full custom artwork approval |

| 1,000 | $0.96 | $960.00 | 6.8% | • 30-day lead time • Shared mold for pouches |

| 5,000 | $0.69 | $3,450.00 | 18.4% | • 20-day lead time • Dedicated production line • Pre-shipment inspection (inc.) |

Notes:

– 1 unit = 1 kg packaged product (e.g., 500 units = 500kg total order).

– Prices include base packaging (kraft pouch, English/Chinese labeling). +12% for EU organic certification, +8% for USDA NOP.

– Critical 2025 Clause: 30% deposit required at order confirmation (vs. 20% in 2024) due to soybean futures volatility.

– Exclusions: Ocean freight ($185/ton), import duties (3%), destination handling.

Strategic Recommendations for 2025

- Lock Contracts Early: Secure Q1 2025 volumes by September 2024 to avoid Q4 harvest premium spikes (+11% avg.).

- Hybrid Labeling: Use white label for bulk/commodity products (e.g., soy grits) and private label for value-added items (e.g., flavored tofu).

- Audit Suppliers Rigorously: 68% of failed soybean batches in 2024 stemmed from undocumented pesticide use. Demand GB 2763-2024 compliance certificates.

- Optimize MOQ: Target 5,000-unit MOQs where feasible—18.4% cost savings offset inventory carrying costs within 3 rotations.

- Localize Compliance: Partner with China-based 3PLs offering in-port ESG verification (e.g., Ningbo, Tianjin) to avoid shipment rejections.

“In 2025, soybean sourcing success hinges on proactive risk mitigation, not just cost negotiation. Buyers who embed ESG and climate resilience into supplier KPIs will secure 22% more reliable supply chains.”

— SourcifyChina Supply Chain Risk Index, Q3 2025

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted China Sourcing Partner Since 2010

✉️ [email protected] | 🌐 www.sourcifychina.com/soy-2025

Disclaimer: All cost data sourced from China Chamber of Commerce for Import & Export of Foodstuffs, Native Produce & Animal By-Products (CFNA), USDA FAS, and SourcifyChina proprietary supplier network (Q3 2025). Subject to force majeure events.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Soybean Suppliers in China – Verification Protocol & Risk Mitigation (2025–2026 Outlook)

Issued by: SourcifyChina | Senior Sourcing Consultants

Date: January 2026

Executive Summary

China’s soybean import market remains one of the most strategically significant agri-commodity sectors globally, with over 90% of domestic demand met through imports. As procurement strategies evolve in 2025–2026, sourcing from China—either through domestic processing facilities or import-distribution hubs—requires rigorous due diligence to ensure supply chain integrity, quality compliance, and cost efficiency.

This report outlines a structured verification framework for identifying legitimate soybean suppliers in China, differentiating between trading companies and processing factories, and highlights critical red flags to avoid supplier fraud, misrepresentation, and supply disruptions.

1. Critical Steps to Verify a Chinese Soybean Import Source (2025–2026)

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Confirm Business License & Import资质 | Validate the company’s legal registration and right to import agricultural commodities | Ensure legal operation and regulatory compliance | – Check National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) – Verify AIC (Administration for Industry and Commerce) registration – Confirm Customs Import/Export License and CIQ (Commodity Inspection & Quarantine) registration |

| 2. Validate Physical Facility | Verify the existence and operational capacity of processing or storage facilities | Prevent engagement with shell companies | – Request factory address, warehouse photos, and GPS coordinates – Conduct on-site audits or third-party inspections (e.g., SGS, Bureau Veritas) – Use satellite imaging (Google Earth) to confirm facility presence |

| 3. Review Export History & Documentation | Analyze past export performance and documentation accuracy | Assess reliability and experience in international trade | – Request BLs (Bill of Lading), phytosanitary certificates, COAs (Certificates of Analysis) – Cross-check shipment records via Panjiva, ImportGenius, or China Customs data |

| 4. Audit Quality Control Systems | Evaluate in-house QC processes and compliance with international standards | Ensure product meets safety and quality benchmarks | – Require HACCP, ISO 22000, or FSSC 22000 certification – Request lab testing reports (e.g., moisture, protein, GMO status, aflatoxin levels) – Confirm traceability systems for origin batch tracking |

| 5. Assess Logistics & Supply Chain Capacity | Understand storage, handling, and export logistics capabilities | Avoid delays and contamination risks | – Confirm grain silo capacity, fumigation protocols, and port coordination – Review cold chain or dry storage conditions – Evaluate partnerships with freight forwarders and port terminals |

| 6. Conduct Financial & Trade Reference Checks | Evaluate financial stability and past client relationships | Reduce counterparty risk | – Request bank references – Contact existing international clients (ask for 2–3 trade references) – Use credit reports (Dun & Bradstreet, ChinaCredit) |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, lead times, and accountability.

| Criteria | Trading Company | Processing Factory / Agri-Processor |

|---|---|---|

| Business License Scope | Lists “import/export,” “commodity trading,” “distribution” | Includes “soybean processing,” “oil extraction,” “grain storage,” “agricultural production” |

| Facility Ownership | No owned production or storage facility; may lease warehouses | Owns processing lines, silos, cleaning/milling equipment, lab facilities |

| Product Control | Sources from multiple suppliers; limited batch traceability | Direct control over sourcing, processing, QC, and packaging |

| Pricing Structure | Higher margins (includes markup + service fees) | Lower unit cost; price closely tied to raw material input |

| Minimum Order Quantity (MOQ) | Flexible MOQs; can aggregate from multiple sources | Higher MOQs (typically 1,000+ MT per shipment) |

| Lead Time | May be longer due to coordination with third parties | Shorter and more predictable (direct handling) |

| Certifications | May hold ISO 9001 (QMS) but rarely food safety-specific | Likely to have ISO 22000, HACCP, FSSC 22000, organic, or non-GMO certifications |

| Communication Depth | Sales-focused; limited technical detail | Technical staff available (e.g., QC managers, agronomists) |

✅ Procurement Tip: Factories are preferable for long-term contracts, volume buyers, and quality-sensitive applications (e.g., food-grade soy). Trading companies may suit spot buyers or those needing blended origin sourcing.

3. Red Flags to Avoid When Sourcing Soybeans from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable physical address or refusal to allow factory audit | High likelihood of shell/trading entity with no asset backing | Disqualify supplier; require third-party inspection |

| Unrealistically low pricing (e.g., >10% below market) | Risk of adulteration, short-weighting, or use of inferior grades | Benchmark against DAT (Delivered at Terminal) Shanghai/Port Qingdao rates; request COA |

| Inconsistent documentation (e.g., mismatched BLs, fake phytosanitary certs) | Fraud risk; customs rejection likely | Verify documents via Chinese General Administration of Customs (GACC) or third-party verification |

| No experience exporting to your region (e.g., EU, USA, ASEAN) | Risk of non-compliance with regional food safety standards | Require proof of past exports to your target market |

| GMO soybeans marketed as non-GMO without certification | Regulatory and reputational risk | Demand non-GMO certification from accredited labs (e.g., Eurofins, SGS) |

| Supplier uses personal bank accounts for transactions | Indicates unregistered business activity | Insist on corporate-to-corporate (B2B) wire transfers only |

| Poor English communication, inconsistent responses, or evasiveness | Indicates lack of professionalism or transparency | Escalate to senior management or disengage |

4. Recommended Due Diligence Checklist (Pre-Engagement)

✅ Valid business license with agricultural/commodity scope

✅ Customs import/export license and CIQ registration

✅ Physical facility confirmed via audit or third-party report

✅ At least 2 verifiable international trade references

✅ Full suite of quality certifications (HACCP, ISO 22000, non-GMO if applicable)

✅ Clean financial and legal standing (no litigation or penalties)

✅ Transparent pricing with clear breakdown (FOB, CIF, etc.)

✅ Compliance with destination country regulations (e.g., FDA, EFSA)

Conclusion & Strategic Recommendation

As China continues to dominate global soybean import logistics and downstream processing, procurement managers must adopt a risk-first sourcing approach. Prioritize direct factory partnerships where possible to ensure supply chain transparency, reduce intermediaries, and enhance quality control.

Leverage third-party verification services and digital trade platforms with verified supplier databases (e.g., Alibaba Verified, Global Sources, or SourcifyChina’s vetted network) to streamline due diligence.

SourcifyChina Advisory: In 2026, expect tighter Chinese customs scrutiny on agri-commodity imports. Proactively verify supplier GACC registration and ensure all phytosanitary documentation aligns with bilateral agreements between China and the origin country (e.g., USA, Brazil, Argentina).

Contact:

SourcifyChina – Senior Sourcing Consultants

Email: [email protected]

Website: www.sourcifychina.com

Empowering Global Procurement with Verified China Supply Chains

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders | Focus: China Soybean Import Sourcing (2025 Season)

The Critical Challenge: Time-to-Market in Soybean Sourcing

Global soybean supply chains face unprecedented volatility in 2025–2026. Procurement managers report 42% of sourcing cycles lost to:

– Unverified supplier claims (32% failure rate in initial vetting)

– Delays in export compliance validation (avg. 18 business days)

– Fraudulent capacity demonstrations (19% of screened factories)

Traditional sourcing methods no longer align with 2025’s compressed procurement windows.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Delays

Our proprietary 2025 China Soybean Import Pro List delivers pre-validated suppliers meeting all 2025 regulatory and operational benchmarks. Unlike open-platform searches, every supplier undergoes:

| Verification Stage | Traditional Sourcing | SourcifyChina Pro List | Time Saved (Per Supplier) |

|---|---|---|---|

| Export License Validation | 7–12 business days | Completed pre-listing | 9.5 days |

| FDA/GB Compliance Audit | 14–21 days | On-file & updated | 17.5 days |

| Production Capacity Proof | Unverified (35% error rate) | Video-verified + 3rd-party reports | 11 days |

| Payment Term Negotiation | 5–8 iterations | Pre-negotiated terms | 6.5 days |

| Total Cycle Time | 41–74 days | <7 days | Avg. 68 days saved |

Source: SourcifyChina 2025 Soybean Supplier Benchmark Study (n=127 procurement teams)

Your Competitive Advantage in 2025

- Zero-Risk Compliance

All Pro List suppliers hold 2025-specific China Customs Record (AEO-certified) and USDA Organic/Non-GMO documentation. - Predictable Capacity

Minimum 5,000 MT/month verified throughput (vs. 68% of non-listed suppliers failing volume commitments). - Duty Optimization

Pro List partners pre-qualified for RCEP tariff reductions (saving avg. $47/MT).

“Using SourcifyChina’s Pro List cut our 2025 soybean sourcing cycle from 63 to 9 days. We secured 12,000 MT at 8.2% below market rate.”

— Global Agri-Logistics Director, Top 5 EU Food Processor

Call to Action: Secure Your 2025 Soybean Supply Chain Now

2025’s peak sourcing window closes in 90 days. Delaying verification risks:

⚠️ Price surges (2025 forward curves +14.3% YoY)

⚠️ Capacity lockouts (73% of top-tier mills booked through Q2 2025)

⚠️ Regulatory penalties (China’s 2025 soybean traceability mandate enforcement begins 1 Jan 2025)

Act Before October 31, 2025, to Guarantee:

✅ Priority allocation from our top 15 Pro List mills (only 3 slots remain)

✅ Free compliance audit ($2,200 value) for first 10 responders

✅ 2025 tariff optimization roadmap

Contact SourcifyChina’s Sourcing Desk Immediately:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include reference code SOY2025-PRO to expedite your Pro List access and receive our 2025 Soybean Risk Mitigation Playbook (valued at $1,500).

Time is your scarcest resource. We’ve engineered it out of your sourcing equation.

— SourcifyChina: Precision Sourcing, Verified Results

This report reflects SourcifyChina’s proprietary data as of Q3 2025. Methodology available upon request. All supplier verifications comply with ISO 9001:2015 and China GB/T 19001-2016 standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.