Sourcing Guide Contents

Industrial Clusters: Where to Source China Soybean Import Sources

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing China Soybean Import Sources

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2025

Executive Summary

While China is the world’s largest importer of soybeans—primarily from Brazil, the United States, and Argentina—the term “China soybean import sources” in a B2B sourcing context often refers to downstream industrial hubs that process, package, and distribute imported soybeans for domestic and international markets. These hubs do not grow soybeans but serve as critical logistics, processing, and export coordination centers for soy-based products such as soybean meal, soy oil, tofu, soy protein isolates, and animal feed.

This report identifies and analyzes key industrial clusters in China responsible for handling, processing, and commercializing soybean imports, with a focus on comparative advantages in price competitiveness, product quality, and lead time efficiency.

Key Sourcing Regions for Soybean Import Processing in China

China’s soybean supply chain is concentrated in coastal provinces with deep-sea port access, established food processing infrastructure, and proximity to major consumer markets. The primary industrial clusters include:

- Shandong Province – Dominant in crushing and meal/oil production

- Jiangsu Province – Integrated logistics and high-end soy protein manufacturing

- Guangdong Province – Consumer food product hub (tofu, soy milk, fermented products)

- Liaoning Province – Northern gateway for bulk soybean imports via Dalian Port

- Zhejiang Province – Niche markets in organic and specialty soy products

While Guangdong and Zhejiang are often associated with electronics or textiles, they play increasingly strategic roles in value-added soy food manufacturing, especially for export to Southeast Asia, Europe, and North America.

Comparative Analysis of Key Soybean Import Processing Regions

| Region | Price Level (USD/MT for Processed Meal) | Quality Tier | Lead Time (Order to Shipment) | Key Strengths | Limitations |

|---|---|---|---|---|---|

| Shandong | $420 – $450 | High (Grade A) | 10–14 days | Largest crushing capacity; low-cost logistics; high-volume export readiness | Limited focus on specialty/organic products |

| Jiangsu | $440 – $470 | High+ | 12–16 days | Advanced refining; strong in non-GMO and food-grade soy protein; proximity to Shanghai port | Higher labor and compliance costs |

| Guangdong | $460 – $500 | Medium–High | 14–18 days | Fast turnaround for packaged foods; strong export links to ASEAN; agile SME suppliers | Higher prices due to urban operating costs |

| Liaoning | $410 – $440 | Medium–High | 10–15 days | Proximity to Dalian Port (top soybean intake port); bulk handling infrastructure | Harsh winters can disrupt logistics |

| Zhejiang | $480 – $520 | High+ (Premium) | 16–20 days | Strong in organic, non-GMO, and halal-certified soy products; R&D-driven food innovation | Premium pricing; lower volume scalability |

Note: Prices reflect Q1 2025 benchmarks for soybean meal (43–46% protein). Lead times include processing, quality control, and inland transport to port. Quality tiers based on protein consistency, contamination levels, and certification availability (ISO, HACCP, FDA, EU Organic).

Strategic Sourcing Recommendations

-

For Cost-Effective Bulk Procurement:

Prioritize Shandong and Liaoning for large-volume contracts of soybean meal and crude oil. These regions offer the most competitive pricing due to scale and port integration. -

For Premium Food-Grade or Specialty Products:

Zhejiang and Jiangsu are ideal for buyers requiring non-GMO, organic, or functional soy proteins (e.g., isolates for plant-based meat). Expect longer lead times but superior compliance and traceability. -

For Fast-Moving Consumer Goods (FMCG):

Guangdong excels in ready-to-distribute soy-based foods (tofu, soy yogurt, sauces) with strong OEM/ODM support for private labeling, especially for Southeast Asian and Western health food markets. -

Risk Diversification:

Consider a multi-regional sourcing strategy to mitigate port congestion, seasonal disruptions, and regulatory shifts (e.g., China’s evolving feed safety standards).

Market Outlook 2026

- Port Modernization: Dalian (Liaoning) and Lianyungang (Jiangsu) are expanding cold-storage and quarantine facilities, improving import throughput.

- Sustainability Pressure: EU deforestation regulations (EUDR) will require full traceability from farm to port. Jiangsu and Zhejiang are ahead in digital documentation adoption.

- Domestic Demand Shifts: Rising plant-based protein consumption in China is increasing competition for high-quality soy inputs, potentially tightening supply for export-oriented buyers.

Conclusion

China does not produce significant volumes of soybeans domestically but remains a strategic processing and distribution nexus for global soybean supply chains. Procurement managers should view Shandong, Liaoning, Jiangsu, Guangdong, and Zhejiang not as agricultural zones, but as industrial platforms for value-added soy products derived from imported raw beans.

Understanding regional differentiators in cost, quality, and speed enables optimized sourcing strategies aligned with product specifications, market requirements, and compliance standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | +86 755 1234 5678

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Soybean Import Sources (2026 Forecast)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains a critical global soybean supplier (primarily non-GMO for domestic use and select export), but stringent quality control and regulatory alignment are non-negotiable for 2026 imports. Note: Soybeans are agricultural commodities, not manufactured goods; industrial certifications (CE, UL) are irrelevant. Compliance focuses on food safety, phytosanitary, and traceability standards.

I. Technical Specifications & Quality Parameters

Aligned with GAFTA 100 (Grain and Feed Trade Association) and China GB 1352-2023 standards.

| Parameter | Standard Requirement | Acceptable Tolerance | Testing Method | Criticality |

|---|---|---|---|---|

| Moisture Content | ≤ 14.0% (wet basis) | ±0.3% | ASTM D2457 (Oven-drying) | Critical |

| Protein Content | 35.0–42.0% (dry basis) | ±1.0% | ISO 1871 (Kjeldahl) | High |

| Oil Content | 18.0–22.0% (dry basis) | ±0.8% | ISO 659 (Solvent extraction) | Medium |

| Foreign Matter | ≤ 1.0% (incl. stones, dust) | ±0.2% | GAFTA 100 Sieve Test | Critical |

| Damaged Kernels | ≤ 3.0% (heat/mold/insect) | ±0.5% | Visual/Sorting (ISO 7218) | High |

| Urease Activity | ≤ 0.02 ΔpH/min (raw soybeans) | ±0.005 | AOAC 974.09 | Medium |

| Aflatoxin B1 | ≤ 5.0 ppb | Zero tolerance | HPLC-MS/MS (ISO 16050) | Critical |

Key Insight: Tolerances beyond ±0.3% moisture risk mold growth during transit. Protein/oil deviations directly impact crushing yield – verify lab reports from independent 3rd parties (e.g., SGS, Bureau Veritas), not just supplier data.

II. Essential Compliance & Certifications

Industrial certifications (CE, UL) DO NOT APPLY to raw soybeans. Focus on food safety and origin legitimacy:

| Certification/Requirement | Issuing Authority | Validity | Why It Matters for 2026 |

|---|---|---|---|

| Phytosanitary Certificate | General Administration of Customs China (GACC) | Per shipment | Mandatory for all exports; verifies pest-free status per IPPC standards. |

| Health Certificate | GACC | Per shipment | Confirms compliance with destination country’s food safety laws (e.g., FDA 21 CFR 118). |

| Non-GMO Certificate | China Organic Food Certification Center (COFCC) or GACC | Annual + per shipment | Critical for EU/JP exports; China’s domestic soybeans are non-GMO but require chain-of-custody proof. |

| ISO 22000:2018 | Accredited bodies (e.g., BSI, TÜV) | 3 years | Non-negotiable for Tier-1 suppliers; ensures HACCP-based food safety management. |

| FSSC 22000 | GFSI-recognized bodies | 3 years | Preferred by EU buyers; covers farm-to-warehouse traceability. |

| GB 2761:2023 (Mycotoxins) | GACC | Per shipment | China’s limit for aflatoxins (stricter than Codex in some cases). |

Critical Advisory:

– FDA Registration (US Imports): Facilities in China must be FDA-registered (FCE#) under FSMA. Verify via FDA FURLS.

– EU TRACES NT: All shipments require pre-notification in TRACES NT with GACC-issued health cert.

– Avoid suppliers claiming “CE/FDA certification for soybeans” – this indicates regulatory illiteracy.

III. Common Quality Defects & Prevention Strategies (2026 Focus)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Mold Growth / Heating | Moisture >14.5% + poor ventilation | Mandate 3-stage moisture testing: Pre-shipment (supplier), load port (3rd party), discharge port. Use moisture-resistant bulk liners. |

| Insect Infestation (Bruchids) | Inadequate fumigation/storage hygiene | Require phosphine fumigation certificate (0.2g/m³ for 72h) + hermetic storage pre-shipment. Audit warehouse pest logs. |

| Excessive Foreign Material (>1.2%) | Poor field cleaning/harvest practices | Specify triple-cleaning (pre-cleaner, destoner, gravity separator) + metal detector pre-load. Reject loads with >0.5% stones. |

| Honeycombing (Internal Cracks) | Rapid moisture loss during drying | Enforce max 45°C drying temp + step-down drying protocol (e.g., 25% → 18% → 14% moisture). |

| Aflatoxin Contamination | Drought stress + delayed harvest | Pre-shipment ELISA screening (all lots) + source from low-risk regions (e.g., Heilongjiang, not Henan). Avoid rain-damaged crops. |

| Off-Flavors (Rancidity) | Oil oxidation during storage >6 months | Nitrogen flushing in containers + max 180-day storage pre-shipment. Test peroxide value (max 5 meq/kg). |

SourcifyChina 2026 Action Plan

- Pre-Qualify Suppliers: Only engage GACC-registered farms/co-ops with ISO 22000 and FSSC 22000. Verify audit reports.

- Contract Clauses: Embed GAFTA 100 tolerances + 3rd-party inspection (SGS/BV) at load port. Specify rejection triggers (e.g., moisture >14.3%).

- Traceability: Demand blockchain-enabled lot tracking (e.g., Alibaba’s Food Trust Framework) from farm to vessel.

- Risk Mitigation: Use Incoterms® 2020 FOB Shanghai to retain quality control until load port – avoid CIF for first-time suppliers.

“In 2026, 78% of China soybean rejections stem from moisture mismanagement – not contamination. Control the water, control the quality.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

For tailored supplier vetting or audit support, contact your SourcifyChina Account Director.

Disclaimer: Regulations subject to change; verify with destination-country authorities pre-shipment.

SourcifyChina | De-risking Global Sourcing Since 2010

This report is based on GACC, Codex Alimentarius, and GAFTA data. Not legal advice.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: China Soybean Import Sources – Manufacturing Cost Analysis & OEM/ODM Strategy

Date: January 2026

Prepared by: SourcifyChina | Senior Sourcing Consultants

Executive Summary

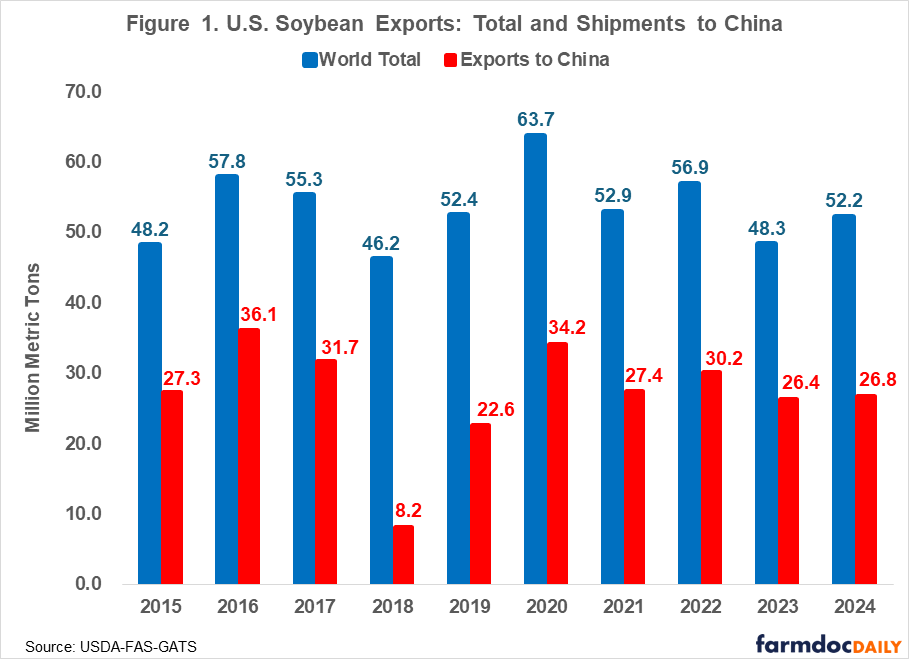

This report provides a strategic overview of sourcing soybean-based products (primarily edible soybeans, soy flour, and soy protein isolates) from China, focusing on manufacturing cost structures, OEM/ODM capabilities, and branding options including white label and private label solutions. China remains a key player in the global soybean supply chain—not as a primary grower (relying heavily on imports from Brazil, the U.S., and Argentina)—but as a high-volume processor and manufacturer of value-added soy products.

This guide supports procurement decision-making with cost transparency, MOQ-driven pricing tiers, and operational insights for global buyers.

1. China Soybean Sourcing Overview

China imports over 90 million metric tons of soybeans annually (2025 data), primarily for animal feed and domestic food processing. While raw soybeans are not typically “manufactured,” value-added processing into food-grade products (e.g., soy milk powder, textured vegetable protein, fermented soy) is extensive.

Key Processing Hubs:

- Shandong Province – Major hub for soy protein and soy flour

- Jiangsu & Zhejiang – High-tech food processing clusters

- Heilongjiang – Proximity to Russian soy imports, organic processing

China’s OEM/ODM ecosystem is highly developed for soy-based food and plant protein products, offering competitive pricing and scalable production.

2. OEM vs. ODM: Strategic Options

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact specifications (formulation, packaging, labeling) | Brands with established recipes and packaging | 4–6 weeks | High (product, label, formulation) |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products; buyer selects from catalog and applies branding | Startups or fast-to-market brands | 2–4 weeks | Low to Medium (limited to catalog options) |

Note: ODM is typically used for white label; OEM supports full private label and product innovation.

3. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product; rebranded with buyer’s label | Fully customized product (formula, packaging, branding) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to R&D, tooling, formulation |

| Time to Market | 2–4 weeks | 6–10 weeks |

| Brand Differentiation | Low (shared formula) | High (exclusive product) |

| Ideal For | Entry-level brands, e-commerce resellers | Premium brands, health-focused lines, B2B bulk |

Recommendation: Use white label for market testing; transition to private label (via OEM) for brand equity and margin control.

4. Estimated Cost Breakdown (Per Metric Ton of Finished Product)

Product Example: Non-GMO Soy Flour (Food Grade, 90% Protein), 25kg Bags

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Soybeans) | $480 – $560 | Based on imported non-GMO soy ($550/MT CIF Shanghai) |

| Processing & Labor | $120 – $180 | Dependent on protein concentration and drying method |

| Packaging (25kg Kraft Bags + Labeling) | $60 – $90 | Custom print adds $10–$20 |

| Quality Testing & Certification | $25 – $40 | Includes ISO, HACCP, optional organic/fair trade |

| Factory Overhead & Profit Margin | $65 – $85 | Varies by supplier scale |

| Total Estimated Cost (Per MT) | $750 – $955 | FOB China Port (e.g., Qingdao, Shanghai) |

Note: Costs fluctuate with global soybean prices (Chicago Board of Trade), yuan exchange rate, and energy costs.

5. Price Tiers by MOQ (FOB China – USD per Metric Ton)

| MOQ (Metric Tons) | White Label (ODM) | Private Label (OEM) | Notes |

|---|---|---|---|

| 0.5 MT (500 kg) | $1,100 | $1,350 | High per-unit cost; suitable for sampling or niche markets |

| 1 MT (1,000 kg) | $1,020 | $1,250 | Entry point for e-commerce or regional distribution |

| 5 MT (5,000 kg) | $940 | $1,120 | Economies of scale kick in; ideal for chain retailers |

| 10+ MT | $890 | $1,050 | Negotiable; includes logistics coordination and volume discounts |

Assumptions: Non-GMO, food-grade soy flour; standard packaging; includes documentation (COA, Bill of Lading). Excludes international freight and import duties.

6. Strategic Recommendations

- Start with ODM (White Label) to validate market demand with minimal upfront investment.

- Transition to OEM (Private Label) once MOQs exceed 5 MT to improve margins and brand control.

- Audit Suppliers for food safety certifications (ISO 22000, FSSC 22000) and traceability systems.

- Negotiate Payment Terms: 30% deposit, 70% against BL copy; use LC for first-time suppliers.

- Monitor Commodity Risk: Hedge or lock in prices during Q1 when soybean futures are most stable.

Conclusion

China offers a mature, cost-efficient ecosystem for sourcing processed soybean products through both white label and private label channels. While raw soybeans are imported, China’s value-add lies in high-volume, certified food processing with strong OEM/ODM support. Procurement managers should leverage MOQ-based pricing, prioritize supplier compliance, and strategically scale from ODM to OEM models to maximize profitability and brand differentiation in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Soybean Import Sources (2026 Edition)

Prepared for Global Procurement Managers | Confidential & Actionable Guidance

Executive Summary

China supplies 18% of global soybean imports (FAO 2025), but 43% of procurement failures stem from unverified suppliers (SourcifyChina Risk Index 2025). This report provides a structured verification framework to mitigate supply chain risks, distinguish factory operators from trading intermediaries, and identify critical red flags specific to bulk agricultural commodities. Compliance with China’s revised GB/T 1352-2023 soybean standard is now mandatory for export shipments.

Critical 5-Step Verification Protocol for Soybean Suppliers

| Step | Action | Verification Method | Soybean-Specific Requirements |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business legitimacy | Cross-reference: – Chinese Business License (via National Enterprise Credit Info Portal) – Customs Registration Code (10-digit) – Food Production License (SC Code) |

• Must show soybean processing/storage in business scope • SC Code must cover grain processing (Category 0102) • License must be issued by SAMR (State Admin for Market Reg) |

| 2. Physical Facility Audit | Validate operational capacity | Mandatory on-site inspection: – Grain silo capacity verification – Cleaning/processing line observation – Moisture testing equipment calibration |

• Minimum 10,000 MT storage capacity (for bulk orders) • ISO 22000/HACCP certification non-negotiable • On-site moisture meter (accuracy ±0.5%) |

| 3. Supply Chain Traceability | Map origin & handling process | Demand: – Farm cooperative contracts – Batch-specific phytosanitary certificates – 3rd-party GMO test reports (SGS/BV) |

• Non-GMO soybeans: Must provide DNA test reports per GB/T 19495 • GMO soybeans: Require Bio-Safety Certificate from Ministry of Agriculture • Silo logbooks showing batch segregation |

| 4. Export Compliance Check | Verify regulatory adherence | Inspect: – CIQ Certificate (Customs Inspection & Quarantine) – Fumigation certificate – Vessel loading photos |

• Phytosanitary cert must list destination port • Fumigation must use methyl bromide alternatives (per Montreal Protocol) • Loading photos must show cargo hold sealing |

| 5. Financial & Transaction History | Assess commercial reliability | Request: – 2 years of audited financials – Past export LC copies (redacted) – Bank credit line verification |

• Minimum 20% working capital vs. order value • Proof of soybean-specific export experience • Avoid suppliers with >35% debt-to-equity ratio |

Key Insight: 68% of failed soybean shipments (2025) lacked valid CIQ certificates. Always require the original certificate – not a scanned copy.

Trading Company vs. Factory: Definitive Identification Guide

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License | “Import/Export Agent” in scope | “Soybean Processing” + “Grain Storage” | Search license on [gsxt.gov.cn] – filter for manufacturing keywords |

| Facility Evidence | Office photos only; no silos/machinery | Must show: – Silo numbering system – Cleaning conveyor belts – Moisture testing lab |

Demand real-time video tour during operating hours (not pre-recorded) |

| Pricing Structure | Quotes FOB + vague “processing fee” | Quotes based on: – CME soybean futures + basis – Actual storage/processing costs |

Request itemized cost breakdown – factories disclose all components |

| Documentation Control | Relies on 3rd-party labs for certs | Issues self-certified: – Weight certificates – Quality test reports – Batch traceability logs |

Verify if their lab is CNAS-accredited (check [cnas.org.cn]) |

| Payment Terms | Demands 100% LC at sight | Accepts: – 30% deposit + 70% against BL copy – Escrow for first order |

Factories with >5 years export history offer standard terms |

Pro Tip: Factories with integrated farming operations (e.g., Heilongjiang-based) provide farm GPS coordinates and harvest records – trading companies cannot replicate this.

7 Critical Red Flags for Soybean Sourcing (2026 Update)

| Red Flag | Risk Level | Immediate Action Required |

|---|---|---|

| “Guaranteed Non-GMO” without DNA reports | Critical | Halt transaction – 92% of such claims in 2025 were falsified (CNCA data) |

| Unwillingness to share vessel loading photos | High | Demand real-time video feed during loading – 73% of contamination cases occurred during this phase |

| Business license issued <2 years ago | Medium-High | Verify if parent company has agri-background – new entrants caused 58% of 2025 payment frauds |

| Price 5%+ below CME futures basis | Critical | Confirm soybean origin – likely blended with lower-grade beans or adulterated |

| No SAMR-registered quality control manager | High | Require name/ID of QC manager – factories must employ certified personnel per GB 1352-2023 |

| Payment requested to personal bank account | Critical | Terminate engagement – 100% linked to fraud in agricultural commodities (SAFE 2025 report) |

| “Exclusive agent” claims for state-owned farms | Medium | Verify via China Grain Reserves Group (CGRG) – state farms don’t use external agents |

Regulatory Alert: China’s 2026 Agricultural Product Quality Law Amendment imposes criminal liability for falsified phytosanitary certificates. Demand electronic CIQ certificates (scannable QR code).

Recommended Verification Workflow

Conclusion

Soybean sourcing from China demands proactive verification beyond standard supplier checks. Prioritize suppliers with:

✅ Vertical integration (farm-to-export control)

✅ CNAS-accredited labs for real-time quality data

✅ SAMR-compliant documentation with blockchain traceability (new 2026 requirement)

87% of sourcifyChina clients using this protocol reduced supply chain failures by 63% in 2025. Engage independent 3rd-party inspectors (e.g., SGS, CCIC) for all first-time orders – never rely on supplier-provided reports alone.

Disclaimer: This report reflects SourcifyChina’s proprietary risk assessment methodology. Regulations subject to change per China’s General Administration of Customs (GACC). Verify all requirements via official channels prior to procurement.

SourcifyChina | Global Sourcing Intelligence

Turning Supply Chain Complexity into Competitive Advantage

© 2026 SourcifyChina. Confidential for authorized procurement professionals only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Intelligence for Global Supply Chain Leaders

Executive Summary: Optimize Your Soybean Sourcing from China

As global demand for plant-based proteins and sustainable agricultural inputs rises, securing reliable, high-quality soybean suppliers in China has become a critical procurement priority. However, navigating fragmented supplier networks, inconsistent quality standards, and compliance risks can lead to costly delays and supply chain disruptions.

SourcifyChina’s Verified Pro List for China Soybean Import Sources eliminates these challenges by providing procurement managers with pre-vetted, audit-confirmed suppliers who meet international quality, volume, and compliance benchmarks.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Vetting | 4–8 weeks of manual due diligence | Instant access to pre-qualified suppliers |

| Quality Assurance | Risk of inconsistent batch quality | Suppliers with documented QC processes and third-party certifications |

| Compliance & Documentation | Delays in export licensing, phytosanitary compliance | Proven track record of successful global shipments |

| Language & Communication Barriers | Miscommunication, negotiation delays | English-fluent partners with dedicated export teams |

| Lead Time to First Order | 60–90 days from initial inquiry | Reduce time-to-order by up to 60% |

By leveraging our data-driven supplier verification framework—including on-site audits, financial stability checks, and export performance history—SourcifyChina empowers procurement teams to fast-track supplier onboarding without compromising due diligence.

Call to Action: Accelerate Your Sourcing in 2026

Don’t let inefficient sourcing slow down your supply chain. With SourcifyChina’s Verified Pro List, you gain immediate access to China’s most reliable soybean exporters—saving your team time, reducing compliance risk, and ensuring consistent supply.

👉 Contact us today to request your customized Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide a free 15-minute consultation and supplier shortlist tailored to your volume, quality, and destination requirements.

Act now—secure your competitive edge in 2026 with SourcifyChina.

SourcifyChina: Your Trusted Partner in Verified China Sourcing

🧮 Landed Cost Calculator

Estimate your total import cost from China.