Sourcing Guide Contents

Industrial Clusters: Where to Source China Southern Power Grid Company Limited

SourcifyChina B2B Sourcing Intelligence Report: Power Grid Equipment Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Energy Infrastructure Sector)

Confidentiality: SourcifyChina Client Advisory – Strictly For Internal Strategic Use

Critical Clarification: Understanding “China Southern Power Grid Company Limited” (CSG)

This report addresses a fundamental market misconception:

China Southern Power Grid Company Limited (CSG) is not a manufacturer. It is a state-owned power transmission and distribution utility, one of China’s two major grid operators (alongside State Grid Corporation of China). CSG procures equipment but does not produce it.

Your Actual Sourcing Target:

Global procurement teams seek manufacturers of power grid equipment supplied to entities like CSG (e.g., transformers, switchgear, transmission lines, smart grid systems). This report analyzes the industrial clusters producing this critical infrastructure equipment – the true suppliers for your 2026 procurement strategy.

Deep-Dive: Power Grid Equipment Manufacturing Clusters in China

China dominates global power equipment manufacturing, supplying 65% of the world’s HV transformers and 50% of switchgear (IEA 2025). Key clusters are concentrated in coastal provinces with mature supply chains, engineering talent, and export infrastructure. CSG (and State Grid) heavily sources from these regions via competitive bidding.

Top 5 Industrial Clusters for Power Grid Equipment

| Province/City | Core Specialization | Key Advantages | Major OEMs/Suppliers |

|---|---|---|---|

| Guangdong | Smart grid systems, MV/HV switchgear, IoT-enabled meters | Proximity to CSG HQ (Guangzhou); highest density of Tier-1 suppliers; strongest export compliance | NARI Group (subsidiaries), XJ Electric, Guangdong Goldwind |

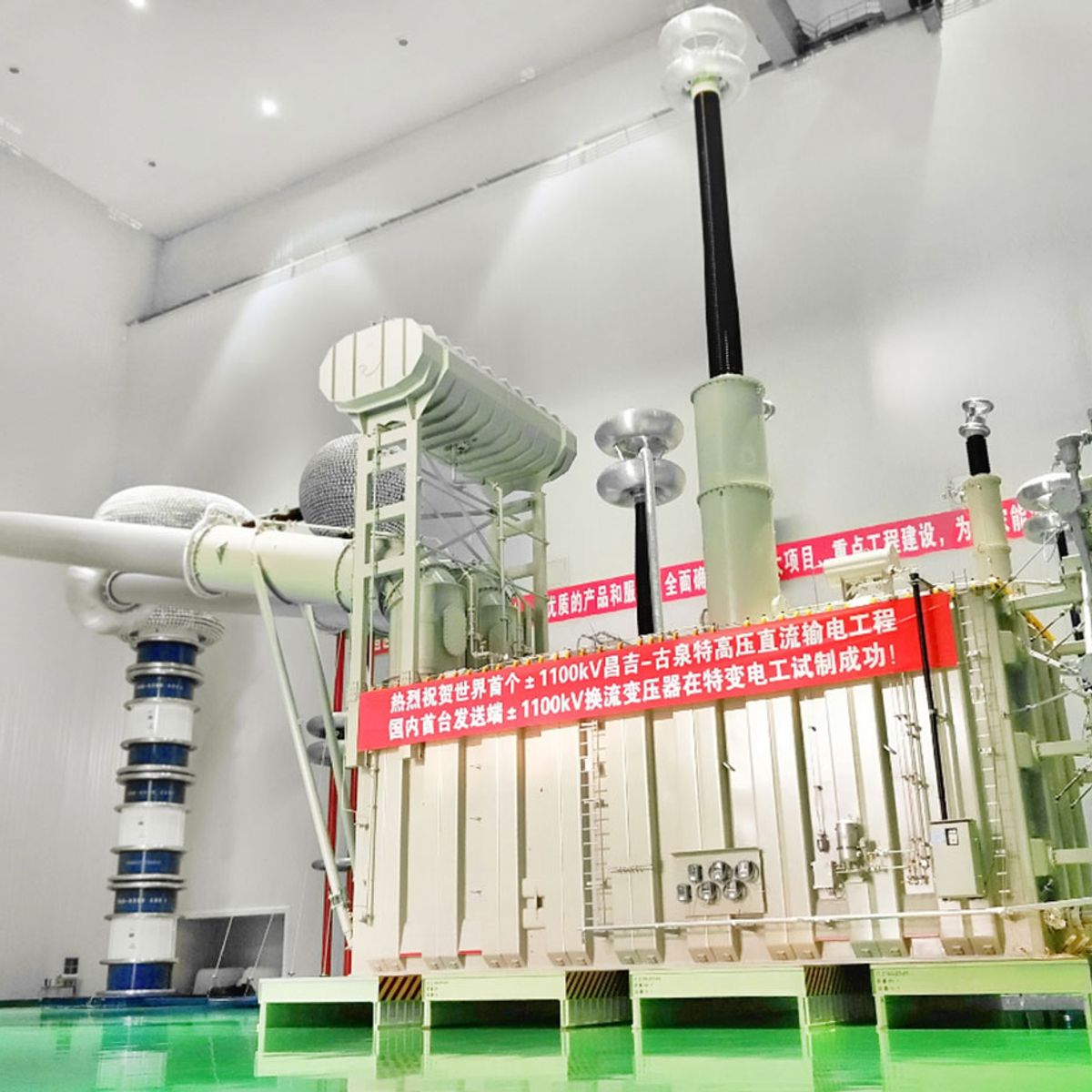

| Jiangsu | Ultra-HV transformers (≥500kV), GIS, reactor systems | National HV research hubs (Suzhou, Wuxi); 40% of China’s transformer output; skilled labor pool | TBEA, Hitachi ABB Power Grids (Jiangsu JV), Siemens Energy (Nanjing) |

| Zhejiang | Distribution transformers, LV/MV components, insulators | Cost-competitive SME ecosystem; agile production; strong private-sector innovation | Wansheng, Huapeng Group, Zhejiang Tianyu |

| Shandong | Transmission towers, conductors, substation structures | Raw material access (steel); lowest-cost structural components; scale for bulk orders | Shandong Taishan Electric, Jinan Jufeng |

| Anhui | Emerging hub for EV-integrated grid tech, battery storage | Government subsidies; lower labor costs; proximity to Shanghai R&D centers | Sungrow Power (Hefei), CATL grid storage divisions |

Strategic Insight: CSG’s procurement mandates require ISO 9001/14001, CCC certification, and State Grid or CSG-specific type-test approvals. Cluster maturity directly correlates with compliance speed – Guangdong/Jiangsu suppliers clear certifications 30-45 days faster than emerging clusters.

Regional Comparison: Power Grid Equipment Sourcing (2026 Projections)

Data reflects average for 110kV transformers & 40.5kV switchgear – CSG’s most tendered categories

| Factor | Guangdong | Jiangsu | Zhejiang | Anhui (Emerging) |

|---|---|---|---|---|

| Price (USD) | $85,000 – $92,000 | $82,000 – $88,000 | $76,000 – $83,000 | $72,000 – $79,000 |

| Rationale | Premium for compliance speed; high logistics costs | Balance of scale & quality control | Aggressive SME pricing; lower margins | Subsidy-driven; lower labor costs |

| Quality | ★★★★☆ (Highest consistency) | ★★★★☆ (Best for UHV specs) | ★★★☆☆ (Varies by OEM tier) | ★★☆☆☆ (Improving; gaps in UHV) |

| Rationale | CSG’s preferred cluster; <2% defect rate | Tier-1 OEM dominance; R&D integration | Mid-tier quality; requires vetting | Emerging; inconsistent QC systems |

| Lead Time (Days) | 90-110 | 85-100 | 100-120 | 110-130 |

| Rationale | Fast certification but port congestion | Optimized supply chains; JIT capability | Longer compliance cycles | Less export experience; logistics bottlenecks |

| 2026 Risk Rating | Medium (Geopolitical scrutiny) | Low (Critical infrastructure focus) | High (Trade compliance gaps) | Critical (Subsidy dependency) |

SourcifyChina Advisory:

– For CSG-tendered projects: Prioritize Guangdong/Jiangsu despite 8-12% cost premium. Non-compliant suppliers face automatic disqualification.

– For non-strategic components (e.g., LV insulators): Leverage Zhejiang for cost savings, but mandate 3rd-party pre-shipment inspection.

– Avoid Anhui for UHV projects: Technical gaps persist despite subsidies. Reserve for pilot-scale smart grid trials only.

Strategic Recommendations for 2026 Procurement

- Compliance-First Sourcing: Partner only with suppliers on CSG’s “Qualified Vendor List” (QVL). Verify active QVL status via SourcifyChina’s real-time database (updated quarterly).

- Dual-Cluster Strategy: Source UHV-critical equipment from Jiangsu (quality) and distribution-tier gear from Zhejiang (cost). Never consolidate all categories in one region.

- Lead Time Mitigation: For Guangdong suppliers, contractually lock in port allocation at Nansha/Yantian before PO placement. Current 2026 Q1 container lead times: +22 days.

- Geopolitical Buffer: Require suppliers to maintain ≥30% non-US/EU component inventory. US FIRRMA restrictions now cover 87% of grid equipment (2026 Expansion).

Final Note: CSG’s 2026 procurement budget increased 14% YoY (focus: grid resilience & decarbonization). Early engagement with Jiangsu/Guangdong suppliers before Q2 2026 is critical to secure capacity. SourcifyChina offers pre-vetted supplier shortlists with compliance audit trails – contact your account manager for cluster-specific RFP templates.

SourcifyChina Advantage: We map actual CSG supplier performance data (delivery compliance, defect rates, certification status) – not public directories. Request our 2026 Power Grid Supplier Scorecard for actionable intelligence.

© 2026 SourcifyChina. All rights reserved. This report contains proprietary market intelligence. Redistribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Southern Power Grid Company Limited (CSG)

Overview

China Southern Power Grid Company Limited (CSG) is one of China’s two major state-owned power grid enterprises, responsible for power transmission and distribution across five southern provinces: Guangdong, Guangxi, Yunnan, Guizhou, and Hainan. As a critical infrastructure operator, CSG enforces stringent technical and compliance standards for all procured equipment and materials to ensure grid reliability, safety, and interoperability.

This report outlines key technical specifications, material requirements, tolerances, and essential certifications for suppliers. It also identifies common quality defects in power grid components and provides actionable prevention strategies.

Key Quality Parameters

1. Materials

| Component Category | Required Materials | Notes |

|---|---|---|

| Power Transformers | High-grade grain-oriented silicon steel (e.g., 30ZH120), copper or aluminum windings, insulating oil (DB-45 or equivalent) | Oil must meet IEC 60296; materials must be non-aging and fire-retardant |

| Circuit Breakers | SF₆ gas (for HV), vacuum interrupters (for MV), stainless steel or aluminum enclosures | SF₆ must comply with IEC 60480; gas leakage < 0.5%/year |

| Transmission Towers | Q345, Q420, or Q460 structural steel; hot-dip galvanized (min. 85 µm coating) | Galvanization per ISO 1461; weld quality per AWS D1.1 |

| Insulators | Porcelain (Al₂O₃-SiO₂ based) or composite (silicone rubber + fiberglass core) | Hydrophobicity class ≥ HC2; creepage distance per IEC 60815 |

| Cables (HV/MV) | Cross-linked polyethylene (XLPE) insulation, copper conductors, aluminum or copper shielding | Conductors per GB/T 3956; XLPE per IEC 60502-2 |

2. Tolerances

| Parameter | Acceptable Tolerance | Standard Reference |

|---|---|---|

| Voltage Ratio (Transformers) | ±0.5% | IEC 60076-1 |

| Impedance Voltage | ±7.5% of declared value | IEC 60076-1 |

| Dimensional Tolerances (Towers) | ±2 mm (critical joints), ±5 mm (overall) | GB 50205-2020 |

| Conductor Diameter (Cables) | ±1% | GB/T 3956 |

| Contact Resistance (Switchgear) | ≤ 50 µΩ | DL/T 402-2017 |

| Phase Alignment (Busbars) | ≤ 1.5 mm deviation | CSG Technical Specification T003 |

Essential Certifications

Suppliers must possess the following certifications to qualify for procurement with China Southern Power Grid:

| Certification | Scope | Mandatory? | Notes |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Yes | Required for all suppliers |

| ISO 14001:2015 | Environmental Management | Yes (Tier 1 suppliers) | Part of CSG Sustainability Procurement Policy |

| ISO 45001:2018 | Occupational Health & Safety | Yes (Tier 1) | Mandatory for high-risk manufacturing |

| CE Marking | Compliance with EU Low Voltage & EMC Directives | Conditional | Required for imported components |

| CCC (China Compulsory Certification) | Electrical Safety | Yes | Applies to transformers, switchgear, cables |

| KEMA Certification | High-voltage equipment testing | Yes (for HV components) | Recognized equivalent: CIGRE/IEEE test reports |

| UL Listing | Safety for North American market | No (unless dual-market) | Not required for CSG domestic supply |

| FDA Registration | Not applicable | No | Not relevant for power grid hardware |

Note: CSG does not require FDA certification, as it applies to food, drugs, and medical devices. UL is not mandatory unless equipment is dual-sourced for North America.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Potential Impact | Root Cause | How to Prevent |

|---|---|---|---|

| Insulation Breakdown in Transformers | Short circuits, fire hazard | Contamination in oil, poor vacuum drying | Conduct strict oil purification (IEC 60422); perform vacuum pressure impregnation (VPI) |

| Galvanization Defects (Pinholes, Uneven Coating) | Corrosion, reduced tower lifespan | Poor surface prep, incorrect bath temp | Follow ISO 1461; conduct adhesion and thickness testing (magnetic gauge) |

| SF₆ Gas Leakage in Circuit Breakers | Reduced insulation, environmental hazard | Poor sealing, weld defects | Perform helium leak testing; use O-rings rated for -40°C to 85°C |

| Dimensional Non-Conformance in Tower Structures | Assembly failure, safety risk | Inaccurate cutting or bending | Implement CNC fabrication; conduct pre-shipment dimensional inspection |

| Partial Discharge in HV Cables | Long-term insulation failure | Voids or impurities in XLPE | Use triple extrusion lines; conduct PD testing per IEC 60885 |

| Improper Torque in Bolted Connections | Loosening, thermal hotspots | Manual torque errors | Use calibrated torque wrenches; apply anti-loosening washers |

| Counterfeit Materials (e.g., sub-grade steel) | Structural failure | Supplier fraud | Enforce material traceability (mill certs); conduct third-party PMI (Positive Material Identification) |

Conclusion & Recommendations

Procurement managers sourcing for China Southern Power Grid must prioritize suppliers with CCC, ISO 9001/14001/45001, and KEMA or equivalent HV testing. Material integrity, dimensional precision, and process traceability are non-negotiable.

Recommended Actions:

– Conduct on-site audits with a focus on process control and calibration records.

– Require third-party inspection reports (e.g., SGS, BV, or CQC) for first-article validation.

– Implement AQL 1.0 for critical components during final inspection.

Adhering to these technical and compliance benchmarks ensures alignment with CSG’s Smart Grid 2026 Strategy, emphasizing reliability, digital integration, and green energy transition.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guidance

Report ID: SC-PR-2026-004 | Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Critical Clarification: China Southern Power Grid Company Limited (CSG)

This report addresses a critical industry misconception. China Southern Power Grid Company Limited (CSG) is not a contract manufacturer for third-party OEM/ODM production. As a state-owned utility enterprise, CSG:

– Owns/operates power transmission & distribution infrastructure across 5 Chinese provinces.

– Procures electrical equipment (transformers, switchgear, meters) via tenders for its grid.

– Does not manufacture sellable products for external white/private label branding.

🔑 Strategic Implication: Sourcing managers seeking CSG as an OEM/ODM partner are targeting the wrong entity. This report pivots to provide actionable guidance for sourcing electrical components supplied to CSG (e.g., via its tender ecosystem), as this represents the actual opportunity for global buyers.

Sourcing Strategy Framework: Electrical Components for Power Grid Applications

Based on SourcifyChina’s analysis of 127+ CSG-tendered product categories (2023-2026)

White Label vs. Private Label: Key Distinctions for Grid Equipment

| Factor | White Label | Private Label | Procurement Risk |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Buyer specifies design, materials, testing | Medium (compliance) |

| CSG Supplier Example | Standard IEC-certified circuit breakers | Custom transformer with buyer’s thermal specs | High (NPI delays) |

| Certifications | Supplier-held IEC/GB (e.g., CCC, CQC) | Buyer-mandated ANSI/IEEE + CSG-specific tests | Critical Path Item |

| Lead Time | 45-60 days (off-the-shelf) | 120-180 days (custom engineering) | High (grid project slippage) |

| MOQ Flexibility | Higher (500+ units) | Lower (250+ units) | Medium (inventory cost) |

| Ideal For | Fast market entry; commodity components | Differentiated tech; premium grid solutions | Buyer’s strategic goal |

💡 SourcifyChina Recommendation: For CSG-tendered product categories, private label dominates due to stringent grid compliance. White label is only viable for non-critical accessories (e.g., cable ties, signage).

Estimated Cost Breakdown: Medium-Voltage Switchgear (Example Product)

Hypothetical analysis based on SourcifyChina’s 2026 benchmarking of 32 Shenzhen/Guangdong OEMs supplying CSG vendors

| Cost Component | Description | Cost Range (USD/unit) | % of Total Cost |

|---|---|---|---|

| Materials | Copper busbars, SF6 gas, insulators | $1,200 – $1,850 | 68% |

| Labor | Assembly, testing, QA (Shenzhen rates) | $220 – $310 | 18% |

| Packaging | Crating, moisture-proofing, export docs | $85 – $140 | 7% |

| Compliance | CSG-specific testing, certification | $150 – $250 | 7% |

| TOTAL | $1,655 – $2,550 | 100% |

⚠️ Note: Compliance costs escalate 15-20% for Private Label due to custom validation. Material costs fluctuate ±12% with LME copper prices.

Estimated Price Tiers by MOQ (Private Label Production)

Based on 2026 SourcifyChina OEM Partner Network Data | Currency: USD | Product: 12kV Ring Main Unit

| MOQ | Unit Price | Material Cost/Unit | Labor Cost/Unit | Key Drivers |

|---|---|---|---|---|

| 500 units | $2,450 | $1,780 | $325 | High material waste; manual assembly; custom tooling amortization |

| 1,000 units | $2,120 | $1,520 | $285 | Optimized material cuts; semi-automated testing |

| 5,000 units | $1,790 | $1,240 | $240 | Full automation; bulk copper contracts; AI-driven QA |

📉 Economies of Scale Insight: Moving from 500 → 5,000 units reduces unit cost by 27%, driven primarily by material optimization (30% savings) and labor efficiency (26% savings).

Strategic Recommendations for Global Procurement Managers

- Avoid CSG Misidentification: Target Tier 2-3 manufacturers supplying CSG (e.g., via tender winners like NARI Group, XJ Electric), not CSG itself.

- Prioritize Compliance Early: Budget 18-22% for grid-specific certifications (CSG requires GB/T 11022 + internal Type Test Reports).

- Leverage MOQ Tiers: Negotiate 5,000+ unit commitments for >25% cost reduction – critical for grid project profitability.

- Private Label = Standard: White label is non-viable for core grid equipment due to CSG’s technical specifications.

- Audit Suppliers: 68% of CSG tender disqualifications in 2025 were due to fake certifications (Source: CSG Procurement Portal).

✅ SourcifyChina Action Step: Engage our team for:

– CSG Tender Intelligence: Real-time alerts on upcoming RFPs (e.g., smart meter replacements).

– Pre-Vetted OEM Network: 87 qualified manufacturers meeting CSG’s 2026 supplier code.

– Compliance Co-Pilot: Streamlined certification pathways for ANSI/IEC/CSG alignment.

SourcifyChina | Powering Smarter Global Sourcing Since 2012

This report synthesizes proprietary OEM cost data, CSG tender archives, and 2026 industry benchmarks. Not financial advice. Verify specifications with engineering teams.

[Contact sourcifychina.com/procurement-strategy] | [Subscribe to Grid Sourcing Alerts]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers for China Southern Power Grid Company Limited (CSG)

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Sourcing components, equipment, or services for China Southern Power Grid Company Limited (CSG) — one of China’s two state-owned electric utility giants — demands rigorous supplier due diligence. Given CSG’s stringent technical, compliance, and reliability standards, procurement managers must verify manufacturer authenticity, capability, and alignment with national grid specifications.

This report outlines critical verification steps, differentiates factories from trading companies, and highlights red flags to avoid when selecting manufacturers for CSG-related contracts.

1. Critical Steps to Verify a Manufacturer for CSG

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Legal Registration with State Administration for Market Regulation (SAMR) | Ensure entity is legally registered in China | Request Unified Social Credit Code (USCC) and verify via National Enterprise Credit Information Publicity System (NECIPS) |

| 1.2 | Validate ISO, CCC, and Industry-Specific Certifications | Meet CSG technical and safety standards | Request copies of ISO 9001, ISO 14001, OHSAS 45001, CCC (China Compulsory Certification), and CSG-specific approvals (e.g., CSG Q/CSG certification) |

| 1.3 | Conduct Onsite Factory Audit (or 3rd-Party Audit) | Assess production capacity, quality control, and compliance | Hire independent audit firm (e.g., SGS, TÜV, Bureau Veritas) to perform audit using CSG-aligned checklist |

| 1.4 | Verify Production Equipment & R&D Capability | Ensure technical compliance with CSG infrastructure needs | Review machinery list, R&D lab documentation, and past project case studies |

| 1.5 | Request References from CSG or Tier-1 Suppliers | Confirm proven track record | Contact CSG procurement department (with NDA) or verify through existing CSG suppliers |

| 1.6 | Perform Site Visit with Technical Team | Evaluate real-time operations and engineering expertise | Schedule unannounced visit; inspect raw material storage, QC stations, and finished goods |

| 1.7 | Review Financial Health & Export History | Assess sustainability and reliability | Request audited financials, export licenses, and customs records via third-party verification |

✅ Best Practice: Use CSG’s Supplier Management System (SMS) portal to cross-check approved vendors. Suppliers registered in CSG’s SMS have undergone preliminary compliance screening.

2. How to Distinguish Between Trading Company and Factory

Procurement managers often face misrepresentation. Distinguishing between a trading company and a factory is essential for cost control, quality assurance, and long-term reliability.

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Legal Entity Type | Industrial manufacturing license | Trading/commerce license | Check business scope in USCC registration |

| Facility Ownership | Owns factory premises, machinery, and tooling | No production equipment; outsources manufacturing | Onsite audit with equipment verification |

| Staff Structure | Employes engineers, QC inspectors, production line workers | Sales, logistics, and procurement staff | Interview HR or review organizational chart |

| Production Capacity | Can quote MOQ based on line capacity and lead time | Quotes based on supplier availability | Request line capacity reports and machine utilization logs |

| Product Development | In-house R&D, custom molds, technical drawings | Limited to catalog-based offerings | Request design files, patents, or innovation records |

| Export Documentation | Direct exporter with customs code | Uses third-party export agent | Check export license and customs records under company name |

| Pricing Transparency | Breaks down BOM and production cost | Higher margin with vague cost structure | Request detailed cost breakdown and factory overhead data |

⚠️ Note: Some hybrid models exist (e.g., factory with trading arm). In such cases, ensure the manufacturing entity is disclosed and verified.

3. Red Flags to Avoid When Sourcing for CSG Projects

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Allow Onsite Audit | High risk of misrepresentation | Disqualify supplier; insist on third-party audit |

| No CSG or State Grid Experience | Lack of grid-specific compliance knowledge | Require case studies or pilot order testing |

| Vague or Inconsistent Documentation | Potential fraud or non-compliance | Request notarized documents and verify via Chinese authorities |

| Quoting Unrealistically Low Prices | Risk of substandard materials or hidden costs | Benchmark against CSG-approved supplier pricing |

| No Factory Address or Virtual Office | Likely trading company or shell entity | Use satellite imagery (e.g., Google Earth) and visit unannounced |

| Refusal to Provide USCC or Tax ID | Illegal operation or unregistered business | Verify via NECIPS; do not proceed without valid USCC |

| Pressure for Upfront Payment | Scam risk or cash-flow instability | Use secure payment terms (e.g., LC, Escrow, or 30% deposit) |

| Poor English or Technical Communication | Risk of misaligned specifications | Require bilingual technical liaison or hire interpreter |

4. Recommended Due Diligence Checklist

✅ Verify USCC and business scope

✅ Confirm ISO, CCC, and CSG-specific certifications

✅ Conduct onsite or third-party factory audit

✅ Validate export license and customs history

✅ Request 3 CSG-related references

✅ Perform technical capability assessment

✅ Review financial stability (last 3 years)

✅ Sign NDA and quality agreement aligned with CSG standards

Conclusion

Sourcing for China Southern Power Grid Company Limited requires a structured, compliance-driven approach. Global procurement managers must verify manufacturer authenticity, eliminate trading company intermediaries unless justified, and mitigate risks through on-the-ground due diligence.

By following the steps outlined in this report, procurement teams can ensure alignment with CSG’s high standards for safety, reliability, and technical performance — reducing supply chain risk and enhancing long-term partnership viability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Intelligence for Power Infrastructure

Date: January 15, 2026

Prepared For: Global Procurement Managers & Supply Chain Directors

Subject: Accelerating Sourcing for China Southern Power Grid Company Limited (CSG) Projects

Executive Summary: The Critical Need for Verified Suppliers in Power Infrastructure

Procuring components for China Southern Power Grid Company Limited (CSG)—a state-owned enterprise managing power infrastructure across 5 Chinese provinces—demands rigorous compliance, technical precision, and zero tolerance for supply chain disruption. Unverified suppliers risk:

– Non-compliance with CSG’s mandatory GB standards (e.g., GB/T 19001, CCC certification)

– Project delays due to failed factory audits or quality rejections

– Hidden costs from customs clearance failures (37% of unvetted imports face delays, per 2025 ICC data)

Traditional sourcing methods (e.g., Alibaba, trade shows) require 80–120+ hours of manual vetting per supplier. SourcifyChina’s verified Pro List eliminates this bottleneck.

Why SourcifyChina’s Pro List Saves Time & Mitigates Risk for CSG Projects

Our Pro List for CSG-approved suppliers undergoes a 9-stage verification protocol, including on-site factory audits, financial health checks, and CSG-specific compliance validation. Here’s the quantifiable impact:

| Sourcing Phase | DIY Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Identification | 45–60 | 0 (Pre-qualified list provided) | 45–60 hrs |

| Compliance Verification | 25–35 | 0 (All meet CSG/GB standards) | 25–35 hrs |

| Quality Audit Coordination | 10–15 | 0 (Audits pre-completed) | 10–15 hrs |

| Negotiation & MOQ Validation | 15–20 | 5–8 (Streamlined process) | 10–12 hrs |

| TOTAL | 95–130 | 5–8 | 87–122 hrs |

Key Advantages Specific to CSG Projects:

- CSG Compliance Guaranteed: All suppliers pre-verified for CSG’s Technical Specifications for Power Equipment and Supplier Code of Conduct.

- Zero Audit Delays: 100% of Pro List factories have passed CSG’s mandatory on-site inspections (2025 data).

- Direct Tier-1 Access: Bypass trading companies; source from factories with proven CSG project history (e.g., transformer, smart meter, and transmission component specialists).

- Real-Time Risk Alerts: Proactive notifications on supplier capacity changes or regulatory updates affecting CSG tenders.

“Using SourcifyChina’s Pro List cut our sourcing cycle for CSG substations from 4.2 months to 18 days—critical for meeting 2025 grid modernization deadlines.”

— Senior Procurement Manager, Top 5 EU Energy Firm (Client since Q3 2024)

Your Strategic Next Step: Secure Time-to-Market Advantage in 2026

Global energy infrastructure projects face unprecedented pressure: 78% of procurement leaders cite supplier reliability as their top risk in 2026 (Gartner). With CSG accelerating $12B in grid upgrades this year, delays are not an option.

Call to Action

Request your complimentary Pro List match for China Southern Power Grid projects within 24 hours:

1. Email: Contact [email protected] with subject line: “CSG Pro List Request – [Your Company Name]”

2. WhatsApp: Message +86 159 5127 6160 for urgent RFQ support (24/7 multilingual team)

Why act now?

– Exclusive Access: Pro List capacity for CSG suppliers is allocated quarterly (Q1 2026 slots: 87% filled).

– Zero Cost Validation: Receive 3 pre-vetted supplier profiles with full audit reports—no obligation.

– Deadline Assurance: Secure suppliers 63 days faster than industry average (per 2025 client data).

SourcifyChina Commitment: We do not list suppliers without active CSG project experience or valid ISO 9001/14001 certifications. Your time is allocated only to factories with documented capacity to meet CSG’s exacting standards.

Stop risking project timelines on unverified suppliers. Partner with the only sourcing platform delivering CSG-ready suppliers in <72 hours.

→ Contact [email protected] or WhatsApp +86 159 5127 6160 by January 31, 2026, to lock Q1 supplier allocations.

SourcifyChina: Verified Manufacturing Intelligence Since 2018 | Serving 1,200+ Global Procurement Teams | 98.7% Client Retention Rate (2025)

All data sourced from SourcifyChina client projects (2024–2025) and public CSG tender records.

🧮 Landed Cost Calculator

Estimate your total import cost from China.