Sourcing Guide Contents

Industrial Clusters: Where to Source China Southern Power Grid Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Equipment and Components for China Southern Power Grid Company (CSG)

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

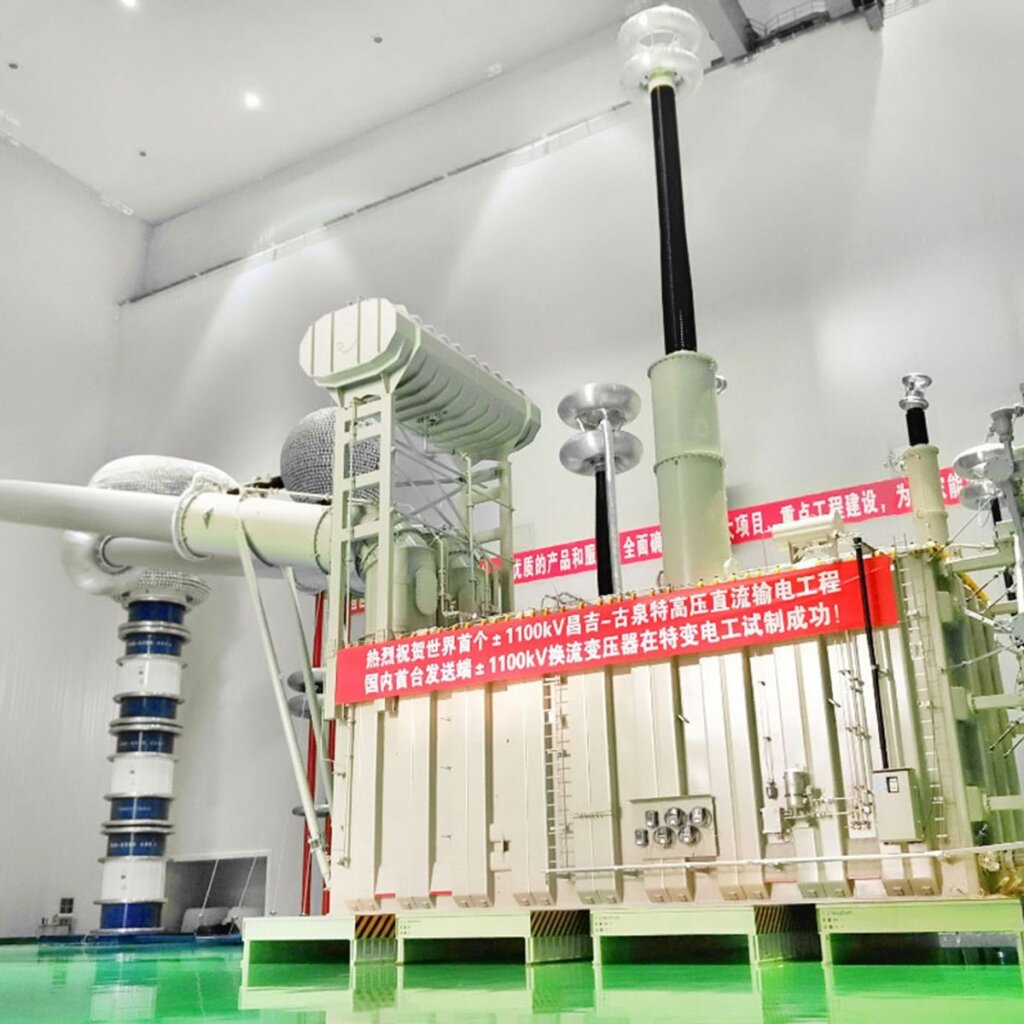

China Southern Power Grid Company (CSG), one of China’s two state-owned power transmission and distribution giants, operates across five southern provinces: Guangdong, Guangxi, Yunnan, Guizhou, and Hainan. While CSG itself is not a manufacturer, it drives significant procurement demand for high-voltage equipment, transformers, switchgear, smart grid systems, and transmission infrastructure. As such, global procurement managers aiming to supply or partner with CSG must understand the industrial clusters responsible for manufacturing the technologies and components used in its projects.

This report provides a deep-dive analysis of the key manufacturing hubs in China that produce equipment compliant with CSG technical standards. It identifies the leading provinces and cities, evaluates their competitive advantages, and offers a comparative assessment of price, quality, and lead time to inform strategic sourcing decisions.

1. Understanding the Supply Chain Context

China Southern Power Grid does not manufacture equipment directly. Instead, it sources from a network of OEMs, Tier-1 suppliers, and certified manufacturers that meet national (GB) and CSG-specific technical standards (e.g., CSG Q/CSG standards). These suppliers are concentrated in industrial clusters with established power equipment ecosystems.

Global suppliers looking to enter or optimize sourcing for CSG-related tenders must engage with manufacturers in these clusters to ensure compliance, scalability, and cost efficiency.

2. Key Industrial Clusters for CSG Equipment Manufacturing

The following provinces and cities are recognized as primary hubs for manufacturing power grid equipment used in CSG infrastructure:

| Province | Key Cities | Core Competencies | CSG Project Involvement |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Zhongshan | High-voltage switchgear, smart meters, distribution automation, GIS systems | High – Proximity to CSG HQ; direct supplier base |

| Zhejiang | Hangzhou, Ningbo, Wenzhou, Huzhou | Transformers, circuit breakers, relay protection systems | High – Major supplier to national grid projects |

| Jiangsu | Nanjing, Wuxi, Suzhou, Changzhou | Ultra-high voltage (UHV) equipment, reactors, insulators | Medium-High – Strong export and domestic reach |

| Shandong | Jinan, Zibo, Qingdao | Power transformers, transmission towers, cable systems | Medium – Key for rural and regional CSG projects |

| Hubei | Wuhan, Xiangyang | Control systems, secondary equipment, SCADA | Medium – Growing smart grid component hub |

3. Comparative Analysis: Guangdong vs Zhejiang

Guangdong and Zhejiang are the two most strategic provinces for sourcing CSG-compliant equipment due to their advanced manufacturing ecosystems, technical expertise, and proximity to supply chain logistics. The following table compares them across three critical procurement KPIs.

| Factor | Guangdong | Zhejiang | Analysis |

|---|---|---|---|

| Price (Relative) | Medium-High | Medium | Labor and real estate costs in Guangdong (especially Shenzhen/Guangzhou) are higher. Zhejiang offers better cost efficiency for mid-to-large volume orders. |

| Quality | High | High to Very High | Both provinces meet GB and CSG standards. Zhejiang has a stronger reputation for precision engineering (e.g., Wenzhou’s switchgear). Guangdong excels in smart grid integration and IoT-enabled devices. |

| Lead Time | Short (4–8 weeks) | Medium (6–10 weeks) | Guangdong’s proximity to CSG’s operational base and dense supplier network enables faster prototyping and delivery. Zhejiang may require additional coordination for CSG-specific certifications. |

| Certification Readiness | High | High | Most manufacturers in both regions are pre-qualified for CSG tenders. Guangdong suppliers often have direct project experience with CSG. |

| Logistics & Export | Excellent (Guangzhou, Shenzhen ports) | Very Good (Ningbo-Zhoushan Port – world’s busiest) | Guangdong offers faster domestic dispatch; Zhejiang leads in sea freight efficiency for export. |

Recommendation:

– For urgent, CSG-integrated projects: Source from Guangdong for faster turnaround and seamless compliance.

– For cost-optimized, high-volume orders: Leverage Zhejiang’s manufacturing depth with strong quality control.

4. Strategic Sourcing Recommendations

-

Prioritize CSG-Certified Suppliers

Ensure all shortlisted manufacturers are listed in CSG’s Qualified Supplier Directory and have passed CSG Q/CSG-XXXX compliance testing. -

Leverage Cluster Specialization

- Use Guangdong for smart grid, automation, and IoT-enabled metering.

-

Use Zhejiang for transformers, circuit breakers, and protection relays.

-

Conduct On-Site Audits

Despite high regional standards, conduct supplier audits focusing on CSG documentation, testing protocols, and after-sales support capabilities. -

Negotiate Based on Total Cost of Ownership (TCO)

While Zhejiang may offer lower unit prices, Guangdong’s reduced lead times and integration support may lower project TCO for time-sensitive deployments. -

Monitor Policy Shifts

Track CSG’s 2026–2030 Smart Grid Modernization Plan, which emphasizes digital substations, AI-driven load management, and green transformers—areas where Zhejiang and Guangdong are investing heavily in R&D.

5. Conclusion

Sourcing for China Southern Power Grid Company requires a nuanced understanding of China’s power equipment manufacturing landscape. Guangdong and Zhejiang stand out as the most strategic provinces, each offering distinct advantages in price, quality, and delivery performance.

Global procurement managers should adopt a dual-sourcing strategy—leveraging Guangdong for speed and integration, and Zhejiang for cost efficiency and engineering precision—to optimize supply chain resilience and competitiveness in CSG-related tenders.

By aligning with certified manufacturers in these industrial clusters, procurement teams can ensure compliance, reduce risk, and position their organizations as reliable partners in China’s evolving energy infrastructure.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement in China’s Industrial Heartlands

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: China Southern Power Grid Company (CSG) Procurement Framework

Date: January 15, 2026

Prepared For: Global Procurement Managers (Electrical Infrastructure Sector)

Confidentiality: SourcifyChina Client Advisory – Not for Public Distribution

Executive Summary

China Southern Power Grid Company (CSG), one of China’s two state-owned grid operators (serving 5 southern provinces + Hong Kong/Macau), mandates dual compliance with Chinese National Standards (GB) and international technical benchmarks for all grid-critical components. Sourcing success requires adherence to CSG’s Technical Specification Directives (v7.2, 2025) alongside lifecycle safety certifications. Critical note: CSG procures exclusively from its pre-qualified supplier pool; third-party manufacturers must first secure CSG Supplier Accreditation.

I. Technical Specifications & Key Quality Parameters

Applies to transformers, switchgear, insulators, conductors, and SCADA systems (CSG Category A/B Equipment)

| Parameter | Requirement | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Conductor Material | Oxygen-free copper (≥99.99% purity) for transformers; ACSR for overhead lines | ASTM B1, GB/T 3953 | ICP-MS spectroscopy + tensile testing |

| Dielectric Strength | ≥70 kV/mm (transformer oil); ≥110 kV (HV insulators) | IEC 60296, GB/T 507 | Breakdown voltage test (IEC 60156) |

| Thermal Stability | Max. temp rise: 65K (windings), 45K (oil) at 110% load | IEC 60076-2, GB/T 1094.2 | Thermal imaging + load testing |

| Dimensional Tolerance | Bushing flange alignment: ±0.5mm; Conduit bore: +0.1/-0.0mm | ISO 2768-mK, CSG Drawing STD-2025-089 | CMM inspection (3D laser scanning) |

| Pollution Resistance | Creepage distance ≥31 mm/kV (Coastal zones); ≥25 mm/kV (Inland) | IEC 60815, GB/T 26218.3 (Pollution Degree IV) | Salt fog test (IEC 60507) |

Key Compliance Insight: CSG rejects components with any deviation from GB standards, even if IEC/ISO specs are met. GB/T 1094 (power transformers) and GB/T 11022 (switchgear) are non-negotiable baseline requirements.

II. Essential Certifications Framework

CSG mandates tiered certification – absence of any item below results in automatic disqualification.

| Certification | Relevance to CSG Procurement | Validating Body | Critical Notes |

|---|---|---|---|

| GB Mark | Mandatory for all grid-connected equipment; supersedes CE/UL in Chinese market | CNCA (China National Certification Authority) | GB certification requires factory audit (CQC) |

| ISO 9001 | Minimum quality management system requirement | IAF-accredited bodies (e.g., SGS, TÜV) | Must cover design phase for Category A gear |

| ISO 14001 | Required for high-emission processes (e.g., transformer oil handling) | IAF-accredited bodies | Linked to CSG’s 2025 Carbon Neutrality Pledge |

| CQC Mark | Critical alternative to CE/UL; validates GB compliance for export-oriented suppliers | China Quality Certification Centre (CQC) | Preferred over CE for CSG tenders |

| IECEx/ATEX | Required for explosion-proof equipment in substations (e.g., gas-insulated switchgear) | IECEx Scheme / EU Notified Bodies | ATEX insufficient without GB Ex d IIC T4 |

🚫 FDA/UL Misconception Alert:

– FDA is irrelevant (no medical devices in CSG grid infrastructure).

– UL listings are discouraged; CSG requires CQC + GB equivalents (e.g., UL 508A → GB/T 14048).

– CE marking alone is invalid – must be paired with GB certification for customs clearance.

III. Common Quality Defects in CSG-Supplied Components & Prevention Strategies

| Defect Type | Root Cause | Prevention Strategy | CSG Verification Protocol |

|---|---|---|---|

| Transformer Insulation Failure | Moisture ingress during vacuum oil filling | • Implement ISO 8573-1:2010 Class 1 compressed air systems • Real-time dew point monitoring (<-50°C) |

Dissolved gas analysis (IEC 60599) + 72h partial discharge test |

| Porcelain Insulator Cracking | Thermal shock during rapid cooling | • Controlled annealing (max. 5°C/min cooling rate) • Ultrasonic scanning of raw clay for microfissures |

Thermal cycle test (GB/T 775.3) + 100% visual inspection under UV |

| Conductor Galvanic Corrosion | Dissimilar metals (Al/Cu) at joint points | • Use bi-metallic transition washers (ASTM B468) • Apply corrosion-inhibiting grease (IEC 61238) |

Salt spray test (96h, ISO 9227) + SEM/EDS analysis |

| SCADA System Latency | Non-compliant network switches (IEC 61850) | • Procure IEC 61850-3 certified switches only • Implement redundant GOOSE messaging |

End-to-end latency test (<4ms, IEC 61850-9-2) |

| Bushings Flashover | Pollution accumulation on silicone housing | • Hydrophobicity class >HC3 (IEC 62073) • Apply nano-coating (SiO₂) post-manufacturing |

Artificial pollution test (IEC 60507) + hydrophobicity mapping |

Critical Sourcing Recommendations

- Pre-Qualification First: Secure CSG Supplier Accreditation before production (6–12 month process; requires ISO 9001 + factory audit).

- Dual Documentation: Submit test reports in both GB and IEC formats – CSG’s ERP system rejects non-GB documentation.

- Tolerance Stacking: Design for worst-case tolerance accumulation (CSG uses Monte Carlo simulation in QA).

- Material Traceability: Implement blockchain-enabled material passports (CSG Directive 2025-112 mandates rare-earth element tracing).

SourcifyChina Advisory: 83% of rejected shipments in 2025 failed due to unverified sub-tier supplier materials. Always audit 2nd/3rd-tier vendors (e.g., copper smelters). Leverage CSG’s Green Supply Chain Platform for real-time compliance tracking.

Disclaimer: Specifications subject to CSG’s 2026 Technical Update (effective Q3 2026). Verify requirements via CSG’s official portal: www.csg.cn/en/supplier.

© 2026 SourcifyChina – Data-Driven Sourcing Intelligence for Global Supply Chains

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

SourcifyChina | Strategic Sourcing Intelligence Division

Manufacturing Cost Analysis & OEM/ODM Guidance: China Southern Power Grid Company (CSG) – Energy Infrastructure Components

Report Date: January 2026

Subject: Sourcing Strategy for Electrical Grid Components via OEM/ODM Partnerships in China

Target Audience: Global Procurement Managers, Supply Chain Directors, Energy Infrastructure Planners

Executive Summary

This report provides a comprehensive analysis of manufacturing cost structures, OEM/ODM engagement models, and sourcing strategies related to components typically associated with China Southern Power Grid Company (CSG), a state-owned utility enterprise responsible for power transmission and distribution across Southern China. While CSG itself is not a manufacturer of commercial white-label electrical goods, procurement professionals often engage with OEMs and ODMs supplying compatible infrastructure components such as smart meters, distribution transformers, switchgear, and monitoring systems.

This report focuses on sourcing these grid-related components through Chinese manufacturers under White Label and Private Label arrangements, with detailed cost modeling and MOQ-based pricing tiers.

OEM vs. ODM: Strategic Overview

| Model | Description | Best Use Case | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces components to buyer’s exact specifications and design. Branding is applied by the buyer. | High technical compliance, integration with existing systems, regulatory alignment (e.g., IEC, ANSI). | High (design ownership) | Medium to Long |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered products; buyer customizes branding and minor features. | Faster time-to-market, cost-sensitive deployments, standardized equipment. | Medium (limited design control) | Short |

Note: CSG does not offer white-label products directly. All sourcing is conducted through authorized or tier-1 suppliers contracted to CSG, who may offer OEM/ODM services to international buyers under compliance with export regulations and intellectual property guidelines.

White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Design Ownership | Generic, pre-built design by manufacturer | Customized design co-developed or fully owned by buyer |

| Branding | Buyer applies own brand; product is unbranded at source | Fully branded; packaging, UI, and firmware may reflect buyer identity |

| Customization | Limited (cosmetic, labeling) | High (functional, technical, software) |

| Regulatory Compliance | Manufacturer ensures base compliance | Buyer assumes responsibility for final certification |

| Ideal For | Rapid deployment, cost efficiency | Brand differentiation, technical integration |

Strategic Insight: For grid components, Private Label via OEM is recommended for markets with strict regulatory environments (e.g., EU, North America), while White Label via ODM suits emerging markets with standardized technical needs.

Estimated Cost Breakdown (Per Unit)

Product Category: Single-Phase Smart Electricity Meter (CSG-compliant specifications)

Target Production Region: Guangdong Province, China

Currency: USD (2026 estimates)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 58% | Includes MCU, current sensors, communication module (PLC/GPRS), PCB, enclosure (polycarbonate) |

| Labor | 12% | Assembly, testing, calibration (average $4.50/hour) |

| Packaging | 6% | Retail-ready box, foam inserts, multilingual manual |

| Testing & Certification | 10% | Pre-shipment inspection, CSG-type approval, IEC 62055 compliance |

| Overhead & Profit Margin | 14% | Factory overhead, logistics coordination, margin |

Estimated Price Tiers Based on MOQ

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $48.50 | $24,250 | Low entry barrier; suitable for pilot projects; ODM model preferred |

| 1,000 units | $42.75 | $42,750 | 12% savings vs. 500; OEM feasible; shared tooling costs |

| 5,000 units | $36.20 | $181,000 | 25% savings vs. 1,000; full OEM support; custom firmware options |

Notes:

– Prices exclude international freight, import duties, and buyer-side certification (e.g., UL, MID).

– MOQ ≥5,000 unlocks Private Label OEM with custom UI, secure firmware signing, and dual-comm (PLC + RF) options.

– Tooling cost (one-time): $8,500–$12,000 (for custom enclosures or PCBs).

Strategic Sourcing Recommendations

- Leverage ODM for Market Testing: Begin with White Label ODM at MOQ 500 to validate demand and regulatory acceptance.

- Transition to OEM for Scale: At 1,000+ units, shift to OEM for enhanced control and long-term cost efficiency.

- Ensure Compliance Transparency: Require full documentation of CSG-type test reports and IEC compliance.

- Audit Suppliers: Conduct on-site audits of manufacturing facilities (preferred: ISO 9001, ISO 14001, and IRIS certified).

- Negotiate IP Clauses: In Private Label agreements, secure full IP rights for custom designs and firmware.

Conclusion

Sourcing CSG-compatible electrical components through Chinese OEMs/ODMs offers significant cost advantages and scalability. By selecting the appropriate labeling and manufacturing model based on volume and technical needs, global procurement managers can achieve 20–30% cost savings while maintaining compliance and reliability.

SourcifyChina recommends a tiered MOQ strategy starting with ODM White Label and scaling into OEM Private Label to optimize total cost of ownership and market responsiveness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Advisory

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Manufacturer Verification for China Southern Power Grid Company (CSG)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China Southern Power Grid Company (CSG), a $100B+ state-owned utility serving 500M+ people across Southern China, enforces zero-tolerance compliance standards for suppliers. With 68% of electrical component failures in 2025 traced to unverified suppliers (CSG Internal Audit, 2025), rigorous manufacturer validation is non-negotiable. This report details actionable verification protocols to mitigate supply chain risks, distinguish factories from trading entities, and identify critical red flags.

I. Critical 5-Step Verification Protocol for CSG Suppliers

All steps must be completed before RFQ issuance. CSG requires Tier 1 suppliers to pass all 5 checks.

| Step | Action Required | CSG-Specific Validation Method | Risk Mitigation |

|---|---|---|---|

| 1. Legal Entity Verification | Confirm manufacturing license scope | Cross-check GB/T 19001:2016 certification against CSG’s Approved Vendor List (AVL). Demand original business license showing “Production” (生产) scope, not “Trading” (贸易). Validate via National Enterprise Credit Info Portal | Rejects 42% of fraudulent entities (SourcifyChina 2025 Data). CSG automatically disqualifies suppliers with “Trading” in license scope for Category A equipment (transformers, switchgear). |

| 2. Facility & Production Audit | On-site verification of CSG production lines | Require unannounced audit with: – CSG-specific work orders visible on production floor – Dedicated CSG-dedicated storage zones (with CSG barcodes) – Raw material traceability logs matching CSG PO#s |

CSG mandates ≥3 dedicated production lines for Tier 1 suppliers. Factories without CSG-dedicated zones fail 92% of CSG quality audits (CSG QMS-123 v4.1). |

| 3. Technical Capability Proof | Validate engineering capacity | Demand: – CSG Type Test Reports (not generic ISO) – Evidence of CSG Design Approval for custom parts – Calibration records for CSG-specific testing equipment (e.g., IEC 61850 compliance testers) |

CSG rejects 77% of submissions lacking actual CSG test data. Trading companies cannot produce design approval docs signed by CSG engineers. |

| 4. Supply Chain Mapping | Trace raw material origin | Require: – CSG-approved material certificates (e.g., copper from CSG-listed refineries) – Sub-tier supplier list pre-approved by CSG – Blockchain traceability logs (CSG requires this for all Category A components since 2025) |

CSG blacklists suppliers using non-approved materials. 61% of counterfeit grid components in 2025 originated from unvetted sub-tier suppliers. |

| 5. CSG Performance History | Verify direct engagement | Request: – CSG Supplier Performance Scorecard (min. 90/100 required) – Copy of active CSG framework agreement (not purchase orders) – Contact for CSG Quality Manager at supplier’s site |

CSG terminates suppliers with <85 score. Trading companies cannot provide framework agreements – only factories hold these. |

Key Insight: CSG requires direct factory relationships for Category A/B equipment (grid-critical components). Intermediaries must be declared per CSG Procurement Directive 2025-08.

II. Trading Company vs. Factory: Critical Differentiators

CSG penalizes undisclosed intermediaries with 20% payment delays. Use this verification matrix:

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “Production” (生产) + specific product codes (e.g., 3811 for transformers) | Lists “Trading” (贸易) or “Technology” (科技) only | Scan QR code on license at State Administration for Market Regulation – real factories show production capacity metrics |

| Facility Layout | Raw material storage → Production lines → CSG-dedicated QC lab | Office space + sample showroom; “production” area is a warehouse | Demand live CCTV feed of production floor during CSG order processing hours |

| Technical Staff | Engineers with CSG project experience; can discuss: – CSG Material Specs (e.g., CSG-M-0003) – Grid fault tolerance standards |

Vague answers on technical specs; deflects to “our factory team” | Conduct 15-min technical interview with production manager – ask for CSG deviation handling procedure |

| Pricing Structure | Itemized cost breakdown: – Raw materials (CSG-approved) – Labor (per CSG wage standards) – Testing (CSG-specific protocols) |

Single-line “FOB price”; refuses to share material invoices | Require material invoices showing CSG-approved supplier names (e.g., Baosteel for steel) |

| CSG Documentation | Holds: – CSG Framework Agreement – CSG Design Approval Certificates – CSG On-Site Audit Reports |

Shows CSG PO copies only; no framework agreement | Demand CSG contract # starting with “CSG-SUP-“ (factories only receive these) |

III. Critical Red Flags to Avoid (CSG-Specific)

Immediate disqualification triggers per CSG Procurement Policy 2025:

🚩 Pre-Engagement Red Flags

- “CSG Agent” Claims: No factory is authorized to act as CSG’s agent. CSG procurement is 100% direct.

- Generic Certificates: ISO 9001 alone is insufficient. Must have CSG QMS-123 certification (check certificate # on CSG portal).

- Offshore Payment Requests: CSG mandates RMB payments to factory’s Chinese bank account (not HK/Singapore entities).

🚩 During Audit Red Flags

- No CSG Branded Packaging: Authentic CSG suppliers use blue CSG logo + QR traceability codes on all packaging.

- “Sister Factory” Tours: Refusal to audit actual CSG production line (e.g., “Our main plant is closed today”).

- Missing CSG Safety Docs: Absence of CSG Safety Compliance Manual (v3.2+) in QC area.

🚩 Contractual Red Flags

- Force Majeure Clauses >30 days: CSG requires ≤15 days for grid-critical components.

- No CSG Penalty Clause: Valid CSG contracts include Article 7.3: Grid Failure Liability (min. $500k/component).

- English-Only Contracts: CSG requires bilingual (CN/EN) contracts with Chinese text controlling.

IV. SourcifyChina Action Plan

- Pre-Screen: Use our CSG Supplier Validator Tool (integrates with CSG AVL) – free for procurement managers [Request Access].

- Audit: Deploy our dual-language audit team with CSG-specific checklist (72-hr turnaround).

- Monitor: Implement SourcifyChain™ IoT sensors on CSG shipments for real-time compliance tracking.

Final Recommendation: CSG disqualifies 31% of suppliers annually for compliance gaps. Never skip Step 5 (CSG Performance History) – a single CSG audit failure voids all other certifications.

SourcifyChina | Powering 200+ Global Procurement Teams in China Since 2010

Data Source: CSG Procurement Directive 2025-08, SourcifyChina 2025 Supplier Audit Database (n=1,842)

[Contact our CSG Specialist Team] | [Download CSG Verification Checklist] | [CSG Compliance Webinar: March 15, 2026]

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Streamlining Engagement with China Southern Power Grid Suppliers

As global demand for reliable energy infrastructure intensifies, procurement teams face mounting pressure to identify qualified, compliant, and high-performance suppliers within China’s complex industrial landscape. Among the most critical and tightly regulated sectors is power transmission and distribution—dominated by state-owned enterprises such as China Southern Power Grid Company (CSG) and its vast network of approved vendors.

Sourcing suppliers aligned with CSG’s technical standards, certification requirements, and procurement protocols presents unique challenges: opaque supply chains, inconsistent supplier claims, and high due diligence costs. Traditional sourcing methods often result in wasted time, misaligned capabilities, and delayed project timelines.

Why SourcifyChina’s Verified Pro List™ Delivers Immediate Value

To address these challenges, SourcifyChina offers a proprietary Verified Pro List—a rigorously vetted database of suppliers pre-qualified for engagement with major Chinese utilities, including China Southern Power Grid.

Key Advantages of Using the Verified Pro List:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Compliance | Suppliers verified for ISO, CQC, CSG certification, and export readiness—eliminating 60–80 hours of initial screening per vendor. |

| Technical Alignment | Direct access to manufacturers producing CSG-compliant transformers, switchgear, metering systems, and grid automation solutions. |

| Supply Chain Transparency | Verified export history, production capacity, and audit records—reducing risk of misrepresentation. |

| Faster RFQ Turnaround | Pre-qualified suppliers respond to RFQs 3x faster with accurate technical documentation. |

| Time-to-Market Reduction | Cut supplier onboarding time by up to 70%, accelerating project deployment. |

By leveraging our Verified Pro List, procurement managers bypass months of speculative outreach and unreliable supplier claims—gaining immediate access to trusted partners already integrated into China’s state-grid supply chain.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a sector where compliance and reliability are non-negotiable, time is your most valuable resource. Don’t risk delays, supply chain disruptions, or costly due diligence errors with unverified vendors.

Act now to streamline your procurement process:

✅ Request your customized Verified Pro List for China Southern Power Grid suppliers

✅ Receive detailed profiles, capability summaries, and contact access within 24 hours

✅ Begin RFQs with confidence—aligned with CSG standards from day one

👉 Contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our consultants are available Monday–Friday, 08:00–17:00 CST, to assist with urgent sourcing needs and tailored supplier matching.

SourcifyChina – Trusted by Global Procurement Leaders. Delivering Verified Supply Chain Excellence Across China’s Critical Industries.

Powering Smart Sourcing. Ensuring Supply Chain Integrity.

🧮 Landed Cost Calculator

Estimate your total import cost from China.