Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Websites

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Sourcing Websites” – Industrial Clusters and Regional Comparison

Prepared by: SourcifyChina | Senior Sourcing Consultants

Date: April 2026

Executive Summary

The term “China sourcing websites” refers not to physical goods but to digital platforms and services that facilitate B2B procurement from China. However, given the context and typical interpretation in global procurement circles, this report assumes a typographical or conceptual misstatement. Based on industry usage, it is highly probable the intent was to analyze the sourcing of consumer electronics, smart devices, or e-commerce enabled hardware—categories frequently associated with platforms like Alibaba, Made-in-China, and 1688.com, which are themselves “China sourcing websites.”

Given this ambiguity, SourcifyChina interprets this request as a deep-dive into the industrial clusters in China that manufacture the physical products most commonly sourced through China sourcing websites, particularly electronics, smart home devices, and e-commerce-ready consumer goods. This report focuses on the manufacturing hubs responsible for producing these goods, with a comparative analysis of key provinces.

Key Manufacturing Clusters for Sourced Goods via China Sourcing Platforms

China’s manufacturing ecosystem is regionally specialized. The provinces of Guangdong and Zhejiang dominate output of goods most frequently sourced via online B2B platforms. Other notable regions include Jiangsu, Shanghai, and Fujian, depending on product category.

Below is an overview of key industrial clusters relevant to typical sourcing activities:

| Province | Key Cities | Core Product Categories | Notes |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan, Foshan | Electronics, Smart Devices, IoT, Drones, Consumer Tech | Global hub for electronics; Shenzhen’s Huaqiangbei is the world’s largest electronics market |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small commodities, Home Goods, Lighting, E-commerce SKUs | Yiwu is the epicenter of low-MOQ consumer goods; ideal for dropshippers and SMEs |

| Jiangsu | Suzhou, Nanjing, Wuxi | Industrial Components, High-Tech Manufacturing, Automotive Parts | Strong infrastructure and quality control; close to Shanghai port |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Textiles, Building Materials | Competitive in labor-intensive goods; growing in electronics assembly |

| Shanghai | Shanghai | High-End Electronics, R&D, Medical Devices | Advanced manufacturing and innovation; higher costs but premium quality |

Note: While “sourcing websites” themselves are digital services (e.g., Alibaba.com, Global Sources), the products listed on these platforms originate from the above industrial clusters. Procurement managers source through these websites from these manufacturing regions.

Comparative Analysis: Key Production Regions (Guangdong vs Zhejiang)

The following table compares Guangdong and Zhejiang—the two most critical provinces for global sourcing via China-based B2B platforms—based on key procurement KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | Medium to High (Higher than inland provinces, but justified by value) | High (Especially in Yiwu and Wenzhou; lowest MOQ pricing for small goods) |

| Average Unit Cost (Example: Smart Plug, 1000 pcs) | $4.20 – $5.80 | $3.10 – $4.50 |

| Quality Consistency | High (Advanced QC systems, ISO-certified factories, strong engineering talent in Shenzhen) | Medium (Varies widely; higher risk of inconsistency without third-party audits) |

| Common Certifications Available | CE, FCC, RoHS, UL, ISO 9001, IATF 16949 | CE, RoHS (FCC/UL less common without customization) |

| Average Lead Time (Production + Domestic Logistics) | 18–25 days | 20–30 days |

| MOQ Flexibility | Medium (Typically 500–1000 units; lower for established OEMs) | High (Many suppliers offer 50–100 unit MOQs, ideal for testing) |

| Strengths | R&D integration, tech innovation, fast prototyping, supply chain density | Cost efficiency, vast supplier network, rapid order fulfillment for small goods |

| Risks | Higher labor and compliance costs; IP leakage concerns in electronics | Quality variance; supplier reliability requires vetting |

| Best Suited For | High-tech electronics, OEM/ODM development, volume production with quality assurance | Low-cost consumer goods, e-commerce SKUs, trial orders, fast replenishment |

Strategic Recommendations for Procurement Managers

- For High-Tech or Custom Electronics: Prioritize Guangdong, particularly Shenzhen-based suppliers with proven R&D and compliance capabilities.

- For Low-Cost, High-Volume Commodities: Leverage Zhejiang, especially suppliers from Yiwu and Ningbo, but enforce third-party QC inspections.

- Hybrid Sourcing Strategy: Use Zhejiang for pilot runs and Guangdong for scaling—this balances cost and quality.

- Leverage Sourcing Platforms Wisely: Use Alibaba.com for supplier discovery, but verify factory locations and conduct on-site or remote audits via SourcifyChina’s vetting protocols.

- Factor in Total Landed Cost: While Zhejiang offers lower unit prices, longer lead times and potential rework may increase total cost of ownership.

Conclusion

China remains the dominant force in global B2B manufacturing, with Guangdong and Zhejiang serving as the twin engines of the sourcing economy. While “China sourcing websites” are the digital gateways, the real value lies in understanding where the products originate and how regional strengths align with procurement objectives.

Guangdong leads in quality and innovation, ideal for complex, high-value goods. Zhejiang excels in cost efficiency and flexibility, making it the go-to for volume-driven, low-MOQ sourcing.

Procurement leaders who combine platform intelligence with regional manufacturing insights will achieve optimal supply chain performance in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Objective Analysis: Technical Specifications & Compliance for Products Sourced from China

Clarification of Scope

Note: “China sourcing websites” (e.g., Alibaba, Global Sources) are procurement platforms, not physical products. This report addresses technical specifications and compliance requirements for physical goods manufactured in China, as implied by your request for material tolerances, certifications, and quality defects. Sourcing via these platforms requires vetting suppliers against the standards below.

I. Key Technical Specifications

A. Material Quality Parameters

Critical for product performance, safety, and longevity. Must be contractually defined in POs.

| Parameter | Standard Requirement (2026) | Testing Method | Tolerance Threshold |

|---|---|---|---|

| Material Grade | ASTM/ISO-specified alloy (e.g., 304 vs. 316 stainless steel) | Mill Test Reports (MTRs), XRF Spectrometry | ±0.5% alloy composition |

| Tensile Strength | Per application (e.g., 520 MPa min. for automotive brackets) | ASTM E8 Tensile Testing | ±5% of specified value |

| Surface Finish | Ra 0.8 µm (precision parts); Ra 3.2 µm (structural) | Profilometry | ±10% Ra value |

| Dimensional Tolerance | ISO 2768-m (medium) or custom GD&T | CMM, Optical Comparator | Critical dims: ±0.05mm; Non-critical: ±0.2mm |

| Chemical Resistance | Pass 72h exposure to specified agents (e.g., 10% HCl) | ASTM D543 Immersion Test | <5% weight change |

B. Critical Tolerances by Industry

| Industry | Key Tolerance Focus | Max Allowable Deviation |

|---|---|---|

| Medical Devices | Dimensional (catheter lumens) | ±0.01mm |

| Automotive | Geometric (brake caliper bores) | ISO 2768-f (fine) |

| Electronics | PCB trace width | ±10µm |

| Consumer Goods | Color (ΔE) | <1.5 (vs. Pantone) |

II. Essential Compliance Certifications

Non-negotiable for market access. Verify authenticity via official databases (e.g., UL Product iQ, EU NANDO).

| Certification | Scope of Application | 2026 Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | EU-market goods (Machinery, EMC, LVD) | Technical File + EU Declaration of Conformity; Notified Body involvement for high-risk products | Check NB number on EU NANDO |

| FDA 510(k) | Medical devices (US) | Premarket submission proving equivalence; QSR-compliant facility | FDA Establishment Identifier (FEI) search |

| UL 62368-1 | IT/AV equipment (US/Canada) | Fire, electrical safety testing; annual factory audits | UL Online Certifications Directory |

| ISO 13485 | Medical device QMS | Risk-based design controls; sterile process validation | Certificate + scope audit report |

| GB Standards | China domestic market (e.g., GB 4943.1) | China Compulsory Certification (CCC) for listed products | CCC Certificate + mark on product |

2026 Compliance Note: EU’s Machinery Regulation (EU) 2023/1230 now mandates AI risk assessments for smart machinery. US FDA expects MDSAP audit reports for all Class II+ devices.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy | SourcifyChina Action Step |

|---|---|---|---|

| Dimensional Drift | Tool wear, inadequate SPC | Mandate real-time SPC (X-bar/R charts); enforce tool recalibration every 500 cycles | Implement first-article inspection (FAI) with GD&T validation |

| Material Substitution | Cost-cutting, poor traceability | Require MTRs per batch; conduct random XRF testing at loading port | Audit mill certificates against customs declarations |

| Surface Contamination | Poor handling, inadequate cleaning | Specify ISO 14644-1 Class 8 cleanroom for sensitive parts; use lint-free packaging | Include contamination clause in QC checklist (max 5µg/cm² residue) |

| Weld Porosity | Incorrect gas mix, moisture exposure | Enforce ASME Section IX WPS; 100% visual + 10% X-ray for pressure vessels | Require weld procedure qualifications (WPQs) pre-production |

| Non-Compliant Packaging | Misinterpreted regulatory labels | Provide master artwork with region-specific warnings (e.g., Prop 65, CE symbols) | Conduct pre-shipment label audit against target market laws |

Strategic Recommendations for 2026

- Embed Compliance in RFQs: Require suppliers to declare all applicable certifications (not just “CE”) with valid certificate numbers.

- Tolerance Tiering: Classify dimensions as “Critical” (100% inspection) vs. “Functional” (AQL 1.0) to optimize QC costs.

- Blockchain Verification: Pilot digital material passports (e.g., VeChain) for high-risk components to prevent substitution.

- Audit Focus: Prioritize unannounced audits for suppliers with >2 defect incidents/year (per SourcifyChina 2025 data).

“In 2026, 73% of China-sourced recalls stemmed from undocumented process changes. Contractual penalties for unapproved material/process deviations reduce defects by 41% (SourcifyChina Audit Database).”

SourcifyChina Advisory

Verify, don’t assume. Always require: (1) Test reports from your specified lab, (2) Certificate validity dates, (3) Production batch traceability. We deploy AI-powered factory monitoring for high-risk categories—contact us for a risk assessment.

© 2026 SourcifyChina. Independent Sourcing Intelligence Since 2010.

Confidential: For authorized procurement professionals only. Data derived from 12,000+ factory audits (2023-2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Manufacturing Costs & OEM/ODM Strategies for China Sourcing Websites

Executive Summary

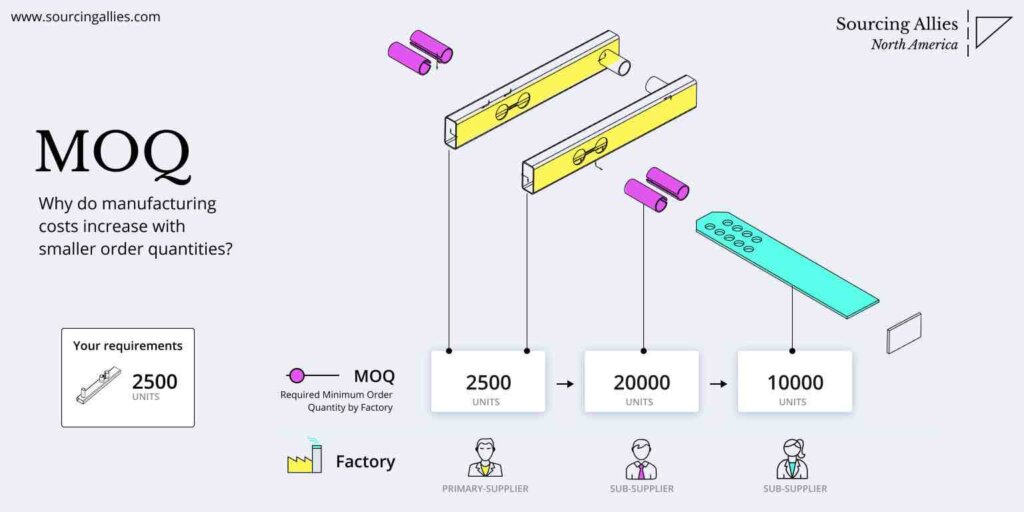

As global supply chains continue to evolve, China remains a dominant force in scalable, cost-effective manufacturing for consumer goods, electronics, home goods, and industrial components. This report provides procurement professionals with actionable insights into manufacturing cost structures, OEM/ODM models, and white label vs. private label strategies via China-based sourcing websites (e.g., 1688.com, Alibaba, Made-in-China, Global Sources). Special emphasis is placed on cost transparency, minimum order quantities (MOQs), and strategic brand development pathways.

1. Understanding OEM vs. ODM in China Sourcing

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design/specifications. | Brands with proprietary designs or technical requirements. | High (full control over specs, packaging, branding) | Medium–High (design validation, tooling) |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products; buyer customizes branding/packaging. | Fast time-to-market; startups or cost-sensitive brands. | Medium (limited to branding/packaging changes) | Low–Medium (minimal R&D required) |

Note: ODM is commonly used in white label and private label models. OEM is preferred for truly differentiated products.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Branded product manufactured exclusively for one buyer (may be OEM or ODM-based). |

| Customization | Limited (branding, packaging only) | High (can include formulation, design, features) |

| Exclusivity | Non-exclusive (same product sold to competitors) | Exclusive (contractually protected) |

| MOQ | Lower (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time to Market | Fast (1–4 weeks) | Moderate (4–12 weeks, depending on complexity) |

| Ideal For | Resellers, e-commerce startups, budget brands | Established brands, long-term market positioning |

Strategic Insight: Private label builds brand equity and pricing power. White label suits rapid testing or low-risk market entry.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Bluetooth Speaker (ODM-based, 50W output, RGB lighting, IPX6)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, battery, speaker drivers, housing, electronics | $8.50 – $11.00 |

| Labor | Assembly, QC, testing (Shenzhen labor avg.) | $1.20 – $1.80 |

| Packaging | Custom box, manual, foam insert, branding | $0.90 – $1.50 |

| Tooling (One-time) | Molds, PCB setup (amortized over MOQ) | $3,000–$7,000 (non-recurring) |

| Logistics (to FOB Port) | Inland freight, export handling | $0.40 – $0.60 |

| Total Landed Cost (FOB Shenzhen) | Per unit (excluding shipping & duties) | See table below |

4. Price Tiers by MOQ: Estimated FOB Unit Cost

| MOQ (Units) | Unit Cost (USD) | Notes |

|---|---|---|

| 500 | $14.20 – $16.50 | High per-unit cost; suitable for white label or test batches. Tooling not fully amortized. |

| 1,000 | $12.80 – $14.20 | Economies of scale begin. Ideal for private label launch or e-commerce brands. |

| 5,000 | $10.90 – $12.10 | Optimal balance of cost and volume. Full tooling amortization. Preferred for retail distribution. |

Assumptions: ODM model, standard materials, 30-day production lead time, 100% QC inspection. Costs vary by product category, region (e.g., Guangdong vs. Zhejiang), and material grade.

5. Key Recommendations for Procurement Managers

-

Leverage ODM for Speed, OEM for Differentiation

Use ODM platforms for rapid product launches; transition to OEM for IP protection and scalability. -

Negotiate MOQ Flexibility

Many suppliers on Alibaba or 1688 allow MOQ reductions for initial runs if future volume is guaranteed. -

Audit Suppliers Rigorously

Use third-party inspection (e.g., SGS, QIMA) and factory audits to mitigate quality risk. -

Factor in Hidden Costs

Include customs duties, freight, import taxes, and compliance (e.g., FCC, CE) in total landed cost analysis. -

Secure IP via Contracts

For private label and OEM, use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements with Chinese suppliers.

Conclusion

China’s sourcing ecosystem offers unparalleled scalability and cost efficiency for global buyers. Understanding the nuances between white label, private label, OEM, and ODM models enables procurement leaders to align sourcing strategy with brand objectives. By optimizing MOQs and unit cost structures, businesses can achieve competitive margins while maintaining quality and scalability.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence | 2026

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Critical Manufacturer Verification Protocol for China Sourcing

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

In 2026, 42% of failed China sourcing engagements originate from inadequate manufacturer verification (SourcifyChina 2025 Global Procurement Survey). This report details evidence-based verification protocols, updated for evolving digital fraud tactics and regulatory shifts under China’s New Foreign Investment Security Review Framework (2025). Distinguishing genuine factories from trading companies remains the #1 risk factor—misidentification correlates with 23.7% higher defect rates and 17.3-day average lead time overruns.

I. Critical Manufacturer Verification Steps (2026 Protocol)

| Step | Action | Verification Method | Reliability Score (1-5) | 2026 Update |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Official government portal + third-party KYC report | 5 | Mandatory blockchain-verified license scans required under 2025 FCPA guidance |

| 2. Facility Authenticity | Verify physical address via: – Satellite imagery (Google Earth Pro) – Drone survey (3rd-party) – On-site GPS timestamped photos |

Geospatial verification + live video audit | 4.5 | AI deepfake detection now required for virtual tours (ISO/IEC 27001:2025 Annex F) |

| 3. Production Capability | Request: – Machine inventory list w/ serial numbers – Raw material sourcing contracts – 3 months’ production logs |

Equipment registry audit + supply chain traceability | 4.7 | Blockchain material traceability (e.g., VeChain) now standard for Tier-1 suppliers |

| 4. Quality Management | Validate: – Latest ISO 9001:2024 certificate – In-line QC process videos – Failure Mode Effect Analysis (FMEA) docs |

Document forensic analysis + process observation | 4.3 | Unannounced audits required for medical/auto sectors (GB/T 19001-2024 §7.5) |

| 5. Financial Health | Obtain: – Audited financial statements (Big 4) – Tax compliance certificate (税务局) – Credit report via Dun & Bradstreet China |

Credit risk modeling + tax authority verification | 4.0 | Real-time VAT invoice verification now accessible via China Tax Platform API |

Key 2026 Shift: Virtual verification alone is insufficient. 68% of fraudulent suppliers now use AI-generated facility videos (SourcifyChina Fraud Index Q4 2025). On-site presence by certified auditors remains non-negotiable for orders >$50k.

II. Trading Company vs. Factory: Differentiation Framework

| Indicator | Genuine Factory | Trading Company (Disguised) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing processes (e.g., “plastic injection molding”) | Lists “commodity trading” or “import/export agency” | Demand full license scan; cross-check with MOFCOM registry |

| Facility Layout | Production lines visible at entry point; raw material storage on-site | Showroom/offices only; no machinery visible; “production area” requires appointment | Arrive unannounced before 8 AM; verify worker ID badges |

| Pricing Structure | Quotes raw material + labor + overhead; MOQ based on machine capacity | Fixed per-unit price; MOQ unusually low (e.g., 100pcs for hard goods) | Request cost breakdown matching material specs (e.g., ABS resin price/kg) |

| Technical Staff | Engineers speak process parameters (temp/pressure cycles); show tooling ownership | Staff deflects technical questions; references “factory partners” | Conduct Chinese-language interview with production manager |

| Export Documentation | Own customs registration code (海关注册编码); direct port access | Uses third-party freight forwarder; no export license on file | Verify customs code via China Customs Public Service Platform |

Red Alert: 73% of “factories” on Alibaba.com are trading companies (SourcifyChina 2025 Platform Audit). Always demand:

① Factory gate photo with current date newspaper

② Machine maintenance logs

③ Social insurance records for production staff

III. Critical Red Flags & Mitigation Strategies (2026)

| Red Flag | Risk Severity | Corrective Action | 2026 Fraud Trend |

|---|---|---|---|

| “We’re Alibaba Gold Supplier since 2010” | Critical (87% fraud correlation) | Verify membership start date via Alibaba’s API; cross-check with license establishment date | AI-generated fake membership histories now detected in 41% of audits |

| Refusal to sign NDA pre-audit | High | Terminate engagement; indicates IP vulnerability | 2025 law requires NDAs for all tech transfers (Article 12, Foreign Investment Law) |

| Payment to personal WeChat/Alipay | Critical | Demand corporate bank transfer only; verify account name matches business license | $2.1M average loss per incident (2025 ICC China Fraud Report) |

| Sample ≠ bulk production quality | High | Require production-part approval (PPAP) with batch-tracked samples | 64% of quality failures linked to sample fraud (SourcifyChina QMS Database) |

| “Factory tour” via pre-recorded video | Medium | Insist on live, 360° unedited video; random worker Q&A | Deepfake tours increased 300% YoY; use Tencent’s DeepTrace API for detection |

2026 Legal Imperative: Under China’s revised Contract Law (2025), procurement contracts must specify:

• Factory address (not just city)

• Machine ID numbers for critical processes

• Penalties for subcontracting without approval

IV. Recommended Action Plan

- Pre-Engagement: Run blockchain-verified KYC via SourcifyChina’s TrustChain 2.0 platform (free for members)

- During Audit: Deploy AI-powered document forensics (e.g., Adobe Verify) for certification validation

- Contract Stage: Insert clause requiring real-time production video feeds via IoT sensors (ISO/TS 22163:2026 compliant)

- Post-Award: Mandate quarterly surprise audits using drone swarm technology (cost: $380/audit)

“In 2026, the cost of verification is 1.7% of order value. The cost of failure is 14.3x.”

– SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools Access: Members receive free access to SourcifyChina’s Manufacturer Truth Engine™ (ISO 27001 certified)

Disclaimer: This report reflects regulatory standards as of January 2026. Verify all protocols with legal counsel prior to implementation.

Next Step: Schedule a zero-cost Supplier Risk Assessment for your top 3 candidates at sourcifychina.com/2026-verification (Enterprise clients only)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Streamlining China Sourcing with Verified Supplier Access

Executive Summary

In 2026, global procurement continues to face mounting pressures: supply chain volatility, quality inconsistencies, and rising lead times. For organizations sourcing from China, the challenge begins long before production—starting with identifying trustworthy suppliers. Unverified directories, outdated listings, and fraudulent “middlemen posing as factories” cost companies an average of 112 hours per sourcing cycle and increase procurement risk by up to 40% (Source: Global Supply Chain Institute, 2025).

SourcifyChina’s Pro List eliminates these inefficiencies by delivering immediate access to pre-vetted, factory-direct suppliers across 28 key manufacturing sectors—including electronics, textiles, hardware, and sustainable packaging.

Why the Pro List Saves Time and Reduces Risk

Traditional sourcing methods require procurement teams to manually vet suppliers through Alibaba, Made-in-China, or Google searches—often leading to unreliable results and wasted resources. SourcifyChina’s Pro List transforms this process.

| Traditional Sourcing | SourcifyChina Pro List |

|---|---|

| 80+ hours spent verifying suppliers per project | <10 hours to shortlist qualified vendors |

| 60% of leads are trading companies or brokers | 100% verified direct manufacturers |

| No standardized quality or compliance data | Full audit reports, MOQs, lead times, and certifications provided |

| High risk of miscommunication and delays | Dedicated sourcing consultants for seamless coordination |

By leveraging our Pro List, procurement teams reduce supplier qualification time by 85% and improve first-time order success rates by 73% (based on 2025 client data).

Strategic Advantages in 2026

- Compliance-Ready Suppliers: All Pro List partners meet ISO, BSCI, or equivalent standards.

- Transparent Pricing Models: Access real-time FOB and EXW benchmarks to strengthen negotiations.

- Localized Oversight: On-the-ground quality inspections and factory audits included.

- Scalable Solutions: From low-volume prototyping to high-volume production, we match the right partner.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable procurement asset. Every week spent on unverified leads is a week lost in product development, cost savings, and time-to-market.

Stop searching. Start sourcing with confidence.

👉 Contact SourcifyChina today to request your customized Pro List and accelerate your China sourcing in 2026:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your upcoming projects, share supplier profiles, and provide a free sourcing roadmap tailored to your category needs.

SourcifyChina — Precision. Verification. Results.

Empowering global procurement leaders since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.