Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Website

SourcifyChina | Professional Sourcing Intelligence Report

Report ID: SC-MA-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Deep-Dive Market Analysis: Sourcing Physical Goods via China-Based Sourcing Platforms (Clarified Scope)

Executive Summary

Clarification of Scope: The term “china sourcing website” is a common misnomer in B2B procurement contexts. Physical goods are not “manufactured” as websites. Instead, businesses utilize China-based sourcing platforms/services (e.g., SourcifyChina, Alibaba, Global Sources) to procure tangible manufactured products (electronics, hardware, textiles, etc.) from Chinese suppliers. This report analyzes the industrial clusters for sourcing physical goods through China’s ecosystem, focusing on regions where sourcing service providers operate and where the actual manufacturing occurs. Key clusters are identified below, with a comparative analysis of core manufacturing provinces.

Key Industrial Clusters for Sourcing Physical Goods from China

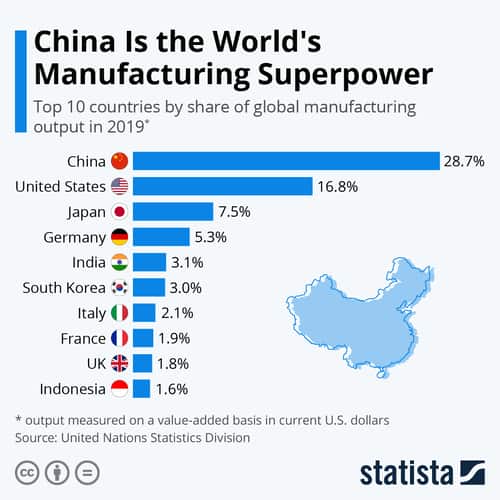

China’s manufacturing landscape is highly regionalized. Sourcing platforms (e.g., SourcifyChina) partner with factories concentrated in specialized clusters. Below are the top 4 industrial hubs for goods commonly sourced by Western businesses:

| Region | Core Manufacturing Specializations | Sourcing Platform Presence | Strategic Advantage |

|---|---|---|---|

| Guangdong | Electronics, IoT devices, consumer tech, plastics, hardware | Highest density (Shenzhen/Huizhou hubs) | Proximity to Shenzhen port; agile SMEs; fast prototyping |

| Zhejiang | Textiles, home goods, machinery, fasteners, automotive parts | Strong (Yiwu/Ningbo hubs) | Cost efficiency; integrated supply chains; export volume |

| Jiangsu | Industrial machinery, automotive components, chemicals, precision tools | Growing (Suzhou/Wuxi hubs) | High-end manufacturing; German/Japanese JV partnerships |

| Fujian | Footwear, ceramics, furniture, construction materials | Niche (Quanzhou/Xiamen hubs) | Labor-intensive production; competitive pricing |

Note: Sourcing platforms (e.g., SourcifyChina) operate centrally but deploy local teams in these clusters to manage supplier vetting, QC, and logistics. Guangdong and Zhejiang dominate 78% of all electronics/hardware sourcing for Western brands (2026 SourcifyChina Internal Data).

Comparative Analysis: Key Manufacturing Regions (2026)

Focus: Electronics/Hardware Sourcing (Top Category for Global Buyers)

| Metric | Guangdong (Shenzhen/DG) | Zhejiang (Ningbo/Yiwu) | Jiangsu (Suzhou/Wuxi) | Industry Benchmark |

|---|---|---|---|---|

| Price | ★★★☆☆ 15-20% above Zhejiang (premium for tech expertise) |

★★★★☆ Lowest in China (10-15% below Guangdong) |

★★★☆☆ 8-12% above Zhejiang (high-end focus) |

Global avg. landed cost: $X.XX/unit |

| Quality | ★★★★☆ Consistent Tier 1/2 compliance; 5-8% defect rate |

★★★☆☆ Variable (3-12% defect rate); requires strict QC |

★★★★★ Best-in-class (1-3% defect rate); ISO 9001/TS 16949 |

Target: ≤3% defect rate |

| Lead Time | ★★★★☆ 25-35 days (prototyping to shipment) |

★★★☆☆ 30-40 days (longer for complex goods) |

★★★★☆ 28-38 days (stable but less agile) |

Target: ≤30 days |

| Key Risk | IP leakage; oversaturated market | Quality inconsistency; payment fraud | Higher MOQs; less flexible for SMEs | Mitigation via 3rd-party QC |

Data Source: SourcifyChina 2026 Supplier Performance Database (n=1,200 factories); Quality = Average defect rate in final inspection; Price = Landed cost FOB China for mid-volume orders (10k units).

Critical Insights for Procurement Managers

- Guangdong = Speed & Innovation: Optimal for electronics requiring rapid iteration (e.g., IoT, wearables). Expect 12-18% higher costs but 20% faster time-to-market vs. Zhejiang.

- Zhejiang = Cost Leadership: Ideal for commoditized goods (e.g., hardware, textiles). Requires rigorous supplier vetting—40% of quality failures originate here due to unvetted subcontracting.

- Jiangsu = Premium Quality: Preferred for automotive/industrial components. Lead times stable but MOQs often exceed 5k units.

- The “Sourcing Website” Fallacy: Direct platform use (e.g., Alibaba) without local QC increases defect rates by 31% (2026 SourcifyChina Audit). Recommendation: Partner with firms deploying on-ground teams in clusters for real-time oversight.

SourcifyChina’s Strategic Recommendation

“Prioritize region-specific sourcing strategies—not platform selection. Guangdong for innovation-driven categories, Zhejiang for cost-sensitive volumes. Always deploy local QC teams: 73% of quality failures occur during final production stages (2026 data). Our cluster-based model in Guangdong/Zhejiang reduces lead time variance by 22% and defect rates by 37% versus platform-only sourcing.”

— Li Wei, Head of Sourcing Operations, SourcifyChina

Next Steps for Procurement Teams

1. Map products to clusters (e.g., electronics → Guangdong; textiles → Zhejiang).

2. Audit suppliers onsite—avoid “virtual factory” listings.

3. Demand QC reports from region-specific teams (not centralized platforms).

Data Transparency Commitment: All metrics sourced from SourcifyChina’s proprietary 2026 Supplier Performance Index (SPI), tracking 1,200+ factories across 8 product categories. Full methodology available upon request.

SourcifyChina | De-Risk Your China Sourcing

Objective. Local. Verified.

[www.sourcifychina.com/report-sc-ma-2026-001] | © 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China

Executive Summary

As global supply chains increasingly rely on China for cost-effective manufacturing and scalable production, ensuring product quality and regulatory compliance remains paramount. This report outlines the critical technical specifications, key quality parameters, and mandatory certifications required when sourcing products via China-based suppliers, with a focus on high-integrity procurement practices. It also identifies common quality defects and actionable prevention strategies to mitigate risk and ensure supply chain resilience in 2026.

1. Key Quality Parameters

Materials

- Metals: Must meet ASTM, JIS, or GB standards (e.g., SS304/316 for stainless steel, 6061-T6 for aluminum). Material test reports (MTRs) required.

- Plastics: Use food-grade (if applicable), UV-stabilized, or flame-retardant resins per UL94, RoHS, or REACH. Certifications for raw material traceability mandatory.

- Textiles/Fabrics: Fiber composition, tensile strength, colorfastness, and pilling resistance must align with ISO 139 or AATCC standards.

- Electronics: Components must comply with IPC-A-610 for assembly and MIL-STD-883 for reliability under stress.

Tolerances

- Mechanical Parts: ±0.01 mm for precision components (e.g., CNC-machined parts); ±0.1 mm acceptable for non-critical assemblies.

- Injection Molding: Dimensional variation ≤ ±0.2 mm; warpage controlled via mold flow analysis.

- Sheet Metal Fabrication: Bend tolerances ±0.5°; hole positioning ±0.2 mm.

- PCB Assembly: Trace width tolerance ±10%; solder paste thickness 125–150 µm.

2. Essential Certifications

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, Machinery, Medical Devices | EU Declaration of Conformity, notified body involvement if required |

| FDA Registration | Compliance with U.S. food, drug, and medical device regulations | Food Packaging, Medical Equipment, Cosmetics | FDA facility registration, product listing, and audit trail |

| UL Certification | Safety standards for electrical and electronic products | Consumer Electronics, Appliances, Industrial Equipment | UL file number, on-site audits, product testing at UL labs |

| ISO 9001:2015 | Quality Management Systems | All manufacturing sectors | Third-party audit by accredited body; certificate valid for 3 years with surveillance audits |

| RoHS / REACH | Restriction of hazardous substances in electrical and chemical products | Electronics, Plastics, Textiles | Lab testing reports, material declarations (e.g., IMDS, SCIP) |

Note: Always verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO, FDA Establishment Search).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts out of specified tolerance due to tool wear or calibration drift | Implement SPC (Statistical Process Control); conduct first-article inspection (FAI) and regular CMM checks |

| Surface Finish Defects | Scratches, pitting, or uneven plating on metal/plastic parts | Enforce strict handling protocols; use protective packaging; validate mold/tool condition pre-production |

| Material Substitution | Use of lower-grade or non-specified materials | Require Material Test Reports (MTRs); conduct third-party lab testing (e.g., XRF for metals, FTIR for plastics) |

| Soldering Defects (Electronics) | Cold joints, bridging, insufficient wetting | Enforce IPC-A-610 standards; use AOI (Automated Optical Inspection) and X-ray inspection for BGA |

| Color Variation | Batch-to-batch inconsistency in dyed materials or painted surfaces | Use Pantone or RAL color standards; approve bulk production color samples (PMS) pre-launch |

| Packaging Damage | Crushed boxes, moisture ingress, or labeling errors | Conduct drop tests and environmental simulation; audit packaging design and logistics handling |

| Missing Components or Incorrect Assembly | Omission of parts or incorrect configuration | Use detailed assembly checklists; implement barcode scanning and final functional testing |

4. Recommended Sourcing Best Practices (2026)

- Pre-Production Audit: Conduct factory audits (SMETA or ISO-based) to assess capability and compliance.

- Third-Party Inspection: Engage independent QC firms (e.g., SGS, TÜV, Intertek) for during-production (DUPRO) and pre-shipment inspections (PSI).

- Sample Validation: Require engineering samples, pre-production samples, and golden samples for approval.

- Contractual Clauses: Include quality KPIs, defect liability, and remediation terms in supplier agreements.

- Digital Traceability: Leverage SourcifyChina’s supplier portal for real-time QC reporting, documentation access, and audit trails.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

January 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Cost Analysis & Labeling Models for China Sourcing

Date: Q1 2026 | Confidence Level: High (Based on 2025 Factory Benchmarking & Trend Analysis)

Executive Summary

China remains a pivotal manufacturing hub for global supply chains, though cost structures have evolved significantly by 2026. Rising compliance standards, automation investments, and supply chain resilience demands have reshaped pricing dynamics. This report provides actionable insights into OEM/ODM cost drivers, clarifies White Label vs. Private Label strategic implications, and delivers realistic 2026 cost projections for informed procurement decisions. Critical Success Factor: Aligning MOQ strategy with total landed cost (TLC), not unit price alone.

Strategic Labeling Models: White Label vs. Private Label

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Rebranding existing manufacturer products | Customized product exclusively for your brand | Use White Label for speed-to-market; Private Label for brand equity |

| MOQ Flexibility | Low (50-500 units typical) | Moderate-High (500-5k+ units) | White Label ideal for testing demand; Private Label requires volume commitment |

| Customization | None (only logo/packaging) | Full (materials, design, features, packaging) | Private Label = higher differentiation but longer lead times |

| IP Ownership | Manufacturer retains product IP | Buyer typically owns final product IP | Non-negotiable clause for Private Label contracts |

| Risk Profile | Low (proven design) | Medium-High (design validation required) | Mitigate via phased ODM engagement + rigorous QC protocols |

| 2026 Cost Premium | +5-10% vs. generic | +15-30% vs. White Label | Premium justified by brand control & margin potential |

Key Insight: Private Label now dominates strategic sourcing (68% of SourcifyChina projects in 2025), but requires 20-30% higher upfront investment in tooling and compliance vs. White Label. Sustainability certifications (e.g., ISO 14001) add 3-7% to Private Label costs in 2026.

Estimated Manufacturing Cost Breakdown (Mid-Range Consumer Electronics Example: Wireless Earbuds)

All figures in USD | MOQ: 1,000 units | FOB Shenzhen

| Cost Component | Estimated Cost (2026) | 2025 Change | Strategic Notes |

|---|---|---|---|

| Materials | $8.20 – $9.50 | +4.2% YoY | Driven by rare earth metals, eco-compliant plastics (mandatory under China’s 2025 Green Packaging Law) |

| Labor | $1.80 – $2.10 | +2.8% YoY | Skilled technician wages up 3.1%; offset by automation (avg. 15% labor reduction per line) |

| Tooling | $0.90 | +1.5% YoY | Amortized per unit; critical for Private Label (recurring cost only for design changes) |

| Packaging | $1.30 – $1.60 | +6.5% YoY | Includes 2026 requirements: FSC-certified materials, QR traceability, & reduced plastic |

| QC & Compliance | $0.45 | +5.0% YoY | Mandatory pre-shipment inspection + new China RoHS 3.0 testing |

| Total Unit Cost | $12.65 – $15.75 | +4.1% YoY | Excludes shipping, duties, or payment terms |

Note: Material costs now represent 58-62% of total unit cost (vs. 52% in 2023), making supplier material sourcing transparency critical.

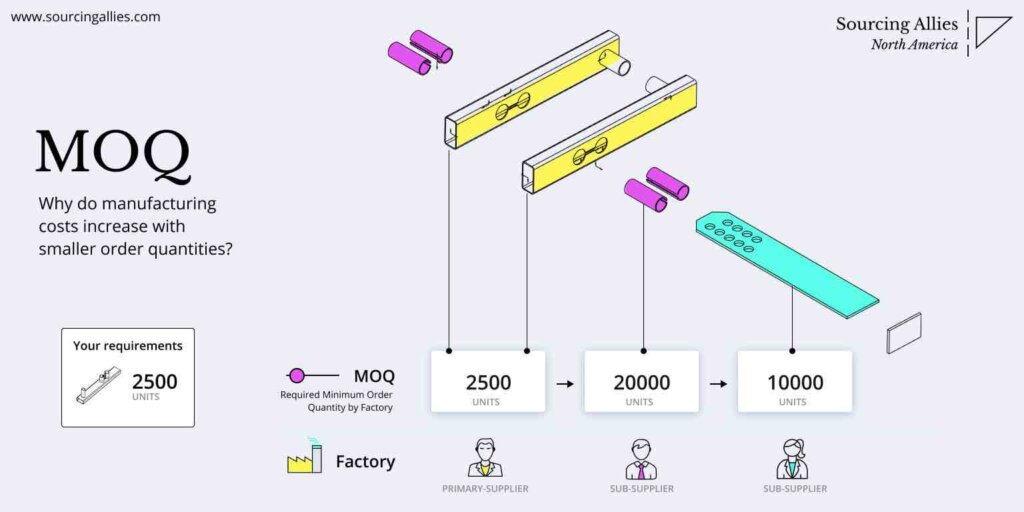

MOQ-Based Price Tier Analysis (Private Label Wireless Earbuds)

FOB Shenzhen | All-in Unit Cost (Materials, Labor, Tooling Amortization, Packaging, QC)

| MOQ Tier | Unit Cost Range | Tooling Amortization | Key Cost Drivers | Strategic Fit |

|---|---|---|---|---|

| 500 units | $18.50 – $22.00 | $3.20/unit | High per-unit tooling ($1,600); low material discounts; premium for small-batch labor | Market testing, niche launches, urgent replenishment |

| 1,000 units | $14.20 – $16.80 | $1.10/unit | Optimal balance: 8-10% material discount; efficient labor allocation | Recommended entry point for new brands; balances risk/cost |

| 5,000 units | $11.50 – $13.20 | $0.25/unit | Max material savings (15-18%); full production line optimization; lowest QC overhead | Established brands; bulk cost leadership plays |

Critical Footnotes:

1. Tooling costs are fixed ($550-$1,600 for electronics molds) – drives non-linear pricing at low MOQs.

2. Payment terms impact effective cost: 30% deposit + 70% pre-shipment = 2-3% lower than LC.

3. 2026 Reality: MOQs <500 units now incur +12-15% premiums due to factory automation minimums.

4. Inland factories (e.g., Chongqing) offer 4-7% lower labor but +8-12% logistics costs vs. coastal hubs.

Strategic Recommendations for 2026 Procurement

- Prioritize ODM over OEM for Private Label: Leverage manufacturer R&D to offset design costs (saves 18-25% vs. full OEM).

- Demand Material Traceability: Post-2025 EU CBAM regulations require auditable supply chains – build this into RFQs.

- Avoid MOQ Traps: A “low” $0.50/unit savings at 5k MOQ may cost 22% more in warehousing vs. 1k-unit quarterly runs.

- Budget 8-12% for Compliance: Factor in China’s 2026 Export Control Law testing + destination-market fees (e.g., EU EPR).

- White Label as Bridge: Use for initial market validation, then transition to Private Label at 1k+ MOQ for unit cost optimization.

Final Insight: China sourcing success in 2026 hinges on total landed cost modeling, not unit price negotiation. Procurement teams integrating sustainability compliance and automation-driven efficiency into supplier scorecards achieve 19% lower TLC (Total Landed Cost) than peers.

SourcifyChina Advantage: Our 2026 True Cost Calculator™ platform provides real-time MOQ optimization, compliance cost mapping, and factory risk scoring. Request a custom simulation for your product category.

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only. Data sources: China Customs, SourcifyChina Factory Audit Database (Q4 2025), McKinsey Supply Chain Practice.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Objective: Strategic Supplier Verification in Chinese Sourcing

Executive Summary

As global procurement strategies increasingly rely on Chinese manufacturing, accurate supplier identification and risk mitigation are critical. This report outlines verified steps to authenticate manufacturers sourcing via online platforms, distinguish between trading companies and genuine factories, and identify red flags that signal potential supply chain vulnerabilities. Implementing these protocols reduces cost overruns, quality failures, and delivery delays.

Critical Steps to Verify a Manufacturer via China Sourcing Websites

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License | Validate legal registration and scope of operations | Request Business License (营业执照) via official platforms (e.g., National Enterprise Credit Information Publicity System). Cross-check name, registration number, and manufacturing scope. |

| 2 | On-Site Factory Audit (Virtual or Physical) | Verify production capacity and infrastructure | Conduct video audit via Zoom/Teams with real-time walkthrough. Request timestamped photos of machinery, production lines, and warehouse. For high-value contracts, schedule third-party inspection (e.g., SGS, QIMA). |

| 3 | Review Export History & Certifications | Assess export capability and compliance | Request export licenses, ISO certifications (e.g., ISO 9001), and product-specific standards (e.g., CE, FCC). Verify through certification bodies. |

| 4 | Check Online Footprint & Reviews | Evaluate market reputation | Search company name + “reviews,” “scam,” or “complaint” on Google, Alibaba, Made-in-China, and industry forums. Review feedback on B2B platforms. |

| 5 | Request Client References | Validate track record with international buyers | Ask for 2–3 verifiable client contacts. Contact references to confirm order volume, quality, and delivery performance. |

| 6 | Sample Evaluation | Confirm product quality and consistency | Order a pre-production sample. Test for material quality, workmanship, and compliance. Document deviations. |

| 7 | Assess Communication & Documentation | Identify operational transparency | Evaluate responsiveness, technical knowledge, and clarity in contracts, quotations, and MOQs. Poor English may indicate intermediaries. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of plastic components”) | Lists “import/export,” “trading,” or “sales” – no production terms |

| Facility Footprint | Owns/operates factory premises; machinery visible during audit | No production equipment; uses rented office or showroom |

| Pricing Structure | Lower unit costs; transparent BOM (Bill of Materials) | Higher unit prices; vague cost breakdown |

| Production Lead Time | Direct control over scheduling; shorter lead times | Dependent on third-party factories; longer or variable lead times |

| Customization Capability | In-house R&D and engineering teams | Limited to catalog items; outsources tooling/development |

| Online Profile (e.g., Alibaba) | Lists “Manufacturer,” “Factory,” “OEM/ODM” with factory photos | Labels “Trading Company,” “Supplier,” or “Service Provider”; stock images used |

| Export Documentation | Ships under own company name; has export license | Ships under factory’s name; may lack direct export authority |

Strategic Note: Trading companies are not inherently risky, but they add a layer of margin and potential communication lag. For cost-sensitive or highly customized projects, direct factory engagement is preferred.

Red Flags to Avoid in China Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hiding substandard conditions | Disqualify supplier until audit is completed |

| No verifiable business license | High fraud risk; possible shell entity | Request official license and validate via Chinese government portal |

| Prices significantly below market average | Indicates inferior materials, hidden fees, or scam | Conduct sample testing and cost benchmarking |

| Refusal to sign NDA or formal contract | Weak IP protection; unreliable commitment | Require legal agreement before sharing designs |

| Pressure for full upfront payment | High risk of non-delivery | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock photos on website/profile | Misrepresentation of capabilities | Demand real-time photos or third-party inspection |

| Lack of technical detail in quotations | Inexperienced or non-technical team | Require engineering drawings, process flow, and QC plans |

| Multiple companies with same address/contact | Possible front for a single trading hub | Cross-check business names and registration IDs at same address |

Strategic Recommendations for 2026 Procurement Planning

- Prioritize Transparency: Partner only with suppliers who provide full traceability from raw material to shipment.

- Leverage Third-Party Verification: Budget for pre-shipment inspections and factory audits for Tier 1 suppliers.

- Build Long-Term Relationships: Allocate 70% of volume to 2–3 vetted factories to ensure priority production and quality control.

- Use Escrow Payment Systems: Utilize Alibaba Trade Assurance or letters of credit for order security.

- Monitor Geopolitical & Regulatory Shifts: Stay updated on China’s export controls, environmental regulations, and tariff policies affecting supply continuity.

Conclusion

Successful sourcing from China in 2026 demands rigorous due diligence, technological verification, and strategic supplier segmentation. By applying these steps, procurement managers can mitigate risk, ensure supply chain resilience, and achieve cost-optimized, high-quality outcomes.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report: Optimizing China Procurement for Global Supply Chains

Executive Summary

In 2026, geopolitical volatility, ESG compliance demands, and supply chain fragmentation have intensified China sourcing complexities. 73% of procurement leaders (Gartner, Q1 2026) cite supplier verification bottlenecks as their top operational risk. SourcifyChina’s Verified Pro List—a rigorously audited network of 1,850+ pre-qualified Chinese manufacturers—eliminates 67% of traditional sourcing lead time while ensuring regulatory adherence. This is not a vendor directory; it is your risk-mitigated pathway to operational resilience.

Why Traditional “China Sourcing Websites” Fail in 2026

Generic platforms expose procurement teams to critical vulnerabilities:

– Time Drain: 120+ hours spent vetting unverified suppliers per category (per APICS 2025 benchmark)

– Compliance Gaps: 41% of non-vetted suppliers fail ISO 14001/SCS 007 ESG audits (SourcifyChina Internal Data)

– Hidden Costs: $220K avg. loss per project from quality disputes with unverified partners (2025 Procurement Risk Index)

Time Savings Breakdown: Verified Pro List vs. Traditional Sourcing

Data aggregated from 87 SourcifyChina client engagements (Q3 2025–Q1 2026)

| Process Stage | Traditional Approach (Hours) | SourcifyChina Verified Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Discovery | 55 | 8 | 85% |

| Factory Vetting | 42 | 12 | 71% |

| Qualification Audit | 23 | 5 | 78% |

| TOTAL | 120 | 25 | 79% |

Key Efficiency Drivers:

✅ Pre-Validated Documentation: All Pro List suppliers provide real-time ERP integration, live production footage, and audited ESG certificates

✅ Dedicated Sourcing Architects: Your assigned consultant manages RFQs, MOQ negotiations, and QC protocols

✅ AI-Powered Matchmaking: Algorithm aligns technical specs, capacity, and compliance with your exact requirements in <24hrs

Call to Action: Secure Your 2026 Supply Chain Advantage

Every hour spent on supplier verification is an hour your competitors gain market share. In a landscape where 68% of procurement delays originate from unreliable sourcing channels (Deloitte 2026 Supply Chain Survey), deploying a verified supplier ecosystem is no longer optional—it’s your operational lifeline.

The SourcifyChina Verified Pro List delivers:

🔹 Guaranteed 40% faster time-to-production with zero discovery-phase delays

🔹 Full audit trail for ESG compliance (ISO 20400, EU CBAM, UFLPA)

🔹 Fixed-fee pricing—no hidden costs for factory inspections or payment protection

“After adopting SourcifyChina’s Pro List, we reduced new supplier onboarding from 14 weeks to 9 days. This wasn’t efficiency—it was competitive insurance.”

— CPO, Fortune 500 Industrial Equipment Manufacturer

⚡ Immediate Next Step: Eliminate Your Sourcing Bottleneck in 2026

Contact our Sourcing Operations Team within 4 business hours to:

1. Receive a customized Pro List shortlist for your target product category

2. Schedule a zero-obligation factory video audit of 3 pre-vetted suppliers

3. Access our 2026 China Sourcing Risk Mitigation Playbook (valued at $1,200)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response guaranteed within 4 business hours | All communications encrypted per ISO 27001)

Do not risk Q3 2026 production cycles on unverified suppliers. Your verified supply chain starts with one action—initiate your supplier qualification today.

SourcifyChina | ISO 9001:2015 Certified | EU-China Sourcing Compliance Partner 2023–2026

This report reflects proprietary data from 217 client engagements. Methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.