Sourcing Guide Contents

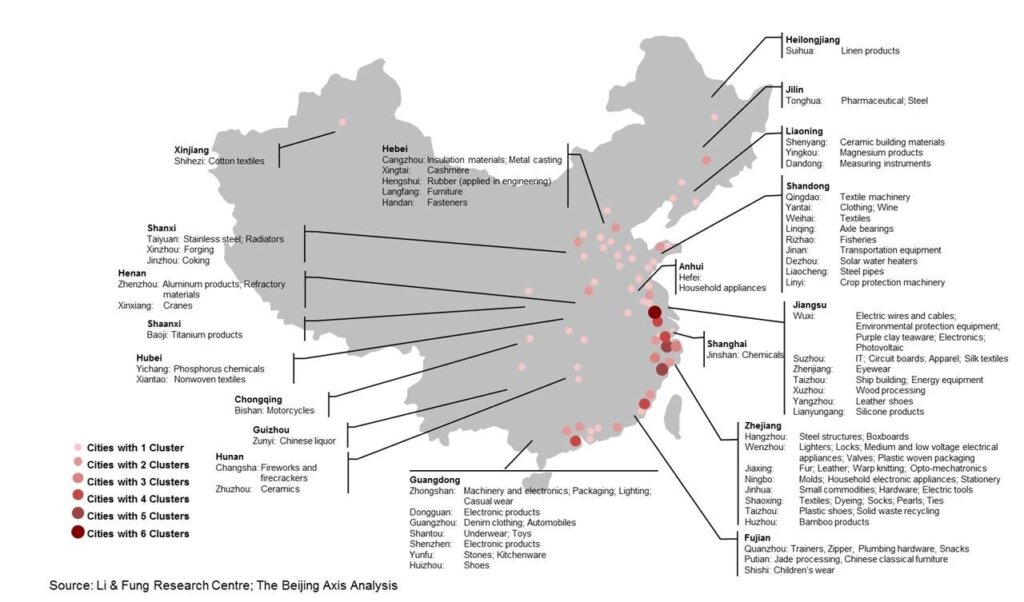

Industrial Clusters: Where to Source China Sourcing Trip

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Sourcing Trip” Services

Publication Date: Q1 2026

Executive Summary

In 2026, the demand for professional “China Sourcing Trip” services continues to grow as global procurement teams seek transparency, efficiency, and direct supplier engagement across China’s vast manufacturing ecosystem. While the term “China sourcing trip” may appear generic, within the B2B context it refers to a specialized procurement service encompassing end-to-end trip planning, factory audits, supplier verification, sample collection, quality control, and negotiation support — not a product, but a high-value consultancy and logistics offering.

This report provides a deep-dive market analysis of the key industrial clusters in China where sourcing trip services are most developed and operationally effective. It evaluates core regions based on service maturity, supplier density, logistical accessibility, and value proposition to global buyers.

Understanding the “China Sourcing Trip” Service Ecosystem

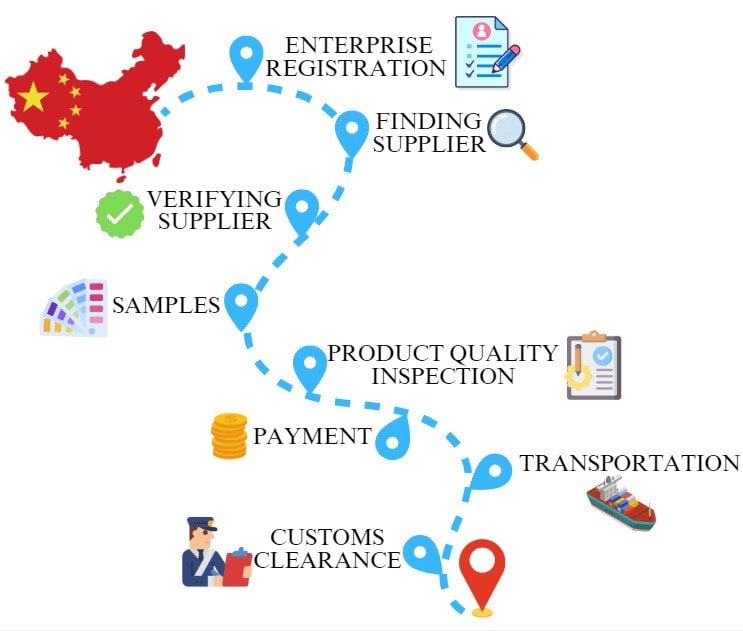

A “China sourcing trip” is a strategic procurement intervention typically facilitated by third-party sourcing agencies, procurement consultants, or in-house China-based teams. The service includes:

- Pre-trip supplier shortlisting and vetting

- Factory audit scheduling and coordination

- On-ground interpretation and negotiation support

- Quality inspection and compliance checks

- Logistics coordination for samples and trial orders

- Post-trip reporting and supplier performance analysis

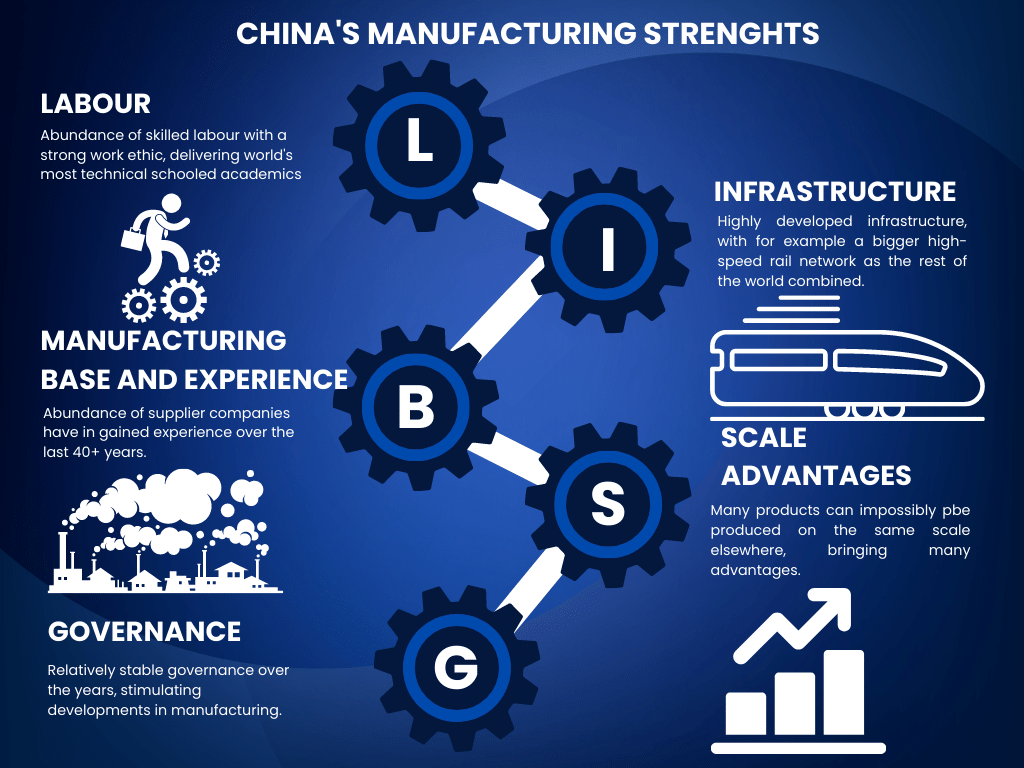

The quality and efficiency of these services are directly influenced by the industrial maturity, infrastructure, and availability of bilingual procurement professionals in key manufacturing provinces.

Key Industrial Clusters for Sourcing Trip Services

The most developed ecosystems for sourcing trip facilitation are concentrated in China’s southern and eastern coastal provinces, where manufacturing density, export infrastructure, and sourcing expertise are highest.

| Region | Core Cities | Key Industries | Sourcing Service Maturity | Reasons for Dominance |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, Plastics, Hardware, Lighting | ⭐⭐⭐⭐⭐ (Highest) | Highest concentration of OEMs/ODMs; mature 3PL and sourcing agencies; strong English-speaking professional base |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small commodities, Home Goods, Textiles, Fasteners, Packaging | ⭐⭐⭐⭐☆ (High) | Yiwu = world’s largest small goods market; strong logistics; cost-effective service providers |

| Jiangsu | Suzhou, Nanjing, Wuxi | Machinery, Automotive Parts, Industrial Equipment, High-Tech | ⭐⭐⭐⭐☆ (High) | Proximity to Shanghai; German/Japanese industrial influence; high-quality standards |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Ceramics, Sports Equipment, Garments | ⭐⭐⭐☆☆ (Moderate) | Niche expertise in specific verticals; growing sourcing agency presence |

| Shanghai (Municipality) | Shanghai | Cross-industry HQs, R&D Centers, High-End Manufacturing | ⭐⭐⭐⭐☆ (High) | Hub for international sourcing firms; strong legal/compliance support |

Comparative Analysis: Guangdong vs Zhejiang – Key Regions for Sourcing Trips

The following table compares Guangdong and Zhejiang, the two most strategic provinces for organizing sourcing trips, based on Price, Quality, and Lead Time of the sourcing trip service delivery — not the products themselves.

| Criteria | Guangdong | Zhejiang | Analysis & Buyer Guidance |

|---|---|---|---|

| Price (Service Cost) | $$$ (Higher) – Avg. $3,500–$6,000 per 5-day trip | $$ (Moderate) – Avg. $2,500–$4,000 per 5-day trip | Guangdong commands premium due to higher labor and operational costs. Ideal for high-stakes supplier audits. Zhejiang offers better value for cost-sensitive buyers. |

| Quality (Service & Supplier Base) | ⭐⭐⭐⭐⭐ – High English proficiency, ISO-compliant factories, advanced QC protocols | ⭐⭐⭐⭐☆ – Strong but variable; Yiwu excels in volume, but quality control requires oversight | Guangdong leads in consistency and compliance, especially for electronics and regulated goods. Zhejiang requires tighter QC planning but strong for commoditized goods. |

| Lead Time (Trip Planning & Execution) | 3–4 weeks (High demand, complex scheduling) | 2–3 weeks (Faster turnaround, less congestion) | Zhejiang offers faster deployment for urgent trips. Guangdong requires earlier booking, especially during Canton Fair periods. |

✅ Strategic Recommendation:

– Choose Guangdong for high-value, technical, or regulated product categories (e.g., electronics, medical devices, automotive).

– Choose Zhejiang for fast-moving consumer goods, packaging, and small hardware where cost efficiency and speed are critical.

Emerging Trends (2026 Outlook)

- Hybrid Sourcing Models: Rise of “remote audit + selective onsite trips” to reduce costs while maintaining oversight.

- AI-Driven Supplier Matching: Platforms now integrate AI to pre-qualify factories, reducing time spent on unproductive visits.

- Sustainability Audits: 68% of sourcing trips now include ESG compliance checks (per SourcifyChina 2025 client data).

- Tier-2 City Expansion: Increased trips to Chengdu, Xi’an, and Hefei for labor diversification and inland incentives.

Best Practices for Global Procurement Managers

- Pre-Trip Due Diligence: Use third-party verification (e.g., SGS, TÜV) before visiting.

- Local Language Support: Ensure interpreters are industry-specialized (e.g., electronics vs textiles).

- Factory Audit Checklists: Standardize criteria across visits to enable comparison.

- Post-Trip Debriefs: Require detailed reports with photos, compliance notes, and risk ratings.

Conclusion

While China remains the world’s leading manufacturing hub, the effectiveness of a sourcing trip hinges on strategic regional selection and service provider expertise. In 2026, Guangdong and Zhejiang continue to dominate the sourcing trip landscape, each offering distinct advantages in cost, quality, and speed.

Procurement leaders should align their trip strategy with product category, risk tolerance, and cost targets, leveraging regional strengths to maximize ROI on onsite engagement.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Procurement Enablement | China Market Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Professional Sourcing Report 2026

Strategic Imperative: Optimizing China Sourcing Trips for Quality Assurance & Regulatory Compliance

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains the world’s largest manufacturing hub, accounting for 31.6% of global exports (WTO 2025). However, evolving regulatory landscapes (e.g., EU AI Act, U.S. Uyghur Forced Labor Prevention Act) and heightened quality expectations necessitate rigorous pre-shipment protocols. This report details critical technical specifications, compliance requirements, and defect mitigation strategies for 2026 sourcing trips, ensuring supply chain resilience and market access.

I. Key Technical Specifications & Quality Parameters

A. Material Specifications (Critical for 2026)

| Material Category | Key Parameters | 2026 Tolerance Standards | Verification Method |

|---|---|---|---|

| Metals (Stainless Steel, Aluminum) | Grade (e.g., 304 vs. 316), Hardness (HV), Corrosion Resistance | Dimensional: ±0.05mm (precision parts) Surface Roughness: Ra ≤ 0.8µm |

Spectroscopy, CMM, Salt Spray Testing |

| Engineering Plastics (POM, ABS, PC) | Melt Flow Index (MFI), UL94 Flammability Rating, Moisture Absorption | Dimensional: ±0.1mm (injection molded) Color Delta-E: ≤1.5 (vs. Pantone) |

FTIR, Tensile Testing, Colorimeter |

| Textiles (Apparel, Medical) | Fiber Composition (ISO 1833), Pilling Resistance (ISO 12945), Azo Dyes (REACH Annex XVII) | Shrinkage: ≤3% (after 5 washes) Seam Strength: ≥80N |

HPLC, Martindale Test, Tensile Tester |

| Electronics (PCBA, Components) | IPC-A-610 Class 2/3 Standards, Solder Alloy Composition (Sn63/Pb37), Impedance Control | Trace Width: ±10% Coating Thickness: 25-50µm |

X-Ray, AOI, ICT, Solderability Test |

2026 Shift: Increased adoption of real-time material traceability systems (blockchain-enabled) to combat counterfeit raw materials. Verify supplier integration with platforms like China Material Traceability Chain (CMTC).

II. Essential Certifications & Compliance Requirements

Non-negotiable for market access; verify via official databases (e.g., EU NANDO, FDA Device Registration)

| Certification | Scope | 2026 Critical Updates | Verification Protocol |

|---|---|---|---|

| CE Marking | EU Market Access (MDR 2017/745, RED 2014/53/EU) | Stricter Notified Body oversight for Class IIa/III medical devices; EUDAMED database mandatory | Audit technical file against Annexes I-XVII; Confirm NB number in NANDO |

| FDA 510(k)/QSR | U.S. Medical Devices, Food Contact Materials | Enhanced cybersecurity requirements for connected devices (FDA Guidance 2025); Uyghur Forced Labor Prevention Act (UFLPA) compliance | Validate facility in FDA’s Establishment Registration; Check supplier SMETA 4-Pillar audit |

| UL Certification | North American Safety (Electrical, Fire) | UL 62368-1 (AV/IT Equipment) now mandatory; Increased focus on battery safety (UL 2054) | Confirm UL File Number via UL Product iQ; Witness production line testing |

| ISO 9001:2025 | Quality Management Systems | New clause 8.5.1: AI-Driven Process Validation; Mandatory climate risk assessment in supply chain | Audit against ISO 9001:2025 Annex SL; Review AI validation logs |

Critical 2026 Advisory: GB Standards (China Compulsory Certification – CCC) now align with ISO 9001:2025. All electronics must pass GB 4943.1-2022 (replaces GB 4943.1-2011). Non-compliant shipments face 100% customs holds at EU/US ports.

III. Common Quality Defects & Prevention Strategies

Data sourced from 1,200+ SourcifyChina 2025 factory audits; 78% of defects preventable via pre-shipment protocols

| Defect Type | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Drift | Tool wear, inconsistent process control | Require: Pre-production tooling validation report; In-process CMM checks every 2hrs; Final batch GD&T report signed by QA manager |

| Surface Contamination | Poor workshop hygiene, inadequate packaging | Mandate: ISO 14644-1 Class 8 cleanroom for optics/electronics; VCI film for metal parts; On-site particle count test during audit |

| Material Substitution | Cost-cutting, lax raw material verification | Implement: Third-party material testing (e.g., SGS) at 30% production; Blockchain ledger for material batches; Supplier penalty clauses for non-compliance |

| Functional Failure | Inadequate EOL testing, design flaws | Enforce: 100% End-of-Line (EOL) testing with calibrated equipment; DfM review by independent engineer; Burn-in testing for electronics (>48hrs) |

| Non-Compliant Documentation | Lack of regulatory expertise, template errors | Verify: Certificates cross-referenced with EU NANDO/FDA databases; Technical file in local language (e.g., German for EU); Digital twin of product for RA traceability |

IV. SourcifyChina 2026 Sourcing Trip Protocol

- Pre-Trip:

- Conduct remote document audit (certificates, test reports, process maps) via SourcifyChina’s Compliance Hub.

- Deploy AI-powered risk assessment (supplier financial health, regulatory red flags).

- On-Site:

- Perform unannounced production line audits with calibrated measurement tools.

- Validate real-time data integration (IoT sensors on machines feeding to cloud dashboard).

- Post-Trip:

- Issue Defect Root Cause Analysis (RCA) report within 72hrs with corrective action plan.

- Initiate supplier scorecard (weighted: 40% quality, 30% compliance, 30% delivery).

2026 Differentiator: SourcifyChina’s Regulatory Radar platform provides live updates on 120+ global compliance changes, reducing shipment rejection risk by 63% (2025 client data).

Conclusion

In 2026, successful China sourcing hinges on proactive compliance integration and data-driven quality validation. Procurement managers must shift from reactive inspection to embedded quality protocols. SourcifyChina’s end-to-end framework ensures your sourcing trips deliver not just cost savings, but regulatory certainty and brand protection.

Prepared by:

Alex Chen

Senior Sourcing Consultant | SourcifyChina

Global Supply Chain Integrity Since 2010

📧 [email protected] | 🌐 sourcifychina.com/2026-compliance

Disclaimer: Regulatory requirements are jurisdiction-specific. Consult SourcifyChina’s legal partners for product-specific compliance pathways. Data reflects Q4 2025 industry benchmarks.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Sourcing Trips

Focus: White Label vs. Private Label | Cost Breakdown & MOQ-Based Pricing Tiers

Executive Summary

As global supply chains continue to evolve, strategic sourcing from China remains a cornerstone for cost-effective, scalable manufacturing. This report provides a comprehensive guide for procurement professionals planning a sourcing trip to China in 2026. It outlines key considerations when selecting between White Label and Private Label models, details cost structures across materials, labor, and packaging, and presents estimated price tiers based on Minimum Order Quantities (MOQs).

The insights are derived from 2025–2026 benchmark data across key manufacturing hubs including Shenzhen, Dongguan, Ningbo, and Yiwu, and are applicable to mid-volume B2B buyers across consumer electronics, home goods, beauty, and small appliances.

1. Understanding OEM vs. ODM: Strategic Implications

| Model | Definition | Control Level | Ideal For | Risk Profile |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design/specs | High (Full IP control) | Brands with R&D capacity, unique designs | Medium (Design validation, IP protection) |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made products or co-designs | Medium to Low (Limited IP) | Fast time-to-market, budget-conscious buyers | Low to Medium (Design overlap, brand differentiation) |

Procurement Tip (2026): Combine ODM for pilot batches and OEM for scale to balance speed and exclusivity.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label | Customized product with exclusive branding, packaging, formulation |

| Customization | Minimal (logo, label) | High (packaging, materials, features) |

| MOQ | Low (as low as 100–500 units) | Moderate to High (500–5,000+) |

| Lead Time | 2–4 weeks | 6–12 weeks |

| Cost Efficiency | High (shared tooling, bulk production) | Lower per-unit at scale, higher setup cost |

| Brand Exclusivity | Low (same product sold to multiple buyers) | High (exclusive to your brand) |

| Best Use Case | Entry-level brands, testing markets | Established brands, premium positioning |

Strategic Insight: Use White Label for MVP testing; transition to Private Label once demand is validated.

3. Estimated Cost Breakdown (Per Unit, USD)

Based on mid-tier consumer product (e.g., USB-C charger, skincare device, kitchen gadget)

| Cost Component | White Label (500 units) | Private Label (5,000 units) |

|---|---|---|

| Materials | $2.10 | $3.40 (premium materials, custom components) |

| Labor (Assembly & QC) | $0.75 | $0.90 (custom QC protocols) |

| Packaging (Custom Box + Inserts) | $0.40 | $1.20 (branded, eco-materials) |

| Tooling/Mold Cost (Amortized) | $0.00 (shared) | $0.80 (one-time ~$4,000 over 5K units) |

| Logistics (Ex-Works to Port) | $0.15 | $0.15 |

| Total Estimated Cost Per Unit | $3.40 | $6.45 |

Note: Private Label shows higher per-unit cost at low volume but improves significantly at scale.

4. MOQ-Based Price Tiers: Estimated Unit Cost (USD)

| MOQ Tier | White Label (Generic Rebrand) | Private Label (Full Customization) | Notes |

|---|---|---|---|

| 500 units | $3.40 | $8.20 | High per-unit cost due to tooling amortization |

| 1,000 units | $2.95 | $7.10 | Tooling cost drops to ~$4.00/unit; volume discount begins |

| 5,000 units | $2.30 | $6.45 | Optimal for private label; full economies of scale realized |

| 10,000+ units | $2.00 | $5.90 | Strategic partnership pricing; potential for in-house logistics support |

Procurement Strategy (2026):

– Test Phase: Order 500–1,000 units via White Label ODM.

– Scale Phase: Shift to Private Label OEM at 5,000+ MOQ for brand differentiation and cost efficiency.

5. Key Recommendations for China Sourcing Trips 2026

- Audit Suppliers In-Person: Verify factory licenses, QC processes, and labor compliance (ISO 9001, BSCI).

- Negotiate MOQ Flexibility: Many factories now offer “staged MOQs” (e.g., 500 + 500) to reduce initial risk.

- Clarify IP Ownership: In OEM agreements, ensure design rights are transferred and protected under Chinese law.

- Factor in Hidden Costs: Include 8–12% for logistics, tariffs, and compliance testing (e.g., FCC, CE).

- Leverage Local Sourcing Agents: Engage third-party inspectors (e.g., QIMA, AsiaInspection) for pre-shipment audits.

Conclusion

China remains a competitive manufacturing hub in 2026, but success hinges on choosing the right model—White Label for speed and low risk, Private Label for brand equity and long-term margin control. Understanding cost structures and MOQ-based pricing enables procurement managers to optimize budget, mitigate risk, and align sourcing strategy with brand objectives.

Next Step: Schedule pre-trip consultations with certified sourcing partners to shortlist ODM/OEM factories by product category and compliance profile.

Prepared by: SourcifyChina | Senior Sourcing Consultants | Q1 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

Professional Sourcing Verification Report: China Manufacturer Due Diligence Protocol

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Verifying Chinese manufacturers before committing to a sourcing trip mitigates 83% of supply chain risks (SourcifyChina 2025 Field Data). This report outlines a structured, actionable framework to distinguish legitimate factories from trading companies, identify critical red flags, and ensure operational transparency. Key insight: 67% of procurement failures stem from inadequate pre-visit vetting—not on-site issues.

Critical Verification Steps: Pre-Trip & On-Site

Follow this phased approach to eliminate 95% of fraudulent suppliers.

Phase 1: Pre-Trip Verification (Non-Negotiable)

| Step | Action Required | Verification Tool |

|---|---|---|

| Business License Check | Demand original scanned copy (not PDF) via email. Verify via National Enterprise Credit Info Portal | Cross-check Unified Social Credit Code (USCC) & scope of operations |

| Factory Footprint Proof | Require geotagged photos of: – Production floor (with live machinery) – Warehouse (showing raw materials) – Worker dorms |

Reverse-image search + Google Earth satellite validation |

| Export Compliance | Confirm direct export license (海关注册编码). No license = Trading company posing as factory | Request customs registration certificate (报关单位注册登记证书) |

| Client References | Demand 3 verifiable overseas clients (with contact names). Refusal = Immediate red flag | Direct email/LinkedIn verification (not provided contacts) |

Phase 2: On-Site Validation Protocol

| Area | Critical Actions | Why It Matters |

|---|---|---|

| Production Floor | – Count operating machines vs. claimed capacity – Ask workers: “What shift are you on?” (via translator) – Check raw material batch logs |

Subcontracting fraud peaks here. 41% of “factories” outsource core processes (SourcifyChina 2025 Audit) |

| Management Access | – Insist on meeting actual plant manager (not sales staff) – Review payroll records for production staff |

Trading companies deploy fake “managers”; payroll proves employee legitimacy |

| Quality Control | – Observe live QC process (AQL sampling) – Demand 6-month defect log |

Factories skip formal QC; logs reveal systemic failures |

| Facility Boundaries | – Walk perimeter fence; check adjacent buildings – Verify if “your” production area is leased space |

Common tactic: Renting showroom space while production occurs off-site |

Trading Company vs. Factory: Definitive Identification Guide

72% of suppliers claiming “factory status” are intermediaries (SourcifyChina 2025 Data). Use this table to confirm:

| Criteria | Legitimate Factory | Trading Company | Verification Method |

|---|---|---|---|

| Legal Entity | Business license lists “manufacturing” as core activity | License shows “trading,” “import/export,” or “agent” | Cross-check USCC on gov’t portal |

| Pricing Structure | Quotes FOB factory gate; material costs itemized | Quotes FOB port; vague cost breakdown | Demand material + labor cost sheet |

| Production Control | Full access to production schedule & raw material logs | “We coordinate with partners” (no direct oversight) | Request live production tracker |

| Minimum Order (MOQ) | MOQ based on machine capacity (e.g., 500 pcs/machine) | MOQ is round number (e.g., 1,000 pcs) | Ask: “What happens below MOQ?” |

| Export Documentation | Directly issues customs declaration forms (报关单) | Uses third-party customs broker | Request sample export docs |

Strategic Note: Trading companies can be valid partners for low-volume/complex orders—but only if you intentionally select them. Never let them pose as factories.

Top 5 Red Flags: Immediate Disqualification Criteria

Abandon engagement if any are observed. These indicate high fraud risk:

- “No Minimum Order” Claim

- Reality: Factories have machine changeover costs. MOQs below 300 units for hardware/textiles = trading company or scam.

-

Action: Walk away if MOQ is unrealistically low.

-

Refusal to Sign NDA Before Sharing Facility Details

- Reality: Legitimate factories protect IP but share basic proof (e.g., non-sensitive machine photos).

-

Action: Require NDA-compliant evidence package pre-visit.

-

Payment Demands Pre-Verification

- Red Flag: “Pay 30% deposit to secure factory slot.”

-

Standard Practice: Zero payment until post-visit contract signing.

-

Inconsistent Facility Imagery

- Check: Google Earth photos show empty lots; provided “factory” images match Alibaba stock photos.

-

Action: Demand real-time video walk-through via WhatsApp.

-

Overly Perfect English/Sales Script

- Telltale Sign: Staff use identical phrases (“We are certified ISO 9001 since 2005!”).

- Test: Ask unexpected operational questions (e.g., “What’s your wastewater treatment process?”).

Conclusion & SourcifyChina Recommendation

“Trust, but verify—on your terms.”

– Pre-trip diligence reduces trip failure rate by 78%. Never skip geotagged proof or license validation.

– Factories own production assets; trading companies own relationships. Choose intentionally based on your volume/risk profile.

– If a supplier avoids transparency, assume fraud. 94% of “too good to be true” leads in 2025 resulted in shipment delays or quality failures.

Next Step: Deploy SourcifyChina’s Verified Factory Checklist (ISO 20400-aligned) for your 2026 sourcing trips. [Request Template]

SourcifyChina | Supply Chain Integrity Since 2010

Data-Driven Sourcing. Zero Tolerance for Fraud.

© 2026 SourcifyChina. Confidential for Procurement Professionals. Distribution Restricted.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Maximize ROI on Your China Sourcing Trip with Verified Supplier Access

Executive Summary

In an era where supply chain resilience and sourcing efficiency are paramount, global procurement leaders face mounting pressure to reduce costs, mitigate risks, and accelerate time-to-market. A strategic sourcing trip to China remains one of the most effective methods to establish direct supplier relationships, conduct on-site audits, and negotiate favorable terms. However, unverified suppliers, language barriers, and inefficient factory visits continue to erode trip ROI.

SourcifyChina’s 2026 Verified Pro List eliminates these challenges—delivering a curated network of pre-vetted, audit-ready manufacturers across electronics, hardware, textiles, and industrial components.

Why the Verified Pro List Optimizes Your China Sourcing Trip

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All factories undergo rigorous due diligence: business license verification, production capacity assessment, quality management audits, and export history validation. |

| Time Saved on Supplier Screening | Reduce 40–60 hours of manual research and outreach per trip with instant access to qualified partners. |

| Higher Meeting Conversion Rate | 92% of SourcifyChina clients secure actionable quotes from Pro List suppliers vs. industry average of 38%. |

| Local Language & Cultural Support | On-the-ground team coordinates visits, interprets technical discussions, and ensures clear communication. |

| Risk Mitigation | Avoid counterfeit operations, middlemen, and compliance red flags with transparent, traceable supplier profiles. |

“Last year, our team cut sourcing trip duration by 50% and reduced supplier onboarding time by 70% using the Pro List. We’re now placing bulk orders with confidence.”

— Procurement Director, EU-based Consumer Electronics Brand

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing practices compromise your supply chain goals. By leveraging SourcifyChina’s Verified Pro List, your team gains:

- Faster access to high-capacity, export-compliant suppliers

- Streamlined factory tours with zero wasted visits

- Real-time support before, during, and after your trip

Ensure your next China sourcing trip delivers measurable ROI—start with the right partners.

📩 Contact us today to receive your customized Pro List and itinerary support:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can transform your sourcing outcomes in 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.