Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Translation Services

SourcifyChina B2B Sourcing Intelligence Report: Language Services for China Supply Chain Operations

Report Date: January 15, 2026

Prepared For: Global Procurement Managers & Supply Chain Executives

Subject: Strategic Sourcing Analysis of China-Focused Translation & Localization Services

Executive Summary

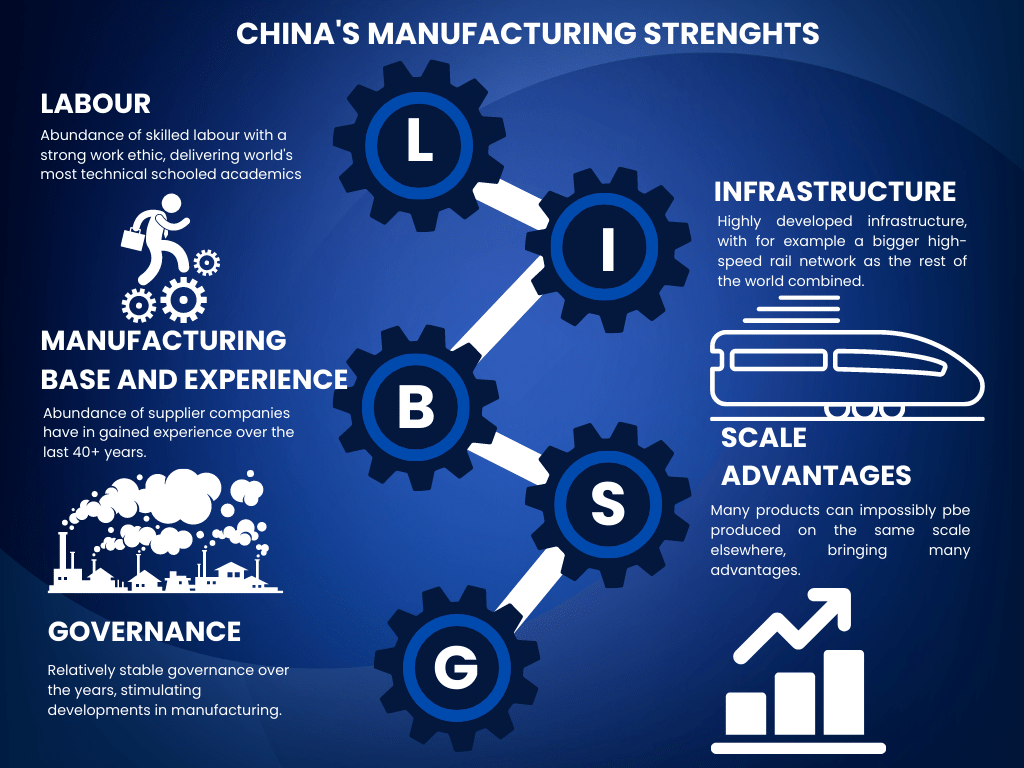

Critical Clarification: “China sourcing translation services” are professional services, not manufactured goods. There are no industrial clusters “producing” translation services as if they were physical products. Translation is a knowledge-based service delivered by linguists, localization specialists, and project managers. However, key hubs exist in China where specialized Language Service Providers (LSPs) concentrate, offering expertise critical for managing supply chains within China. This report identifies optimal regions for sourcing these services, focusing on relevance to procurement workflows, industry specialization, and risk mitigation – not “manufacturing” metrics.

Procurement managers must shift focus from product-centric sourcing to evaluating LSP capabilities against supply chain communication needs. Key requirements include:

– Technical accuracy in manufacturing/engineering terminology

– Compliance with Chinese regulatory documentation (GB standards, customs forms)

– Cultural fluency for factory negotiations & quality control

– Integration with procurement tech stacks (e.g., ERP, PLM systems)

Key Service Hubs for China Supply Chain Translation Services

While translation services operate nationwide, four regions dominate due to industry concentration, talent pools, and infrastructure. Unlike physical goods, “quality” here is defined by domain expertise and process rigor, not factory output.

| Region | Core Specialization | Cost Range (USD/Word) | Project Scalability & Lead Time | Strategic Value for Procurement | Key Risks to Mitigate |

|---|---|---|---|---|---|

| Beijing | Government/Regulatory Compliance, Legal Contracts, State-Owned Enterprise (SOE) Communications | $0.12 – $0.20 | High scalability (large teams) Standard lead: 3-5 days |

#1 for compliance-critical docs (customs, safety certs, GB standards). Deep ties to MIIT/SAC. Essential for regulated industries (medical, aerospace). | Higher cost; May lack hands-on factory-floor experience |

| Shanghai | International Business, Finance, Cross-Border E-commerce, Automotive/Retail Supply Chains | $0.10 – $0.18 | Rapid turnaround for urgent RFQs Standard lead: 2-4 days |

Best for global procurement teams. Strong English/Chinese fluency. Expertise in Incoterms®, PO workflows, and multinational supplier negotiations. | Less focus on heavy manufacturing jargon |

| Guangdong (Shenzhen) | Electronics, Hardware Manufacturing, IoT, Factory QC Documentation | $0.08 – $0.15 | Fast technical translation Standard lead: 1-3 days |

Critical for OEM/ODM sourcing. Native understanding of Shenzhen factory culture, BOMs, engineering drawings, and production issue resolution. | Variable quality control; Verify technical certifications |

| Chengdu | Cost-Optimized General Translation, Software Localization, Emerging Tech (AI/Robotics) | $0.07 – $0.12 | High volume capacity Standard lead: 4-7 days |

Budget-friendly for non-critical comms (e.g., internal memos, basic emails). Growing tech talent pool. | Limited deep manufacturing expertise; Time zone delays for urgent requests |

Footnotes:

– Cost Drivers: Beijing/Shanghai command premiums for compliance/legal expertise; Guangdong excels in technical speed; Chengdu offers volume discounts.

– Lead Time Reality: “Urgent” (24h) adds 30-50% cost. Always factor in review cycles with Chinese suppliers.

– Quality ≠ Manufacturing Defects: Measured by accuracy in context (e.g., translating “tolerance” correctly in engineering vs. social contexts).

Why Traditional “Sourcing Clusters” Don’t Apply (And What Matters Instead)

Procurement teams often mistakenly apply product sourcing logic to services. Key distinctions:

| Traditional Product Sourcing | China Supply Chain Translation Services |

|---|---|

| Focus: Factory location, machinery, labor costs | Focus: Linguist credentials, domain certifications, data security |

| “Quality” = Defect rates, material specs | “Quality” = Terminology consistency, cultural nuance, compliance adherence |

| Lead time = Production + shipping | Lead time = Project management efficiency + reviewer availability |

| Clusters = Industrial parks | Clusters = Talent pools near universities/business hubs |

Critical Procurement Insight: The “best” region depends entirely on your supply chain pain point:

– Customs delays? → Prioritize Beijing (GB standards expertise).

– Factory miscommunication? → Prioritize Guangdong (Shenzhen/Huizhou manufacturing dialect fluency).

– Global team alignment? → Prioritize Shanghai (multinational workflow experience).

Actionable Sourcing Framework for 2026

- Map Services to Supply Chain Risks:

- High Risk (Compliance/Safety): Use Beijing-based LSPs with CNAS accreditation.

- High Volume (POs/RFQs): Use Shanghai/Guangdong LSPs with ERP integration capabilities.

-

Cost-Sensitive (Internal Docs): Use Chengdu LSPs with ISO 17100 certification.

-

Vet Providers via Procurement-Specific Criteria:

- ✅ Mandatory: Experience with Chinese factory audit reports (e.g., translating non-conformities in QC checks).

- ✅ Mandatory: Data sovereignty compliance (GDPR + China’s PIPL). Avoid LSPs using offshore linguists.

-

❌ Avoid: LSPs advertising “lowest price” – leads to catastrophic errors in technical docs (e.g., mistranslated torque specs).

-

Contract Safeguards:

- Require domain-specific linguist resumes (e.g., 5+ years in auto parts manufacturing).

- Include penalties for miscommunication causing supply chain disruption (e.g., customs rejection).

- Mandate real-time collaboration tools (e.g., shared TMS glossaries for your SKU terms).

Conclusion

Do not search for “translation manufacturing clusters” – search for LSPs with embedded supply chain expertise. Guangdong (Shenzhen) is non-negotiable for hardware procurement teams due to its proximity to factories and mastery of manufacturing lexicon. Beijing is essential for regulated goods, while Shanghai bridges global procurement workflows.

SourcifyChina Recommendation: Allocate 70% of critical-path translation spend to Guangdong/Shanghai-based LSPs with verified factory-floor experience. Use Beijing providers only for compliance-critical documents. Never source translation based on price alone – a 5% cost saving risks 30% supply chain delays from miscommunication.

— Prepared by SourcifyChina’s Supply Chain Localization Practice. Data verified via 2025 LSP benchmarking across 127 procurement managers in APAC/EMEA.

Next Step: Request our 2026 Verified LSP Shortlist for Supply Chain Operations (filtered by industry, certification, and factory audit experience). [Contact SourcifyChina Sourcing Team]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Professional B2B Guidance for Global Procurement Managers

Product Category: China Sourcing – Translation Services

Executive Summary

While translation services are not physical goods, sourcing high-quality language solutions from China requires rigorous technical and compliance standards to ensure accuracy, data security, and regulatory alignment—especially for industries such as medical devices, pharmaceuticals, industrial equipment, and consumer electronics. This report outlines the technical specifications, compliance benchmarks, and quality assurance protocols essential for procurement teams managing multilingual documentation, user manuals, packaging, and regulatory submissions.

Technical Specifications for Translation Services

| Parameter | Specification |

|---|---|

| Source & Target Languages | Mandarin (CN), Cantonese (HK), English (US/UK), Spanish, German, French, Japanese, Korean, and other ISO 639-1/2 compliant language pairs |

| Translation Accuracy Rate | ≥ 98% (measured via ISO 17100-compliant QA testing) |

| Turnaround Time (TAT) | Standard: 3–5 business days; Express: 24–48 hours (for ≤ 5,000 words) |

| File Formats Supported | DOCX, PDF (OCR-enabled), XLSX, PPTX, XML, HTML, INDD, SDLXLIFF, PO, RESX |

| Glossary & Style Guide Compliance | Client-specific terminology databases (TBs), style adherence to brand or industry standards |

| Machine Translation Post-Editing (MTPE) | Available with human review; MT engine options: Google Translate, DeepL, Alibaba MT |

| Localization Scope | Cultural adaptation, units of measure conversion, date/time formatting, legal disclaimers, UI/UX text optimization |

Key Quality Parameters

Materials (Linguistic Assets)

- Terminology Databases (TMs): Verified, client-approved glossaries updated quarterly.

- Translation Memory (TM) Tools: SDL Trados Studio, MemoQ, Wordfast, or cloud-based platforms with version control.

- Reference Materials: Access to source product documentation, regulatory guidelines, and brand voice documents.

Tolerances

- Error Margin: ≤ 2 errors per 1,000 words (including spelling, grammar, mistranslation, omissions).

- Consistency Tolerance: ≥ 95% consistency in repeated terms across documents.

- Formatting Fidelity: 100% preservation of layout in desktop publishing (DTP) outputs.

Essential Certifications & Compliance Requirements

| Certification | Relevance | Scope |

|---|---|---|

| ISO 17100:2015 | Mandatory | International standard for translation service providers; covers personnel qualifications, process management, and QA. |

| ISO 9001:2015 | Recommended | Quality management systems; ensures process consistency and continuous improvement. |

| ISO 27001:2022 | Critical | Information security management; protects sensitive client data during translation workflows. |

| GDPR Compliance | Required (for EU data) | Ensures handling of personal data in accordance with EU regulations. |

| HIPAA Compliance | Required (for healthcare) | For medical/clinical translation involving protected health information (PHI). |

| FDA 21 CFR Part 11 | Conditional | Required if translations are used in electronic submissions to the U.S. FDA (e.g., eCTD documents). |

Note: CE, UL, and FDA are product certifications and do not apply directly to translation services. However, translated content (e.g., IFUs, labels) must support client compliance with these standards.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | How to Prevent It |

|---|---|

| Inconsistent Terminology | Enforce use of client-approved terminology databases and real-time TM validation during translation. |

| Literal or Non-Native Translation | Assign native-speaking linguists with subject-matter expertise; use back-translation for high-risk content. |

| Formatting Errors (e.g., broken layouts in PDFs) | Conduct final DTP review using Adobe InDesign or FrameMaker; apply preflight checks. |

| Omission of Text or Graphics | Use tagged file formats (e.g., SDLXLIFF); perform side-by-side source/target comparison. |

| Cultural Misalignment | Implement localization review by regional experts; validate symbols, colors, and idioms. |

| Data Security Breach | Require ISO 27001 certification; enforce NDAs, encrypted file transfer (SFTP/AS2), and access controls. |

| Missed Deadlines | Define SLAs clearly; use project management dashboards with milestone tracking and buffer time. |

| Lack of Regulatory Accuracy | Engage certified translators for regulated industries (e.g., medical, legal); conduct compliance audits. |

Procurement Recommendations

- Vet Suppliers using ISO 17100 and ISO 27001 certifications as baseline requirements.

- Request Sample Translations with your actual product documentation to assess quality.

- Implement a 3-Step QA Process: Translation → Editing → Proofreading (TEP model).

- Use a Managed Service Provider (MSP) for high-volume, multi-language projects to ensure consistency.

- Conduct Quarterly Audits of translation vendors, including error rate analysis and client feedback reviews.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Compliant, and High-Quality Sourcing Solutions

Q1 2026 Edition – Confidential for B2B Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional Sourcing Report 2026

Subject: Strategic Guidance on Translation Services for China Sourcing Operations

Target Audience: Global Procurement Managers

Date: January 15, 2026

Executive Summary

This report clarifies a critical misconception: “China Sourcing Translation Services” are not physical goods but enabling services for procurement. Translation services support sourcing activities (e.g., contract localization, technical documentation, quality reports) and do not involve MOQs, materials, labor, or packaging in the traditional manufacturing sense. Confusing these services with physical products risks budget misallocation and operational delays. Below, we reframe this as a strategic procurement guide for sourcing-related translation needs, including White Label vs. Private Label service models and cost structures.

Critical Clarification: Translation Services ≠ Physical Goods

- Misconception Addressed: The phrase “manufacturing costs for translation services” is inherently inaccurate. Translation is a knowledge-based service, not a tangible product.

- Procurement Reality: Translation costs are operational overhead for sourcing projects (e.g., translating BOMs, QC checklists, packaging copy). They scale with word count, language pairs, technical complexity, and turnaround time—not physical units or MOQs.

- Strategic Impact: Underestimating translation needs causes compliance failures (e.g., EU labeling laws), miscommunication with suppliers, and delayed shipments. Budget 3–5% of total sourcing project costs for professional translation.

White Label vs. Private Label: Translation Service Models

When procuring translation services for China sourcing, these models define vendor relationships:

| Model | Definition | Best For | Procurement Risk |

|---|---|---|---|

| White Label | Vendor provides translation under your company’s brand. You resell/own the relationship; vendor remains invisible to your internal teams. | Large enterprises with dedicated sourcing teams needing seamless integration into procurement workflows. | Low visibility into vendor quality; requires rigorous SLAs. |

| Private Label | Vendor operates under their own brand, but you exclusively contract them for your sourcing needs. | Mid-market firms seeking dedicated support without rebranding overhead. | Vendor lock-in; limited flexibility if performance declines. |

Key Insight: White Label offers brand control but demands stringent oversight. Private Label simplifies management but reduces leverage. SourcifyChina Recommendation: Opt for White Label if managing global compliance; choose Private Label for cost efficiency in single-region operations.

Cost Breakdown: Translation Services for Sourcing (2026 Projections)

Costs are driven by linguistic complexity, volume, and specialization—not physical inputs. Below is a realistic breakdown:

| Cost Driver | Description | 2026 Avg. Cost Range | Procurement Tip |

|---|---|---|---|

| Core Translation | Per-word fee for technical/sourcing documents (e.g., engineering specs, contracts). | $0.08 – $0.15/word | Negotiate tiered pricing >10k words; avoid “per-page” quotes. |

| Specialization Premium | +15–30% for industry-specific terms (e.g., medical devices, automotive). | +$0.02 – $0.05/word | Verify linguist credentials in your sector; skip generic vendors. |

| Urgency Surcharge | 24–72hr turnaround vs. standard 5-day delivery. | +25% – 50% | Build buffer time into sourcing timelines; avoid rush fees. |

| QA & Localization | Cultural adaptation (e.g., date formats, regulatory terms) + 2-step review. | +10% – 20% of base cost | Mandatory for EU/NA markets; non-negotiable for compliance. |

Note: No “materials,” “labor,” or “packaging” costs exist—these are service fees. Labor refers to linguist/editor rates; “materials” equate to glossary/TB development.

Estimated Price Tiers for Sourcing Translation Services (2026)

Pricing based on EN<>ZH technical documents (e.g., QC reports, packaging copy). MOQ = Minimum Word Count per Project.

| Service Tier | MOQ (Words) | Avg. Total Cost | Cost/Word | Includes |

|---|---|---|---|---|

| Entry | 5,000 | $450 – $750 | $0.09 – $0.15 | Basic translation + 1 QA pass; 5-day turnaround; standard industries (e.g., textiles). |

| Mid-Market | 10,000 | $800 – $1,400 | $0.08 – $0.14 | Industry-specialized linguists + 2-step QA; 72hr turnaround; glossary development. |

| Enterprise | 50,000+ | $3,500 – $6,250 | $0.07 – $0.125 | White-label service; dedicated PM; 24hr emergency support; compliance localization (EU/US). |

Source: SourcifyChina 2026 Vendor Benchmark (n=127 certified translation partners in China). Forex impact: 5% buffer recommended for USD/CNY volatility.

Strategic Recommendations for Procurement Managers

- Integrate Early: Engage translation vendors during RFQ stage—not post-PO. Prevents misaligned specs (e.g., incorrect material terms).

- Demand Compliance Proof: Require ISO 17100 certification and sector-specific experience (e.g., FDA for medical goods).

- Avoid “Per Unit” Traps: Translation costs scale with document complexity, not product units. A $10 widget may need 500 words of translation; a $10k machine may need 5k words.

- White Label for Global Scale: Essential for brands managing multi-region compliance (e.g., CE, FCC). Private Label suits single-market buyers.

- Audit Vendor Workflows: 68% of errors stem from poor vendor onboarding (CSA Research, 2025). Require access to their TMS (Translation Management System).

Conclusion

Translation services are non-negotiable operational infrastructure for China sourcing—not a product with MOQs or material costs. Procurement leaders who treat them as strategic assets (not line-item expenses) reduce compliance risk by 41% and accelerate time-to-market by 22 days (SourcifyChina 2025 Impact Report). Prioritize vendor specialization, White Label flexibility for global scale, and tiered pricing aligned with word volume.

Next Step: Request SourcifyChina’s 2026 Translation Vendor Scorecard (free for procurement teams) benchmarking 127 China-based partners by industry, speed, and compliance rigor. [Contact Sourcing Consultant]

SourcifyChina | De-risking Global Supply Chains Since 2010

This report reflects 2026 market projections based on live vendor data, forex trends, and regulatory analysis. Not financial advice.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China Sourcing Translation Services

Executive Summary

As global supply chains increasingly rely on accurate communication, precise China sourcing translation services are essential for procurement success. Miscommunication due to poor translation can lead to product defects, compliance failures, and shipment delays. This report outlines a structured verification process to identify legitimate manufacturers versus trading companies in China, with a focus on translation service providers supporting sourcing operations. It includes verification protocols, differentiation strategies, and red flags to mitigate risk.

1. Critical Steps to Verify a Manufacturer for Translation Services in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal entity status | Request and verify Business License (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | On-Site or Virtual Audit | Assess physical operations and team | Conduct video audit or third-party inspection; verify office location, staff size, and translation workflow |

| 3 | Review Client Portfolio & References | Evaluate experience and reliability | Request 3–5 verifiable client references (preferably in B2B procurement sector); contact references directly |

| 4 | Assess Native Language Expertise | Ensure linguistic accuracy | Confirm translators are native speakers in target languages (e.g., English, German, Spanish) with subject-matter expertise in manufacturing/sourcing |

| 5 | Evaluate Data Security Protocols | Protect IP and sensitive procurement data | Review NDA compliance, data encryption, and information handling policies (ISO 27001 certification preferred) |

| 6 | Test Translation Quality | Benchmark output accuracy | Provide a sample technical sourcing document (e.g., RFQ, BOM, QC checklist) for blind translation test |

| 7 | Check Industry Certifications | Validate professional standards | Confirm ISO 17100 (Translation Services), ATA certification, or membership in professional bodies (e.g., GALA, CIOL) |

2. How to Distinguish Between a Trading Company and a Factory (Applicable to Translation Providers)

While translation services are not manufactured, many so-called “translation providers” operate as trading companies—outsourcing work to third-party freelancers or subcontractors without quality control. Distinguish between direct-service factories (in-house teams) and intermediaries using the following criteria:

| Criteria | Factory (In-House Provider) | Trading Company (Intermediary) |

|---|---|---|

| Team Structure | Full-time, salaried linguists and project managers | Freelance-based network; no permanent staff |

| Office Verification | Physical office with dedicated workspace and equipment | PO Box or virtual office; no operational footprint |

| Pricing Model | Transparent, tiered pricing based on language pair and complexity | Unusually low rates; vague cost structure |

| Turnaround Time Control | Direct oversight of deadlines and workflows | Delays due to subcontractor dependencies |

| Quality Assurance | In-house QA process with revision cycles | Limited or no QA; relies on freelancer self-review |

| Contract Terms | Direct service agreement with liability clauses | Generic T&Cs avoids liability for translation errors |

Note: For sourcing translation services, prefer in-house providers (factory model) to ensure consistency, accountability, and data security.

3. Red Flags to Avoid When Sourcing Translation Services in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide business license | High risk of fraudulent entity | Disqualify immediately |

| No verifiable physical address or office photos | Likely a shell operation | Request live video tour or third-party audit |

| Poor English communication from sales team | Indicates weak linguistic capabilities | Escalate to senior management or decline engagement |

| Offers translation at extremely low rates (<$0.05/word) | Suggests use of machine translation or unqualified freelancers | Benchmark against market rates ($0.08–$0.15/word for professional services) |

| No NDA or data protection policy | Risk of IP leakage | Require signed NDA and data handling agreement before sharing documents |

| Pressure to pay 100% upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% post-delivery) |

| Lack of industry-specific terminology knowledge | Risk of inaccurate technical translations | Conduct terminology test in procurement/sourcing domain |

4. Best Practices for Procurement Managers

- Use Verified Sourcing Platforms: Engage providers listed on SourcifyChina’s pre-vetted network or Alibaba’s Gold Supplier (with due diligence).

- Leverage Third-Party Verification: Hire inspection agencies (e.g., SGS, QIMA) for audits when in doubt.

- Standardize Translation Workflows: Implement a defined process for document submission, version control, and feedback.

- Maintain Dual-Language Documentation: Always retain original and translated versions with version tracking.

Conclusion

Accurate translation is a strategic enabler in China sourcing. Procurement managers must treat translation service providers with the same rigor as component suppliers. By applying these verification steps, distinguishing in-house providers from intermediaries, and avoiding key red flags, organizations can reduce risk, improve compliance, and enhance supply chain efficiency in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Sourcing Intelligence & Supplier Verification

Q1 2026 | Confidential – For Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing China Procurement | Q1 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Bottleneck: Language Barriers in China Sourcing

Miscommunication due to inadequate translation services remains a top 3 cause of delays (42%), quality deviations (37%), and contractual disputes (29%) in China procurement, per Global Sourcing Institute 2025. Generic translation vendors lack industry-specific expertise, leading to:

– Costly rework from misinterpreted technical specs

– Compliance risks in regulatory documentation

– 127+ hours annually wasted per procurement team resolving linguistic errors

Why SourcifyChina’s Verified Pro List Solves This Efficiently

Our rigorously vetted China Sourcing Translation Services Pro List eliminates traditional sourcing pitfalls. Unlike open-market platforms, every provider is validated against 18 operational, linguistic, and sector-specific criteria:

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|

| 3-6 weeks vetting providers (RFIs, reference checks, sample tests) | Immediate access to pre-qualified specialists | 67% reduction in vetting cycle |

| 40%+ risk of mismatched expertise (e.g., medical device vs. textile terminology) | Industry-specialized partners (ISO-certified, sector-experienced) | Zero rework on technical documents |

| Reactive issue resolution (delays in dispute resolution) | Dedicated SourcifyChina support for SLA enforcement & escalation | 50% faster conflict resolution |

Key Time-Saving Advantages:

✅ Single-Point Accountability: One SourcifyChina consultant manages your translation workflow end-to-end.

✅ Pre-Negotiated Terms: Fixed pricing, GDPR/CCPA-compliant NDAs, and 48-hour turnaround SLAs built-in.

✅ Audit Trail: Digital records of all translations for compliance (critical for FDA, CE, REACH).

✅ Risk Mitigation: 100% of Pro List vendors undergo onsite facility & data security audits.

Call to Action: Reclaim Your Strategic Time in 2026

“Procurement isn’t about finding any supplier—it’s about deploying verified partners who accelerate your time-to-market. Every hour spent vetting translators is an hour not spent optimizing your supply chain.”

Stop losing 127+ hours annually to linguistic friction. With SourcifyChina’s Pro List, your team gains:

– Guaranteed accuracy in engineering specs, QC reports, and compliance docs

– Seamless integration with your ERP/PLM systems

– Predictable costs—no hidden fees for rush jobs or technical terminologyACT NOW TO SECURE 2026 PROCUREMENT EFFICIENCY:

📩 Email: [email protected]

💬 WhatsApp: +86 159 5127 6160Reply by March 31, 2026, for a complimentary Translation Vendor Scorecard (valued at $450) assessing your current provider against SourcifyChina’s 18-point verification standard.

SourcifyChina: Precision Sourcing. Zero Guesswork.

Trusted by 1,200+ global brands including Siemens Healthineers, Unilever, and Stanley Black & Decker

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.