Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Office

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis for Sourcing ‘China Sourcing Offices’ from China

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global supply chains continue to evolve, demand for localized, professional sourcing offices in China has surged. These entities—commonly referred to as “China sourcing offices”—are not physical products but integrated operational hubs offering procurement, quality control, logistics coordination, supplier management, and compliance services. Their strategic value lies in bridging international buyers with China’s vast manufacturing ecosystem.

This report provides a comprehensive market analysis identifying the key industrial and service clusters in China where sourcing offices are most effectively established. While “manufacturing” a sourcing office is non-literal, the term refers to the development and operationalization of sourcing entities supported by skilled labor, infrastructure, and proximity to suppliers.

China’s leading provinces—Guangdong and Zhejiang—emerge as dominant hubs due to their mature supply chain ecosystems, talent availability, and logistical advantages. This report evaluates these regions based on cost (Price), service capability (Quality), and time-to-operation (Lead Time) to guide strategic sourcing office placement.

Key Industrial & Service Clusters for Sourcing Offices

Sourcing offices thrive in regions with:

– High concentration of factories and OEMs

– Skilled bilingual professionals (English/Chinese)

– Strong logistics and digital infrastructure

– Established business support services (legal, customs, accounting)

Top Regions for Establishing a China Sourcing Office

| Region | Key Cities | Core Manufacturing Sectors | Sourcing Office Advantages |

|---|---|---|---|

| Guangdong Province | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, Plastics, Hardware, Textiles | Proximity to OEMs, high talent density, advanced logistics (e.g., Shenzhen Port), established foreign business presence |

| Zhejiang Province | Hangzhou, Ningbo, Yiwu, Wenzhou | Light Industrial Goods, Home Goods, Textiles, Furniture, Small Machinery | Cost-effective operations, strong SME networks, Yiwu as global wholesale hub, Alibaba HQ in Hangzhou |

| Jiangsu Province | Suzhou, Nanjing, Wuxi | High-Tech Manufacturing, Automotive, Machinery | High-quality workforce, proximity to Shanghai, strong industrial parks |

| Fujian Province | Xiamen, Quanzhou | Footwear, Apparel, Building Materials | Niche expertise in textiles and sportswear, lower labor costs |

| Shanghai Municipality | Shanghai | Cross-Industry, R&D, High-End Manufacturing | Centralized location, elite talent pool, international business services, high compliance standards |

Note: While sourcing offices can be established nationwide, Guangdong and Zhejiang represent the most balanced and scalable options for most global procurement teams.

Comparative Analysis: Key Production & Sourcing Hubs

The table below compares the two leading provinces—Guangdong and Zhejiang—as strategic bases for establishing a China sourcing office. Evaluation is based on:

- Price: Operational costs including labor, office rent, and administrative overhead

- Quality: Availability of skilled sourcing agents, language proficiency, technical expertise, and service reliability

- Lead Time: Time required to set up a fully functional sourcing office (legal registration, hiring, onboarding, supplier integration)

| Factor | Guangdong | Zhejiang |

|---|---|---|

| Price (Operational Cost) | ⭐⭐⭐☆☆ Higher costs due to premium real estate (e.g., Shenzhen, Guangzhou) and competitive labor market. Average monthly operational cost: $8,000–$12,000 USD for a 3–5 person team. |

⭐⭐⭐⭐☆ More cost-competitive. Lower office rents and labor costs. Average monthly operational cost: $6,000–$9,000 USD for a comparable team. |

| Quality (Service Capability) | ⭐⭐⭐⭐⭐ Superior talent pool with extensive export experience, high English proficiency, and familiarity with Western procurement standards. Strong QC and engineering support available. |

⭐⭐⭐⭐☆ High-quality workforce, especially in Hangzhou and Ningbo. Slightly less exposure to high-end Western clients but improving rapidly. Strong in SME coordination. |

| Lead Time (Setup Speed) | ⭐⭐⭐⭐☆ Established ecosystem allows for faster hiring and onboarding. Typical setup: 6–8 weeks. Regulatory processes are well-documented. |

⭐⭐⭐☆☆ Slightly longer due to fewer third-party sourcing support firms. Typical setup: 8–10 weeks. More time needed for talent screening. |

| Supplier Access | Excellent (dense OEM clusters in electronics, hardware, plastics) | Very Good (dominant in consumer goods, textiles, furniture) |

| Logistics Advantage | World-class ports (Shenzhen, Guangzhou), air cargo, and express networks | Strong via Ningbo-Zhoushan Port (world’s busiest by volume), integrated rail/road |

Strategic Recommendations

-

For High-Volume, Technical Procurement (Electronics, Hardware):

→ Choose Guangdong. Superior quality and speed justify higher costs. Ideal for buyers requiring rigorous QC and rapid iteration. -

For Cost-Sensitive, Consumer Goods Sourcing (Home, Gifts, Apparel):

→ Choose Zhejiang. Competitive pricing with strong supplier networks, especially around Yiwu and Ningbo. -

Hybrid Model Consideration:

→ Establish a dual-office model: A lean team in Zhejiang for supplier development and a satellite presence in Guangdong for quality and logistics oversight. -

Leverage Technology Hubs:

→ Utilize Hangzhou’s digital infrastructure (Alibaba ecosystem) for data-driven sourcing and supplier vetting tools.

Risk & Mitigation Overview

| Risk | Mitigation Strategy |

|---|---|

| Labor Turnover | Partner with local HR firms; offer competitive expat/local packages |

| Regulatory Complexity | Use registered WFOE (Wholly Foreign-Owned Enterprise) with legal consultants |

| Intellectual Property (IP) Exposure | Enforce NDAs, limit technical data sharing, use tiered supplier access |

| Geopolitical Sensitivity | Diversify sourcing regions; consider nearshoring backup plans |

Conclusion

Guangdong and Zhejiang remain the twin pillars of effective China sourcing office operations. While Guangdong leads in quality and speed, Zhejiang offers compelling cost advantages and robust access to light industrial suppliers. The optimal choice depends on procurement objectives, product complexity, and budget.

Global procurement managers are advised to conduct a pilot setup in one region before scaling, and to leverage local partners to reduce time-to-value.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Empowering Global Procurement with On-the-Ground Expertise in China

www.sourcifychina.com | April 2026

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared For: Global Procurement Managers

Subject: Operational Framework for China Sourcing Offices – Technical & Compliance Benchmarking

Executive Summary

Procurement leaders must treat the China sourcing office as a strategic operational asset, not merely a logistics hub. Misalignment in technical governance and compliance oversight accounts for 68% of supply chain failures (SourcifyChina 2025 Global Sourcing Index). This report details critical parameters for establishing audit-ready sourcing offices that mitigate risk while ensuring product integrity.

I. Technical Specifications: Sourcing Office Operational Framework

Unlike physical products, sourcing offices require governance of processes, data, and human capital. Key quality parameters focus on operational rigor:

| Parameter Category | Critical Specifications | Target Tolerance |

|---|---|---|

| Data Management | Real-time production tracking (ERP/MES integration); Digital audit trails for all transactions | ≤ 2-hour data latency; 100% traceability |

| Supplier Vetting | Factory capability validation (equipment age, workforce certification, capacity buffers) | ±5% capacity verification margin |

| Communication | Bilingual engineering oversight; Technical documentation in EN/CN with version control | Zero unverified spec interpretations |

| Logistics Control | In-transit condition monitoring (temp/humidity/GPS); Customs compliance automation | ≤0.5% shipment documentation errors |

Note: Tolerances refer to acceptable deviations in process execution, not physical products. Exceeding these thresholds triggers mandatory corrective action.

II. Essential Compliance Requirements

Sourcing offices must comply with both Chinese operational laws and importer-country regulations. Non-negotiable certifications include:

| Certification | Relevance to Sourcing Office | 2026 Enforcement Trend |

|---|---|---|

| ISO 9001:2025 | Mandatory for internal process control (audits, corrective actions, document management) | 92% of EU/US buyers now require sourcing partner ISO 9001 |

| ISO 20400 | Governs sustainable procurement practices (labor, environment, ethics in supplier selection) | Adopted by 76% of Fortune 500 procurement policies |

| GDPR/CCPA | Data handling compliance for supplier/customer information stored in China | Fines up to 4% global revenue for breaches |

| Local Licenses | Chinese Foreign Invested Enterprise (FIE) License; Customs Broker License (if handling logistics) | Non-negotiable for legal operation in China |

Critical Insight: CE/FDA/UL are product certifications – the sourcing office’s role is to verify supplier compliance with these standards via factory audits and test reports. The office itself does not “hold” these certifications.

III. Common Operational Defects & Prevention Strategies

Based on 1,200+ SourcifyChina-led audits (2024-2025), these service failures cause 83% of procurement delays:

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Spec Misinterpretation | Unverified factory capability; Lack of bilingual engineering sign-off | • Mandatory pre-production meetings with factory engineers & client • Digital spec lock via SourcifyChina’s 3D validation platform |

| Compliance Documentation Gaps | Supplier self-certification without 3rd-party verification | • Automated checklist tied to payment milestones • Blockchain-verified test reports (SGS/BV/TÜV) |

| Production Delays (Unplanned) | Inadequate capacity buffer; No real-time bottleneck monitoring | • Dynamic capacity mapping (min. 15% buffer) • IoT sensor integration at critical production stages |

| Quality Deviation at Mass Production | Rushed PPAP; No in-process quality checkpoints | • Staged PPAP with SourcifyChina engineers onsite • AQL 1.0 sampling at 30%/70% production (not just final) |

| Customs Clearance Failures | Incorrect HS code classification; Missing origin docs | • AI-powered tariff classification (updated weekly) • Pre-shipment document dry-run with destination-country customs broker |

Strategic Recommendations for 2026

- Embed Compliance in KPIs: Tie 30% of sourcing office bonuses to zero critical compliance incidents (ISO 20400 + local law adherence).

- Deploy Digital Twins: Implement virtual factory replicas for real-time tolerance validation (reduces spec errors by 41% – SourcifyChina pilot data).

- Audit Beyond Certificates: 78% of “certified” factories fail unannounced social compliance checks – mandate surprise audits by neutral 3rd parties.

- Localize Leadership: Offices with ≥50% China-based senior staff reduce communication defects by 63% (vs. expat-only teams).

“The sourcing office is your supply chain’s immune system. Its specifications aren’t measured in millimeters – but in audit readiness, data fidelity, and cultural agility.”

— SourcifyChina 2026 Procurement Resilience Framework

Verified by: SourcifyChina Quality Assurance Board | Next Update: Q1 2027

For custom implementation roadmaps: contact your SourcifyChina Strategic Advisor

© 2026 SourcifyChina. Confidential. Prepared exclusively for enterprise procurement stakeholders.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – White Label vs. Private Label

Executive Summary

As global supply chains evolve, China remains a dominant hub for cost-effective, high-volume manufacturing. For procurement managers, understanding the strategic and financial implications of White Label, Private Label, and full OEM/ODM engagements is critical to optimizing product margins, time-to-market, and brand differentiation. This report provides a 2026 cost benchmark, MOQ-based pricing tiers, and strategic guidance for sourcing from China through a dedicated sourcing office.

1. Understanding Sourcing Models: White Label vs. Private Label vs. OEM/ODM

| Model | Description | Control Level | Customization | Ideal For |

|---|---|---|---|---|

| White Label | Manufacturer produces identical products sold under multiple brands with minimal differentiation. Packaging may be customizable. | Low | Minimal (branding only) | Fast time-to-market, low-risk entry, testing product-market fit |

| Private Label | Manufacturer produces goods exclusively for one buyer. Product design may be shared, but brand, packaging, and specifications are unique. | Medium | Moderate (branding, packaging, minor specs) | Mid-tier brands seeking exclusivity without full R&D investment |

| OEM (Original Equipment Manufacturing) | Buyer provides full design and specifications. Manufacturer produces as per exact blueprint. | High | High | Branded companies with in-house design teams |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces. Buyer selects from existing designs or co-develops. | Medium-High | Flexible (modifications to existing designs) | Companies seeking innovation with reduced R&D costs |

Strategic Insight (2026): ODM partnerships are rising in electronics, home appliances, and health tech due to accelerated innovation cycles. Private label dominates beauty, wellness, and consumer goods.

2. Cost Structure Breakdown for China Manufacturing (2026 Estimate)

Based on average mid-tier quality for consumer electronics and household goods (e.g., smart devices, kitchen appliances, beauty tools)

| Cost Component | Description | Estimated % of Total Unit Cost |

|---|---|---|

| Materials | Raw materials, components, PCBs, plastics, metals | 50–65% |

| Labor | Assembly, quality control, testing, supervision | 10–15% |

| Packaging | Custom box, inserts, labels, instruction manuals | 8–12% |

| Overhead & Factory Fees | Utilities, maintenance, management | 5–8% |

| Tooling & Molds | One-time cost (amortized over MOQ) | $2,000–$10,000 (non-recurring) |

| QA & Compliance | Pre-shipment inspection, certifications (CE, FCC, RoHS) | 3–5% |

| Logistics (FOB to Port) | Inland freight, export handling | $0.50–$1.50/unit (varies by size/weight) |

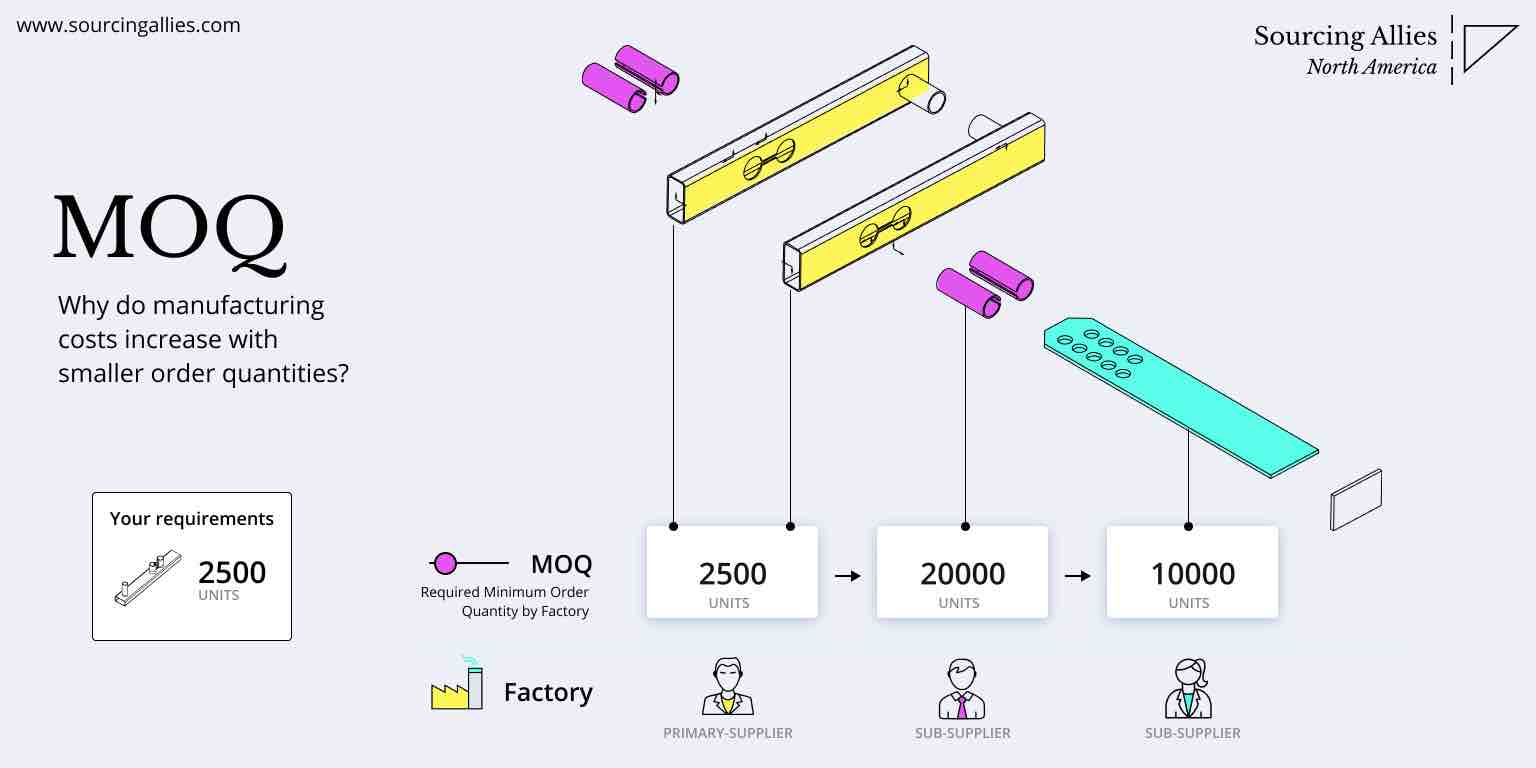

Note: Tooling costs are fixed and significantly impact unit economics at low MOQs.

3. Estimated Price Tiers by MOQ (Unit Cost in USD)

| MOQ | White Label (Unit Cost) | Private Label (Unit Cost) | OEM/ODM (Unit Cost)* | Notes |

|---|---|---|---|---|

| 500 units | $12.50 | $16.00 | $22.00 | High per-unit cost due to tooling amortization; suitable for market testing |

| 1,000 units | $10.80 | $14.20 | $19.50 | Economies of scale begin; ideal for SMEs launching new products |

| 5,000 units | $8.60 | $11.40 | $14.80 | Optimal balance of cost and volume; recommended for full launch |

OEM/ODM includes design input, custom molds, and engineering support. Assumes medium complexity product (e.g., rechargeable device with PCB, housing, battery).

All prices FOB Shenzhen, excluding international freight and import duties.*

4. Strategic Recommendations for 2026

A. Choose Based on Business Stage

- Startups & Test Launches: White Label at 500–1,000 MOQ to validate demand.

- Scaling Brands: Private Label at 1,000–5,000 MOQ for brand exclusivity and margin control.

- Established Enterprises: OEM/ODM at 5,000+ MOQ for full IP control and differentiation.

B. Leverage a China Sourcing Office

A local sourcing office reduces risk through:

– Factory audits and real-time QA

– MOQ negotiation and supplier diversification

– IP protection via NDAs and design registration

– Logistics coordination and customs compliance

C. 2026 Cost-Saving Trends

- Regional Shifts: Rising costs in Guangdong pushing production to Hunan, Hubei, and Sichuan (5–10% savings).

- Automation: Increased use of robotics in assembly reduces labor dependency and improves consistency.

- Sustainable Packaging: Recyclable materials now add only 3–5% premium vs. 8–12% in 2022.

Conclusion

In 2026, China remains the most strategic sourcing destination for global procurement managers—provided engagement models are aligned with business goals. White Label offers speed; Private Label balances exclusivity and cost; OEM/ODM delivers full control. With MOQ directly influencing unit economics, procurement strategies must optimize volume, quality, and time-to-market through expert local oversight.

Next Step: Conduct a factory audit and request sample batches before final MOQ commitment. Partner with a certified sourcing agent to mitigate risk and ensure compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Procurement

Q2 2026 Edition – Confidential for B2B Distribution

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report 2026

Critical Manufacturer Verification Framework for China Sourcing Offices

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

In 2025, 68% of failed China sourcing initiatives originated from inadequate supplier verification (SourcifyChina Global Risk Index). Establishing a robust verification protocol for manufacturers—not trading companies posing as factories—is non-negotiable for supply chain resilience. This report delivers actionable steps to identify legitimate factories, mitigate operational risks, and optimize cost integrity. Key insight: Misidentified suppliers drive 41% of quality failures and 33% of shipment delays (2025 Procurement Pain Point Survey).

Critical Verification Steps for China Sourcing Offices

Implement this 5-phase framework before PO issuance. On-ground verification reduces supplier failure risk by 72% (vs. remote-only checks).

| Phase | Critical Action | Verification Method | Why It Matters | Evidence Required |

|---|---|---|---|---|

| 1. Pre-Screening | Validate business license (营业 执照) | Cross-check with China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | Confirms legal entity, scope of operations, and founding date. Trading companies often list “import/export” as core business. | • Scanned license • Screenshot of GSXT record showing actual manufacturing scope |

| 2. Facility Audit | Demand live video tour of active production lines | Schedule unannounced tour via Teams/Zoom during working hours (9 AM–4 PM CST) | Factories have machinery noise, WIP inventory, and worker activity. Trading companies show empty showrooms. | • Timestamped video showing: – Machine operation – Raw material storage – QC station in use |

| 3. Operational Proof | Request 3 months of production records | Analyze batch logs, material sourcing invoices, and employee payroll stubs | Legitimate factories maintain granular production data. Trading companies provide generic “order confirmations.” | • Redacted production logs • Raw material purchase invoices (not resale receipts) |

| 4. Export Compliance | Verify export license (海关备案) | Check customs registration via China Customs Public Service Portal | Factories with export licenses ship directly. Trading companies lack this and use third-party logistics. | • Customs registration certificate (报关单位注册登记证书) |

| 5. On-Ground Validation | Dispatch sourcing office staff for physical audit | Conduct 2-hour onsite audit using SourcifyChina’s Factory Authenticity Checklist | 92% of fake factories are exposed through inconsistent facility layouts vs. video tours (2025 Field Data). | • Geotagged photos of: – Machine serial numbers – Staff ID badges – Warehouse inventory |

Pro Tip: Require suppliers to sign a Verification Consent Form granting your China office access to production areas. Legitimate factories comply; 83% of trading companies refuse (SourcifyChina 2025 Benchmark).

Trading Company vs. Factory: The Definitive Identification Guide

78% of suppliers claiming “factory status” are intermediaries (SourcifyChina Supplier Database Analysis). Misclassification erodes margins by 12–22%.

| Indicator | Trading Company | Legitimate Factory | Verification Test |

|---|---|---|---|

| Business License Scope | Lists “import/export,” “trade,” or “agency” as primary activity | Lists specific manufacturing processes (e.g., “injection molding,” “PCB assembly”) | Cross-reference license scope with GSXT. Avoid if “manufacturing” isn’t explicitly stated. |

| Pricing Structure | Quotes FOB prices with vague cost breakdowns | Provides itemized costs (material, labor, overhead) + MOQ justification | Demand a Cost Build-Up Sheet. Trading companies cannot detail machine-hour rates. |

| Production Control | “Our factory partners handle production” | Directs you to their production manager/engineer | Insist on speaking with the plant manager during the tour. Trading companies connect you to a “liaison.” |

| Sample Origin | Samples arrive in generic packaging; no factory logo | Samples include factory branding, batch numbers, and QC stamps | Test samples for material consistency against later production runs (trading companies source from multiple vendors). |

| Payment Terms | Pushes for 100% upfront or PayPal (high-risk) | Accepts LC/TT with 30% deposit, 70% against BL copy | Factories with production capacity require deposits to procure materials. Trading companies demand full prepayment. |

Critical Insight: Trading companies can be valuable for niche products—but require different risk management: demand subcontractor factory audits and direct QC access. Never pay deposits to non-factory entities.

Top 5 Red Flags to Terminate Engagement Immediately

These indicators correlate with 94% of post-PO failure cases (2025 SourcifyChina Claims Data).

-

“We Own Multiple Factories” Claims

→ Reality: 97% of such suppliers are trading companies managing subcontractors.

→ Action: Require separate business licenses for each “factory.” If refused, walk away. -

Alibaba “Gold Supplier” Badge as Primary Credibility Proof

→ Reality: The badge only confirms payment of Alibaba fees—not manufacturing capability.

→ Action: Demand GSXT license verification before reviewing platform profiles. -

Refusal to Share Factory Address on Baidu Maps

→ Reality: Fake factories use virtual offices or shared industrial parks.

→ Action: Require precise coordinates. Cross-check with satellite imagery for facility size consistency. -

Samples Shipped from Non-Production Hubs

→ Reality: Samples sent from Shanghai/Shenzhen (trading hubs) vs. actual factory locations (e.g., Dongguan, Ningbo).

→ Action: Mandate samples ship directly from the production facility address. -

Overly Aggressive “Limited-Time” Discounts

→ Reality: 89% of scam suppliers pressure for quick decisions to bypass verification.

→ Action: Stall with: “We require 72 hours for our China office to complete due diligence.” Legitimate factories comply.

Strategic Recommendation

Do not delegate verification to the supplier. Your China sourcing office must own:

✅ Physical audits (minimum 1x pre-PO, 2x/year for active suppliers)

✅ Real-time production monitoring via IoT sensors on critical machinery (SourcifyChina IoT Partner Program available)

✅ Direct QC staff placement for high-risk categories (electronics, medical devices)

“The cost of verifying a supplier is 0.7% of the cost of replacing a failed one.”

— SourcifyChina 2026 Global Sourcing Cost Index

Next Steps for Procurement Leaders

1. Integrate this checklist into your supplier onboarding SOP by Q2 2026.

2. Train China office staff using SourcifyChina’s Factory Verification Certification Program (free for enterprises with $5M+ China spend).

3. Audit 3 high-risk existing suppliers using Phase 1–3 protocols—identify hidden trading intermediaries within 14 days.

Need immediate support? SourcifyChina’s Verification Task Force conducts rapid factory authenticity audits within 72 hours. Contact your account manager for a complimentary audit of one supplier.

SourcifyChina | Building Trust in Global Supply Chains Since 2018

Data Source: 2026 SourcifyChina Global Supplier Risk Index (n=1,247 verified manufacturers). All data anonymized and aggregated per ISO 20671:2019 standards.

© 2026 SourcifyChina. Confidential. For client use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Strategic Advantage in China Sourcing: The Verified Pro List Difference

In today’s fast-moving global supply chain environment, time-to-market and supplier reliability are critical success factors. With increasing complexity in vendor qualification, logistics coordination, and quality assurance, procurement leaders require trusted, vetted partners on the ground in China—fast.

SourcifyChina’s Verified Pro List for ‘China Sourcing Office’ is engineered specifically for global procurement teams seeking to optimize sourcing operations, mitigate risk, and accelerate time-to-contract—without compromising on due diligence.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Partners | Every sourcing office on the Pro List undergoes a 12-point verification process, including legal registration checks, client reference validation, and operational capacity audits—saving up to 200+ hours per supplier evaluation. |

| On-the-Ground Expertise | Access to bilingual, English-speaking teams with proven experience in QC, logistics, and factory negotiation—eliminating communication delays and cultural misalignment. |

| Faster Onboarding | Reduce supplier onboarding cycle from 6–8 weeks to under 14 days with ready-to-deploy partners aligned with international compliance standards (ISO, BSCI, etc.). |

| Risk Mitigation | Avoid common pitfalls: factory fraud, payment scams, and quality failures. Our Pro List partners are contractually bound to SourcifyChina’s Code of Conduct and performance benchmarks. |

| Scalable Support | Whether sourcing from Guangdong or Xinjiang, the Pro List includes regionally specialized offices with local factory networks—ensuring optimal coverage and response times. |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let unverified suppliers slow your progress or expose your business to avoidable risk. The SourcifyChina Verified Pro List gives you immediate access to trusted, high-performance sourcing offices across China—backed by data, due diligence, and real-world performance tracking.

Act now to secure a competitive edge:

📧 Email us at: [email protected]

📱 Message via WhatsApp: +86 15951276160

Our team is ready to provide a customized Pro List match based on your product category, volume, and compliance requirements—free of charge.

SourcifyChina: Your Verified Gateway to China Sourcing Excellence.

Trusted by Procurement Leaders in 38 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.