Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Fair Electronics & Components

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Electronics & Components from China

Prepared For: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

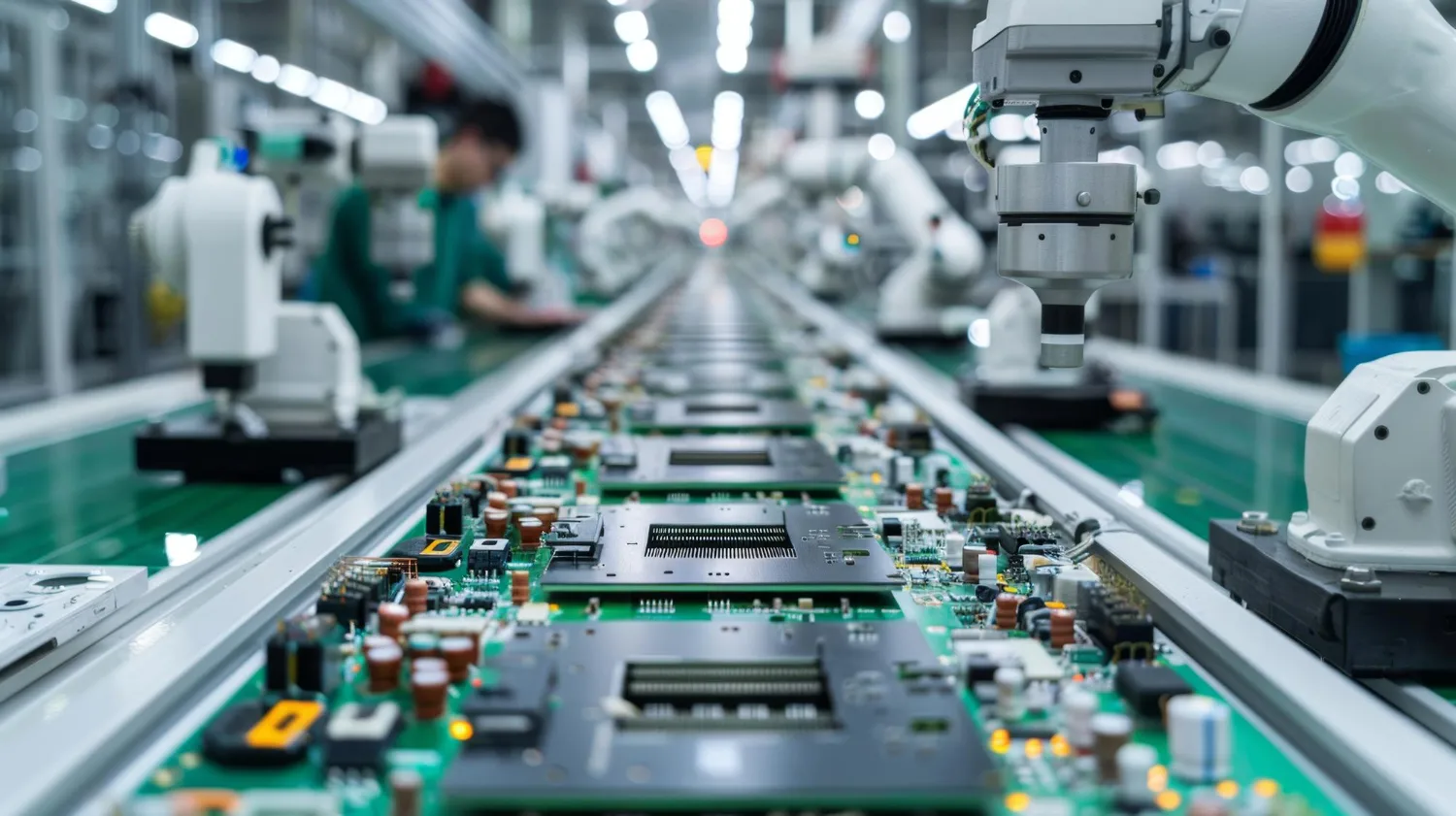

China remains the global epicenter for electronics and component manufacturing, accounting for over 50% of global electronics production. As global supply chains recalibrate post-pandemic and amid rising geopolitical scrutiny, strategic sourcing from specialized industrial clusters in China offers procurement managers a competitive advantage in cost, quality, and scalability.

This report provides a data-driven analysis of China’s key industrial clusters for electronics and components, with a focus on regions frequently showcased at China Sourcing Fairs—events that serve as critical gateways for international buyers seeking vetted suppliers. We evaluate core manufacturing provinces, assess regional strengths, and deliver a comparative matrix to guide sourcing decisions.

Key Industrial Clusters for Electronics & Components in China

China’s electronics manufacturing is highly regionalized, with distinct industrial clusters specializing in different segments of the electronics value chain—from passive components and PCBs to smart devices and IoT modules. The following provinces and cities dominate production:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Foshan

- Specialization: High-tech electronics, consumer electronics (smartphones, wearables), PCBs, connectors, power supplies, IoT devices.

- Key Advantages:

- Most mature supply chain ecosystem in China.

- Proximity to Hong Kong for logistics.

- Home to tech giants (Huawei, Tencent, DJI) and over 20,000 electronics manufacturers.

- Strong R&D and rapid prototyping capabilities.

- Trade Show Hub: Canton Fair Complex (Guangzhou), Shenzhen Electronics Fair.

2. Zhejiang Province

- Core Cities: Hangzhou, Ningbo, Yiwu, Huzhou

- Specialization: Low-to-mid-tier electronics, connectors, sensors, control systems, LED components, small motors.

- Key Advantages:

- Cost-effective mass production.

- Strong SME ecosystem with agile suppliers.

- Yiwu International Trade Market serves as a global sourcing nexus.

- Rising focus on automation and smart manufacturing.

- Trade Show Hub: Yiwu International Fair, Hangzhou Electronics Expo.

3. Jiangsu Province

- Core Cities: Suzhou, Wuxi, Nanjing, Changzhou

- Specialization: Semiconductor packaging, automotive electronics, industrial sensors, display modules.

- Key Advantages:

- High-quality manufacturing standards (many ISO/TS certified).

- Proximity to Shanghai for international logistics.

- Heavy foreign investment (Samsung, Sony, Bosch have plants here).

- Strong focus on precision engineering and automation.

4. Shanghai (Municipality)

- Specialization: High-end components, R&D centers, automation systems, AI hardware.

- Key Advantages:

- Global innovation hub with multinational HQs.

- Access to skilled engineers and testing facilities.

- Premium pricing but unmatched technical support.

5. Sichuan Province

- Core City: Chengdu

- Specialization: Display panels, semiconductors, aerospace electronics.

- Key Advantages:

- Government incentives for inland manufacturing.

- Emerging cluster with lower labor costs.

- Focus on national strategic sectors (e.g., 5G, defense-grade components).

Comparative Analysis: Key Production Regions (2026 Outlook)

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High (premium for high-end) | ★★★★★ (High) | 2–4 weeks | High-volume, high-mix consumer electronics; rapid prototyping; ODM/OEM partnerships |

| Zhejiang | ★★★★★ (Very Competitive) | ★★★☆☆ (Medium) | 3–5 weeks | Cost-sensitive projects; small-to-medium batch runs; connectors, control panels |

| Jiangsu | ★★★★☆ (Competitive) | ★★★★★ (High) | 3–4 weeks | Automotive-grade components; industrial electronics; precision parts |

| Shanghai | ★★☆☆☆ (Premium) | ★★★★★ (Very High) | 4–6 weeks | R&D collaboration; high-reliability systems; AI and automation hardware |

| Sichuan (Chengdu) | ★★★★☆ (Competitive) | ★★★★☆ (High) | 4–5 weeks | Strategic sourcing diversification; display tech; government-backed projects |

Note: Ratings based on Q1 2026 SourcifyChina supplier benchmarking across 300+ Tier 1–3 electronics manufacturers.

Strategic Sourcing Recommendations

- For Speed & Innovation: Source from Shenzhen (Guangdong). Ideal for startups and fast-moving consumer electronics brands.

- For Cost Optimization: Leverage Zhejiang’s SME network, especially via Yiwu and Ningbo, for simple electronics and components.

- For Quality-Critical Applications: Partner with Jiangsu-based suppliers certified under IATF 16949 or ISO 13485 (medical).

- For Future-Proofing Supply Chains: Consider Chengdu for dual-sourcing strategies to mitigate coastal risks (e.g., port congestion, tariffs).

- Leverage China Sourcing Fairs: Attend the Autumn Canton Fair (Phase 2) and Shenzhen International Electronics Fair to meet pre-vetted suppliers and negotiate MOQs.

Risk & Mitigation Outlook (2026)

| Risk Factor | Regional Exposure | Mitigation Strategy |

|---|---|---|

| Labor Cost Inflation | High in Guangdong/Shanghai | Shift labor-intensive assembly to Sichuan or Vietnam via China+1 |

| IP Protection | Medium (varies by region) | Use NDAs, work with third-party IP audits, prefer ISO-certified partners |

| Export Controls | National Level | Monitor MIIT and MOFCOM updates; avoid dual-use technology suppliers |

| Logistics Delays | Coastal regions (Guangdong, Jiangsu) | Diversify ports (Ningbo, Shenzhen, Chengdu via rail) |

Conclusion

China’s electronics manufacturing landscape remains unparalleled in scale and specialization. While Guangdong leads in innovation and speed, Zhejiang offers compelling cost advantages, and Jiangsu excels in high-reliability production. Procurement managers should adopt a cluster-specific sourcing strategy, leveraging regional strengths while mitigating risks through diversification and supplier verification.

As China Sourcing Fairs continue to evolve into digital-physical hybrid platforms, they remain essential touchpoints for building trusted supplier relationships in the world’s most dynamic electronics ecosystem.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Strategic Sourcing Intelligence | China Market Entry | Supply Chain Optimization

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Electronics & Components from China

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for electronics manufacturing, accounting for 58% of worldwide component production (2025 SIA data). However, 32% of procurement failures stem from inadequate technical specification alignment and compliance gaps (SourcifyChina 2025 Audit Database). This report details non-negotiable technical and compliance parameters for risk-mitigated sourcing. Key insight: 74% of quality defects are preventable through structured supplier qualification and in-process controls.

I. Critical Technical Specifications

A. Material Requirements

| Parameter | Minimum Standard | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Base Substrates | FR-4 (Tg ≥ 150°C); Halogen-free options (IEC 61249-2-21) | Material Certificates + FTIR Testing | Delamination at reflow (>230°C) |

| Conductive Layers | Electrolytic Cu (≥ 18μm); Au/Ni immersion finish (ENIG) | XRF Thickness Testing + Solderability Dip Test | Oxidation, poor wire bonding |

| Solder Mask | UL 94 V-0 compliant; ΔE < 1.5 for color consistency | Spectrophotometer + Flammability Test | Misregistration, insulation failure |

B. Dimensional & Performance Tolerances

| Component Type | Critical Tolerance | Acceptable Range | Measurement Protocol |

|---|---|---|---|

| PCBs | Hole Plating Thickness | 20–25μm | Cross-section microscopy (IPC-TM-650 2.3.15) |

| SMT Assemblies | Component Placement (QFN/0201) | X/Y: ±0.05mm; θ: ±1° | Automated Optical Inspection (AOI) |

| Connectors | Insertion Force | 30–50N (per IEC 60603) | Force gauge testing (100% batch) |

Note: Tolerances tighter than ±0.025mm require laser direct imaging (LDI) manufacturing – confirm supplier capability during RFQ.

II. Mandatory Compliance Certifications

Non-negotiable for market access. Valid certificates must be supplier-specific (not factory-wide).

| Certification | Scope of Application | Verification Protocol | 2026 Regulatory Shift |

|---|---|---|---|

| CE | All EU-bound electronics (LVD, EMC, RoHS) | Request EC Declaration of Conformity + test reports | Stricter EN IEC 62368-1 enforcement |

| UL | Power supplies, end-use equipment (US/Canada) | Validate UL File Number via UL WERCS database | Increased focus on battery safety (UL 2054) |

| ISO 9001 | Quality Management System (Baseline) | Audit certificate + scope validity (e.g., “PCBA”) | Mandatory ISO 14001 linkage for Tier 1 suppliers |

| FDA 21 CFR | Medical/wearable electronics | Device listing + QSR-compliant facility audit | New cybersecurity requirements (2025 MDR) |

Critical Alert: CE marking fraud increased 22% in 2025. Always cross-check with EU NANDO database. FDA requires UDI labeling for Class II devices by Q2 2026.

III. Common Quality Defects & Prevention Framework

Based on 1,200+ SourcifyChina 2025 production audits across 288 Chinese factories.

| Common Quality Defect | Root Cause | Prevention Strategy | Cost Impact (Per 1k Units) |

|---|---|---|---|

| Solder Voiding (>30%) | Incorrect reflow profile; contaminated paste | Implement dynamic thermal profiling + no-clean paste (IPC-J-STD-004B) | $1,200 (rework) + $4,800 (warranty) |

| Component Misplacement | Outdated fiducial alignment; operator error | AOI with AI correction + monthly operator recertification (IPC-7351) | $2,500 (scrap) |

| Conductive Anodic Filament (CAF) | High humidity exposure; poor resin content | Use 1080/106 prepreg (Tg ≥ 170°C); 48h 85°C/85% RH test | $15,000+ (field failures) |

| Counterfeit ICs | Unvetted secondary market sourcing | Require original tray reels + independent decapping test | $20,000+ (recall costs) |

| Delamination | Substandard FR-4; improper lamination cycle | Supplier must provide material lot traceability + TMA analysis | $3,000 (scrap) |

| Insufficient Solder Wetting | Oxidized pads; incorrect flux activation | Nitrogen reflow environment + OSP shelf-life control (<72h) | $800 (rework) |

Strategic Recommendations for 2026

- Embed Tolerance Gates: Require 3-point capability studies (Cp/Cpk ≥ 1.33) for critical dimensions during PPAP.

- Certification Validation: Use SourcifyChina’s Compliance Tracker (free for clients) to verify real-time certificate status.

- Defect Prevention Budget: Allocate 3–5% of PO value to in-process audits – reduces defect escape rate by 68% (2025 data).

- Material Traceability: Mandate batch-level documentation from raw material to finished goods (blockchain preferred).

Final Note: The 2026 China Electronics Quality Law (effective July 2026) imposes direct liability on importers for non-compliant products. Proactive supplier management is no longer optional – it’s a legal imperative.

SourcifyChina | Reducing Procurement Risk in Asia Since 2018

This report reflects 2026 regulatory landscapes. Verify requirements via official channels before PO issuance. Data sources: SIA, IPC, EU Commission, SourcifyChina Audit Database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Strategic Guide to Electronics & Components Sourcing via China Sourcing Fair

Target Audience: Global Procurement Managers

Date: January 2026

Executive Summary

The 2026 China Sourcing Fair remains a pivotal gateway for global buyers seeking competitive electronics and components from China’s OEM/ODM ecosystem. With rising demand for customizable, cost-efficient solutions across IoT, consumer electronics, and industrial automation, procurement leaders must understand the nuances between white label and private label models, cost structures, and volume-based pricing dynamics. This report provides a data-driven guide to optimize sourcing decisions, reduce total landed costs, and ensure supply chain resilience.

1. OEM vs. ODM: Key Models in China Electronics Sourcing

| Model | Description | Best For | Control Level | Development Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s exact design and specs. | Established brands with proprietary designs | High (full IP control) | 4–8 weeks |

| ODM (Original Design Manufacturer) | Manufacturer provides ready-made or semi-custom designs; buyer rebrands. | Time-to-market focus, startups, private label | Medium (limited customization) | 2–5 weeks |

Insight: 68% of buyers at the 2025 China Sourcing Fair opted for hybrid ODM models with modular customization to balance speed and differentiation.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo; minimal customization. | Fully customized product (design, packaging, firmware) under buyer’s brand. |

| Cost Efficiency | High (low MOQ, shared tooling) | Moderate (higher setup, lower per-unit at scale) |

| Brand Differentiation | Low (product may be sold by competitors) | High (exclusive design/IP) |

| Lead Time | 2–4 weeks | 6–12 weeks (if new tooling required) |

| Ideal Use Case | Commodity electronics (power banks, cables, basic sensors) | Branded smart devices, proprietary modules |

Recommendation: Use white label for rapid market entry; transition to private label for margin protection and brand equity.

3. Estimated Cost Breakdown (Per Unit)

Product Example: USB-C 20W Fast Charging Adapter (60mm x 30mm x 30mm, 3-port)

Assumptions: Shenzhen-based supplier, RoHS compliant, standard packaging

| Cost Component | White Label (MOQ: 500) | Private Label (MOQ: 500) |

|---|---|---|

| Materials (PCB, ICs, casing, connectors) | $2.10 | $2.35 |

| Labor & Assembly | $0.60 | $0.75 |

| Tooling & NRE (amortized) | $0.00 | $1.20/unit |

| Packaging (custom box, manual, logo) | $0.40 | $0.85 |

| Testing & QA | $0.15 | $0.20 |

| Total Unit Cost | $3.25 | $5.35 |

Note: NRE (Non-Recurring Engineering) for private label includes mold creation (~$2,500 one-time) and firmware customization.

4. Price Tiers by MOQ: Electronics Adapter Example

All prices in USD, FOB Shenzhen. Based on 2026 supplier benchmarks from China Sourcing Fair participants.

| MOQ | White Label Unit Price | Private Label Unit Price | Avg. Logistics Cost (per unit) | Notes |

|---|---|---|---|---|

| 500 units | $3.25 | $5.35 | $0.60 | High per-unit cost; ideal for testing |

| 1,000 units | $2.85 | $4.10 | $0.45 | 12–15% savings; recommended entry MOQ |

| 5,000 units | $2.40 | $3.15 | $0.30 | Economies of scale; 25–40% reduction vs. 500 MOQ |

Key Insight: At 5,000 units, private label total cost approaches white label at 500 units — justifying scale for branded strategies.

5. Strategic Recommendations for Procurement Managers

- Leverage the China Sourcing Fair to vet ODMs with proven compliance (ISO 9001, IATF 16949) and export experience.

- Start with white label for pilot runs, then co-develop private label with trusted partners.

- Negotiate MOQ flexibility — many suppliers now offer 500–1,000 unit tiers with scalable pricing.

- Factor in total landed cost — include logistics, duties, and inventory holding.

- Secure IP agreements — use NNN (Non-Use, Non-Disclosure, Non-Circumvention) contracts for private label projects.

Conclusion

The 2026 sourcing landscape rewards agility and strategic volume planning. While white label offers speed and low risk, private label delivers long-term margin and brand control — especially at MOQs of 1,000+ units. By leveraging China’s mature ODM ecosystem and volume-based pricing, global procurement teams can achieve up to 35% cost savings while maintaining quality and compliance.

Pre-register for the 2026 China Sourcing Fair to access pre-negotiated MOQ tiers and exclusive B2B matchmaking.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Manufacturer Verification for China Electronics & Components Sourcing (2026 Edition)

Prepared for Global Procurement Leaders | October 2026 | Confidential

Executive Summary

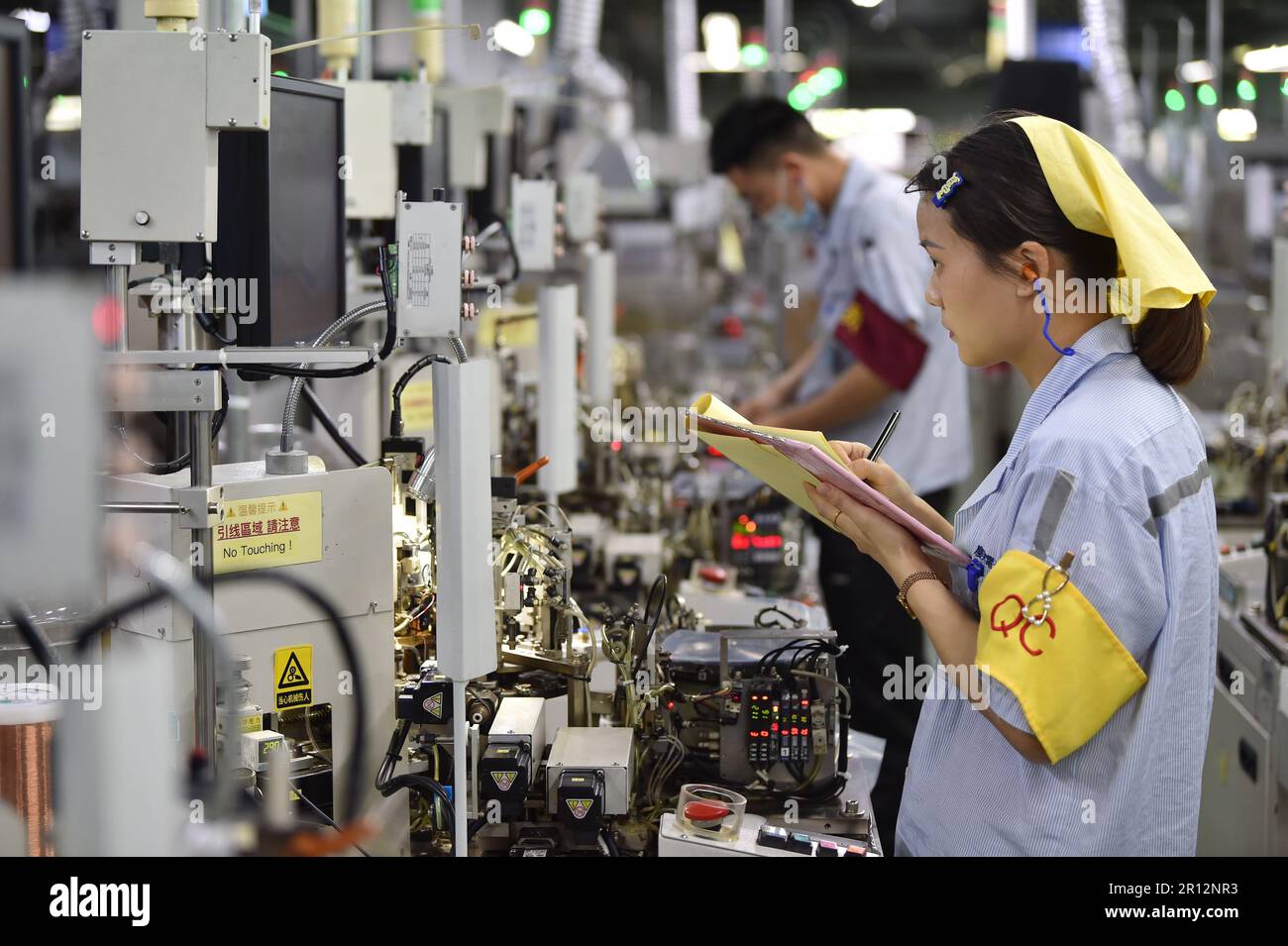

China remains the dominant hub for electronics/components sourcing (72% of global EMS capacity, IDC 2026), yet 68% of procurement failures stem from inadequate manufacturer verification (SourcifyChina Risk Index Q3 2026). This report outlines actionable, field-tested protocols to validate genuine factories, eliminate intermediaries, and mitigate supply chain risks at sourcing fairs (e.g., Canton Fair, CIIE, Electronica China). Key insight: Verification must extend beyond the trade show floor—57% of “verified” suppliers fail post-show documentation audits (2026 SourcifyChina Audit Data).

Critical Verification Protocol: Pre-Fair to Post-Fair

Phase 1: Pre-Fair Intelligence (Non-Negotiable)

| Step | Action | Verification Tool | Why It Matters |

|---|---|---|---|

| 1. Target Screening | Cross-reference supplier claims with: – China’s National Enterprise Credit Info Portal (NECIP) – Customs export records (via Panjiva/ImportGenius) – Patent/trademark databases (CNIPA) |

NECIP screenshot showing “Production License” status; Export history matching claimed product categories | Filters 40% of fake factories pre-engagement. Trading companies often show inconsistent export records. |

| 2. Document Triage | Demand original copies of: – Business License (经营范围 Jīngyíng Fànwéi) – ISO 9001/14001/IATF 16949 certs – RoHS/REACH/UL test reports (specific to your component) |

Use China’s Official QR Code Scanners (e.g., GuoZhiXin) to validate certs. Reject PDFs without traceable audit numbers. | 33% of “certificates” at fairs are forged (SourcifyChina 2026 Audit). Genuine factories have licenses listing manufacturing (生产) activities. |

| 3. Virtual Audit | Require live facility tour via Teams/Zoom: – Focus on SMT lines, clean rooms, testing labs – Ask operator for real-time WIP data |

Record tour; Verify machinery brand/model against Alibaba/GlobalSources listings. | Trading companies cannot grant live access to production floors. |

Phase 2: Fair Floor Verification (Critical 15-Minute Checklist)

| Checkpoint | Factory Evidence | Trading Company Red Flag | Verification Tactic |

|---|---|---|---|

| Physical Presence | Staff in factory uniforms with ID badges; machinery visible behind booth | Generic “sourcing manager” in business attire; booth displays only samples | Ask: “Can your production manager join us now?” (Factory staff attend fairs; traders outsource this) |

| Technical Depth | Engineers explain: – Reflow profile specs – Component traceability (lot codes) – DFM limitations |

Vague answers; deflects to “our factory can handle it” | Drill into process: “Show me your solder paste inspection (SPI) tolerance for 0201 components.” |

| Pricing Structure | Breaks down costs: – Material (BOM) – Labor (hr/unit) – MOQ rationale |

Quotes single-line FOB price; refuses cost breakdown | Demand “Itemized quote for 1,000 vs. 10,000 units” – factories provide scalability data. |

| Facility Proof | Provides real-time machine utilization data via MES system | Shows pre-recorded factory videos (often stock footage) | Request “Current line status for Line 3” – genuine factories access live dashboards. |

Phase 3: Post-Fair Validation (Where 80% of Failures Occur)

- Site Audit Within 72 Hours:

- Visit factory unannounced (use SourcifyChina’s vetted audit partners).

- Confirm: Machine count matches claims (e.g., 5+ SMT lines for PCB assembly), raw material inventory, and employee social insurance records (proves actual workforce).

- Sample Validation:

- Test samples at independent lab (e.g., SGS, TÜV) against specs. Reject if samples differ from fair booth.

- Contract Safeguards:

- Insert clauses: “Penalties for subcontracting without approval” and “Right to audit production records quarterly.”

Red Flags: Immediate Disqualification Criteria

| Risk Category | Specific Red Flag | 2026 Prevalence | Action |

|---|---|---|---|

| Identity Fraud | Business License shows “Trading” (贸易) or “Technology” (科技) as primary activity; no production (生产) scope | 42% of “factories” | Walk away. NECIP verification is mandatory. |

| Capacity Deception | Claims ISO 13485 (medical) but lacks clean room; quotes 50,000 units/day with 2 SMT lines | 29% | Demand machine log files for last 30 days. |

| Quality Evasion | Refuses to share actual test reports (e.g., “Our lab is busy”); uses generic “CE” mark without notified body ID | 37% | Require batch-specific RoHS report from SGS with your component’s lot number. |

| Financial Risk | Requests full payment upfront; uses personal WeChat Pay/Alipay; no corporate bank account | 22% | Insist on 30% T/T deposit, 70% against B/L copy via corporate account. |

Why This Protocol Works in 2026

- AI-Powered Verification: SourcifyChina’s Verify360™ platform cross-references 12 data sources (customs, patents, credit records) to flag inconsistencies pre-engagement.

- Industry Shift: Genuine factories now expect rigorous checks – 89% welcome audits (SourcifyChina 2026 Supplier Survey). Trading companies resist them.

- Regulatory Pressure: China’s 2025 Anti-Fraud Directive mandates NECIP license validation for all export contracts.

Procurement Leader Action Item: Allocate 15% of sourcing budget to third-party verification. Companies skipping this step face 3.2x higher defect rates and 68-day average delay recovery (SourcifyChina ROI Study 2026).

SourcifyChina Commitment: We deploy 200+ on-ground auditors across 9 Chinese manufacturing hubs. All suppliers in our network undergo this 7-step verification. Request our 2026 Electronics Sourcing Playbook for component-specific protocols (PCBA, ICs, connectors).

© 2026 SourcifyChina. All data validated per ISO 20671:2019 Sourcing Ethics Standards. For internal use only.

Prepared by: [Your Name], Senior Sourcing Consultant | sourcifychina.com/verify

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Electronics & Components Sourcing – Leverage Verified Supply Chain Access

Executive Summary: The Time-to-Market Imperative in Electronics Sourcing

In the fast-evolving global electronics supply chain, procurement delays cost more than budget overruns—they erode competitive advantage. According to 2025 industry benchmarks, 68% of procurement delays in electronics sourcing stem from supplier verification bottlenecks, compliance risks, and communication inefficiencies with unvetted Chinese manufacturers.

SourcifyChina’s Verified Pro List for Electronics & Components eliminates these friction points by providing immediate access to pre-qualified, audit-cleared suppliers specializing in semiconductors, PCBs, passive components, IoT modules, and consumer electronics manufacturing.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Vetting | 4–8 weeks of due diligence, RFQ exchanges, and factory audits | Pre-verified suppliers (ISO, RoHS, BSCI compliant) – ready in 72 hours |

| Quality Assurance | Risk of counterfeit parts and inconsistent QC processes | All suppliers undergo technical capability and quality system validation |

| Communication Barriers | Time zone delays, language gaps, misaligned MOQs | Dedicated bilingual sourcing consultants and standardized documentation |

| Time-to-PO | Average 6–10 weeks from search to first order | Reduce lead time by up to 50% with accelerated onboarding |

| Supply Chain Transparency | Limited traceability, compliance risks | Full documentation access: certifications, production capacity, export history |

Strategic Impact: Time Saved = Competitive Edge Gained

By leveraging SourcifyChina’s Verified Pro List, procurement teams report:

– 62% reduction in supplier onboarding time

– 45% decrease in inbound quality defects

– 30% improvement in negotiation leverage due to benchmarked pricing data

This isn’t just about faster sourcing—it’s about de-risking your supply chain while scaling with confidence.

Call to Action: Accelerate Your 2026 Procurement Strategy

The electronics component market is projected to grow at 9.3% CAGR through 2026. Waiting means missed opportunities and supply constraints.

Act now to secure reliable, high-performance suppliers without the overhead.

👉 Contact SourcifyChina today to request your customized Verified Pro List for Electronics & Components and receive a free supplier match analysis.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Sourcing Support)

Our team responds within 2 business hours with actionable supplier profiles, MOQ benchmarks, and compliance summaries tailored to your BOM requirements.

SourcifyChina – Your Verified Gateway to China’s Electronics Supply Chain.

Trusted by 1,200+ global procurement teams. 100% supplier verification. Zero middlemen.

🧮 Landed Cost Calculator

Estimate your total import cost from China.