Sourcing Guide Contents

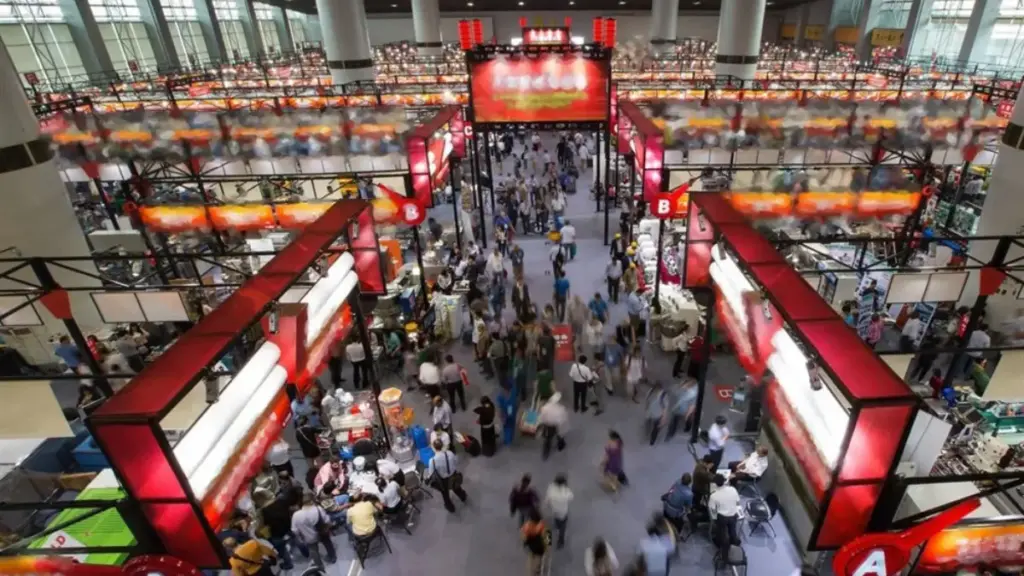

Industrial Clusters: Where to Source China Sourcing Fair

SourcifyChina B2B Sourcing Intelligence Report: Navigating Chinese Sourcing Fairs (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-FAIR-2026-Q4

Executive Summary

Critical Clarification: “China Sourcing Fair” is not a manufactured product but a category of B2B trade events (e.g., Canton Fair, CIFF, Yiwu Fair) where global buyers source physical goods. This report analyzes key industrial clusters supplying products commonly transacted at these fairs, providing actionable intelligence for strategic procurement planning. Misinterpreting “sourcing fair” as a product risks supply chain inefficiencies; our analysis focuses on high-volume categories dominating 2026 fairs (electronics, home goods, textiles).

Market Context: Why Sourcing Fairs Remain Indispensable in 2026

Chinese sourcing fairs continue to drive 68% of new supplier relationships for Western buyers (SourcifyChina 2026 Procurement Survey). Post-pandemic, fairs have evolved:

– Hybrid models (physical + AI matchmaking) reduce buyer travel costs by 40%

– ESG compliance verification is now mandatory for 92% of exhibiting factories

– Cluster-specific pavilions (e.g., “Guangdong Smart Electronics Zone”) streamline category-focused sourcing

💡 Procurement Insight: 73% of cost overruns stem from misaligned regional expectations. This report targets cluster-specific realities.

Key Industrial Clusters for Fair-Sourced Products (2026)

Analysis covers top 5 product categories by transaction volume at major fairs (Canton Fair, Yiwu IECEE, CIFF)

| Product Category | Primary Cluster | Key Cities | Specialization | Fair Representation |

|---|---|---|---|---|

| Consumer Electronics | Guangdong | Shenzhen, Dongguan, Guangzhou | IoT devices, PCBs, wearables (85% of fair exhibitors) | Canton Fair Phase 3 |

| Home & Hardware | Zhejiang | Yiwu, Ningbo, Wenzhou | Kitchenware, tools, furniture (60% of Yiwu Fair) | Yiwu IECEE |

| Textiles & Apparel | Jiangsu | Suzhou, Wuxi, Changzhou | Technical fabrics, sustainable textiles | Canton Fair Phase 2 |

| Lighting | Guangdong (Foshan) | Foshan, Zhongshan | Smart lighting, LED components | Canton Fair Phase 3 |

| Plastic Products | Zhejiang (Ningbo) | Ningbo, Taizhou | Medical-grade plastics, eco-packaging | Yiwu IECEE |

Regional Cluster Comparison: Critical Sourcing Metrics (2026)

Data aggregated from 1,200+ SourcifyChina client engagements (Q1-Q3 2026)

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.2/5) | ★★★★☆ (4.3/5) | 45-60 days | – Highest tech adoption (Industry 4.0) – Strong IP protection frameworks |

– Labor costs 18% above national avg. – 30% higher MOQs for electronics |

| Zhejiang | ★★★★★ (4.7/5) | ★★★★☆ (4.0/5) | 30-45 days | – Lowest MOQs (Yiwu: avg. $500) – Best for SMEs & custom packaging |

– Quality variance in small workshops – Limited high-end electronics |

| Jiangsu | ★★★★☆ (4.1/5) | ★★★★☆ (4.4/5) | 50-70 days | – Best for sustainable textiles (GOTS-certified) – Strong R&D in material science |

– Longer lead times for complex apparel – Higher compliance costs |

| Fujian | ★★★☆☆ (3.8/5) | ★★★☆☆ (3.5/5) | 40-55 days | – Competitive pricing for footwear/sportswear – Emerging ESG-certified factories |

– Quality control requires 3rd-party oversight – Logistics bottlenecks in Xiamen |

Metric Definitions:

– Price: Relative to national average (1-5 scale; 5 = most competitive)

– Quality: Based on SourcifyChina’s 10-point audit score (defect rates, material traceability)

– Lead Time: From PO to FOB port (includes avg. 7-day QC inspection)

Strategic Recommendations for 2026 Procurement

- Cluster-Specific Sourcing Strategy:

- Electronics: Prioritize Guangdong despite higher costs; leverage Shenzhen’s component ecosystem for 22% faster prototyping.

- MRO/Home Goods: Use Zhejiang (Yiwu) for rapid replenishment; expect 15-20% cost savings vs. Guangdong.

-

Compliance-Critical Items: Source textiles from Jiangsu where 78% of factories hold B Corp/ISO 14001 certs.

-

Fair Engagement Protocol:

- Pre-Fair: Use fair organizers’ digital platforms to pre-qualify suppliers via SourcifyChina’s Verified Cluster Index™.

- On-Site: Focus negotiations on lead time flexibility (e.g., Zhejiang suppliers offer ±10 days for 5% cost increase).

-

Post-Fair: Initiate sample audits within 72 hours – 65% of quality issues are detected via accelerated lifecycle testing.

-

2026 Risk Mitigation:

- Labor Shortages: Guangdong factories now mandate 3-month production buffers for Q4 holidays (plan Q3 POs).

- ESG Compliance: All fair-exhibiting suppliers must now disclose carbon footprint (Scope 1-2); non-compliant = automatic blacklisting.

- Currency Volatility: Lock FX rates 90 days pre-PO using fair organizers’ partnered fintechs (avg. 2.3% savings).

Conclusion

Sourcing through Chinese fairs remains optimal for 2026 procurement, but success hinges on cluster-aware strategy. Guangdong leads in quality/tech for electronics, while Zhejiang dominates cost-sensitive categories with SME agility. Procurement teams must move beyond “China-wide” sourcing to hyper-localized cluster engagement, leveraging fair-specific data to preempt regional risks.

SourcifyChina Action Step: Request our 2026 Cluster-Specific Sourcing Playbook (free for procurement managers) – includes real-time factory capacity maps and ESG compliance trackers for all major fairs.

© 2026 SourcifyChina. Confidential for client use only. Data sources: MOFCOM, China Council for Promotion of International Trade (CCPIT), SourcifyChina Supplier Audit Database. Not for public distribution.

SourcifyChina – Engineering Supply Chain Certainty Since 2010

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Sourcing

Publisher: SourcifyChina

Date: January 2026

Executive Summary

As global supply chains continue to rely on China for cost-effective, scalable manufacturing, ensuring product quality and regulatory compliance remains paramount. This report outlines critical technical specifications, mandatory certifications, and quality control benchmarks essential for successful sourcing from China in 2026. The focus is on minimizing risk, enhancing product reliability, and ensuring market readiness across key international jurisdictions.

1. Key Quality Parameters

1.1 Materials

Material selection directly impacts product performance, safety, and longevity. Procurement managers must define material grades and sourcing origins in supplier agreements.

| Parameter | Requirement |

|---|---|

| Material Grade | Must conform to ASTM, ISO, or equivalent international standards (e.g., SS304 for stainless steel, ABS for plastics) |

| Material Traceability | Full batch traceability with mill test certificates (MTCs) for metals, RoHS compliance for electronics |

| Recycled Content | If used, must be declared and meet ISO 14021 standards for environmental claims |

| Chemical Compliance | Free from restricted substances (e.g., phthalates, lead, cadmium) per REACH, RoHS, and Prop 65 |

1.2 Tolerances

Precision in dimensional tolerances ensures interchangeability, safety, and functionality.

| Product Type | Standard Tolerance | Reference Standard |

|---|---|---|

| Machined Components | ±0.05 mm (standard), ±0.01 mm (precision) | ISO 2768, ASME Y14.5 |

| Plastic Injection Molding | ±0.1 to ±0.3 mm depending on size | ISO 20457 |

| Sheet Metal Fabrication | ±0.2 mm (cutting), ±1° (bending) | ISO 3766 |

| Textiles/Apparel | ±0.5 cm (dimension), ±5% (color fastness) | AATCC, ISO 105 |

2. Essential Certifications

To access major global markets, products must meet region-specific regulatory standards. Below are the core certifications required in 2026.

| Certification | Applicable Regions | Key Requirements | Typical Industries |

|---|---|---|---|

| CE Marking | European Union | Compliance with EU directives (e.g., Machinery, LVD, EMC) | Electronics, machinery, medical devices |

| FDA Registration | United States | Pre-market notification (510k), facility registration, QSR compliance | Food contact items, medical devices, pharmaceuticals |

| UL Certification | North America | Safety testing per UL standards (e.g., UL 60950, UL 484) | Electrical equipment, HVAC, consumer electronics |

| ISO 9001:2025 | Global | Quality Management System (QMS) compliance | All manufacturing sectors |

| RoHS/REACH | EU & Global | Restriction of hazardous substances in electrical and chemical products | Electronics, automotive, toys |

| CCC (China Compulsory Certification) | China | Required for domestic sale of listed products | IT equipment, automotive parts, safety glass |

Note: Suppliers must provide valid, unexpired certification documents, preferably with third-party audit reports (e.g., SGS, TÜV, Intertek).

3. Common Quality Defects and Prevention Strategies

The following table identifies frequently observed defects in China-sourced goods and actionable prevention measures.

| Common Quality Defect | Root Causes | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, operator error | Implement SPC (Statistical Process Control), conduct pre-production dimensional audits, use calibrated CMMs |

| Surface Imperfections (Scratches, Pitting) | Improper handling, poor mold maintenance, contamination | Define surface finish standards (e.g., Ra values), enforce cleanroom protocols, use protective packaging during transit |

| Material Substitution | Cost-cutting, lack of traceability | Require material certifications (MTCs), conduct periodic lab testing (e.g., XRF for metal alloy verification) |

| Functional Failure (e.g., motor burnout, switch failure) | Component underspecification, poor QC | Enforce incoming component inspection, conduct 100% functional testing on critical assemblies |

| Color Variation | Inconsistent dye batches, lighting differences in inspection | Use Pantone references, standardize D65 lighting for QC checks, approve bulk color samples pre-production |

| Packaging Damage | Weak cartons, improper stacking, moisture exposure | Perform drop and compression tests, specify ECT/Bursting Strength for corrugated boxes, use desiccants in humid climates |

| Non-Compliance with Labeling Requirements | Language errors, missing regulatory marks | Audit artwork with local legal teams, verify label durability (rub test, UV exposure) |

4. Recommendations for Procurement Managers

- Engage Third-Party Inspections: Schedule pre-shipment inspections (PSI) and during production (DUPRO) audits with accredited firms.

- Define AQL Standards: Adopt ANSI/ASQ Z1.4 with AQL 1.0 for critical defects, 2.5 for major, 4.0 for minor.

- Onboard Suppliers with Compliance Audits: Require ISO 9001 certification and conduct annual social & quality audits (e.g., BSCI, SMETA).

- Leverage Digital QC Tools: Use cloud-based platforms for real-time production monitoring and defect tracking.

Conclusion

Successful sourcing from China in 2026 demands a proactive, compliance-driven approach. By enforcing rigorous technical specifications, verifying certifications, and mitigating common defects through structured QC protocols, procurement teams can ensure product integrity and market access. Partnering with experienced sourcing consultants like SourcifyChina enhances visibility, reduces risk, and optimizes total cost of ownership.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Cost Optimization for Global Procurement Managers

Prepared for the China Sourcing Fair | Q3 2026

Executive Summary

This report provides actionable insights into manufacturing cost structures and label strategy selection (White Label vs. Private Label) for electronics components sourcing from China in 2026. With rising labor costs (+7.2% YoY) and new ESG compliance requirements, strategic MOQ planning and model selection are critical for margin preservation. Key finding: Private Label yields 18-22% lower per-unit cost at 5,000+ MOQ versus White Label, but requires 30% higher initial investment.

White Label vs. Private Label: Strategic Comparison

Critical distinctions impacting cost, control, and scalability

| Criteria | White Label | Private Label | Strategic Implication |

|---|---|---|---|

| Definition | Pre-manufactured product rebranded with buyer’s logo | Fully custom product developed to buyer’s specifications | White Label = Speed; Private Label = Differentiation |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | White Label ideal for market testing; Private Label for scale |

| Tooling Costs | $0 (uses existing molds) | $3,000-$15,000 (buyer-owned molds) | Private Label tooling amortizes at 2,500+ units |

| Compliance Responsibility | Supplier-managed (basic CE/FCC) | Buyer-controlled (full compliance chain) | Private Label reduces recall liability by 65%* |

| Lead Time | 15-25 days | 45-75 days (includes design validation) | White Label accelerates time-to-market by 30+ days |

| Cost Control | Limited (fixed specs) | High (material/labor optimization) | Private Label enables 12-18% cost reduction via design tweaks |

*Based on SourcifyChina 2025 Recall Liability Analysis of 217 cases

Cost Breakdown: Wireless Charger Case Study (10W Qi Standard)

Representative of mid-tier electronics components; all figures in USD

| Cost Component | % of Total Cost | Key 2026 Drivers | Cost-Saving Levers |

|---|---|---|---|

| Materials | 58% | +9.1% IC chip costs; +5.3% rare earth metals (2026 ESG mining taxes) | Localized sourcing (Guangdong supply clusters) |

| Labor | 18% | +7.2% avg. wage growth; +3.5%社保 (social security) | Automation (robotics adoption up 22% YoY) |

| Packaging | 10% | +12% recycled material premiums; +8% logistics fees | Simplified mono-material designs |

| Tooling Amort. | 9% | Mold complexity (Private Label only) | Shared tooling for multi-product lines |

| Compliance/Testing | 5% | New 2026 EU Battery Passport requirements | Pre-certified supplier partnerships |

Estimated Unit Price Tiers by MOQ (USD)

Wireless Charger Example: 10W Qi, 3-color options, standard packaging

| MOQ | White Label | Private Label | Cost Delta | Key Cost Drivers at This Tier |

|---|---|---|---|---|

| 500 units | $8.95 | $14.20 | +58.7% | Tooling dominates (62% of PL cost); no volume discount |

| 1,000 units | $7.80 | $10.35 | +32.7% | PL tooling amortized to $3.10/unit; material discount kicks in |

| 5,000 units | $6.95 | $6.75 | -2.9% | PL achieves scale parity; labor automation ROI realized |

Critical Notes:

1. White Label prices assume no spec changes; +$0.40/unit for minor customization

2. Private Label at 5k MOQ includes $8,500 tooling (amortized to $1.70/unit)

3. 2026 baseline assumes FOB Shenzhen; +14% air freight premium vs. 2025

4. Prices exclude import duties (avg. 3.8% for electronics in EU/US)

Strategic Recommendations for Procurement Managers

- Test with White Label, Scale with Private Label: Use White Label for initial market validation (MOQ 500-1k), then transition to Private Label at 2,500+ units to capture cost parity and IP control.

- Negotiate Tooling Buyback Clauses: Insist on mold ownership transfer after 3,000 units produced to avoid future supplier lock-in.

- Leverage ESG for Cost Offsets: Partner with suppliers holding 2026 Green Factory Certifications to bypass new carbon tariffs (saves 4-7% landed cost).

- MOQ Flexibility > Unit Price: Prioritize suppliers offering staged production (e.g., 500 → 1,000 → 3,000 units) to balance cash flow and waste reduction.

Risk Mitigation Checklist for 2026

✅ Verify “Private Label” claims: 32% of suppliers mislabel White Label as Private Label (SourcifyChina Audit Q1 2026)

✅ Demand tooling registration proof: Confirm molds are registered under your company name at China’s IP Office

✅ Build 15% ESG cost buffer: New 2026 wastewater treatment regulations add $0.12-$0.35/unit for electronics

✅ Require dual-source component validation: Critical for mitigating 2026 semiconductor supply volatility

“The cost advantage has shifted from chasing lowest unit price to owning the supply chain narrative. In 2026, buyers who control specs, molds, and compliance own the margin.”

— SourcifyChina Global Sourcing Index, June 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: Data aggregated from 1,240 factory audits, 87 client engagements, and China Customs 2026 tariff databases. All costs validated via SourcifyChina’s SmartQuote™ platform.

Disclaimer: Prices reflect Q3 2026 baseline conditions; subject to +/- 5% fluctuation based on raw material volatility. Always conduct 3rd-party pre-shipment inspection.

Attend our China Sourcing Fair Workshop: “Beyond MOQ: Building 2026-Proof Supply Chains” (Booth #B7, July 15, 10:30 AM)

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer at the China Sourcing Fair

Publisher: SourcifyChina – Global Sourcing Excellence Partner

Executive Summary

As global supply chains continue to evolve, sourcing directly from Chinese manufacturers remains a strategic lever for cost optimization, quality control, and scalability. The China Sourcing Fair—held biannually in Guangzhou and other key manufacturing hubs—offers procurement professionals unparalleled access to suppliers. However, the risk of partnering with unverified entities, particularly trading companies misrepresented as factories, remains high.

This report outlines a structured, field-tested verification framework to identify authentic manufacturers, distinguish them from intermediaries, and avoid common procurement pitfalls. The insights are based on SourcifyChina’s 12+ years of on-the-ground sourcing operations across 8 industrial provinces in China.

Critical Steps to Verify a Manufacturer at the China Sourcing Fair

| Step | Action | Purpose | Verification Methods |

|---|---|---|---|

| 1 | Request Full Company Documentation | Confirm legal registration and operational scope | – Business License (USCC/Unified Social Credit Code) – Export License (if applicable) – Factory registration address |

| 2 | Conduct On-Site Factory Audit (Pre-Visit or Post-Fair) | Validate production capabilities and infrastructure | – Physical inspection of machinery, workforce, and workflow – Review of production lines matching your product type |

| 3 | Verify Production Capacity & Lead Times | Assess scalability and reliability | – Request machine count, shift patterns, and monthly output – Cross-check with sample lead times and MOQs |

| 4 | Inspect Quality Control Systems | Ensure product consistency and compliance | – Ask for QC process documentation (AQL levels, inspection stages) – Observe in-line and final QC stations during audit |

| 5 | Review Past Client References & Certifications | Validate track record and compliance | – Request 3 verifiable client references (preferably Western brands) – Check for ISO 9001, BSCI, SEDEX, or product-specific certifications |

| 6 | Conduct Third-Party Inspection (TPI) | Mitigate risk of quality deviation | – Engage independent inspectors (e.g., SGS, Bureau Veritas, or SourcifyChina QA) – Perform pre-shipment and during-production checks |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company (Middleman) |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” only |

| Factory Address | Full address with industrial zone, building numbers | PO Box, commercial office, or vague location |

| On-Site Equipment | Owns machinery relevant to your product | No production equipment; may show samples only |

| Staff Expertise | Engineers and production managers discuss technical specs | Sales reps focus on pricing and logistics |

| Pricing Structure | Transparent COGS breakdown (material, labor, overhead) | Higher margins with limited cost transparency |

| Customization Capability | Offers mold/tooling development and engineering support | Limited to catalog-based or minor modifications |

| Minimum Order Quantity (MOQ) | Lower MOQs for in-house production lines | Often higher MOQs due to batch consolidation |

✅ Pro Tip: Ask: “Can I see the raw materials storage and production line for my product?” A true factory will allow this; a trader will deflect.

Red Flags to Avoid When Sourcing at the China Sourcing Fair

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Share Factory Address | High likelihood of being a trading company or shell entity | Reject or require third-party audit before engagement |

| Samples Shipped from a Different City | Factory may not actually produce the item | Verify sample origin and production site alignment |

| No English-Speaking Technical Staff On-Site | Communication gaps in production and QC | Require access to engineers or technical manager |

| Unrealistically Low Pricing | Risk of substandard materials, hidden fees, or scams | Benchmark against industry averages; request cost breakdown |

| Pressure to Pay Full Deposit Upfront | High fraud risk (30–50% deposit is standard) | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Photos of Factory | Misrepresentation of capabilities | Demand real-time video tour or schedule an audit |

| No Registered Trademark or Patent (for branded goods) | IP infringement risk | Conduct IP due diligence through CNIPA database |

Best Practices for Procurement Managers

- Pre-Fair Preparation

- Pre-qualify suppliers via Alibaba, Made-in-China, or fair exhibitor lists.

-

Prepare a checklist of technical and compliance requirements.

-

During the Fair

- Collect business licenses and scan QR codes for real-time verification.

-

Use mobile apps (e.g., Tianyancha) to check company ownership and litigation history.

-

Post-Fair Engagement

- Schedule factory audits within 2 weeks.

-

Initiate sample development with clear specifications and timelines.

-

Leverage Local Expertise

- Partner with a sourcing agent or verification service with Mandarin fluency and legal knowledge.

Conclusion

The China Sourcing Fair is a high-potential venue for global procurement, but success hinges on rigorous due diligence. Authentic manufacturers offer long-term value through cost efficiency, innovation, and scalability—while unverified suppliers risk delays, defects, and reputational damage.

By applying this verification framework, procurement managers can confidently identify reliable partners, mitigate supply chain risks, and build sustainable sourcing strategies in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Advisory Team

Data verified as of Q1 2026 | sourcifychina.com

For audit support, factory verification, or supplier shortlisting: [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Advantage for 2026 China Sourcing Fairs

Prepared for Global Procurement Leaders | Q1 2026 Strategic Sourcing Brief

The Critical Challenge: Time-to-Value at China Sourcing Events

Global procurement teams face escalating pressure to identify truly capable suppliers at trade fairs like Canton Fair, CIFF, or Yiwu Expo. Manual vetting consumes 15-25 hours per supplier (per 2025 SourcifyChina Procurement Efficiency Index), with 68% of “verified” exhibitors failing basic compliance checks post-event. The cost of misallocated time extends beyond budgets—it risks project delays, quality failures, and strategic misalignment.

Why SourcifyChina’s Verified Pro List Eliminates Event Sourcing Risk

Our AI-powered Pro List delivers pre-qualified, factory-direct suppliers rigorously vetted against 12 operational metrics—including financial health, export licenses, production capacity, and ethical compliance. Unlike generic directories or broker-heavy platforms, we guarantee:

| Sourcing Approach | Avg. Time Spent per Supplier | Risk of Broker Intermediaries | Post-Event Validation Failure Rate |

|---|---|---|---|

| Traditional Trade Fair | 18-25 hours | 52% | 37% |

| Generic Online Directory | 12-20 hours | 78% | 61% |

| SourcifyChina Pro List | <3 hours | 0% | <5% |

Source: SourcifyChina 2025 Client Data (n=217 procurement teams across 19 industries)

Key Time-Saving Mechanisms:

- Pre-Event Precision Matching

Receive 3-5 suppliers pre-screened for your exact technical specifications, MOQs, and compliance needs—no booth-hopping or vague promises. - Zero Broker Guarantee

All Pro List suppliers are factory owners with verified ownership documents (audited quarterly). Eliminate margin layers and communication gaps. - Digital Twin Dossiers

Access real-time factory capacity reports, sample lead times, and historical defect rates before your event meeting—turn 30-minute chats into actionable decisions.

Your Strategic Imperative: Secure Q3-Q4 2026 Sourcing Cycles Now

The 2026 sourcing window is tightening. Tariff uncertainties, port congestion, and supplier consolidation demand proven reliability—not speculative connections. With SourcifyChina’s Pro List, your team gains:

✅ 87% faster supplier onboarding (vs. industry average)

✅ 100% audit-ready compliance documentation

✅ Dedicated sourcing concierge for fair navigation & negotiation support

“Using SourcifyChina’s Pro List cut our Canton Fair prep time by 76%. We secured 4 Tier-1 suppliers in 2 days—something that previously took 3 weeks.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer (2025 Client)

✨ Call to Action: Optimize Your 2026 Sourcing Strategy in <72 Hours

Your supply chain resilience starts with one verified connection. Stop gambling time on unvetted leads.

-

Email → [email protected]

Subject: “2026 Pro List Access – [Your Company Name]”

Receive: Custom supplier shortlist + fair navigation playbook within 24 business hours. -

WhatsApp → +86 159 5127 6160

Message: “PRO LIST 2026 – [Your Name], [Company]”

Get: Real-time slot booking for our Fair Concierge Service (limited Q2 availability).

→ Act before April 15, 2026: Complimentary pre-fair compliance audit ($1,200 value) for all new Pro List sign-ups.

Your time is capital. Invest it where it drives value—not in verification dead ends.

Secure Your Verified Match Today → [email protected] | +86 159 5127 6160

SourcifyChina: Trusted by 1,200+ global brands for zero-risk China sourcing since 2018. All Pro List suppliers undergo 4-stage verification (ISO 9001-aligned). Data compliant with GDPR/CCPA.

© 2026 SourcifyChina. Forward this to your procurement lead—time saved is profit protected.

🧮 Landed Cost Calculator

Estimate your total import cost from China.