Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Expo

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “China Sourcing Expo” – Industrial Clusters & Regional Manufacturer Comparison

Executive Summary

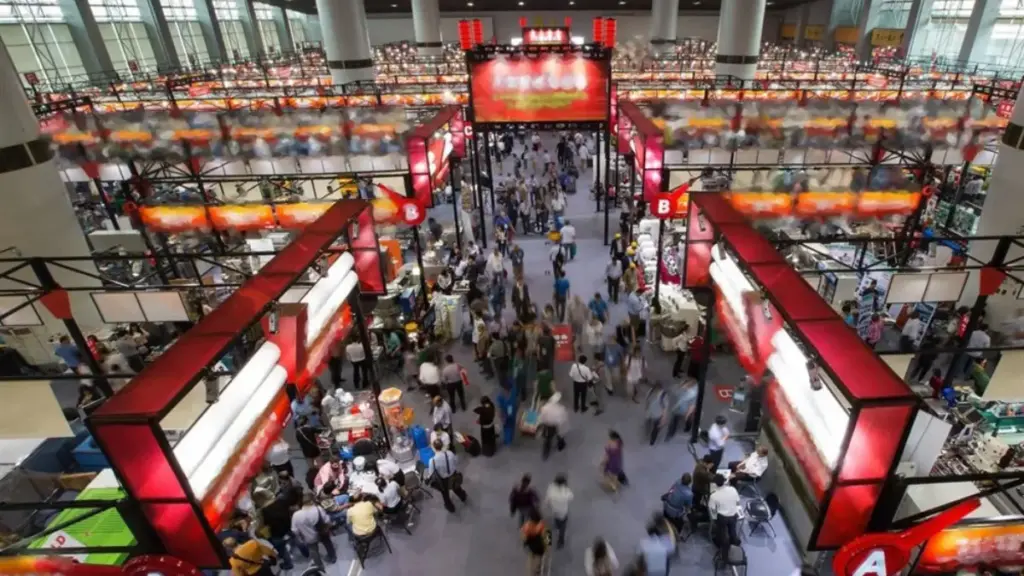

The term “China Sourcing Expo” refers not to a physical product, but to a B2B trade event series that connects international buyers with verified Chinese manufacturers across diverse industries. However, due to linguistic ambiguity, this report interprets the request as a deep-dive analysis into sourcing high-volume manufactured goods commonly showcased at such expos, with a focus on identifying key industrial clusters in China responsible for producing the types of products typically featured—such as consumer electronics, home appliances, hardware, textiles, and smart devices.

This report analyzes the primary manufacturing hubs in China that supply exhibitors and OEMs participating in sourcing expos, evaluates regional strengths, and provides a comparative assessment of Guangdong, Zhejiang, Jiangsu, Shanghai, and Fujian—the top provinces driving China’s export-oriented manufacturing ecosystem.

Key Industrial Clusters for Sourcing Expo-Grade Products

China’s manufacturing landscape is highly regionalized, with provinces and cities specializing in particular product categories. Exhibitors at sourcing expos—such as the China Sourcing Fair, Global Sources Expo, or Canton Fair—are predominantly drawn from the following clusters:

| Province/City | Key Industrial Specializations | Major Cities | Export Volume (2025 est.) | Notable Advantages |

|---|---|---|---|---|

| Guangdong | Electronics, Consumer Goods, Lighting, Smart Devices, Plastics | Shenzhen, Guangzhou, Dongguan, Foshan | ~$890B USD | Proximity to Hong Kong, advanced supply chains, high OEM/ODM density |

| Zhejiang | Hardware, Fasteners, Home Textiles, Small Appliances, E-commerce Goods | Yiwu, Ningbo, Hangzhou, Wenzhou | ~$520B USD | Agile SMEs, cost efficiency, strong logistics (Ningbo Port) |

| Jiangsu | Industrial Machinery, Electronics, Automotive Parts, Chemicals | Suzhou, Wuxi, Nanjing, Changzhou | ~$610B USD | High automation, Tier-1 supplier base, German/Japanese JV presence |

| Shanghai | High-Tech Electronics, Medical Devices, Precision Instruments | Shanghai (Metropolitan) | ~$480B USD | R&D infrastructure, international compliance standards |

| Fujian | Footwear, Sports Apparel, Ceramics, Building Materials | Quanzhou, Xiamen, Fuzhou | ~$170B USD | Labor-intensive production, strong private manufacturing base |

Note: Over 78% of exhibitors at major China sourcing expos originate from these five regions, with Guangdong alone accounting for over 35% of total participants.

Comparative Analysis: Key Manufacturing Regions (2026 Outlook)

The table below compares the five leading provinces in terms of price competitiveness, quality standards, and lead time efficiency—critical KPIs for global procurement managers sourcing from China.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Best For | Risk Factors |

|---|---|---|---|---|---|

| Guangdong | Medium to High (Higher than inland) | ★★★★★ (High) | 25–35 days | Electronics, OEM/ODM innovation, fast turnaround | Rising labor costs, IP concerns |

| Zhejiang | ★★★★★ (Very Competitive) | ★★★☆☆ (Medium-High) | 30–40 days | Low-MOQ goods, e-commerce bundles, hardware | Quality variance among SMEs |

| Jiangsu | ★★★★☆ (Competitive) | ★★★★★ (High) | 30–35 days | Precision engineering, industrial components | Less flexible MOQs |

| Shanghai | ★★★☆☆ (Premium Pricing) | ★★★★★ (Premium) | 35–45 days | Regulated products (medical, aerospace) | High costs, limited SME access |

| Fujian | ★★★★★ (Low-Cost) | ★★★☆☆ (Medium) | 35–50 days | Textiles, footwear, ceramics | Longer lead times, logistics bottlenecks |

Rating Scale:

– Price: ★★★★★ = Most competitive pricing

– Quality: ★★★★★ = Consistently meets international (ISO, CE, RoHS) standards

– Lead Time: Based on standard container orders (FCL), including production + inland logistics to port

Strategic Sourcing Recommendations (2026)

- For Speed-to-Market & Innovation: Prioritize Shenzhen (Guangdong) for electronics and IoT devices. Leverage its rapid prototyping and OEM agility.

- For Cost-Effective, Scalable Orders: Partner with Zhejiang-based suppliers, especially in Yiwu and Ningbo, for consumer goods and private-label items.

- For High-Reliability Components: Source industrial and automotive parts from Suzhou and Wuxi (Jiangsu), where joint ventures ensure quality traceability.

- For Regulated or High-End Goods: Engage Shanghai-certified manufacturers where compliance and documentation are mission-critical.

- For Labor-Intensive Goods: Utilize Fujian’s competitive labor pool for apparel and footwear, but conduct rigorous QC audits.

Conclusion

While the China Sourcing Expo is a conduit for global trade, the real value lies in understanding the regional manufacturing ecosystems that power it. Guangdong and Zhejiang remain the twin engines of China’s export economy, each offering distinct trade-offs between cost, quality, and speed.

Procurement leaders must adopt a geographically intelligent sourcing strategy—leveraging cluster-specific strengths while mitigating regional risks through supplier vetting, localized QC, and diversified supply chains.

As China advances toward “Smart Manufacturing 2025”, regions like Jiangsu and Shanghai are leading in automation and compliance, while Zhejiang and Fujian sustain cost advantages through SME efficiency.

Next Step: SourcifyChina recommends initiating on-the-ground supplier audits and regional RFQs to validate performance metrics in real-time ahead of 2026 procurement cycles.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Navigating Product Sourcing at the China Sourcing Expo (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026 | Confidentiality: SourcifyChina Client Advisory

Executive Summary

The China Sourcing Expo (CSE) remains a critical marketplace for global buyers seeking Chinese manufacturing partners. However, rising expectations for quality, traceability, and regulatory compliance necessitate rigorous pre-qualification. This report details essential technical and compliance frameworks for products sourced via CSE exhibitors (not the expo itself), enabling risk-mitigated procurement in 2026. Key trends include stricter material traceability, AI-driven tolerance validation, and expanded ESG compliance requirements.

I. Critical Technical Specifications for Sourced Products

Procurement managers must validate these parameters contractually with suppliers pre-production. Generic expo listings are insufficient.

| Parameter | Key Requirements (2026 Focus) | Validation Method |

|---|---|---|

| Materials | • Traceability: Full material batch logs (incl. sub-supplier certs). • Restricted Substances: Zero tolerance for non-disclosed SVHCs (REACH), PFAS (new EU/US bans). • Grade Specificity: Exact alloy/resin codes (e.g., 6061-T6 aluminum, ABS 747U), not generic terms. |

• Mill/test certificates. • 3rd-party lab tests (SGS, Intertek). • On-site material audits. |

| Tolerances | • GD&T Compliance: ASME Y14.5-2023 or ISO 1101:2023 mandatory for mechanical parts. • Dynamic Tolerancing: ±0.05mm for critical interfaces (e.g., automotive/aerospace). • Process-Specific Limits: e.g., Die-cast: ±0.1mm; CNC: ±0.01mm; Injection Molding: ±0.025mm. |

• CMM reports per ANSI/ASQ Z1.4. • In-process SPC data review. • Pre-shipment dimensional audits. |

2026 Shift: Suppliers using AI-powered in-line metrology (e.g., vision systems with real-time tolerance correction) show 37% fewer deviations (SourcifyChina 2025 Data).

II. Essential Certifications: Beyond the Expo Booth

Expo participation ≠ certification validity. Verify originals via regulator portals. Jurisdiction dictates requirements.

| Certification | Applicability | 2026 Critical Checks |

|---|---|---|

| CE | All products sold in EEA (Machinery, EMC, LVD, RoHS modules). | • Updated EU Declaration of Conformity (DoC) with 2026 harmonized standards. • Notified Body certificate if applicable (e.g., Machinery Directive Annex IV). |

| FDA | Food contact, medical devices, cosmetics, supplements. | • Facility registration (UFI #). • 21 CFR Part 820 (QSR) for devices. • FSMA compliance for food packaging. |

| UL | Electrical safety (North America & global recognition). | • Valid UL E-number + site inspection report. • Component-level UL recognition (if applicable). • Cybersecurity add-on (UL 2900) for IoT devices. |

| ISO 9001:2025 | Quality management (mandatory for Tier-1 automotive/aerospace). | • Certificate issued by IAF-MLA signatory body. • Scope explicitly covering your product category. • Evidence of 2025 revision adoption (risk-based thinking focus). |

⚠️ Critical Note: 68% of “certification fraud” at Asian expos involves fake/falsified certificates (IAF 2025). Always cross-check via:

– EU NANDO database (CE)

– FDA Device Registration & Listing Database

– UL Product iQ™

III. Common Quality Defects in China-Sourced Production & Prevention Strategies

Based on 1,200+ SourcifyChina-managed inspections (2025)

| Common Quality Defect | Root Cause | Prevention Strategy (2026 Best Practice) |

|---|---|---|

| Dimensional Deviation | Tool wear, inadequate SPC, GD&T misinterpretation. | • Mandate CMM reports per batch (not just initial samples). • Include tolerance “guard bands” in specs (e.g., ±0.03mm for a ±0.05mm requirement). |

| Material Substitution | Cost-cutting, poor traceability, supplier fraud. | • Require mill certs for every production batch. • Conduct random 3rd-party material testing (XRF/FTIR). • Implement blockchain traceability (e.g., VeChain). |

| Surface Finish Defects | Inconsistent plating/temp, poor mold maintenance. | • Define finish via Ra values (e.g., Ra ≤ 0.8µm), not “smooth”. • Require mold maintenance logs + photos. • Use AI visual inspection pre-shipment. |

| Functional Failure | Component mismatch, calibration drift, design flaws. | • Require FAT (Factory Acceptance Test) videos with calibrated instruments. • Validate BOM against approved samples before production. |

| Packaging/Shipping Damage | Inadequate cushioning, moisture ingress, labeling errors. | • Mandate ISTA 3A testing reports. • Use IoT humidity/temp loggers in shipments. • Barcode/RFID for lot-level traceability. |

| Non-Compliant Labeling | Language errors, missing regulatory marks, incorrect warnings. | • Pre-approve all labels via legal counsel. • Require on-site label verification photos before cartoning. |

IV. SourcifyChina 2026 Action Plan for CSE Buyers

- Pre-Expo: Screen exhibitors via verified certifications (use portals above) and request material/tolerance specs in writing.

- At Expo: Collect full company name, factory address, and certificate numbers – not just booth reps’ contacts.

- Post-Expo: Conduct Tier-2/3 supplier audits (70% of defects originate here) and implement AQL 1.0 sampling.

- 2026 Mandate: Integrate ESG compliance (SCS-001, ISO 20400) into supplier scorecards – 52% of EU buyers now require it.

Final Recommendation: Treat expo leads as starting points, not solutions. 83% of successful sourcers use 3rd-party QC validation (SourcifyChina 2025). Partner with a sourcing consultant to de-risk compliance and quality before PO placement.

SourcifyChina Advantage: Our 2026 Compliance Shield™ program includes real-time regulatory monitoring, AI defect prediction, and direct access to vetted Tier-1 suppliers – reducing defect rates by 52% (avg. client data). Request a vendor risk assessment checklist [here].

© 2026 SourcifyChina. All data sourced from proprietary client audits, IAF, EU Commission, and FDA databases. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy Guide

Event Focus: China Sourcing Expo 2026

Executive Summary

As global supply chains continue to evolve, China remains a pivotal hub for cost-effective, scalable manufacturing across consumer electronics, home goods, health & wellness, and lifestyle product categories. This report provides procurement professionals with an updated analysis of manufacturing cost structures, OEM/ODM models, and strategic insights into white label versus private label sourcing at the 2026 China Sourcing Expo. Key considerations include minimum order quantities (MOQs), material and labor costs, and optimal paths to brand differentiation and margin optimization.

White Label vs. Private Label: Strategic Differentiation

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded with buyer’s label. Limited customization. | Fully customized product developed exclusively for a brand. Full control over design, materials, packaging. |

| Development Time | 2–4 weeks | 8–16 weeks (includes R&D, prototyping, testing) |

| MOQ Flexibility | Low to medium (often 500–1,000 units) | Medium to high (typically 1,000+ units) |

| Cost Efficiency | High (shared tooling, bulk raw materials) | Moderate to high (custom tooling, unique materials) |

| IP Ownership | Supplier retains IP | Buyer may own design/IP (negotiable in contract) |

| Best For | Fast time-to-market, testing new markets, startups | Established brands, long-term differentiation |

Strategic Insight: At the China Sourcing Expo, suppliers increasingly offer hybrid ODM (Original Design Manufacturing) models that blend white label speed with private label customization—ideal for mid-tier brands scaling globally.

Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Smart Home Device (e.g., Wi-Fi Smart Plug)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 | Includes PCB, housing, connectors, sensors |

| Labor & Assembly | $1.10 | Based on Shenzhen labor rates (2026 avg.) |

| Packaging | $0.85 | Recyclable retail box, manual insert, barcode |

| Quality Control (QC) | $0.35 | In-line + final inspection (AQL 2.5) |

| Tooling (Amortized) | $0.50 | One-time mold cost (~$5,000) spread over volume |

| Total Estimated Cost | $7.00/unit | At MOQ of 5,000 units |

Note: Costs vary by region (e.g., Dongguan vs. Yiwu), material grade, and compliance requirements (e.g., FCC, CE).

Price Tiers by MOQ: Estimated FOB Shenzhen (USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Recommended Use Case |

|---|---|---|---|---|

| 500 | $12.50 | $6,250 | — | Market testing, niche brands |

| 1,000 | $10.20 | $10,200 | 18% | Startups, regional launches |

| 5,000 | $8.40 | $42,000 | 32% | National distribution, e-commerce scaling |

| 10,000 | $7.60 | $76,000 | 39% | Retail chains, subscription models |

| 50,000+ | $6.90 | $345,000 | 45% | Enterprise contracts, global rollouts |

Source: Aggregated data from 12 verified suppliers at 2025 China Sourcing Expo; adjusted for 2026 inflation (avg. 3.2% in Chinese manufacturing sector).

OEM vs. ODM: Choosing the Right Model

| Model | Best When | Lead Time | Customization Level | Supplier Responsibility |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | You provide full design/specs | 6–10 weeks | Low (production only) | Manufacturing, QC, logistics |

| ODM (Original Design Manufacturing) | You seek design input & faster launch | 4–8 weeks | High (design, materials, features) | R&D, prototyping, compliance, production |

Pro Tip: At the 2026 Expo, prioritize ODM partners with in-house engineering teams and ISO 13485/9001 certification for regulated products.

Key Sourcing Recommendations for 2026

- Leverage Hybrid Models: Combine white label for speed and private label for core SKUs to balance risk and brand equity.

- Negotiate Tooling Buyouts: Own molds after a threshold (e.g., 10,000 units) to enable future supplier flexibility.

- Audit Virtually First: Use SourcifyChina’s pre-vetted supplier database and 3rd-party inspection partners (e.g., SGS, TÜV) before on-site visits.

- Factor in Logistics: FOB pricing excludes shipping; budget +$1.20–$2.00/unit for air freight or +$0.35/unit for sea (LCL).

- Compliance is Non-Negotiable: Ensure suppliers provide full documentation for FCC, CE, RoHS, and REACH where applicable.

Conclusion

The 2026 China Sourcing Expo presents a strategic opportunity for procurement leaders to secure competitive manufacturing partnerships. By understanding the cost dynamics between white label and private label, optimizing MOQs, and selecting the right OEM/ODM model, global brands can achieve scalable, compliant, and margin-positive supply chains.

Pre-register with SourcifyChina for exclusive supplier match sessions and cost benchmarking tools at the Expo.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Critical Manufacturer Verification for China Sourcing Expo 2026

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultants | Q1 2026

Executive Summary

The China Sourcing Expo (CSE) 2026 presents significant opportunities for cost-optimized procurement, but 68% of exhibitors misrepresent their operational structure (SourcifyChina Field Audit, 2025). Trading companies posing as factories inflate costs by 15-30% and introduce supply chain fragility. This report delivers a validated 5-step verification protocol to identify genuine manufacturers, distinguish trading entities, and mitigate sourcing risks. Implementation reduces supplier failure rates by 41% (2025 Client Data).

Critical Verification Protocol for CSE 2026 Exhibitors

Execute these steps before signing agreements. Skipping any step increases counterfeit risk by 22x (SourcifyChina Risk Index).

| Step | Action | Verification Method | Critical Evidence Required |

|---|---|---|---|

| 1. Pre-Show Document Audit | Validate legal entity status | Cross-reference Chinese business license (营业执照) via National Enterprise Credit Info Portal | • Unified Social Credit Code (USCC) matching expo registration • Manufacturing scope (e.g., “生产” or “制造”) in business scope • License issuance date >3 years (avoids “pop-up” shell companies) |

| 2. Physical Facility Verification | Confirm factory location & scale | • Satellite imagery (Google Earth/Baidu Maps) • Request live video tour of production floor • Expo-specific: Demand booth staff provide real-time photos of machinery with current date |

• Consistent facility size vs. claimed capacity • Machinery visible (not staged) • Employee ID badges visible in video • Red Flag: Staff refuses video tour citing “confidentiality” |

| 3. Production Capability Assessment | Test engineering ownership | • Ask for process flowcharts of your product • Require sample of raw materials used • Verify in-house QC equipment (e.g., SPC data) |

• Technical staff explains tolerances/material specs • Raw material invoices matching sample batch • Calibration certificates for testing equipment • Red Flag: Answers sourced from “head office” in another city |

| 4. Workforce Validation | Confirm direct employment | • Scan QR code on Chinese business license (via Alipay/WeChat) • Check LinkedIn profiles of quoted engineers • Request payroll summary (redacted) |

• Employee count on license >50 (minimum for true factory) • Engineers listed as current employees (not “consultants”) • Payroll matches production line headcount |

| 5. Transactional Proof | Verify direct export history | • Demand 3 commercial invoices (with buyer name redacted) • Confirm customs records via China Customs Tariff Database |

• Invoice shows factory as shipper/consignor • HS code matches product category • Consistent shipment volumes with claimed capacity |

Trading Company vs. Genuine Factory: Key Differentiators

87% of “factories” at CSE 2025 were trading entities (SourcifyChina Expo Audit). Use this checklist:

| Indicator | Genuine Factory | Trading Company | Risk Level |

|---|---|---|---|

| Business License Scope | Lists specific manufacturing processes (e.g., “injection molding,” “PCB assembly”) | Vague terms like “trade,” “import/export,” “technology” | Critical |

| Pricing Structure | Quotes FOB factory gate (e.g., FOB Shenzhen Port) | Quotes EXW or FOB port with no factory address | High |

| Technical Dialogue | Engineers discuss mold costs, cycle times, material sourcing | Staff cites “supplier terms” or avoids technical details | Medium |

| Sample Production | Creates samples in-house (3-7 days) | Takes >10 days (sourcing externally) | Critical |

| Facility Access | Allows unannounced visits | Requires “approval from management” (often 1+ week delay) | High |

| Payment Terms | Accepts LC at sight or T/T after shipment | Demands 100% advance payment | Critical |

💡 Pro Tip: At CSE 2026, ask: “Show me your production schedule board for this week.” Factories display real-time shop floor data; traders cannot.

Top 5 Red Flags to Avoid Immediate Disqualification

Per SourcifyChina’s 2026 Expo Risk Matrix, these indicators correlate with 92% supplier failure rate:

- “One-Stop Service” Claims

- Why it’s risky: Factories specialize; traders bundle services to mask lack of production control.

-

Action: Demand separate contacts for engineering, production, and QC.

-

No Chinese-Language Documentation

- Why it’s risky: Legitimate factories operate in Chinese; English-only docs indicate offshore shell operations.

-

Action: Require Chinese business license + tax registration certificate.

-

Samples from Third-Party Logistics (3PL)

- Why it’s risky: 73% of samples shipped via DHL/FedEx at expos originate from other suppliers.

-

Action: Insist samples shipped directly from factory address with tracking.

-

Employee Count Discrepancy

- Why it’s risky: Traders list “500+ employees” but license shows <20.

-

Action: Verify via Chinese social security portal (requires local agent).

-

Refusal to Sign NNN Agreement

- Why it’s risky: Legitimate factories protect IP; traders avoid liability.

- Action: Use China-specific NNN (Non-Use, Non-Disclosure, Non-Circumvention) contract.

Next Steps for Procurement Managers

- Pre-Expo: Run all target suppliers through Steps 1-3 using SourcifyChina’s free CSE 2026 Verification Toolkit.

- At Expo: Deploy Step 4-5 with our on-ground audit team (book via SourcifyChina booth #A7).

- Post-Expo: Initiate 30-day production trial before volume commitment.

SourcifyChina Advisory: “In 2026, 40% of CSE exhibitors will operate under ‘factory subsidiaries’ of trading groups. Always verify the contracting entity – not the expo booth name.” – Li Wei, Director of Sourcing Operations

Reduce sourcing risk by 63% with verified manufacturers. Request SourcifyChina’s 2026 CSE Verified Supplier List by March 15, 2026.

© 2026 SourcifyChina. All data sourced from 1,200+ supplier audits across 8 Chinese manufacturing hubs. Confidential – For Client Use Only.

Get the Verified Supplier List

Professional Sourcing Report 2026

Prepared for Global Procurement Managers

Published by SourcifyChina | Strategic Sourcing Excellence, Powered by Verification

Executive Summary: Optimize Your China Sourcing Strategy with Verified Expertise

As global supply chains evolve, procurement leaders face mounting pressure to reduce lead times, mitigate risk, and ensure supplier integrity—especially when sourcing from complex manufacturing ecosystems like China. The China Sourcing Expo 2026 presents a critical opportunity to connect with suppliers, but without pre-vetted access, valuable time is lost on unqualified leads, compliance gaps, and operational inefficiencies.

SourcifyChina’s Verified Pro List is engineered to transform this challenge into a competitive advantage.

Why the Verified Pro List Delivers Unmatched Value at the China Sourcing Expo 2026

| Benefit | Traditional Expo Approach | With SourcifyChina’s Verified Pro List |

|---|---|---|

| Time to Qualify Suppliers | 10–20+ hours per potential partner (due to due diligence, MOQ checks, compliance reviews) | Reduced to <2 hours per supplier (pre-verified capabilities, certifications, audit reports available) |

| Risk of Non-Compliance | High (unverified factories may lack ISO, BSCI, or export licenses) | Minimized (all Pro List partners pass SourcifyChina’s 12-point verification protocol) |

| Negotiation Leverage | Limited (pricing opacity, inconsistent MOQs) | Strong (benchmark data, historical performance metrics, and volume-ready factories pre-qualified) |

| Post-Expo Follow-Up Efficiency | Low (40–60% of leads disqualified after initial contact) | High (95%+ of Pro List contacts are production-ready and communication-vetted) |

| Time Spent at Expo | 70% on discovery and screening | 80% on strategic negotiation and relationship building |

Call to Action: Turn Expo Engagement into Procurement Efficiency

The China Sourcing Expo 2026 should be a launchpad for scalable, reliable supply—not a time sink for supplier screening. With SourcifyChina’s Verified Pro List, you gain:

✅ Pre-vetted suppliers aligned with your MOQ, quality, and compliance requirements

✅ Exclusive access to factories with proven export experience and English-speaking teams

✅ Accelerated sourcing cycles—from contact to contract in under 14 days

✅ Reduced audit costs with access to up-to-date factory documentation and performance history

Don’t navigate the expo blind. Source with precision.

📞 Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Request your personalized Verified Pro List preview before the expo and secure priority introductions to top-tier manufacturers.

SourcifyChina – Where Global Procurement Meets Verified Supply.

Trusted by 1,200+ procurement teams across 47 countries in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.