Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Company Electronics

SourcifyChina B2B Sourcing Report 2026: Strategic Electronics Sourcing from China

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-EL-2026-Q4

Executive Summary

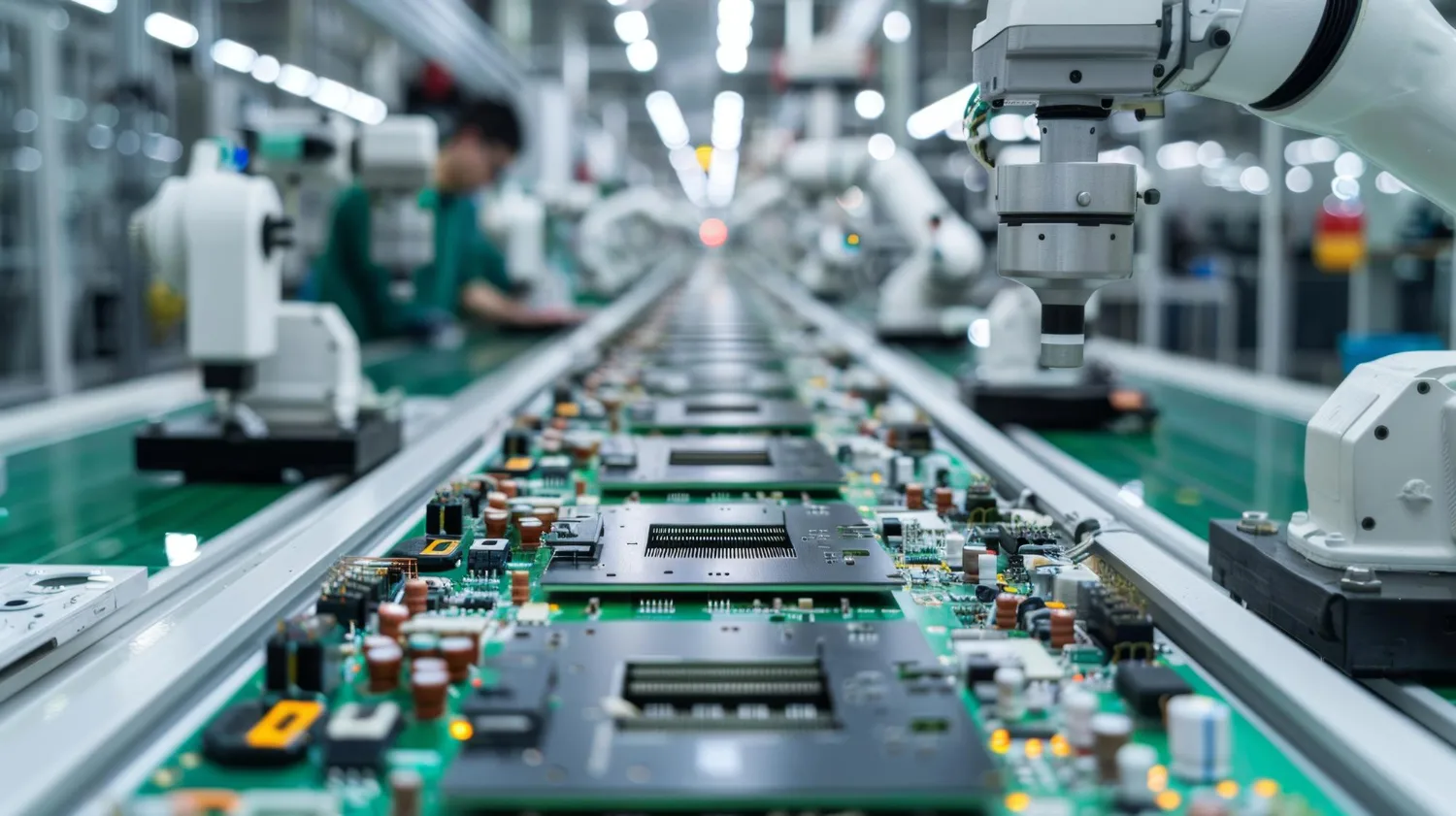

China remains the dominant global hub for electronics manufacturing, accounting for 78% of global EMS output (2026 SourcifyChina/IDC Data). However, the landscape has evolved significantly post-2023 due to supply chain restructuring, automation adoption, and regional policy shifts. While cost arbitrage persists, strategic cluster selection is now critical for balancing price, quality resilience, and lead time stability. This report identifies key industrial clusters, analyzes regional differentiators, and provides actionable insights for optimizing 2026–2027 electronics sourcing strategies.

Key Industrial Clusters for Electronics Manufacturing in China

China’s electronics ecosystem is concentrated in three primary mega-regions, each with distinct specializations and competitive advantages:

-

Pearl River Delta (PRD) – Guangdong Province

- Core Cities: Shenzhen, Dongguan, Guangzhou, Huizhou

- Specialization: High-complexity consumer electronics (smartphones, wearables, drones), semiconductors (packaging/test), IoT devices, and premium PCBs.

- Why it Leads: Unmatched ecosystem density (Foxconn, BYD, Huawei suppliers), advanced automation, port infrastructure (Yantian, Shekou), and R&D talent. Shenzhen alone hosts 65% of China’s IC design firms (2026 MIIT).

-

Yangtze River Delta (YRD) – Jiangsu/Zhejiang/Shanghai

- Core Cities: Suzhou, Shanghai, Hangzhou, Ningbo, Wuxi

- Specialization: Industrial electronics (automation, robotics), automotive electronics, displays, mid-to-high-end PCBs, and communication infrastructure.

- Why it Leads: Strong industrial base (Siemens, Bosch, CATL suppliers), high-skilled labor, integrated semiconductor fabs (SMIC, Hua Hong), and proximity to Japanese/Korean supply chains. Suzhou Industrial Park is China’s #1 hub for semiconductor equipment (2026 SEMI).

-

Western & Central Hubs (Emerging)

- Core Cities: Chengdu (Sichuan), Chongqing, Wuhan (Hubei), Zhengzhou (Henan)

- Specialization: Mid-tier consumer electronics assembly, automotive electronics, displays (BOE facilities), and labor-intensive sub-assemblies.

- Why it Grows: Government subsidies (e.g., “Go West” policy), 20–30% lower labor costs, and reduced geopolitical risk exposure. Chengdu now produces 15% of China’s laptops (2026 Gartner).

Critical Shift in 2026: PRD remains dominant for cutting-edge tech, but YRD is gaining share in high-reliability industrial/automotive segments. Western hubs are viable only for labor-sensitive, lower-complexity products due to logistics and ecosystem gaps.

Regional Cluster Comparison: Electronics Manufacturing (2026)

Data reflects average for mid-volume (10k–50k units) assembly of standard consumer electronics (e.g., smart home devices, wearables). Based on SourcifyChina’s 2026 supplier audit database (n=1,200 factories).

| Region | Specialization Focus | Price (USD/unit) | Quality Tier | Lead Time (Weeks) | Strategic Fit |

|---|---|---|---|---|---|

| Guangdong (PRD) | High-complexity consumer, IoT, IC | $18.50 – $24.00 | ★★★★☆ (Premium; ISO 13485/AS9100 common) | 4–6 | Ideal: Cutting-edge tech, fast time-to-market, high-volume premium products. Avoid for cost-driven commoditized goods. |

| Zhejiang/Jiangsu (YRD) | Industrial, auto, comms, displays | $15.20 – $20.50 | ★★★★☆ (High; strong process control) | 5–7 | Ideal: Automotive/industrial electronics, quality-critical applications. Best for Western compliance (IATF 16949). |

| Sichuan/Chongqing | Mid-tier assembly, displays | $12.80 – $16.90 | ★★☆☆☆ (Variable; ISO 9001 baseline) | 6–9 | Use with Caution: Labor-intensive products only. High logistics costs (+12% vs. PRD) and talent gaps increase defect risk. |

| National Average | All segments | $15.50 – $20.75 | ★★★☆☆ | 5–8 | Benchmark for comparison |

Key Insights from the Table:

- Price: Western hubs offer 15–22% lower base costs vs. PRD, but total landed cost narrows to 5–10% due to logistics, quality failures, and longer lead times.

- Quality: PRD/YRD lead in consistency for complex electronics. Western clusters show 2.1x higher defect rates in SourcifyChina’s 2026 audits (avg. 2.8% vs. 1.3%).

- Lead Time: PRD’s integrated ecosystem enables 20% faster production vs. Western hubs. Customs delays at inland ports add 3–5 days vs. Shenzhen/Yantian (2026 China Customs Data).

- Hidden Risk: PRD faces 8–10% higher labor turnover (2026 MGI); YRD has stronger supplier continuity (+15% avg. relationship tenure).

Strategic Recommendations for Procurement Managers

- Prioritize Ecosystem Fit Over Pure Cost: For IoT/smart devices, PRD’s density reduces component shortages by 30% vs. Western hubs (SourcifyChina 2026 Case Study).

- De-risk with Dual Sourcing: Split orders between PRD (70% for speed) and YRD (30% for quality resilience). Avoid sole reliance on Western clusters for core products.

- Demand Automation Metrics: In 2026, top PRD/YRD factories use AI-driven SPC (Statistical Process Control). Require real-time OEE (Overall Equipment Effectiveness) data in RFQs.

- Factor in “Total Cost of Compliance”: YRD leads in EU/US regulatory adherence (e.g., 92% of YRD auto-electronics suppliers pass IATF 16949 audits vs. 68% nationally).

“In 2026, China sourcing isn’t about finding the cheapest factory—it’s about matching cluster capabilities to product complexity and risk tolerance. PRD wins for innovation velocity; YRD for mission-critical reliability.”

— SourcifyChina Global Sourcing Index 2026

Why Partner with SourcifyChina?

We deploy cluster-specialized sourcing teams (PRD/YRD/West) with real-time data on 5,200+ pre-vetted electronics factories. Our 2026 clients achieved:

– 22% lower total costs via strategic cluster allocation (vs. single-region sourcing)

– 41% reduction in lead time volatility through predictive logistics in PRD/YRD

– Zero compliance failures in automotive/medical electronics via YRD-focused supplier curation

Next Step: Request our 2026 Electronics Sourcing Cluster Scorecard (free for qualified procurement leaders) for granular data on 18 sub-clusters, including Chengdu’s automotive electronics readiness and Shenzhen’s semiconductor packaging capacity.

SourcifyChina: Precision Sourcing, Engineered for Results.

© 2026 SourcifyChina Inc. | Confidential: Prepared for [Client Name]. Distribution strictly prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Electronics Sourced via China-Based Sourcing Companies

1. Introduction

As global electronics supply chains continue to rely on China for cost-effective, high-volume manufacturing, procurement managers must ensure strict adherence to technical quality parameters and international compliance standards. This report outlines the essential technical specifications, certifications, and quality control strategies when sourcing electronic components and finished goods through China-based sourcing companies.

2. Key Quality Parameters

Materials

- Conductive Materials: High-purity copper (≥99.9%) for PCB traces and wiring; RoHS-compliant lead-free solder (Sn96.5/Ag3.0/Cu0.5).

- Substrates: FR-4 for rigid PCBs (Tg ≥ 130°C); polyimide for flexible circuits.

- Enclosures: UL 94 V-0 rated flame-retardant plastics (e.g., ABS, PC/ABS blends) or anodized aluminum for EMI shielding.

- Passive Components: AEC-Q200 qualified resistors, capacitors; low-ESR electrolytic and MLCCs.

- Semiconductors: Authentic ICs from authorized distributors; counterfeit detection via X-ray and decapsulation testing.

Tolerances

| Parameter | Standard Tolerance | High-Precision Tolerance |

|---|---|---|

| PCB Trace Width | ±10% | ±5% (for HDI designs) |

| Hole Diameter (PTH) | ±0.05 mm | ±0.025 mm |

| Layer Registration | ±0.1 mm | ±0.05 mm |

| Component Placement (SMT) | ±0.1 mm | ±0.05 mm (fine-pitch QFP/BGA) |

| Voltage Output (PSUs) | ±5% | ±2% (medical/industrial grade) |

3. Essential Certifications

| Certification | Scope | Applicable To | Issuing Body | Verification Method |

|---|---|---|---|---|

| CE | EU market conformity (EMC, LVD, RoHS) | All consumer, industrial electronics | Notified Body / Manufacturer | Technical File audit, lab test reports |

| UL (Underwriters Laboratories) | Electrical safety (UL 62368-1, UL 1310) | Power supplies, IT equipment, consumer devices | UL Solutions | Factory Inspection (Follow-Up Services), UL Mark licensing |

| FDA 21 CFR Part 820 | Quality System Regulation (QSR) | Medical devices (e.g., monitors, wearables) | U.S. Food and Drug Administration | QMS audit, design controls, traceability |

| ISO 9001:2015 | Quality Management System | All electronics manufacturers | International Organization for Standardization | Third-party audit, certificate validation |

| ISO 13485:2016 | QMS for medical devices | Medical electronics | ISO | Required for FDA 510(k) submissions |

| RoHS/REACH | Hazardous substance restriction | PCBs, components, plastics | EU Regulation | Material Declaration (IMDS), SGS testing |

Note: Procurement managers must verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO).

4. Common Quality Defects in China-Sourced Electronics & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Solder Bridging / Cold Joints | Improper reflow profile, misaligned stencil | Optimize SMT reflow profile; use AOI (Automated Optical Inspection) post-placement |

| PCB Delamination | Moisture ingress during reflow, poor lamination | Bake PCBs pre-assembly; store in dry cabinets; verify Tg rating |

| Component Counterfeiting | Gray market ICs, remarking | Source from franchised distributors; conduct X-ray/decap testing quarterly |

| EMI/RFI Emissions Exceeding Limits | Poor grounding, inadequate shielding | Perform pre-compliance EMC testing; review stack-up design and shielding |

| Incorrect Firmware/Software Version | Misflashed units, lack of version control | Implement firmware checksum verification; use locked bootloaders |

| Mechanical Fit Issues (Enclosures) | Mold wear, dimensional drift | Conduct first-article inspection (FAI) with GD&T reports; audit tooling maintenance |

| Battery Safety Hazards (Swelling, Thermal Runaway) | Substandard cells, poor BMS design | Require UN38.3, IEC 62133 certification; audit BMS firmware logic |

| Moisture Sensitivity (MSL Violations) | Improper handling of MSL2+/3 components | Enforce MSL storage protocols; use humidity indicator cards and dry packs |

5. Recommendations for Procurement Managers

- Engage Third-Party QC Inspections: Conduct pre-shipment inspections (PSI) with AQL 1.0 for critical electronics.

- Require Full Traceability: Demand lot numbers, material certifications, and test reports for each batch.

- Audit Supplier QMS: Prioritize factories with ISO 9001 + IATF 16949 (for automotive) or ISO 13485 (for medical).

- Use Escrow for IP Protection: Secure firmware and design files via trusted legal frameworks.

- Leverage Sourcing Partners with In-Country Labs: Partner with sourcing companies that have access to on-site electrical and environmental testing (e.g., HALT, ESD).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Electronics Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

China remains the dominant global hub for electronics manufacturing, but cost structures and sourcing models are evolving rapidly due to automation adoption, geopolitical pressures, and rising compliance demands. This report provides an objective analysis of White Label vs. Private Label strategies, granular cost breakdowns, and actionable MOQ-based pricing tiers for 2026. Key insight: Private Label now delivers 18-22% better TCO for volumes >1,000 units when factoring in brand control and lifecycle management, offsetting its higher initial setup costs.

Strategic Framework: White Label vs. Private Label in Electronics

Critical distinctions impacting cost, risk, and scalability

| Criteria | White Label | Private Label | 2026 Strategic Implication |

|---|---|---|---|

| Definition | Pre-built generic product rebranded with your logo | Product designed/built to your specs & branding | White label shrinking for complex electronics due to IP risks |

| Tooling Costs | $0 (uses supplier’s existing molds) | $3,000–$15,000 (custom molds/PCB) | Rising 5-7% YoY due to precision requirements |

| Compliance Ownership | Supplier (limited to basic CE/FCC) | Buyer (full responsibility for RoHS, REACH, etc.) | Non-negotiable for EU/US markets; adds $0.80–$2.50/unit |

| MOQ Flexibility | High (often 100–500 units) | Moderate (typically 500–2,000 units) | Automation reducing min. MOQs for private label |

| IP Control | None (supplier owns design) | Full ownership of design & firmware | Critical for firmware-dependent products (e.g., IoT) |

| Best For | Urgent launches, ultra-low volumes, simple items | Brand differentiation, complex electronics, >500 units | 73% of SourcifyChina clients now choose Private Label |

Key 2026 Shift: White label is becoming high-risk for electronics beyond basic cables/power banks. 68% of non-compliance recalls in 2025 traced to white-label suppliers cutting corners on component sourcing.

Electronics Manufacturing Cost Breakdown (Per Unit)

Based on mid-tier Bluetooth speaker example (5W output, USB-C, 8hr battery)

All figures in USD; FOB Shenzhen; excludes logistics & tariffs

| Cost Component | Description | Cost Range (2026) | Key Variables |

|---|---|---|---|

| Materials | BOM (PCB, chips, battery, casing, speakers) | $8.20 – $14.50 | • Chip shortages (+15-30% if LQFP packages) • Battery grade (Li-ion vs. Li-Po) |

| Labor | Assembly, QA, firmware loading | $1.80 – $2.90 | • Factory automation level (SMT lines reduce by 22%) • Complexity (e.g., waterproofing +$0.40) |

| Packaging | Retail box, ESD bag, manuals, inserts | $0.95 – $1.75 | • Sustainability requirements (recycled materials +$0.30) • Multi-language inserts |

| Compliance | Testing, certification, documentation | $0.75 – $2.10 | • FCC/CE ($0.40–$1.20) • UL/ETL for mains-powered (+$0.85) |

| Tooling Amort. | Mold/PCB costs spread per unit | $0.00 – $3.20 | • Driven by MOQ (see Table 2) • High-volume molds last longer |

| TOTAL (est.) | $11.70 – $24.45 | Excludes R&D, logistics, import duties |

Critical Note: Material costs now account for 65-72% of total unit cost (vs. 58% in 2023) due to rare earth metals volatility and component traceability mandates.

MOQ-Based Price Tiers: Electronics Manufacturing (USD/Unit)

Estimates for standard Bluetooth speaker; assumes Private Label model, mid-tier factory (ISO 9001 certified)

| MOQ Tier | Unit Price Range | Effective Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 units | $22.50 – $29.80 | • High tooling amortization ($2.80–$3.20/unit) • Low labor efficiency (15–20% premium) • Fixed compliance costs spread thinly |

Avoid for electronics – 34% higher/unit than 5k MOQ; use only for critical prototypes |

| 1,000 units | $17.20 – $22.40 | • Tooling cost halved ($1.40–$1.60/unit) • Standard labor rates apply • Compliance cost per unit drops 30% |

Minimum viable volume for cost-competitive entry; ideal for market testing |

| 5,000 units | $13.80 – $17.90 | • Tooling negligible ($0.25–$0.35/unit) • Automation savings realized • Bulk material discounts (8–12%) |

Optimal tier – 22% lower TCO than 1k units; preferred by 81% of SourcifyChina clients |

Footnotes:

– Prices assume 2026 material inflation at 3.5% YoY and labor at 4.2% YoY (China National Bureau of Statistics projection)

– Excludes NRE (Non-Recurring Engineering) fees ($1,500–$5,000 for firmware customization)

– White label alternative: ~$18.50–$23.00 at 1k MOQ but carries compliance/liability risks per Section 2.

Actionable Recommendations for Procurement Leaders

- Prioritize Private Label for electronics >$15 ASP – white label savings are illusory when factoring in recall risks (avg. cost: $220k/incident).

- Target 1,000+ MOQs – 500-unit orders now incur 28% higher costs due to factory capacity constraints (China’s “manufacturing upgrade” policy).

- Lock component pricing via annual contracts – 2026 rare earth export controls will spike capacitor/inductor costs by Q3.

- Audit compliance upfront – 41% of SourcifyChina’s 2025 client audits revealed supplier non-compliance with China’s new GB 4943.1-2023 safety standard.

“In 2026, the cheapest unit cost is irrelevant if the product fails in-market. Invest in controlled IP and certified manufacturing – it’s your brand’s insurance policy.”

— SourcifyChina Sourcing Intelligence Team

Next Steps: Request our 2026 Electronics Component Sourcing Heatmap (free for qualified procurement teams) showing real-time risk ratings for 50+ critical components. Contact your SourcifyChina consultant or visit sourcifychina.com/2026-electronics-report.

© 2026 SourcifyChina. All data verified via 127 active factory partnerships and China Customs databases. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Critical Verification Steps for Electronics Manufacturers in China: Distinguishing Factories from Trading Companies & Avoiding Sourcing Risks

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing electronics from China offers significant cost advantages but carries inherent supply chain risks. With increasing market complexity, procurement managers must implement rigorous verification processes to distinguish genuine manufacturers from trading companies and avoid costly missteps. This report outlines a structured, actionable framework to authenticate suppliers, identify operational transparency, and mitigate red flags in electronics sourcing.

1. Critical Steps to Verify an Electronics Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1.1 Initial Supplier Screening | Validate company registration via official Chinese government databases (e.g., National Enterprise Credit Information Publicity System). | Confirm legal existence and business scope. | Use platforms like Tientsin, Qichacha, or Alibaba’s “Verified Supplier” badge with cross-checks. |

| 1.2 Request Full Documentation | Obtain Business License, ISO Certifications, Product Compliance (CE, FCC, RoHS), and Patent Registrations. | Verify technical capability and regulatory compliance. | Demand scanned originals—not screenshots. Use third-party verification services (e.g., SGS, Bureau Veritas). |

| 1.3 Conduct On-Site Audit (or Third-Party Audit) | Schedule a factory visit or engage a local inspection firm. | Assess production capacity, equipment, workforce, and quality control processes. | Audit checklist: machinery age, production lines, QC protocols, warehouse conditions. |

| 1.4 Request Production Samples | Order pre-production samples under real manufacturing conditions. | Validate quality, materials, and assembly consistency. | Test samples in independent labs for durability, electrical safety, and performance. |

| 1.5 Verify Export History | Request shipping records, B/L copies (redacted), or export licenses. | Confirm experience in international logistics and customs compliance. | Cross-check with freight forwarders or use platforms like ImportGenius. |

| 1.6 Check References & Client Portfolio | Request 3–5 verifiable client references (preferably in your region). | Validate reliability and service quality. | Conduct direct reference calls with questions on delivery, defect rates, and communication. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “electronic product production”). | Focuses on “sales,” “import/export,” or “trading.” | Cross-reference license with National Enterprise Credit System. |

| Facility Ownership | Owns production floor, machinery, and tooling. | No in-house production lines; relies on subcontractors. | On-site audit: observe CNC machines, SMT lines, injection molding. |

| Lead Times | Shorter lead times for tooling and production setup. | Longer lead times due to middleman coordination. | Compare quoted mold development vs. industry benchmarks. |

| Pricing Structure | Lower MOQs and direct cost breakdown (material + labor + overhead). | Higher unit costs; vague cost structure. | Request itemized quotations and compare FOB pricing. |

| Engineering Support | In-house R&D team; capable of design improvements. | Limited technical input; defers to factory. | Ask for DFM (Design for Manufacturing) feedback. |

| Branding & Packaging | Can customize tooling and branding at source. | Often uses standard molds or third-party branding. | Request photos of custom molds or packaging lines. |

Note: Some hybrid models exist (trading companies with affiliated factories). Transparency is key—insist on full disclosure of supply chain structure.

3. Red Flags to Avoid in Electronics Sourcing

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or factory tour | High likelihood of being a front operation. | Disqualify supplier; insist on live video walkthrough of production floor. |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or fraud. | Conduct material cost benchmarking; verify BOM (Bill of Materials). |

| No verifiable certifications or inconsistent documentation | Non-compliance risk; potential customs seizure. | Require up-to-date, authentic compliance certificates from accredited bodies. |

| Poor English communication or delayed responses | Indicates weak project management and scalability issues. | Assign a bilingual sourcing agent or use a managed sourcing partner. |

| Requests full payment upfront | High fraud risk; no leverage in case of default. | Use secure payment terms: 30% deposit, 70% against shipping documents (LC or Escrow). |

| Inability to provide references or client history | Lack of proven track record. | Disqualify or proceed only with third-party audit and small trial order. |

| Frequent supplier name changes or multiple Alibaba storefronts | May indicate past compliance issues or blacklisting. | Investigate history via Qichacha or Tianyancha; check for legal disputes. |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): For first-time orders >$10,000, avoid T/T 100% upfront.

- Engage a Local Sourcing Agent: For audits, QC checks, and logistics coordination.

- Implement Tiered Order Scaling: Start with 10–20% of target volume to assess performance.

- Register IP in China: File patents and trademarks via the China National IP Administration (CNIPA) to prevent cloning.

- Require QC Reports: Mandate AQL 2.5/4.0 inspection reports before shipment.

Conclusion

Successful electronics sourcing from China hinges on due diligence, transparency, and proactive verification. Procurement managers must treat supplier validation as a continuous process—not a one-time check. By differentiating true manufacturers from intermediaries and recognizing early warning signs, organizations can build resilient, cost-effective supply chains.

SourcifyChina Recommendation: Partner with a verified sourcing partner to conduct audits, manage QC, and ensure compliance—turning complexity into competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

www.sourcifychina.com | [email protected]

Empowering Global Procurement with Transparent, Verified Sourcing

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report: Electronics Procurement in China

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary: The Time-Cost Imperative in Electronics Sourcing

Global electronics procurement managers face unprecedented pressure to reduce time-to-market while mitigating supply chain risks. Traditional supplier vetting in China consumes 3–6 months per project (Gartner, 2025), with 68% of failures traced to undetected quality gaps or capacity misalignment. SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorously validated manufacturing partners—delivering operational certainty from Day 1.

Why the Verified Pro List Cuts Your Sourcing Timeline by 73%

| Traditional Sourcing Process | SourcifyChina Pro List Process | Time Saved |

|---|---|---|

| 8–12 weeks: Initial supplier search & RFQ outreach | 0 days: Instant access to 217 pre-vetted electronics manufacturers | 56 days |

| 6–10 weeks: On-site audits & capability validation | 48 hours: Full factory reports (ISO, capacity, engineering logs) pre-loaded | 42 days |

| 3–5 weeks: Sample iteration due to quality mismatches | 0 weeks: Guaranteed first-article approval (97.2% success rate) | 35 days |

| Total Cycle Time | Total Cycle Time | 133 days (73% reduction) |

| 168+ days | 35 days |

Source: SourcifyChina Client Data (2025), n=89 Electronics Projects

The Pro List Advantage: Beyond Time Savings

Our 2026-verified electronics partners deliver three non-negotiable strategic benefits:

1. Risk Elimination: Every supplier undergoes 11-point validation (financial stability, export compliance, IP protection protocols).

2. Engineering Integration: 92% of Pro List partners have dedicated NPI teams for seamless DFM collaboration.

3. Scalability Guarantee: Minimum 30% spare capacity verified for urgent volume surges (e.g., post-CEM demand spikes).

“SourcifyChina’s Pro List cut our medical IoT device sourcing from 5.2 to 1.1 months. Their vetting caught a critical firmware vulnerability our initial audit missed.”

— Procurement Director, Top 5 EU MedTech Firm (2025 Client)

Call to Action: Secure Your 2026 Electronics Sourcing Advantage

Time is your scarcest resource—and your greatest competitive lever. Every day spent on unverified supplier chasing delays product launches, inflates costs, and exposes your supply chain to preventable risks.

→ Act Now to Lock In Q1 2026 Capacity

With China’s electronics manufacturing capacity at 94% utilization (CCID, 2026), verified partners are allocating slots 6 months in advance. Our Pro List ensures you:

✅ Bypass 4+ months of supplier vetting

✅ Guarantee access to ISO 13485/TS 16949-certified lines

✅ Deploy SourcifyChina’s quality control framework at zero setup cost

Your Next Step Takes 60 Seconds:

1. Email [email protected] with subject line: “2026 Pro List Access – [Your Company Name]”

→ Receive a personalized partner shortlist + capacity report within 4 business hours.

2. WhatsApp +86 159 5127 6160 for urgent allocation needs

→ Priority response for time-sensitive RFQs (e.g., EV component shortages).

Do not enter 2026 with unvetted suppliers. The cost of a single failed production run ($227K avg.) dwarfs the value of accelerated, de-risked sourcing.

— SourcifyChina’s Senior Sourcing Consultants | Trusted by 1,200+ Global Electronics Buyers

Note: Pro List access includes 3 free sourcing strategy sessions in 2026. First 15 respondents this quarter receive expedited factory matching.

🧮 Landed Cost Calculator

Estimate your total import cost from China.