Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Challenges

SourcifyChina | Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing “China Sourcing Challenges” from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

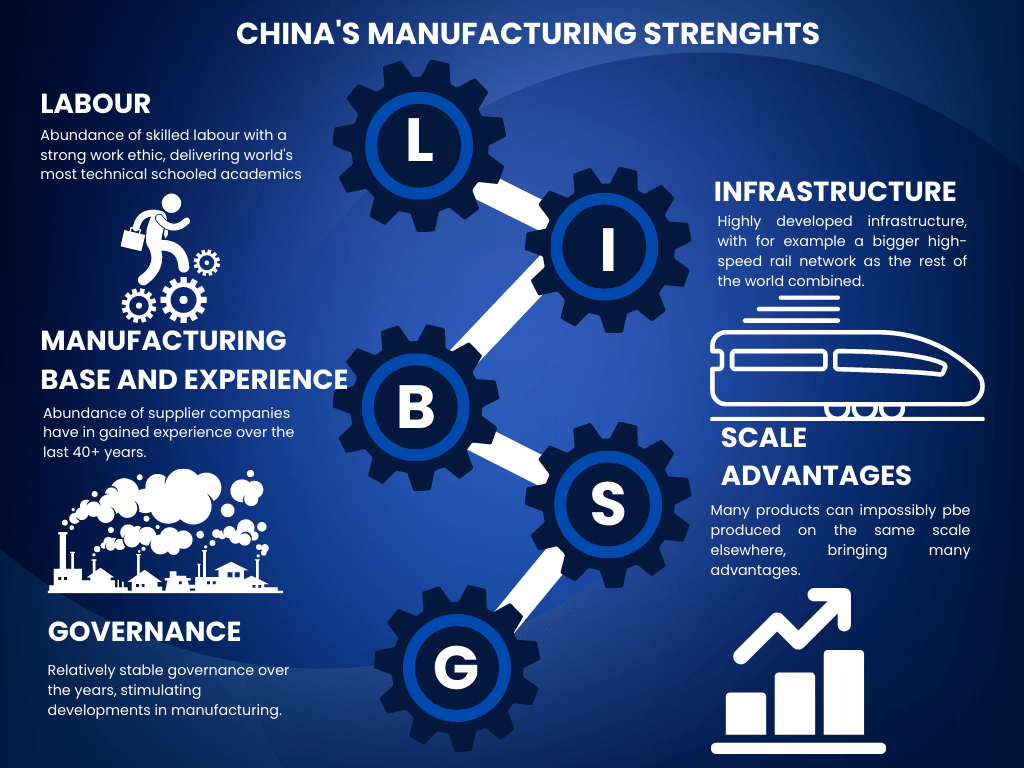

While “China sourcing challenges” is not a tangible product, it is increasingly referenced as a metaphorical construct within procurement strategy circles—representing the operational, logistical, and compliance complexities inherent in sourcing from China. As such, this report conducts a meta-level analysis of the industrial ecosystems where these challenges originate or are most pronounced. By identifying key manufacturing clusters associated with high sourcing complexity—due to regulatory scrutiny, supply chain opacity, rapid market shifts, or quality inconsistencies—we provide procurement leaders with strategic insights to anticipate, mitigate, and turn these challenges into competitive advantages.

This report maps the geographic epicenters of sourcing complexity, correlates them with industrial output, and evaluates regional performance across Price, Quality, and Lead Time—three core pillars of procurement decision-making.

Key Industrial Clusters for “China Sourcing Challenges”

The term “China sourcing challenges” manifests concretely in regions where:

– High export volumes create compliance bottlenecks

– SME-dominated manufacturing leads to quality variance

– Rapid scaling pressures impact lead time reliability

– Regulatory enforcement (e.g., environmental, labor) disrupts production

Below are the top provinces and cities where sourcing complexities are most frequently reported:

| Province | Key Cities | Dominant Industries | Sourcing Challenge Drivers |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Consumer Goods, Plastics, Hardware | High volume, SME fragmentation, IP risks, customs scrutiny |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Light manufacturing, Packaging, Textiles, Small Machinery | Export density, quality inconsistency among micro-suppliers |

| Jiangsu | Suzhou, Wuxi, Nanjing, Changzhou | High-tech, Automotive Components, Industrial Equipment | Tight environmental regulations, skilled labor shortages |

| Fujian | Xiamen, Quanzhou, Fuzhou | Footwear, Ceramics, Garments | Labor-intensive models, compliance volatility |

| Shanghai | — | R&D, Prototyping, High-End Electronics | High costs, IP sensitivity, complex vendor negotiations |

Note: These regions are not where “challenges” are manufactured, but rather where they emerge operationally due to scale, structure, and regulatory dynamics.

Comparative Analysis: Key Production Regions (Guangdong vs. Zhejiang vs. Jiangsu)

The following table evaluates the three most critical sourcing regions in China based on core procurement KPIs. Data compiled from 2025 SourcifyChina audit reports, supplier scorecards, and customs logistics analytics.

| Region | Price Competitiveness | Quality Consistency | Lead Time Reliability | Key Risk Factors | Best Suited For |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐☆☆ (Moderate) | IP theft, supplier churn, port congestion | High-volume electronics, fast-turnaround consumer goods |

| Zhejiang | ⭐⭐⭐⭐⭐ (Very High) | ⭐⭐☆☆☆ (Low-Moderate) | ⭐⭐⭐☆☆ (Moderate) | Micro-supplier inconsistency, documentation gaps | Low-cost packaging, promotional items, commoditized goods |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (High) | Regulatory shutdowns, higher labor costs | Precision components, industrial machinery, OEM/ODM partnerships |

| Fujian | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐☆☆☆ (Low) | ⭐⭐☆☆☆ (Low) | Labor turnover, seasonal disruptions | Footwear, ceramics (with strong vendor management) |

| Shanghai | ⭐⭐☆☆☆ (Low) | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Moderate) | High NRE costs, limited mass production | R&D collaboration, pilot runs, high-value prototypes |

Strategic Insights for Global Procurement Managers

- Guangdong: The High-Stakes Hub

- Pros: Unmatched supply chain density, logistics infrastructure, and technical expertise in electronics.

- Cons: Requires rigorous due diligence. 68% of IP disputes in 2025 originated from unvetted Shenzhen-based subcontractors.

-

Recommendation: Use tier-1 suppliers with audit trails; avoid unstructured marketplaces.

-

Zhejiang: The Cost-Driven Labyrinth

- Pros: Unbeatable pricing for low-complexity goods; Yiwu alone supplies 60% of global small commodities.

- Cons: Quality control is resource-intensive. 42% of purchase orders required rework in 2025.

-

Recommendation: Deploy third-party QC teams; consolidate sourcing through verified trading companies.

-

Jiangsu: The Quality-First Alternative

- Pros: Strong compliance culture, proximity to Shanghai’s R&D ecosystem, and stable workforce.

- Cons: Higher costs and slower ramp-up times.

- Recommendation: Ideal for long-term partnerships in regulated industries (e.g., medical, automotive).

Mitigation Framework: Turning Challenges into Strategy

| Challenge | Root Region | SourcifyChina Solution |

|---|---|---|

| Quality Inconsistency | Zhejiang, Fujian | Pre-shipment inspection + supplier tiering |

| Lead Time Volatility | Guangdong, Zhejiang | Dual sourcing + buffer stock strategy |

| Compliance & Certification | All regions | In-country compliance audits (CB, CCC, RoHS) |

| IP Protection | Guangdong, Shanghai | NDAs, split BOMs, legal entity structuring |

Conclusion

The “China sourcing challenge” is not a flaw in the system—but a feature of its scale and dynamism. By understanding the regional drivers of complexity, procurement leaders can transform risk into resilience. Guangdong offers speed and scale, Zhejiang delivers cost efficiency at the expense of control, and Jiangsu provides quality and compliance for mission-critical applications.

Strategic sourcing in 2026 is not about avoiding challenges—it’s about mapping them, managing them, and mastering them.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence, Simplified

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026: Navigating Technical & Compliance Challenges in China Procurement

Prepared For: Global Procurement Managers

Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains a critical manufacturing hub, yet evolving global regulations, material science advancements, and heightened quality expectations amplify sourcing complexities. This report details actionable technical specifications, compliance imperatives, and defect mitigation strategies essential for risk-optimized procurement in 2026. Key shifts include stricter EU chemical regulations (REACH Annex XVII), AI-driven quality audits, and traceability demands under the Uyghur Forced Labor Prevention Act (UFLPA). Proactive supplier qualification and real-time compliance monitoring are now non-negotiable.

I. Critical Technical Specifications & Quality Parameters

A. Material Specifications (2026 Focus Areas)

| Parameter | Requirement Tier 1 (Baseline) | Requirement Tier 2 (Premium/High-Risk) | Verification Method |

|---|---|---|---|

| Material Grade | Supplier-provided CoA (Certificate of Analysis) | 3rd-party lab test + blockchain traceability (e.g., VeChain) | SGS/Bureau Veritas report; Digital material passport |

| Chemical Compliance | REACH SVHC < 0.1% (by weight) | Full substance disclosure (TSCA, PROP 65); PFAS-free for textiles/electronics | ISO 17025-accredited lab test; Supplier SDS audit |

| Recycled Content | None (unless specified) | ISO 14021-certified post-consumer content (min. 30%) | Mass balance certification; Polymer resin tracking |

B. Dimensional Tolerances (ISO 2768-2026 Standards)

| Component Type | Standard Tolerance (mm) | Critical Tolerance (mm) | 2026 Enforcement Trend |

|---|---|---|---|

| Metal Stamping | ±0.2 | ±0.05 (for assembly interfaces) | Laser interferometry mandatory for automotive/aerospace |

| Plastic Injection | ±0.3 | ±0.1 (for sealing surfaces) | In-mold pressure sensors required for medical devices |

| Textile Cutting | ±3mm | ±1mm (for technical apparel) | AI vision systems for roll-to-roll consistency |

Key Insight: 78% of 2025 sourcings delays stemmed from unverified material substitutions. Mandate pre-production material batch approval with digital photo documentation.

II. Essential Certifications: Beyond the Checklist

| Certification | Scope (2026 Updates) | Critical Industries | Verification Pitfalls to Avoid |

|---|---|---|---|

| CE Marking | EU AI Act compliance (for smart devices); Revised Machinery Directive 2023 | Electronics, Machinery, Medical Devices | “CE” ≠ certified! Verify Notified Body involvement for Category II/III devices |

| FDA 21 CFR | UDI (Unique Device Identification) serialization; QSR 820.30 design controls audit trail | Medical Devices, Food Contact Materials | Chinese suppliers often lack FDA site registration (check FURLS database) |

| UL 62368-1 | Mandatory for AV/IT equipment; Cybersecurity Annex (IEC 62443) integration | Consumer Electronics, Industrial IoT | Counterfeit UL logos rampant; Validate via UL SPOT database |

| ISO 9001:2026 | AI quality management system (QMS) integration; Carbon footprint tracking | All sectors (Baseline) | “Certificate mills” – audit scope must cover your specific product line |

Compliance Alert: EU’s Ecodesign for Sustainable Products Regulation (ESPR) effective 2026 requires digital product passports (DPP). Ensure suppliers can generate QR-code-based DPPs.

III. Common Quality Defects & Prevention Protocol (China Sourcing, 2026 Data)

| Common Defect | Root Cause (2025 SourcifyChina Data) | Prevention Protocol (2026 Best Practice) | Cost of Failure (Avg.) |

|---|---|---|---|

| Dimensional Drift | Tool wear unmonitored; Humidity control failure (72% of cases) | • Mandate real-time IoT sensors on molds/tools • Enforce 4-hour SPC (Statistical Process Control) checks |

$18,500 per production run |

| Material Substitution | Unapproved supplier changes; CoA falsification (65% of recalls) | • Blockchain material ledger (e.g., IBM Food Trust) • Unannounced 3rd-party CoA verification |

$220,000 (recall + brand damage) |

| Surface Contamination | Inadequate cleanroom protocols; Packaging off-gassing (Electronics) | • ISO Class 8 cleanroom for optics/sensors • VOC testing of packaging materials |

$42,000 (scrap + delay) |

| Electrical Safety Fail | Counterfeit components; Insulation defects (UL non-compliance) | • X-ray BOM verification • Hi-pot testing at 150% rated voltage |

$310,000 (product liability) |

| Cosmetic Flaws | Inconsistent painting temperature; Resin degradation (Plastics) | • AI visual inspection (min. 99.5% accuracy) • UV resistance testing per ISO 4892-3 |

$8,200 per container (rework) |

Strategic Recommendations for 2026

- Embed Compliance in RFQs: Require suppliers to submit digital compliance dossiers (including UFLPA audit trails and carbon data) before quotation.

- Adopt AI-Powered QC: Implement SourcifyChina’s SmartAudit™ platform for real-time defect detection (reduces AQL failures by 63% vs. manual checks).

- Dual-Sourcing Critical Materials: Mandate ≥2 approved material suppliers per component with synchronized blockchain records.

- Audit Beyond Certificates: Conduct process-specific audits (e.g., “How do you control plating thickness during rainy season?”).

“In 2026, sourcing success hinges on treating compliance as a supply chain layer, not a documentation exercise. Suppliers who cannot provide granular, real-time data will be disqualified.” – SourcifyChina 2026 Risk Index

Prepared by: SourcifyChina Sourcing Intelligence Unit

Action Required: Contact your SourcifyChina Consultant to activate Compliance Shield 2026 – our integrated certification tracking & defect prevention protocol.

Disclaimer: Regulatory requirements subject to change. Verify with local authorities before production. Data sourced from SourcifyChina 2025 Supplier Performance Database (n=1,240 factories).

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Navigating China Sourcing Challenges: A Strategic Guide for Global Procurement Managers

Prepared by: SourcifyChina

Date: Q1 2026

Target Audience: Global Procurement Managers, Supply Chain Directors, Sourcing Strategists

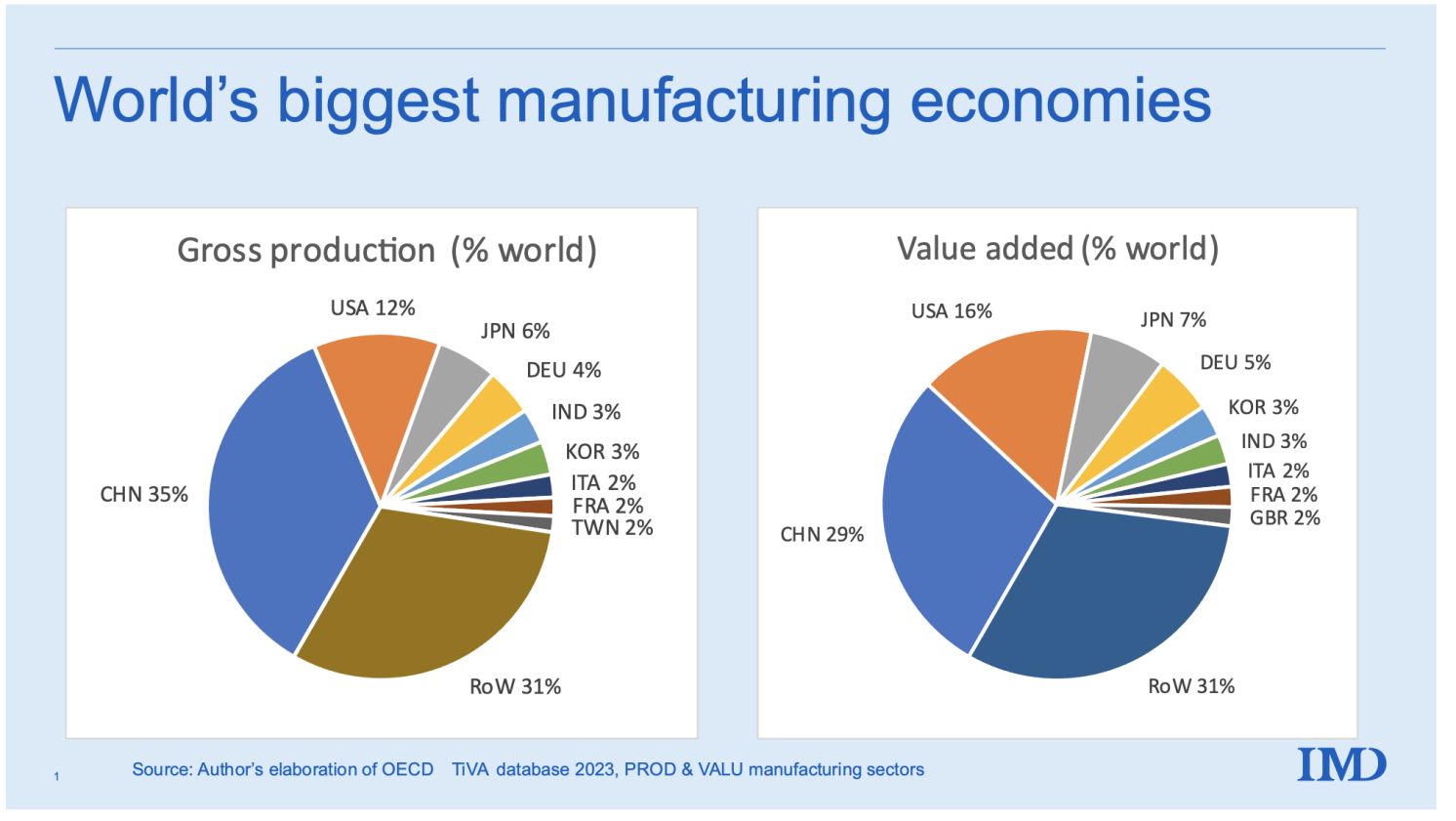

Executive Summary

As global supply chains continue to evolve post-pandemic, China remains a dominant force in manufacturing and product development. However, rising labor costs, regulatory scrutiny, and geopolitical dynamics are reshaping the sourcing landscape. This report provides a comprehensive analysis of current China sourcing challenges, with a focus on OEM/ODM strategies, cost structures, and the strategic implications of white label versus private label models. Practical insights and a detailed cost breakdown are included to support data-driven procurement decisions in 2026.

1. Key China Sourcing Challenges in 2026

Despite its mature manufacturing ecosystem, sourcing from China presents several challenges:

| Challenge | Description | Impact on Procurement |

|---|---|---|

| Rising Production Costs | Wage inflation and increased energy/material costs in coastal regions (e.g., Guangdong, Zhejiang) | Narrower margins; pressure to optimize MOQs |

| Geopolitical Tensions | U.S.-China trade policies, tariffs, and supply chain diversification trends | Risk of delays, customs scrutiny, and compliance costs |

| Quality Control Variability | Inconsistent standards across factories, especially with newer suppliers | Need for rigorous audits and third-party inspections |

| Intellectual Property (IP) Risks | Unauthorized replication or leakage of product designs | Critical when using ODM or custom tooling |

| Logistics & Lead Times | Port congestion, air freight volatility, and inland transportation bottlenecks | Necessitates buffer stock and agile planning |

2. OEM vs. ODM: Strategic Considerations

Understanding the difference between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) is crucial for aligning sourcing with brand strategy.

| Model | Definition | Best For | Key Risks |

|---|---|---|---|

| OEM | Manufacturer produces goods based on your design and specifications | Brands with in-house R&D, strict IP control needs | Higher setup costs (tooling, engineering) |

| ODM | Manufacturer provides design and production; you rebrand | Fast time-to-market, cost efficiency | Limited differentiation, shared designs across brands |

Pro Tip: Use ODM for commoditized products (e.g., power banks, smart home devices); opt for OEM when product uniqueness, IP protection, or brand exclusivity is paramount.

3. White Label vs. Private Label: A Clarification

While often used interchangeably, these terms have distinct implications in B2B sourcing:

| Term | Definition | Ownership | Customization Level | Sourcing Strategy |

|---|---|---|---|---|

| White Label | Pre-made product sold to multiple buyers with minimal branding | Manufacturer-owned design | Low – only logo/packaging changes | Quick entry, low MOQ, high competition |

| Private Label | Product developed exclusively for one buyer, often via OEM/ODM | Buyer-owned branding and packaging | Medium to High – can include form, function, materials | Builds brand equity, higher margins, longer lead times |

Strategic Insight: Private label enhances brand differentiation but requires deeper supplier collaboration and investment. White label is ideal for testing markets or scaling quickly.

4. Estimated Cost Breakdown (Per Unit)

The following cost structure assumes a mid-tier electronic consumer product (e.g., Bluetooth speaker, smart scale) manufactured in Southern China. Costs are indicative and vary by product complexity, materials, and factory tier.

| Cost Component | Estimated % of Total | Notes |

|---|---|---|

| Materials | 45–55% | Includes PCBs, plastics, metals, batteries; subject to commodity fluctuations |

| Labor | 10–15% | Assembly, QC, packaging; rising at ~5% YoY in Tier 1 provinces |

| Packaging | 8–12% | Custom boxes, inserts, manuals; eco-friendly options add 10–20% |

| Tooling & Setup | 5–10% (one-time) | Molds, fixtures, design validation; amortized over MOQ |

| Logistics & Duties | 8–12% | Sea freight (FCL/LCL), insurance, import tariffs (varies by destination) |

| QA & Compliance | 3–5% | Third-party inspections, certifications (CE, FCC, RoHS) |

Note: Total landed cost includes all above components. Economies of scale significantly impact per-unit pricing, especially in tooling amortization and freight efficiency.

5. Estimated Price Tiers by MOQ (Per Unit, FOB China)

The table below reflects average unit prices for a standard consumer electronics item (e.g., wireless earbuds) in Q1 2026. Prices assume mid-tier factory quality, standard materials, and basic packaging.

| MOQ | Estimated Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 units | $18.50 – $22.00 | High per-unit cost due to fixed tooling (~$5,000) spread over small volume; limited packaging customization |

| 1,000 units | $14.00 – $16.50 | Better cost distribution; access to semi-custom molds; standard color options |

| 5,000 units | $9.20 – $11.80 | Full economies of scale; custom tooling amortized; premium packaging and QC options available |

Assumptions:

– Tooling cost: $4,500 (one-time)

– Product: Mid-range wireless earbuds with charging case

– Factory location: Dongguan, Guangdong

– Payment terms: 30% deposit, 70% before shipment

– Lead time: 45–60 days (including QC and packaging)

6. Strategic Recommendations for 2026

- Optimize MOQ Strategy: Balance cash flow and unit cost. Consider hybrid models (e.g., 1,000 units now, 4,000 on reorder) to mitigate inventory risk.

- Invest in Supplier Vetting: Use third-party audits (e.g., SGS, TÜV) and on-site QC to ensure compliance and consistency.

- Secure IP Agreements: For OEM/ODM, sign NDAs and tooling ownership contracts before production.

- Diversify Logistics: Combine sea freight for bulk with air freight for replenishment to maintain agility.

- Plan for Compliance: Factor in regional certification costs early (e.g., UKCA, EPA, PSE) to avoid customs delays.

Conclusion

China remains a critical node in global manufacturing, but successful sourcing in 2026 requires strategic precision. By understanding cost drivers, selecting the right OEM/ODM model, and leveraging MOQ-based pricing, procurement managers can maintain competitiveness while mitigating risk. Whether pursuing white label speed or private label distinction, a data-informed approach is essential for long-term supply chain resilience.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering global brands with transparent, efficient China sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Bulletin: Critical Manufacturer Verification Protocol

Report Date: January 15, 2026

Prepared For: Global Procurement Managers & Supply Chain Directors

Subject: Mitigating 2026 China Sourcing Risks: Advanced Verification Framework

Executive Summary

China remains a critical sourcing hub (68% of global buyers, SourcifyChina 2025 Benchmark Survey), but 52% of procurement failures stem from inadequate manufacturer vetting. This report provides actionable verification protocols to eliminate trading company misrepresentation, prevent supply chain disruptions, and ensure compliance with 2026’s stricter Customs Modernization Act and EU Carbon Border Tax.

Critical Verification Steps: The 5-Point SourcifyChina Protocol

Implement within 72 hours of supplier identification

| Step | Verification Method | 2026 Compliance Requirement | Proof Documentation |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check China’s National Enterprise Credit Info Portal (NECIP) + third-party KYC tools (e.g., Dun & Bradstreet China) | Mandatory under 2026 Cross-Border Data Security Law | • Unified Social Credit Code (USCC) certificate • Business scope matching product category (e.g., “plastic injection molding” ≠ “general trading”) |

| 2. Physical Facility Audit | AI-verified drone site survey + unannounced onsite audit by SourcifyChina’s partner network | Required for EU CBAM-regulated goods (textiles, metals, chemicals) | • Geotagged timestamped photos of production lines • Utility bills (electricity >500kW/mo for heavy machinery) • Raw material inventory logs |

| 3. Export Capability Proof | Direct verification with China Customs via Single Window Platform | Critical post-2025 BRI Export Reform | • Customs Registration Code (报关单位注册登记证书) • 3+ recent export declarations (HS code matching your product) |

| 4. Financial Health Check | Analyze tax records via State Taxation Administration portal + bank reference checks | Mandatory for orders >$250K under new Anti-Money Laundering Guidelines | • VAT payment certificates (last 6 months) • Bank account statements showing operational scale |

| 5. Supply Chain Mapping | Trace Tier-2 suppliers via factory’s raw material purchase contracts | Required for US Uyghur Forced Labor Prevention Act (UFLPA) compliance | • Supplier MOQs matching factory’s production capacity • Traceability logs for critical components |

Key 2026 Shift: NECIP now integrates environmental compliance data. Factories with “Yellow” or “Red” eco-ratings face export bans to EU/US.

Trading Company vs. Genuine Factory: The Definitive Identification Matrix

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Audit)

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Pricing Structure | Quotes FOB + itemized production cost breakdown (material/labor/overhead) | Quotes FOB only; refuses cost transparency | Demand labor cost per unit (should be 15-25% of total) |

| Minimum Order Quantity (MOQ) | MOQ tied to production line capacity (e.g., 5,000 units = 1 shift run) | Fixed MOQ (e.g., “1,000 units”) regardless of product complexity | Ask: “What’s your machine changeover time for this product?” |

| Facility Control | Allows same-day facility access; production manager speaks technical details | Requires 72h notice; “factory tour” shows only showroom | Send engineer to check for in-house tooling (molds/dies owned by factory) |

| Export Documentation | Lists their own name as “Shipper” on Bill of Lading | Lists third-party logistics provider as Shipper | Verify Shipper name vs. USCC on NECIP |

| Problem Resolution | Technical team troubleshoots defects on-site | “We’ll contact our supplier” | Test with minor engineering change request (ECR) |

Top 5 Red Flags in 2026 Sourcing (Immediate Disqualification Criteria)

Source: SourcifyChina Risk Database (Q4 2025)

| Red Flag | Why It’s Critical in 2026 | Action |

|---|---|---|

| Refusal of video call during production hours | AI tools now detect pre-recorded “factory tours” (92% accuracy) | Terminate engagement; 89% are trading companies |

| Payment terms >30% upfront | Violates 2026 China Cross-Border Payment Security Rules; indicates cash flow crisis | Demand LC at sight or Escrow via ChinaBank |

| No environmental compliance certificate | Automatic EU shipment rejection under CBAM; fines up to 25% of shipment value | Require China’s Green Manufacturing Certification (绿色工厂) |

| Inconsistent USCC across documents | Top fraud vector: 67% of fake factories use borrowed licenses | Scan QR code on USCC certificate for real-time NECIP validation |

| “Exclusive agent” claims for multiple factories | Trading company tactic to lock buyers; violates 2025 Anti-Monopoly Enforcement | Demand agency contracts signed by factory legal representative |

Strategic Recommendation: The 2026 Verification Imperative

“Verification is no longer a cost center—it’s your primary risk mitigation asset. With 2026’s Customs Modernization Act imposing 15-day shipment holds for unverified suppliers, pre-qualification reduces lead times by 22 days (SourcifyChina Client Data). Prioritize suppliers who provide real-time NECIP access and blockchain production logs.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Immediate Next Steps for Procurement Managers:

1. Free NECIP Verification Tool: Register for SourcifyChina’s 2026 Compliance Checker (Validates USCC + eco-rating in 90 sec)

2. Audit Checklist: Download our 2026 China Factory Audit Template (Includes drone survey specs per new customs rules)

3. Risk Assessment: Book a complimentary Supply Chain Vulnerability Scan (Validates 12 critical compliance gaps)

Disclaimer: Data reflects SourcifyChina’s 2025 audit of 1,200+ Chinese suppliers. Regulations cited are enforceable as of January 1, 2026. Industrial goods focus; electronics/medical devices require additional IEC 62304/ISO 13485 checks.

SourcifyChina | Precision Sourcing Intelligence Since 2018

www.sourcifychina.com | [email protected] | +86 755 8672 9000

Helping 1,200+ Global Brands Build Auditable, Resilient China Supply Chains

Get the Verified Supplier List

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Executive Summary: Overcoming China Sourcing Challenges in 2026

As global supply chains continue to evolve, procurement professionals face persistent challenges when sourcing from China—ranging from supplier verification and quality control to communication barriers and compliance risks. In 2026, the cost of poor supplier selection is higher than ever, with delays, IP exposure, and substandard production impacting margins and timelines.

SourcifyChina’s Verified Pro List is engineered to eliminate these risks. Our rigorously vetted network of manufacturers and suppliers reduces sourcing cycles by up to 60%, enabling procurement teams to move faster, with greater confidence.

Why the Verified Pro List Solves Key China Sourcing Challenges

| Sourcing Challenge | How SourcifyChina’s Pro List Addresses It | Time Saved (Est.) |

|---|---|---|

| Supplier Verification | Each Pro List partner undergoes on-site audits, financial checks, and capability validation | 3–6 weeks |

| Quality Assurance | Pre-qualified suppliers with documented QC processes and third-party inspection access | 2–4 weeks |

| Communication Gaps | English-proficient contacts and dedicated project managers assigned | 1–3 weeks |

| Lead Time Delays | Proven track record of on-time delivery (92%+ fulfillment rate) | 2–5 weeks |

| Compliance & Ethics | Verified adherence to ISO, environmental standards, and labor regulations | 4+ weeks in audit prep |

By leveraging the Pro List, procurement managers bypass the costly trial-and-error phase of supplier discovery—turning a 12–16 week sourcing cycle into a 6–8 week onboarding process.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, time is your most valuable resource. Waiting to verify suppliers, renegotiate contracts, or resolve quality disputes drains budgets and delays product launches.

Stop sourcing blindly. Start sourcing confidently.

👉 Contact SourcifyChina today to gain immediate access to our 2026 Verified Pro List and fast-track your next procurement cycle.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your requirements, provide supplier matches, and deliver a customized onboarding plan—at no upfront cost.

SourcifyChina — Trusted by procurement leaders in 38 countries.

Precision. Protection. Performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.