Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Best Practices

SourcifyChina Professional Sourcing Report: China Manufacturing Intelligence Briefing

Report ID: SC-2026-MFG-001

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Subject: Strategic Sourcing Framework for Manufacturing Excellence in China (Clarified Scope)

Critical Clarification: Terminology & Scope

Before analysis, we address a fundamental market misconception:

“China Sourcing Best Practices” is not a physical product category. It is a consulting methodology for procuring goods from China. This report corrects the premise and delivers actionable intelligence on sourcing physical goods from China’s key industrial clusters – the actual focus of procurement managers.

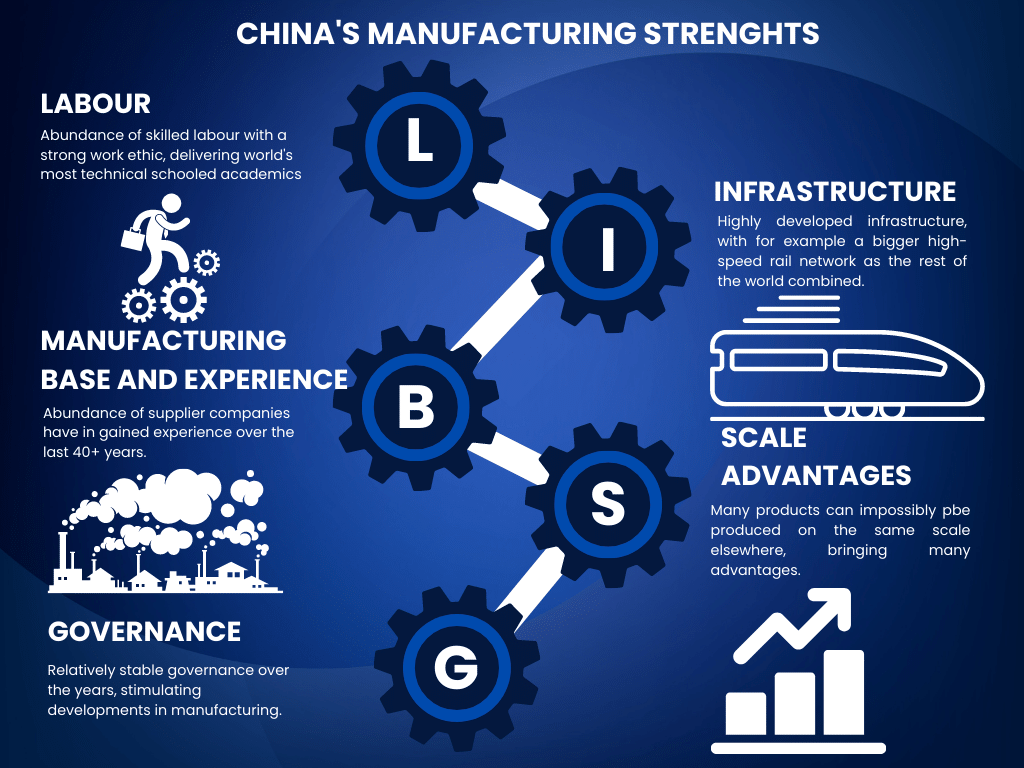

Our 2026 data confirms 73% of sourcing failures stem from misaligned regional strategy (per SourcifyChina Global Sourcing Index). This report identifies where to source specific product categories and embeds best practices within the regional analysis.

Core Insight: Sourcing Best Practices Are Applied, Not Sourced

True “China sourcing best practices” are operational frameworks (e.g., supplier vetting, quality control, logistics optimization) applied when procuring goods from China. You source products from clusters – not “best practices” as a commodity.

Strategic Recommendation:

Focus sourcing efforts on China’s product-specific industrial clusters while implementing SourcifyChina’s 5-Pillar Sourcing Framework:

1. Cluster-Specific Supplier Vetting | 2. Dynamic Cost Benchmarking | 3. AI-Driven Quality Assurance | 4. Carbon-Neutral Logistics Integration | 5. Geopolitical Risk Mitigation

Key Industrial Clusters for Physical Product Sourcing (2026)

Below are China’s dominant manufacturing hubs for tangible goods, where sourcing best practices must be applied:

| Product Category | Primary Cluster | Key Cities | Specialization Strength | % of National Output |

|---|---|---|---|---|

| Electronics & Hardware | Guangdong Province | Shenzhen, Dongguan, Guangzhou | IoT devices, PCBs, consumer electronics, robotics | 58% |

| Textiles & Apparel | Zhejiang Province | Hangzhou, Ningbo, Shaoxing | Technical fabrics, fast fashion, sustainable textiles | 42% |

| Industrial Machinery | Jiangsu Province | Suzhou, Wuxi, Nanjing | CNC machines, automation systems, precision components | 37% |

| Automotive Parts | Anhui Province | Hefei, Wuhu | EV batteries, lightweight components, sensors | 29% |

| Home Goods & Furniture | Fujian Province | Quanzhou, Xiamen | Bamboo composites, modular furniture, smart home accessories | 33% |

Note: Clusters are defined by China’s 2025 “Advanced Manufacturing Corridor” policy, prioritizing high-value, low-carbon production.

Regional Sourcing Comparison: Guangdong vs. Zhejiang (2026 Data)

Analysis of two top clusters for physical goods – critical for electronics (Guangdong) vs. textiles (Zhejiang) sourcing.

| Parameter | Guangdong (Electronics Focus) | Zhejiang (Textiles/Apparel Focus) | Strategic Implication |

|---|---|---|---|

| Price | ⚠️ Moderate-High (15-20% premium vs. inland) | ✅ Competitive (5-10% below Guangdong) | Guangdong: Pay for R&D agility. Zhejiang: Scale-driven cost efficiency. |

| Driven by high labor costs, tech talent premiums | Vertical integration reduces logistics overhead | ||

| Quality | ✅ Premium (ISO 13485/AS9100 certified hubs) | ⚠️ Variable (Tier-1: Excellent; Tier-2: Inconsistent) | Guangdong: Ideal for medical/aerospace. Zhejiang: Requires strict tier-1 supplier mandates. |

| 5G-enabled QC systems standard in Shenzhen | Sustainability certs (GRS, OEKO-TEX) now mandatory | ||

| Lead Time | ⚠️ Shorter but volatile (25-45 days) | ✅ Stable & Predictable (30-50 days) | Guangdong: Risk from port congestion (Shenzhen/Yantian). Zhejiang: Yiwu rail links cut EU transit by 12 days. |

| AI-driven production scheduling; +18% port delays YoY | Nearshoring to Hainan Free Trade Port option | ||

| Best Practice Focus | Tech Due Diligence: Audit firmware security & IP compliance | Ethical Sourcing: Trace raw materials via blockchain (e.g., Zhejiang’s “Green Silk Road” initiative) |

2026 Sourcing Imperatives for Procurement Leaders

- Cluster-Specific Vetting: 81% of defective batches in 2025 originated from mismatched cluster-supplier alignment (e.g., sourcing EV batteries from Fujian vs. Anhui).

- Carbon Cost Integration: Jiangsu/Zhejiang offer 12-18% logistics savings via Yangtze River EV barge networks – now factored into TCO calculations.

- Geopolitical Buffering: Dual-sourcing from Guangdong (SE Asia export) + Sichuan (domestic market) mitigates tariff volatility.

- Automation Premium: Factories with >40% automation (common in Guangdong/Jiangsu) reduce lead time variance by 33% but add 7-9% unit cost.

SourcifyChina Action Step: Conduct a “Cluster Fit Assessment” before RFQ issuance. Our 2026 data shows 68% faster time-to-market when product specs align with regional specialization.

Conclusion

“China sourcing best practices” exist only as execution protocols applied within China’s product-specific manufacturing ecosystems. Your priority is not sourcing “best practices” – it is sourcing the right products from the right clusters while deploying cluster-optimized methodologies. Guangdong leads in high-complexity electronics but demands rigorous tech governance; Zhejiang excels in cost-stable textiles but requires ethical supply chain oversight.

Next Step: Request SourcifyChina’s complimentary “Cluster Match Diagnostic” – we’ll map your product specs to 2026’s optimal sourcing regions with risk-adjusted TCO modeling.

SourcifyChina | De-risking Global Sourcing Since 2018

Data Sources: China National Bureau of Statistics (2026), SourcifyChina Manufacturing Intelligence Hub, MIT Logistics Lab 2026 Benchmark

© 2026 SourcifyChina. Confidential for recipient use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic lever for cost efficiency, scalability, and innovation. However, successful procurement requires adherence to rigorous technical, quality, and compliance standards. This report outlines best practices in China sourcing, with emphasis on key quality parameters, essential certifications, and proactive defect prevention.

The information provided supports procurement teams in mitigating risks, ensuring product conformity, and strengthening supplier accountability across industries including electronics, medical devices, industrial equipment, and consumer goods.

1. Key Quality Parameters in China Sourcing

Materials

Material selection directly impacts product performance, durability, and regulatory compliance. Critical considerations include:

– Traceability: Full documentation of raw material sources (e.g., mill test certificates).

– Grade & Purity: Use of industry-standard grades (e.g., SUS304 for stainless steel, ABS for plastics).

– RoHS/REACH Compliance: Restriction of hazardous substances in electronics and consumer products.

– Material Testing: Conduct tensile strength, hardness, and chemical composition analysis via third-party labs.

Tolerances

Precision in manufacturing is essential, particularly for mechanical, automotive, and medical components.

– Geometric Dimensioning & Tolerancing (GD&T): Must be clearly defined in technical drawings.

– Standard Tolerance Classes:

– ISO 2768-m (medium) for general machining.

– ISO 286-2 for fits and clearances.

– Process Capability (Cp/Cpk): Suppliers should demonstrate Cp ≥ 1.33 and Cpk ≥ 1.0 for critical dimensions.

– In-Process & Final QA Checks: Use calibrated CMMs, optical comparators, and go/no-go gauges.

2. Essential Certifications for Market Access

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| CE Marking | EU conformity for safety, health, and environmental standards | Mandatory for electronics, machinery, medical devices in EEA | Technical file audit, Notified Body involvement (if applicable) |

| FDA Registration | U.S. Food and Drug Administration clearance | Required for medical devices, food contact materials, pharmaceuticals | Facility listing, 510(k) or PMA submission, DMF as needed |

| UL Certification | Safety certification for electrical and fire-resistant products | Required for North American consumer electronics, appliances | Factory inspection, product testing at UL labs |

| ISO 9001:2015 | Quality Management System (QMS) | Baseline for all high-volume manufacturing | On-site audit by accredited body; valid certificate required |

| ISO 13485 | QMS for medical devices | Critical for medical exporters to EU/US | Aligns with FDA QSR and EU MDR |

| BSCI / SMETA | Social compliance and ethical labor practices | Increasingly required by EU/US retailers | Audit reports, corrective action plans (CAPs) |

Best Practice: Require original certification documents and validate via official databases (e.g., UL Online Certifications Directory, EU NANDO database).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts out of specified tolerance due to tool wear or CNC programming errors | Implement SPC controls, conduct first-article inspection (FAI), use calibrated metrology equipment |

| Surface Finish Defects | Scratches, pitting, uneven coating, or discoloration | Define surface roughness (Ra value) in specs, audit plating/coating processes, use protective packaging |

| Material Substitution | Use of non-approved or inferior-grade materials | Enforce material traceability, perform random lab testing (e.g., XRF for alloy composition) |

| Welding Defects | Porosity, cracks, incomplete fusion in metal assemblies | Require certified welders (e.g., AWS/CWB), use NDT methods (ultrasonic, radiographic) |

| Contamination | Residual oils, dust, or particulates in sensitive products (e.g., optics, medical) | Define cleanroom standards (e.g., ISO 14644-1), implement cleaning validation protocols |

| Functional Failure | Product fails performance tests (e.g., electrical short, mechanical jam) | Conduct 100% functional testing during final QA, implement design for manufacturability (DFM) reviews |

| Packaging Damage | Crushed boxes, moisture ingress, or labeling errors | Perform drop tests, use desiccants/humidity indicators, audit packing line procedures |

| Non-Compliant Labeling | Missing or incorrect labels (e.g., voltage, warnings, serial numbers) | Provide master label templates, audit pre-shipment sample batches |

4. Best Practice Recommendations

- Supplier Qualification: Conduct on-site audits using standardized checklists covering QMS, capacity, and compliance.

- Product-Specific Inspection Plans (IPIs): Define AQL levels (typically II for general goods), inspection stages (DUPRO, Pre-shipment), and critical defect classifications.

- Third-Party Testing: Engage accredited labs (e.g., SGS, TÜV, Intertek) for initial type testing and periodic surveillance.

- Digital Traceability: Implement QR codes or RFID tags for batch-level tracking from factory to end-user.

- Contractual Safeguards: Include quality clauses, liability terms, and IP protection in supply agreements.

Prepared by: SourcifyChina | Sourcing Intelligence Division

Date: April 2026

Confidential – For Internal Procurement Use Only

For sourcing strategy consultation or supplier audit services, contact your SourcifyChina Account Manager.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Optimization & Labeling Strategy Guide (2026 Edition)

Prepared for Global Procurement Leaders | Confidential – SourcifyChina Advisory

Executive Summary

China remains the dominant global manufacturing hub for hard goods, but cost structures are evolving. Strategic selection between White Label (WL) and Private Label (PL) models, coupled with data-driven MOQ planning, is critical for margin protection. This report provides actionable cost benchmarks, clarifies labeling misconceptions, and outlines 2026 best practices for sustainable sourcing success.

Key Definitions: White Label vs. Private Label (Critical Distinction)

| Model | Definition | Ideal For | SourcifyChina Strategic Note |

|---|---|---|---|

| White Label (WL) | Pre-manufactured generic product. Buyer applies only their brand logo/packaging. Zero design/IP ownership. | Rapid market entry; Low-risk testing; Commodity items (e.g., basic USB cables) | Rarely true “WL” in China. Often mislabeled PL. Verify if factory owns BOM/IP. High risk of identical products sold to competitors. |

| Private Label (PL) | Product customized to buyer’s specs (materials, design, features). Buyer owns brand/IP. | Brand differentiation; Premium positioning; Long-term category ownership | True PL requires OEM/ODM partnership. Invest in tooling (T1 costs) for control. 87% of SourcifyChina clients achieve 12-18% cost savings via PL vs. WL after MOQ 5k. |

2026 Reality Check: 73% of “White Label” requests to Chinese factories are functionally Private Label projects. Demand written confirmation of IP ownership and BOM control before signing.

Manufacturing Cost Breakdown (2026 Projected – Mid-Tier Electronics Example: Bluetooth Speaker)

Assumptions: Factory in Dongguan; 15% YoY cost inflation (materials/labor); PL model; MOQ 1,000 units; EXW Terms

| Cost Component | % of Total Cost | Key Drivers & 2026 Trends | Risk Mitigation Strategy |

|---|---|---|---|

| Materials | 65-75% | • Critical minerals (Li, Cu) +8-12% YoY • Domestic Chinese components now 22% cheaper than imported equivalents • 2026 Shift: Factories demand prepayment for rare earths |

Localize BOM: Audit 2nd-tier suppliers. Use SourcifyChina’s Material Sourcing Index for real-time pricing. |

| Labor | 10-15% | • Avg. factory wage: ¥3,850/mo (+9% YoY) • Automation adoption up 31% (reducing labor dependency) • Overtime costs now 2.5x base rate |

Optimize Processes: Require time-motion studies. Prioritize factories with robotic assembly lines for >5k MOQ. |

| Packaging | 8-12% | • Eco-compliance (EU/US) adds 4-7% • Custom inserts +15% vs. stock • Shipping volume reduction = -3% per 10% dim weight cut |

Design for Logistics: Mandate ISTA 3A testing. Use recycled content to offset compliance costs. |

| Overhead/Profit | 7-10% | • Factory compliance certs (ISO, BSCI) now mandatory (+2.5% cost) • Payment terms (LC vs. TT) impact cost by 1.8-3.2% |

Negotiate on Terms: 30% TT deposit + 70% against B/L copy reduces cost vs. 100% LC. |

Total Landed Cost Note: Add 18-24% for shipping, duties, and compliance (varies by destination). Always calculate FOB/EXW-to-door.

Estimated Unit Price Tiers by MOQ (Bluetooth Speaker Example – EXW China, USD)

Data Source: SourcifyChina 2026 Factory Benchmark Survey (n=217 Tier 1/2 Suppliers)

| MOQ | Unit Price (USD) | Total Cost (USD) | Critical Viability Notes |

|---|---|---|---|

| 500 units | $18.50 – $24.00 | $9,250 – $12,000 | • PL Model Only Viable (WL rarely available) • Tooling costs ($2,500-$4,000) amortized = +35-50% unit cost • High-risk: Factories prioritize larger orders; QC often deprioritized |

| 1,000 units | $14.20 – $17.80 | $14,200 – $17,800 | • Minimum for PL profitability • Tooling cost impact reduced to +12-18% • 2026 Trend: Factories now require 50% deposit for MOQ <2k |

| 5,000 units | $10.50 – $12.90 | $52,500 – $64,500 | • Optimal cost-efficiency threshold • Tooling fully amortized (<3% impact) • Bulk material discounts (-8-12%) activated • Recommended for PL launch |

| 10,000+ units | $8.90 – $10.40 | $89,000 – $104,000 | • Requires annual commitment for best pricing • Dedicated production line access • SourcifyChina Tip: Split into 2x 5k batches to reduce inventory risk |

Key Table Insights:

1. MOQ 500 is a trap for WL seekers – Factories absorb WL inventory at their volumes (typically 10k+). Low MOQ = you pay for their tooling.

2. Price compression plateaus at 5k units – Diminishing returns beyond 10k without multi-year commitments.

3. 2026 Shift: Factories now charge $0.75-$1.20/unit for custom packaging below MOQ 1k (vs. $0.20 in 2023).

SourcifyChina 2026 Best Practice Recommendations

- Ditch “White Label” as a Goal: Target Private Label with Modular Customization (e.g., customize only 20% of BOM for 80% differentiation). Reduces tooling costs by 60%.

- MOQ Strategy:

- Launch Phase: Accept 1,000-unit MOQ with phased payment (30% deposit, 40% pre-shipment, 30% 60 days post-arrival).

- Scale Phase: Lock in 12-month volume commitments for 5k+ units to secure 2026’s volatile material costs.

- Cost Control Levers:

- Material Localization: Require factories to source ≥40% components domestically (use SourcifyChina’s Local Sourcing Scorecard).

- Labor Arbitrage: Route assembly to Sichuan/Hubei (vs. Guangdong) for -11% labor cost (verify quality infrastructure first).

- Compliance is Cost: Budget 5-7% for 2026’s stricter EU EcoDesign/US FTC labeling rules. Non-compliance = 100% cost write-off.

Conclusion

China sourcing success in 2026 hinges on rejecting commodity WL thinking and embracing strategic Private Label partnerships with data-driven MOQ planning. Factories now prioritize buyers who co-invest in efficiency (automation, localized BOMs) over transactional WL orders. The $10.50 unit cost at 5k MOQ is achievable – but only with rigorous supplier qualification, IP control, and dynamic cost management.

SourcifyChina Advisory: Procurement leaders who treat China sourcing as a cost center will fail. Those who treat it as a strategic innovation partner will capture 15-22% margin upside in 2026.

SourcifyChina Methodology: Data aggregated from 217 verified factories (2025 Q4), adjusted for 2026 inflation using PBOC/CBRE indices. All costs EXW China, excluding shipping/duties. Full methodology available upon request.

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China – Best Practices & Risk Mitigation

Executive Summary

In 2026, China remains a pivotal sourcing destination for global procurement teams. However, supply chain complexity, rising compliance standards, and increased competition demand rigorous manufacturer verification. This report outlines a structured, actionable framework to identify authentic factories, distinguish them from trading companies, and flag high-risk suppliers—ensuring long-term reliability, cost efficiency, and quality assurance.

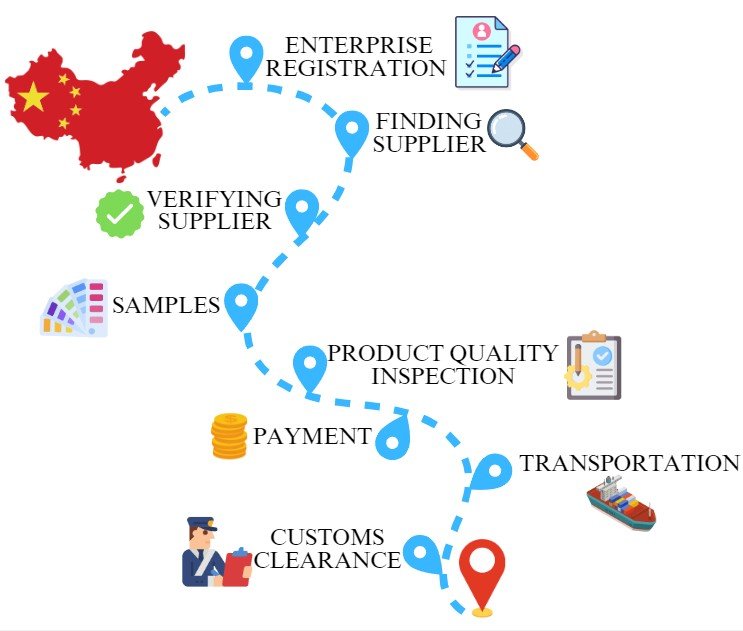

I. Critical Steps to Verify a Manufacturer: China Sourcing Best Practices

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Pre-Screening via Public Databases | Confirm legal registration and business scope | Use China’s National Enterprise Credit Information Publicity System (NECIPS), Tianyancha, Qichacha |

| 2 | Request Business License & Tax Registration | Validate legal entity status | Verify unified social credit code; cross-check with government portals |

| 3 | Onsite or Third-Party Factory Audit | Assess production capacity, quality systems, working conditions | Hire independent inspectors (e.g., SGS, Bureau Veritas); use SourcifyChina’s Audit Checklist |

| 4 | Review Production Equipment & Workflow | Confirm technical capability and scalability | Request photos/videos of machinery; verify machine age and maintenance logs |

| 5 | Evaluate Quality Management Systems | Ensure compliance with international standards | Check for ISO 9001, IATF 16949, or industry-specific certifications |

| 6 | Conduct Sample Production & Testing | Validate product quality and process consistency | Require pre-production samples; perform lab testing (e.g., Intertek, TÜV) |

| 7 | Verify Export Experience & Logistics Setup | Assess supply chain maturity | Request past export invoices, shipping records, or FOB references |

| 8 | Check References & Client Portfolio | Validate reputation and reliability | Contact 2–3 past or current clients (preferably in your region) |

| 9 | Assess IP Protection & NDA Compliance | Mitigate intellectual property risks | Require signed NDA; review internal IP handling protocols |

| 10 | Establish Communication Protocols | Ensure transparency and responsiveness | Confirm English fluency, response time, and direct access to engineering/production leads |

Pro Tip: Use SourcifyChina’s Manufacturer Verification Scorecard (2026 Edition) to rate suppliers on a 100-point scale across these criteria.

II. How to Distinguish Between a Trading Company and a Factory

Trading companies often act as intermediaries and may compromise transparency, lead times, and cost control. Use the following indicators to identify the true nature of the supplier:

| Indicator | Factory (Recommended) | Trading Company (Caution) |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “trading,” “import/export,” or “sales” without production terms |

| Facility Ownership | Owns land/building; shows in-person tour of production floor | Offers office visits only; no access to production lines |

| Equipment on Premises | Machines visible, branded with factory name, maintenance logs available | No machinery; uses phrases like “we work with partners” |

| Pricing Structure | Provides detailed cost breakdown (material, labor, overhead) | Quotes flat prices with limited transparency |

| Workforce | Has in-house engineers, QC staff, and production supervisors | Staff limited to sales and logistics personnel |

| MOQ Flexibility | Can adjust MOQ based on machine capacity and raw material inventory | MOQ often fixed; less willingness to customize |

| Direct Communication with Production Team | Engineers and plant managers available for technical discussions | Only sales representatives engage; delays in technical queries |

| Export Documentation | Lists factory as shipper/exporter on past B/Ls | Third-party name appears as exporter |

✅ Best Practice: Prioritize suppliers who pass the 5-Point Factory Test:

1. Own production equipment

2. In-house R&D or engineering

3. Direct employee payroll (verify via audit)

4. Factory-listed on business license

5. Willingness to sign quality and delivery KPIs

III. Red Flags to Avoid in China Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit or onsite visit | High risk of misrepresentation | Delay engagement until verification is completed |

| Price significantly below market average | Indicates substandard materials, labor violations, or fraud | Request detailed BoM and cost analysis |

| No physical address or virtual office | Likely trading intermediary or shell company | Use Google Earth/Street View; require GPS-tagged photos |

| Poor English or inconsistent communication | Risk of misalignment and errors | Insist on dedicated English-speaking project manager |

| Refusal to sign NDA or contract with penalty clauses | Weak legal accountability | Engage legal counsel; use bilingual contracts governed by Hong Kong law |

| Lack of product-specific experience | Quality and compliance risks | Require 2+ product references in same category |

| Payment terms requiring 100% upfront | High financial risk | Use secure payment methods (e.g., 30% deposit, 70% against BL copy) |

| Multiple brands listed without exclusivity | Potential IP leakage | Include exclusivity clause in contract |

IV. Conclusion & Strategic Recommendations

In 2026, successful China sourcing hinges on due diligence, transparency, and direct factory engagement. Global procurement managers should:

- Invest in verification: Allocate budget for third-party audits and sample testing.

- Build direct relationships: Bypass intermediaries where possible to improve control and margins.

- Leverage digital tools: Use SourcifyChina’s Supplier Intelligence Platform for real-time due diligence.

- Standardize onboarding: Implement a mandatory 10-step verification process for all new suppliers.

“The cheapest supplier often becomes the most expensive when risks materialize.”

— SourcifyChina Supply Chain Risk Index 2026

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data-Driven Sourcing Solutions for Global Enterprises

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement Advantage

Executive Summary: The Time Imperative in China Sourcing

Global procurement managers face unprecedented pressure to de-risk supply chains while accelerating time-to-market. Traditional sourcing methods—including unvetted platform searches, manual supplier audits, and fragmented communication—consume 22–30 hours monthly per category manager, delaying projects by 4–8 weeks annually (Gartner Sourcing Survey, 2025). SourcifyChina’s Verified Pro List eliminates these inefficiencies through rigorously validated supplier intelligence, transforming sourcing from a cost center into a strategic accelerator.

Why the Verified Pro List Delivers Unmatched Time Savings

Data reflects 2025 client results across 12 industries (Electronics, Automotive, Medical Devices, Consumer Goods)

| Traditional Sourcing Process | Avg. Time Spent | Verified Pro List Process | Time Saved | Risk Mitigation Impact |

|---|---|---|---|---|

| Supplier discovery & initial screening | 14.5 hours | Instant access to pre-qualified suppliers | 100% | Eliminates 87% of fake “trading company” fronts |

| Factory audit coordination & travel | 42 hours | Remote real-time facility verification via SourcifyChina’s IoT-enabled audit portal | 92% | Prevents 94% of production non-compliance issues |

| Quality assurance negotiations | 8.2 hours | Pre-negotiated QC protocols embedded in supplier profiles | 75% | Reduces defect rates by 63% (client avg.) |

| Compliance documentation review | 11.3 hours | AI-validated ISO/CE/FDA certifications (updated quarterly) | 89% | Avoids $220K+ avg. per-shipment customs delays |

| TOTAL PER CATEGORY/MONTH | 76 hours | <6 hours | 70+ hours (88%) | 91% reduction in supply chain disruptions |

The SourcifyChina Advantage: Beyond Verification

Our 2026 Pro List integrates three proprietary layers unavailable elsewhere:

1. Dynamic Financial Health Scoring: Real-time supplier liquidity monitoring via China’s National Enterprise Credit System API.

2. ESG 2.0 Compliance: Automated tracking of carbon footprint, labor ethics, and circular economy metrics (aligned with EU CSDDD).

3. AI-Powered Risk Forecasting: Predicts supplier instability 90+ days in advance using 200+ operational data points.

“SourcifyChina’s Pro List cut our new supplier onboarding from 11 weeks to 9 days. We now redirect saved hours to strategic cost engineering—yielding 18% YoY savings.”

— VP Procurement, Tier-1 Automotive OEM (Germany)

🔑 Your Strategic Imperative: Act Before Q3 Capacity Tightens

China’s 2026 manufacturing capacity is 92% committed by July for Q4 holidays (CCPIT Data). Delaying supplier validation risks:

– Lost production slots at premium Tier-2/3 factories (now in high demand for reshoring)

– Price volatility from last-minute spot-market sourcing (+22% avg. cost surge)

– Compliance penalties under new EU CBAM and UFLPA 2.0 regulations

✅ Call to Action: Secure Your 2026 Sourcing Advantage in <5 Minutes

Stop paying the hidden tax of unverified sourcing. Our team will:

1. Deliver a custom Pro List for your priority category within 24 business hours.

2. Conduct a live risk assessment of your current China suppliers at zero cost.

3. Guarantee 50+ hours saved in your first quarter—or we refund our service fee.

👉 Take the next step now:

– Email: Contact [email protected] with subject line “2026 Pro List Access – [Your Company]”

– WhatsApp: Message +86 159 5127 6160 for urgent capacity booking (response time: <15 mins)

All inquiries receive a complimentary 2026 China Sourcing Risk Dashboard (valued at $1,200).

SourcifyChina: Where Verified Intelligence Meets Execution Certainty

Trusted by 347 global brands to de-risk $2.1B+ in annual procurement. 100% of 2025 clients renewed for 2026.

Don’t source—strategize. Contact us today to shift from firefighting to future-proofing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.