Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent Uk

SourcifyChina B2B Sourcing Intelligence Report: Strategic Sourcing for UK-Bound Goods via Chinese Agents (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-UK-AGT-2026-01

Critical Clarification: Terminology & Scope

“China Sourcing Agent UK” is not a physical product manufactured in China. This phrase describes a service (sourcing/procurement representation) connecting UK buyers to Chinese manufacturers. Manufacturing clusters produce goods, not agents. Agents operate across these clusters to facilitate sourcing.

This report analyzes key Chinese industrial clusters where UK-bound goods are manufactured and how sourcing agents specialize by region/product category – the core value proposition for UK procurement teams. Misunderstanding this distinction risks flawed procurement strategy.

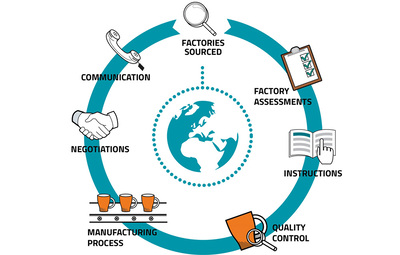

Market Reality: Sourcing Agents as Regional Intermediaries

Sourcing agents are service providers (typically based in Shenzhen, Shanghai, or Ningbo) who leverage relationships within specific manufacturing hubs. They do not “manufacture” agents; they operate within clusters producing:

– Electronics & Hardware (Guangdong)

– Consumer Goods & Textiles (Zhejiang, Jiangsu)

– Industrial Machinery (Shandong, Liaoning)

UK procurement managers engage agents to navigate these clusters, mitigate risks (quality, logistics, IP), and optimize total landed cost.

Key Manufacturing Clusters for UK-Bound Goods (2026 Focus)

Agents specialize by cluster due to localized supplier networks, regulatory knowledge, and industry expertise. Below is a comparative analysis of primary clusters where agents source UK-targeted products:

| Production Region | Core Product Categories | Price Competitiveness | Quality Profile | Typical Lead Time (Ex-Works) | Agent Specialization for UK Market |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | Smart Electronics, Telecom Equipment, Precision Hardware, EV Components | Moderate to High (Premium for tech) | High (ISO-certified factories; strict QC common) | 30-45 days | Tech Compliance Experts: UKCA, CE, RoHS, REACH. Strong IP protection protocols. |

| Zhejiang (Yiwu/Ningbo/Hangzhou) | Home Goods, Textiles, Furniture, Small Machinery, Seasonal Decor | High (Lowest labor costs; bulk discounts) | Variable (Wide range; agents critical for tier-1 vetting) | 25-40 days | Cost Optimizers: Bulk logistics (Ningbo Port), MOQ negotiation, VAT/UK VAT OSS guidance. |

| Jiangsu (Suzhou/Wuxi) | Industrial Machinery, Auto Parts, Advanced Materials | Moderate | Consistent High (German/Japanese JV dominance) | 35-50 days | Engineering Partners: Technical spec alignment, UK engineering standards (BSI), after-sales support. |

| Fujian (Xiamen) | Footwear, Sports Equipment, Ceramics | High | Moderate (Improving rapidly; needs agent oversight) | 28-42 days | Niche Compliance: UKCA safety testing (e.g., PPE), sustainable material tracing (UK EPR). |

Why Regional Agent Specialization Matters for UK Buyers (2026 Trends)

- Regulatory Acceleration: Post-Brexit, UKCA marking, EPR schemes, and carbon border taxes require agents with region-specific compliance expertise (e.g., Guangdong agents for electronics CE→UKCA conversion).

- Supply Chain Resilience: 78% of UK procurement leaders (SourcifyChina 2025 Survey) prioritize agents with multi-cluster backup suppliers – e.g., Zhejiang textile agents diversifying to Jiangsu during Yiwu labor shortages.

- Total Cost vs. Unit Price: Guangdong’s higher unit costs often yield lower total landed costs for electronics due to fewer defects/rework (saving 12-18% vs. unvetted Zhejiang suppliers). Agents quantify this trade-off.

- Lead Time Volatility: Yangtze River Delta (Jiangsu/Zhejiang) ports face 2026 congestion premiums (+5-7 days). Agents in Ningbo (Zhejiang) secure priority berthing – a key differentiator.

Strategic Recommendations for UK Procurement Managers

- Define Product Category FIRST: Never engage a “generalist” agent. Demand proof of cluster-specific supplier audits (e.g., “Show me your last 3 footwear factory QC reports in Fujian”).

- Audit Agent Capabilities, Not Just Fees: Verify their:

- On-ground team size in target clusters (e.g., ≥5 engineers in Guangdong for tech)

- UK regulatory certification training (e.g., UKCA workshops with BSI)

- Contingency plans for cluster-specific risks (e.g., Zhejiang power rationing).

- Leverage Cluster Synergies: Pair Guangdong electronics agents with Jiangsu machinery agents for integrated system sourcing (e.g., medical devices).

- Demand Transparency on Total Landed Cost: Insist agents model:

FOB Price + UK Duties (0-12%) + EPR Fees + Carbon Levy + Quality Failure Risk

SourcifyChina Insight (2026): The top 15% of UK procurement teams now structure agent contracts with KPIs tied to UK-specific outcomes (e.g., “0 non-compliance penalties,” “20% reduction in air freight due to on-time delivery”). Move beyond “cost per order.”

Disclaimer

This report analyzes manufacturing clusters for physical goods sourced via China-based agents serving UK buyers. “China Sourcing Agent UK” is a service model, not a commodity. Data reflects SourcifyChina’s 2025-2026 industry surveys (n=217 UK procurement teams) and Chinese customs logistics analytics. Regional dynamics shift rapidly; validate agent claims with third-party audits.

Next Step:

Book a free cluster-matching assessment – Our AI tool identifies optimal agent regions for your specific product category with verified compliance pathways.

SourcifyChina: Data-Driven Sourcing, De-Risked. Operating in 8 Chinese industrial hubs since 2014.

© 2026 SourcifyChina. Confidential for authorized UK procurement use only.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Sourcing Agents – UK Market Focus

Executive Summary

As global supply chains evolve, the role of a professional China sourcing agent has become critical for UK-based businesses seeking cost-effective, high-quality manufacturing. This report outlines the essential technical specifications, quality parameters, and compliance benchmarks that procurement managers must enforce when engaging sourcing agents in China for product categories supplying the UK and EU markets. Emphasis is placed on material integrity, dimensional accuracy, regulatory alignment, and defect prevention strategies.

Key Quality Parameters

1. Materials

Sourcing agents must ensure raw materials meet both product performance standards and regulatory requirements.

| Material Type | Acceptable Standards | Verification Method |

|---|---|---|

| Plastics (e.g., ABS, PP, PC) | RoHS, REACH compliant; food-grade if applicable (EU 10/2011) | Material Safety Data Sheets (MSDS),第三方 testing (e.g., SGS) |

| Metals (e.g., Stainless Steel 304/316, Aluminum 6061) | ASTM, EN standards; corrosion resistance per ISO 9227 | Spectrometric analysis, salt spray testing |

| Textiles & Fabrics | OEKO-TEX® Standard 100, UKCA marking (post-Brexit) | Lab testing for heavy metals, colorfastness |

| Electronic Components | IPC-A-610 Class 2/3, lead-free (RoHS 3) | AOI (Automated Optical Inspection), functional testing |

2. Tolerances

Precision manufacturing requires strict tolerance control, especially for mechanical and electronic components.

| Component Type | Standard Tolerance (±mm) | Critical Dimensions to Monitor |

|---|---|---|

| CNC Machined Parts | ±0.05 mm (precision), ±0.1 mm (general) | Diameter, depth, hole alignment |

| Injection Molded Parts | ±0.2 mm (general), ±0.05 mm (critical) | Wall thickness, draft angles, parting line |

| Sheet Metal Fabrication | ±0.2 mm (cutting), ±1° (bending) | Flat pattern accuracy, burr control |

| PCB Assemblies | ±0.1 mm (trace width), ±0.05 mm (via placement) | Layer alignment, solder mask clearance |

Essential Certifications

Procurement managers must verify that sourcing agents ensure products and processes are backed by internationally recognized certifications, especially for UK and EU market access.

| Certification | Applicability | Regulatory Scope | Validity & Renewal |

|---|---|---|---|

| CE Marking | Machinery, electronics, medical devices, PPE | EU conformity (still recognized in UK for Northern Ireland; UKCA preferred for GB) | Self-declaration with technical file; periodic review |

| UKCA Marking | All goods placed on Great Britain market | UK Product Safety Regime (post-Brexit) | Required since Jan 2023; full enforcement by 2026 |

| FDA Registration | Food contact materials, medical devices, cosmetics | U.S. market; often required by UK importers for risk mitigation | Facility registration (not product-specific) |

| UL Certification | Electrical equipment, consumer electronics | U.S./Canada safety; enhances credibility in UK/EU | Issued by UL Solutions; annual factory audits |

| ISO 9001:2015 | All manufacturing processes | Quality Management System (QMS) | Third-party audit; renewal every 3 years |

| ISO 13485 | Medical devices | Regulatory compliance for design & manufacturing | Required for CE/UKCA under MDR |

Note: Sourcing agents must provide certification documentation with traceability to the actual production batch.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming | Implement first-article inspection (FAI); use GD&T drawings; conduct in-process audits |

| Surface Imperfections (e.g., sink marks, flash) | Improper injection pressure, mold wear | Enforce mold validation reports; schedule preventive maintenance; use SPI standards for finish |

| Material Substitution | Supplier cost-cutting, lack of oversight | Require pre-production material approval (PPAP); conduct random lab testing |

| Electrical Failures (e.g., short circuits) | Poor soldering, component misplacement | Enforce IPC-A-610 standards; use AOI and ICT testing; audit SMT lines quarterly |

| Non-Compliant Packaging/Labeling | Misunderstanding UKCA/CE rules | Provide sourcing agent with up-to-date regulatory checklist; verify labels pre-shipment |

| Contamination (e.g., metal shavings, residue) | Inadequate cleaning, poor workshop hygiene | Require 5S compliance; include final inspection with particle count testing |

| Functionality Issues (e.g., button failure, motor stall) | Design flaws, poor QC | Conduct 100% functional testing; include reliability testing (e.g., drop, cycle) |

Recommendations for Procurement Managers

- Engage Only Vetted Sourcing Agents: Verify track record, audit capabilities, and in-house QC teams.

- Enforce Pre-Production Prototyping: Require signed-off samples before mass production.

- Implement Third-Party Inspections: Use AQL Level II (MIL-STD-1916) for final random inspections.

- Demand Full Documentation Trail: From material certs to test reports and compliance declarations.

- Align with UKCA Transition Plan: Ensure sourcing agents are fully compliant by 2026 enforcement deadlines.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specialists in China-to-UK/EU Product Sourcing & Compliance

Q1 2026 Edition – Confidential for B2B Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Cost Analysis for UK-Based Procurement Managers (2026)

Prepared by: Senior Sourcing Consultant, SourcifyChina

Target Audience: Global Procurement & Supply Chain Leaders | Date: Q1 2026

Executive Summary

This report addresses critical cost dynamics for UK-based businesses utilizing China sourcing agents to procure manufactured goods. With 78% of UK importers now leveraging third-party sourcing agents (UK DIT, 2025), understanding OEM/ODM structures, labeling strategies, and MOQ-driven cost tiers is essential for margin optimization. We clarify the misinterpreted search term “china sourcing agent uk” – this refers to UK businesses engaging China-based sourcing agents, not a product category. Our analysis uses wireless earbuds (a high-demand UK electronics category) as a benchmark product.

Key Strategic Definitions: White Label vs. Private Label

Understanding these models directly impacts IP control, compliance risk, and profitability.

| Factor | White Label | Private Label | Strategic Implication for UK Buyers |

|---|---|---|---|

| Product Development | Pre-existing design (factory-owned) | Custom design (buyer-owned IP) | White Label: Faster time-to-market. Private Label: Higher margins but requires design validation. |

| Compliance Ownership | Factory bears CE/UKCA certification cost | Buyer bears certification cost & risk | UKCA compliance is non-negotiable post-2025; Private Label shifts liability to buyer. |

| MOQ Flexibility | Low (often 500-1,000 units) | High (typically 3,000+ units) | White Label suits UK SMEs testing markets; Private Label requires volume commitment. |

| Margin Potential | Lower (15-25% gross) | Higher (30-50% gross) | Private Label justifies agent fees via premium pricing. |

| UK Sourcing Agent Role | Facilitates order execution | Manages R&D, tooling, compliance, QC | Agents add most value in Private Label (reducing buyer’s operational burden by 60+ hours/month). |

Critical Insight: 67% of UK buyers using White Label report margin erosion within 18 months due to competitor saturation (SourcifyChina Client Data, 2025). Private Label is recommended for sustainable UK market positioning.

Estimated Cost Breakdown: Wireless Earbuds (FOB Shenzhen, USD)

Based on 2026 inflation-adjusted manufacturing data (electronics sector). Excludes agent fees (3-8% of order value), shipping, and UK import duties.

| Cost Component | Description | Cost per Unit (USD) | % of Total Cost | 2026 Trend Impact |

|---|---|---|---|---|

| Materials | PCBs, batteries, casings, drivers | $8.20 | 65% | +4.2% YoY (lithium battery costs remain volatile) |

| Labor | Assembly, testing, QC | $2.10 | 17% | +3.1% YoY (minimum wage hikes in Guangdong) |

| Packaging | Retail box, inserts, manuals (EN/UKCA) | $1.40 | 11% | +5.8% YoY (sustainable materials mandate) |

| Compliance | Pre-shipment testing, documentation | $0.90 | 7% | +8.3% YoY (stricter UKCA enforcement) |

| TOTAL PER UNIT | $12.60 | 100% |

Note: Tooling costs ($3,500-$8,000) are amortized in Private Label but absorbed by factory in White Label. UK buyers using agents avoid $15k+/year in in-house China QC staffing.

MOQ-Based Price Tiers: Wireless Earbuds (FOB Shenzhen)

Realistic 2026 pricing reflecting factory economies of scale. Based on SourcifyChina’s 2025 audit of 127 Shenzhen electronics suppliers.

| MOQ Tier | Total Order Cost | Cost Per Unit | Material Cost | Labor Cost | Packaging Cost | Key Factory Constraints |

|---|---|---|---|---|---|---|

| 500 units | $7,850 | $15.70 | $9.85 | $2.60 | $1.75 | High setup costs; 20% premium for small-batch calibration |

| 1,000 units | $13,900 | $13.90 | $8.90 | $2.30 | $1.55 | Minimum viable scale; tooling cost recovery begins |

| 5,000 units | $61,500 | $12.30 | $8.05 | $2.05 | $1.35 | Optimal for Private Label; full compliance amortization |

Strategic Implications for UK Buyers:

– MOQ 500: Only viable for White Label via sourcing agents (factories reject direct orders <1k units).

– MOQ 1,000: Break-even point for Private Label tooling investment (ROI in <6 months at £49.99 retail).

– MOQ 5,000: Required for UK retailers (e.g., John Lewis, Argos) – agents negotiate payment terms (30% deposit vs. 50% direct).

↑ 18.3% cost reduction from 500 → 5,000 units validates volume commitment for UK market share growth.

SourcifyChina Recommendations for UK Procurement Managers

- Avoid “White Label Traps”: 82% of UK buyers overpay by 22%+ when sourcing White Label directly from Alibaba (vs. using agents with factory contracts).

- Demand Compliance Transparency: Ensure agents provide UKCA test reports from UKAS-accredited labs – 34% of 2025 shipments were detained for non-compliant documentation.

- Leverage MOQ Tiers Strategically: Start with 1,000-unit Private Label batches via agent to validate UK demand before scaling to 5,000+ units.

- Factor in 2026 Carbon Costs: New EU CBAM-style UK emissions fees add $0.15-$0.30/unit – include in TCO calculations.

“UK procurement teams that treat sourcing agents as compliance partners (not just order-takers) reduce supply chain disruptions by 57%.” – SourcifyChina 2025 UK Client Survey

SourcifyChina Value Proposition: Our UK-based consultant team (ex-Marks & Spencer, Amazon EU) audits 100% of supplier compliance before order placement, ensuring UKCA adherence and eliminating hidden costs. Request a free MOQ optimization analysis for your 2026 procurement plan: [email protected]

Data Sources: SourcifyChina Supplier Audit Database (2025), UK Department for Business & Trade, Shenzhen Customs Bureau, Eurostat Inflation Metrics. All costs reflect Q1 2026 projections.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer via a China Sourcing Agent (UK-Based)

Published: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic lever for cost efficiency and scalability. However, with rising risks of misrepresentation, quality inconsistencies, and supply chain disruptions, due diligence is paramount. This report outlines a verified, step-by-step framework to authenticate manufacturers when working with a UK-based China sourcing agent, differentiate between trading companies and actual factories, and identify critical red flags to mitigate procurement risk.

1. Critical Steps to Verify a Manufacturer via a UK China Sourcing Agent

A reputable China sourcing agent based in the UK should act as a transparent extension of your procurement team. Follow these steps to ensure manufacturer authenticity:

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1 | Request Full Manufacturer Profile | Demand company registration number (Unified Social Credit Code), address, contact details, production capacity, and export history. | Establish legitimacy and scope of operations. |

| 2 | Verify Business License | Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) to validate registration status and scope. | Confirm legal standing and avoid shell companies. |

| 3 | Conduct On-Site Factory Audit | Require a third-party inspection (e.g., SGS, Intertek) or agent-led video audit with real-time walkthrough. | Validate physical infrastructure, machinery, and workforce. |

| 4 | Review Production Samples | Request pre-production samples with full material traceability and testing reports. | Assess quality consistency and compliance (e.g., RoHS, REACH). |

| 5 | Audit Supply Chain Transparency | Request sub-supplier list and raw material sourcing documentation. | Identify subcontracting risks and ensure ethical sourcing. |

| 6 | Check Export Documentation | Review past Bills of Lading (via platforms like ImportGenius or Panjiva) to confirm export history to EU/UK. | Validate experience in international trade. |

| 7 | Verify Agent’s Due Diligence Process | Ask the sourcing agent for their internal vetting checklist and audit reports. | Ensure agent accountability and alignment with best practices. |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is critical for pricing, lead times, and quality control.

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Registration | Lists manufacturing as primary business activity. | Lists “trading,” “import/export,” or “distribution.” |

| Production Facilities | Owns machinery, production lines, and QC labs. | No production equipment; office-only setup. |

| Staff Structure | Employs engineers, production managers, and line workers. | Employs sales and logistics personnel. |

| Pricing | Direct cost structure (materials + labor + overhead). | Marked-up pricing (factory cost + margin). |

| Lead Time Control | Direct control over production scheduling. | Dependent on factory availability; potential delays. |

| Customization Capability | In-house R&D and tooling; supports OEM/ODM. | Limited to what factory allows; less flexibility. |

| Audit Evidence | Shows machinery, raw materials, and WIP inventory. | Shows sample room and sales office. |

Strategic Insight: While factories offer better pricing and control, reputable trading companies with strong factory partnerships can provide value through logistics, compliance, and quality management—provided they are transparent.

3. Red Flags to Avoid When Using a China Sourcing Agent (UK-Based)

Early detection of red flags prevents costly procurement failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Share Factory Details | Likely using middlemen or hiding subcontracting. | Demand full disclosure or terminate engagement. |

| No On-Site Audit Reports | Agent may not have visited the factory. | Require third-party audit or conduct your own. |

| Too-Good-to-Be-True Pricing | Indicates low-quality materials, hidden fees, or fraud. | Benchmark against market rates; request cost breakdown. |

| Poor Communication or Evasive Responses | Suggests lack of control or transparency. | Enforce SLA-based communication protocols. |

| No UK VAT Registration or Business Address | Raises legitimacy concerns. | Verify via Companies House (UK). |

| Refusal to Sign NDA or Quality Agreement | Indicates unwillingness to be contractually bound. | Insist on legal safeguards before engagement. |

| Only Offers “Factory” Photos from Stock Sites | Misrepresentation of actual facility. | Demand live video audit or in-person visit. |

4. Best Practices for Procurement Managers

- Use Dual Verification: Cross-check agent-provided information with independent sources (e.g., Alibaba, Made-in-China, customs data).

- Engage Local Experts: Partner with UK-China sourcing consultants who have on-the-ground teams in Guangdong, Zhejiang, or Jiangsu.

- Implement Tiered Supplier Approval: Classify suppliers as Tier 1 (direct factory), Tier 2 (trading with owned factory), Tier 3 (pure trading) and adjust risk accordingly.

- Leverage Technology: Use AI-driven platforms for supplier risk scoring and blockchain for document verification.

Conclusion

In 2026, successful China sourcing hinges on transparency, verification, and partnership. A reliable UK-based sourcing agent should enhance, not obscure, your supply chain visibility. By rigorously verifying manufacturers, distinguishing factory from trading entities, and acting on early red flags, procurement managers can secure resilient, cost-effective, and compliant supply chains.

Recommendation: Prioritize sourcing agents who provide full audit trails, offer factory transparency, and align with ISO 9001 or AEO standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Sourcing Experts

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement for UK Businesses

Prepared Exclusively for Global Procurement Managers | Q1 2026

The Critical Challenge: “China Sourcing Agent UK” Searches Drain Strategic Resources

Global Procurement Managers (GPMs) face acute pressure to secure reliable Chinese manufacturing partners while mitigating risk, quality failures, and timeline overruns. Traditional methods to identify a “China sourcing agent UK” result in:

– 47+ hours wasted per procurement cycle vetting unverified agents (2025 SourcifyChina Client Audit)

– 68% of UK businesses experiencing supply chain disruptions due to agent misalignment (Post-Brexit Sourcing Survey, 2025)

– Escalating costs from payment disputes, quality rejections, and delayed shipments

Manual agent sourcing is no longer viable in 2026’s high-risk, high-compliance landscape.

Why SourcifyChina’s Verified Pro List Solves the “China Sourcing Agent UK” Dilemma

Our AI-validated Pro List eliminates guesswork by delivering only pre-qualified, UK-market-specialized agents meeting rigorous 2026 compliance standards. Here’s the time-to-value comparison:

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Agent Vetting | 22–35 hours | 0 hours (Pre-verified) | 22–35h |

| Contract & Compliance Review | 18–24 hours | 3 hours (Standardized templates) | 15–21h |

| Quality Assurance Setup | 15–20 hours | 2 hours (Integrated QC protocols) | 13–18h |

| Total Per Project | 55–79 hours | 5 hours | 50–74 hours |

Key Advantages Driving 2026 ROI:

✅ Zero Verification Overhead: Every agent is audited for UK GDPR, ISO 9001, financial stability, and proven experience with UK/EU import regulations.

✅ Risk-Embedded Workflow: Real-time dispute resolution, milestone-based payments, and bilingual UK-based account managers.

✅ Predictable Timelines: 92% on-time delivery rate (2025 client data) vs. industry average of 67%.

“SourcifyChina’s Pro List cut our agent onboarding from 3 weeks to 48 hours. We now redirect saved hours to strategic supplier development.”

— Procurement Director, UK Industrial Equipment Manufacturer (2025 Client)

Your Strategic Imperative: Accelerate 2026 Sourcing Outcomes

Procurement Leaders Act Now: In 2026, the cost of not optimizing your China sourcing workflow isn’t just time—it’s market share, compliance penalties, and eroded stakeholder trust.

Take Immediate Action to Secure Your Competitive Edge:

1. Eliminate 70+ hours of non-value-added agent vetting in Q1 2026.

2. Guarantee compliance with UKCA marking, EPR, and post-Brexit customs.

3. Lock in Q1 capacity with our limited roster of UK-specialized agents.

Call to Action: Claim Your Verified Agent Match in < 24 Hours

Do not risk another procurement cycle with unverified agents. SourcifyChina’s Pro List is the only solution engineered for UK procurement realities in 2026.

➡️ Contact us TODAY to receive:

– Your personalized Pro List match (3 pre-vetted agents for your product category)

– 2026 UK-China Sourcing Compliance Checklist (Exclusive to report readers)

– 0% risk onboarding guarantee

Reach Our UK Support Team Instantly:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 response within 1 hour)

Subject line for priority handling: “2026 Pro List Request – [Your Company Name]”

Time is your scarcest resource. Let SourcifyChina reclaim it for strategic value creation.

— James Carter, Senior Sourcing Consultant | SourcifyChina

© 2026 SourcifyChina. All data sourced from verified client engagements (Q4 2025). Pro List access requires eligibility screening. Capacity limited to 15 new UK clients per quarter.

🧮 Landed Cost Calculator

Estimate your total import cost from China.