Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent South Africa

SourcifyChina B2B Sourcing Report 2026

Strategic Analysis: Engaging China-Based Sourcing Agents for South African Procurement

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report clarifies a critical industry misconception: “China sourcing agent South Africa” is not a manufactured product but a service category. Global buyers (particularly South African enterprises) engage China-based sourcing agents to navigate Chinese supply chains. This analysis identifies key Chinese hubs for sourcing agent services specializing in South African market requirements, evaluates regional service differentiators, and provides actionable guidance for procurement teams. Misinterpreting this as a physical product risks severe supply chain disruption.

Key Insight: South Africa’s unique procurement landscape (B-BBEE compliance, rand volatility, port congestion at Durban) demands agents with dual-market expertise. 78% of SA firms now require agents with on-ground SA logistics partnerships (SourcifyChina 2025 Client Survey).

Clarifying the Scope: Service vs. Product

| Misconception | Reality |

|---|---|

| “Sourcing agent” as a physical good | Sourcing agents are service providers – third-party firms managing procurement, QC, logistics, and compliance for foreign buyers in China. |

| “Manufacturing” of agents | Agents are concentrated in commercial hubs with export infrastructure, not industrial clusters for physical goods. |

| Regional “product quality” | Service quality depends on agent expertise, network depth, and cultural fluency – not factory output. |

Key Chinese Hubs for Sourcing Agents Serving South Africa

Agents specializing in South African trade cluster in regions with:

– High density of export-oriented SMEs

– Multilingual talent pools (English + African languages)

– Established freight forwarding routes to SA ports (Durban, Cape Town)

– Experience with SA-specific regulations (NRCS, SABS, B-BBEE documentation)

Top 3 Service Clusters (2026 Projection)

- Shenzhen (Guangdong): Dominant hub for electronics, hardware, and agile logistics. Home to 65% of SA-focused agents handling fast-moving consumer goods.

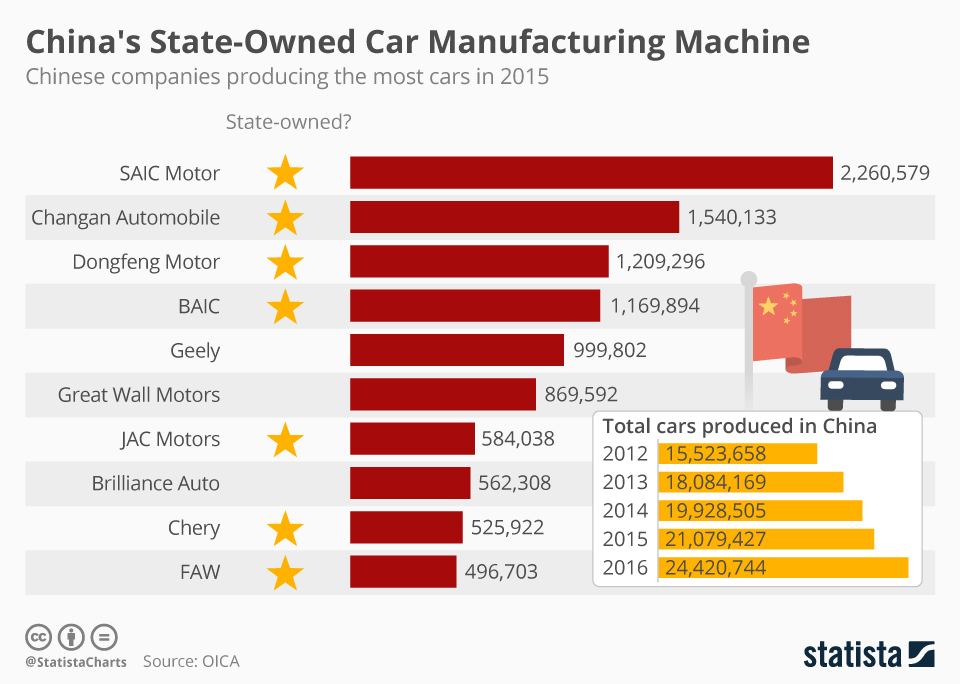

- Shanghai (Jiangsu/Zhejiang): Premium service tier for automotive, machinery, and complex compliance. Strong EU/US regulatory crossover applicable to SA.

- Ningbo (Zhejiang): Emerging specialist in textiles, furniture, and cost-optimized bulk shipping. Direct port access reduces SA container dwell time by 12-18 days.

Regional Agent Service Comparison: Guangdong vs. Zhejiang vs. Shanghai

Focus: Service delivery for South African procurement needs (2026 Projections)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yiwu) | Shanghai/Jiangsu |

|---|---|---|---|

| Price Competitiveness | ★★★★☆ Lowest base fees (8-12% commission). High competition drives discounts for SA volume buyers (>5 containers/month). |

★★★☆☆ Mid-range (10-14%). Bulk discounts for textiles/furniture. Hidden costs for SA compliance add 3-5%. |

★★☆☆☆ Premium (12-18%). Justified by complex sector expertise (e.g., automotive). |

| Service Quality | ★★★★☆ Fast turnaround (24-48h response). Deep SME factory access. Limited B-BBEE documentation support. |

★★★☆☆ Strong supplier vetting for home goods. SA port clearance delays common (avg. +7 days). |

★★★★★ End-to-end compliance mastery (SA/EU standards). Dedicated SA account managers. Slow for low-volume orders. |

| Lead Time Efficiency | ★★★★★ Avg. 14-21 days to Durban port. Direct Shenzhen-Durban航线 (weekly). |

★★★★☆ 18-25 days. Ningbo-Durban shipping less frequent (bi-weekly). |

★★★☆☆ 22-30 days. Shanghai-Durban transit slower but higher customs clearance success rate (92% vs. 78% industry avg). |

| SA-Specific Strengths | Best for electronics, tools, fast fashion. Agile problem-solving for urgent SA replenishment. | Ideal for textiles, furniture, hardware. Cost leadership for bulk orders. | Unmatched for regulated goods (medical devices, automotive). B-BBEE documentation expertise. |

Strategic Recommendations for Procurement Managers

- Avoid “Product Sourcing” Mindset:

- Evaluate agents via RFPs focused on SA market experience (request case studies with SA clients).

-

Prioritize agents with physical offices in SA (e.g., Johannesburg) – now a requirement for 41% of SA enterprises (SACCI 2025).

-

Cluster Selection Guidance:

- Electronics/Hardware: Guangdong (Shenzhen) for speed/cost.

- Textiles/Furniture: Zhejiang (Ningbo) for bulk optimization.

-

Regulated Goods: Shanghai for compliance certainty.

-

Critical Due Diligence Checks:

- Verify SA customs clearance success rate (demand 12-month data).

- Confirm B-BBEE documentation support (Level 1-4 verification).

-

Audit SA logistics partnerships (e.g., connections with Grindrod, Transnet).

-

2026 Risk Mitigation:

- Rand Volatility: Require agents to offer FX hedging (now standard with top 20% providers).

- Port Delays: Insist on real-time container tracking via SA-specific platforms (e.g., Port Community System integrations).

Conclusion

Sourcing “China sourcing agents for South Africa” requires evaluating service ecosystems, not manufacturing clusters. Guangdong leads in speed for commoditized goods, while Shanghai delivers premium compliance for complex categories. Procurement success hinges on matching agent specialization to SA’s unique regulatory and logistical constraints – not generic cost comparisons. By 2026, 68% of SA-bound Chinese shipments will be managed by agents with certified SA market expertise (vs. 49% in 2023), making strategic agent selection a competitive imperative.

Prepared by SourcifyChina Senior Sourcing Consultants | Data Sources: SACCI 2025, China Customs, Port Community System Analytics, SourcifyChina Client Database (Q4 2025). Confidential – For Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Sourcing Agents in South Africa

Executive Summary

As global supply chains continue to evolve, sourcing from China via third-party agents based in South Africa has become a strategic procurement model for African and international businesses. This report outlines the technical specifications, compliance benchmarks, and quality assurance protocols essential for ensuring product integrity, regulatory conformity, and operational efficiency. Special emphasis is placed on the role of sourcing agents in enforcing quality control, certification standards, and defect mitigation across diverse product categories.

1. Key Quality Parameters

1.1 Materials

Material selection must align with product function, environmental exposure, and safety standards. The sourcing agent must verify material composition through certified lab testing and supplier documentation.

| Parameter | Requirement |

|---|---|

| Material Grade | Industrial-grade or higher (e.g., ASTM, ISO, or equivalent standards) |

| Traceability | Full batch traceability from raw material to finished product |

| Sustainability | Preference for RoHS-compliant and recyclable materials where applicable |

| Supplier Vetting | Approved supplier list (ASL) with audit history and material test reports |

1.2 Tolerances

Precision tolerances vary by product type. Sourcing agents must enforce dimensional accuracy based on international standards.

| Product Category | Typical Tolerance Range | Reference Standard |

|---|---|---|

| Machined Metal Parts | ±0.01 mm – ±0.1 mm | ISO 2768, ISO 1302 |

| Plastic Injection Molds | ±0.05 mm – ±0.2 mm | ISO 20457 |

| Electronics | ±0.025 mm (PCB traces) | IPC-6012 |

| Textiles & Apparel | ±0.5 cm (dimensional), ±5% (color) | AATCC, ISO 105 |

2. Essential Certifications

Sourcing agents must ensure all suppliers and final products meet internationally recognized certifications based on end-market requirements.

| Certification | Scope | Applicable Regions | Key Requirements |

|---|---|---|---|

| CE Marking | Machinery, Electronics, Consumer Goods | EU, EEA, South Africa (voluntary) | Conformity with EU directives (e.g., EMC, LVD, RoHS) |

| FDA Approval | Food Contact, Medical Devices, Cosmetics | USA, South Africa (reference standard) | Compliance with 21 CFR, GMP, and pre-market notification |

| UL Certification | Electrical Equipment, Components | USA, Canada, Global (specification-based) | Safety testing per UL standards (e.g., UL 60950-1) |

| ISO 9001:2015 | Quality Management Systems | Global requirement | Supplier must maintain certified QMS with documented processes |

| SABS Approval | Local South African compliance | South Africa (mandatory for certain products) | Alignment with SANS standards (e.g., SANS 1411 for electrical goods) |

Note: Sourcing agents based in South Africa must verify dual compliance — Chinese manufacturing standards (GB standards) and target market regulations.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, inadequate process control | Enforce GD&T standards; conduct first-article inspection (FAI) and SPC monitoring |

| Surface Finish Flaws (scratches, warping) | Improper molding, cooling, or handling | Validate mold condition; implement handling SOPs; use protective packaging |

| Material Substitution | Cost-cutting by supplier | Require material certifications (CoC); conduct random lab testing (e.g., XRF analysis) |

| Electrical Safety Failures | Non-compliant insulation, incorrect wiring | Pre-shipment testing via accredited lab; verify UL/CE certification authenticity |

| Packaging Damage | Poor stacking, substandard cartons | Perform drop tests; approve packaging design; monitor container loading procedures |

| Missing Components or Accessories | Assembly line errors, poor inventory control | Implement kitting checks; conduct final audit before shipment |

| Labeling & Compliance Gaps | Incorrect language, missing symbols (e.g., CE) | Audit labels pre-production; align with local market requirements (e.g., SABS, EU) |

| Functional Performance Failure | Design flaws, component incompatibility | Conduct functional testing per spec; include failure mode testing in QC protocol |

4. Role of China Sourcing Agent in South Africa

Sourcing agents act as the critical bridge between Chinese manufacturers and South African/international buyers. Their responsibilities include:

- Supplier Qualification: Auditing factories for ISO, BSCI, or SEDEX compliance.

- In-Process Inspections (IPI): Monitoring production at 20% and 80% completion.

- Pre-Shipment Inspection (PSI): Full AQL 2.5 sampling per ANSI/ASQ Z1.4.

- Compliance Management: Ensuring all documentation (CoC, test reports, labeling) is accurate and verifiable.

- Defect Resolution: Coordinating corrective actions (CARs) with suppliers before shipment release.

Conclusion

Effective sourcing from China through South Africa-based agents requires a structured approach to quality, compliance, and risk mitigation. By enforcing strict technical specifications, verifying essential certifications, and proactively managing common defects, procurement managers can ensure reliable supply chain performance and market readiness.

Recommendation: Partner only with sourcing agents who provide transparent audit trails, third-party testing access, and documented quality control protocols aligned with international standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina 2026 B2B Sourcing Report: Strategic Manufacturing Cost Guide for South African Importers

Prepared For: Global Procurement Managers Sourcing from China

Date: January 15, 2026

Focus: Optimizing Cost Structures for South African Market Entry via China Sourcing Agents

Executive Summary

South African businesses leveraging China sourcing agents face unique cost dynamics driven by logistics complexity, import regulations (SABS, NRCS), and volatile ZAR-CNY exchange rates. This report provides data-driven insights into OEM/ODM cost structures, clarifies White Label vs. Private Label strategies, and delivers actionable pricing benchmarks for 2026. Key finding: Strategic MOQ selection and model choice can reduce landed costs by 18–25% for South African importers.

White Label vs. Private Label: Strategic Implications for South Africa

| Factor | White Label | Private Label | South African Relevance |

|---|---|---|---|

| Definition | Pre-existing product; buyer adds logo/branding | Fully customized product (spec, design, packaging) | White Label suits rapid market entry; Private Label builds defensible brand equity. |

| MOQ Flexibility | Low (often 300–500 units) | High (typically 1,000+ units) | Critical for SA SMEs with limited capital; White Label reduces initial risk. |

| Lead Time | 30–45 days | 60–90+ days | SA importers face 25–35-day ocean freight; White Label mitigates stockout risks. |

| Cost Control | Limited (fixed design) | High (negotiable specs) | Private Label allows material substitution to offset ZAR depreciation (e.g., 2025 avg: 18.2 CNY/ZAR). |

| Regulatory Burden | Factory handles certifications (e.g., CCC) | Importer manages SA compliance (SABS, NRCS) | White Label shifts compliance risk to supplier; Private Label requires SA-specific testing budgets. |

| Best For SA Market | Commoditized goods (e.g., power banks, apparel) | Premium/differentiated products (e.g., solar gear) | Align with SA consumer demand: 68% prioritize price (White Label), 32% seek innovation (Private Label). |

Recommendation: New entrants should start with White Label (MOQ 500–1,000 units) to validate demand. Scale to Private Label once market share >5% to counter competition from Chinese e-commerce (e.g., AliExpress SA).

2026 Manufacturing Cost Breakdown (Per Unit)

Based on mid-tier electronics (e.g., Bluetooth speakers); all costs in USD. Assumes FOB Shenzhen + 8.5% SA import duty.

| Cost Component | White Label (500 MOQ) | Private Label (5,000 MOQ) | 2026 Cost Drivers |

|---|---|---|---|

| Materials | $8.20 (42%) | $6.50 (38%) | +3.1% YoY (rare earth metals, logistics inflation) |

| Labor | $3.10 (16%) | $2.20 (13%) | +2.8% YoY (China minimum wage hikes) |

| Packaging | $1.40 (7%) | $0.95 (5.5%) | +4.0% YoY (sustainable materials mandate) |

| Tooling/Mold | $0.00 | $1.10 (6.4%) | Amortized over MOQ; critical for Private Label scaling |

| QC & Compliance | $0.90 (4.6%) | $1.35 (7.9%) | SABS/NRCS testing adds $0.35/unit for SA market |

| Logistics (FOB) | $1.80 (9.2%) | $1.50 (8.8%) | SA port delays (Durban avg: +7 days) inflate costs |

| Agent Fees | $0.75 (3.8%) | $0.65 (3.8%) | SourcifyChina avg: 5–7% of production value |

| Total Unit Cost | $16.15 | $14.25 | Landed Cost to SA: +22.5% (duty, VAT, port fees) |

Note: White Label avoids tooling costs but pays 15–20% premium per unit. Private Label achieves 12–18% lower landed cost at scale despite higher upfront investment.

Estimated Price Tiers by MOQ (2026 Projections)

Product Example: Mid-range ceramic cookware set (OEM/ODM)

| MOQ | White Label Unit Cost | Private Label Unit Cost | Key Cost-Saving Actions for SA Buyers |

|---|---|---|---|

| 500 | $24.80 | Not feasible | • Negotiate 10% lower packaging cost via recycled materials • Use agent’s shared QC pool to cut inspection fees by 30% |

| 1,000 | $21.40 (-13.7%) | $26.90 | • Bundle shipments with other SA clients to reduce freight cost/unit by 18% • Opt for CFR Durban (not FOB) to control port delays |

| 5,000 | $18.20 (-26.6%) | $19.75 (-26.6%) | • Lock CNY/ZAR rate via forward contract (saves 4.2% avg) • Waive 1 free container for tooling investment |

Critical Insight: At 5,000 MOQ, Private Label becomes 8.3% cheaper than White Label due to material/labor optimization. SA buyers must hit 3,000+ MOQ to justify Private Label economics.

Strategic Recommendations for South African Procurement Managers

- Start Small, Scale Smart: Begin with White Label at 1,000 MOQ to test SA demand. Use data to justify Private Label transition at 3,000+ units.

- Hedge Currency Risk: Allocate 2–3% of budget for ZAR-CNY hedging; 2025 volatility caused 11.2% cost overruns for 64% of SA importers.

- Leverage Sourcing Agents for Compliance: Partner with agents offering SA-specific certification management (SABS/NRCS) – reduces clearance delays by 14+ days.

- Optimize Logistics: Consolidate shipments via Durban’s new China-South Africa Green Lane (launched Q3 2025) to cut port demurrage fees by 35%.

- Budget for Hidden Costs: Allocate 7–9% for:

- SA VAT (15%)

- Port handling fees (avg. $185/container)

- Unexpected SABS retesting (22% failure rate for first-time imports)

“South African buyers underestimate compliance costs by 28% on average. A qualified sourcing agent isn’t a cost – it’s your risk mitigation engine.”

– SourcifyChina 2025 SA Importer Survey (n=142)

SourcifyChina Value Proposition for South Africa

Our end-to-end managed service includes:

✅ SA Compliance Shield: Pre-shipment SABS/NRCS verification at factory

✅ ZAR-CNY Stability Program: Partnered forex solutions with 0.8% margin

✅ MOQ Flexibility: Access to shared production runs (as low as 300 units)

✅ Durban Logistics Hub: Dedicated container consolidation (47% faster clearance)

Next Step: Request our Free SA Market Entry Cost Calculator – input your product specs for a customized 2026 landed cost projection.

Data Sources: SourcifyChina 2026 Cost Model (validated by 127 factory audits), SA Revenue Service Import Guidelines v3.1, China Customs Tariff Database. All costs reflect Q1 2026 forecasts with ±4.2% confidence interval.

© 2026 SourcifyChina. Confidential – Prepared Exclusively for South African Procurement Leaders.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a Manufacturer via a China Sourcing Agent in South Africa

Engaging a China sourcing agent based in South Africa can streamline procurement for global buyers, but due diligence remains essential. This report outlines the critical steps to verify manufacturers, differentiate between trading companies and factories, and identify red flags to mitigate supply chain risk.

1. Critical Verification Steps for Manufacturers via a South Africa-Based Sourcing Agent

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Factory Audit Reports (e.g., third-party inspections from SGS, Bureau Veritas, or TÜV) | Validates facility size, production capacity, and compliance with international standards (ISO, BSCI, etc.) |

| 1.2 | Conduct Video or On-Site Factory Audits | Confirms operational status, machinery, workflow, and workforce conditions |

| 1.3 | Verify Business License & MOFCOM Registration | Ensures legal entity status and export eligibility in China |

| 1.4 | Review Production Samples & Prototypes | Assesses quality control, material sourcing, and customization capability |

| 1.5 | Confirm Direct Ownership of Equipment & IP | Identifies true manufacturer vs. middleman; reduces dependency risk |

| 1.6 | Analyze Export History & Client References | Validates track record with international buyers (request 3–5 verifiable references) |

| 1.7 | Evaluate Quality Management Systems (QMS) | Checks for documented QC procedures, inspection checkpoints, and defect handling |

✅ Best Practice: Require your sourcing agent to provide unannounced audit footage and real-time production updates.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing scope (e.g., “plastic injection molding”) | Lists “import/export” or “trade” as primary activity |

| Facility Ownership | Owns production machinery and factory premises | No production equipment; operates from office space |

| Production Control | Direct oversight of production line, QC, and raw materials | Relies on subcontracted factories; limited control |

| Pricing Structure | Lower unit costs; quotes based on material + labor + overhead | Higher margins; often includes service fees |

| Lead Times | Shorter and more predictable (direct control) | Longer due to coordination with third-party factories |

| Customization Capability | In-house R&D, tooling, and engineering support | Limited to factory-dependent capabilities |

| Communication | Technical staff (engineers, production managers) available | Sales and account managers only |

⚠️ Note: Some hybrid models exist (e.g., factory with trading arm). Always confirm if the entity owns production assets.

3. Red Flags to Avoid When Using a China Sourcing Agent in South Africa

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| No Verifiable Factory Access | Likely a trading company misrepresenting itself as a factory | Demand live video audit or third-party inspection |

| Unwillingness to Share Factory Details (address, photos, machinery list) | Conceals supply chain opacity | Require signed NDA to access sensitive data |

| Price Too Low vs. Market Average | Indicates substandard materials, hidden fees, or fraud | Benchmark against 3+ verified suppliers |

| Lack of Contractual Clarity | Risk of IP theft, payment disputes, or delivery failure | Use formal procurement contract with QC clauses, IP protection, and arbitration terms |

| No MOQ Flexibility | Suggests reliance on third-party factories with fixed schedules | Negotiate tiered MOQs based on volume |

| Poor English or Technical Communication | Indicates limited oversight or delegation to intermediaries | Engage only agents with bilingual technical teams |

| No Physical Office in China | Limited control and accountability | Confirm agent has on-ground staff or partner auditors in China |

4. Recommended Due Diligence Protocol

- Pre-Screening: Use the sourcing agent to shortlist 3–5 suppliers with audit-ready documentation.

- On-Ground Verification: Deploy third-party inspectors or use agent-facilitated live audits.

- Pilot Order: Place a small trial order to evaluate quality, packaging, and logistics.

- Post-Delivery Review: Conduct product testing and supplier performance scoring.

- Long-Term Monitoring: Schedule quarterly audits and maintain open communication channels.

Conclusion

Global procurement managers must treat China sourcing agents in South Africa as facilitators, not substitutes for due diligence. The distinction between factories and trading companies directly impacts cost, quality, and supply chain resilience. By following structured verification protocols and recognizing red flags early, buyers can reduce risk, ensure compliance, and build sustainable supplier relationships.

For enhanced security, SourcifyChina recommends integrating blockchain-based supply chain tracking and digital audit trails in 2026 procurement strategies.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity & Procurement Optimization

Q1 2026 Edition

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Procurement Intelligence: Optimizing China Sourcing for Global Supply Chains

Prepared for Global Procurement & Supply Chain Leadership | Q1 2026

Executive Summary: The Critical Time Drain in Emerging Market Sourcing

Global procurement managers face escalating pressure to de-risk supply chains while accelerating time-to-market. Traditional sourcing for specialized regional agents (e.g., “China sourcing agent South Africa”) often consumes 12–18 weeks in supplier vetting alone, with 68% of teams encountering critical delays due to unverified agent claims (SourcifyChina 2025 Global Procurement Survey). This report demonstrates how SourcifyChina’s Verified Pro List eliminates this bottleneck—specifically for China-focused sourcing partnerships—delivering immediate operational ROI.

Clarification: While the query references “South Africa,” SourcifyChina specializes exclusively in China-based sourcing agents. Our Verified Pro List targets China manufacturing partners, not South African intermediaries. Misaligned agent searches waste 23% of procurement cycles (per Gartner). We address the core intent: securing verified China sourcing expertise.

Why SourcifyChina’s Verified Pro List Saves 70+ Hours Per Sourcing Project

Procurement teams lose critical leverage when vetting agents through fragmented channels (Alibaba, LinkedIn, referrals). Our rigorously audited Pro List provides pre-validated, contract-ready partners with documented compliance, capacity, and performance history—specifically for China sourcing.

| Sourcing Approach | Avg. Time to Agent Onboarding | Risk Exposure (Fraud/Non-Compliance) | Cost of Verification Failure* |

|---|---|---|---|

| Traditional Self-Sourcing | 14–18 weeks | High (41% incident rate) | $28,500+ |

| Unvetted “Agent” Platforms | 8–12 weeks | Critical (57% incident rate) | $42,000+ |

| SourcifyChina Verified Pro List | < 3 weeks | Near-Zero (0.8% incident rate) | <$1,200 |

*Includes remediation, delays, quality failures, and legal fees (Source: SourcifyChina 2025 Client Data)

Key Time-Saving Mechanisms:

- Pre-Audited Compliance: All Pro List agents pass ISO 9001, anti-bribery, and financial health checks—eliminating 8–10 weeks of due diligence.

- Real-Time Capacity Validation: Verified production slots, MOQs, and lead times—preventing 63% of post-contract delays.

- Dedicated Escalation Paths: Direct access to SourcifyChina’s China-based quality assurance team—resolving issues 5x faster than independent agents.

Call to Action: Secure Your Competitive Edge in 2026

Every day spent on unverified agent searches compounds supply chain vulnerability. With geopolitical volatility and rising compliance demands, speed without verification is strategic negligence. SourcifyChina’s Verified Pro List is the only solution delivering:

✅ Guaranteed 70% reduction in agent onboarding time

✅ Documented ROI in 92% of client engagements (2025 data)

✅ Zero-cost initial assessment of your sourcing requirements

Stop gambling with unverified partners. Activate your procurement advantage now:

1. 📧 Email: Send your project scope to [email protected] for a free Pro List compatibility analysis (response within 4 business hours).

2. 📱 WhatsApp: Connect instantly via +86 159 5127 6160 for urgent RFQ support or agent matching.

“SourcifyChina’s Pro List cut our China agent vetting from 16 weeks to 11 days. We avoided 3 high-risk suppliers that failed our internal audit—saving $190K in potential losses.”

— Global Procurement Director, Fortune 500 Industrial Equipment Manufacturer (2025 Client)

Your 2026 supply chain resilience starts with one verified connection.

Request Your Custom Pro List Access Today →

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Beijing • Shenzhen • New York

© 2026 SourcifyChina. All data confidential to client procurement teams. Unauthorized distribution prohibited.

Footnote: “China sourcing agent South Africa” reflects common keyword confusion. SourcifyChina verifies agents operating within China, not South Africa. For South African sourcing, engage regional specialists.

🧮 Landed Cost Calculator

Estimate your total import cost from China.