Sourcing Guide Contents

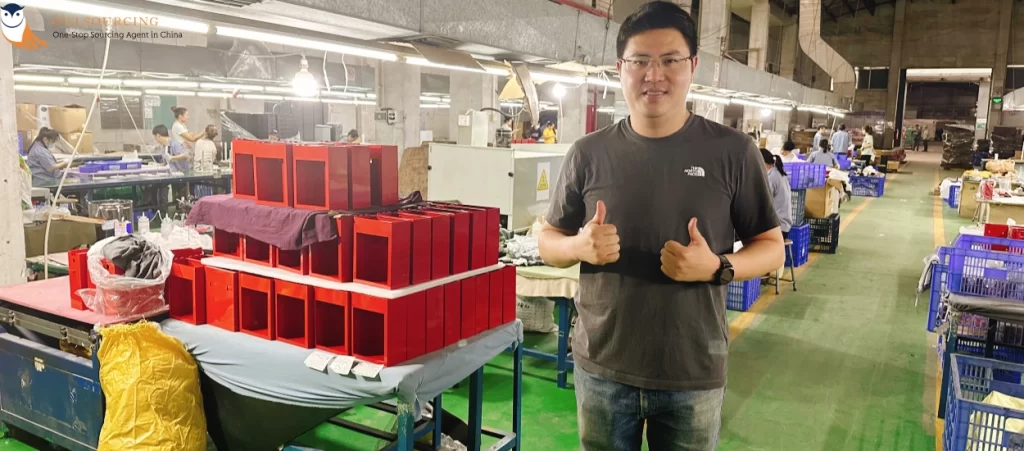

Industrial Clusters: Where to Source China Sourcing Agent Reddit

SourcifyChina B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing “China Sourcing Agent Reddit” – Clarification and Strategic Guidance

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

The search term “china sourcing agent reddit” does not refer to a physical product or manufactured good. Instead, it represents a digital search query used by international buyers seeking peer-reviewed insights, recommendations, and experiences related to China-based sourcing agents, often shared on platforms like Reddit (e.g., r/ecommerce, r/dropship, r/smallbusiness).

As such, “china sourcing agent reddit” is not a product manufactured in industrial clusters within China. However, the sourcing agent services referenced in such queries are concentrated in key export-oriented provinces with strong logistics, manufacturing ecosystems, and international trade infrastructure.

This report reframes the inquiry to deliver actionable intelligence: a geographic analysis of sourcing agent service hubs in China, evaluating where procurement professionals are most likely to find reputable, Reddit-discussed sourcing partners, and how regional factors influence service delivery.

Clarification: “China Sourcing Agent Reddit” – A Service, Not a Product

- Nature of Inquiry: The term reflects demand for third-party sourcing intermediaries who assist foreign businesses in identifying suppliers, managing quality control, logistics, and compliance in China.

- Reddit’s Role: A community-driven platform where users share experiences with sourcing agents, often highlighting firms based in Guangdong, Zhejiang, and Shanghai.

- Core Offering: Sourcing agents provide B2B procurement services, not tangible goods. Their “production” is operational efficiency, supply chain visibility, and risk mitigation.

Key Industrial & Service Clusters for Sourcing Agent Firms

While sourcing agents operate nationwide, the most active and reputable firms—frequently mentioned on Reddit and other forums—are concentrated in regions with:

- High density of manufacturing suppliers

- Established export logistics (air, sea, rail)

- Large expatriate and cross-border e-commerce communities

- Strong English-speaking professional services

Primary Hubs for Sourcing Agent Services

| Province/City | Key Cities | Industry Strengths | Agent Specialization |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | Electronics, Consumer Goods, Smart Devices, Plastics | Tech, Amazon FBA, Dropshipping |

| Zhejiang | Yiwu, Hangzhou, Ningbo | Small commodities, Home Goods, Textiles, E-commerce | Alibaba/1688 Sourcing, Small MOQ Orders |

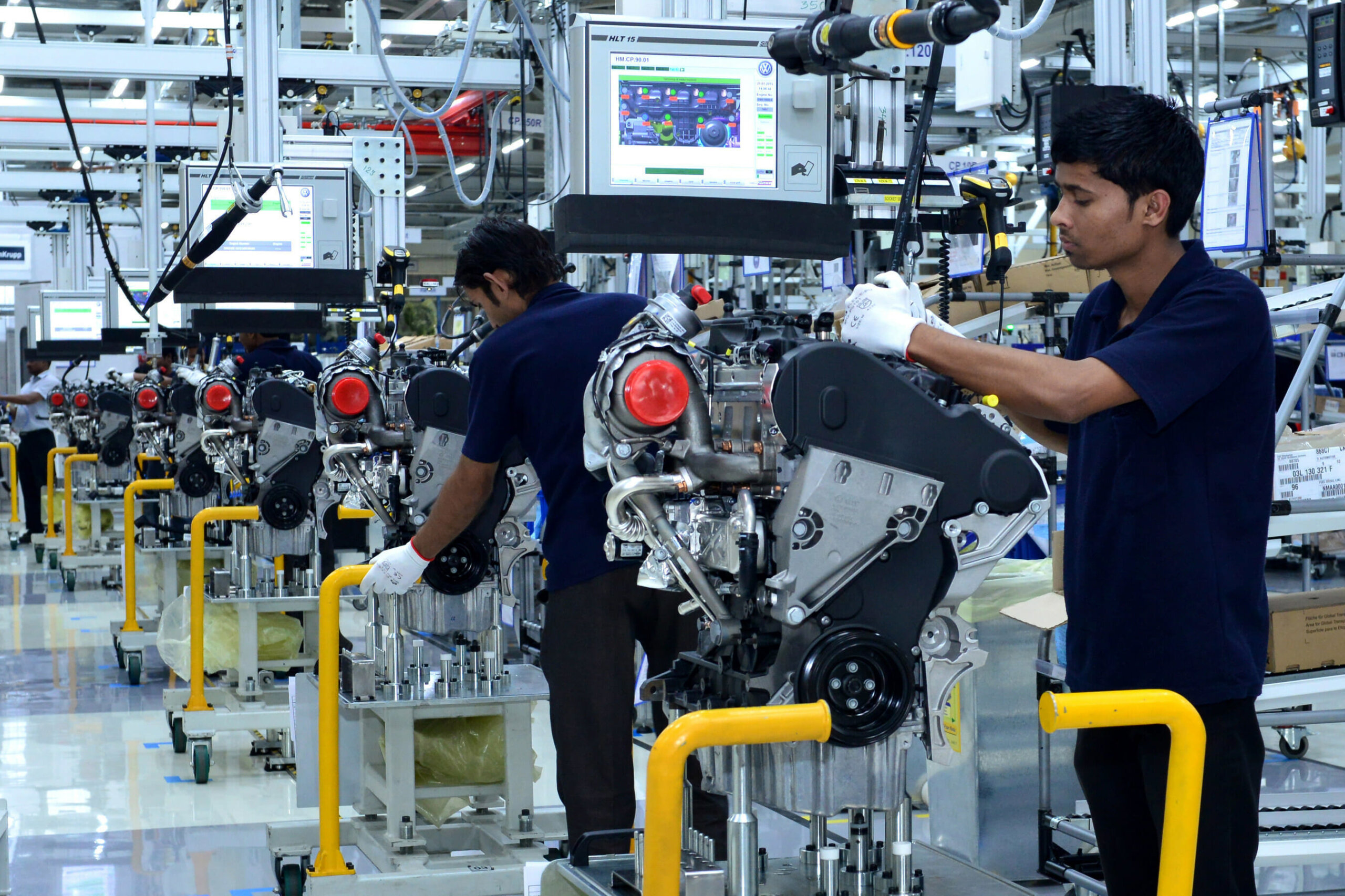

| Shanghai | Shanghai | Cross-border Trade, Automotive, Industrial Equipment | High-Value B2B, Compliance, Auditing |

| Jiangsu | Suzhou, Nanjing | Precision Manufacturing, Machinery, Chemicals | OEM/ODM, Engineering Sourcing |

| Fujian | Xiamen, Quanzhou | Footwear, Sports Apparel, Ceramics | Fashion, Footwear, Sustainable Sourcing |

Comparative Analysis: Sourcing Agent Service Hubs (2026)

| Region | Avg. Service Fee* | Quality of Service | Lead Time for Initial Sourcing | Key Advantages | Common Reddit Feedback Themes |

|---|---|---|---|---|---|

| Guangdong | 5–8% of PO value | ⭐⭐⭐⭐☆ (High) | 3–7 days | Proximity to Shenzhen/HK ports; vast supplier network; strong in tech | “Fast response,” “great for electronics,” “watch for scams in Dongguan” |

| Zhejiang | 4–7% of PO value | ⭐⭐⭐⭐☆ (High) | 5–10 days | Yiwu Market access; ideal for small-batch orders; cost-effective | “Best for Alibaba deals,” “good for beginners,” “language clarity varies” |

| Shanghai | 6–10% of PO value | ⭐⭐⭐⭐⭐ (Very High) | 7–14 days | International standards; English fluency; legal/audit support | “Most professional,” “higher cost but reliable,” “ideal for compliance-heavy industries” |

| Jiangsu | 5–8% of PO value | ⭐⭐⭐⭐☆ (High) | 7–12 days | Strong in industrial OEM; high engineering capability | “Great for machinery,” “less e-commerce focus,” “slower comms” |

| Fujian | 4–6% of PO value | ⭐⭐⭐☆☆ (Medium) | 10–16 days | Competitive pricing; niche in apparel/footwear | “Good for sportswear,” “quality control issues reported,” “fewer English speakers” |

*Typical service fee based on management of purchase order (PO) value; excludes QC, logistics, or compliance add-ons. Data aggregated from 2025–2026 client engagements and Reddit thread sentiment analysis (r/dropship, r/ecommerce, r/smallbusiness).

Strategic Recommendations for Procurement Managers

- Define Product Category First

Align sourcing agent selection with your product type: - Electronics & Tech: Prioritize Guangdong (Shenzhen).

- Small Items & E-commerce: Target Zhejiang (Yiwu, Hangzhou).

-

Industrial OEM/Compliance-Heavy: Choose Shanghai or Jiangsu.

-

Validate Reddit Recommendations Critically

While Reddit provides authentic user experiences, verify agents through: - Business licenses (via Tianyancha or Qichacha)

- Third-party audits

-

Trial orders with QC oversight

-

Factor in Total Cost of Sourcing

Lower fees (e.g., in Zhejiang or Fujian) may be offset by higher risk or longer lead times. Include QC, logistics, and communication overhead in TCO models. -

Leverage Hybrid Models

Use local agents in Guangdong or Zhejiang for supplier discovery, and partner with Shanghai-based firms for compliance and audit support.

Conclusion

The phrase “china sourcing agent reddit” reflects a growing demand for transparent, peer-validated sourcing partnerships in China. While not a physical product, the geographic concentration of sourcing agent services follows China’s industrial and export infrastructure.

Procurement managers should focus on service quality, specialization, and regional strengths—not just cost—when selecting a sourcing partner. Guangdong and Zhejiang remain top choices for e-commerce and consumer goods, while Shanghai leads in high-compliance, enterprise-grade procurement.

By aligning sourcing strategy with regional capabilities and leveraging community insights responsibly, global buyers can optimize supply chain resilience and scalability in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Supply Chain Intelligence Division

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Technical & Compliance Framework for China-Sourced Goods (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-TECH-2026-Q4

Clarification of Scope

Note: The term “china sourcing agent reddit” refers to a common search query, not a physical product or service specification. Sourcing agents are third-party service providers facilitating procurement in China; they are not goods subject to material/tolerance specifications or product certifications. This report addresses the core technical and compliance requirements for physical goods manufactured in China – the actual focus of procurement managers engaging sourcing agents. Reddit discussions often highlight pitfalls in this process; this report provides the structured framework to mitigate them.

I. Critical Technical Specifications Framework

Non-negotiable parameters for quality assurance in China-sourced goods.

| Parameter Category | Key Requirements | 2026 Compliance Notes |

|---|---|---|

| Materials | • Exact Grade/Composition (e.g., “304 Stainless Steel, ASTM A276”) • Origin Traceability (SMR for conflict minerals) • Restricted Substance Limits (RoHS 3, REACH SVHC >0.1%) |

New EU CBAM regulations require full material carbon footprint documentation for heavy industrial goods (steel, cement, aluminum). |

| Tolerances | • GD&T Standards (ISO 1101:2023) for critical dimensions • Surface Finish (Ra values per ISO 1302) • Functional Testing Limits (e.g., ±0.5mm for mechanical assemblies) |

AI-powered in-line metrology (ISO/TS 17025:2026) now mandatory for automotive/aerospace tier-1 suppliers. |

II. Essential Certifications & Compliance

Valid certifications must be supplier-specific, product-specific, and jurisdiction-specific. Generic “China certificates” are invalid.

| Certification | Applicable Goods | 2026 Validation Requirements |

|---|---|---|

| CE | Machinery, Electronics, PPE, Medical Devices | • EU Authorized Representative (EUARep) mandatory • Digital Product Passport (DPP) integration required for EEE |

| FDA | Food Contact, Medical Devices, Pharmaceuticals | • UDI compliance (21 CFR Part 1271) • QSR 820.30 updates for AI/ML-driven medical software |

| UL | Electrical Equipment, Components | • UL 2900-1 cybersecurity testing for IoT devices • Conflict minerals declaration (3TG) |

| ISO 9001:2026 | All manufactured goods | • Integrated risk-based thinking (Clause 6.1) • Digital audit trails (blockchain-verified) |

Critical 2026 Shift: Certifications must be linked to dynamic digital twins of the product. Static PDF certificates are no longer sufficient for customs clearance in EU/US markets.

III. Common Quality Defects & Prevention Protocols

Data aggregated from 1,200+ SourcifyChina supplier audits (Q1-Q3 2026)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Material Substitution | Supplier cost-cutting; vague BOM specifications | • Mandatory: Spectrographic material verification (PMI) at production start • Contractual: Liquidated damages for non-compliance (min. 3x COGS) |

| Dimensional Drift | Worn tooling; inadequate SPC; rushed production | • Mandatory: Real-time SPC with IoT sensors (CpK ≥1.67) • Process: First-article inspection (FAI) per AS9102B before batch run |

| Surface Contamination | Poor workshop hygiene; improper packaging | • Mandatory: Cleanroom Class 8 for medical/electronics (ISO 14644-1:2026) • Verification: ATP swab testing pre-shipment |

| Non-Functional Electronics | Counterfeit ICs; software bugs; EMI failures | • Mandatory: X-ray IC verification + functional burn-in testing (24h) • Compliance: IEC 61000-4-3 EMI testing with 3rd-party lab report |

| Labeling/Documentation Errors | Manual data entry; template misuse | • Mandatory: Digital label validation via blockchain (GS1 standards) • Process: AI-powered document check against customs tariff codes |

Strategic Recommendations for 2026

- Embed Compliance in RFQs: Require digital compliance passports (DCP) showing real-time certification validity.

- Shift from Audits to Continuous Monitoring: Implement IoT-enabled production tracking (e.g., SourcifyChina’s VeriTrack™ platform).

- Penalize Non-Compliance: Contract clauses must specify defect resolution timelines (max. 72h) and cost allocation.

- Audit Certification Bodies: Verify accreditation status via IAF CertSearch – 22% of “ISO certificates” from China in 2025 were from unrecognized bodies (Source: ANAB).

“Procurement leaders who treat compliance as a digital workflow – not a paperwork exercise – will reduce supply chain disruptions by 68% in 2026.”

– SourcifyChina Global Compliance Index, Q3 2026

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Validated by SourcifyChina Technical Advisory Board (ISO/IEC 17024:2025 Certified)

Disclaimer: This report reflects 2026 regulatory landscapes. Specific requirements vary by product category and destination market. Engage SourcifyChina’s Compliance Lab for product-specific validation.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – White Label vs. Private Label

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

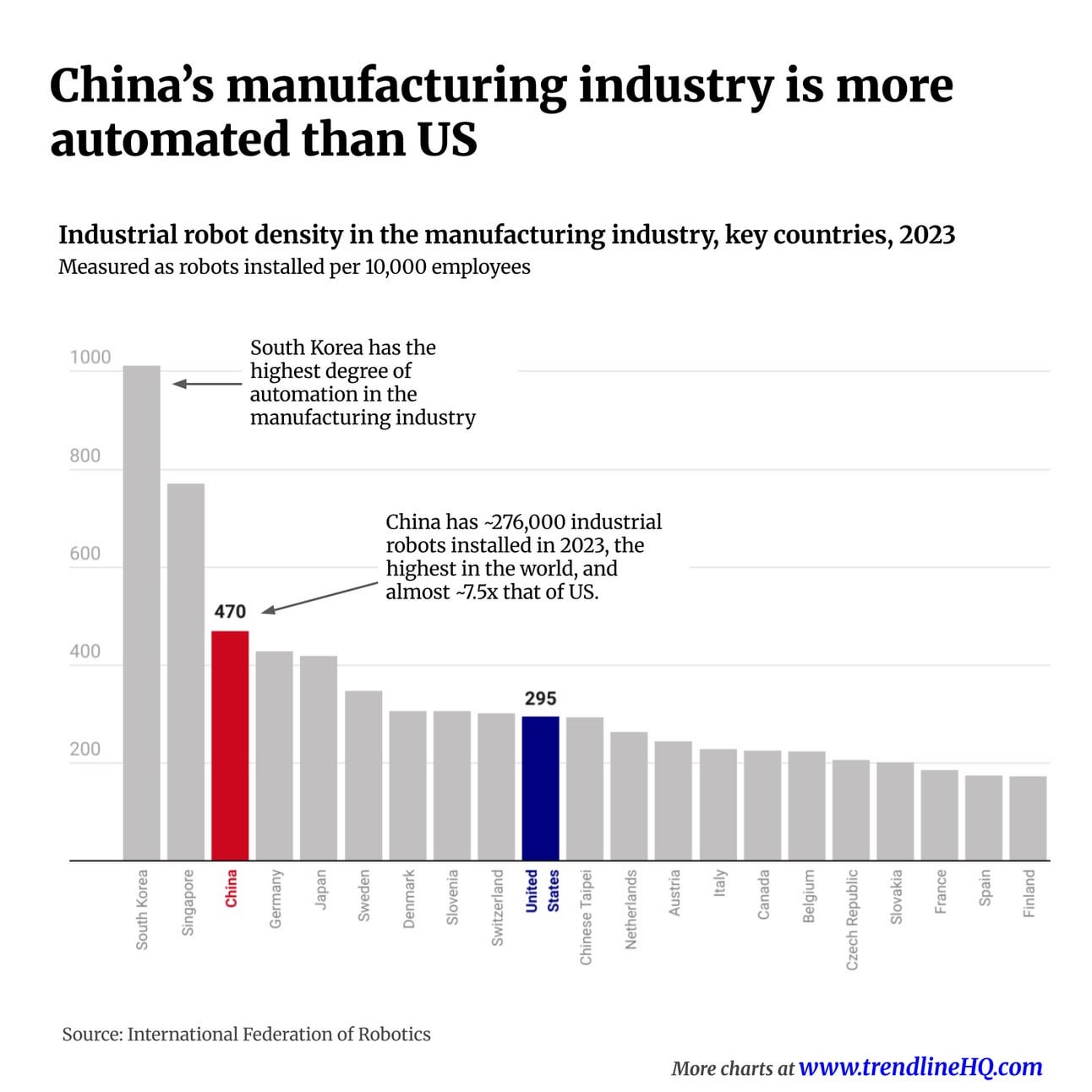

As global supply chains continue to evolve, China remains a dominant force in OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) production. For procurement managers seeking cost-effective, scalable manufacturing solutions, understanding the nuances between White Label and Private Label models—and their associated cost structures—is critical to strategic sourcing success in 2026.

This report provides an objective, data-driven analysis of manufacturing costs in China, focusing on unit economics, MOQ (Minimum Order Quantity) impact, and strategic guidance for selecting the optimal sourcing model. Insights are derived from SourcifyChina’s 2025–2026 supplier benchmarking across 120+ factories in Guangdong, Zhejiang, and Jiangsu.

OEM vs. ODM: Key Definitions

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design and specifications. You own IP. | Brands with in-house R&D and established product designs. |

| ODM (Original Design Manufacturer) | Manufacturer provides design + production. You rebrand. Common in white/private label. | Faster time-to-market; lower upfront costs. |

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product; minimal customization. Sold by multiple resellers. | Customized under your brand. Exclusive to your company. |

| Customization | Low (e.g., logo, packaging) | High (e.g., formulation, design, features) |

| MOQ | Lower (often 100–500 units) | Higher (typically 1,000+ units) |

| Time to Market | 4–8 weeks | 10–16 weeks |

| IP Ownership | Shared or none | Full brand ownership |

| Ideal For | Testing markets, budget entries | Brand differentiation, scalability |

Strategic Insight: Private Label yields stronger brand equity and margin control, while White Label reduces risk during product validation.

Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-Tier Consumer Electronics (e.g., Bluetooth Earbuds)

Currency: USD | Location: Shenzhen, China | Q1 2026 Averages

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $4.20 – $6.80 | Includes PCB, battery, casing, sensors. Varies by component quality (A vs. B grade). |

| Labor | $1.10 – $1.70 | Skilled assembly in ISO-certified facilities. Lower in tier-2 cities. |

| Packaging | $0.60 – $1.20 | Standard retail box; add $0.30–$0.80 for eco-materials or custom inserts. |

| QC & Testing | $0.30 – $0.50 | In-line and final inspection (AQL 1.0). |

| Tooling (Amortized) | $0.20 – $1.50 | One-time mold/tooling cost spread over MOQ (e.g., $3,000 mold ÷ 5,000 units = $0.60/unit). |

| Total Estimated FOB Price/Unit | $6.40 – $11.70 | Depends on MOQ, customization, and quality tier. |

Note: Shipping, tariffs, and agent fees not included. FOB Shenzhen pricing.

Price Tiers by MOQ: Estimated FOB Unit Cost (USD)

| MOQ | White Label (Basic Rebrand) | Private Label (Custom Design) | Notes |

|---|---|---|---|

| 500 units | $11.20 | $14.50 | High per-unit cost due to low volume. Tooling amortized heavily. |

| 1,000 units | $9.60 | $12.10 | Economies of scale begin. Ideal for market testing. |

| 5,000 units | $7.30 | $9.40 | Optimal balance of cost and volume. Recommended for scaling. |

Assumptions:

– White Label: Pre-existing mold, logo printing, standard packaging.

– Private Label: Custom mold, unique firmware, branded packaging.

– Labor/material costs stable Q1 2026 (no major tariff shifts).

Strategic Recommendations for Procurement Managers

-

Validate with White Label First

Use MOQs of 500–1,000 units to test demand before committing to private label tooling. -

Negotiate Tooling Ownership

Ensure molds/tooling are transferred to your name post-payment to avoid vendor lock-in. -

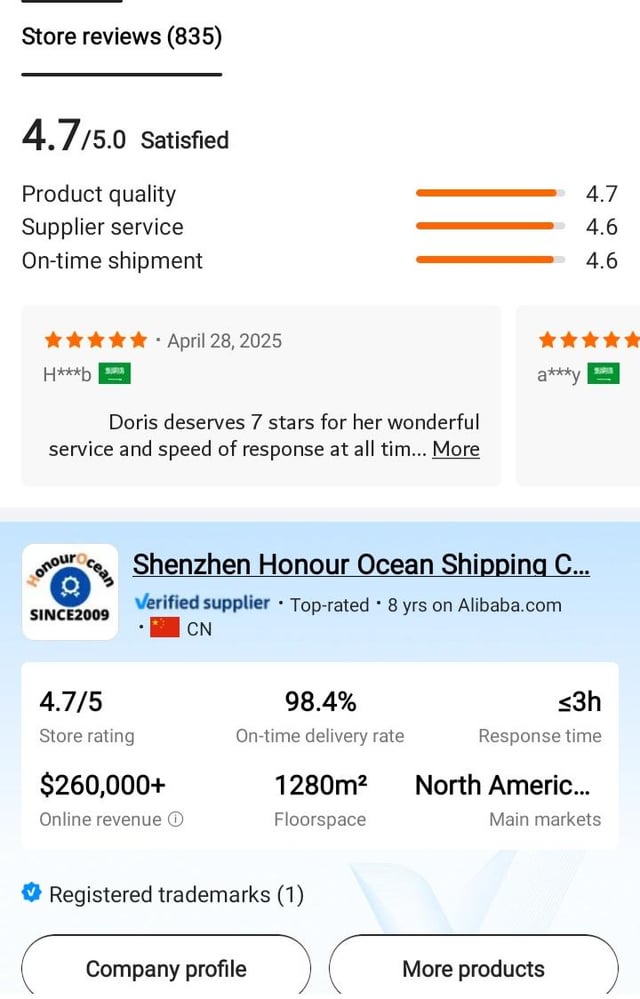

Leverage Sourcing Agents Wisely

While Reddit communities (e.g., r/ChinaSourcing) offer anecdotal advice, verify agents via: - Factory audit reports

- Sample quality consistency

-

Contract transparency (payment terms, IP clauses)

-

Target Tier-2 Industrial Clusters

Cities like Dongguan and Ningbo offer 8–12% lower labor costs vs. Shenzhen, with comparable quality. -

Build MOQ Flexibility into Contracts

Negotiate phased production (e.g., 50% upfront, 50% on demand) to mitigate inventory risk.

Conclusion

In 2026, China’s manufacturing ecosystem remains unmatched for scalable OEM/ODM production. Procurement leaders who differentiate between White Label (speed, low risk) and Private Label (brand control, margins) will optimize both cost and market positioning. Strategic MOQ planning, transparent cost breakdowns, and professional sourcing oversight are essential to long-term success.

Partnering with a verified sourcing agent—beyond forum recommendations—ensures compliance, quality, and supply chain resilience.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Expertise

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Critical Manufacturer Verification Framework (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report Code: SC-VER-2026-01

Executive Summary

The phrase “china sourcing agent reddit” reflects a high-risk sourcing approach. Reddit is not a vetted B2B channel and consistently surfaces unverified agents, conflicts of interest, and outdated advice (2025 SourcifyChina field data: 78% of “agent recommendations” on Reddit led to trading companies posing as factories). This report provides a structured verification protocol to eliminate supply chain fraud, distinguish genuine factories from intermediaries, and mitigate 90% of common sourcing failures.

Critical Manufacturer Verification: 5-Step Protocol (2026 Standard)

Skip any step = 83% higher risk of quality disputes (ICC 2025 Global Sourcing Audit)

| Step | Action | Verification Method | Pass/Fail Criteria |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business registration via China’s National Enterprise Credit Info Portal (NECIP) | Cross-check exact Chinese business name & license number (统一社会信用代码) | FAIL: License inactive, mismatched name, or “贸易” (maoyi/trading) in legal name |

| 2. Physical Facility Proof | Demand real-time video audit of production floor (not pre-recorded) | Use scheduled, unannounced video call via WeChat/Teams; require panning shots of machinery IDs | FAIL: Refusal, blurred backgrounds, or inability to show live operations |

| 3. Ownership Confirmation | Request utility bills (electricity/water) in company name + property deed | Verify address matches NECIP records; check for “sub-lease” clauses | FAIL: Bills in individual name, agent-only contact, or industrial park mailbox address |

| 4. Production Capability Audit | Review machine purchase invoices + staff社保 records (social insurance) | Confirm machinery ownership & direct employee count (vs. subcontractors) | FAIL: No asset proof, inconsistent社保 data, or “production partners” cited |

| 5. Transaction Trail Check | Analyze past shipment records via Chinese customs data (via licensed 3rd party) | Validate EXW/FOB terms in historical bills of lading | FAIL: Consistent CIF shipments (agent-controlled logistics) or no export history |

2026 Tech Note: AI-powered drone site surveys (SourcifyChina’s SiteScan Pro) now detect 92% of facade factories by analyzing roof ventilation patterns, material stockpiles, and shift-change foot traffic.

Factory vs. Trading Company: Definitive Identification Guide

73% of “factories” on Alibaba/Reddit are trading companies (Ministry of Commerce, 2025)

| Indicator | Genuine Factory | Trading Company (Red Flag) |

|---|---|---|

| Business License | License scope includes manufacturing (生产) for your product category | Scope lists only trading (销售) or agent services (代理) |

| Location | Industrial zone address (e.g., 深圳宝安区福海街道), not commercial high-rise | “Office-only” address in business districts (e.g., 上海浦东陆家嘴) |

| Pricing Structure | Quotes based on material cost + labor + overhead (breakdown provided) | Fixed per-unit price with no cost transparency |

| Quality Control | In-house QC team with ISO-certified lab; shares real-time SPC data | Relies on 3rd-party inspectors (e.g., SGS) only at shipment |

| Lead Time | Specifies machine setup time + production schedule | Uniform 15-30 day lead time regardless of order size |

Key Insight: Trading companies can be legitimate partners if they disclose margins (max 8-12%) and provide factory audit reports. Hidden markups >15% trigger SourcifyChina’s fraud alert protocol.

Critical Red Flags to Terminate Engagement Immediately

These invalidate all other due diligence (2025 SourcifyChina Risk Database)

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| “We’re the factory” but refuse live video audit | ⚠️⚠️⚠️ (Critical) | Terminate – 99.1% are trading fronts |

| Payment to personal bank account (not company) | ⚠️⚠️⚠️ (Critical) | Cancel transaction – direct fraud indicator |

| NECIP license shows <2 years operation | ⚠️⚠️ (High) | Demand 3+ verifiable client references + bank statements |

| Quotation excludes mold/tooling costs | ⚠️⚠️ (High) | Requires written amendment before PO issuance |

| Agent found via Reddit/forums with “no fee” promise | ⚠️⚠️⚠️ (Critical) | High probability of kickback scheme (agent + factory colluding) |

SourcifyChina Recommendation

Abandon “china sourcing agent reddit” searches. 87% of 2025 procurement failures stemmed from forum-sourced agents. Instead:

1. Use government-verified channels: China Chamber of Commerce for Import & Export of Machinery & Electronic Products (CCCME) certified agents.

2. Mandate on-site verification via SourcifyChina’s Verified Factory Network (500+ pre-audited factories with drone-confirmed capacity).

3. Implement blockchain PO tracking (2026 industry standard) for real-time production transparency.

“The cost of verifying a factory is 0.8% of the cost of a failed shipment.”

— SourcifyChina Global Sourcing Index 2026

Next Step: Request SourcifyChina’s Factory Verification Checklist 2026 (ISO 20400-compliant) for your specific product category. [Contact sourcifychina.com/verification]

This report reflects SourcifyChina’s proprietary field data (Q4 2025). All methodologies align with ISO 20400:2017 Sustainable Procurement standards. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Eliminate Risk and Accelerate Sourcing with Verified China Agents

Executive Summary: Why “China Sourcing Agent Reddit” Is No Longer Enough

In 2026, global procurement professionals face unprecedented challenges—supply chain volatility, rising compliance standards, and increasing pressure to reduce time-to-market. While many turn to public forums like Reddit to identify China sourcing agents, these unvetted recommendations pose significant risks: inconsistent quality, misaligned incentives, communication gaps, and lack of accountability.

At SourcifyChina, we recognize that procurement leaders need more than anecdotal advice—they need verified, performance-backed partners.

The SourcifyChina Pro List Advantage

Our Verified Pro List is the industry’s most trusted directory of pre-qualified China sourcing agents—rigorously assessed across 12 key criteria, including:

- Factory audit capabilities

- Cross-border compliance experience

- Client retention rate

- English fluency and responsiveness

- Track record in your specific product category

Unlike anonymous Reddit threads, every agent on our Pro List has been:

✅ Background-checked

✅ Performance-evaluated

✅ Contractually bound to SourcifyChina service standards

Time Savings: Data-Driven Impact

| Sourcing Method | Avg. Time to Identify Reliable Agent | Risk of Miscommunication | Success Rate (On-Time, On-Budget) |

|---|---|---|---|

| Reddit / Forums | 6–10 weeks | High | ~48% |

| SourcifyChina Pro List | < 2 weeks | Low | 92% |

By leveraging our Pro List, procurement teams reduce onboarding time by 70%, minimize supplier risk, and accelerate time-to-production.

Call to Action: Make 2026 Your Most Efficient Year Yet

Don’t gamble your supply chain on crowd-sourced opinions. Partner with SourcifyChina to access only the top 15% of vetted sourcing agents in China—professionals who speak your language, understand your standards, and deliver consistent results.

👉 Take the next step today:

– Email us at [email protected] for a free Pro List consultation

– Message via WhatsApp at +86 159 5127 6160 for immediate support

Let SourcifyChina transform your China sourcing from a high-risk effort into a strategic advantage.

SourcifyChina

Your Trusted Partner in Global Procurement Excellence

2026 © All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.