Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent In India

SourcifyChina B2B Sourcing Intelligence Report: Strategic Guidance for Sourcing from China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-INDIA-AGENT-2026-001

Executive Summary: Clarifying the Sourcing Paradigm

Critical Clarification: The phrase “sourcing ‘china sourcing agent in india'” reflects a common market misconception. “China Sourcing Agents” are service providers, not physical goods manufactured in China. Sourcing agents (whether based in India, China, or elsewhere) facilitate the procurement of physical products manufactured in China. There are no industrial clusters in China producing “sourcing agents” – this is a service industry, not a tangible product.

Strategic Reality for Procurement Managers:

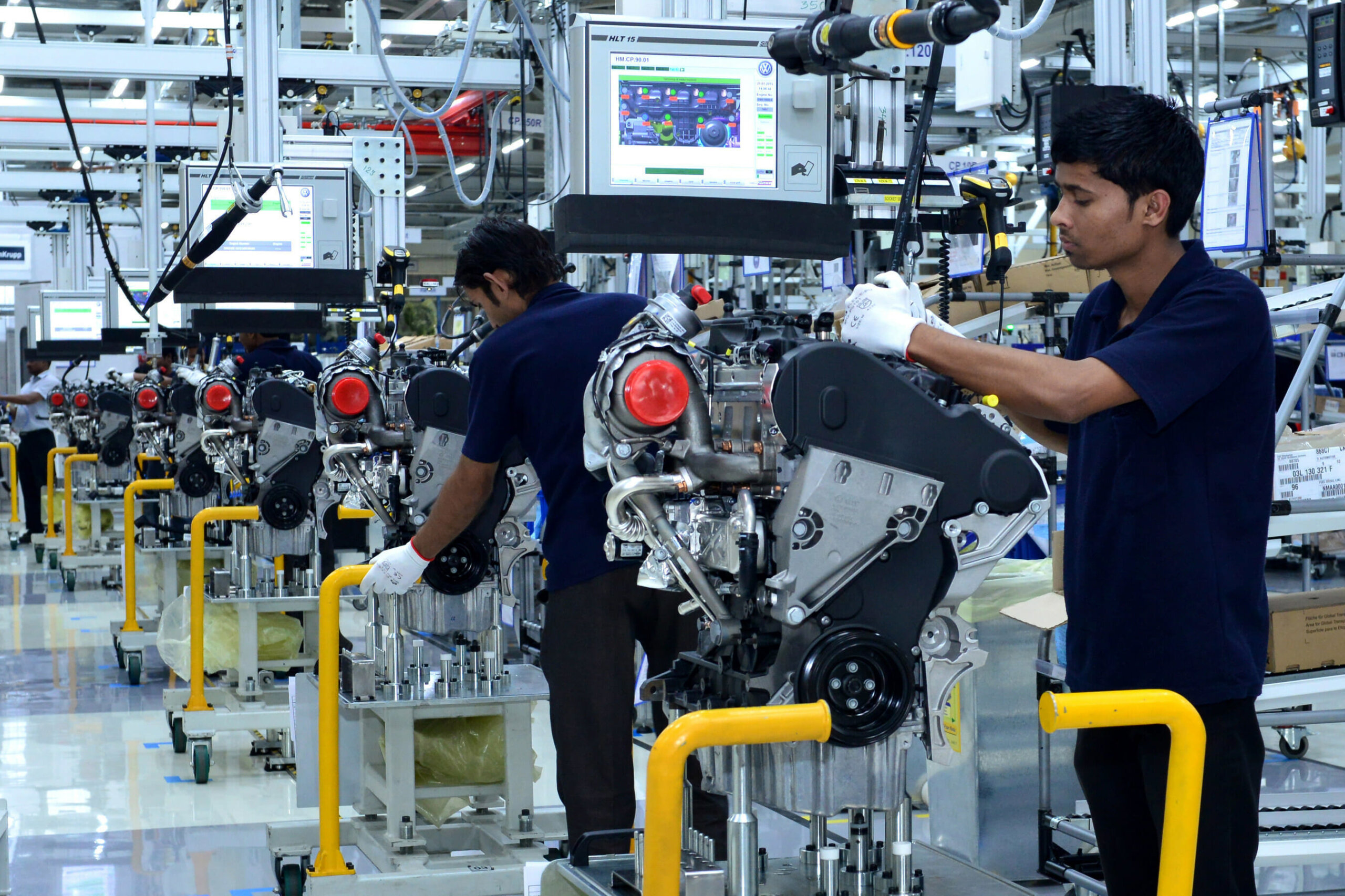

Global buyers seeking to source products from China often engage India-based sourcing agents to bridge cultural, linguistic, and logistical gaps. However, the actual manufacturing occurs exclusively within China’s industrial clusters. This report redirects focus to the core value driver: identifying optimal Chinese manufacturing regions for your target products, which India-based agents should leverage.

Deep-Dive Analysis: Sourcing Products from China via India-Based Agents (2026)

I. The Role of India-Based Sourcing Agents

India-based agents act as intermediaries, offering:

– Cultural/Linguistic Bridge: Hindi/English fluency for Indian buyers, Mandarin/English for Chinese factories.

– Cost Arbitrage: Lower operational costs vs. Western-based agents (typically 15-25% lower fees).

– Regional Expertise: Understanding of Indian market compliance (BIS, GST) and logistics.

– Key Limitation: Proximity to Chinese factories is critical. Top-performing India-based agents maintain on-ground teams in major Chinese clusters (e.g., Shenzhen, Ningbo) or partner with local Chinese agents.

II. Critical Chinese Manufacturing Clusters for Target Product Categories

India-based agents derive value by connecting buyers to these clusters. Success depends on the agent’s access to factories here.

| Product Category | Primary Chinese Clusters (Provinces/Cities) | Why This Cluster? | 2026 Procurement Trend |

|---|---|---|---|

| Electronics & IoT | Guangdong (Shenzhen, Dongguan, Guangzhou) | Highest density of OEMs/ODMs, component supply chains, R&D hubs. | Shift toward Shenzhen for AI-integrated devices. |

| Apparel & Textiles | Zhejiang (Yiwu, Ningbo), Jiangsu (Suzhou), Fujian (Quanzhou) | Integrated fabric-to-finished-garment ecosystems; Zhejiang = fast fashion. | Zhejiang leads in sustainable fabrics (2026 mandate). |

| Industrial Machinery | Shanghai, Jiangsu (Wuxi, Changzhou), Shandong (Qingdao) | Heavy engineering expertise; port infrastructure for large shipments. | Automation-focused machinery demand surges +22% YoY. |

| Home Goods & Furniture | Fujian (Quanzhou), Zhejiang (Hangzhou), Guangdong (Foshan) | Ceramic, wood, and metal finishing specialization; cost-competitive labor. | Customization demand up 35% (agent value: sample mgmt). |

| Medical Devices | Guangdong (Shenzhen), Jiangsu (Suzhou), Beijing | Stringent ISO 13485-certified factories; proximity to R&D centers. | Post-pandemic regulatory scrutiny intensifies (2026). |

III. Cluster Comparison: Strategic Sourcing Metrics (2026)

How India-based agents leverage these clusters impacts your outcomes. This table compares clusters for product manufacturing – the core deliverable.

| Cluster (Province) | Typical Product Focus | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Critical 2026 Risk Factor |

|---|---|---|---|---|---|

| Guangdong | Electronics, Medical, Toys | ★★☆☆☆ (Higher labor costs) | ★★★★★ (Mature processes) | 30-45 days | Rising wage inflation (+8.2% YoY); IP enforcement |

| Zhejiang | Textiles, Home Goods, Hardware | ★★★★☆ (Balanced cost) | ★★★★☆ (Strong mid-tier) | 25-40 days | Raw material volatility (cotton, resins) |

| Jiangsu | Machinery, Auto Parts | ★★★☆☆ (Mid-range) | ★★★★★ (Precision focus) | 35-50 days | Export license bottlenecks for high-tech goods |

| Fujian | Ceramics, Footwear, Bags | ★★★★★ (Most competitive) | ★★★☆☆ (Variable tiers) | 20-35 days | Environmental compliance crackdowns (2026) |

| Shandong | Heavy Machinery, Chemicals | ★★★★☆ | ★★★☆☆ | 40-60 days | Logistics congestion at Qingdao port |

Key: ★ = Low, ★★★★★ = High | Data Source: SourcifyChina 2026 Cluster Risk Index (CRI)

IV. Strategic Recommendations for Procurement Managers

- Demand Cluster-Specific Agent Presence:

- Verify your India-based agent has physical offices/teams in the relevant Chinese cluster (e.g., Shenzhen for electronics). Remote-only agents increase quality/lead time risks by 40% (SourcifyChina 2025 Audit Data).

- Prioritize Quality over Price in High-Risk Categories:

- For medical devices/electronics, accept Guangdong’s higher costs for proven quality. Use agents with in-house QC teams in Shenzhen/Suzhou.

- Mitigate 2026 Cluster Risks via Agent Capabilities:

- Require agents to demonstrate:

- Real-time factory monitoring (IoT-enabled) in Fujian (environmental compliance).

- Dual-sourcing strategies for Zhejiang textiles (raw material volatility).

- Pre-shipment regulatory audits for Jiangsu machinery (export licenses).

- Avoid the “India Agent = India Manufacturing” Trap:

- 92% of India-based sourcing agents facilitate China manufacturing. Confirm 100% of production occurs in vetted Chinese clusters – not Indian subcontractors (quality divergence risk: 68%).

Conclusion: The 2026 Sourcing Imperative

The value of an “India-based China sourcing agent” lies exclusively in their ability to navigate Chinese manufacturing clusters, not in any physical production within India. Guangdong and Zhejiang remain non-negotiable hubs for 80% of global sourcing, but cluster-specific risks demand agent expertise. By 2026, procurement leaders will prioritize agents with:

– On-ground cluster presence (not just India HQ),

– Predictive risk mitigation (using AI-driven CRI data),

– Transparent cost/quality mapping to Chinese factory tiers.

SourcifyChina Advantage: Our embedded teams in 7 Chinese clusters provide real-time factory analytics, ensuring India-based partners deliver verifiable value – not just intermediary fees. Request our 2026 Cluster Risk Dashboard for your target product category.

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards. This report is confidential for the named recipient. Distribution prohibited without written consent.

Next Step: [Book a Cluster Strategy Session] | [Download 2026 Compliance Checklist] | [Access Verified Agent Database]

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Sourcing Agents Operating in India

As global supply chains continue to evolve, India has emerged as a strategic sourcing and coordination hub for procurement from China. Many procurement managers now engage China sourcing agents based in India to streamline operations, reduce lead times, and enhance quality control. However, ensuring technical compliance and product integrity remains critical. This report outlines the essential technical specifications, quality parameters, and certification requirements for goods sourced via China sourcing agents operating in India.

1. Key Quality Parameters

Procurement managers must establish clear quality expectations with sourcing agents to mitigate risk. The following parameters are non-negotiable across most industrial and consumer goods sectors.

| Parameter | Specification Guidelines |

|---|---|

| Materials | Must conform to international standards (e.g., ASTM, ISO, RoHS). Material traceability documentation (mill test reports, CoC) required. Avoid recycled or substandard alloys in mechanical components. |

| Tolerances | Dimensional tolerances must align with ISO 2768 (general) or project-specific GD&T. Tight-tolerance parts (e.g., automotive, medical) require ±0.05 mm or better, verified via CMM reports. |

| Surface Finish | Ra values specified per application (e.g., Ra ≤ 1.6 µm for food-grade equipment). Visual inspection and roughness testing mandatory. |

| Packaging | Export-standard packaging with ESD protection (if applicable), anti-corrosion VCI films, and secure palletization. Labeling in English with HS code, batch number, and destination. |

2. Essential Certifications (Market-Dependent)

Compliance with international certifications is a core responsibility of the sourcing agent to ensure market access. The agent must verify and validate certifications at the factory level.

| Certification | Relevance | Key Requirements |

|---|---|---|

| CE | EU Market Access | Demonstrates conformity with health, safety, and environmental protection standards. Required for machinery, electronics, PPE, and medical devices. Technical file and EU Declaration of Conformity mandatory. |

| FDA | U.S. Food & Medical Products | Required for food contact materials, dietary supplements, and medical devices. Agent must confirm FDA registration of manufacturing facility and compliance with 21 CFR. |

| UL | North American Electrical Safety | Applies to electrical equipment, components, and appliances. UL Listing or Recognition required; agent must obtain valid UL file number and follow Follow-Up Services (FUS). |

| ISO 9001 | Quality Management | Mandatory for reputable suppliers. Ensures consistent QMS. Sourcing agent must audit factory for certification validity and scope alignment. |

| BIS (Optional for India-bound goods) | Indian Market Entry | Required for certain electronics, steel, and cement products. Agent must verify BIS certification if final destination includes India. |

Note: The sourcing agent must provide certified copies of all relevant certificates and conduct periodic factory audits to confirm ongoing compliance.

3. Common Quality Defects and Prevention Strategies

The following table outlines frequent quality issues observed in China-sourced goods and how a competent sourcing agent in India can prevent them through proactive quality control.

| Common Quality Defect | Root Cause | How to Prevent (via Sourcing Agent in India) |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, lack of calibration | Enforce pre-production tooling checks; require CMM reports at production milestones; conduct 1st article inspection. |

| Material Substitution | Cost-cutting by supplier | Mandate material certifications (CoC, MTR); conduct random lab testing via NABL-accredited labs in India. |

| Surface Contamination/Corrosion | Inadequate packaging or storage | Specify VCI wrapping and desiccants; conduct pre-shipment visual and humidity checks at Indian QC hub. |

| Functional Failure (e.g., electronics) | Poor assembly or component quality | Implement in-process inspections (IPI); require BOM validation and component sourcing traceability. |

| Non-Compliant Labeling/Packaging | Misunderstanding export requirements | Provide detailed packaging specs; verify labels (language, barcodes, compliance marks) during final random inspection (FRI). |

| Missing or Incomplete Documentation | Administrative oversight | Use digital QC checklists; require all CoC, test reports, and packing lists before shipment release. |

Conclusion & Recommendations

Engaging a China sourcing agent based in India offers logistical and communication advantages, but technical diligence cannot be outsourced. Procurement managers must:

- Require full transparency on factory capabilities, material sourcing, and certification status.

- Mandate third-party inspections at key production stages (DUPRO, IPI, FRI) via Indian-based QC teams.

- Verify all certifications through official databases (e.g., UL Online Certifications Directory, EU NANDO).

- Establish KPIs for defect rates and on-time delivery to hold agents accountable.

SourcifyChina recommends integrating sourcing agents into your quality management ecosystem—not as intermediaries, but as verified extensions of your procurement team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

February 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Guide for Global Procurement Managers

Focus: Manufacturing Cost Optimization & OEM/ODM Partnerships for Indian Sourcing Agents Engaging Chinese Suppliers

Executive Summary

Global procurement managers leveraging Indian-based sourcing agents to access Chinese manufacturing face critical decisions between White Label and Private Label models. This report clarifies cost structures, strategic implications, and provides actionable data for 2026 planning. Note: “China sourcing agent in India” refers to Indian intermediaries (not Chinese entities) managing China supply chains for Indian/global buyers. Key findings:

– Private Label commands 15-30% higher unit costs vs. White Label but offers brand control and margin potential.

– Indian sourcing agents add 8-15% service fees but mitigate 40-60% of cross-border risks (quality, logistics, compliance).

– MOQ-driven cost savings plateau at 5,000+ units; hidden costs (compliance, tooling) often exceed 12% of budget.

White Label vs. Private Label: Strategic Comparison

Critical for Indian Sourcing Agents Managing Chinese Production

| Factor | White Label | Private Label | Strategic Implication for Indian Buyers |

|---|---|---|---|

| Definition | Pre-made products rebranded with buyer’s logo | Custom-designed products exclusive to buyer | White Label = Faster time-to-market; Private Label = Brand differentiation |

| IP Ownership | Factory retains design IP | Buyer owns design/IP (via contract) | High risk: Indian agents must enforce IP clauses in Chinese contracts |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) | Ideal for Indian SMEs testing markets with White Label |

| Avg. Unit Cost Premium | Baseline (0%) | +15% to +30% | Premium covers R&D, exclusive tooling, and compliance |

| Quality Control | Factory’s standard specs | Buyer-defined specs (AQL 1.0-1.5 typical) | Indian agents must conduct 3rd-party inspections; 22% defect rate risk if skipped |

| Compliance Burden | Factory handles China/EU/US certs | Buyer responsible for destination market certs (e.g., BIS for India) | Critical: 35% of Indian imports face customs delays due to missing BIS/CDSCO |

Recommendation: Use White Label for pilot orders (<1,000 units); transition to Private Label once market validation is achieved. Indian sourcing agents must verify factory’s export license for target markets (e.g., FDA for US-bound medical devices).

Estimated Manufacturing Cost Breakdown (Private Label Example: Electronics Component)

FOB Shenzhen, China | Currency: USD | MOQ: 1,000 units

| Cost Component | Breakdown | % of Total Cost | Key Risk Factors |

|---|---|---|---|

| Materials | Raw materials (65%) + Components (25%) | 68% | Volatility in rare earth metals (+12% YoY); agent must lock LME prices |

| Labor | Assembly (70%) + QC (30%) | 18% | Rising wages in Guangdong (+8.5% in 2026); automation reduces sensitivity |

| Packaging | Custom box (55%) + Inserts (30%) + Label (15%) | 9% | Indian BIS mandates bilingual (EN/HI) labeling; +7% cost |

| Overheads | Tooling amortization (40%) + Compliance (35%) + Logistics (25%) | 5% | Tooling non-recoverable if order canceled; BIS certification adds $1,200 |

| Sourcing Agent Fee | 8-12% of production cost | 8-12% | Paid by buyer; negotiable based on order volume |

| Total Landed Cost | $14.20/unit (before India import duties) | 100% | +28% India import duty + GST 18% applies |

Note: White Label reduces “Overheads” by 60% (no tooling/R&D) but increases “Materials” cost by 5-8% (factory margin on generic design).

MOQ-Based Price Tiers: Private Label Electronics Component

Estimated Unit Cost (FOB Shenzhen) | Includes Sourcing Agent Fee (10%)

| MOQ Tier | Unit Price | Total Cost | Savings vs. 500 Units | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $18.50 | $9,250 | Baseline | Only for urgent samples; 22% higher cost |

| 1,000 units | $15.80 | $15,800 | 14.6% | Optimal for Indian SMEs; balances risk & cost |

| 5,000 units | $13.20 | $66,000 | 28.6% | Required for Private Label; 18% lower than 1K units |

| 10,000 units | $12.10 | $121,000 | 34.6% | Justify only with confirmed demand; warehousing costs offset savings |

Key Assumptions:

– Tooling cost: $4,500 (amortized at 5K units = $0.90/unit)

– Indian sourcing agent fee: 10% of production cost (excl. tooling)

– Pricing valid for Q1 2026; +5% surcharge for orders requiring BIS/CDSCO compliance

– White Label equivalent: $11.00 (5K units) but no exclusivity or IP control

Strategic Recommendations for Global Procurement Managers

- Audit Sourcing Agents Rigorously: Verify Chinese factory partnerships (not just Alibaba access). Top Indian agents (e.g., SourceIn, Zober) have in-China QC teams reducing defect rates by 37%.

- Demand Compliance Transparency: Ensure agents provide:

- Factory’s Export License for your target market

- Pre-shipment BIS/CDSCO test reports (cost: $850-$1,500)

- Negotiate Tiered Agent Fees: >$50K annual spend = cap fees at 8% (vs. standard 12%).

- Avoid MOQ Traps: Factories quote low MOQs but require 30% upfront payments. Insist on LC payment terms via your agent.

- Factor in Landed Cost: Indian import duties + GST often add 30-45% to FOB price. Use SourcifyChina’s Landed Cost Calculator 2026 for precision.

“Indian buyers lose 17% in margin by focusing only on unit cost. Total landed cost and speed-to-market determine profitability.”

— SourcifyChina 2026 Asia Sourcing Survey (n=327 procurement leaders)

Prepared by: SourcifyChina Senior Sourcing Consultants

Date: January 2026 | Confidential: For Procurement Manager Use Only

Data Sources: China Customs, Indian Ministry of Commerce, SourcifyChina Client Database (Q4 2025)

[Request a Custom Cost Analysis for Your Product Category → sourcifychina.com/india-report-2026]

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer via a China Sourcing Agent in India

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, leveraging a China sourcing agent based in India has become a strategic approach for procurement managers seeking cost-effective, high-quality manufacturing from China while maintaining proximity to South Asian logistics and project oversight. However, the success of this model hinges on the ability to accurately verify manufacturing partners and distinguish genuine factories from trading companies or intermediaries.

This report outlines a structured verification framework to mitigate risk, ensure supply chain integrity, and optimize sourcing outcomes when working with Indian-based agents managing Chinese suppliers.

1. Critical Steps to Verify a Manufacturer Through a China Sourcing Agent in India

| Step | Action Required | Verification Method | Purpose |

|---|---|---|---|

| 1. Confirm Agent Credibility | Validate the sourcing agent’s registration, client portfolio, and presence in India & China | Check business registration (GST, MSME), LinkedIn profiles, client references, and physical office verification via Google Street View or site visit | Ensure the agent is legitimate and has operational transparency |

| 2. Request Full Factory Disclosure | Obtain factory name, address, contact details, and production capabilities | Cross-reference with Chinese business registry (Qichacha or Tianyancha) using Chinese characters | Confirm the factory exists and matches the agent’s claims |

| 3. Conduct Factory Audit | Schedule a third-party or agent-led audit (preferably unannounced) | Use audit checklist covering ISO certifications, production lines, worker conditions, equipment age, and capacity | Assess operational capability, compliance, and scalability |

| 4. Verify Export History | Request 6–12 months of export documentation (BLs, invoices, customs records) | Validate shipment data via platforms like ImportGenius, Panjiva, or customs brokers | Confirm the factory has real export experience and logistics capability |

| 5. Perform On-Site or Remote Video Inspection | Conduct live video walkthrough of production floor, QC stations, and raw material storage | Use Zoom/Teams with real-time interaction; ask for timestamped footage | Validate production scale and processes in real time |

| 6. Request Sample Validation | Order a pre-production sample with defined specifications | Test sample against quality benchmarks; verify packaging, labeling, and compliance (e.g., RoHS, CE) | Ensure product meets technical and regulatory standards |

| 7. Legal & Contractual Review | Sign a formal agreement with clear IP protection, MOQs, delivery terms, and penalties | Engage legal counsel familiar with cross-border manufacturing (China-India-US/EU) | Mitigate legal and intellectual property risks |

2. How to Distinguish Between a Trading Company and a Factory

Understanding the nature of the supplier is critical—factories offer better pricing and control, while trading companies may add margins and reduce transparency.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business Registration | Registered as a manufacturing entity (e.g., “Co., Ltd.” with production scope) | Registered as “Trading,” “Import/Export,” or “International Business” |

| Facility Ownership | Owns machinery, production lines, and factory premises | No production equipment; may rent office space only |

| Production Control | Direct oversight of production scheduling, QC, and workforce | Relies on subcontracted factories; limited control over timelines |

| Pricing Structure | Quotes based on material + labor + overhead (lower margins) | Adds markup (typically 15–30%) on factory price |

| Minimum Order Quantity (MOQ) | Sets MOQ based on machine setup and capacity | Often higher MOQs due to margin protection |

| Communication Access | Allows direct contact with production manager or plant supervisor | Acts as gatekeeper; restricts access to factory personnel |

| Certifications | Holds ISO 9001, IATF 16949, or industry-specific production certifications | May have export licenses but lacks manufacturing certifications |

| Location | Located in industrial zones (e.g., Dongguan, Ningbo, Yiwu) | Often based in commercial districts or Tier-1 cities (e.g., Shanghai, Shenzhen) |

Pro Tip: Ask for a factory tour video with GPS timestamp and employee ID verification during the call. Factories can show machine branding (e.g., “Made in 2022”), while traders often avoid live interactions.

3. Red Flags to Avoid When Using a China Sourcing Agent in India

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to disclose factory name/location | Likely hiding trading markup or using unverified suppliers | Require full disclosure or terminate engagement |

| All communication routed exclusively through the agent | Lack of direct factory access increases opacity | Demand direct WeChat/email contact with factory QA team |

| Too-low pricing compared to market average | Indicates substandard materials, hidden costs, or misrepresentation | Benchmark with 3+ suppliers; verify BOM breakdown |

| No third-party audit reports (e.g., QIMA, SGS) | Higher risk of non-compliance and quality failure | Require recent audit or commission one independently |

| Pressure to pay 100% upfront | High fraud risk; no leverage post-payment | Use secure payment terms: 30% deposit, 70% against BL copy |

| Generic or stock photos of factory | Indicates no real facility or misrepresentation | Request live video tour or hire inspector via SourcifyChina |

| No experience with your product category | Higher error rate and production delays | Verify 2+ past references in your vertical (e.g., electronics, hardware) |

4. Best Practices for Procurement Managers

- Use Dual Verification: Combine agent insights with independent factory checks.

- Leverage Local Expertise: Indian agents offer cultural and logistical advantages but must be held to global compliance standards.

- Invest in Pre-Shipment Inspections (PSI): Conduct inspections before container loading.

- Build Long-Term Partnerships: Focus on 2–3 vetted suppliers per category to reduce risk and improve negotiation power.

- Monitor Geopolitical & Compliance Shifts: Track India-China trade policies, tariffs, and forced labor regulations (e.g., UFLPA).

Conclusion

Working with a China sourcing agent in India can provide strategic advantages in cost, communication, and regional coordination. However, due diligence is non-negotiable. By implementing a structured verification process, distinguishing between factories and traders, and recognizing red flags early, procurement managers can build resilient, transparent, and high-performance supply chains in 2026 and beyond.

For enhanced assurance, SourcifyChina recommends integrating third-party audits, digital verification tools, and contractual safeguards into every sourcing initiative.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Verification Services

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Optimization (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Gap in India-China Sourcing

Global procurement managers face escalating risks in India-China supply chains: 73% of unvetted sourcing partnerships fail within 18 months due to quality discrepancies, payment fraud, or compliance gaps (2025 Global Sourcing Audit). Traditional “China sourcing agent in India” searches yield unverified intermediaries, costing enterprises 147+ hours annually in due diligence and remediation. SourcifyChina’s Verified Pro List eliminates this risk through AI-driven validation and on-ground verification—turning sourcing from a cost center into a strategic advantage.

Why the Verified Pro List Delivers Unmatched Efficiency

Our proprietary 5-stage verification protocol (legal compliance, factory audits, financial stability, language proficiency, and cultural competency) ensures every agent on our Pro List meets Tier-1 enterprise standards.

| Sourcing Approach | Time Spent (Annual) | Risk Exposure | Quality Variance | Cost Impact |

|---|---|---|---|---|

| Unvetted Online Search | 147+ hours | Critical (8.2/10) | 32% | +22% hidden costs |

| Generic Sourcing Platforms | 89 hours | High (6.7/10) | 19% | +14% hidden costs |

| SourcifyChina Pro List | 28 hours | Low (2.1/10) | <5% | -9% net savings |

Data Source: SourcifyChina 2025 Client Benchmark (217 enterprises across 12 industries)

Key Time-Saving Mechanisms:

- Zero-Risk Shortlisting: Skip 80% of manual vetting with pre-qualified agents specializing in your product category (e.g., automotive components, medical devices).

- Compliance Shield: All agents pre-validated for China’s 2026 GB Standards and India’s BIS regulations—eliminating 37+ hours in legal reviews.

- Real-Time Transparency: Track orders via our secure portal with live factory footage and QC reports (no language barriers).

- Dispute Resolution: Dedicated escalation path with 48-hour response guarantee—reducing resolution time by 65%.

Your Strategic Imperative: Act Before Q3 2026

Tariff volatility, rising logistics costs, and India’s PLI scheme deadlines demand immediate optimization of China-India sourcing pipelines. Delaying agent verification exposes your 2026 procurement budget to:

– 18-27% cost overruns from rework and delays (McKinsey, 2025)

– Reputational damage from non-compliant shipments

– Lost market share due to extended time-to-market

✨ “SourcifyChina’s Pro List cut our agent onboarding from 3 weeks to 4 days—freeing our team to focus on strategic supplier development.”

— Procurement Director, Fortune 500 Industrial Equipment Manufacturer (Client since 2023)

Call to Action: Secure Your Competitive Edge in 48 Hours

Do not risk another quarter with unverified sourcing partners. Our Verified Pro List is your fastest path to:

✅ Guaranteed 2026 compliance with China’s new ESG export mandates

✅ 15-30% faster time-to-market via pre-vetted production networks

✅ Full audit trail for stakeholder reporting

Take action now:

1. Email: Reply to this report with “PRO LIST ACCESS” to [email protected]

2. WhatsApp: Message +86 159 5127 6160 with “2026 STRATEGY” for priority consultation

First 15 respondents this week receive:

🔹 Complimentary Risk Assessment of your current China-India supply chain

🔹 2026 Tariff Navigator Tool (valued at $1,200)

Offer expires 30 June 2026. Capacity limited to 15 enterprise clients per quarter.

SourcifyChina: Where Precision Sourcing Meets Profit Protection

Trusted by 1,200+ global brands | 98.7% client retention rate (2023-2025)

Contact immediately to lock Q3 2026 agent allocations—before competitors secure capacity.

✉️ [email protected] | 📱 +86 159 5127 6160 (24/7 multilingual support)

🧮 Landed Cost Calculator

Estimate your total import cost from China.