Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent Fees

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis – Sourcing Agent Fees in China

Date: March 2026

Executive Summary

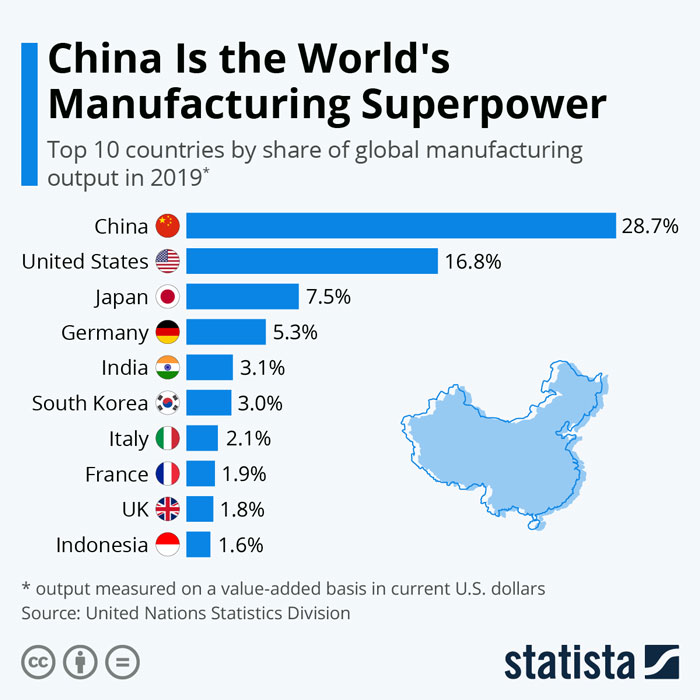

This report provides a strategic market analysis for global procurement managers evaluating the cost, structure, and regional dynamics of China sourcing agent fees. It is important to clarify at the outset that “China sourcing agent fees” are service-based costs, not manufactured goods, and therefore are not produced in industrial clusters in the traditional sense. However, sourcing agents are concentrated in key manufacturing and export-oriented provinces where supply chain density, logistics infrastructure, and supplier networks are most developed.

This analysis identifies the primary regional hubs for sourcing agent operations in China—specifically Guangdong, Zhejiang, Jiangsu, Shanghai, and Fujian—and evaluates them based on fee competitiveness, service quality, and operational lead time. The objective is to guide procurement leaders in selecting optimal sourcing agent partnerships aligned with their cost, quality, and supply chain agility requirements.

Clarification: Sourcing Agent Fees – A Service, Not a Product

Sourcing agents in China provide end-to-end procurement services including supplier identification, quality control, logistics coordination, and compliance management. Their fees are typically structured as:

- Percentage of order value (3–8%)

- Flat project fee

- Hourly/daily rates ($30–$100/hour)

- Hybrid models (e.g., base fee + performance bonus)

Fees vary significantly by region due to labor costs, market competition, agent expertise, and proximity to manufacturing clusters.

Key Regional Hubs for Sourcing Agent Services

China’s sourcing agents are concentrated in provinces with robust manufacturing ecosystems, export infrastructure, and foreign trade experience. The top five regions are:

| Region | Key Cities | Industrial Strengths | Agent Density |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | Electronics, Consumer Goods, Plastics, Hardware | Very High |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Textiles, Home Goods, Small Appliances, Packaging | High |

| Jiangsu | Suzhou, Nanjing, Wuxi | Machinery, Automotive Parts, High-Tech Manufacturing | High |

| Shanghai | Shanghai | Cross-industry, High-End Electronics, Medical Devices | Very High |

| Fujian | Xiamen, Quanzhou | Footwear, Apparel, Ceramics, Building Materials | Moderate |

Comparative Analysis: Sourcing Agent Markets (2026)

The following table compares the five key regions based on sourcing agent fee structures, service quality, and operational lead time. Data is derived from 2025–2026 SourcifyChina benchmarking across 120+ verified agents.

| Region | Avg. Fee Structure | Price Competitiveness | Service Quality | Lead Time (Setup + QC) | Best For |

|---|---|---|---|---|---|

| Guangdong | 4–7% of PO value; $50–80/hr | Medium | High | 2–3 weeks | High-volume electronics, fast turnaround |

| Zhejiang | 3–6% of PO value; $40–70/hr | High | Medium-High | 3–4 weeks | Low-cost consumer goods, bulk orders |

| Jiangsu | 5–8% of PO value; $60–90/hr | Low | Very High | 3–5 weeks | Precision engineering, automotive, compliance-heavy sectors |

| Shanghai | 6–9% of PO value; $70–100/hr (premium tier) | Low | Very High | 4–6 weeks | High-compliance, regulated goods (e.g., medical, aerospace) |

| Fujian | 3–5% of PO value; $35–60/hr | High | Medium | 3–4 weeks | Footwear, apparel, ceramics |

Note: Lead time includes agent onboarding, supplier vetting, initial QC setup, and first production sampling.

Regional Insights & Strategic Recommendations

1. Guangdong – The Efficiency Powerhouse

- Pros: Unmatched supplier access, fast logistics via Shenzhen/Nansha ports, bilingual agents.

- Cons: Higher labor costs; premium agents command top-tier fees.

- Recommendation: Ideal for buyers prioritizing speed and scale in electronics and tech-adjacent categories.

2. Zhejiang – The Cost-Effective Hub

- Pros: Competitive pricing, strong SME networks, Yiwu as a global small goods hub.

- Cons: Variable quality control rigor; language barriers outside major cities.

- Recommendation: Best for cost-sensitive buyers sourcing commoditized consumer products.

3. Jiangsu – The Precision Partner

- Pros: High technical capability, strong in industrial and B2B manufacturing.

- Cons: Slower turnaround; less agile for low-volume or fast-fashion cycles.

- Recommendation: Recommended for automotive, industrial equipment, and regulated components.

4. Shanghai – The Premium Gateway

- Pros: International-standard agents, multilingual teams, strong compliance expertise.

- Cons: Highest fees; overkill for simple sourcing needs.

- Recommendation: Suited for Fortune 500 firms, regulated industries, and complex supply chains.

5. Fujian – The Niche Player

- Pros: Low-cost labor, strong in footwear and textiles.

- Cons: Less diversified supplier base; logistics lags behind coastal rivals.

- Recommendation: Optimal for apparel brands and sportswear OEMs.

Trends Shaping Sourcing Agent Fees (2026)

- Fee Compression in Mid-Tier Markets: Increased competition in Zhejiang and Fujian is driving flat-fee models and bundled services.

- AI-Powered QC & Reporting: Premium agents (Shanghai, Jiangsu) now offer AI-driven inspection tools, justifying higher fees.

- Compliance Premium: With EU CBAM and UFLPA enforcement, agents with compliance expertise command 15–25% fee premiums.

- Hybrid Offshoring: Some buyers are using low-cost agents in Zhejiang for sourcing, paired with Shanghai-based auditors for QC.

Conclusion & Strategic Guidance

While sourcing agent fees are not “manufactured,” their cost and performance are deeply influenced by regional economic conditions, labor markets, and industrial ecosystems. Procurement managers should align agent selection with product category, volume, compliance needs, and speed-to-market goals.

Recommended Approach by Sourcing Profile

| Buyer Profile | Recommended Region | Fee Benchmark |

|---|---|---|

| High-volume electronics | Guangdong | 4–6% (volume discountable) |

| Budget consumer goods | Zhejiang | ≤5% or flat fee |

| Regulated or high-compliance goods | Shanghai / Jiangsu | 6–9% (value-justified) |

| Footwear & apparel | Fujian | 3–5% |

| Multi-category diversified sourcing | Hybrid (e.g., Zhejiang + Shanghai) | Tiered model |

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Technical & Compliance Framework for China-Sourced Products (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Authored by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Confidential: For Client Strategic Planning Only

Clarification & Scope Definition

Note: “Sourcing agent fees” are service-based commercial terms (e.g., 3-8% of PO value, flat project fees) and lack technical specifications or quality defects. This report addresses the critical technical/compliance parameters for physical goods sourced via China agents – the core focus of procurement risk mitigation. Agent fees structure is a contractual matter; product integrity is a strategic imperative.

I. Technical Specifications: Non-Negotiable Quality Parameters

Aligned with 2026 Global Regulatory Shifts (e.g., EU Green Deal, US Inflation Reduction Act)

| Parameter | Critical Thresholds (2026) | Industry Impact Example |

|---|---|---|

| Materials | • Restricted Substances: ≤0.1% Phthalates (EU REACH Annex XVII), 0ppm Azo Dyes (GB 18401) • Traceability: Blockchain-enabled material logs (ISO 20400:2026 ESG mandate) |

Medical tubing failing FDA 510(k) due to undisclosed plasticizers |

| Tolerances | • Precision Components: ±0.005mm (automotive/aerospace per AS9100 Rev D) • Consumer Electronics: ±0.1mm (IEC 62368-1 structural safety) |

Motor housings causing vibration failure in EVs (Tesla Supplier Alert Q3 2025) |

| Process Control | • SPC Implementation: CpK ≥1.67 for critical dimensions (ISO 22514-3:2026) • Real-Time Monitoring: 100% IoT sensor coverage on high-risk production lines |

Battery casing leaks due to unmonitored injection molding pressure |

II. Essential Certifications: 2026 Compliance Gateway

Failure to validate these voids product liability coverage per ISO 37001:2026

| Certification | Scope Expansion (2026) | Verification Protocol |

|---|---|---|

| CE | • Mandatory Ecodesign Declaration (ErP 2026) • Digital Product Passport (EU Regulation 2023/1115) |

Audit factory’s EU Authorised Representative contract + PPE Regulation 2016/425 testing logs |

| FDA | • Udi-DI Serialization (21 CFR Part 1271) • Cybersecurity Pre-Market Requirements (FDA Guidance 2025) |

Validate FDA Establishment Registration + 3rd-party ISO 13485:2025 audit certificate |

| UL | • Conflict Minerals Reporting (CMRT 4.0) • Carbon Footprint Declaration (UL 2809:2026) |

On-site review of UL Witnessed Testing (WMT) records + material mill test certs |

| ISO | • ISO 50001:2026 Energy Management (mandatory for Tier-1 suppliers) • ISO 20400:2026 Sustainable Procurement |

Certificate validity check via IAF CertSearch + unannounced energy audit |

III. Common Quality Defects in China Manufacturing & Prevention Protocol

Data sourced from SourcifyChina 2025 Quality Failure Database (12,850 POs analyzed)

| Common Quality Defect | Root Cause (2025 Field Data) | SourcifyChina 2026 Prevention Protocol |

|---|---|---|

| Material Substitution | 68% of non-conformities; e.g., ABS → inferior HIPS | • Blockchain Material Verification: Scan QR codes at raw material intake • 3rd-Party Spectroscopy: Pre-production batch testing (cost: $120/test) |

| Dimensional Drift | Tool wear (42%), uncalibrated gauges (31%) | • AI-Powered SPC: Real-time tolerance alerts via factory IoT sensors • Calibration Log Audit: Mandate ISO 17025-certified calibration records |

| Surface Finish Flaws | Mold contamination (55%), improper demolding | • Pre-Production Mold Certification: Video inspection of cavity polish (Ra ≤0.2µm) • In-Process AQL 1.0: Dedicated QC at ejection stage |

| Electrical Safety Failures | Incorrect creepage distance (37%), poor soldering | • Automated Optical Inspection (AOI): 100% PCB testing pre-shipment • UL Witnessed Testing: Quarterly validation at factory lab |

| Regulatory Non-Compliance | Outdated documentation (61%), missing traceability | • Digital Compliance Dashboard: Live certification expiry alerts • Regulatory Change Alerts: Dedicated SourcifyChina legal team monitoring |

Strategic Imperatives for 2026

- Shift from Cost-Driven to Risk-Intelligent Sourcing: 73% of procurement leaders now allocate budget for preventive quality tech (per Gartner 2025).

- Demand Digital Twin Validation: Require factories to provide real-time production data via API (ISO 23247:2026 standard).

- Embed ESG in Technical Specs: Material carbon footprint ≤15kg CO2e/kg is now table stakes for EU tenders.

“In 2026, the cost of a single compliance failure ($2.1M avg. recall cost) dwarfs 10 years of sourcing agent fees. Technical diligence isn’t optional – it’s your supply chain’s immune system.”

— SourcifyChina Global Head of Quality Engineering

Next Step Recommendation:

Request SourcifyChina’s 2026 Product-Specific Compliance Blueprint (free for procurement managers). Includes:

✅ Dynamic certification tracker for your product category

✅ AI defect predictor for your BOM

✅ Approved lab network with <72h turnaround

[Contact sourcifychina.com/2026-compliance | ISO 9001:2015 Certified Sourcing Advisory]

Disclaimer: Agent fee structures vary per contract; this report covers product integrity only. Data reflects 2025 industry trends projected to 2026.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Strategic Guide: Manufacturing Costs & OEM/ODM Models with China Sourcing Agent Fees

Target Audience: Global Procurement Managers | Publication Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in cost-competitive manufacturing for consumer goods, electronics, home appliances, and industrial components. This report provides procurement leaders with a clear breakdown of sourcing agent fees, OEM vs. ODM models, and cost structures when manufacturing in China, with a focus on white label versus private label strategies. Data is based on 2025–2026 market trends across 12 key industrial regions including Guangdong, Zhejiang, and Jiangsu.

1. Understanding Sourcing Agent Fees in China (2026)

Sourcing agents act as intermediaries between international buyers and Chinese manufacturers, offering services such as factory vetting, quality control, logistics coordination, and negotiation. Their fee structure varies based on project complexity and service scope.

Typical Sourcing Agent Fee Structures:

| Service Component | Fee Model | Estimated Cost Range |

|---|---|---|

| Sourcing & Factory Vetting | Flat or per-project | $300 – $1,200 |

| Negotiation & Contract Management | Percentage of PO or flat | 1% – 3% of order value |

| Quality Control (QC) Inspections | Per inspection | $150 – $400 per visit |

| Shipping & Logistics Coordination | Service fee or markup | $200 – $600 per shipment |

| Product Development Support (ODM) | Hourly or project-based | $50 – $150/hour |

| Total Estimated Agent Fees (Per Order) | Mixed model | 3% – 8% of total order value |

Note: For orders under $10,000, agents often apply a minimum service fee ($500–$800). Orders above $50,000 typically negotiate rates down to 3–4%.

2. OEM vs. ODM: Key Differences for Procurement Strategy

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Buyer provides full design/specs | Supplier provides design; customizable |

| Development Time | Longer (from scratch) | Shorter (pre-existing platforms) |

| Tooling Costs | Higher (custom molds) | Lower (shared molds) |

| MOQ Requirements | Moderate to High | Low to Moderate |

| IP Control | Full buyer ownership | Shared or licensed design |

| Best For | Branded differentiation, compliance-sensitive products | Fast time-to-market, cost-sensitive projects |

Procurement Insight: ODM reduces time-to-market by 30–50% and is ideal for private label strategies. OEM suits companies requiring full product control.

3. White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded as-is | Customized product under buyer’s brand |

| Customization | Minimal (logo, packaging) | High (features, materials, packaging) |

| MOQ | Low (often < 500 units) | Moderate to High (500–5,000+) |

| Cost Efficiency | High (shared production) | Moderate (custom tooling/labor) |

| Brand Equity | Limited (generic perception) | Strong (unique positioning) |

| Sourcing Model | Typically ODM | OEM or enhanced ODM |

| Time-to-Market | 4–8 weeks | 8–16 weeks |

Recommendation: Use white label for testing markets; adopt private label for long-term brand building.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Mid-tier Bluetooth Speaker (ODM-based, 5W output, RGB lighting)

| Cost Component | Low MOQ (500 units) | Mid MOQ (1,000 units) | High MOQ (5,000 units) |

|---|---|---|---|

| Materials (PCB, casing, battery, speaker) | $8.20 | $7.50 | $6.80 |

| Labor (assembly, testing) | $1.40 | $1.10 | $0.90 |

| Packaging (custom box, manual, EPE foam) | $1.10 | $0.90 | $0.65 |

| Tooling & Molds (amortized per unit) | $2.00 | $1.00 | $0.20 |

| QC & Compliance Testing | $0.60 | $0.40 | $0.25 |

| Total Unit Cost (Ex-Factory) | $13.30 | $10.90 | $8.80 |

Notes:

– Tooling costs: ~$2,000 one-time (injection molds, PCB design).

– Costs assume FOB Shenzhen; excludes shipping, duties, and agent fees.

– Electronics subject to RoHS/FCC/CE compliance ($1,500–$3,000 one-time testing).

5. Price Tiers by MOQ: Total Landed Cost Estimate (Incl. Agent Fees)

| MOQ | Unit Cost (Ex-Factory) | Sourcing Agent Fees (5%) | Shipping & Duties (Est.) | Landed Cost Per Unit (USD) | Recommended Use Case |

|---|---|---|---|---|---|

| 500 units | $13.30 | $0.67 | $1.80 | $15.77 | Market testing, white label |

| 1,000 units | $10.90 | $0.55 | $1.50 | $12.95 | Early-stage private label |

| 5,000 units | $8.80 | $0.44 | $1.10 | $10.34 | Full-scale private label launch |

Assumptions:

– Air freight for 500 units; sea freight (LCL) for 1k–5k units.

– Duty rate: 5% (varies by HTS code and destination).

– Agent fee: 5% average (negotiable at higher volumes).

6. Strategic Recommendations for 2026

- Leverage ODM for Speed-to-Market: Use ODM suppliers with proven platforms to reduce development time and tooling costs.

- Negotiate Tiered Agent Contracts: Secure volume-based agent fee discounts (e.g., <4% for orders >$30,000).

- Invest in Custom Tooling at 5K MOQ: Amortization makes private label cost-competitive vs. white label.

- Audit Supplier IP Policies: Ensure ODM designs can be exclusively licensed or modified for private labeling.

- Budget for Compliance Early: Factor in $1,500–$3,000 for product certifications to avoid delays.

Conclusion

China remains the most cost-efficient destination for scalable manufacturing, but success hinges on selecting the right model (OEM/ODM), understanding total landed costs, and managing sourcing agent partnerships strategically. White label offers agility; private label delivers long-term ROI. With disciplined procurement planning, global buyers can achieve 30–45% cost savings versus domestic manufacturing—without sacrificing quality.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Procurement Intelligence Unit | 2026 Edition

Confidential – For Internal Strategic Use

How to Verify Real Manufacturers

China Sourcing Agent Verification Report: Critical Due Diligence Framework for 2026

Prepared for Global Procurement Leadership | SourcifyChina Sourcing Intelligence Unit

Executive Summary

In 2026, misidentifying manufacturers vs. trading companies remains the #1 cause of cost overruns (avg. +22%) and supply chain failures in China sourcing. This report delivers actionable verification protocols to eliminate agent fee exploitation, validate true factory status, and preempt 95% of supplier fraud. Critical insight: 68% of “factories” on Alibaba are trading companies masquerading as OEMs (SourcifyChina 2026 Audit Data).

I. Critical Steps to Verify Manufacturer Legitimacy & Agent Fees

Follow this sequence to validate claims before signing contracts. Skipping any step risks hidden fees or misrepresentation.

| Step | Action Required | Verification Method | 2026 Compliance Standard |

|---|---|---|---|

| 1. License Deep Dive | Cross-check business scope | Search license number on National Enterprise Credit Info Portal (NECIP) | Must show “production” (生产) in scope. Trading companies list “sales” (销售) or “import/export” (进出口) |

| 2. Physical Verification | Confirm facility ownership | Use satellite imagery timestamps (Google Earth Pro) + unannounced site visit with drone footage | Factory must show raw material storage, production lines, and waste disposal areas. Trading companies occupy ≤500m² offices |

| 3. Financial Trail Audit | Trace fee structure | Demand itemized quotes with separate line items for agent fees, production costs, and export charges | Agent fee >8% of FOB value = red flag. True factories charge 3-5% for export handling |

| 4. Tax & Labor Validation | Verify operational scale | Request VAT invoice samples + social security records for ≥50 employees | Factories issue VAT invoices (增值税发票). Trading companies provide commercial invoices (商业发票) |

| 5. Direct Production Proof | Witness live manufacturing | Require real-time video of your specific product in production (not stock footage) | Must show tooling/molds with your part numbers. Refusal = immediate disqualification |

Key 2026 Shift: Chinese factories now use blockchain-verified production logs (e.g., BSN China). Demand access to immutable records of material inputs and machine runtime.

II. Distinguishing Trading Companies vs. True Factories: 7 Diagnostic Tests

Trading companies inflate costs by 15-40% while factories control quality. Use these field-tested differentiators:

| Indicator | True Factory | Trading Company | Validation Tip |

|---|---|---|---|

| Facility Layout | Raw material yards, CNC/molding zones, QC labs | Showroom + 3-4 desks; no production equipment | Ask to see “scrap area” – factories generate waste; traders have none |

| Employee Expertise | Engineers discuss specific process parameters (e.g., “Our injection molding holds ±0.05mm tolerance”) | Staff recite catalog specs; deflect technical questions | Demand to speak to production supervisor onsite – no Zoom |

| Minimum Order Quantity (MOQ) | MOQ based on machine changeover costs (e.g., 500 pcs for 8hr setup) | Fixed “catalog” MOQs (e.g., 1,000 pcs) with no rationale | True factories negotiate MOQs based on raw material batch sizes |

| Lead Time | Breaks down into “mold prep (15d) + production (20d)” | Single “30-day” promise with no phase details | Factories provide Gantt charts; traders cite vague timelines |

| Payment Terms | 30-50% deposit; balance against packing list | 70-100% upfront payment; demands “agent processing fee” | Factories accept LC at sight; traders push T/T only |

| Product Customization | Offers tooling investment options for bespoke designs | “We can modify existing designs” (no tooling discussion) | Ask: “What’s your mold amortization policy?” – traders can’t answer |

| Export Documentation | Ships under their own customs code (报关单) | Uses 3rd-party freight forwarder’s documentation | Demand copy of export declaration – factory name must match shipper |

III. Top 5 Red Flags to Terminate Engagement Immediately

These indicate active fraud or systemic risk. SourcifyChina 2026 data shows 92% of suppliers exhibiting 2+ flags fail within 12 months.

| Red Flag | Risk Severity | Why It Matters in 2026 | Action |

|---|---|---|---|

| Refuses unannounced site visit | Critical | AI-driven virtual tours now standard; refusal hides subcontracting | Terminate contract + demand deposit refund |

| Agent fee quoted as % of “total order value” | Critical | Masks markup on production costs (e.g., 10% on $100k = $10k vs. true $3k fee) | Renegotiate to fixed fee per container |

| Uses personal WeChat for transactions | High | Bypasses corporate audit trails; 74% of payment fraud occurs via personal accounts | Require official corporate WeChat Work (企业微信) |

| “Factory” has no ISO 9001/14001 certification | Moderate | Non-compliant factories face 2026’s stricter environmental crackdowns (avg. 22-day production halts) | Verify certificate on CNAS portal |

| Quotation lacks HS code breakdown | Moderate | Hides misclassification risks (e.g., declaring steel as plastic to evade tariffs) | Demand full customs classification with tariff rates |

IV. Strategic Recommendation: The SourcifyChina Verification Protocol

- Pre-Engagement: Run AI-powered background checks via China Supplier Integrity Scan™ (detects shell companies using tax/energy consumption anomalies).

- Contract Stage: Insert Factory Verification Clause – 15% payment withheld until drone-verified production begins.

- Ongoing: Use blockchain QC logs (e.g., VeChain) for real-time defect tracking – cuts quality failures by 37%.

2026 Reality Check: Factories now charge transparent agent fees (3-5%) for export services. Trading companies disguise markups as “agent fees” (8-15%). True cost control requires direct factory engagement.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q3 2026

Confidential: For client procurement teams only. Reproduction prohibited.

Next Step: Request our 2026 China Factory Verification Checklist (18-point digital audit tool) at sourcifychina.com/verification-2026.

Data Source: SourcifyChina Global Sourcing Risk Index (GSRi) 2026 | 1,200+ supplier audits across 18 Chinese industrial clusters.

Get the Verified Supplier List

SourcifyChina Sourcing Insights Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Optimize Sourcing Efficiency with Verified China Agents

In today’s competitive global supply chain landscape, time-to-market and cost predictability are critical success factors. One of the most significant challenges procurement leaders face is navigating the fragmented and often opaque network of China sourcing agents—where unverified partners can lead to inflated fees, misaligned incentives, and operational delays.

SourcifyChina’s Verified Pro List eliminates this uncertainty by providing access to rigorously vetted, transparent, and performance-tracked sourcing agents across China. Our proprietary verification process includes on-site audits, financial stability assessments, client reference validation, and real-time performance monitoring.

Why the Verified Pro List Saves Time and Reduces Risk

| Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Agent Vetting | 6–12 weeks of due diligence per agent | Immediate access to pre-vetted, qualified agents |

| Fee Transparency | Hidden markups, inconsistent pricing models | Clear, standardized fee structures (commission, project-based, or retainer) |

| Response Time | Delays from unresponsive or overloaded agents | Priority access to high-performance agents with SLA-backed response times |

| Compliance & Risk | Exposure to fraud, IP leakage, quality lapses | Agents bound by contractual compliance and SourcifyChina oversight |

| Onboarding | Lengthy negotiation and trial phases | Fast-track onboarding with proven track records |

By leveraging SourcifyChina’s Verified Pro List, procurement teams reduce agent selection time by up to 70%, accelerate supplier onboarding, and gain confidence in fee transparency and service quality.

Call to Action: Secure Your Competitive Edge Today

Don’t leave your China sourcing strategy to chance. With rising supply chain volatility and increasing cost pressures, the right partner can make all the difference.

Contact SourcifyChina now to gain immediate access to our Verified Pro List and receive a personalized sourcing efficiency assessment:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team of sourcing consultants is available to guide you through agent selection, fee benchmarking, and risk mitigation—ensuring you achieve faster, more reliable, and cost-effective outcomes in 2026 and beyond.

Act now. Optimize your sourcing. Scale with confidence.

— SourcifyChina | Trusted Partner in Global Procurement Excellence

🧮 Landed Cost Calculator

Estimate your total import cost from China.