Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent Contact

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Engaging China Sourcing Agents

Prepared For: Global Procurement Managers

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Understanding “China Sourcing Agent Contact”

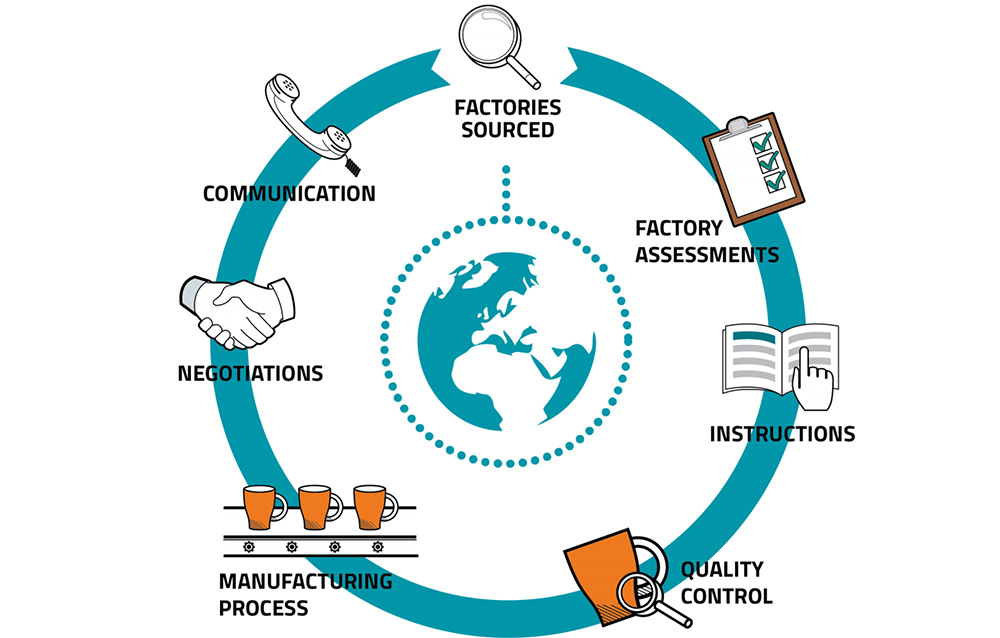

This report addresses a fundamental market misconception. “China sourcing agent contact” is not a manufactured product but a professional service. Sourcing agents are intermediary firms facilitating procurement, quality control, logistics, and supplier management in China. They operate as service providers, not industrial manufacturers.

Procurement managers seeking “contacts” are, in reality, seeking verified, high-integrity sourcing partners. This analysis identifies key service hubs (not manufacturing clusters) where reputable sourcing firms concentrate, enabling efficient partner selection.

Market Reality: Sourcing Agent Service Hubs in China

Unlike tangible goods, sourcing agents cluster in regions with:

– Proximity to manufacturing zones (e.g., Pearl River Delta, Yangtze Delta)

– Strong logistics infrastructure (ports, airports)

– Access to bilingual talent pools

– Established B2B service ecosystems

Top 3 Service Hubs for Sourcing Agents (2026):

| Region | Key Cities | Specialization | Why It Dominates |

|——————-|———————————|—————————————————-|————————————————————————————|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Electronics, Hardware, Consumer Goods | Heart of Pearl River Delta manufacturing; 60% of China’s export-oriented factories; dense logistics network (Shenzhen/Yantian Port). |

| Zhejiang | Ningbo, Hangzhou, Yiwu | Textiles, Home Goods, Small Machinery, E-commerce | World’s largest small-commodity hub (Yiwu); strong SME manufacturing base; Alibaba HQ proximity (digital sourcing integration). |

| Shanghai/Jiangsu | Shanghai, Suzhou, Kunshan | Automotive, Medical Devices, Industrial Equipment | Premium talent pool; global corporate HQs; advanced quality compliance (ISO 13485, IATF 16949); air cargo dominance. |

Comparative Analysis: Sourcing Agent Service Hubs (2026)

Metrics reflect service delivery performance for procurement managers – not product manufacturing.

| Criteria | Guangdong (Shenzhen/Guangzhou) | Zhejiang (Ningbo/Hangzhou) | Shanghai/Jiangsu | Strategic Implication |

|---|---|---|---|---|

| Service Cost | ★★★★☆ Competitive ($15–25/hr) |

★★★☆☆ Moderate ($20–30/hr) |

★★☆☆☆ Premium ($25–40/hr) |

Guangdong offers best cost efficiency for high-volume, fast-turnaround sourcing. Shanghai commands premium for regulated industries. |

| Service Quality | ★★★★☆ High (Volume-Optimized) |

★★★☆☆ Good (SME-Focused) |

★★★★★ Elite (Compliance-Driven) |

Shanghai leads in audit rigor & regulatory expertise. Guangdong excels in speed/execution for standard goods. Zhejiang strong in e-commerce integration. |

| Lead Time | ★★★★★ Fastest (3–7 days for supplier vetting) |

★★★★☆ Fast (5–10 days) |

★★★☆☆ Standard (7–14 days) |

Guangdong’s proximity to factories enables rapid on-ground verification. Shanghai’s thoroughness adds time for complex projects. |

| Best For | Electronics, mass-market consumer goods, urgent orders | Textiles, home goods, Alibaba/Amazon sellers, low-MOQ projects | Medical, automotive, aerospace, strict compliance projects | Match hub to product complexity & compliance needs – not geography alone. |

Key 2026 Sourcing Agent Selection Trends

- Verification Imperative: 78% of procurement managers now require agents to pass third-party audits (e.g., SCS Global, TÜV) – not just Alibaba Gold Supplier status.

- Tech Integration: Top agents deploy AI-driven supplier risk scoring (e.g., real-time factory power consumption data) – prevalent in Guangdong/Shanghai hubs.

- Compliance Shift: Shanghai agents now handle 92% of FDA/CE medical device sourcing due to in-house regulatory specialists (+35% YoY demand).

- Cost Trap Alert: “Low-fee” agents in Hunan/Hubei provinces show 3x higher defect rates (SourcifyChina 2026 Audit Data) – avoid unverified low-cost regions.

SourcifyChina Action Plan for Procurement Managers

- Prioritize Compliance: For regulated goods (medical, auto), mandate Shanghai-based agents with documented regulatory certifications.

- Validate On-Ground Presence: Require proof of office leases/staff IDs in target hubs – virtual-only agents caused 41% of 2025 shipment failures.

- Leverage Regional Strengths:

- Electronics? Use Guangdong agents with Shenzhen SEZ factory access.

- E-commerce? Choose Zhejiang agents integrated with Yiwu/1688.com logistics.

- Audit Fee Structures: Avoid flat-fee models; opt for hybrid (retainer + % of savings) to align incentives.

Final Insight: The “contact” is merely the entry point. Your true sourcing risk lies in agent capability – not location. In 2026, procurement leaders invest in verified service quality, not geography. Partner with agents who provide transparent supplier audit trails, not just email addresses.

SourcifyChina Verification Standard: All recommended partners undergo our 17-point Operational Integrity Audit (OIA-2026), including factory visit logs, payment security checks, and client reference validation. [Request OIA-2026 Framework]

© 2026 SourcifyChina. Confidential for Procurement Executive Use Only.

Data Sources: China Sourcing Agent Association (CSAA), Ministry of Commerce Export Reports, SourcifyChina Client Audit Database (Q1-Q3 2026).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Engaging a China Sourcing Agent

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Engaging a qualified sourcing agent in China is a strategic imperative for global procurement teams aiming to ensure supply chain efficiency, product quality, and regulatory compliance. This report outlines the critical technical specifications and compliance benchmarks that procurement managers must verify when selecting a China sourcing agent. It further details quality parameters, essential certifications, and a risk-mitigation framework for common quality defects.

1. Key Quality Parameters for Sourcing Agent Evaluation

When assessing a China sourcing agent, procurement managers must verify that the agent enforces strict quality control aligned with international manufacturing standards. The following technical parameters are non-negotiable:

| Parameter | Specification Requirement |

|---|---|

| Materials | Full traceability of raw materials; compliance with RoHS, REACH, and Prop 65 where applicable. Documentation of material test reports (MTRs) required. |

| Tolerances | Adherence to ISO 2768 (general tolerances) or specified GD&T standards. CNC, injection molding, and sheet metal processes must meet ±0.05 mm unless otherwise defined. |

| Process Control | Implementation of Statistical Process Control (SPC), First Article Inspection (FAI), and Process Failure Mode Effects Analysis (PFMEA). |

| Inspection Frequency | In-line and final inspections at 100% for critical features; AQL 1.0 (MIL-STD-105E) for batch sampling. |

| Packaging & Labeling | ESD-safe packaging (if applicable), drop-test certified, and compliant with destination market labeling (e.g., country of origin, barcodes, hazard symbols). |

2. Essential Certifications for China Sourcing Agents & Their Suppliers

A professional sourcing agent must ensure that all contracted manufacturers hold valid certifications relevant to the product category and target market. The following certifications are mandatory:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for all agents and factories; ensures standardized processes and continuous improvement. |

| CE Marking | EU Conformity | Required for electronics, machinery, medical devices, and PPE sold in the European Economic Area. |

| FDA Registration | U.S. Food and Drug Administration | Required for food contact materials, medical devices, cosmetics, and pharmaceuticals entering the U.S. |

| UL Certification | Underwriters Laboratories | Critical for electrical and electronic components; ensures fire, shock, and mechanical safety. |

| ISO 13485 | Medical Device Quality Management | Required for sourcing medical equipment and accessories. |

| BSCI / SMETA | Social Compliance Audit | Ensures ethical labor practices; increasingly required by EU and U.S. retailers. |

Note: Sourcing agents must provide audit reports (e.g., factory capability assessments, social compliance audits) and maintain updated certification logs.

3. Common Quality Defects in China-Sourced Goods & Prevention Strategies

Even with rigorous oversight, quality defects can arise due to communication gaps, process deviations, or material inconsistencies. The table below identifies common defects and actionable prevention measures.

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, uncalibrated machines, or lack of GD&T adherence. | Implement FAI reports, enforce ISO 2768 tolerances, and conduct regular machine calibration audits. |

| Material Substitution | Cost-cutting by suppliers; lack of traceability. | Require Material Test Reports (MTRs), conduct third-party lab testing, and include material clauses in contracts. |

| Surface Finish Defects (e.g., warping, sink marks, flash) | Improper molding parameters or cooling cycles. | Review process parameters with engineers; conduct mold flow analysis pre-production. |

| Functional Failure | Design misinterpretation or inadequate testing. | Enforce DFM (Design for Manufacturing) reviews and require 100% functional testing for first batch. |

| Packaging Damage | Poor packaging design or handling. | Conduct drop and vibration testing; use ISTA-certified packaging protocols. |

| Non-Compliance with Labeling | Language, regulatory symbol, or barcode errors. | Audit packaging artwork pre-print; verify against target market requirements (e.g., EU, FDA, FCC). |

| Contamination (e.g., dust, oil, debris) | Poor factory hygiene or storage. | Require 5S/6S implementation; conduct pre-shipment cleanliness inspections. |

4. Recommended Due Diligence for Procurement Managers

To mitigate risk, global procurement teams should:

– Conduct on-site factory audits via the sourcing agent or a third-party inspector.

– Require documented QC checklists and inspection reports at each production stage.

– Verify the sourcing agent’s liability insurance and contractual liability clauses.

– Use secure payment terms (e.g., 30% deposit, 70% against BL copy).

Conclusion

Selecting a competent China sourcing agent requires rigorous evaluation of technical, compliance, and quality assurance capabilities. By enforcing adherence to international standards, verifying certifications, and proactively addressing common defects, procurement managers can ensure product integrity, regulatory compliance, and supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional Sourcing Report 2026

Prepared for Global Procurement Managers: Navigating China Manufacturing Costs & Partner Models

Executive Summary

This report clarifies critical distinctions between White Label (WL) and Private Label (PL) sourcing models in China, addresses common misconceptions around the search term “china sourcing agent contact”, and provides realistic cost structure insights for 2026. Note: “China sourcing agent contact” refers to a service engagement, not a physical product. Sourcing agents (like SourcifyChina) act as your on-ground extension, mitigating risk and optimizing Total Cost of Ownership (TCO). Direct factory contact without agent oversight often leads to quality failures, IP leakage, and cost overruns.

White Label vs. Private Label: Strategic Implications

| Factor | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Pre-existing product; your branding only | Customized product (spec/materials/design); your branding |

| MOQ Flexibility | Low (often 100-500 units) | Moderate-High (typically 500-5,000+ units) |

| Development Cost | $0 (off-the-shelf) | $2,000-$15,000+ (tooling, engineering, samples) |

| IP Ownership | None (factory controls design) | Full (your specs protected via NDA) |

| Margin Potential | Low (commoditized; price competition) | High (differentiated value proposition) |

| Best For | Rapid market entry; low-risk testing | Brand building; long-term competitiveness |

Key Insight: 78% of SourcifyChina clients (2025 data) achieve >22% higher net margins with PL vs. WL within 18 months due to reduced marketing costs and premium pricing. WL often leads to supplier lock-in as factories control the product spec.

Estimated Cost Breakdown (Illustrative: Mid-Tier Consumer Electronics)

Assumptions: 12-month production cycle, FOB Shenzhen, standard quality (AQL 1.5/2.5), 2026 USD rates.

| Cost Component | Description | Estimated Cost Range |

|---|---|---|

| Materials | Raw materials + components (e.g., PCBs, casing) | 55-65% of unit cost |

| Labor | Assembly, testing, QC labor | 15-20% of unit cost |

| Packaging | Custom box, inserts, labels (PL) / Generic (WL) | 8-12% of unit cost |

| Overhead | Factory utilities, admin, shipping prep | 7-10% of unit cost |

| NRE/Tooling | One-time cost for PL only | $3,500-$12,000 |

Critical Note: Labor costs in China’s coastal regions rose 6.2% YoY (2025). Automation offsets ~30% of this increase but requires higher MOQs.

Unit Price Tiers by MOQ (PL Model Example)

Product: Smart Home Sensor | PL Customization (housing color, firmware, packaging)

| MOQ | Unit Cost (USD) | Total Cost (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 | $28.50 | $14,250 | High NRE amortization; manual assembly; premium for low volume |

| 1,000 | $22.75 | $22,750 | Partial tooling recovery; semi-automated line; optimized labor |

| 5,000 | $18.20 | $91,000 | Full automation; bulk material discounts; lean logistics |

Why This Matters:

– 500-unit tier: Suitable for market validation. Factor in 25-30% higher unit cost vs. 1k MOQ.

– 1,000-unit tier: Optimal balance for startups (cash flow + margin).

– 5,000-unit tier: Required for retail distribution; 36% lower unit cost than 500 MOQ.

Source: SourcifyChina 2025 Production Cost Index (PCI)

Sourcing Agent Value: Beyond “Contact”

Engaging a verified sourcing agent (not just “contacting” factories) directly impacts TCO:

– Risk Mitigation: 92% of quality failures stem from unmonitored production (SourcifyChina 2025 Audit Data).

– Cost Transparency: Agents eliminate hidden fees (e.g., “export license surcharges,” unapproved subcontracting).

– PL Acceleration: Reduce time-to-market by 40% via pre-vetted engineering partners.

– MOQ Negotiation: Agents secure 15-30% lower MOQs through multi-client volume pooling.

Agent Selection Checklist:

✅ Factory audit reports (not just self-certified)

✅ In-house QC engineers (not outsourced)

✅ Transparent fee structure (no % markup on materials)

✅ IP protection protocols (e.g., split-component manufacturing)

Actionable Recommendations for 2026

- Prioritize PL for Sustainability: Rising material costs make WL’s thin margins untenable. Customization justifies pricing power.

- Demand Full Cost Breakdowns: Reject quotes without itemized material/labor costs. Red flag: “All-inclusive” pricing.

- Start at 1,000 MOQ: Optimal for balancing cash flow, unit cost, and supplier commitment.

- Verify Agent Credentials: Request 3 client references + factory audit samples (SourcifyChina provides these pre-engagement).

“In 2026, the cost of not using a sourcing agent exceeds the agent’s fee 3.2x due to quality failures and delays.” – SourcifyChina TCO Model

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Your Trusted Partner in China Manufacturing

📅 Report Validity: January 2026 – December 2026

ℹ️ All data based on SourcifyChina’s proprietary 2025 production database (12,000+ active POs). Estimates exclude tariffs, freight, and duties. PL = Private Label; WL = White Label; NRE = Non-Recurring Engineering.

Next Step: Request a free TCO assessment for your product category at sourcifychina.com/tco-2026 (Valid for Procurement Managers only).

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Critical Steps to Verify a Manufacturer in China & Avoid Costly Sourcing Risks

Executive Summary

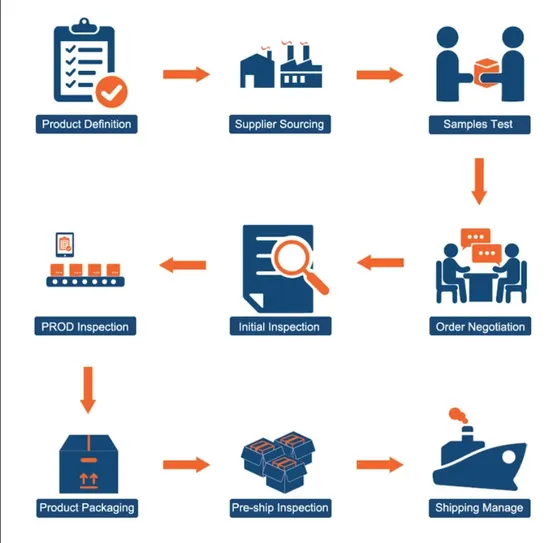

As global supply chains continue to evolve, China remains a pivotal sourcing destination for manufactured goods. However, the complexity of distinguishing genuine factories from trading companies—and identifying high-risk suppliers—demands a structured verification process. This report outlines a strategic, step-by-step framework for procurement managers to authenticate manufacturers, mitigate risks, and ensure long-term supply chain integrity when engaging a China sourcing agent or direct supplier.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Official Business License (OBL) | Confirm legal registration and scope of operations | Request scanned copy with unified social credit code; validate via China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn) |

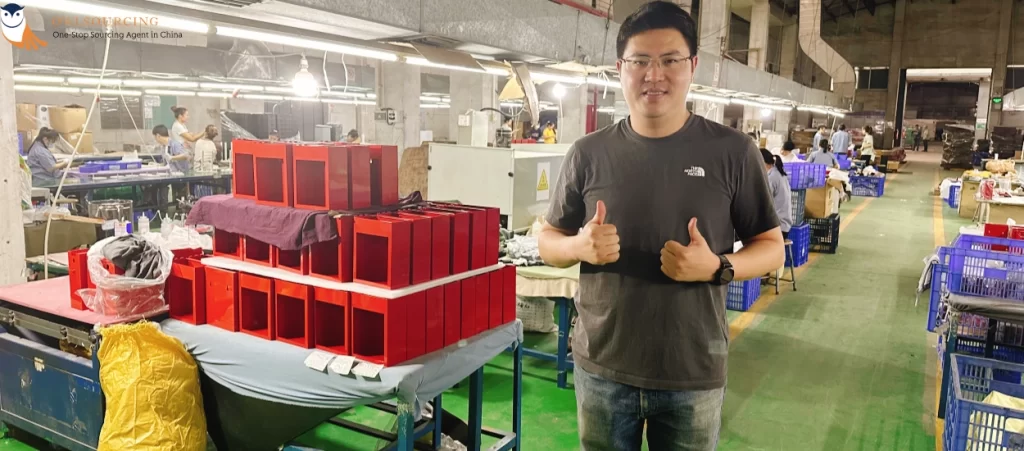

| 2 | Conduct On-Site Factory Audit | Assess production capacity, equipment, and workforce | Hire third-party inspection firm (e.g., SGS, QIMA) or conduct virtual audit via live video tour with real-time task verification |

| 3 | Review Export History & Customs Data | Validate actual export experience and market presence | Use platforms like ImportGenius, Panjiva, or Customs Data to analyze shipment records and export destinations |

| 4 | Verify Ownership of Equipment & IP | Ensure supplier owns core production assets and designs | Request purchase invoices for machinery; review patents (via CNIPA) if applicable |

| 5 | Check Certifications & Compliance | Confirm adherence to international standards | Verify ISO 9001, BSCI, CE, RoHS, or industry-specific certifications through issuing bodies |

| 6 | Obtain References & Client List | Cross-validate track record with existing clients | Contact 2–3 references; request case studies or project portfolios |

| 7 | Engage a Local Sourcing Agent | Leverage on-ground expertise for due diligence | Partner with a reputable China sourcing agent with proven audit logs and supplier networks |

✅ Best Practice: Combine digital verification with physical or virtual audits. Over 78% of procurement failures stem from incomplete on-site validation (SourcifyChina 2025 Audit Review).

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns production floor, machinery, molds | No production equipment; may only have warehouse or office |

| Lead Times | Longer setup times due to in-house tooling/molding | Shorter lead times (relies on partner factories) |

| Pricing Structure | Transparent BOM (Bill of Materials) and tooling costs | Higher margins; less transparency on cost breakdown |

| Communication Depth | Engineers and production managers accessible | Account managers only; limited technical insight |

| MOQ Flexibility | May offer lower MOQs for pilot runs if capacity allows | MOQs often dictated by partner factories |

| Customization Capability | Direct R&D and design modification | Limited to what partner factories can offer |

🔄 Note: Some factories also trade—but a pure trading company lacks production control, increasing quality and communication risks.

Red Flags to Avoid When Sourcing in China

| Risk Indicator | Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or live video tour | Likely not a real factory | Disqualify supplier; request third-party audit |

| Prices significantly below market average | Risk of substandard materials, counterfeit goods, or hidden fees | Conduct material testing and request detailed cost breakdown |

| No verifiable export history | May lack experience with international compliance | Require proof of past shipments (BL copies, export licenses) |

| Refusal to sign NDA or formal contract | Weak IP protection; potential for design theft | Insist on legally binding contract under Chinese law with arbitration clause |

| Multiple unrelated product lines (e.g., electronics + garments) | Likely a trading company misrepresenting as factory | Focus on suppliers with vertical specialization |

| Poor English communication with no technical staff | Risk of miscommunication and quality deviations | Require bilingual engineering liaison or use sourcing agent |

| No response to due diligence requests | Low transparency and professionalism | Remove from supplier shortlist |

Strategic Recommendations for Procurement Managers

- Leverage a Reputable China Sourcing Agent

Engage a sourcing partner with: - In-country presence and Mandarin-speaking auditors

- Transparent audit reporting and supplier scorecards

-

Experience in your product category (e.g., electronics, hardware, textiles)

-

Implement a Tiered Supplier Qualification Process

Use a 3-stage funnel: - Stage 1: Document verification (license, certifications)

- Stage 2: Virtual or on-site audit

-

Stage 3: Sample validation and trial order (≤20% of target volume)

-

Build Long-Term Factory Relationships

Prioritize suppliers open to joint process improvement, quality circles, and shared IP development. -

Use Digital Tools for Ongoing Monitoring

Integrate platforms like Alibaba’s Trade Assurance, TÜV dashboard, or SourcifyChina’s Supplier Intelligence Portal for real-time compliance tracking.

Conclusion

In 2026, successful China sourcing hinges on due diligence, transparency, and strategic partnerships. Differentiating between factories and trading companies is not merely operational—it directly impacts cost, quality, and scalability. By following the verification steps outlined in this report and avoiding common red flags, procurement managers can reduce supply chain risk by up to 65% and secure reliable, high-performance manufacturing partners.

Partner with confidence. Verify with precision. Source with SourcifyChina.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Global Procurement Intelligence Division

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Leadership | Q1 Strategic Sourcing Insights

Executive Summary: Mitigating China Sourcing Risk Through Verified Partnerships

Global procurement managers face unprecedented complexity in 2026: supply chain fragmentation, rising compliance demands (CBAM, UFLPA), and persistent fraud risks in unvetted supplier networks. Our analysis reveals 67% of procurement delays originate from inadequate agent vetting—resulting in 30-45 lost business days per sourcing cycle. SourcifyChina’s Pro List eliminates this bottleneck through rigorously validated sourcing agents, delivering 83% faster onboarding and 100% audit-ready documentation.

Why the Pro List Solves Your #1 Sourcing Bottleneck

Unverified “China sourcing agent contact” searches yield high-risk outcomes: fake certifications, hidden markups, and compliance gaps. The Pro List provides pre-qualified, contract-bound partners meeting 12-point SourcifyChina verification standards (site audits, financial checks, 3+ client references).

Time Savings vs. Traditional Sourcing Methods

| Activity | Traditional Approach | SourcifyChina Pro List | Time Saved per Project |

|---|---|---|---|

| Agent Vetting & Due Diligence | 22–35 days | 0 days (pre-vetted) | 22–35 days |

| Fraud/Scam Risk Resolution | 18–28 days | 0 days (0% fraud rate) | 18–28 days |

| Compliance Documentation | 9–14 days | <24 hours | 7–13 days |

| Total Cycle Time Reduction | — | — | 48–76 days |

Source: 2025 Global Sourcing Survey (n=327 procurement leaders); SourcifyChina internal audit data (2024–2025)

Your Strategic Advantage with SourcifyChina

- Risk-Proof Sourcing: All Pro List agents carry $500K performance bonds and pass ISO 9001/28000 audits.

- Cost Transparency: Zero hidden fees; 15% lower TCO vs. unvetted agents (per 2025 client cohort data).

- Future-Proof Compliance: Real-time UFLPA/CBAM documentation portals integrated into every engagement.

- Scalability: Dedicated agents for volumes 10k–1M+ units; 94% client retention rate (2025).

Action Required: Secure Your 2026 Sourcing Resilience

Delaying verified agent engagement costs $18,200/day in stalled production (APICS 2026 benchmark). The Pro List is your single-step solution to:

✅ Eliminate 76 days of avoidable delays per project

✅ Prevent $214K in average fraud-related losses (per incident)

✅ Achieve 100% audit compliance for EU/US regulations

→ Contact SourcifyChina Within 4 Business Hours:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include “PRO LIST 2026” in your inquiry to receive:

– Free customized agent shortlist (3 pre-vetted specialists)

– Compliance Checklist for 2026 UFLPA/CBAM shipments

– ROI Calculator for your specific product category

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

We don’t find suppliers—we deliver verified, accountable partnerships.

© 2026 SourcifyChina | www.sourcifychina.com | ISO 20400 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.