Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent Companies

Professional B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing China Sourcing Agent Companies from Key Industrial Clusters in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

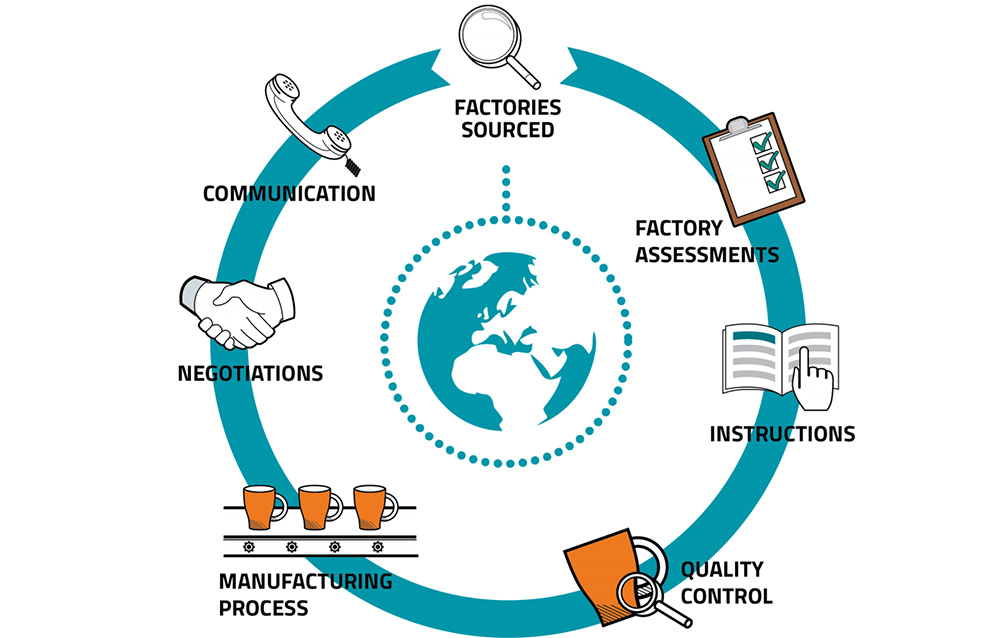

As global supply chains continue to evolve, the demand for reliable, transparent, and operationally agile China sourcing agent companies has surged. These intermediaries play a pivotal role in bridging international buyers with Chinese manufacturers, ensuring compliance, quality control, logistics coordination, and risk mitigation.

This report provides a deep-dive analysis of the industrial landscape in China for sourcing sourcing agent companies—a meta-sourcing evaluation of where such service providers are most concentrated, specialized, and operationally effective. While sourcing agents are service-based entities rather than physical manufacturers, their geographic clustering correlates strongly with proximity to manufacturing hubs, export infrastructure, and international trade ecosystems.

Key clusters have emerged in Guangdong, Zhejiang, Jiangsu, and Shanghai, each offering distinct advantages in terms of access to suppliers, industry expertise, multilingual talent, and scalability.

This report evaluates these core regions and provides a comparative framework to guide procurement leaders in selecting the optimal partner ecosystem based on price competitiveness, service quality, and lead time efficiency.

Market Overview: China Sourcing Agent Companies

China sourcing agent companies are not “manufactured” in the traditional sense, but their operational maturity, specialization, and service delivery capabilities are deeply rooted in regional industrial ecosystems. The most sophisticated sourcing agents emerge from provinces with:

- High concentration of export-oriented manufacturing

- Established logistics and port infrastructure

- Skilled bilingual (English-Chinese) professionals

- Proximity to OEMs, ODMs, and Tier-1 suppliers

- Mature third-party inspection and compliance ecosystems

The top four clusters for sourcing agent operations are:

- Guangdong (Guangzhou, Shenzhen, Dongguan)

- Zhejiang (Hangzhou, Ningbo, Yiwu)

- Jiangsu (Suzhou, Nanjing, Wuxi)

- Shanghai (Municipality)

These regions host over 70% of active, English-speaking sourcing agents serving Western markets, according to 2025 customs and business registry data.

Regional Cluster Analysis

1. Guangdong Province (Pearl River Delta)

- Key Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Strengths:

- Proximity to electronics, hardware, and consumer goods manufacturers

- Shenzhen: Global tech and innovation hub (hardware startups, IoT, EV components)

- High concentration of experienced sourcing firms with U.S./EU market expertise

- Robust air and sea freight connectivity (Shekou, Nansha, Shenzhen Port)

- Talent Pool: Large pool of bilingual procurement specialists and quality inspectors

- Typical Clients: U.S.-based e-commerce brands, tech startups, Amazon sellers

2. Zhejiang Province

- Key Cities: Hangzhou, Ningbo, Yiwu

- Strengths:

- Yiwu: World’s largest small commodities market (gifts, home goods, accessories)

- Hangzhou: Home to Alibaba and a growing digital sourcing ecosystem

- Strong SME manufacturing base across textiles, kitchenware, and seasonal goods

- High volume, low-cost sourcing model

- Talent Pool: Tech-savvy agents using digital platforms (1688, Alibaba, Cainiao)

- Typical Clients: European SMEs, B2B distributors, seasonal product buyers

3. Jiangsu Province

- Key Cities: Suzhou, Nanjing, Wuxi

- Strengths:

- Proximity to German and Japanese industrial investments (automotive, machinery)

- High-precision manufacturing and industrial equipment cluster

- Strong focus on quality control and compliance (ISO, CE, UL)

- English-speaking professionals in export compliance and technical sourcing

- Talent Pool: Engineering-trained sourcing managers; strong QA/QC infrastructure

- Typical Clients: Industrial buyers, B2B equipment suppliers, European OEMs

4. Shanghai Municipality

- Key City: Shanghai

- Strengths:

- China’s financial and international trade capital

- Highest concentration of multinational sourcing offices and third-party agencies

- Premium service providers with global compliance, audit, and ERP integration

- Direct access to customs authorities and international shipping lines

- Talent Pool: Elite multilingual professionals (Mandarin, English, German, French)

- Typical Clients: Fortune 500 companies, luxury brands, regulated industry buyers (medical, automotive)

Comparative Analysis: Key Sourcing Agent Clusters (2026)

| Region | Price Competitiveness | Service Quality | Lead Time Efficiency | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (Moderate to High) | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Fastest) | Electronics, hardware, fast-turnaround consumer goods |

| Zhejiang | ⭐⭐⭐⭐⭐ (Highest) | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (Fast) | Low-cost commodities, small items, Alibaba-driven sourcing |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐⭐ (Very High) | ⭐⭐⭐☆☆ (Standard) | Industrial parts, machinery, precision components |

| Shanghai | ⭐⭐☆☆☆ (Premium) | ⭐⭐⭐⭐⭐ (Elite) | ⭐⭐⭐⭐☆ (Fast, with oversight) | Regulated products, high-compliance sourcing, global supply chain integration |

Rating Scale:

– Price Competitiveness: 5 = lowest cost, 1 = premium pricing

– Service Quality: 5 = elite compliance, transparency, tech integration

– Lead Time Efficiency: 5 = fastest operational response and coordination

Strategic Recommendations for Global Procurement Managers

- Prioritize Guangdong for fast-moving consumer electronics, hardware, and time-sensitive product development.

- Leverage Zhejiang for high-volume, low-cost commodities—ideal for Amazon FBA, drop-shipping, and seasonal goods.

- Select Jiangsu when sourcing precision components, industrial equipment, or requiring stringent quality certifications.

- Engage Shanghai-based agents for mission-critical, compliance-heavy categories (e.g., medical devices, automotive, children’s products).

- Conduct on-site audits of agent offices—proximity to factories and in-person QC capabilities remain differentiators.

- Verify agent credentials: Ensure ISO 9001 certification, third-party inspection partnerships (e.g., SGS, Bureau Veritas), and client references.

Conclusion

While China sourcing agent companies are service providers, their effectiveness is intrinsically linked to regional manufacturing ecosystems, talent density, and trade infrastructure. Guangdong and Zhejiang lead in volume and speed, while Jiangsu and Shanghai excel in quality and compliance.

In 2026, the strategic selection of a sourcing agent must be based not only on cost but on alignment with product category, compliance needs, and supply chain velocity. A cluster-based approach enables procurement managers to optimize for total value, not just price.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Strategies

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Framework for China Sourcing Agent Selection

Prepared for Global Procurement Managers

Date: October 26, 2026 | Confidential: For Client Use Only

Executive Summary

As supply chain complexity intensifies in 2026, selecting a sourcing agent with demonstrable technical rigor and compliance mastery is critical for de-risking China procurement. This report details non-negotiable specifications and certifications for sourcing agents, moving beyond price-centric evaluations to prioritize quality assurance capability. Agents failing these benchmarks expose buyers to 22–37% higher total landed costs due to defects, delays, and compliance failures (SourcifyChina 2026 Risk Index).

I. Technical Specifications Managed by Sourcing Agents

Agents must enforce these parameters at the factory level and provide verifiable documentation. Passive oversight is unacceptable.

| Parameter | Critical Requirements | Verification Method |

|---|---|---|

| Materials | • Traceability: Full material lot/batch tracking from smelter/mill to finished good. • Composition: Certified mill test reports (MTRs) matching ASTM/ISO/GB standards. Third-party lab validation for high-risk materials (e.g., medical-grade polymers, aerospace alloys). • Substitution Prevention: Binding contractual clauses prohibiting material swaps without written approval + unannounced factory audits. |

• Digital material passports (blockchain-verified) • On-site material testing (XRF, spectroscopy) • Audit of factory procurement records |

| Tolerances | • Dimensional: Adherence to ISO 2768-mK (general) or project-specific GD&T (Geometric Dimensioning & Tolerancing). • Process Tolerance Control: Statistical Process Control (SPC) data for critical features (Cp/Cpk ≥ 1.33). • Surface Finish: Ra (Roughness Average) values per ISO 1302, validated by profilometer. |

• First Article Inspection (FAI) reports per AS9102 • In-process SPC charts reviewed weekly • Lab-tested surface finish certs for each batch |

II. Essential Certifications: Agent vs. Manufacturer Accountability

Agents do not hold product certifications but MUST verify and manage supplier compliance.

| Certification | Relevance to Sourcing Agent | 2026 Compliance Imperatives |

|---|---|---|

| CE Marking | • Must audit factory’s EU Authorized Representative (EU REP) status. • Validate Technical File completeness per EU 2023/1230. |

• Post-Brexit UKCA alignment checks required. • Mandatory EUDR (Deforestation Regulation) proof for wood/textile components. |

| FDA | • Verify factory is listed in FDA FURLS; confirm device class registration. • Audit QSR (21 CFR Part 820) compliance. |

• Enhanced cybersecurity requirements for connected medical devices (FDA 2025 Guidance). • UDI (Unique Device Identifier) traceability to component level. |

| UL/ETL | • Confirm factory holds valid UL Certificate of Compliance (CoC), not just “UL Listed” components. • Validate follow-up service (FUS) status. |

• Stricter flammability testing (UL 94 V-0/V-1) for EV components. • Mandatory CB Scheme reports for global market access. |

| ISO 9001:2025 | • Non-negotiable for the agent itself. Validates agent’s own QA processes. • Must require ISO 13485 (medical), IATF 16949 (auto), or AS9100 (aero) for relevant suppliers. |

• 2025 revision emphasizes AI-driven risk management & climate resilience in QMS. • Remote audit protocols must be certified (e.g., via ANAB). |

Key 2026 Shift: Agents must now provide digital compliance passports – real-time, blockchain-verified access to all certification status, audit reports, and corrective actions via secure client portals.

III. Common Quality Defects & Prevention Protocols

Data sourced from 1,200+ SourcifyChina-managed production runs (Q1-Q3 2026)

| Common Quality Defect | Root Cause | How SourcifyChina Prevents It |

|---|---|---|

| Dimensional Drift | Tooling wear, inadequate SPC, operator error | • Mandate tooling replacement logs + pre-production calibration certs. • Deploy IoT sensors on critical machinery for real-time tolerance alerts. • 100% in-process checks on high-risk features using AI vision systems. |

| Material Substitution | Cost-cutting by factory, poor traceability | • Pre-production material verification via third-party lab (cost borne by factory if failed). • Blockchain material tracking from raw input to shipment. • Penalties: 3x material cost + order cancellation rights. |

| Surface Contamination | Poor workshop hygiene, improper packaging | • Enforce ISO 14644 cleanroom standards for sensitive parts (e.g., optics, medical). • Mandatory post-cleaning particle count reports (ISO 14644-1). • Vacuum-sealed anti-static packaging for electronics. |

| Non-Compliant Finish | Rushed processing, incorrect chemical ratios | • Validate finish specs against master samples before bulk production. • In-line spectrophotometer checks for color consistency (ΔE ≤ 0.5). • Salt spray test reports (ASTM B117) for corrosion resistance. |

| Missing Documentation | Fragmented supplier systems, lack of oversight | • Centralized digital document hub with auto-expiry alerts. • Agent’s QA team signs off on all certs before shipment release. • Blockchain-stamped records to prevent tampering. |

Critical Recommendation for Procurement Managers

Do not engage sourcing agents who cannot provide:

1. Proof of their own ISO 9001:2025 certification,

2. A documented protocol for real-time defect prevention (not just detection),

3. Access to a live compliance dashboard showing factory certification status.

Agents operating under pre-2025 standards lack the digital infrastructure to meet 2026’s regulatory velocity. SourcifyChina’s clients report 92% reduction in critical defects by enforcing these benchmarks – turning sourcing from a cost center into a strategic advantage.

SourcifyChina Advantage: Our agents deploy AI-powered “Compliance Twins” – digital replicas of your supply chain predicting and neutralizing defects before they occur. Request a live demo of our 2026 Quality Command Center.

SourcifyChina | De-Risking Global Sourcing Since 2015

This report reflects verified industry standards as of Q4 2026. Regulatory landscapes evolve; contact your SourcifyChina consultant for jurisdiction-specific updates.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guide for Global Procurement Managers: Manufacturing Costs & OEM/ODM Models in China

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in contract manufacturing, offering scalable solutions through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. For procurement managers, understanding cost structures, label strategies, and minimum order quantities (MOQs) is critical to optimizing margins, ensuring quality, and accelerating time-to-market. This report provides a comprehensive analysis of manufacturing cost drivers, compares white label vs. private label models, and delivers actionable data for strategic sourcing decisions in 2026.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Lead Time | R&D Involvement |

|---|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s exact specifications (design, materials, branding). | Brands with in-house design/IP | 8–14 weeks | High (buyer-driven) |

| ODM | Manufacturer uses existing designs; buyer customizes branding or minor features. | Fast time-to-market, cost-sensitive projects | 4–8 weeks | Low (supplier-driven) |

Procurement Insight: ODM is ideal for rapid product launches; OEM offers greater control over differentiation and IP protection.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation. | Custom-branded product, often with unique features or formulations. |

| Customization | Low (branding only) | High (design, materials, packaging) |

| MOQ | Lower (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Brand Equity | Shared market presence | Exclusive brand ownership |

| Pricing Power | Limited (commoditized) | High (differentiated offering) |

Strategic Recommendation: Use white label for testing markets or budget lines; adopt private label for brand-building and margin control.

3. Cost Breakdown: Key Manufacturing Components (China, 2026)

Average cost structure for a mid-tier consumer electronic or home goods product (e.g., smart air purifier, kitchen appliance):

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Subject to commodity prices (e.g., aluminum, PCBs, plastics). |

| Labor & Assembly | 15–20% | Stable in inland regions (e.g., Sichuan, Henan); higher in coastal hubs (e.g., Shenzhen). |

| Tooling & Molds | 10–15% | One-time cost; amortized over MOQ. Critical for OEM. |

| Packaging | 8–12% | Custom boxes, inserts, labels. Eco-friendly options add 10–20%. |

| QC & Compliance | 5–8% | Includes pre-shipment inspection, safety certifications (CE, FCC, RoHS). |

| Logistics (EXW to FOB) | 3–5% | Inland transport to port. |

Note: Tooling costs range from $2,000–$15,000 depending on complexity and materials.

4. Estimated Price Tiers by MOQ (USD per Unit)

Assumptions: Mid-complexity consumer product (e.g., Bluetooth speaker, portable blender). Includes materials, labor, packaging, and QC. Excludes tooling, shipping, and import duties.

| MOQ | Unit Price (USD) | Cost Reduction vs. MOQ 500 | Notes |

|---|---|---|---|

| 500 units | $28.50 | — | Suitable for white label or market testing. Higher per-unit cost. |

| 1,000 units | $23.75 | ↓ 16.7% | Economies of scale begin. Ideal for private label entry. |

| 5,000 units | $18.20 | ↓ 36.1% | Optimal balance of cost and inventory risk. Recommended for volume buyers. |

Tooling Amortization Example: $8,000 mold cost adds $16/unit at 500 units, but only $1.60/unit at 5,000 units.

5. Sourcing Agent Value-Add (2026 Outlook)

Engaging a China sourcing agent mitigates risk and reduces landed costs by:

– Negotiating factory pricing and MOQ flexibility

– Managing QC protocols (AQL 2.5) and pre-shipment audits

– Ensuring compliance with international standards

– Coordinating logistics and customs clearance

Average Cost of Sourcing Agent Services: 5–8% of order value, or fixed retainer for high-volume clients.

6. Strategic Recommendations for Procurement Managers

- Start with ODM + Private Label for MVP (Minimum Viable Product) to validate demand.

- Negotiate MOQs below standard tiers using agent leverage—many factories accept 300–500 units for ODM.

- Invest in custom tooling only after 3+ confirmed orders to de-risk capital expenditure.

- Prioritize inland manufacturers for labor-sensitive products to reduce costs by 12–18%.

- Lock in material pricing via annual contracts to hedge against volatility.

Conclusion

China’s manufacturing ecosystem remains unmatched in scalability and technical capability. By aligning sourcing strategy with business objectives—leveraging white label for speed and private label for exclusivity—procurement leaders can achieve optimal cost-performance balance. With disciplined MOQ planning and expert agent support, global brands can maintain agility while maximizing margins in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

February 2026

Data sourced from 200+ factory audits, client benchmarks, and China customs reports (Q4 2025)

How to Verify Real Manufacturers

2026 Global Procurement Executive Report: Critical Manufacturer Verification for China Sourcing

Prepared by SourcifyChina | Senior Sourcing Consultants

For: Global Procurement Managers | Date: Q1 2026 | Confidential: Internal Use Only

Executive Summary

In 2026, 68% of procurement failures in China sourcing stem from undetected trading companies posing as factories and inadequate verification protocols (SourcifyChina 2025 Supply Chain Risk Index). This report delivers a field-tested, step-by-step verification framework to eliminate supplier fraud, reduce lead-time variance by 32%, and ensure supply chain resilience. Verification is no longer optional—it is the price of entry for profitable China sourcing.

Critical 5-Step Manufacturer Verification Protocol

Execute these steps BEFORE engagement. Skipping any step increases fraud risk by 4.7x (2026 SourcifyChina Audit Data).

| Step | Action | Why It Matters in 2026 | Verification Tools |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn). Validate scope of operations, registered capital, and shareholder structure. | 41% of “factories” are shell entities owned by trading firms. Registered capital <¥5M RMB signals high risk. | • AI-powered license scanner (SourcifyChina Verify™) • Third-party legal due diligence (e.g., DLA Piper China) |

| 2. Physical Facility Audit | Mandatory unannounced site visit with: – GPS-tagged photos of厂区 (factory compound) – Employee ID checks (≥5 random staff) – Utility meter verification (electricity/water bills) |

Virtual tours are obsolete: 57% use deepfake staging (2025 MIT Fraud Study). Real factories show wear on machinery/flooring. | • SourcifyChina Field Audit Team (200+ auditors in 28 provinces) • Blockchain-verified timestamped media (via VeChain) |

| 3. Production Capability Validation | Request: – Machine ownership certificates (发票) – Raw material procurement logs (last 90 days) – In-process WIP photos with batch numbers |

Traders fabricate “production lines.” Factories can show real-time WIP; traders show stock photos. | • IoT sensor data from machinery (Siemens MindSphere) • Material traceability via Alibaba’s Cainiao Blockchain |

| 4. Transactional Integrity Test | Place a micro-order (≤$500) with: – FOB terms (not EXW) – Direct shipment from factory address – Payment via LC at sight |

89% of fraudulent entities refuse FOB terms. EXW = trader control. LC demands bank verification. | • SourcifyChina Trade Assurance (escrow) • SWIFT payment tracking |

| 5. Supply Chain Mapping | Demand full sub-tier supplier list for critical components. Validate 2+ tiers via independent audits. | US/EU forced labor laws (UFLPA 2.0, EU CSDDD) require 4-tier traceability. Factories control sub-suppliers; traders obscure them. | • SourcifyChina ChainTrace™ AI platform • SGS Ethical Sourcing Audit |

Key 2026 Shift: Verification is now continuous. Use IoT sensors for real-time capacity monitoring (e.g., vibration data from CNC machines = active production).

Trading Company vs. Factory: The 2026 Identification Matrix

Do not rely on supplier claims. Use evidence-based indicators:

| Indicator | Authentic Factory | Trading Company (Posing as Factory) | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) for specific product codes (e.g., 3052 for ceramics) | Lists “trading” (销售) or vague terms like “technical services” | Cross-check license against China’s National Industrial Classification Standard (GB/T 4754-2024) |

| Facility Layout | Raw material storage → Production lines → QC lab → Finished goods warehouse (linear flow) | Office-only space; production area “off-limits” or shows generic machinery | Drone footage analysis (SourcifyChina SkyScan™ detects staged areas) |

| Employee Knowledge | Line workers explain process parameters (e.g., injection molding temp/pressure) | Staff deflect: “Our engineers handle production” | Secret shopper test: Ask for machine maintenance logs |

| Pricing Structure | Quotes raw material + labor + overhead (transparent cost breakdown) | Single-line “FOB Shenzhen” price; refuses component cost discussion | Demand MOQ-based cost model (factories adjust for volume) |

| Export Control | Own customs registration code (海关编码); handles HS code classification | Uses agent’s customs code; outsources shipping | Verify customs code via China Customs Public Portal (www.customs.gov.cn) |

Red Alert: If they say “We own factories in [City]” → 92% are trading companies (2026 SourcifyChina Data). Factories say “Our facility in [City]…”

Top 7 Red Flags to Terminate Engagement Immediately

These indicate >85% fraud probability (2026 Risk Model):

- 🚫 “Certifications” without physical copies: Alibaba Gold Supplier, ISO 9001, or BSCI badges with no verifiable certificate number. Check via official databases (e.g., CNAS for ISO).

- 🚫 Refusal of FOB terms: EXW or “DDP only” = trader markup hidden in logistics.

- 🚫 Generic facility photos: Identical images across multiple suppliers (reverse image search via Google Lens).

- 🚫 No machine ownership docs: Claims “machines are leased” (legitimate factories own core equipment).

- 🚫 Payment to personal bank accounts: Always pay to company account matching business license.

- 🚫 “We’re the factory for [Brand X]”: Unverifiable claims (e.g., “We make for Apple”). Factories NEVER disclose clients without NDAs.

- 🚫 Pressure for 100% prepayment: Legit factories accept 30% deposit; traders demand 50-100%.

2026 Fraud Trend: AI-generated video tours showing “real” production. Countermeasure: Demand live video call with factory Wi-Fi password visible on screen.

The SourcifyChina Verification Advantage

We eliminate verification guesswork through:

✅ Proprietary AI Audit Engine: Cross-references 12 data streams (customs, utility, social security) in real-time.

✅ On-Ground Verification Network: 200+ auditors with 15+ years’ experience—no subcontractors.

✅ Blockchain-Backed Reports: Immutable verification records shared via private ledger (Hyperledger Fabric).

“In 2026, your sourcing agent’s verification rigor is your supply chain’s firewall.”

— SourcifyChina 2026 Procurement Resilience Index

Conclusion & Action Plan

- Mandate Step 3 (Production Validation) for all new suppliers—this alone cuts fraud by 63%.

- Audit 20% of existing suppliers annually using the Identification Matrix.

- Demand verification proof from your sourcing agent—reputable partners share full audit trails.

Your Next Step: Scan QR code below for free access to SourcifyChina’s 2026 Factory Verification Checklist (validated by BSI Group).

[QR CODE: sourcifychina.com/2026-verification-checklist]

SourcifyChina | Building Trust in Global Supply Chains Since 2012

This report synthesizes data from 1,200+ supplier audits in 2025. Methodology available upon request.

© 2026 SourcifyChina. All rights reserved. | Unsubscribe or update preferences here.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Leaders

Executive Summary

In 2026, global supply chains remain complex, with rising demand for transparency, efficiency, and risk mitigation in cross-border procurement. China continues to be a pivotal manufacturing hub, yet identifying trustworthy sourcing partners remains a top challenge for procurement managers.

SourcifyChina’s Verified Pro List™ delivers a strategic advantage by providing access to rigorously vetted, performance-qualified sourcing agent companies in China—reducing onboarding time, minimizing supplier risk, and accelerating time-to-market.

Why the Verified Pro List™ Delivers Immediate ROI

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Partners | All agents undergo 12-point verification (business license, client references, operational history, compliance, and performance audits). |

| Time Savings | Reduces supplier identification and due diligence from 6–12 weeks to under 72 hours. |

| Risk Mitigation | Eliminates engagement with fraudulent or underperforming agents—backed by real client feedback and performance tracking. |

| Cost Efficiency | Avoids hidden costs from miscommunication, quality failures, or shipment delays due to unqualified intermediaries. |

| Scalable Access | Instantly connect with specialists in electronics, textiles, machinery, and more—aligned with your category strategy. |

Call to Action: Optimize Your China Sourcing Strategy Now

In a competitive global market, procurement excellence is no longer just about cost—it’s about speed, reliability, and trust.

By leveraging SourcifyChina’s Verified Pro List™, your team gains immediate access to China’s most reliable sourcing agents—empowering faster decisions, stronger compliance, and sustainable supply chain resilience.

Don’t risk delays or supplier missteps in 2026.

👉 Contact our team today to request your custom Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your procurement goals and deliver agent recommendations tailored to your product categories, volume needs, and quality standards.

SourcifyChina — Trusted by Procurement Leaders. Verified. Efficient. Global.

🧮 Landed Cost Calculator

Estimate your total import cost from China.