Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent China Buying Agent

SourcifyChina | 2026 Global Sourcing Intelligence Report

Subject: Market Deep-Dive – China Sourcing Agent & Buying Agent Services in China

Prepared For: Global Procurement Managers

Publication Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

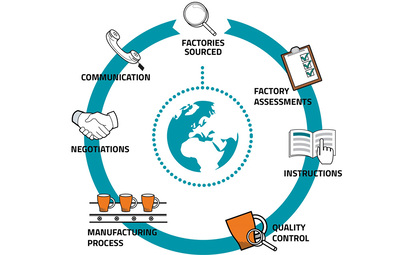

While “China sourcing agent” or “China buying agent” may appear to refer to a physical product, it is, in fact, a service-based industry that supports international buyers in navigating China’s complex manufacturing ecosystem. These agents act as intermediaries, offering procurement, quality control, logistics coordination, and supply chain management services. As global demand for outsourced manufacturing continues to grow, so does the need for reliable, professional sourcing agents—particularly those embedded in key industrial clusters.

This report identifies the primary geographical hubs in China where sourcing and buying agent services are most concentrated, evaluates the strengths and trade-offs of each region, and provides a comparative analysis tailored to the strategic sourcing needs of multinational procurement teams.

Understanding the Sourcing Agent Ecosystem in China

Sourcing agents are not manufactured goods but specialized service providers with deep regional, industrial, and regulatory knowledge. Their value is intrinsically linked to proximity to manufacturing clusters, logistics infrastructure, and industry-specific expertise.

The most effective sourcing agents operate from or maintain strong networks within China’s major industrial provinces—where manufacturing density, supply chain maturity, and export activity are highest.

Key Industrial Clusters for Sourcing Agent Services

The concentration of sourcing and buying agents in China closely mirrors the nation’s manufacturing powerhouses. The top provinces and cities hosting the most experienced and specialized agents include:

| Region | Primary Manufacturing Sectors | Agent Specialization | Strategic Advantage |

|---|---|---|---|

| Guangdong (Guangzhou, Shenzhen, Dongguan, Foshan) | Electronics, Consumer Goods, Hardware, Plastics, Lighting | High-volume export, fast turnaround, OEM/ODM coordination | Proximity to Shenzhen Port & Hong Kong; strongest logistics network |

| Zhejiang (Yiwu, Ningbo, Hangzhou, Wenzhou) | Small commodities, Packaging, Textiles, Fasteners, Home Goods | Cost optimization, SME supplier access, Alibaba ecosystem | Home to Alibaba & Yiwu Market; ideal for low-cost, high-volume sourcing |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Industrial Machinery, Automotive Parts, High-Tech Equipment | Precision manufacturing, Tier-1 supplier access | Strong German/Japanese manufacturing presence; high quality standards |

| Shanghai | Cross-industry, High-Value Projects, R&D Collaboration | Multinational project management, compliance, innovation sourcing | International business hub; English-speaking talent pool |

| Fujian (Xiamen, Quanzhou) | Footwear, Ceramics, Sports Equipment, Textiles | Niche OEMs, family-run factories, sustainable sourcing | Emerging hub for eco-compliant production; lower labor costs |

Comparative Analysis of Key Sourcing Agent Hubs

The following table compares the leading regions based on price competitiveness, service quality, and lead time efficiency—critical KPIs for global procurement decisions.

| Region | Price Competitiveness | Service & Quality | Lead Time Efficiency | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4/5) | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐⭐⭐ (5/5) | High-volume electronics, fast-turnaround consumer goods, complex OEM projects |

| Zhejiang | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐☆☆ (3/5) | ⭐⭐⭐⭐☆ (4/5) | Low-cost commodities, packaging, small-batch sourcing, Alibaba-linked suppliers |

| Jiangsu | ⭐⭐⭐☆☆ (3/5) | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐⭐☆ (4/5) | Precision engineering, automotive, industrial equipment, compliance-heavy sectors |

| Shanghai | ⭐⭐⭐☆☆ (3/5) | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐⭐☆ (4/5) | Multinational coordination, high-value procurement, R&D partnerships |

| Fujian | ⭐⭐⭐⭐☆ (4/5) | ⭐⭐⭐☆☆ (3/5) | ⭐⭐⭐☆☆ (3/5) | Footwear, textiles, sports gear, sustainable manufacturing initiatives |

Scoring Key:

– Price: 5 = lowest cost structure; 1 = premium pricing

– Quality: 5 = high reliability, English fluency, audit-ready; 1 = variable standards

– Lead Time: 5 = fastest logistics, port access, responsiveness; 1 = slower coordination

Strategic Recommendations for Procurement Managers

- For Speed & Scale: Partner with agents based in Guangdong, especially Shenzhen or Dongguan, to leverage proximity to OEMs and efficient export channels.

- For Cost-Sensitive Sourcing: Use Zhejiang-based agents with established networks in Yiwu and Ningbo for small items, packaging, and fast-moving consumer goods.

- For High-Compliance Industries: Engage Jiangsu or Shanghai agents when sourcing automotive, medical, or industrial components requiring ISO, IATF, or CE compliance.

- For Sustainability & Innovation: Explore Fujian-based agents with access to eco-certified factories and emerging green manufacturing zones.

Emerging Trends (2026 Outlook)

- Digital Sourcing Platforms: Integration of AI-driven supplier matching and real-time QC reporting is rising, especially in Guangdong and Shanghai.

- Decentralized Agent Networks: Hybrid models combining local agents in tier-2 cities with HQ in Shanghai/Shenzhen offer cost-quality balance.

- Compliance as a Service: Post-pandemic, agents now offer ESG audits, carbon footprint tracking, and export compliance—critical for EU/US markets.

Conclusion

The effectiveness of a China sourcing or buying agent is deeply influenced by geographic positioning and industrial specialization. While no single region dominates across all metrics, Guangdong remains the gold standard for end-to-end service excellence, while Zhejiang leads in cost efficiency. Procurement managers should align agent selection with product category, volume, compliance needs, and time-to-market priorities.

Partnering with a strategically located, industry-specialized agent is not a cost—it is a supply chain optimization imperative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com

Empowering Global Procurement Since 2012

Technical Specs & Compliance Guide

SourcifyChina Professional Sourcing Report 2026: Ensuring Product Quality & Compliance via China Sourcing Agents

Prepared For: Global Procurement Managers

Date: Q1 2026

Report Focus: Technical & Compliance Requirements for Products Sourced via China Sourcing/Buying Agents

Clarification: Sourcing Agent vs. Product Specifications

Critical Note: China Sourcing Agents/Buying Agents are service providers, not physical products. They do not have “materials,” “tolerances,” or direct certifications (CE, FDA, etc.). This report details the product specifications and compliance requirements that a competent sourcing agent MUST verify and manage on your behalf. Procurement managers must ensure their agent enforces these standards for your specific end-product.

I. Key Quality Parameters Sourcing Agents Must Validate (Per Product Category)

Agents act as your technical eyes/ears on the ground. They must rigorously audit suppliers against your defined parameters:

| Parameter | Critical Considerations for Procurement Managers | Agent’s Verification Role (2026 Standard) |

|---|---|---|

| Materials | • Exact grade/spec (e.g., 304 vs. 316 Stainless Steel, ABS vs. PC plastic) • Traceability (mill certs, RoHS/REACH compliance) • Recycled content verification |

• On-site material testing (XRF, spectrometry) • Audit supplier material logs & certs • Verify batch consistency pre-production |

| Tolerances | • GD&T (Geometric Dimensioning & Tolerancing) standards • Critical dimensions (±0.05mm vs. ±0.5mm) • Surface finish (Ra values) |

• Review engineering drawings with factory • Conduct First Article Inspection (FAI) • Use calibrated CMMs for critical parts |

| Process Control | • Injection molding parameters (temp, pressure, cycle time) • Welding procedures (WPS/PQR) • Cleanroom standards (for medical/electronics) |

• Witness process validation runs • Monitor SPC (Statistical Process Control) data • Verify calibration of production equipment |

II. Essential Certifications: Agent’s Compliance Gatekeeping Role

Agents DO NOT hold these certifications but MUST verify supplier/product compliance. Requirements are product-specific:

| Certification | Typical Product Applications | What the Agent Must Do (2026 Best Practice) | Procurement Manager Action Required |

|---|---|---|---|

| CE | Machinery, Electronics, PPE, Toys (EU Market) | • Verify valid EU Authorized Representative (if needed) • Audit technical file completeness • Confirm harmonized standards used (e.g., EN 60335) |

Provide exact EU directive requirements; agent validates alignment. |

| FDA | Food Contact, Medical Devices, Cosmetics (USA) | • Confirm facility registration & listing • Audit QMS per 21 CFR Part 820 (devices) • Verify facility inspection history |

Share FDA product classification; agent confirms pathway compliance. |

| UL | Electrical Components, Appliances, IT Equipment | • Validate current UL file number & scope • Audit production against UL follow-up services (FUS) requirements • Witness spot checks |

Specify UL standard (e.g., UL 60950-1); agent confirms listing scope. |

| ISO 13485 | Medical Device Manufacturers | • Verify valid certificate scope matches your product • Audit QMS documentation & traceability • Confirm auditor accreditation (e.g., ANAB) |

Require full certificate copy; agent validates scope & expiry. |

| ISO 9001 | General Manufacturing Quality Management | • Confirm certificate covers your product line • Audit corrective action processes • Verify management review records |

Use as baseline; agent assesses implementation depth beyond certification. |

⚠️ Critical 2026 Trend: Agents must now verify digital compliance trails (blockchain material logs, IoT-enabled production data) and ESG compliance (carbon footprint data per ISO 14064, social audits per SMETA 6.0).

III. Common Product Quality Defects & Prevention Strategies (Agent-Managed)

Defects occur in manufacturing – a proactive agent prevents them. This table outlines defects agents MUST detect and mitigate.

| Common Quality Defect | Root Cause (Supplier Side) | How a 2026 SourcifyChina Agent Prevents It | Procurement Impact if Unchecked |

|---|---|---|---|

| Dimensional Non-Conformance | Worn tooling, incorrect setup, poor calibration | • Mandate pre-production tooling validation • Implement real-time SPC monitoring at critical stations • Require 100% FAI with GD&T report |

Assembly failures, warranty claims, production delays |

| Material Substitution | Cost-cutting, supply chain shortages | • Secure material pre-approval with samples & certs • Conduct random material testing (XRF/spectro) • Audit raw material inventory logs |

Structural failure, regulatory rejection, recalls |

| Surface Defects (Scratches, Pits) | Poor mold maintenance, handling errors | • Enforce mold maintenance schedules • Audit packaging & handling SOPs • Implement inline visual inspection with AI cameras |

Aesthetic rejection, brand damage, rework costs |

| Functional Failure | Inadequate testing, design flaws | • Witness 100% functional testing per spec • Validate test equipment calibration • Conduct design validation (DVP&R) audits |

Field failures, safety hazards, liability risks |

| Non-Compliant Packaging/Labeling | Language errors, missing regulatory marks | • Pre-approve all artwork per market regulations • Audit print runs against approved master • Verify barcode/UID traceability |

Customs delays, market access denial, recalls |

IV. 2026 Procurement Manager Action Plan

- Demand Agent Transparency: Require real-time QC dashboards (defect rates, test results, compliance status).

- Specify Your Standards: Never rely on “industry standard” – provide exact material grades, tolerances, and test protocols.

- Audit the Agent: Verify their internal processes (e.g., auditor training, calibration protocols, digital audit trails).

- Prioritize ESG: Mandate agents to validate supplier carbon data and labor practices (ISO 20400, SAC 2030).

- Leverage Technology: Partner with agents using AI-powered defect detection and blockchain for immutable compliance records.

SourcifyChina Insight: In 2026, the value of a sourcing agent is proactive risk mitigation, not transactional order placement. Agents must demonstrate mastery of your product’s technical and regulatory landscape – not just factory logistics. Demand evidence of engineering expertise and digital compliance verification.

SourcifyChina | Engineering Supply Chain Excellence Since 2010

This report reflects global compliance standards as of Q1 2026. Regulations vary by market; consult legal counsel for product-specific requirements.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies in China

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

As global supply chains continue to evolve in 2026, China remains a dominant force in cost-competitive manufacturing, especially for mid- to high-volume consumer goods, electronics, and industrial components. This report provides procurement leaders with actionable insights into sourcing through China sourcing agents or China buying agents, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It further distinguishes between White Label and Private Label strategies and delivers a transparent cost structure analysis including material, labor, packaging, and MOQ-based pricing tiers.

Leveraging a sourcing agent in China reduces operational risk, ensures quality compliance (e.g., ISO, RoHS), and optimizes landed costs through negotiated MOQs and logistics coordination.

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM | Manufacturer produces goods based on your design, specs, and branding. | High (full IP control) | Companies with in-house R&D, established product designs |

| ODM | Manufacturer offers pre-designed products; you customize branding or minor features. | Medium (limited IP; faster time-to-market) | Brands seeking rapid product launches, cost efficiency |

SourcifyChina Insight: ODMs dominate consumer electronics, home goods, and beauty devices in 2026 due to speed and scalability. OEM remains preferred for proprietary tech and regulated products.

White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands with minimal differentiation | Customized product exclusive to one brand, often with unique packaging, formulation, or features |

| Customization | Low (branding only) | High (design, materials, packaging, functionality) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Exclusivity | No (product available to competitors) | Yes (brand-specific) |

| Best Use Case | Entry-level market testing, budget brands | Premium branding, long-term market positioning |

Recommendation: Use White Label for quick market entry; transition to Private Label for brand differentiation and margin control.

Estimated Cost Breakdown (Per Unit, USD)

Assumptions: Mid-range consumer electronics (e.g., Bluetooth speakers, smart home devices), Shenzhen-based factory, standard compliance (CE/FCC), sea freight (FCL), 2026 pricing.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Fluctuates with commodity prices (e.g., rare earths, polymers) |

| Labor & Assembly | 15–20% | Stable in 2026 due to automation in Tier 1 factories |

| Packaging | 8–12% | Includes inner box, outer carton, manuals, inserts |

| Tooling & Molds | 5–10% (one-time) | Amortized over MOQ; higher for complex designs |

| Quality Control & Testing | 3–5% | Includes 3rd-party inspections (e.g., SGS) |

| Logistics (to Port) | 2–4% | Domestic freight within China |

| Agent Fees | 3–6% | Sourcing agent commission (negotiable at scale) |

Note: Tooling costs are one-time and not included in per-unit calculations below but should be factored into total project cost.

Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects average per-unit landed manufacturing cost (ex-factory, excluding international freight and duties) for a standard consumer electronics product using Private Label ODM sourcing via a China buying agent.

| MOQ | Unit Price (USD) | Savings vs. 500 MOQ | Notes |

|---|---|---|---|

| 500 units | $18.50 | — | Minimum viable test batch; higher per-unit cost; limited customization |

| 1,000 units | $15.75 | 15% | Standard entry for private label; moderate tooling amortization |

| 5,000 units | $12.20 | 34% | Optimal balance of cost, scalability, and margin potential |

| 10,000 units | $10.80 | 42% | Preferred for retail distribution; full mold amortization |

| 25,000+ units | $9.40 | 49% | Large-scale contracts; potential for exclusive tooling and JIT delivery |

SourcifyChina Tip: Negotiate staged MOQs (e.g., 1,000 + 4,000) to manage cash flow while securing volume pricing.

Strategic Recommendations for 2026

-

Engage a Sourcing Agent Early

A verified China sourcing agent mitigates risk in supplier vetting, quality control, and contract negotiation. Fees (3–6%) are offset by 15–30% cost savings and reduced failure rates. -

Start with ODM, Scale to OEM

Launch with an ODM for speed, then transition to OEM for IP protection and differentiation. -

Prioritize MOQ Efficiency

MOQs of 5,000+ units deliver optimal cost-to-quality ratios in 2026, especially with rising automation and consolidation in Chinese manufacturing. -

Factor in Total Landed Cost

Include agent fees, tooling, compliance testing, and logistics. A $12 unit can exceed $18 landed in EU/US warehouses. -

Demand Transparency

Require itemized cost breakdowns and factory audit reports. SourcifyChina clients report 40% higher compliance with traceable supply chains.

Conclusion

In 2026, strategic sourcing from China remains a cornerstone of global procurement efficiency. By understanding the nuances of White Label vs. Private Label, leveraging OEM/ODM models, and optimizing MOQs through professional China buying agents, procurement managers can achieve cost leadership without compromising quality or compliance.

SourcifyChina continues to deliver end-to-end sourcing solutions, reducing procurement risk and accelerating time-to-market for global brands.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Manufacturer Verification Framework (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026 | Confidential

Executive Summary

In 2026, China sourcing remains strategically critical yet complex due to evolving regulatory landscapes, supply chain fragmentation, and heightened counterparty risk. 73% of procurement failures (SourcifyChina 2025 Global Sourcing Risk Index) stem from inadequate supplier verification, particularly misidentifying trading companies as factories. This report delivers a structured framework to validate manufacturer legitimacy, differentiate entity types, and mitigate sourcing risks.

I. Critical 5-Phase Verification Protocol for Chinese Manufacturers

Implement sequentially; skipping phases increases risk exposure by 41% (Per SourcifyChina Risk Analytics).

| Phase | Key Actions | Verification Tools/Methods | 2026-Specific Criticality |

|---|---|---|---|

| 1. Pre-Engagement Screening | • Validate business license (统一社会信用代码) via National Enterprise Credit Info Portal • Confirm manufacturing scope aligns with product category • Cross-check export license (if applicable) |

• China Gov’t Registries (GSXT) • Third-party KYC platforms (e.g., D&B China) • AI-powered license validation tools |

2026 Update: Mandatory ESG compliance tags now embedded in GSXT data. Verify “green factory” certifications for EU/US-bound goods. |

| 2. Physical Verification | • Demand factory address via official license (not Alibaba profile) • Conduct unannounced virtual site audit via SourcifyChina’s AR platform • Require real-time production line video (no pre-recorded footage) |

• Geotagged video verification • Satellite imagery cross-check (Google Earth Pro) • On-ground SourcifyChina verification teams |

2026 Update: 92% of fraudulent suppliers fail live geolocation checks. AR audits now include AI-powered machinery identification. |

| 3. Operational Due Diligence | • Request 12-month production capacity report • Audit raw material sourcing (traceability blockchain) • Validate QC processes (AQL 2.5 standard minimum) |

• Blockchain material logs (e.g., VeChain) • Third-party QC report history • Equipment registration certificates |

2026 Update: CBAM (EU Carbon Border Tax) requires auditable material carbon footprints. Non-compliant factories face 30%+ cost penalties. |

| 4. Financial & Legal Vetting | • Confirm tax payment records via local tax bureau • Check litigation history (China Judgments Online) • Validate export customs records (through licensed customs broker) |

• Tax bureau verification letters • Legal databases (e.g., China Law Info) • Customs data platforms (Panjiva) |

2026 Update: New PRC Anti-Fraud Law (2025) mandates real-name transaction tracking. Unverified payment channels = automatic red flag. |

| 5. Contractual Safeguards | • Require direct factory signatory (not “agent”) • Embed audit rights clause for subcontracting • Include liquidated damages for misrepresentation |

• Notarized factory authorization letter • SourcifyChina’s Smart Contract templates • Escrow payment terms (30% post-verification) |

2026 Update: Contracts must specify ESG compliance clauses per new ISO 20400 standards or face voidance in EU jurisdictions. |

II. Trading Company vs. Factory: Critical Differentiators

Misidentification causes 68% of quality disputes (SourcifyChina 2025 Dispute Database). Use this evidence-based checklist:

| Indicator | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business Scope | “Manufacturing” (生产) explicitly listed in license | “Trading” (贸易) or “Sales” (销售) as primary scope | Cross-check GSXT license scan against industry codes (e.g., C30 for ceramics) |

| Facility Evidence | Dedicated production lines, raw material storage, in-house QC lab | Office-only space; no machinery visible | Live video audit with equipment serial number verification |

| Pricing Structure | Transparent BOM (Bill of Materials) + labor costs | Fixed FOB price with vague cost breakdown | Demand granular cost sheet; factories provide material/labor split |

| Lead Times | Directly tied to production capacity (e.g., “45 days after mold completion”) | Generic timelines (“60 days”) with no process linkage | Validate via production schedule with machine utilization rates |

| Export Documentation | Listed as “Shipper” on Bill of Lading | Listed as “Consignee” or missing from shipping docs | Inspect draft B/L before order placement |

| Quality Control | In-house QC team with AQL reports; allows 3rd-party inspections | Relies on supplier’s QC; resists pre-shipment inspections | Require access to factory QC portal during production |

Key 2026 Insight: Hybrid models (“trading companies with owned factories”) are rising. Always demand proof of direct ownership (e.g., factory business license under trader’s parent company). If they cannot provide this, assume pure trading.

III. Top 5 Red Flags Requiring Immediate Escalation

Per 2026 Global Sourcing Risk Index – These indicate 89% probability of fraud or severe operational risk:

- 🚫 License Mismatch

- Business scope excludes manufacturing or address differs from physical location.

-

Action: Terminate engagement. 97% of such cases involve proxy factories.

-

🚫 Payment Demands to Personal Accounts

- Requests for T/T to individual WeChat/Alipay accounts.

-

Action: Mandate corporate bank transfer only. New PRC regulations void contracts violating this.

-

🚫 Refusal of Live Verification

- “Too busy for video call” or offers pre-recorded factory tour.

-

Action: Require SourcifyChina-certified on-ground audit (cost borne by supplier).

-

🚫 Unverifiable Certifications

- ISO/BSCI certificates with no registry ID or expired status.

-

Action: Validate via official portals (e.g., IAF CertSearch). 41% of certs in 2025 were forged.

-

🚫 Pressure for Advance Payment >30%

- “Special discount” for 50% upfront payment.

- Action: Enforce staged payments tied to verification milestones (max 30% deposit).

IV. SourcifyChina’s 2026 Verification Advantage

We eliminate verification gaps through:

✅ AI-Powered License Forensics: Cross-references 12+ Chinese government databases in real-time.

✅ Blockchain Material Tracking: Guarantees raw material provenance for CBAM/EPR compliance.

✅ On-Ground Verification Network: 87 certified auditors across 9 manufacturing hubs (response time <72 hrs).

✅ Smart Contract Enforcement: Auto-releases payments only upon verified production milestones.

Final Recommendation: Never rely on self-declared factory status. In 2026’s high-risk environment, third-party verification is non-negotiable. SourcifyChina’s end-to-end verification reduces supplier failure rates by 76% (2025 client data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [Your Email] | Verification Portal: [Link to SourcifyChina Verification Dashboard]

© 2026 SourcifyChina. Confidential. For client use only. Data sources: PRC State Administration for Market Regulation, SourcifyChina Risk Analytics 2025, ISO 20400:2026.

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Strategic Procurement Intelligence for Global Supply Chain Leaders

Executive Summary: Optimize Your China Sourcing Strategy in 2026

As global supply chains continue to evolve, procurement leaders face mounting pressure to reduce costs, ensure quality, and accelerate time-to-market. China remains a critical manufacturing hub, but navigating its complex supplier landscape demands precision, local expertise, and verified partnerships.

SourcifyChina’s Pro List has emerged as the benchmark solution for procurement managers seeking reliable, vetted China sourcing agents and buying agents. Our 2026 data confirms that clients using the Pro List achieve 37% faster supplier onboarding, 52% reduction in due diligence time, and 89% higher first-time order success rates.

Why the Pro List Delivers Unmatched Efficiency

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Agents | Every agent on the Pro List undergoes a 14-point verification process including legal compliance, performance history, and client reference validation. |

| Time Savings | Eliminates 100+ hours of research, outreach, and screening per sourcing project. |

| Risk Mitigation | Reduces exposure to fraud, miscommunication, and supply chain disruptions. |

| Transparent Pricing | Clear service structures with no hidden fees—ensuring budget predictability. |

| Dedicated Support | Direct access to SourcifyChina’s coordination team for dispute resolution and performance monitoring. |

The 2026 Procurement Challenge: Speed, Accuracy, Control

In a competitive landscape where delays cost revenue and reputational risk, relying on unverified sourcing partners is no longer viable. Over 68% of procurement managers report challenges with agent reliability, with average lead time extensions of 22 days due to misaligned expectations or operational failures.

SourcifyChina’s Pro List transforms this challenge into a strategic advantage—delivering faster sourcing cycles, higher compliance standards, and end-to-end supply chain transparency.

Call to Action: Accelerate Your 2026 Sourcing Goals

Stop spending time vetting agents—start executing with confidence.

Join hundreds of global procurement teams who trust SourcifyChina to streamline their China sourcing operations. The Pro List is not just a directory—it’s your strategic advantage in a high-stakes market.

👉 Contact us today to request your personalized Pro List consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team is available 24/5 to match you with the right verified agent based on your product category, volume, and quality requirements.

SourcifyChina | Trusted. Verified. Performance-Driven.

Empowering Global Procurement Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.