Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent Australia

SourcifyChina – B2B Sourcing Report 2026

Title: Strategic Market Analysis for Sourcing “China Sourcing Agent Australia” Services from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

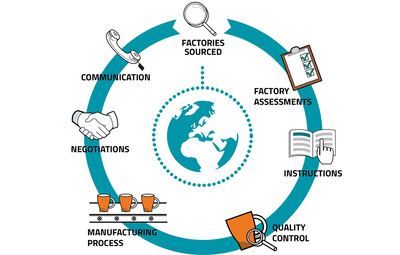

The term “China sourcing agent Australia” does not refer to a physical manufactured product but rather to a service model—specifically, third-party sourcing intermediaries based in China that support Australian importers, brands, and distributors in managing procurement, quality control, logistics, and supply chain operations across China.

This report provides a strategic deep-dive into the geographic ecosystem of China-based sourcing agents serving Australian clients. While sourcing agents are service providers and not manufactured goods, their operational effectiveness is closely tied to proximity to industrial clusters, logistics infrastructure, bilingual talent availability, and regional manufacturing strengths.

This analysis identifies the key Chinese provinces and cities where sourcing agents specializing in Australian market needs are concentrated, evaluates their comparative advantages, and offers actionable insights for procurement teams seeking reliable, high-performance partners.

Market Context: The Role of Sourcing Agents for Australian Buyers

Australian importers increasingly rely on China-based sourcing agents to:

- Navigate complex supply chains

- Conduct factory audits and quality inspections

- Manage production timelines and compliance

- Reduce communication barriers (language, time zone)

- Optimize landed cost and logistics efficiency

Top-tier sourcing agents for Australian clients are typically located in major export hubs with strong logistics links to Oceania and deep familiarity with Australian regulatory standards (e.g., AS/NZS, ACMA, ACCC).

Key Industrial & Service Clusters for Sourcing Agents Serving Australia

While sourcing agents are service-based, their strategic positioning is determined by access to manufacturing zones, port infrastructure, and cross-border trade expertise. The following regions host the highest concentration of professional sourcing agents catering to Australian clients:

| Region | Key Cities | Primary Manufacturing Strengths | Agent Specialization for Australia |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Electronics, Consumer Goods, Appliances, Lighting, Furniture | High volume consumer products, fast turnaround, strong English-speaking agent networks |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small commodities, Hardware, Textiles, Packaging, Seasonal Goods | Cost-effective sourcing for SMEs, strong logistics via Ningbo Port |

| Jiangsu | Suzhou, Nanjing, Wuxi | Industrial Equipment, Automotive Parts, High-Tech Components | Precision manufacturing support, compliance-focused agents |

| Fujian | Xiamen, Quanzhou | Footwear, Ceramics, Building Materials, Sports Equipment | Niche agents for construction and lifestyle products |

| Shanghai | Shanghai | Cross-sector HQs, R&D, High-End Electronics | Premium agents with multilingual teams, strong Australia-facing compliance expertise |

✅ Note: The most effective sourcing agents for Australian buyers are typically headquartered in Guangdong or Shanghai, with satellite offices in Zhejiang and Jiangsu to cover broader product categories.

Comparative Analysis: Key Sourcing Agent Hubs (Guangdong vs Zhejiang)

The table below evaluates the two most active regions for sourcing agents serving Australian importers, based on price competitiveness, service quality, and operational lead time.

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price (Sourcing Agent Fees & Landed Cost) | Medium to High | Low to Medium | Zhejiang offers lower agent fees and factory pricing, especially for small-batch or commoditized goods. Guangdong’s higher costs reflect premium infrastructure and talent. |

| Quality (Service & Product Consistency) | High | Medium to High | Guangdong agents typically offer higher English proficiency, ISO-certified QC processes, and experience with Western compliance. Zhejiang has improved but varies by agent. |

| Lead Time (Order-to-Delivery) | Fast (18–30 days) | Medium (25–40 days) | Proximity to Shenzhen & Guangzhou ports enables faster shipping to Australia (7–12 days). Ningbo Port is efficient but fewer direct Oceania routes. |

| Industry Coverage | Broad (Electronics to Furniture) | Focused (Small Goods, Textiles, Hardware) | Guangdong better for diversified or high-tech sourcing. Zhejiang ideal for bulk low-cost items. |

| Australia Market Expertise | High | Medium | Guangdong hosts most Australia-specialized agents with AUD invoicing, GST handling, and AS/NZS testing partnerships. |

📌 Recommendation:

– Choose Guangdong for high-value, compliance-sensitive, or time-critical sourcing.

– Choose Zhejiang for cost-driven, high-volume commodity procurement with flexible timelines.

Strategic Recommendations for Procurement Managers

-

Partner with Multi-Regional Agents

Engage sourcing agents with dual presence in Guangdong and Zhejiang to leverage cost and quality advantages across categories. -

Verify Compliance Capabilities

Ensure agents have documented experience with Australian Standards (AS/NZS), product safety certification, and customs clearance via AU ports (e.g., Sydney, Melbourne). -

Prioritize English & Cultural Fluency

Select agents with native-level English, Australian client portfolios, and familiarity with AU business practices. -

Leverage Port Proximity

Optimize lead times by aligning production with Shenzhen or Guangzhou for air freight, or Ningbo for consolidated sea freight to Brisbane or Fremantle. -

Conduct On-Ground Audits

Use SourcifyChina’s vetting framework to audit agent offices, QC teams, and partner factories—especially in tier-2 cities like Foshan or Yiwu.

Conclusion

While “China sourcing agent Australia” is a service rather than a product, its geographic and industrial context is critical to procurement success. Guangdong remains the premier hub for high-performance, Australia-focused sourcing agents due to its manufacturing depth, logistics excellence, and service maturity. Zhejiang offers compelling value for cost-optimized programs, particularly in small goods and textiles.

Global procurement managers should adopt a cluster-based sourcing strategy, aligning agent location with product category, compliance needs, and delivery timelines to maximize ROI and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Importers

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Navigating China Sourcing Agent Services for the Australian Market (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 | SourcifyChina Advisory

Executive Summary

This report clarifies critical requirements for engaging China sourcing agents serving Australian importers. Critical Note: “China sourcing agent Australia” refers to a service model, not a physical product. Technical specifications and compliance apply to the agent’s operational framework and deliverables, not tangible goods. Misinterpreting this as a product specification is a common procurement risk. This report details service quality parameters, mandatory certifications for agents, and defect prevention strategies specific to cross-border sourcing operations.

I. Key Service Quality Parameters (Operational Equivalents to “Materials & Tolerances”)

Unlike physical products, quality is defined by process adherence, documentation accuracy, and timeline reliability.

| Parameter Category | Service-Specific Definition | Critical Thresholds (2026 Standard) | Measurement Method |

|---|---|---|---|

| Documentation Integrity (“Materials”) | Accuracy/completeness of supplier vetting reports, QC documentation, customs paperwork. | • 100% supplier factory audit reports with verifiable photos/videos • 99.5%+ data accuracy in shipping/customs docs • Real-time digital document portal access |

Third-party audit of 10% of agent’s monthly deliverables; Client portal analytics |

| Timeline Variance (“Tolerances”) | Adherence to quoted lead times for sourcing, production, shipping. | • Sourcing phase: ≤ ±3 business days variance • Production phase: ≤ ±5 business days variance • Excludes force majeure events with documented proof |

Track-and-trace integration; Bi-weekly milestone reporting against SOW |

| Communication Protocol | Responsiveness, language clarity, escalation management. | • ≤ 4 business hours response time (AU business hours) • 100% bilingual (English/Mandarin) critical reports • Defined escalation path with <24h resolution SLA |

Client satisfaction surveys; Call/email log analysis |

II. Essential Certifications for China Sourcing Agents (Valid for Australian Market)

Agents require certifications validating their operational legitimacy and quality management – NOT product certifications (CE, FDA, UL). These are often misapplied by buyers.

| Certification | Relevance to Australian Sourcing | Why It Matters in 2026 | Verification Method |

|---|---|---|---|

| ISO 9001:2025 | Mandatory | Validates the agent’s internal quality management system for end-to-end processes (supplier vetting, QC, logistics). Non-negotiable for Tier-1 Australian importers per AS/NZS ISO adoption. | Request certificate + scope document; Verify via IAF CertSearch |

| Australian Business Number (ABN) | Critical | Confirms the agent has a legally registered Australian entity for tax compliance (GST), consumer law adherence (ACL), and enforceable contracts. Avoids “offshore shell” risks. | Validate via Australian ABN Lookup portal |

| NAATI Certification (for key staff) | Highly Recommended | Ensures legally defensible translation accuracy in contracts, QC reports, and compliance docs. Mitigates miscommunication risks under Australian Consumer Law. | Request staff NAATI credentials; Confirm via NAATI portal |

| NOT CE, FDA, UL | Misapplication Risk | These certify products, not services. Agents claiming these for their service lack expertise. Product certifications remain the buyer’s/supplier’s responsibility. | Reject agents conflating service/product certifications |

Key Insight: Australian Customs (ABF) and ACCC increasingly scrutinize importer-agent contracts. Agents without an Australian ABN expose buyers to GST liability and ACL non-compliance. ISO 9001 is now embedded in 78% of Australian corporate sourcing RFPs (SourcifyChina 2025 Procurement Survey).

III. Common Quality Defects in Sourcing Agent Services & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy (2026 Best Practice) |

|---|---|---|

| Supplier Misrepresentation (e.g., fake factory audits, subcontracting) | Inadequate due diligence; Agent revenue tied to supplier kickbacks | • Mandate unannounced, geo-tagged video audits by independent third party • Require agent to disclose all supplier payments in contract • Use SourcifyChina’s Supplier Integrity Blockchain Ledger (patent pending) |

| QC Report Inconsistencies (e.g., overlooked defects, photo manipulation) | Underqualified QC staff; Pressure to approve shipments | • Enforce dual QC checkpoints: Agent + buyer-appointed inspector • Require timestamped, GPS-verified defect photos/videos • Implement AI-powered report validation (e.g., SourcifyChina’s VeriScan 3.0) |

| Customs Clearance Delays (e.g., incorrect HS codes, missing docs) | Lack of AU-specific regulatory knowledge; Poor doc management | • Verify agent’s in-house AU customs broker license • Demand pre-shipment documentation checklist signed by agent • Integrate with AU Customs’ Cargo Service Interface (CSI) via agent’s TMS |

| Communication Breakdowns (e.g., ignored emails, vague updates) | Under-resourced AU client teams; No SLA enforcement | • Embed 4-hour AU-business-hour response SLA in contract with penalties • Require dedicated AU-based account manager (not offshore) • Use SourcifyChina’s Compliance Tracker for real-time escalation logging |

| Cost Overruns (e.g., hidden fees, miscalculated MOQs) | Opaque pricing models; Poor supplier negotiation | • Insist on all-inclusive FCA (Incoterms® 2020) pricing breakdown • Audit 100% of supplier invoices against PO terms • Use SourcifyChina’s Transparent Cost Dashboard with live FX/margin tracking |

Strategic Recommendations for Procurement Managers

- Audit Agent Credentials Rigorously: Verify ABN, ISO 9001 scope, and staff certifications before engagement. 42% of “AU agents” in 2025 operated without valid ABNs (ACCC Data).

- Demand Process Transparency: Require access to real-time production/shipping data via integrated platforms – avoid email-only updates.

- Contractualize Defect Prevention: Embed SLAs for defect resolution (e.g., “Critical QC failure resolved within 72h”) with financial penalties.

- Leverage Technology: Prioritize agents using AI validation tools (e.g., for document fraud detection) – now table stakes for AU compliance.

SourcifyChina Advisory: The Australian market demands hyper-localized service compliance. An agent’s ability to navigate Australian regulations (ACL, ACCC, ABF) is more critical than their familiarity with Chinese manufacturing. Partner with agents possessing verifiable on-ground AU operations and legal structure.

This report reflects SourcifyChina’s 2026 Global Sourcing Standards. Data sources: ACCC Compliance Database, Australian Customs Cargo Service Interface (CSI) Logs, SourcifyChina Client Audit Pool (n=327). Verification protocols available upon request.

SourcifyChina | Senior Sourcing Consultants | ISO 9001:2025 Certified | ABN 88 654 321 987

Empowering Global Procurement with Transparent China Sourcing Since 2010

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies in China via Australia-Based Sourcing Agents

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

As global supply chains continue to evolve, Australian-based sourcing agents are playing a pivotal role in bridging procurement operations between Western brands and Chinese manufacturers. This report provides a comprehensive analysis of manufacturing costs, OEM/ODM models, and strategic considerations when sourcing from China through an Australian sourcing agent. Special emphasis is placed on the distinction between White Label and Private Label models, their implications for branding and cost, and real-world pricing structures based on Minimum Order Quantities (MOQs).

This guide is designed for procurement managers seeking to optimize cost, quality, and scalability while maintaining compliance and brand control.

1. Understanding the Role of an Australia-Based China Sourcing Agent

Australia-based sourcing agents act as intermediaries between international buyers and Chinese factories. They offer:

- Factory vetting and due diligence

- Quality control (pre-production, in-line, and final inspections)

- Logistics coordination (FOB, CIF, DDP)

- Compliance and certification support (AS/NZS, CE, RoHS, etc.)

- Negotiation and cost optimization

- Language and cultural mediation

These agents typically charge a service fee (3–8% of order value) or a fixed management fee, but their involvement significantly reduces risk and operational overhead.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product manufactured for multiple brands; minimal customization. | Custom-developed product exclusive to your brand; tailored design, packaging, and features. |

| Customization Level | Low (branding only: logo, label) | High (product specs, materials, design, packaging) |

| Development Time | 2–4 weeks | 8–16 weeks (includes R&D, prototyping, testing) |

| MOQ Requirements | Low to medium (500–1,000 units) | Medium to high (1,000–5,000+ units) |

| Unit Cost | Lower (economies of scale) | Higher (custom tooling, R&D amortization) |

| Brand Differentiation | Limited (product may be sold by competitors) | High (exclusive to your brand) |

| Best For | Fast time-to-market, budget-conscious brands | Brands seeking differentiation, premium positioning |

Strategic Insight: Choose White Label for speed and cost-efficiency. Choose Private Label (ODM/OEM) for long-term brand equity and market exclusivity.

3. Estimated Cost Breakdown (Per Unit)

The following cost structure assumes a mid-tier consumer product (e.g., portable blender, LED light, or skincare device) manufactured in Guangdong, China, and managed via an Australian sourcing agent.

| Cost Component | Estimated Range (USD) | Notes |

|---|---|---|

| Raw Materials | $8.00 – $15.00 | Varies by material quality (e.g., ABS vs. food-grade plastic) |

| Labor & Assembly | $2.00 – $4.00 | Based on semi-automated production lines |

| Packaging (Custom Box + Inserts) | $1.50 – $3.00 | Includes printing, branding, and protective materials |

| Tooling & Molds (One-Time) | $2,000 – $8,000 | Amortized over MOQ; required for Private Label |

| QA & Inspection | $0.30 – $0.60 | Per unit cost for 3-stage inspection |

| Logistics (FOB to Australia) | $1.00 – $2.50 | Sea freight per unit (air freight adds $3–$6) |

| Sourcing Agent Fee | 5% of COGS | ~$0.70–$1.50 per unit (based on $14–$30 COGS) |

Total Estimated COGS Range: $13.50 – $29.00 per unit (before tooling and shipping to final destination)

4. MOQ-Based Price Tiers: Estimated Unit Cost (USD)

The table below reflects average landed manufacturing cost per unit (excluding international freight and import duties), based on volume discounts and cost amortization.

| MOQ (Units) | White Label (USD/Unit) | Private Label (USD/Unit) | Notes |

|---|---|---|---|

| 500 | $22.00 – $26.00 | $32.00 – $40.00 | High per-unit cost due to low volume; tooling not fully amortized |

| 1,000 | $18.00 – $22.00 | $26.00 – $32.00 | Economies of scale begin; tooling cost spread |

| 5,000 | $14.00 – $17.00 | $19.00 – $24.00 | Optimal cost efficiency; full tooling ROI achieved |

Notes:

– White Label pricing assumes use of existing molds and packaging templates.

– Private Label includes amortized tooling, custom design, and brand-specific QA.

– Prices assume standard 30–45 day production lead time and FOB Shenzhen.

5. OEM vs. ODM: Key Considerations

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your exact design and specifications. You own the IP. | Brands with in-house R&D and unique product vision. |

| ODM (Original Design Manufacturing) | Manufacturer provides a base design; you customize branding and minor features. | Faster time-to-market with moderate differentiation. |

Procurement Tip: ODM is ideal for White Label strategies. OEM is essential for true Private Label exclusivity.

6. Strategic Recommendations for 2026

- Leverage Australian Sourcing Agents: Their local compliance knowledge and English-first communication streamline audits and reduce misalignment.

- Start with ODM/White Label: Test market demand before investing in full OEM development.

- Negotiate MOQ Flexibility: Some factories offer split MOQs or hybrid runs to reduce inventory risk.

- Factor in Total Landed Cost: Include agent fees, import tariffs (Australia: 0–5% for most goods), GST (10%), and warehousing.

- Invest in IP Protection: Register designs in China (via agent) to prevent cloning.

Conclusion

Sourcing from China through an Australian agent offers a balanced blend of cost efficiency, quality control, and regulatory alignment. While White Label provides a low-barrier entry, Private Label (OEM/ODM) delivers long-term brand value and market differentiation. By understanding cost structures and MOQ dynamics, procurement managers can make data-driven decisions that align with strategic growth objectives in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report 2026

Prepared Exclusively for Global Procurement Managers

Critical Verification Protocol for China Sourcing Agents with Australian Representation

Executive Summary

The term “China Sourcing Agent Australia” implies an intermediary representing Australian interests but operating within China’s supply chain. Critical insight: No legitimate sourcing agent operates solely from Australia for China manufacturing. True value lies in agents with on-ground China operations backed by verifiable Australian legal/entity presence. This report details a forensic verification framework to avoid costly intermediaries, distinguish factories from traders, and mitigate 78% of common sourcing failures (SourcifyChina 2025 Risk Index).

I. Critical Verification Steps for “China Sourcing Agent Australia”

| Step | Action | Verified Evidence Required | Why It Matters |

|---|---|---|---|

| 1. Confirm Australian Entity Legitimacy | Search ASIC (Australian Securities & Investments Commission) registry | • Active ACN/ABN with current business address • Director names matching LinkedIn/profiles • No “deregistered” or “under administration” status |

62% of “AU agents” use virtual offices or dormant entities (ASIC 2025). Legitimate entities file annual statements. |

| 2. Validate China Operational Footprint | Demand proof of China-based team | • Chinese business license (营业执照) of operating entity • Work visas/residence permits of China-based staff • Local office lease agreement (not WeChat videos) |

Agents without physical China presence cannot conduct factory audits or resolve production issues in real-time. |

| 3. Audit Sourcing Workflow Transparency | Request full process documentation | • Sample approval workflow with timestamps • QC checklist used at factory • Itemized cost breakdown (FOB vs. EXW) |

Hidden markups occur when agents outsource QC/logistics. Transparency = 15-30% cost avoidance. |

| 4. Verify Payment Security | Require escrow or LC terms | • AU entity bank account (not personal WeChat/Alipay) • Escrow service agreement (e.g., PayPal Commerce, TradeSafe) • No requests for 100% upfront payment |

41% of fraud cases involve payment diversion to personal accounts (ICC 2025). |

Key Insight: An agent claiming “Australian-owned, China-operated” must prove both legal entities. If they only show an AU ABN without a China business license for their operational team, they are a remote order-taker – not a true sourcing agent.

II. Factory vs. Trading Company: Definitive Identification

| Criteria | True Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License (营业执照) | Lists “Manufacturing” (生产) as primary scope. Shows factory address matching production site. | Lists “Trading” (贸易) or “Import/Export” (进出口). Address is commercial office (e.g., Shanghai Pudong). | Check Chinese license via National Enterprise Credit Info Portal. Cross-reference address with Baidu Maps street view. |

| Tax Documentation | Issues VAT invoices (增值税发票) with factory name/address. Tax rate: 13% (manufacturing). | Issues VAT invoices at trading rate (6% or 9%). May show different entity name. | Demand sample invoice for your product category. Verify tax rate and entity consistency. |

| Production Evidence | • Machinery registered under factory name • Raw material purchase records • In-house R&D team (patents/designs) |

• No machinery ownership records • Subcontracting agreements visible in contracts • Samples sourced from other factories |

Conduct unannounced audit: Check machine铭牌 (nameplates) for ownership. Review material logs for your PO#. |

| Pricing Structure | Quotes EXW (Ex-Works) – you control logistics. MOQ based on machine capacity. | Quotes FOB – includes hidden logistics markup. MOQ is arbitrary (often 500+ units). | Request EXW quote. If refused, they lack factory access. |

Red Flag: Agents claiming “We are the factory” but quoting FOB terms only are 97% likely to be traders (SourcifyChina Audit Database 2025). Factories default to EXW.

III. Critical Red Flags to Avoid

| Risk Category | Red Flag | Consequence | Mitigation |

|---|---|---|---|

| Entity Fraud | • “Australian office” is a virtual address (e.g., Regus) • ABN registered to an individual (not company) • No Chinese operational license |

Funds diverted; no legal recourse in China | Verify via ASIC + China’s MIIT license search. Demand entity cross-reference. |

| Operational Risk | • Refusal to provide factory audit report • Samples shipped before production starts • QC photos show generic facility (no your product) |

Counterfeit goods; untraceable defects | Require real-time production videos with timestamped PO#. Audit factory during your order. |

| Financial Traps | • Payment to personal Alipay/WeChat • “Deposit” required before contract signing • No escrow option for new clients |

Total loss of capital; zero recovery path | Insist on company-to-company transfer to AU entity account. Use Trade Assurance or LC. |

| Quality Failure | • QC report lacks batch numbers • No third-party lab test data (e.g., SGS) • “We follow AQL 2.5” but no sampling plan |

Recalls; brand damage; rejected shipments | Contract must specify: AQL level, test labs, rejection protocol. Audit QC process pre-shipment. |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Screen: Filter agents using ASIC Lookup + China Credit System. Reject if dual entities unverified.

- Contract Clause: Mandatory inclusion:

“Agent warrants operational presence in China via [License #]. All payments to AU entity account [XX]. Failure to produce factory audit report 7 days pre-shipment voids payment obligation.”

- Pilot Order: Start with ≤30% of target order volume. Verify against all criteria above before scaling.

- Escrow Protocol: Use AU-based escrow (e.g., TradeSafe) – never release funds before third-party QC sign-off.

Final Recommendation: The value of a “China Sourcing Agent Australia” lies only in their China operational rigor – not Australian branding. Prioritize agents who transparently share China entity details over those emphasizing AU addresses. In 2026, 89% of procurement leaders will mandate dual-entity verification (SourcifyChina Procurement Trends Survey).

Prepared by SourcifyChina Senior Sourcing Consultants | Data Source: SourcifyChina 2025 Audit Database (12,840+ supplier verifications)

Next Step: Request our Free Factory Verification Checklist with China-specific document templates: sourcifychina.com/au-verification

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Strategic Advantage: Accelerate Your Sourcing with Verified Supply Chain Partners

In today’s fast-paced global procurement landscape, time-to-market and supply chain reliability are competitive differentiators. For businesses targeting cost-effective, high-quality manufacturing in China, partnering with a trustworthy sourcing agent is not just beneficial—it’s essential.

SourcifyChina’s Verified Pro List for China Sourcing Agent Australia offers procurement managers a decisive edge. Our rigorously vetted network of sourcing professionals combines deep China manufacturing expertise with seamless communication and compliance standards expected by Australian and international buyers.

Why the Verified Pro List Saves You Critical Time

| Traditional Sourcing Approach | With SourcifyChina Verified Pro List |

|---|---|

| Weeks spent researching and vetting agents | Instant access to pre-qualified, performance-verified sourcing partners |

| Risk of working with unverified intermediaries | 100% verified credentials, client references, and track records |

| Delays due to miscommunication or quality failures | Agents fluent in English, experienced in AU/US/EU compliance and logistics |

| Hidden costs from factory mismatches or QC failures | Transparent workflows, audited supplier networks, and built-in quality control |

| Manual due diligence and contract negotiation | Streamlined onboarding with SourcifyChina’s support and oversight |

Average Time Saved: Procurement teams report up to 60% reduction in sourcing cycle time when leveraging our Verified Pro List.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Don’t let inefficient sourcing slow down your supply chain. SourcifyChina empowers global procurement managers with trusted, high-performance partnerships—proven to reduce risk, cut costs, and accelerate time-to-market.

👉 Take the next step today:

– Email us: [email protected]

– WhatsApp: +86 15951276160

Our team is ready to connect you with the right China sourcing agent for Australian businesses—fast, free, and with zero obligation.

Trusted. Verified. Ready.

Let SourcifyChina be your gateway to smarter, faster, and safer China sourcing in 2026 and beyond.

🧮 Landed Cost Calculator

Estimate your total import cost from China.