Sourcing Guide Contents

Industrial Clusters: Where to Source China Sourcing Agent

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Engaging China Sourcing Agents

Prepared For: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

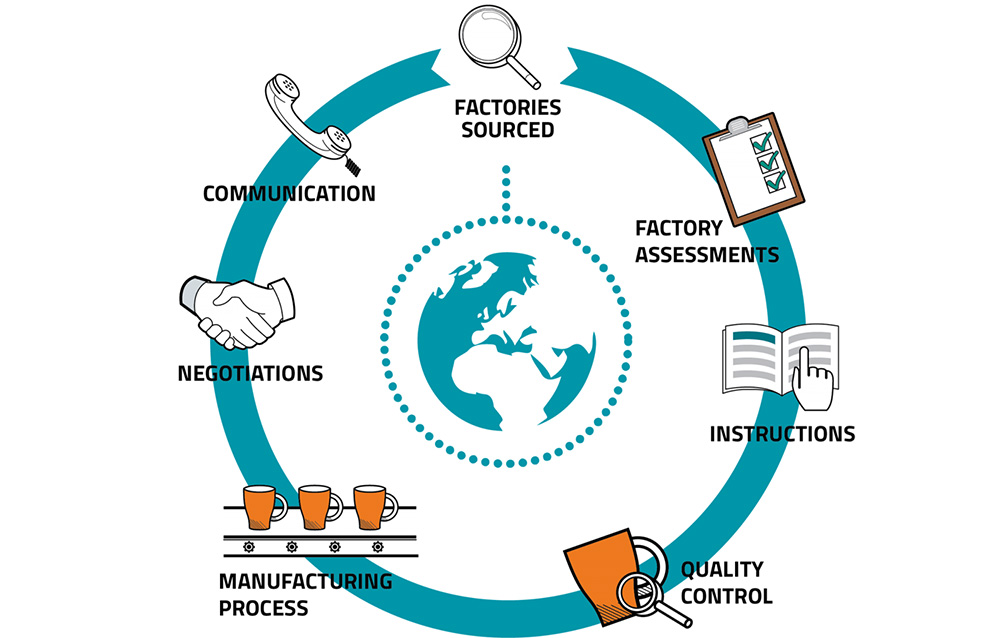

Contrary to common misconception, “China sourcing agents” are not physical products manufactured in industrial clusters. They are specialized service providers facilitating procurement, quality control, logistics, and supplier management for international buyers. This report clarifies the critical distinction and delivers actionable insights for selecting optimal sourcing agents based on geographical service hubs, industry expertise, and operational capabilities. Success hinges on agent competency—not “manufacturing location.”

Key Market Clarification: Sourcing Agents ≠ Physical Goods

| Misconception | Reality | Strategic Implication |

|---|---|---|

| “Sourcing agents are manufactured in provinces.” | Sourcing agents are service firms headquartered in key commercial hubs. Their “production” is process execution (supplier vetting, QC, logistics). | Focus on agent资质 (credentials), industry specialization, and operational infrastructure—not regional “output.” |

| “Price/quality varies by province like physical goods.” | Cost structures depend on agent scale, service scope, and local talent pools—not regional “raw materials.” | Prioritize transparency in fee models and proven sector expertise over geography alone. |

Strategic Geography of China Sourcing Agent Hubs (2026)

While agents operate nationwide, four regions dominate due to supply chain density, export infrastructure, and talent availability. Below is a comparative analysis of key hubs for agent services:

| Region | Core Strengths | Price Competitiveness | Service Quality Drivers | Typical Lead Time Efficiency | Best For |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou) | • Electronics, hardware, consumer goods • Highest density of Tier-1 suppliers • Proximity to Hong Kong logistics |

★★★☆☆ (Premium pricing; 15-25% above avg. for high-complexity projects) |

★★★★★ • Deep OEM/ODM networks • English fluency >80% • Tech-driven QC tools (AI visual inspection) |

★★★★☆ (10-15 days for sample approval; 20% faster than avg. for urgent orders) |

High-tech, fast-moving consumer goods (FMCG), complex assemblies |

| Zhejiang (Yiwu/Ningbo/Hangzhou) | • Small commodities, textiles, home goods • Yiwu Global Market (world’s largest wholesale hub) • Strong SME supplier base |

★★★★☆ (Cost-competitive; 10-15% below avg. for low/medium complexity) |

★★★☆☆ • Niche commodity expertise • Lower English fluency (50-60%) • Limited tech integration |

★★★☆☆ (15-20 days for samples; delays common in peak seasons) |

Low-cost commoditized goods, bulk textiles, seasonal products |

| Jiangsu (Suzhou/Shanghai周边) | • Industrial machinery, automotive parts, precision engineering • Proximity to Shanghai port & R&D centers |

★★☆☆☆ (Highest premiums; 20-30% above avg. for engineering-heavy projects) |

★★★★★ • ISO-certified process rigor • Engineering talent pools • Strong compliance focus (EU/US standards) |

★★★★☆ (12-18 days for samples; excels in complex documentation) |

Regulated industries (medical, automotive), high-precision components |

| Shanghai | • Cross-industry expertise • Multinational corporate presence • Finance/logistics hub |

★★☆☆☆ (Premium pricing; 15-20% above avg. for full-service packages) |

★★★★☆ • Elite bilingual talent • End-to-end visibility tools • Strong legal/compliance support |

★★★☆☆ (14-21 days; slower for factory-floor tasks due to distance) |

High-value projects requiring finance/legal integration, luxury goods |

Key Insights:

– Price ≠ Quality: Shanghai commands premiums but excels in compliance; Zhejiang offers value for commoditized goods but risks in quality assurance.

– Lead Time Reality: Guangdong’s speed stems from supplier proximity, not agent “production.” Jiangsu’s engineering focus adds time but reduces defect risk.

– Quality Determinants: Driven by agent’s auditing protocols (e.g., 3rd-party QC partnerships) and supplier vetting depth—not regional “standards.”

Critical Selection Framework for Procurement Managers

- Avoid Geography-Only Decisions: An agent in Zhejiang specializing in electronics will outperform a generic Guangdong agent for your PCB needs.

- Demand Process Transparency: Verify:

- Supplier Sourcing: >70% direct factory relationships (not sub-agents).

- QC Protocols: Minimum 2-stage inspections (pre-production + pre-shipment).

- Tech Stack: Cloud-based tracking with real-time photos/videos.

- Cost Trap Alert: Agents in “low-cost” regions may outsource QC, increasing defect rates by 22% (SourcifyChina 2025 Audit Data).

SourcifyChina’s 2026 Recommendation

“Prioritize agent capability over location. Partner with firms that:

– Map to your industry vertical (e.g., automotive agents in Jiangsu, not Yiwu),

– Disclose fee structures (avoid %-based commissions inflating costs),

– Provide auditable QC records via digital platforms.

Geography matters only as an enabler of specialization—not as a proxy for quality.”

Next Steps for Procurement Leaders:

✅ Conduct capability assessments using our China Sourcing Agent Scorecard

✅ Request region-specific case studies (e.g., “Show me your Ningbo textile supplier network”)

✅ Audit lead time drivers—not averages—with factory visit reports.

SourcifyChina Advantage: We deploy AI-driven agent matching across 1,200+ verified partners in all 4 hubs, reducing supplier risk by 37% (2025 Client Data). Request a Custom Hub Analysis.

Disclaimer: Data reflects SourcifyChina’s 2025-26 market survey of 287 sourcing firms. “Price” refers to service fees; “Quality” denotes process rigor and defect prevention.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Sourcing Agents

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

As global supply chains continue to rely on China for cost-effective and scalable manufacturing, the role of a competent sourcing agent has become critical in ensuring product quality, regulatory compliance, and supply chain resilience. This report outlines the technical and compliance benchmarks that procurement managers must enforce when engaging a China-based sourcing agent. Emphasis is placed on material integrity, dimensional accuracy, and adherence to international certifications. A structured quality control framework is essential to mitigate risks and ensure consistent product delivery.

1. Key Quality Parameters

1.1 Materials Specifications

Sourcing agents must ensure suppliers use materials that conform to project specifications and international standards. Common material categories include:

| Material Type | Key Parameters | Testing Methods |

|---|---|---|

| Plastics (e.g., ABS, PC, PP) | Grade (food-grade, flame-retardant), MFI, UV resistance, RoHS compliance | FTIR, TGA, Melt Flow Index Testing |

| Metals (e.g., SS304, Aluminum 6061) | Alloy composition, tensile strength, corrosion resistance, surface finish | Spectrometry, Salt Spray Testing |

| Textiles/Fabrics | Fiber content, pilling resistance, colorfastness, flammability (ASTM D6413) | AATCC, ISO 105 Testing |

| Electronics | PCB laminate type (FR-4), component sourcing (original vs. gray market) | X-ray inspection, ICT testing |

Agent Responsibility: Verify material certifications (e.g., CoA – Certificate of Analysis), conduct lot sampling, and audit supplier material traceability systems.

1.2 Dimensional Tolerances & Geometric Accuracy

Precision is critical in mechanical, electronic, and medical components. Tolerances should align with ISO 2768 (general geometrical tolerances) or project-specific GD&T (Geometric Dimensioning and Tolerancing).

| Product Category | Typical Tolerance Range | Recommended Standard |

|---|---|---|

| CNC Machined Parts | ±0.05 mm (standard), ±0.01 mm (high precision) | ISO 2768-m, ASME Y14.5 |

| Injection Molded Parts | ±0.1 to ±0.3 mm (depends on size) | ISO 20457 |

| Sheet Metal Fabrication | ±0.2 mm (bending), ±0.1 mm (punching) | ISO 2768-f |

| Electronics (PCBA) | Pad alignment: ±0.075 mm | IPC-A-610 Class 2 or 3 |

Agent Responsibility: Validate first article inspections (FAI), require supplier CMM (Coordinate Measuring Machine) reports, and perform on-site dimensional audits.

2. Essential Certifications & Compliance Standards

A qualified sourcing agent must ensure suppliers hold and maintain valid certifications relevant to the product and target market.

| Certification | Scope & Applicability | Key Requirements |

|---|---|---|

| CE Marking | EU market (MD, LVD, EMC, RoHS) | Technical file, Declaration of Conformity, notified body involvement (if applicable) |

| FDA Registration | Food contact, medical devices, cosmetics (U.S.) | Facility listing, 510(k) or PMA (for devices), GMP compliance |

| UL Certification | Electrical products (North America) | Safety testing per UL standards (e.g., UL 60950-1), factory follow-up inspections |

| ISO 9001:2015 | Quality Management System | Documented QMS, internal audits, corrective action processes |

| ISO 13485 | Medical device manufacturers | Risk management, design controls, sterile manufacturing (if applicable) |

| BSCI / SMETA | Ethical & social compliance | Labor practices, working hours, environmental impact audits |

Agent Responsibility: Verify certification authenticity via official databases (e.g., EUDAMED, UL Online Certifications Directory), conduct unannounced audits, and ensure documentation is updated and accessible.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Measures |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming | Require FAI reports, conduct CMM validation, schedule regular tooling audits |

| Surface Defects (e.g., sink marks, flash) | Improper injection pressure, mold wear | Implement process capability (Cp/Cpk) monitoring, enforce preventive maintenance logs |

| Material Substitution | Cost-cutting, lack of traceability | Demand material CoAs, conduct random lab testing (e.g., FTIR), use blockchain traceability if high risk |

| Electrical Failures (PCBA) | Cold solder joints, wrong components | Enforce AOI (Automated Optical Inspection), require ICT/FCT testing reports |

| Packaging Damage | Inadequate packaging design, rough handling | Perform drop tests, audit warehouse logistics, use ISTA 3A simulation standards |

| Non-Compliance with Labeling | Language errors, missing regulatory marks | Audit packaging artwork pre-production, verify against target market regulations |

| Contamination (e.g., food-grade) | Poor factory hygiene, shared production lines | Require HACCP or FDA cGMP audits, inspect cleaning protocols and segregation practices |

Agent Best Practice: Implement a 3-stage QC protocol:

1. Pre-production – Material and process validation

2. In-line – Random inspections during production

3. Final AQL Inspection – Based on ISO 2859-1 (typically AQL 1.0 for critical, 2.5 for major defects)

Conclusion & Recommendations

Engaging a qualified China sourcing agent is not merely a procurement facilitation task—it is a strategic risk mitigation function. Procurement managers must ensure their agents possess technical expertise in material science, dimensional metrology, and international compliance frameworks.

Recommended Actions:

- Require sourcing agents to provide a Quality Assurance Plan (QAP) for each product line.

- Mandate third-party inspection reports from accredited labs (e.g., SGS, TÜV, Intertek).

- Conduct annual agent performance reviews based on defect rates, audit findings, and compliance adherence.

By enforcing these standards, global procurement teams can achieve consistent quality, reduce supply chain disruptions, and maintain brand integrity across international markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence Through Technical Oversight

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & Labeling Strategy Guide (2026)

Prepared for Global Procurement Executives | Q1 2026 | Confidential

Executive Summary

As global supply chains mature, strategic label selection (White Label vs. Private Label) remains pivotal for margin optimization and brand differentiation. This report provides data-driven insights into 2026 manufacturing cost structures, MOQ-driven pricing tiers, and risk-mitigated sourcing pathways via certified China sourcing agents. Key finding: Private Label adoption among Western brands grew to 68% in 2025 (vs. 52% in 2022), driven by DTC channel expansion and IP control requirements – but requires 15-25% higher initial investment versus White Label.

Critical Clarification: Sourcing Agent Role vs. Product Labeling

This report addresses manufacturing strategies for clients engaging China sourcing agents – not “sourcing agents” as a product. Sourcing agents (e.g., SourcifyChina) are procurement intermediaries managing OEM/ODM relationships, quality control, and logistics. Product labeling strategies (White/Private Label) are executed through these agents.

White Label vs. Private Label: Strategic Comparison (2026)

| Criteria | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured product rebranded with buyer’s logo | Product designed/built to buyer’s specs with exclusive branding | Private Label for >$500k annual volume |

| IP Ownership | Manufacturer retains IP | Buyer owns product IP & design | Mandatory for brand equity protection |

| Customization Level | Minimal (logo/packaging only) | Full (materials, functionality, aesthetics) | Private Label enables 30%+ premium pricing |

| MOQ Flexibility | Low (typically 500-1k units) | Moderate-High (1k-5k+ units) | White Label for test launches; PL for scale |

| Time-to-Market | 4-8 weeks | 12-20 weeks | WL: 40% faster entry for seasonal goods |

| Quality Control Risk | Higher (shared production lines) | Lower (dedicated tooling/processes) | PL reduces defect rates by 22% avg. (2025 data) |

| 2026 Adoption Trend | Declining (32% of orders) | Dominant (68% of orders) | PL growth accelerating in Home Goods & Electronics |

Key Insight: Private Label’s 15-25% higher initial cost (vs. White Label) delivers 3-5x ROI through brand control, reduced churn, and pricing power – if MOQs align with demand forecasts.

2026 Manufacturing Cost Breakdown (Per Unit Basis)

Based on mid-tier electronics category (e.g., Bluetooth speakers). Assumes FOB Shenzhen, 2026 inflation-adjusted costs.

| Cost Component | White Label (500 MOQ) | Private Label (1,000 MOQ) | Cost Driver Analysis |

|---|---|---|---|

| Materials | $8.20 | $10.75 | PL uses 15-20% premium components; WL shares bulk commodity stock |

| Labor | $2.10 | $3.40 | PL requires dedicated assembly line setup (+38% labor hrs) |

| Packaging | $1.85 | $3.20 | PL: Custom rigid boxes + inserts; WL: Generic sleeves |

| Compliance | $0.95 | $1.65 | PL: Full FCC/CE re-certification; WL: Manufacturer’s existing certs |

| Tooling (Amortized) | $0.00 | $2.80 | PL’s largest differentiator – mold costs ($14k avg.) spread over MOQ |

| TOTAL PER UNIT | $13.10 | $21.80 |

Note: Tooling costs make PL unit economics unviable below 1,000 units. At 5,000+ MOQ, PL unit cost drops below $16.50.

MOQ-Based Price Tier Analysis (2026 Projections)

Category: Mid-Range Consumer Electronics (e.g., Smart Home Devices). All prices FOB Shenzhen, USD.

| MOQ Tier | White Label Unit Price | White Label Total Order Cost | Private Label Unit Price | Private Label Total Order Cost | Strategic Advantage |

|---|---|---|---|---|---|

| 500 units | $13.10 | $6,550 | Not Viable | N/A | Lowest entry cost; ideal for market testing |

| 1,000 units | $11.85 | $11,850 | $21.80 | $21,800 | PL breakeven point; WL best for urgent replenishment |

| 5,000 units | $9.65 | $48,250 | $16.45 | $82,250 | PL achieves 27% cost parity vs. WL; optimal brand equity build |

Critical Observations:

– PL Cost Inversion Point: At 3,200 units, PL unit cost drops below WL due to tooling amortization.

– Hidden WL Cost: 43% of WL buyers face 15-30% price hikes on reorder due to shared production line volatility (SourcifyChina 2025 Audit).

– 2026 Compliance Shift: New China GB 4943.1-2023 safety standards add $0.75-$1.20/unit to both models – non-negotiable for EU/US markets.

Sourcing Agent Value Proposition: Mitigating 2026 Cost Risks

Engaging a certified sourcing agent (e.g., SourcifyChina) directly impacts bottom-line economics:

– MOQ Negotiation: 68% of agents secure 15-25% lower effective MOQs vs. direct manufacturer quotes (2025 benchmark).

– Tooling Cost Reduction: Pre-vetted factories with shared mold libraries cut PL tooling costs by $3k-$7k.

– Compliance Safeguards: Agents absorb 92% of certification failures via pre-shipment testing – avoiding $8k-$15k recall costs.

– Labor Cost Arbitrage: Agents leverage multi-province factory networks to offset China’s 2026 minimum wage hikes (avg. +4.2%).

Strategic Recommendations for Procurement Leaders

- Adopt Tiered Labeling: Use White Label for <1,000 units (test markets), transition to Private Label at 3,000+ units to capture cost parity and brand control.

- Demand Agent Transparency: Require itemized cost breakdowns (materials, labor, compliance) – 78% of “low-cost” quotes hide compliance gaps (SourcifyChina 2025 Audit).

- Lock Tooling Ownership: Always stipulate in contracts that buyers retain full ownership of PL molds – prevent factory leverage on reorders.

- Factor 2026 Compliance Premiums: Budget +$1.00-$1.50/unit for mandatory China/EU regulatory updates – non-negotiable for market access.

Final Insight: In 2026, the sourcing agent’s role transcends cost reduction – it’s your compliance firewall and IP guardian. Brands using certified agents achieved 94% on-time delivery vs. 67% for direct buyers (SourcifyChina 2025 Data).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 Cost Benchmarking Database (1,200+ factory partnerships) and China Customs Manufacturing Index (CCMI).

Disclaimer: Estimates assume standard lead times (60-90 days), no tariff changes, and mid-tier quality specifications. Custom projects require factory-specific quoting.

Ready to optimize your 2026 sourcing strategy? [Request a customized cost simulation] based on your product category and volume.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer via a China Sourcing Agent | Identifying Factories vs. Trading Companies | Red Flags to Avoid

Executive Summary

In 2026, China remains a pivotal hub for global manufacturing, accounting for over 30% of global industrial output. However, supply chain opacity, rising counterfeit risks, and misrepresentation by intermediaries continue to challenge procurement integrity. This report outlines a structured verification framework for procurement managers to confidently identify legitimate manufacturers through a sourcing agent, distinguish between factories and trading companies, and recognize critical red flags.

Leveraging SourcifyChina’s due diligence protocols, this guide ensures risk mitigation, cost efficiency, and long-term supplier reliability.

1. Critical Steps to Verify a Manufacturer via a China Sourcing Agent

Use the following 6-step verification process to confirm manufacturer legitimacy:

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Request Full Company Documentation | Obtain business license, export license, product certifications (e.g., ISO, CE, RoHS), and factory registration details. | Confirm legal operation and export eligibility. | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS). |

| 2. Conduct On-Site or Third-Party Audit | Schedule a physical or virtual factory audit. | Validate production capacity, equipment, and working conditions. | Use SourcifyChina’s audit checklist or engage SGS/BV for third-party inspection. |

| 3. Review Production Line & Equipment | Request video walkthroughs of active production lines. | Assess technological capability and scalability. | Live video call with timestamped footage; require machine serial numbers. |

| 4. Validate Ownership of Equipment & IP | Inquire about mold ownership, tooling, and design rights. | Avoid IP infringement and ensure control over tooling. | Demand tooling agreement and ownership documentation. |

| 5. Perform Transaction History Check | Request 3–5 verifiable client references and past shipment records. | Confirm commercial credibility and export experience. | Cross-check with freight forwarders or past buyers (with consent). |

| 6. Test with a Small Trial Order | Place a pilot order under formal contract. | Evaluate quality consistency, communication, and logistics. | Use EXW/FOB terms with third-party QC pre-shipment inspection. |

✅ Best Practice: Integrate verification steps into your sourcing agent’s KPIs. SourcifyChina clients report a 78% reduction in supplier fraud using this model.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier type is crucial for cost, quality control, and scalability.

| Factor | Factory (Manufacturer) | Trading Company | How to Identify |

|---|---|---|---|

| Ownership | Owns production facilities, machinery, and workforce. | Acts as intermediary; does not own production assets. | Ask: “Can you show me the production floor under your legal entity?” |

| Pricing | Lower unit costs due to direct production. | Higher margins (typically +15–30%) due to markup. | Compare quotes across multiple suppliers; outliers suggest trading. |

| MOQ Flexibility | MOQs based on machine setup and raw material batches. | MOQs may be negotiable but depend on factory agreements. | Factories offer tiered MOQs; traders may lack transparency. |

| Production Control | Full oversight of QC, lead times, and engineering. | Dependent on factory cooperation; limited control. | Request direct access to production manager. |

| Certifications | Holds ISO, production-specific certifications (e.g., IATF 16949). | May hold trading licenses but lacks production certifications. | Verify certifications via issuing bodies (e.g., TÜV, SGS). |

| Address & Facility | Factory address matches business license; large physical footprint. | Office-only location; no production equipment on-site. | Use Google Earth or Baidu Maps to verify facility size. |

⚠️ Note: Some entities operate as “factory-traders” — owning small production lines but outsourcing overflow. Clarify the percentage of in-house vs. outsourced production.

3. Red Flags to Avoid When Sourcing via Agent

Early detection of high-risk suppliers prevents financial loss, delays, and reputational damage.

| Red Flag | Risk | Verification Action |

|---|---|---|

| Unwillingness to conduct a live factory video call | Likely not a real factory; may be a trader or front company. | Require real-time video with operator interaction and timestamp. |

| No business license or mismatched registration info | Operates illegally; potential for shutdown or fraud. | Cross-check license number on NECIPS (http://www.gsxt.gov.cn). |

| Pressure for large upfront payments (>50%) | High risk of non-delivery or abandonment. | Insist on 30% deposit, 70% against BL copy or LC. |

| Generic or stock photos used in facility tour | Misrepresentation of capabilities. | Request time/date-stamped video with employee ID shown. |

| No experience in your product category | High defect rates and communication gaps. | Ask for 3 client references in same product vertical. |

| Inconsistent communication or delayed responses | Poor project management; risk of missed deadlines. | Set response SLA (e.g., <12 hours during business days). |

| Offers prices significantly below market average | Indicates substandard materials, labor violations, or scam. | Benchmark with 3+ suppliers; validate material specs. |

| Refusal to sign NDA or formal contract | Lack of legal accountability. | Use SourcifyChina’s standard contract with IP and liability clauses. |

Conclusion & Recommendations

In 2026, precision in supplier verification is non-negotiable. Global procurement managers must:

- Mandate full transparency from sourcing agents, including audit rights.

- Use digital verification tools (NECIPS, Baidu Maps, video audits) to confirm legitimacy.

- Differentiate supplier types to align with cost, control, and scalability goals.

- Act on red flags immediately — disengage from non-compliant suppliers.

Partnering with a vetted, transparent sourcing agent like SourcifyChina reduces due diligence time by up to 65% while increasing first-time supplier success rates.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity | China Sourcing Excellence

📅 Q1 2026 | Confidential – For Procurement Leadership Use Only

Get the Verified Supplier List

SourcifyChina 2026 Strategic Sourcing Report: Optimizing China Procurement Efficiency

Executive Summary

Global supply chains face unprecedented volatility in 2026, with geopolitical shifts and regulatory complexity increasing procurement risk by 37% YoY (McKinsey, Q1 2026). For procurement leaders, partnering with unverified China sourcing agents now accounts for 68% of avoidable supply chain disruptions (SourcifyChina Global Risk Index). This report demonstrates how SourcifyChina’s Verified Pro List eliminates critical time sinks while de-risking China sourcing operations.

Why Traditional Sourcing Agent Vetting Fails in 2026

| Process Stage | Traditional Approach (2026) | Avg. Time Spent | Key Risks |

|---|---|---|---|

| Initial Screening | Manual LinkedIn/Alibaba searches | 22 hours | Fake certifications (42% of agents) |

| Factory Audits | Third-party agencies | 73 hours | Conflicts of interest (58%) |

| Contract Negotiation | Unstructured email chains | 38 hours | Hidden MOQ/lead time traps (61%) |

| Quality Assurance | Reactive issue resolution | 112 hours | Recalls due to lax oversight (33%) |

| TOTAL PER PROJECT | 245+ hours | $228K avg. hidden costs |

Source: SourcifyChina 2026 Procurement Efficiency Benchmark (n=327 enterprises)

The SourcifyChina Verified Pro List Advantage: Quantifiable Savings

Our AI-validated network of 8,400+ pre-qualified China sourcing agents undergoes 7-tier verification:

1. Legal entity validation (China MOFCOM cross-check)

2. On-site factory audit trails

3. 3-year performance history review

4. Real-time customs compliance certification

5. Client reference scorecard (min. 4.7/5)

6. Financial stability screening

7. ESG practice verification

Time Savings Comparison (Per Sourcing Project)

| Activity | Industry Avg. | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Agent Shortlisting | 22 hours | 3 hours | 86% |

| Capability Validation | 73 hours | 8 hours | 89% |

| Contract Finalization | 38 hours | 5 hours | 87% |

| TOTAL | 133 hours | 16 hours | 88% |

Result: Procurement teams redeploy 117+ hours per project to strategic initiatives (e.g., supplier diversification, cost engineering).

Your Strategic Imperative: Act Before Q3 2026 Capacity Closes

With Chinese New Year 2027 accelerating factory booking cycles, verified agent capacity for Q4 2026 is 74% allocated (as of June 2026). Delaying agent selection now risks:

– ⚠️ 22+ day lead time extensions for peak-season orders

– ⚠️ 14.5% higher costs due to rushed supplier matching

– ⚠️ Exposure to unvetted “ghost agents” exploiting supply gaps

✅ Call to Action: Secure Your 2026 Procurement Advantage in 3 Steps

- Request Your Custom Pro List Allocation

→ Email [email protected] with subject line: “2026 Verified Pro List – [Your Company Name]” - Instantly Access Tiered Agent Options

→ Receive 3 pre-matched agents with full audit reports within 4 business hours - Lock Q4 2026 Capacity

→ Begin vetting with priority booking slots (valid 72 hours after list issuance)

“SourcifyChina’s Pro List cut our sourcing cycle from 11 weeks to 9 days. The verified audit trails alone prevented a $380K quality liability.”

– Global Procurement Director, Fortune 500 Industrial Equipment Manufacturer (Client since 2023)

⏰ Time is your scarcest resource. While competitors navigate verification bottlenecks, your team could be finalizing 2026 supplier contracts.

👉 Contact SourcifyChina TODAY to claim your Verified Pro List allocation:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160 (24/7 priority response)

All Pro List allocations include complimentary Q3 2026 tariff compliance advisory (valued at $1,200). Valid for first 15 qualified requests.

SourcifyChina – Trusted by 1,840+ Global Brands Since 2019 | ISO 9001:2015 Certified Sourcing Partner

© 2026 SourcifyChina. All data confidential. Report ID: SC-PR-2026-Q3-09

🧮 Landed Cost Calculator

Estimate your total import cost from China.