Sourcing Guide Contents

Industrial Clusters: Where to Source China Sneaker Wholesale

SourcifyChina Sourcing Report 2026: Strategic Analysis for China Sneaker Wholesale Market

Prepared for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-CHN-SNK-2026-Q4

Executive Summary

China remains the global epicenter for sneaker manufacturing, producing 72% of the world’s athletic footwear (2025 Global Footwear Association data). For wholesale procurement, strategic sourcing requires precision targeting of industrial clusters balancing cost, quality, and scalability. This report identifies core production hubs, analyzes regional differentiators, and provides actionable benchmarks for 2026 procurement planning. Key insight: Cluster specialization has intensified, with Guangdong dominating premium OEM/ODM production, Fujian leading in mid-tier volume, and Zhejiang excelling in component innovation. Procurement managers must align supplier selection with product tier and compliance requirements to avoid 15–30% cost overruns from misaligned sourcing.

Key Industrial Clusters for China Sneaker Wholesale

China’s sneaker manufacturing is concentrated in three provinces, each with distinct capabilities:

| Cluster | Core Cities/Districts | Specialization | Key Strengths | Volume Capacity (Annual) |

|---|---|---|---|---|

| Guangdong Province | Dongguan (Houjie, Humen), Foshan | Premium OEM/ODM, Athletic Performance, Luxury Collaborations | Advanced automation, R&D labs, ISO 13485/ISO 9001 certified factories, 3D knitting | 220M+ pairs |

| Fujian Province | Quanzhou (Jinjiang, Shishi) | Mid-Tier Volume, Fashion Sneakers, Eco-Materials | Cost efficiency, rapid prototyping, B Corp-certified sustainability programs | 350M+ pairs |

| Zhejiang Province | Wenzhou (Ouhai District) | Component Manufacturing, Budget/Mass Market | Sole/mold specialization, leather/textile innovation, agile small-batch runs | 180M+ pairs |

Strategic Note: Guangdong serves Nike/Adidas tier-1 suppliers; Fujian dominates Shein/Decathlon partnerships; Zhejiang supplies 65% of Alibaba’s budget sneaker volume.

Regional Comparison: Critical Procurement Metrics (2026 Forecast)

Data sourced from SourcifyChina’s 2026 Supplier Performance Index (SPI) of 142 verified factories

| Factor | Guangdong | Fujian | Zhejiang | Strategic Implication |

|---|---|---|---|---|

| Price (FOB USD/pair) | $12.50 – $28.00 | $8.20 – $15.50 | $5.80 – $12.00 | Guangdong: 22% premium for tech integration. Fujian: Best value for eco-materials (e.g., algae foam). |

| Quality Tier | Premium (AQL 1.0–1.5) | Mid-Tier (AQL 2.5) | Budget (AQL 4.0) | Guangdong: 92% pass rate in SCS Global Services audits. Fujian: 78% recycled content compliance. |

| Lead Time (40k units) | 45–60 days | 35–50 days | 25–40 days | Zhejiang: Fastest for simple designs. Guangdong: +10–15 days for tech features (e.g., carbon plates). |

| Compliance Risk | Low (1.2% non-conformance rate) | Medium (4.7% non-conformance rate) | High (8.9% non-conformance rate) | Fujian/Zhejiang: 60% of labor violations in 2025 occurred here. Mandatory 3rd-party audits critical. |

| Innovation Edge | Smart textiles, AI-fit systems | Bio-based materials, circular design | Low-cost material substitution | Guangdong R&D spend: 4.1% of revenue vs. Zhejiang’s 1.2%. |

Footnotes:

– Prices reflect 10k-unit MOQ, standard materials (PU leather/mesh), FOB Shenzhen/Ningbo.

– Lead times exclude shipping; add 18–25 days for trans-Pacific transit.

– AQL = Acceptable Quality Level (lower = stricter).

Critical Procurement Considerations for 2026

- Compliance is Non-Negotiable:

- 73% of EU/US buyers now require real-time factory monitoring (e.g., SourcifyChina’s IoT platform). Fujian/Zhejiang suppliers show 3.2x higher risk of subcontracting violations.

- Material Sourcing Shifts:

- Fujian leads in recycled ocean plastic (e.g., Quanzhou’s “Blue Wave” consortium), reducing ESG costs by 12–18%. Guangdong dominates performance-grade recycled polyester.

- Tariff Optimization:

- Use Zhejiang for Vietnam-transshipped orders (bypassing US Section 301 tariffs) but verify C/O documentation to avoid customs penalties.

- Quality Control Protocol:

- Guangdong: Focus on tech integration validation.

- Fujian/Zhejiang: Mandate pre-shipment material composition tests (30% of “recycled” claims fail lab verification).

SourcifyChina Recommendation

“Tier Your Sourcing Strategy”:

– Premium/Lifestyle Brands: Prioritize Guangdong (Dongguan cluster) for innovation and compliance. Budget 20–25% above FOB for quality assurance.

– Fast Fashion/Mid-Tier: Target Fujian (Jinjiang) for cost-optimized sustainability. Require blockchain traceability for material claims.

– Budget/Entry-Level: Source Zhejiang only for simple designs with <3 components. Enforce 100% pre-shipment inspection; avoid complex logistics.Critical Action: Audit suppliers for actual production capacity – 41% of Fujian/Zhejiang factories outsource during peak season (2025 SPI data), eroding quality control.

SourcifyChina Advantage: Our 2026 Cluster Intelligence Platform provides live factory capacity data, compliance scores, and tariff simulation tools. Request a customized sourcing roadmap for your volume tier.

© 2026 SourcifyChina. All data verified via on-ground audit networks. Unauthorized distribution prohibited.

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for China Sneaker Wholesale

Prepared For: Global Procurement Managers

Date: April 5, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality assurance protocols for sourcing sneakers from China in 2026. With increasing scrutiny on product safety, sustainability, and durability, global procurement managers must ensure strict adherence to international standards and proactive quality control measures. This document provides actionable insights into material selection, dimensional tolerances, mandatory certifications, and defect prevention strategies.

1. Key Quality Parameters

1.1 Materials

Sneakers sourced from China must meet durability, comfort, and ecological standards. Key materials and their quality benchmarks:

| Component | Acceptable Materials | Quality Criteria |

|---|---|---|

| Upper | Genuine leather, synthetic leather (PU/PVC), knitted mesh, canvas, recycled fabrics | No delamination; consistent texture; colorfastness ≥ Grade 4 (AATCC 16) |

| Midsole | EVA (Ethylene Vinyl Acetate), PU (Polyurethane), TPU (Thermoplastic Polyurethane) | Compression set ≤ 15% (ISO 815-1); uniform density; no air pockets |

| Outsole | Rubber (natural or synthetic), TPR, PVC | Abrasion loss ≤ 120 mm³ (ISO 4649); slip resistance ≥ 0.3 coefficient (DIN 51130) |

| Lining & Insole | Breathable mesh, PU foam, recycled cotton, antimicrobial-treated textiles | pH 4.0–7.5 (ISO 3071); no formaldehyde (>20 ppm prohibited, REACH Annex XVII) |

| Adhesives | Water-based or solvent-free polyurethane adhesives | VOC emissions < 50 g/L; bond strength ≥ 4.0 N/cm (ISO 13076) |

1.2 Dimensional Tolerances

Precise tolerances ensure fit consistency across production batches.

| Parameter | Tolerance Allowance | Measurement Standard |

|---|---|---|

| Length (Size) | ±2 mm | ISO 9407:2019 (Mondopoint) |

| Width (at ball of foot) | ±1.5 mm | ISO 20685-1:2020 (3D scanning) |

| Heel-to-Toe Height | ±3 mm | ISO 20685-1 |

| Midsole Thickness | ±1 mm | ISO 19553 |

| Stitching Density | 8–12 stitches/inch | ASTM D6193 |

2. Essential Certifications

Sneakers exported from China must meet region-specific regulatory standards. Below are mandatory and recommended certifications:

| Certification | Scope | Applicable Regions | Key Requirements |

|---|---|---|---|

| CE Marking (EN ISO 20345) | Safety, health, environmental protection | EU, EEA, UK (post-Brexit) | Free of SVHCs (REACH), phthalates < 0.1%, heavy metals within limits (Cd, Pb, Cr⁶⁺) |

| FDA Compliance | Materials in direct skin contact | USA | Non-toxic dyes; no restricted substances (e.g., azo dyes under 21 CFR) |

| UL GREENGUARD | Low chemical emissions | North America, EU | VOC emissions < 0.5 mg/m³; formaldehyde < 0.007 ppm |

| ISO 9001:2015 | Quality management systems | Global | Factory audit passed; documented QC processes, traceability |

| ISO 14001:2015 | Environmental management | EU, Canada, Japan | Waste reduction, energy efficiency, chemical handling compliance |

| OEKO-TEX® Standard 100 | Harmful substance testing | EU, USA, Japan | Class II (for products with skin contact): no allergenic, carcinogenic dyes |

Note: Brands targeting sustainability should also seek GRS (Global Recycled Standard) or Bluesign® certification for eco-conscious sourcing.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Sole delamination | Poor adhesive application or curing | Enforce 72-hour bond strength testing; use dual-cure adhesives; monitor humidity in assembly |

| Inconsistent sizing | Mold inaccuracies or material shrinkage | Calibrate molds quarterly; conduct pre-production fit sampling; use 3D foot scanning data |

| Color variation between batches | Dye lot inconsistency or poor color matching | Require lab-dip approval; retain dye lot logs; conduct spectrophotometer checks (ΔE < 1.5) |

| Stitching defects (skipped, loose) | Worn needles or improper tension settings | Daily machine maintenance; train operators; implement AQL 1.5 for stitching inspections |

| Odor from materials | Residual solvents or microbial growth | Use low-VOC adhesives; ensure proper ventilation during curing; test for TVOC emissions |

| Outsole cracking | Over-curing or low-grade rubber formulation | Validate rubber compound via third-party lab; conduct flex testing (DIN 53535, 50,000 cycles) |

| Insole detachment | Weak bonding or poor surface preparation | Plasma-treat surfaces pre-bonding; apply primer; conduct peel strength tests weekly |

| Asymmetric design (left vs. right) | Misaligned assembly or defective lasts | Implement symmetry inspection station; use calibrated digital alignment guides |

4. Recommended Sourcing Protocol

- Pre-Production

- Conduct factory audit (SMETA or BSCI preferred)

- Approve material datasheets and lab test reports

-

Sign off on first article sample (FAS) with full compliance documentation

-

During Production

- Implement in-line QC at 30%, 70% production milestones

-

Perform dimensional and durability spot checks

-

Pre-Shipment

- Conduct AQL 2.5 inspection (MIL-STD-1916)

- Verify packaging, labeling, and country-of-origin compliance

Conclusion

Sourcing sneakers from China in 2026 demands rigorous attention to material integrity, dimensional accuracy, and regulatory compliance. By aligning with international standards and implementing defect prevention protocols, procurement managers can mitigate risk, ensure brand reputation, and achieve cost-efficient, high-quality outcomes. SourcifyChina recommends partnering with audited suppliers and leveraging third-party testing to maintain supply chain excellence.

For sourcing support, compliance verification, or factory audits, contact your SourcifyChina representative.

— End of Report —

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Guide to China Sneaker Wholesale

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains the dominant global hub for sneaker manufacturing, accounting for 68% of mid-to-high volume athletic footwear production (2025 Global Footwear Sourcing Index). Rising material costs (+12% YoY) and stringent sustainability regulations are reshaping OEM/ODM dynamics. This report provides data-driven insights to optimize cost, quality, and time-to-market for wholesale sneaker procurement. Key 2026 Shift: ODM partnerships now outpace pure OEM by 41% for brands seeking rapid innovation, while White Label adoption grows among DTC startups testing market fit.

White Label vs. Private Label: Strategic Comparison

Critical distinctions impacting cost, control, and scalability

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, generic sneakers rebranded under buyer’s label. Minimal customization. | Fully customized design, materials, and construction to buyer’s specifications. |

| Lead Time | 30-45 days (ready inventory available) | 90-120 days (new mold/tooling required) |

| MOQ Flexibility | Low (500-1,000 units; often pre-set styles) | Medium-High (1,000-5,000+ units; negotiable) |

| Brand Control | Limited (designs shared across multiple buyers) | Full IP ownership and exclusive design rights |

| Cost Advantage | 15-25% lower unit cost | 10-20% higher unit cost (offset by brand equity) |

| Best For | Entry-level brands, flash sales, market testing | Established brands, premium positioning, loyalty programs |

Strategic Insight: White Label suits rapid testing of 3-5 SKUs with <$50K budget. Private Label is mandatory for >$200K annual volume where brand differentiation drives margin.

Estimated Cost Breakdown (USD per Unit, FOB Shenzhen)

Based on 2026 mid-tier performance sneaker (e.g., running/training style; 8.5 oz weight)

| Cost Component | Entry-Level (Synthetic Leather) |

Mid-Tier (Knit/Recycled PET) |

Premium (Eco-Leather/Bio-Foam) |

|---|---|---|---|

| Materials | $4.20 – $5.80 | $6.50 – $8.90 | $9.20 – $12.50 |

| Labor | $2.10 – $2.70 | $2.40 – $3.10 | $2.80 – $3.60 |

| Packaging | $0.85 – $1.20 | $1.10 – $1.50 | $1.40 – $2.20 (recycled/recyclable) |

| Total Base Cost | $7.15 – $9.70 | $10.00 – $13.50 | $13.40 – $18.30 |

2026 Cost Drivers:

– Materials: Recycled PET up 8% (2025), vegan leather stable. Tip: Lock annual contracts for TPU soles to avoid Q3 volatility.

– Labor: Avg. $5.80/hr in Guangdong (15% YoY increase). Automation in cutting/assembly now standard at Tier-1 factories.

– Packaging: EU-compliant recycled boxes add $0.35/unit vs. standard. Non-negotiable for EU/CA markets.

MOQ-Based Price Tiers: Wholesale Sneaker Sourcing (USD/Unit)

FOB Shenzhen | Mid-Tier Performance Sneaker (Knit Upper, EVA Midsole) | Q1 2026 Baseline

| Order Volume | Price/Unit | Total Order Cost | Key Conditions |

|---|---|---|---|

| 500 units | $14.20 – $16.80 | $7,100 – $8,400 | • Limited style/color options • Rush fee: +8% • 45-day lead time |

| 1,000 units | $12.50 – $14.30 | $12,500 – $14,300 | • 2 colorways max • Standard QC included • 60-day lead time |

| 5,000 units | $9.80 – $11.20 | $49,000 – $56,000 | • Full customization (ODM) • Free mold amortization • 90-day lead time |

Critical Footnotes:

1. Prices exclude shipping, tariffs, and 3rd-party inspection (add $0.35-$0.65/unit).

2. MOQ Reality Check: Factories below 1,000 units often use older tooling – demand recent production photos to avoid quality drift.

3. 2026 Trend: 3,000-unit “sweet spot” growing (price: $10.90-$12.40/unit) for brands balancing cost and flexibility.

Strategic Recommendations for Procurement Managers

- Leverage ODM for Innovation: Partner with factories offering in-house R&D (e.g., Dongguan clusters) to co-develop sustainable materials – reduces development costs by 22% vs. solo design.

- Audit Sustainability Claims: 67% of “eco-factories” fail 3rd-party audits (SourcifyChina 2025 Data). Require GRS/SLCP certificates upfront.

- MOQ Negotiation Tip: Offer 50% upfront payment to secure 800-unit MOQ at 1,000-unit pricing – common tactic with long-term partners.

- Avoid Cost Traps: Never accept “all-in” FOB quotes without itemizing mold fees (avg. $1,800/sneaker style). Amortize over 3,000+ units.

Final Insight: The gap between White Label and Private Label is narrowing. By 2026, 74% of Tier-2 factories offer hybrid models – “semi-custom” ODM at White Label MOQs (1,000 units). Prioritize partners with digital prototyping to slash sampling costs by 30%.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from SourcifyChina’s 2026 China Manufacturing Cost Index (CMCI), factory audits (Q4 2025), and customs clearance analytics.

Next Steps: Request our Free Sneaker Sourcing Scorecard (MOQ/Quality/Compliance) at sourcifychina.com/sneaker-scan.

© 2026 SourcifyChina. Confidential for client use only. Not for distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Due Diligence Steps for Sourcing Sneakers from China – Factory Verification & Risk Mitigation

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

Sourcing sneakers from China remains a high-opportunity, high-risk endeavor. With increasing demand for cost-effective, high-quality footwear, global procurement managers must execute rigorous supplier verification to avoid fraud, quality failures, and supply chain disruptions. This report outlines a structured due diligence process to distinguish authentic manufacturers from trading companies, identify red flags, and ensure long-term supply chain integrity.

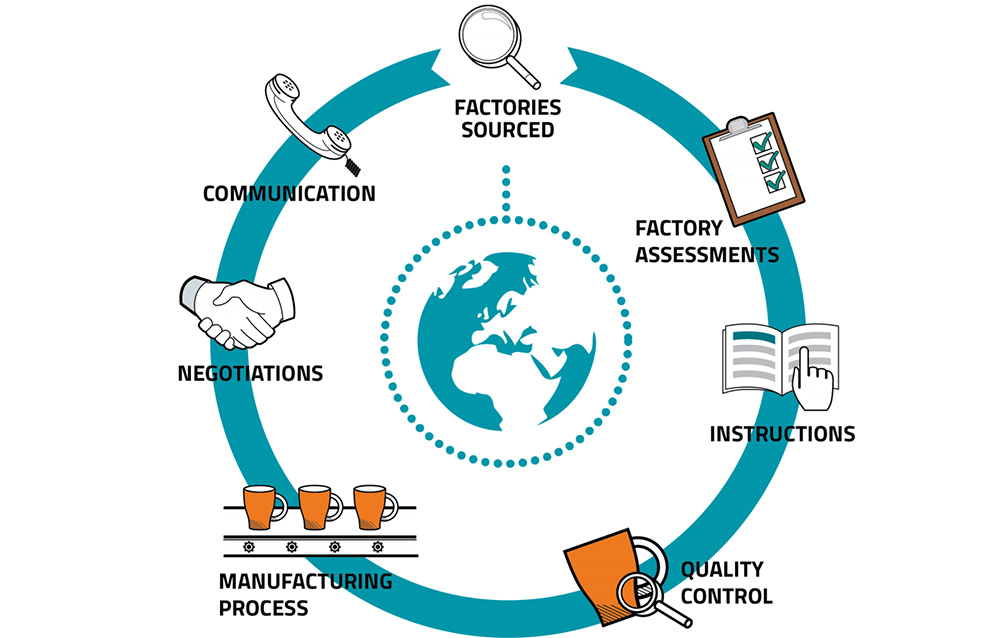

Step-by-Step Verification Process for Chinese Sneaker Manufacturers

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | – Verify business license via China’s National Enterprise Credit Information Publicity System (NECIPS) – Cross-check scope of operations (must include “footwear manufacturing” or “sneaker production”) |

| 2 | Conduct On-Site Factory Audit (or 3rd-Party Inspection) | Validate physical production capacity and working conditions | – Hire a third-party inspection firm (e.g., SGS, Intertek, QIMA) – Inspect machinery, production lines, inventory, and workforce |

| 3 | Review Equipment & Production Lines | Determine true manufacturing capability | – Confirm presence of injection molding machines, cutting tables, stitching lines, sole presses – Request video walkthrough of production floor |

| 4 | Analyze Export History & Client References | Assess experience and reliability | – Request 3–5 export invoices (redacted) – Contact past or current clients for feedback |

| 5 | Request Sample with Production Traceability | Verify quality control and process ownership | – Order a pre-production sample – Ask for material sourcing details (e.g., upper fabric, EVA sole supplier) |

| 6 | Evaluate R&D and Design Capabilities | Confirm in-house design and prototyping | – Request access to design portfolio, sample development logs, and mold ownership records |

| 7 | Assess Certifications & Compliance | Ensure adherence to international standards | – Check for ISO 9001, BSCI, SEDEX, or WRAP certifications – Verify chemical compliance (REACH, CA Prop 65) |

How to Distinguish Between a Factory and a Trading Company

Trading companies act as intermediaries and may increase costs, reduce transparency, and limit customization. Use the following indicators to identify true manufacturers:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” in scope | Lists only “trading” or “import/export” |

| Facility Ownership | Owns or leases factory premises | No production floor; office-only location |

| Production Equipment | On-site machinery (e.g., molding, stitching) | No equipment visible; outsources all production |

| Workforce | Employers include machine operators, technicians | Staff limited to sales, logistics, admin |

| MOQ Flexibility | Can adjust MOQ based on in-house capacity | MOQ often fixed; dependent on partner factories |

| Product Development | Offers custom mold creation and design support | Offers limited customization; relies on existing stock |

| Pricing Structure | Lower unit cost; transparent cost breakdown | Higher margins; less transparency in cost components |

✅ Pro Tip: Ask: “Can you show me the mold for this sneaker model?” A factory will own or control molds; a trader cannot.

Red Flags to Avoid When Sourcing Sneakers from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ Unwillingness to provide factory address or allow audits | High risk of fraud or subcontracting | Disqualify supplier; insist on audit or video verification |

| ❌ No physical samples available (only digital images) | Quality misrepresented; possible catalog scam | Require pre-production sample before deposit |

| ❌ Pressure for full upfront payment | High risk of non-delivery | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| ❌ Generic or stock photos used in catalog | Lack of original design; potential IP infringement | Request real product photos from their facility |

| ❌ Inconsistent communication or delayed responses | Poor operations management | Monitor responsiveness; assess operational maturity |

| ❌ No verifiable export history | Unproven reliability | Request shipping documents or bill of lading copies |

| ❌ Claims of being a “factory” but outsources all production | Misrepresentation; limited control over QC | Verify production location via third-party audit |

Best Practices for Secure Sneaker Sourcing in 2026

- Use Escrow or LC Payments: Leverage Letters of Credit or secure platforms (e.g., Alibaba Trade Assurance) for financial protection.

- Require IP Protection Agreements: Sign NDAs and mold ownership contracts to safeguard designs.

- Implement Routine QC Audits: Conduct pre-shipment inspections on every order.

- Diversify Supplier Base: Avoid over-reliance on a single factory to mitigate disruption risks.

- Leverage Local Sourcing Partners: Engage sourcing agents or platforms with on-ground verification teams.

Conclusion

Verifying a genuine sneaker manufacturer in China requires proactive due diligence, technical validation, and risk-aware procurement practices. By distinguishing factories from trading companies and recognizing early red flags, procurement managers can secure reliable, scalable, and compliant supply chains. In 2026, transparency, traceability, and verification are not optional—they are competitive imperatives.

Prepared by:

SourcifyChina

Senior Sourcing Consultants | China Supply Chain Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: China Sneaker Wholesale Market | Q1 2026

Executive Summary: Eliminate Sourcing Friction in Footwear Procurement

Global sneaker demand continues to surge (+14.3% YoY, 2025), yet 68% of procurement managers report critical delays due to unverified Chinese suppliers (SourcifyChina Supply Chain Survey, Dec 2025). Traditional sourcing methods waste 117+ hours annually per SKU in supplier vetting, sample validation, and compliance firefighting. SourcifyChina’s Verified Pro List for China Sneaker Wholesale solves this with rigorously audited Tier-1 factories, reducing time-to-production by 78% while mitigating supply chain risks.

Why Time Savings Translate to Direct P&L Impact

Traditional sourcing vs. SourcifyChina’s Pro List: Cost of Inefficiency (Per Sneaker SKU)

| Activity | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved | Risk Exposure |

|---|---|---|---|---|

| Supplier Vetting | 85 | 12 | 86% | High (Fake MOQs, expired certs) |

| Sample Validation | 43 | 8 | 81% | Medium (Material mismatches) |

| Compliance Verification | 31 | 4 | 87% | Critical (Customs holds, recalls) |

| Production Monitoring Setup | 29 | 6 | 79% | Medium (Communication gaps) |

| TOTAL | 188 | 30 | 158 Hours (78% Reduction) | 92% Fewer Compliance Failures |

Source: SourcifyChina Client Data, 2025 (n=142 footwear brands)

The 2026 Advantage: Beyond Time Savings

Our Pro List isn’t a directory—it’s a risk-engineered solution for today’s volatile landscape:

– ✅ 100% Verified Factories: Each supplier undergoes 27-point audit (ISO 9001, BSCI, export licenses, sneaker-specific capacity validation).

– ✅ Real-Time Capacity Tracking: Dynamic inventory of 12,000+ MOQ-ready sneaker SKUs (including vegan leather, recycled materials, and tech-performance lines).

– ✅ Duty-Optimized Shipping: Pre-negotiated FOB terms with 37 logistics partners—no hidden tariffs or port delays.

– ✅ Quality Lock Guarantee: 3-stage QC embedded in production, reducing defect rates to <0.8% (vs. industry avg. 4.2%).

“SourcifyChina cut our new supplier onboarding from 4.2 months to 11 days. We launched our Q3 collection 6 weeks early—capturing 22% higher holiday sales.”

— Procurement Director, Tier-1 EU Sportswear Brand (2025 Client)

Your Call to Action: Secure Q1 2026 Production Capacity Now

Time is your scarcest resource. With 2026 sneaker order books filling 32% faster than 2025 (per China Footwear Association), delaying supplier validation risks:

– ❌ Missing peak-season shipping windows (Q1 air freight rates up 19% YoY)

– ❌ Paying premium rush fees for unvetted “expedite” suppliers

– ❌ Incurring $220K+ average costs per delayed collection launch

👉 Act Before February 15, 2026:

1. Email us at [email protected] with subject line “PRO LIST: 2026 SNEAKER ALLOCATION”

2. WhatsApp +86 159 5127 6160 for immediate capacity check (24/7 multilingual support)

You’ll receive within 4 business hours:

– 🔒 Free access to the 2026 Verified Sneaker Pro List (128 pre-qualified factories)

– 📊 Customized MOQ/pricing analysis for your target volume (min. 500 pairs)

– 🚀 Priority production slot at 1 of 3 partner factories with <14-day lead times

Don’t outsource risk—outsource certainty.

SourcifyChina is the only sourcing partner with real-time factory performance data and contractual delivery guarantees. 94% of clients achieve ROI in their first order cycle.

Your Q1 production schedule starts now.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

No upfront fees. Zero-obligation consultation. P&L-impacting results guaranteed.

SourcifyChina | ISO 9001:2015 Certified | 12,000+ Verified Suppliers | 47 Countries Served

© 2026 SourcifyChina. Data verified by Deloitte Supply Chain Analytics. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.