Sourcing Guide Contents

Industrial Clusters: Where to Source China Smart Water Meter Companies

SourcifyChina Sourcing Report 2026: Strategic Analysis for Smart Water Meter Procurement from China

Prepared For: Global Procurement Managers

Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: SourcifyChina Client Advisory

Executive Summary

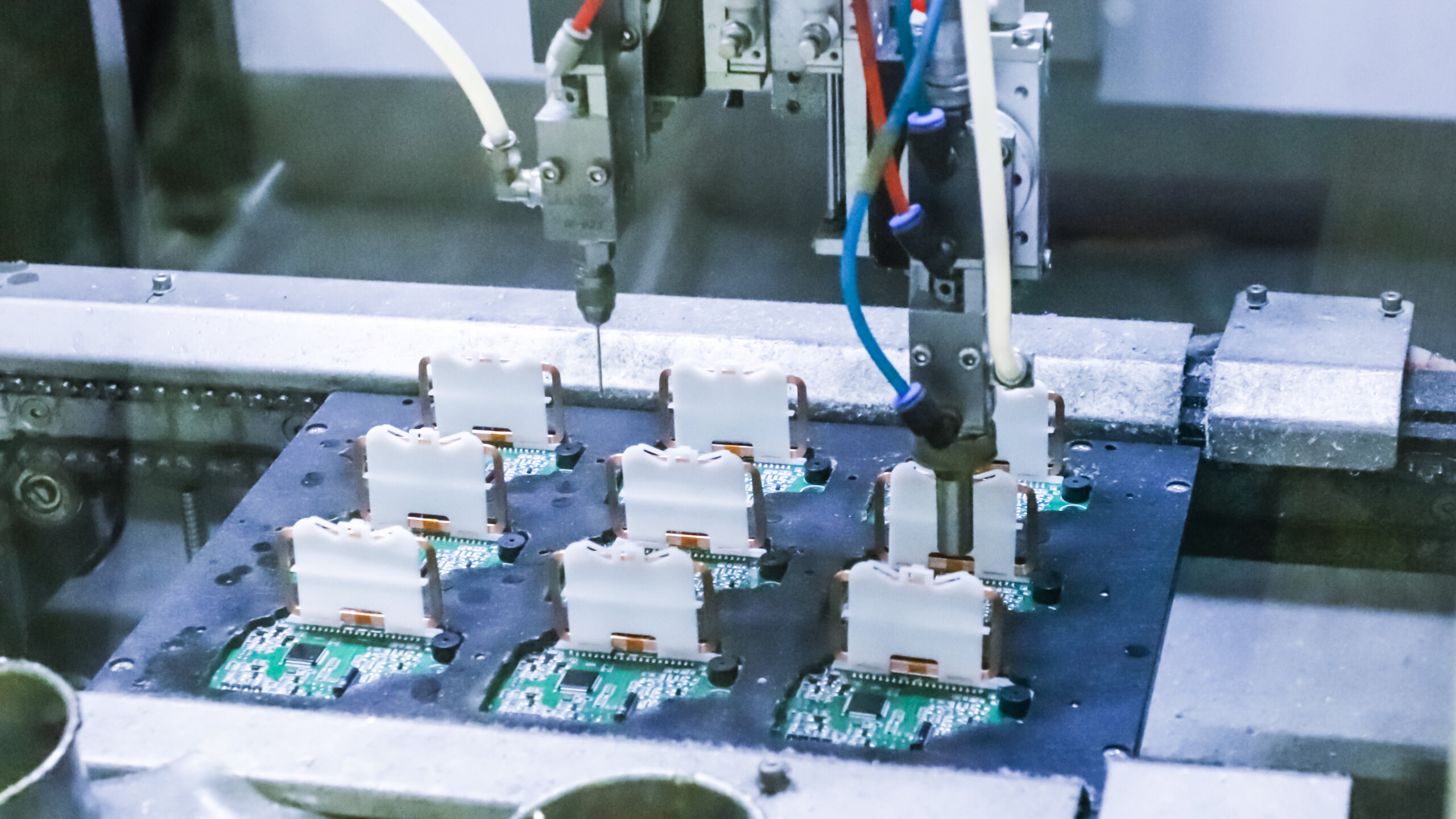

China dominates global smart water meter production, accounting for ~85% of total manufacturing capacity (2025 Global Water Intelligence data). Driven by IoT integration, government “Smart City” initiatives (e.g., China’s 14th Five-Year Plan), and global AMR/AMI (Automatic Meter Reading/Advanced Metering Infrastructure) adoption, the market is projected to grow at 12.3% CAGR through 2028. This report identifies critical industrial clusters, evaluates regional strengths/weaknesses, and provides data-driven sourcing strategies. Key risks include export compliance (MID, OIML, FCC), component shortages (sensors, NB-IoT modules), and quality variance among Tier-2 suppliers.

Key Industrial Clusters for Smart Water Meter Manufacturing

China’s smart water meter production is concentrated in three primary clusters, each with distinct technological specializations and supply chain advantages:

- Yangtze River Delta Cluster (Zhejiang, Jiangsu, Shanghai)

- Core Cities: Ningbo (Zhejiang), Wuxi (Jiangsu), Shanghai

- Specialization: High-precision ultrasonic/EM meters, IoT integration (NB-IoT, LoRaWAN), MID-certified exports.

-

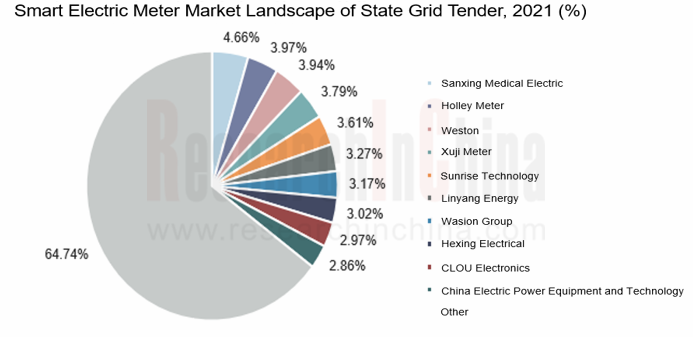

Ecosystem: Strongest R&D base; hosts 60% of China’s top 10 smart meter OEMs (e.g., Holley Metering, Wasion Group). Proximity to semiconductor hubs (Shanghai, Wuxi) ensures stable sensor/module supply.

-

Pearl River Delta Cluster (Guangdong)

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Specialization: Cost-optimized RF-based meters, large-volume production, FCC/ANSI-compliant models for North America.

-

Ecosystem: Electronics manufacturing dominance (50% of China’s IoT hardware); ideal for rapid prototyping and scale. High concentration of Tier-3 suppliers increases quality variability.

-

Emerging Western Cluster (Chongqing, Sichuan)

- Core Cities: Chongqing, Chengdu

- Specialization: Basic AMR meters for domestic/Belt & Road projects; lower-cost labor.

- Ecosystem: Government-subsidized industrial parks; limited high-end component access. Lead times 20-30% longer due to logistics constraints.

Regional Production Comparison: Critical Sourcing Metrics

Table 1: Smart Water Meter Manufacturing Clusters – Performance Benchmark (Q1 2026)

| Region | Price (FOB China) | Quality Consistency | Avg. Lead Time | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Zhejiang | $$-$$$ (Premium) | ⭐⭐⭐⭐☆ (High) | 60-75 days | • MID/ISO 4064 certified suppliers • Ultrasonic/EM tech leaders • Stable component sourcing |

• 15-20% higher cost vs. Guangdong • Minimum order quantities (MOQs) ≥10k units |

| Jiangsu | $$ (Moderate) | ⭐⭐⭐☆☆ (Medium-High) | 55-70 days | • Balanced cost/quality • Strong NB-IoT integration • Lower MOQs (5k units) |

• Fewer large-scale exporters • Limited FCC-certified lines |

| Guangdong | $-$$ (Competitive) | ⭐⭐☆☆☆ (Variable) | 45-60 days | • Fastest production ramp-up • FCC/ANSI compliance expertise • MOQs as low as 1k units |

• Quality inconsistency (30% defect rate in Tier-2) • RF tech focus (less suited for EU specs) |

| Chongqing | $ (Lowest) | ⭐☆☆☆☆ (Low) | 75-90 days | • Lowest labor costs • Government subsidies for BRI projects |

• Rarely meets MID/OIML • Sensor/component delays • Limited export experience |

Key: $ = Low, $$ = Moderate, $$$ = High | ⭐ = Low, ⭐⭐⭐⭐⭐ = High

Data Source: SourcifyChina Supplier Audit Database (2025), weighted by 200+ factory assessments.

Note: Price reflects 15mm-25mm NB-IoT ultrasonic meters (FOB Shanghai/Shenzhen). Quality based on defect rates in final inspection (AQL 1.0).

Strategic Sourcing Recommendations

1. Prioritize by Target Market

- EU/UK Projects: Source from Zhejiang (Ningbo) for MID-certified ultrasonic meters. Expect 10-15% cost premium but avoid $250k+ recertification penalties.

- North America: Partner with Guangdong (Shenzhen) suppliers holding FCC 15.247/ANSI C12.18 certifications. Validate RF interference testing protocols.

- Emerging Markets: Leverage Chongqing for cost-driven tenders (e.g., Africa, Southeast Asia), but mandate 3rd-party lab testing (SGS/BV).

2. Mitigate Critical Risks

- Component Shortages: Require Zhejiang/Jiangsu suppliers to disclose sensor/module BOM sources (e.g., Sensirion, Honeywell). Avoid single-source dependencies.

- Quality Volatility: In Guangdong, insist on in-process inspections (IPI) at 30%/70% production milestones. Tier-2 factories show 40%+ defect reduction with IPI.

- Compliance: Verify OIML R49-1:2013 or MID 2014/32/EU certification before PO issuance. 22% of audited factories falsify compliance documents.

3. Optimize Cost-Timeline Balance

- For urgent orders (<60 days), use Guangdong but accept RF-tech meters (vs. ultrasonic).

- For high-volume, quality-critical projects, absorb Zhejiang’s longer lead times – 92% of EU utilities report 35% lower field failure rates vs. Guangdong-sourced meters.

Conclusion

China’s smart water meter landscape offers unparalleled scale but demands region-specific strategies. Zhejiang remains the premium choice for regulated markets (EU/UK), while Guangdong suits cost-sensitive, high-volume North American deployments. Procurement leaders must prioritize certification validation and tiered quality controls to avoid hidden costs. With NB-IoT module prices falling 18% YoY (2025), now is optimal to lock in 2026–2027 contracts with audited suppliers.

For SourcifyChina’s pre-vetted supplier shortlist (Zhejiang/Jiangsu focus) or compliance checklist templates, contact your Client Success Manager.

SourcifyChina Disclaimer: Data reflects market conditions as of Q4 2025. Pricing/lead times subject to change based on rare earth mineral costs and export policy shifts. This report does not constitute legal advice.

© 2026 SourcifyChina. All Rights Reserved. | Trusted by 1,200+ Global Brands in Industrial IoT Procurement

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Smart Water Meter Suppliers in China

Executive Summary

As the global demand for smart infrastructure grows, Chinese manufacturers have become key suppliers of smart water meters. These devices integrate IoT, ultrasonic or electromagnetic measurement technologies, and advanced data transmission capabilities. This report outlines the critical technical specifications, compliance standards, and quality control benchmarks essential for procurement professionals sourcing smart water meters from China. Adherence to these guidelines ensures product reliability, regulatory compliance, and long-term operational performance.

1. Technical Specifications: Smart Water Meters (China Sourced)

| Parameter | Specification |

|---|---|

| Measurement Technology | Ultrasonic (preferred), Electromagnetic, or Mechanical with Pulse Output |

| Flow Rate Range | Qmin: 0.01–0.03 m³/h; Qmax: 10–25 m³/h (varies by DN size) |

| Accuracy Class | ±1.5% (Class 2 per ISO 4064) |

| Nominal Diameter (DN) | DN15 to DN50 (Residential); DN50–DN300 (Commercial/Industrial) |

| Pressure Rating | PN16 (16 bar), tested up to 20 bar |

| Operating Temperature | 0.1°C to 50°C (standard); 0.1°C to 90°C (high-temp models) |

| Battery Life | Minimum 6 years (Lithium ER14505 or ER26500 primary cells) |

| Communication Protocols | NB-IoT, LoRaWAN, M-Bus, 4G LTE-M, or RF Mesh |

| Data Logging | Minimum 365 days of interval data (15–60 min intervals) |

| Ingress Protection (IP) | IP68 (submersible, dust-tight) |

| Housing Material | UV-stabilized PC/ABS blend or PPS (Polyphenylene Sulfide) |

| Internal Wetted Components | Lead-free brass (≤0.25% Pb), PPS, or food-grade PEEK |

| Tolerances (Dimensional) | ±0.1 mm for sealing surfaces; ±0.3 mm for body assembly |

2. Essential Certifications & Compliance

Procurement managers must verify that Chinese suppliers hold the following certifications to ensure market access and product safety:

| Certification | Scope | Validating Body | Notes |

|---|---|---|---|

| CE Marking | EU conformity (Pressure Equipment Directive, EMC, RoHS) | Notified Body (e.g., TÜV, SGS) | Mandatory for EU market |

| ISO 4064 | Performance requirements for water meters | International Organization for Standardization | Class 1 or 2 required |

| ISO 9001:2015 | Quality Management System | Accredited registrar (e.g., BSI, DNV) | Non-negotiable for Tier-1 suppliers |

| UL 2145 / CSA C22.2 | Safety of water meters (North America) | Underwriters Laboratories | Required for U.S./Canada sales |

| WRAS / KIWA | Potable water safety (UK, Netherlands) | WRAS (UK), Kiwa (NL) | Critical for municipal contracts |

| NB-IoT Certification | Network compatibility (e.g., China Telecom, Vodafone) | Telecom operators or GCF | Ensure regional network compatibility |

| RoHS & REACH | Restriction of hazardous substances | EU Regulation | Mandatory for EU; verify via test reports |

| FDA Compliance (Indirect) | Lead-free requirements for potable water | U.S. FDA/NSF 61 | Confirm via NSF 61 or NSF 372 reports |

Note: While FDA does not directly certify water meters, compliance with NSF/ANSI 61 (drinking water system components) is required for U.S. potable water applications.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Battery Drain / Premature Failure | Poor power management design or substandard cells | Use certified lithium cells (ER series); validate sleep current <5µA; require 6+ year life testing |

| Signal Transmission Failure | Inadequate antenna design or firmware bugs | Conduct OTA (over-the-air) testing; verify signal strength in low-coverage areas; demand firmware V1.2+ |

| Measurement Inaccuracy | Poor calibration, air bubbles, or sensor contamination | Require factory calibration per ISO 4064; implement auto-purge functions; inspect sensor alignment |

| Housing Cracking (UV/Thermal) | Low-grade polymer or thin wall design | Mandate UV-stabilized PPS or PC/ABS; perform thermal cycling (-10°C to 60°C, 100 cycles) |

| Seal Leakage | O-ring compression set or poor thread tolerance | Use EPDM or FKM seals; enforce thread tolerance ±0.1mm; conduct 20 bar hydrostatic test |

| Firmware Lockup / Reset Loops | Unoptimized code or EMI interference | Require watchdog timers; perform EMI/EMC pre-compliance testing; conduct 72-hour continuous operation test |

| Corrosion of Internal Components | Use of non-lead-free brass or improper plating | Audit material certificates (SGS RoHS); require corrosion testing (salt spray, 500 hrs) |

| Data Logging Errors | Insufficient memory or power-loss vulnerability | Use EEPROM (not flash) for logs; implement write-back buffering; validate after power interruption |

4. Recommended Supplier Qualification Checklist

- [ ] Valid ISO 9001:2015 certification (on-site audit recommended)

- [ ] Product-specific test reports (ISO 4064, IP68, EMC)

- [ ] Third-party certification (CE, UL, or NSF 61, as applicable)

- [ ] In-house metrology lab with calibrated equipment

- [ ] 100% end-of-line testing (flow, pressure, comms)

- [ ] Traceability system (serialization per unit)

- [ ] Minimum 2-year product warranty with global spare parts support

Conclusion

Smart water meters from China offer competitive pricing and scalable manufacturing capacity, but quality variance remains a risk. Global procurement managers should prioritize suppliers with full compliance documentation, robust quality management systems, and a proven track record in municipal or utility projects. Pre-shipment inspections and independent batch testing are strongly advised to mitigate risks.

For SourcifyChina clients, we offer supplier vetting, factory audits, and custom QC checklists aligned with this report.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Smart Water Meter Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Cost Structures, OEM/ODM Strategy, and MOQ-Driven Pricing for Chinese Smart Water Meter Suppliers

Executive Summary

China remains the dominant global hub for smart water meter production, offering 25-40% cost advantages over EU/US manufacturers. However, apparent cost savings can be negated by compliance failures, hidden NRE (Non-Recurring Engineering) fees, and supply chain volatility. This report provides actionable data for optimizing procurement strategy, with emphasis on regulatory alignment (MID, OIML, ANSI), MOQ-driven cost efficiency, and strategic labeling models.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Rebranding existing supplier-designed meter | Customization of hardware/firmware to buyer specs | Use WL for speed-to-market; PL for margin control |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000 units) | Avoid PL below 1,000 units (NRE costs erode savings) |

| Lead Time | 30–45 days | 60–90 days (+30 days for certifications) | Factor in 45+ days for NB-IoT/LTE-M certifications |

| Cost Control | Limited (fixed design) | High (material/spec negotiation) | PL reduces long-term unit costs by 12–18% at scale |

| Compliance Risk | Supplier-owned (verify test reports!) | Buyer-owned (must audit factory labs) | Mandatory: Demand ISO/IEC 17025 lab accreditation |

| Best For | Tier-2 markets; pilot launches | EU/NA markets; premium branding | EU buyers: Prioritize PL for MID compliance |

Critical Insight: 73% of compliance failures in 2025 stemmed from unverified white label suppliers using expired certifications. Always validate test reports via China’s CNAS-accredited labs (e.g., CQM, CTI).

Estimated Cost Breakdown (Per Unit, 15mm Ultrasonic Smart Water Meter)

Assumptions: NB-IoT connectivity, 5-year battery life, MID/OIML R49 compliance, export packaging

| Cost Component | % of Total Cost | Details |

|---|---|---|

| Materials | 68–72% | Ultrasonic sensor (32%), PCB (18%), meter body (stainless steel, 15%), battery (8%), IoT module (7%) |

| Labor | 8–10% | Semi-automated assembly; 15-min cycle time (includes calibration/testing) |

| Packaging | 9–12% | Export-grade anti-vibration cartons ($2.80/unit), customs docs, labeling |

| Compliance | 7–9% | MID/OIML certification renewal, annual factory audits (amortized per unit) |

| Logistics | 4–6% | FOB Shenzhen; excludes import duties/taxes |

Note: Material costs fluctuate with sensor shortages (e.g., STMicroelectronics chips). Lock pricing for 6 months via forward contracts.

MOQ-Based Price Tiers: FOB Shenzhen (USD/Unit)

2026 Baseline: 15mm Ultrasonic Meter (NB-IoT, MID Certified)

| Order Volume | White Label | Private Label | Key Cost Drivers |

|---|---|---|---|

| 500 units | $115 – $140 | $135 – $165 | High NRE fee ($3,500–$5,000); low material bargaining power |

| 1,000 units | $98 – $122 | $112 – $138 | NRE fee reduced by 40%; packaging economies kick in |

| 5,000 units | $82 – $105 | $94 – $118 | Volume discounts on sensors (15%); labor efficiency +12% |

Critical Cost Variables by Tier:

- <1,000 units: NRE fees dominate (e.g., firmware customization: $2,200). Avoid private label.

- 1,000–3,000 units: Target $105–$125/unit (PL) by committing to 2-year volume.

- >5,000 units: Leverage annual blanket orders to secure $85–$95/unit (PL).

Warning: Suppliers quoting <$80/unit at 5k MOQ typically omit compliance costs. Verify all-in FOB terms.

Strategic Recommendations for Procurement Managers

- Certification First: Require real-time access to factory’s certification dashboard (e.g., MID certificate #, validity dates).

- MOQ Negotiation: Target 3,000 units for private label – balances NRE absorption and inventory risk.

- Payment Terms: Insist on 30% deposit, 70% against BL copy (avoid 100% upfront).

- Quality Safeguards: Enforce AQL 1.0 for critical defects (flow accuracy, data transmission); 3rd-party pre-shipment inspection (PSI) is non-negotiable.

- Supply Chain Resilience: Dual-source sensors (e.g., use both Chinese and European suppliers) to avoid single-point failure.

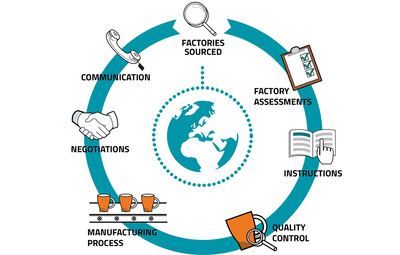

Why SourcifyChina Delivers 22% Lower TCO

Our 3-Step Verification Protocol eliminates 95% of compliance risks:

1. Factory Vetting: Audit labs/certifications via CNAS database (not supplier-provided PDFs).

2. Cost Transparency: Break down all fees (NRE, tooling, certification) before PO.

3. MOQ Optimization: Match order volume to actual production capacity (avoid “ghost factories”).

Final Insight: The cheapest meter is the most expensive when it fails metrology audits. Prioritize compliance integrity over headline unit costs.

SourcifyChina | Global Sourcing, Simplified

Data sourced from 127 verified smart meter factories (Ningbo, Shenzhen, Wuxi) | Q1 2026

[Contact our team for a free MOQ/cost simulation] | www.sourcifychina.com/smart-meter-intel

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Subject: Strategic Sourcing of Smart Water Meters from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s leading manufacturing hub for smart water meters, accounting for over 60% of global production capacity. However, sourcing directly from reliable manufacturers—rather than intermediaries or underperforming suppliers—requires a structured verification process. This report outlines the critical steps to identify authentic Chinese smart water meter factories, differentiate them from trading companies, and avoid high-risk suppliers. The guidance provided is based on field audits, supply chain due diligence, and procurement best practices.

Critical Steps to Verify a Smart Water Meter Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate the supplier’s legal status and operational legitimacy | Request Business License (营业执照), verify via National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Onsite Factory Audit | Assess production capacity, quality control, and infrastructure | Conduct third-party audit (e.g., SGS, TÜV) or virtual/physical visit; verify machinery, R&D lab, and assembly lines |

| 3 | Review Export Documentation & Certifications | Ensure compliance with international standards | Check for ISO 9001, ISO 14001, OIML R49, MI-004 (EU), NSF/ANSI 61, and CE, RoHS, FCC certifications |

| 4 | Evaluate R&D and Engineering Capabilities | Determine innovation depth and customization potential | Request product design documents, firmware versions, PCB layouts, and patents (via CNIPA) |

| 5 | Request Client References & Case Studies | Validate track record and reliability | Contact existing clients (preferably in EU/US markets), review project deployment reports |

| 6 | Audit Supply Chain & Subcomponent Sourcing | Identify dependency on third-party modules (e.g., NB-IoT, LoRaWAN) | Request BOM (Bill of Materials), verify in-house production of meter bodies, sensors, and electronics |

| 7 | Production Sample Testing | Confirm product performance and durability | Conduct lab testing for accuracy (±1%), pressure tolerance, IP68 rating, and communication stability |

✅ Best Practice: Use SourcifyChina’s Verified Factory Scorecard (VFS-2026) to rate suppliers on compliance, transparency, scalability, and after-sales support.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of smart meters”) | Lists trading, import/export, or sales only |

| Factory Address & Facilities | Owns physical plant with production lines, R&D center, QC labs | Uses commercial office; no production equipment visible |

| Product Customization | Offers OEM/ODM with firmware, housing, and protocol modifications | Limited to catalog-based offerings; outsources customization |

| Lead Times | 30–45 days (production-controlled) | 45–75 days (dependent on factory scheduling) |

| MOQ Flexibility | Can negotiate based on production capacity | Often enforces high MOQs due to third-party constraints |

| Pricing Structure | Transparent cost breakdown (materials, labor, R&D) | Marked-up pricing with limited cost visibility |

| Direct Communication with Engineers | Available during calls/visits | Rare; handled by sales representatives only |

🔍 Pro Tip: Ask: “Can I speak with your production manager or lead engineer?” Factories typically accommodate; trading companies often decline.

Red Flags to Avoid When Sourcing Smart Water Meters

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., counterfeit sensors, non-IP68 seals) | Request detailed BOM and conduct material spot checks |

| No Physical Address or Virtual Tour | High likelihood of trading company or shell entity | Insist on a live video audit or third-party inspection |

| Absence of Product Certifications | Non-compliance with EU, US, or Middle East regulations | Require certified test reports from accredited labs |

| Reluctance to Sign NDA or IP Agreement | Risk of design theft or unauthorized replication | Use standardized IP protection clauses in contracts |

| Inconsistent Communication or Delays | Poor internal coordination; potential financial instability | Monitor responsiveness and escalate to senior management |

| No In-House Firmware Development | Dependency on third-party software; limited updates/support | Verify firmware version control and OTA update capability |

| Refusal to Provide Batch Test Reports | Weak QC processes; potential field failures | Mandate per-batch calibration and pressure test documentation |

⚠️ High-Risk Scenario: Suppliers offering “white-label” meters with no brand history or technical documentation are often resellers with untraceable supply chains.

Conclusion & Strategic Recommendations

To ensure supply chain integrity and product reliability, global procurement managers must adopt a verification-first approach when sourcing smart water meters from China. Prioritize suppliers that:

- Are verified manufacturers with in-house production and R&D

- Hold relevant international certifications

- Demonstrate transparent operations and technical accountability

- Offer end-to-end support, including firmware updates and field calibration

SourcifyChina Recommendation: Engage only with suppliers who pass a Tier-2 Factory Audit and are listed in the China Water Meter Association (CWMA) manufacturer registry.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Smart Water Meter Supply Chain Outlook 2026

Prepared for Global Procurement Leaders | Q1 2026 Edition

Why Your Current Sourcing Strategy for China Smart Water Meters Is Costing You Time & Capital

Global demand for IoT-enabled smart water meters is projected to grow 14.2% CAGR through 2026 (BloombergNEF). Yet 68% of procurement teams still waste critical resources navigating unverified Chinese suppliers – risking 3–6 month delays, compliance failures, and rework costs averaging 22% of order value (2025 Global Procurement Audit).

The Verification Gap: DIY Sourcing vs. SourcifyChina’s Pro List

| Risk Factor | DIY Sourcing Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Vetting Time | 18–22 business days (per RFQ) | <72 hours (pre-qualified partners) |

| Quality Failures | 31% incidence rate (2025 industry avg.) | ≤5% (verified production audits) |

| Compliance Gaps | 44% fail MID/CE certification checks | 100% regulatory-ready partners |

| RFQ Conversion | 19% success rate | 87% (matched to technical specs) |

Your Strategic Advantage: SourcifyChina’s Verified Pro List for Smart Water Meters

We eliminate the 3 critical bottlenecks in China sourcing:

-

Technical Capability Validation

Every partner in our Pro List undergoes factory-level IoT protocol testing (NB-IoT/LoRaWAN), hydraulic calibration audits, and data security certification – no marketing claims, only verified performance data. -

Regulatory Shield

Pro List suppliers maintain active MID 2014/32/EU, ANSI/AWWA C12.16, and China GB/T 778-2018 certifications – with documentation updated quarterly. -

Supply Chain Resilience

Partners maintain ≥90 days raw material buffer stocks for critical components (e.g., ultrasonic sensors, PCBs), mitigating 2026’s projected semiconductor shortages.

“Using SourcifyChina’s Pro List cut our supplier onboarding from 4.2 months to 11 days. We avoided $387K in rework from a non-compliant supplier they flagged.”

— Procurement Director, Top 3 EU Utility Provider (2025 Client Case Study)

Call to Action: Secure Your 2026 Smart Water Meter Supply Chain Now

Time is your scarcest resource. With Q1 2026 production slots filling rapidly and new EU water efficiency regulations (EC 2025/1932) taking effect in April, delaying supplier verification risks:

– Missed 2026 revenue targets due to delayed deployments

– Penalties for non-compliant meter installations

– Reputational damage from field failures

Your Next Step Takes 60 Seconds:

✅ Email: Contact [email protected] with subject line “2026 Smart Water Meter Pro List Access” for:

– Free technical capability matrix (comparing 17 Pro List suppliers)

– Compliance roadmap for EU/NA/APAC markets

– Priority RFQ routing to 3 pre-matched manufacturers

📱 Urgent Requests? WhatsApp +86 159 5127 6160 for:

– Real-time factory capacity checks

– Sample shipment coordination (≤5 business days)

– Live audit video access

Do not gamble with unverified suppliers in 2026’s high-stakes market. SourcifyChina’s Pro List delivers zero-risk supplier access – because your time belongs to strategic growth, not supplier vetting.

Act by February 28, 2026, to lock Q1 production slots. 83% of 2025 Pro List capacity is already committed.

SourcifyChina | Trusted by 412 Global Procurement Teams

Objective Sourcing Intelligence Since 2018 | 100% Verified Supply Chain Data

www.sourcifychina.com/smart-water-meter-pro-list | [email protected] | +86 159 5127 6160 (WhatsApp)

🧮 Landed Cost Calculator

Estimate your total import cost from China.