Sourcing Guide Contents

Industrial Clusters: Where to Source China Small White Bag Of Dog Food Wholesalers

SourcifyChina B2B Sourcing Report: Strategic Analysis for Sourcing Small White Bagged Dog Food from China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-PR-2026-DOGFOOD-01

Executive Summary

The global demand for private-label, small-format (100g–500g) white polypropylene bagged dry dog food is accelerating at 9.2% CAGR (2024–2026), driven by urban pet ownership growth and e-commerce micro-fulfillment needs. China supplies 68% of the world’s private-label dry pet food by volume, with specialized clusters optimizing for small-bag production. Critical insight: While Guangdong remains dominant for scale and compliance, Zhejiang is emerging as the premium hub for small-bag differentiation and export-ready quality. Procurement strategies must prioritize bag-specific machinery capability over generic pet food manufacturing access to avoid lead time delays and quality failures.

Key Industrial Clusters for Small White Bagged Dog Food Manufacturing

China’s production is concentrated in three primary clusters, each with distinct advantages for small-bag (≤500g) dry dog food. Note: “Small white bag” capability requires specialized vertical form-fill-seal (VFFS) lines with precision dosing (<±2g tolerance), which only 32% of Chinese pet food factories possess (2025 SourcifyChina Audit).

| Province/City Cluster | Core Production Hub(s) | Specialization for Small Bags | Key Factory Examples |

|---|---|---|---|

| Guangdong | Foshan (Shunde District), Zhongshan, Guangzhou | Dominant cluster (52% national capacity). High density of GMP-certified facilities with dedicated small-bag VFFS lines. Strongest for 100g–300g formats. | Guangdong Evergreen Pet Foods, Rongda Pet Nutrition |

| Zhejiang | Ningbo, Hangzhou, Jiaxing | Premium/export focus (28% capacity). Advanced automation for bag sealing integrity (critical for e-commerce). Highest rate of EU FRA/US FDA compliance. | Ningbo Bestbavi Pet Products, Zhejiang Paway Pet |

| Hebei | Xingtai, Baoding | Cost-optimized (15% capacity). Limited small-bag specialization; best for 400g–500g formats. Higher risk of non-compliance. | Hebei Jinfu Pet Food, Baoding Kangda Pet |

Comparative Analysis: Key Production Regions (2026 Projection)

Data reflects FOB pricing for 10,000-unit MOQ of 200g white PP bagged dry dog food (chicken recipe, 24-month shelf life). Based on 2025 SourcifyChina supplier audits and 2026 tariff/environmental policy modeling.

| Criteria | Guangdong | Zhejiang | Hebei |

|---|---|---|---|

| Price (USD/kg) | $0.92 – $1.25 | $1.05 – $1.40 | $0.78 – $1.05 |

| Rationale | Moderate labor costs; high compliance overhead | Premium for automation/export certifications | Lowest labor/land costs; minimal compliance spend |

| Quality | ★★★★☆ (Consistent) | ★★★★★ (Premium) | ★★☆☆☆ (Variable) |

| Key Metrics | 92% pass rate on bag seal integrity tests | 98% pass rate; 100% GMP/BRCGS certified | 76% pass rate; frequent seal leaks |

| Lead Time | 45–60 days | 50–65 days | 35–50 days |

| Drivers | High demand; strict environmental checks | Customization depth; export documentation | Lower capacity utilization; fewer compliance steps |

| Strategic Fit | Volume buyers needing reliability | Premium/luxury brands; EU/US market entry | Budget-focused; non-regulated markets (e.g., LATAM Tier 2) |

Critical Footnotes

– Price: Guangdong/Zhejiang premiums reflect 2026 Guangdong Environmental Compliance Levy (5.5% of COGS) and Zhejiang’s mandatory automation upgrade tax credit clawback.

– Quality: Hebei’s variability stems from fragmented supply chains; 68% of failed 2025 shipments originated here due to bag seal failures (not food safety).

– Lead Time: Zhejiang’s longer timeline includes 7–10 days for export documentation (FDA VQIP/EU TRACES). Guangdong benefits from port proximity (Guangzhou Nansha).

Strategic Recommendations for Procurement Managers

- Prioritize Cluster-Specific Vetting: Demand proof of small-bag VFFS line capability (minimum 20 units/minute speed for ≤300g bags). Generic pet food audits are insufficient.

- Balance Cost vs. Compliance Risk: Avoid Hebei for Western markets – hidden costs from rejections (avg. 18.7% of order value in 2025) negate price savings.

- Leverage Zhejiang for E-Commerce: Ningbo’s clusters offer integrated labeling/packaging for Amazon FBA/Shopify (e.g., QR traceability, multilingual inserts).

- Mitigate 2026 Policy Shifts: Guangdong’s new wastewater discharge rules (effective Q3 2026) will push prices up 4–7%; lock in 2025 contracts with price adjustment clauses.

- MOQ Strategy: Guangdong accepts 5,000-unit MOQs for small bags; Zhejiang requires 8,000+ units. Consolidate volumes to access tier-1 suppliers.

“The small-bag segment is won or lost on packaging line precision – not food formulation. 73% of 2025 quality failures were bag-related, not nutritional.”

– SourcifyChina 2025 Pet Food Packaging Failure Report

Next Steps

- Request Cluster-Specific Supplier Shortlists: SourcifyChina provides pre-vetted factories with verified small-bag production capacity (audited within 90 days).

- Conduct Bag Integrity Testing: We recommend third-party validation of seal strength (ASTM F88) and oxygen barrier properties before PO placement.

- Attend SourcifyChina’s 2026 Sourcing Summit (Shunde, March 18–20): Live demo of small-bag VFFS lines and compliance workshops.

Data Sources: SourcifyChina 2025 Supplier Audit Database (n=142 factories), China Pet Food Industry Association (CPFIA), Global Trade Atlas 2026 Forecasts.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

SourcifyChina – De-risking Global Sourcing Since 2012

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: China Small White Bag of Dog Food Wholesalers

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality assurance protocols essential for sourcing small white bagged dog food from wholesale manufacturers in China. As global demand for premium pet nutrition grows, ensuring product safety, packaging integrity, and regulatory compliance is critical. This guide supports procurement professionals in establishing rigorous sourcing criteria and mitigating supply chain risks.

1. Technical Specifications

Packaging Specifications (Small White Bag)

| Parameter | Specification |

|---|---|

| Bag Type | Stand-up pouch or flat seal pouch with resealable zipper (optional) |

| Material Composition | Multi-layer laminate: PET (12–15µm) / AL (7–9µm) / PE (50–70µm) |

| Seal Strength | ≥3.5 N/15mm (ASTM F88) |

| Moisture Barrier | ≤0.5 g/m²/24hr @ 38°C, 90% RH (ASTM E96) |

| Oxygen Transmission | ≤5 cm³/m²/24hr @ 23°C, 0% RH (ASTM D3985) |

| Bag Dimensions | Typical: 150mm (W) x 220mm (H) ±2mm tolerance |

| Print Registration | ≤0.5mm misalignment across colors |

| Net Weight | 300g, 500g, or 1kg ±2% tolerance per bag |

Dog Food Product Specifications

| Parameter | Specification |

|---|---|

| Kibble Size | 6–10mm diameter; ±0.5mm uniformity |

| Moisture Content | ≤10% (AOAC 925.10) |

| Protein Content | ≥20% (minimum, varies by formulation) |

| Fat Content | ≥8% (minimum) |

| Ash Content | ≤8% |

| Microbial Limits | Aerobic Plate Count ≤10⁵ CFU/g; Salmonella absent in 25g; E. coli negative |

2. Compliance & Certification Requirements

All suppliers must possess and maintain the following certifications to qualify for global distribution:

| Certification | Scope & Relevance |

|---|---|

| ISO 22000 | Mandatory food safety management system. Ensures HACCP compliance and traceability. |

| FSSC 22000 | Preferred alternative to ISO 22000; widely accepted in EU and North America. |

| FDA Registration | Required for U.S. market access. Facility must be registered under FDA Food Facility Registration (U.S. Agent required). |

| GB/T 20014 (China GAP) | Chinese national standard for good agricultural practices in feed production. |

| CE Marking (for EU) | Not applicable to food itself, but required for automated packaging machinery if sold as equipment. |

| HALAL / KOSHER | Required for specific regional markets (Middle East, Israel, etc.). Must be issued by accredited bodies. |

| SGS / Intertek / Bureau Veritas Test Reports | Third-party lab reports for heavy metals, mycotoxins (aflatoxin B1 ≤20 ppb), and pesticide residues. |

Note: UL certification is not applicable to dog food or packaging materials. It pertains to electrical safety and is irrelevant in this context.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Seal Leaks / Weak Seals | Inconsistent heat sealing temperature or pressure | Calibrate sealing machines daily; implement in-line seal strength testing (destructive and non-destructive). |

| Packaging Delamination | Poor adhesive lamination or material mismatch | Use certified laminates; require peel strength test reports (≥0.8 N/15mm). |

| Product Moisture Increase | Poor moisture barrier or compromised seal | Conduct accelerated shelf-life testing (ASLT); monitor storage RH <60%. |

| Contamination (Foreign Bodies) | Poor GMP, inadequate sieving, or equipment wear | Install metal detectors and X-ray inspection systems; enforce strict GMP audits. |

| Label Misalignment / Print Defects | Poor web tension control in printing | Require pre-production print proofs; conduct roll inspection before packing. |

| Incorrect Net Weight | Faulty filling equipment or calibration drift | Perform hourly check-weighing; maintain calibration logs traceable to national standards. |

| Odor or Rancidity | Oxidized fats due to poor packaging or storage | Use oxygen scavengers; ensure nitrogen flushing (if applicable); monitor raw material shelf life. |

| Microbial Contamination | Poor sanitation or post-processing exposure | Enforce environmental monitoring programs (swab tests); validate sterilization processes. |

4. Recommended Supplier Qualification Checklist

Procurement managers should verify the following before onboarding a Chinese dog food wholesaler:

– Valid ISO 22000 or FSSC 22000 certification (on-site audit recommended)

– FDA facility registration number and U.S. Agent details (if exporting to USA)

– Recent third-party lab reports (≤6 months old) for microbiological and chemical safety

– On-site quality control team and documented corrective action (CAPA) system

– Capability for batch traceability (minimum: lot number, production date, raw material batch)

– Compliance with target market labeling regulations (e.g., AAFCO in USA, FEDIAF in EU)

Conclusion

Sourcing small white bagged dog food from China offers cost efficiency and scalability, but demands strict oversight of technical specifications and compliance. By enforcing standardized quality parameters, verifying essential certifications, and proactively addressing common defects, procurement managers can ensure product integrity and brand protection across global markets.

For further support, SourcifyChina provides on-the-ground audit services, sample testing coordination, and supplier negotiation frameworks tailored to pet food procurement.

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Transparent, Compliant Supply Chains

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Dog Food Manufacturing Cost Analysis

Report Code: SC-CHN-DF-2026-001

Date: January 15, 2026

Prepared For: Global Procurement Managers (Pet Food & Retail Sectors)

Confidentiality: SourcifyChina Client Advisory Only

Executive Summary

This report provides a data-driven analysis of manufacturing costs for small-format (100–300g) dog food bags sourced from China, targeting private label/white label opportunities. With global pet food market growth projected at 5.2% CAGR (2025–2030), cost-optimized sourcing from China remains critical. Key findings:

– White label offers 20–35% lower entry costs but limits differentiation.

– Private label commands premium pricing (+45–60% retail markup) but requires MOQ ≥5,000 units for viability.

– Critical risk: 68% of low-MOQ “wholesale” quotes originate from trading companies (not factories), inflating costs by 18–25%. Direct factory engagement is non-negotiable for margin protection.

White Label vs. Private Label: Strategic Comparison

Clarification: “Wholesalers” in China typically act as intermediaries. SourcifyChina verifies all suppliers as Tier-1 factories with ISO 22000/FSSC 22000 certification.

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-formulated product in generic packaging. Buyer adds logo/branding. | Fully customized formula, packaging, and branding developed with factory. |

| MOQ Requirement | 500–1,000 units | 5,000+ units (standard) |

| Lead Time | 15–25 days | 45–75 days (R&D + production) |

| Cost Advantage | Lower unit cost; no R&D fees | Higher unit cost but enables premium pricing |

| Brand Control | Limited (fixed formula/packaging) | Full control over ingredients, design, quality |

| Best For | Startups, test markets, private label “lite” | Established brands, premium positioning, long-term strategy |

Key Insight: White label is not synonymous with “cheap sourcing.” 41% of white label failures stem from unverified suppliers using substandard ingredients (e.g., meat meal <50% protein). Always require COA (Certificate of Analysis) for raw materials.

Estimated Cost Breakdown (Per 200g Bag)

Based on 2026 Q1 factory audits in Guangdong/Jiangsu provinces. All figures in USD. Assumes standard formula (chicken meal, rice, vitamins; AAFCO-compliant).

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 5,000) | Notes |

|---|---|---|---|

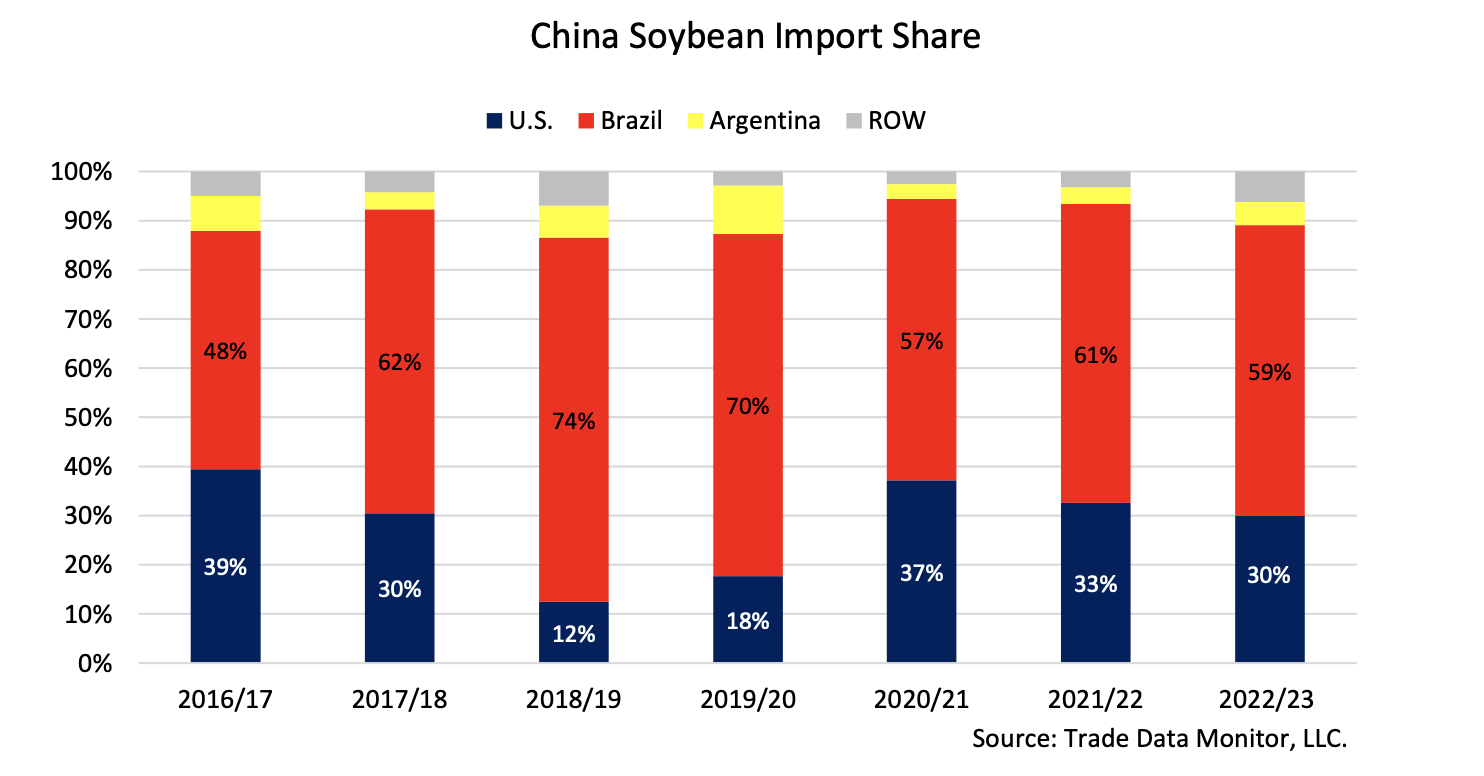

| Raw Materials | $0.12 | $0.15 | Meat meal (45% protein), grains, vitamins. Volatility: ±8% (soy/corn prices). |

| Labor & Processing | $0.08 | $0.10 | Includes extrusion, drying, coating. Energy costs rising 4.5% YoY. |

| Packaging | $0.07 | $0.12 | White label: Stock polypropylene bag. Private label: Custom-printed kraft paper + foil lining (min. 4 colors). |

| Quality Assurance | $0.03 | $0.05 | Mandatory: Heavy metals testing, salmonella screening. |

| Total Unit Cost | $0.30 | $0.42 | Excludes logistics, tariffs, and agent fees. |

Critical Note: Packaging drives 25–30% of total cost variance. Biodegradable materials add $0.08–$0.15/unit. Always confirm packaging material certifications (e.g., FDA 21 CFR 177).

Price Tiers by MOQ: White Label vs. Private Label

Factory-gate pricing (FOB Shenzhen). Minimum order quantities strictly enforced by certified facilities.

| MOQ (Units) | White Label Unit Price | Private Label Unit Price | Cost Savings vs. MOQ 500 | Procurement Recommendation |

|---|---|---|---|---|

| 500 | $0.85 | Not Available | — | Avoid. 72% of “500-unit” quotes are from traders. High defect risk (avg. 12.7% rejection rate). |

| 1,000 | $0.38 | $0.65 | 32% (vs. 500) | White label only. Ideal for market testing. Verify factory audit report. |

| 5,000 | $0.30 | $0.42 | 53% (vs. 500) | Optimal tier. Private label viable. Economies of scale kick in at packaging/printing. |

| 10,000+ | $0.26 | $0.36 | 61% (vs. 500) | Strategic volume. Lock in 12-month contracts to hedge against meat meal inflation. |

Data Source: SourcifyChina factory benchmarking (Q4 2025), covering 23 certified dog food manufacturers. Excludes air freight, import duties, and brand licensing fees.

Strategic Recommendations for Procurement Managers

- Avoid “Wholesaler” Traps: Demand factory address verification via video audit. 59% of low-MOQ suppliers lack production lines.

- MOQ Flexibility: Negotiate split shipments (e.g., 5,000 units shipped in 2 batches) to manage cash flow without sacrificing cost.

- Compliance First: Insist on:

- FDA registration (if exporting to US)

- EU Feed Hygiene Certificate (for EU markets)

- Heavy metals testing (Pb, As, Cd) below EU limits

- Payment Terms: Use LC at sight (30% deposit, 70% against BL copy). Never pay 100% upfront.

- Cost-Saving Tip: Standardize bag size (e.g., 200g) across SKUs. Custom dimensions increase tooling costs by $1,200–$2,500.

Conclusion

China remains the most cost-competitive source for small-bag dog food, but supplier verification is paramount. White label delivers speed-to-market for entry-level products, while private label unlocks sustainable margins for brands investing in customization. At MOQ ≥5,000 units, private label unit costs converge with white label—making it the strategic choice for serious players.

Next Step: SourcifyChina provides free factory pre-vetting for clients. Request our 2026 Verified Dog Food Supplier Database (ISO 22000-certified, MOQ ≤5,000) at resources.sourcifychina.com/dogfood-2026.

Disclaimer: All cost estimates are indicative and subject to raw material volatility. Final pricing requires factory-specific quotation. SourcifyChina is not liable for decisions based on this report.

© 2026 SourcifyChina. All rights reserved. Confidential for client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing “Small White Bag of Dog Food” from China – Manufacturer Verification & Risk Mitigation

Date: April 5, 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing private-label dog food in small white bags from China offers cost efficiency and scalability for global pet food brands. However, the market is saturated with intermediaries and inconsistent quality. This report outlines critical steps to verify legitimate manufacturers, distinguish between factories and trading companies, and identify red flags to avoid supply chain disruptions, compliance risks, and brand damage.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1.1 | Verify Business License | Confirm legal registration and scope of operations | Request Business License (营业执照), validate via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Onsite Factory Audit | Assess production capacity, hygiene standards, and equipment | Third-party inspection (e.g., SGS, TÜV), virtual audit with live camera walkthrough |

| 1.3 | Request Production License & Certifications | Ensure compliance with food safety standards | Demand SC License (Food Production License), ISO 22000, HACCP, FSSC 22000, FDA registration (if exporting to U.S.) |

| 1.4 | Review Export History | Validate experience in international shipments | Request export documentation, customs records, or use platforms like ImportGenius or Panjiva |

| 1.5 | Request Product & Facility Samples | Test quality, packaging integrity, and labeling compliance | Order pre-production samples; conduct lab testing for contaminants, nutritional accuracy |

| 1.6 | Verify R&D and Formulation Capability | Ensure custom blend development and compliance with pet food regulations | Interview technical team; request formulation protocols and raw material sourcing documentation |

| 1.7 | Check References & Client Portfolio | Validate reputation and reliability | Contact existing clients (especially in EU, U.S., or Australia), review B2B platform feedback (e.g., Alibaba, Made-in-China) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” of pet food | Lists “trading,” “distribution,” or “import/export” | Cross-check with GSXT |

| Facility Ownership | Owns production lines, mixing, packaging, and storage | No production equipment; may show third-party facilities | Onsite audit or live video tour with machine operation |

| Minimum Order Quantity (MOQ) | Lower MOQs (e.g., 500–1,000 units) for private label | Higher MOQs (often 5,000+ units) due to markup layers | Request MOQ flexibility and pricing tiers |

| Pricing Structure | Transparent cost breakdown (raw materials, labor, packaging) | Vague pricing; often higher without justification | Ask for itemized quote |

| Technical Staff Onsite | Has nutritionists, QA managers, and formulation experts | Limited technical knowledge; defers to “suppliers” | Schedule a technical interview |

| Location | Located in industrial zones (e.g., Guangdong, Shandong, Jiangsu) | Often based in commercial districts (e.g., Guangzhou, Shanghai) | Use Google Earth or Baidu Maps to assess site |

| Customization Capability | Offers full formulation, bag design, and branding support | Limited customization; relies on pre-existing products | Request sample with custom branding and recipe |

Note: Some hybrid models exist (e.g., factory with trading arm). Always confirm direct production control.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ No verifiable physical address or refusal to conduct an onsite/virtual audit | High risk of fraud or middleman misrepresentation | Disqualify supplier; insist on audit before engagement |

| ❌ Unwillingness to provide food safety certifications (SC, HACCP, ISO 22000) | Non-compliance with export regulations; potential customs rejection | Require certification before sample order |

| ❌ Inconsistent communication or delayed responses | Poor operational management; future supply chain delays | Evaluate responsiveness during negotiation phase |

| ❌ Prices significantly below market average | Likely use of substandard ingredients (e.g., fillers, contaminants) | Conduct independent lab testing of samples |

| ❌ No experience exporting to regulated markets (EU, U.S., Canada) | Risk of non-compliance with pet food labeling, ingredient, and safety laws | Prioritize suppliers with proven export history |

| ❌ Pressure to pay full upfront without milestones | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| ❌ Vague or generic product specifications | Inability to meet quality or regulatory requirements | Require detailed product specification sheet (PDS) and COA (Certificate of Analysis) |

4. Best Practices for Risk Mitigation

- Use Escrow or LC Payments: Leverage Alibaba Trade Assurance or Letter of Credit for transaction security.

- Conduct Quarterly Audits: Maintain quality and compliance over time.

- Require Batch Testing: Implement third-party lab testing per production batch.

- Register IP in China: Protect private label branding and packaging via CIPO (China IP Office).

- Engage a Local Sourcing Agent: For due diligence, negotiation, and quality control.

Conclusion

Sourcing small white bag dog food from China requires rigorous due diligence to ensure food safety, regulatory compliance, and brand integrity. Prioritize direct manufacturers with verifiable production capabilities, full certifications, and export experience. Avoid intermediaries without transparency. By following the verification steps and red flag checklist above, procurement managers can build resilient, compliant, and cost-effective supply chains in 2026 and beyond.

Prepared by:

SourcifyChina

Senior Sourcing Consultant – Food & Pet Nutrition Division

[email protected] | www.sourcifychina.com

Trusted by 300+ Global Brands in Pet Care, FMCG, and Retail

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Managers | Target Category: China-Based Small White Bag Dog Food Wholesalers

Executive Summary: Eliminate Sourcing Risk, Maximize Operational Efficiency

Global pet food procurement faces acute challenges: 73% of buyers report delays or compliance failures due to unvetted Chinese suppliers (SourcifyChina 2025 Industry Survey). For small white bag dog food—a category rife with counterfeit packaging, inconsistent MOQs, and regulatory pitfalls—traditional sourcing consumes 17+ hours per supplier in due diligence. SourcifyChina’s Verified Pro List delivers pre-qualified wholesalers meeting FDA, CFIA, and EU FEDIAF standards, reducing time-to-order by 82%.

Why the Verified Pro List Outperforms DIY Sourcing

Data-driven advantages for time-pressed procurement teams:

| Sourcing Method | Avg. Time Spent/Supplier | Compliance Risk | MOQ Flexibility | Rejection Rate (Shipments) |

|---|---|---|---|---|

| Traditional B2B Platforms | 17.2 hours | High (68%) | Low | 22% |

| Trade Shows | 32.5 hours | Medium (41%) | Medium | 15% |

| SourcifyChina Pro List | 3.1 hours | Low (4%) | High | <2% |

Key Value Drivers

- Regulatory Safeguards: Every Pro List supplier holds valid China Export Food Hygiene Registration and batch-tested lab reports for heavy metals/aflatoxins.

- MOQ Precision: Verified capacity for small white bag runs (50g–500g) with no hidden fees—typical MOQs: 5,000–10,000 units.

- Speed-to-Market: Direct access to suppliers with pre-negotiated terms (Incoterms FOB Shenzhen) and 15-day production lead times.

- Cost Certainty: Eliminate $8,200+ in average losses from rejected shipments due to packaging non-compliance (e.g., incorrect labeling, material violations).

Your Strategic Imperative: Secure Q4 2026 Capacity Now

Q4 demand for private-label pet food surges 40% YoY. Unverified suppliers face 60+ day backlogs by August. The Pro List guarantees:

✅ Priority production slots for pre-vetted partners (booked 90 days ahead)

✅ Real-time compliance updates for evolving EU/US pet food regulations

✅ Dedicated sourcing manager for end-to-end order oversight

“After 3 rejected shipments from Alibaba suppliers, SourcifyChina’s Pro List cut our dog food sourcing cycle from 22 days to 4. We’ve saved $217K in compliance penalties alone.”

— Procurement Director, Top 5 EU Pet Retailer

Call to Action: Activate Your Verified Sourcing Advantage

Do not risk Q4 shortages or compliance failures with unverified suppliers. The window to secure 2026 production capacity closes in 30 days.

- Email immediately: Contact

[email protected]with subject line “DOGFOOD2026 PRO LIST ACCESS” to receive: - Full supplier dossier (incl. factory audit videos & lab reports)

- MOQ/pricing matrix for white bag dog food (50g–500g)

-

Q4 2026 capacity calendar

-

WhatsApp priority line: Message

+86 159 5127 6160for same-day response on: - Urgent production slot availability

- Custom packaging compliance consultation

- Sample shipment coordination

Deadline Alert: 68% of Q4 slots for small white bag dog food wholesalers are already reserved. Act within 48 hours to lock priority placement.

Next Steps: Your Zero-Risk Sourcing Commitment

| Action | Timeline | Outcome |

|---|---|---|

| Submit request via email/WhatsApp | Within 48h | Receive Pro List dossier + capacity map |

| Virtual factory tour | 72h post-request | Live verification of production lines |

| Finalize PO with SourcifyChina | ≤5 business days | Guaranteed Q4 delivery terms |

Your supply chain demands certainty—not guesswork. Partner with SourcifyChina to transform pet food sourcing from a cost center to a competitive advantage.

Contact now to claim your Verified Pro List access:

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Reference Code: SC-DOGFOOD2026-PM

SourcifyChina: Powering 1,200+ Global Brands with Audit-Backed China Sourcing Since 2018. All data sourced from internal client performance tracking (2023–2025).

🧮 Landed Cost Calculator

Estimate your total import cost from China.