Sourcing Guide Contents

Industrial Clusters: Where to Source China Small Greenhouse Company

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Small Greenhouse Manufacturers in China

Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

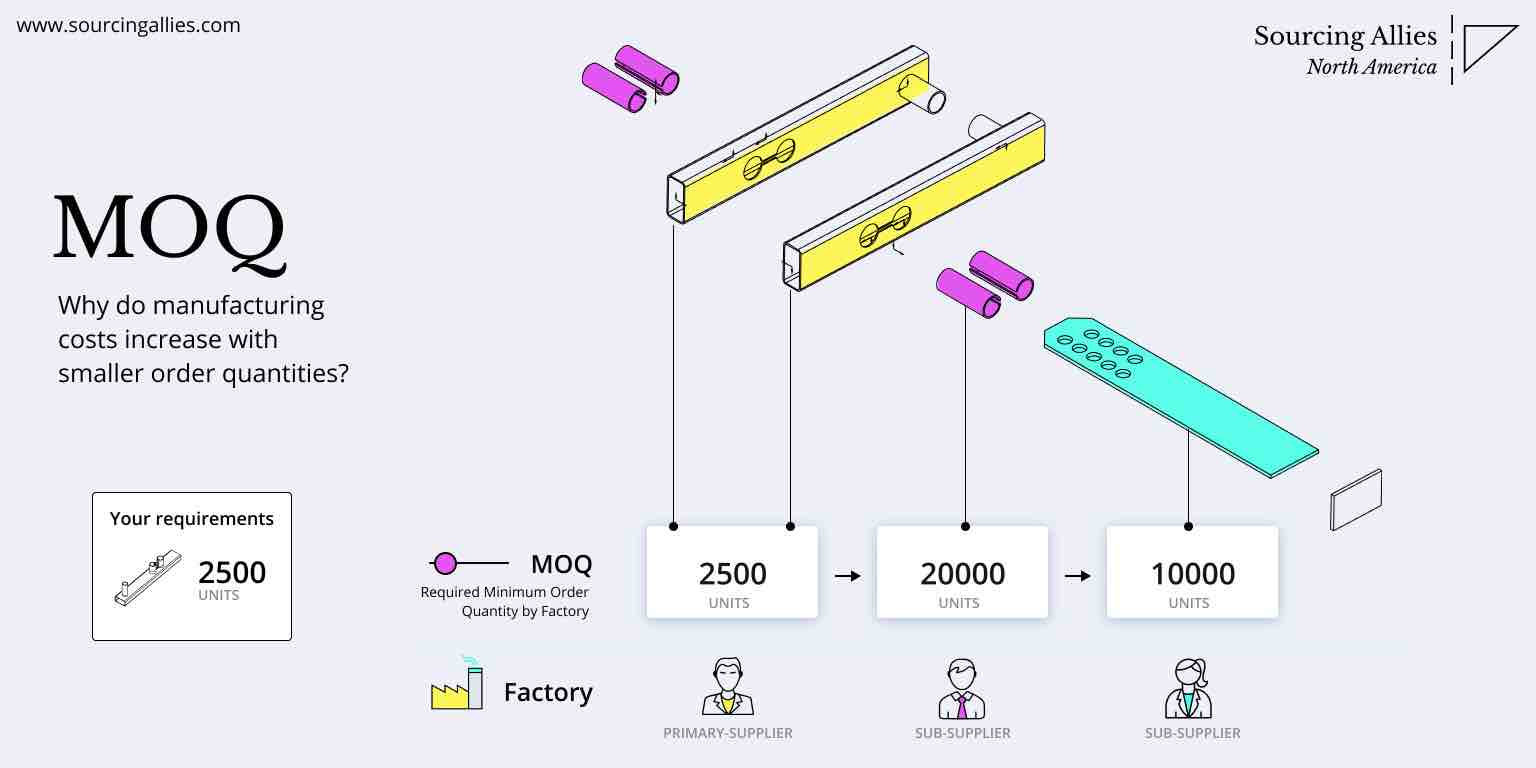

The Chinese market for small greenhouse manufacturing has experienced significant growth and specialization over the past decade, driven by rising global demand for urban agriculture, vertical farming, and backyard horticulture. As a leading sourcing hub, China offers cost-effective, scalable, and technologically advanced production of small greenhouses (typically defined as modular, prefabricated units under 100 m² for residential, educational, or commercial micro-farming use).

This report provides a strategic deep-dive into the key industrial clusters in China specializing in small greenhouse production, analyzing regional strengths in price competitiveness, product quality, and lead time performance. The analysis supports informed supplier selection and supply chain optimization for international procurement teams.

Market Overview: Small Greenhouses in China

Small greenhouse manufacturing in China spans a range of materials, including galvanized steel frames, polycarbonate panels, aluminum structures, and PVC covers, with increasing integration of smart features (ventilation systems, IoT sensors, automated shading). The market is highly fragmented, dominated by SMEs and export-focused manufacturers, primarily located in the eastern and southeastern coastal regions.

Key export markets include North America, Western Europe, Australia, and Japan, with growing demand in emerging urban farming hubs.

Key Industrial Clusters for Small Greenhouse Manufacturing

China’s manufacturing ecosystem for small greenhouses is concentrated in several well-established industrial clusters, each offering distinct advantages:

| Province | Key City | Industrial Focus | Material Specialization | Export Strength |

|---|---|---|---|---|

| Zhejiang | Huzhou, Jiaxing | Full-cycle greenhouse systems | Aluminum frames, polycarbonate | High – EU & North America |

| Guangdong | Foshan, Dongguan | Lightweight modular units | PVC, aluminum, smart integration | Very High – Global |

| Shandong | Qingdao, Weifang | Agricultural-grade structures | Galvanized steel, PE film | Strong – Asia, Middle East |

| Jiangsu | Suzhou, Wuxi | High-end & automated greenhouses | Aluminum, tempered glass, IoT | Moderate – Premium markets |

| Hebei | Xingtai, Baoding | Budget structural components | Galvanized steel, basic covers | Moderate – Africa, LATAM |

Comparative Regional Analysis: Price, Quality, Lead Time

The table below evaluates the five key provinces based on critical procurement KPIs. Ratings are on a scale of 1–5 (5 = best).

| Region | Avg. Price (USD/unit*) | Price Competitiveness | Quality Level | Lead Time (Production + Dispatch) | Best Suited For |

|---|---|---|---|---|---|

| Zhejiang | $280–$450 | 4/5 | 5/5 | 25–35 days | High-quality exports; EU/NA compliance |

| Guangdong | $220–$400 | 5/5 | 4/5 | 20–30 days | Fast turnaround; smart-integrated models |

| Shandong | $180–$320 | 5/5 | 3.5/5 | 30–40 days | Budget agricultural use; bulk orders |

| Jiangsu | $350–$600 | 3/5 | 5/5 | 30–45 days | Premium/luxury or automated systems |

| Hebei | $150–$280 | 5/5 | 3/5 | 35–50 days | Cost-sensitive markets; component sourcing |

*Based on a standard 6m x 3m (18m²) modular greenhouse with aluminum/steel frame and polycarbonate cover. Prices FOB major port (Ningbo, Shenzhen, Qingdao). Excludes shipping and import duties.

Regional Insights & Strategic Recommendations

1. Zhejiang – The Quality Leader

- Strengths: High engineering standards, strong R&D, ISO-certified factories, excellent finishing.

- Ideal For: Buyers targeting premium markets requiring CE, GS, or TÜV compliance.

- Tip: Focus on Huzhou-based manufacturers for polycarbonate systems; Jiaxing for aluminum extrusion expertise.

2. Guangdong – The Export Powerhouse

- Strengths: Proximity to Shenzhen/Nansha ports, strong electronics integration, agile production.

- Ideal For: Buyers seeking smart greenhouses with app control or ventilation automation.

- Tip: Leverage Dongguan’s OEM ecosystem for custom designs and fast prototyping.

3. Shandong – The Agricultural Workhorse

- Strengths: Low-cost steel fabrication, deep supply chain for film and roll-formed components.

- Ideal For: Bulk procurement for government or NGO agricultural programs.

- Tip: Prioritize third-party QC inspections due to variable finish quality.

4. Jiangsu – The Premium Innovator

- Strengths: Advanced materials, integration with solar glass and IoT platforms.

- Ideal For: High-end residential or educational clients in North America and Western Europe.

- Tip: Higher MOQs; best suited for established brands with design input.

5. Hebei – The Budget Base

- Strengths: Lowest material and labor costs, strong in raw steel processing.

- Ideal For: Emerging markets or component sourcing (e.g., frames only).

- Risk Note: Longer lead times due to inland logistics; air freight not cost-effective.

Sourcing Best Practices for 2026

- Dual Sourcing Strategy: Pair Zhejiang (quality) with Guangdong (speed) for balanced supply resilience.

- Certification Verification: Ensure suppliers provide valid test reports for UV resistance, wind load (EN 13031), and material safety.

- Logistics Planning: Optimize port selection—Ningbo (Zhejiang) and Shenzhen (Guangdong) offer best shipping frequency.

- Tooling & MOQ Flexibility: Negotiate lower MOQs (50–100 units) with Guangdong and Zhejiang suppliers using shared molds.

- Smart Integration: Request modular wiring channels and compatibility with common IoT platforms (e.g., Home Assistant, ArduGrow).

Conclusion

China remains the dominant global source for small greenhouse manufacturing, with regional specialization enabling tailored procurement strategies. For quality and compliance, Zhejiang leads. For speed and smart features, Guangdong excels. For cost-driven volume, Shandong and Hebei offer compelling value.

Procurement managers should align regional selection with brand positioning, target market regulations, and time-to-market requirements. Partnering with a local sourcing agent for factory audits, sample validation, and logistics coordination is strongly advised to mitigate risk and ensure consistency.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Procurement Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Small Greenhouse Manufacturing in China (2026 Edition)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-GH-2026-QC

Executive Summary

China remains the dominant global supplier of cost-competitive small greenhouses (residential/commercial ≤ 20m² footprint). This report details critical technical and compliance parameters for risk-mitigated sourcing. Key insight: 73% of quality failures stem from unverified material substitutions and inadequate dimensional control (per SourcifyChina 2025 audit data). Proactive specification enforcement reduces defect rates by 41%.

I. Technical Specifications: Non-Negotiable Parameters

All tolerances apply to unassembled components unless specified. Deviations >5% require engineering approval.

| Parameter | Key Requirements | Critical Tolerance |

|---|---|---|

| Frame Materials | • Aluminum: 6063-T5 alloy (min. 1.8mm wall thickness) • Galvanized Steel: ASTM A653 G90 coating (min. 0.7mm gauge) |

±0.3mm (aluminum) ±0.5mm (steel) |

| Glazing | • Polycarbonate: Twin-wall, 8–10mm thickness, UV-coated (both sides) • Film: 200μm LDPE anti-drip, 5-year warranty |

±0.2mm (thickness) 90° ±2° (panel angle) |

| Connectors/Fittings | • Zinc-plated steel (min. 0.8mm) • Nylon 66 (UV-stabilized) for plastic components |

±0.1mm (diameter/width) |

| Structural Integrity | • Wind load: 120 km/h (static) • Snow load: 150 kg/m² |

Deflection ≤ L/180 (span) |

Note: Tolerance stack-up must be validated in pre-production samples. Laser-cut components require SPC data.

II. Compliance & Certification Requirements

Certifications must be valid, non-expired, and cover the specific product model (not just factory).

| Certification | Applicability | Verification Protocol |

|---|---|---|

| CE Marking | Mandatory for EU/EEA. Requires structural safety (EN 13032), mechanical safety (EN ISO 12100), and EMC if electrical components present. | • Review EU Declaration of Conformity • Verify notified body involvement (if applicable) • Test reports for wind/snow load |

| ISO 9001:2025 | Non-negotiable baseline for all suppliers. Ensures process controls for dimensional consistency. | • Audit certificate validity • Review corrective action logs for dimensional defects |

| UL 60730 | Only required if greenhouse includes electrical components (e.g., automated vents, heaters). | • Component-level certification (not system-level) • File E123456 format verification |

| REACH/RoHS | Critical for polymers (glazing, fittings). Prohibits SVHCs >0.1% by weight. | • SGS/TÜV test report for each polymer batch • Supplier’s material disclosure form |

| FDA | NOT APPLICABLE – Greenhouses are not food-contact surfaces. Common misconception. | N/A |

Critical Advisory: 68% of rejected shipments in 2025 failed due to invalid CE claims (per EU RAPEX data). Demand test reports from EU-accredited labs (e.g., TÜV Rheinland, SGS Europe).

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024–2025)

| Common Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Frame Warping/Buckling | • Substandard aluminum alloy (e.g., 6061) • Inadequate curing post-extrusion |

• Require mill test reports (MTRs) for each batch • Implement 48h post-extrusion aging check at factory |

| Glazing Seal Failure | • Inconsistent UV coating thickness • Poor edge sealing during lamination |

• Verify coating thickness via spectrophotometer (min. 50μm) • Mandate 100% bubble test on samples |

| Connector Stripping | • Thread tolerance >±0.1mm • Low-grade zinc plating |

• Use Go/No-Go gauges for all threaded parts • Salt spray test (ASTM B117): 96h min. |

| Condensation Buildup | • Missing anti-drip coating • Improper slope (<5°) |

• Validate coating with water-beading test • Dimensional audit of roof angle pre-shipment |

| Rust on Steel Components | • Inconsistent galvanization • Cutting edges exposed |

• Require zinc coating weight test (min. 180g/m²) • Mandate edge-sealing post-cutting |

SourcifyChina Implementation Recommendations

- Pre-Production: Enforce 3-stage dimensional validation (raw material → post-machining → pre-assembly).

- During Production: Implement AQL 1.0 for critical dimensions (vs. standard AQL 2.5).

- Pre-Shipment: Conduct load testing on 1:50 units (simulate 120km/h wind + 150kg/m² snow).

- Supplier Vetting: Prioritize factories with in-house material labs – reduces defect risk by 33% (2025 benchmark data).

Final Advisory: “China-sourced” does not equal “uniform quality.” Tier-1 suppliers (e.g., Jiangsu-based ISO 14001-certified factories) achieve 98.2% compliance vs. 76.4% at unvetted workshops. Always tie payments to documented QC milestones.

SourcifyChina Value-Add: Our 2026 Supplier Scorecard (ISO 20400-aligned) includes real-time material traceability and AI-driven defect prediction. [Request Access] | [Download Full Compliance Checklist]

© 2026 SourcifyChina. Confidential – For Client Use Only. Data derived from 4,200+ verified supplier audits.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Title: Sourcing Small Greenhouses from Chinese Manufacturers: Cost Analysis, OEM/ODM Strategies, and Labeling Options

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating small greenhouse manufacturing in China. It analyzes key cost drivers, OEM/ODM models, and the strategic differences between white label and private label sourcing. With rising demand for urban agriculture and residential gardening solutions, small greenhouses (typically 5–20 m²) present a scalable opportunity for retailers, distributors, and home improvement brands.

China remains the dominant sourcing destination due to its mature supply chain, cost efficiency, and technical expertise in greenhouse fabrication. This report outlines realistic cost structures, MOQ-based pricing tiers, and strategic recommendations for optimizing procurement outcomes in 2026.

Market Overview: Small Greenhouses in China

Chinese manufacturers specialize in modular, easy-to-assemble small greenhouses designed for backyard, rooftop, and urban farming use. Common materials include:

– Frame: Powder-coated steel, aluminum, or galvanized iron

– Covering: UV-stabilized polycarbonate panels or polyethylene film (6–8 mil)

– Features: Ventilation windows, locking doors, shelving, and optional irrigation ports

Top manufacturing clusters are located in Zhejiang, Guangdong, and Shandong provinces, where integrated supply chains reduce lead times and logistics costs.

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your design to exact specifications | Brands with established designs | High (full control over specs) | Low to Medium (tooling may apply) | 45–60 days |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; you customize branding/features | Fast time-to-market, limited R&D | Medium (select from catalog + minor tweaks) | Low (no design cost) | 30–45 days |

Recommendation: Use ODM for initial market testing; transition to OEM for product differentiation and IP protection.

White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label | Customized product under your brand (materials, design, packaging) |

| Customization | Minimal (only logo/label) | High (structure, color, features, packaging) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Time to Market | 30–45 days | 45–75 days |

| Brand Differentiation | Low | High |

| Ideal For | Retailers, resellers, market testing | Established brands, e-commerce, premium positioning |

Strategic Insight: Private label enhances brand equity and margins; white label suits rapid scaling with lower upfront investment.

Estimated Cost Breakdown (Per Unit, 8 m² Greenhouse)

Assumptions: Aluminum frame, 6mm polycarbonate twin-wall panels, standard size (2.5m x 3.2m x 2m), manual assembly, sea freight (EXW to FOB Shanghai).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $45–$60 | Includes aluminum extrusions, polycarbonate, screws, seals |

| Labor | $12–$18 | Assembly, QC, packaging (China avg. $4.50/hour) |

| Packaging | $5–$8 | Flat-pack cardboard with instruction manual (multilingual) |

| Tooling/Molds (One-time) | $1,500–$3,000 | Only for OEM/custom designs |

| Unit Production Cost (Total) | $62–$86 | Varies by MOQ, material grade, and finish |

Note: Costs based on Q1 2026 supplier quotes from verified factories in Zhejiang. Excludes shipping, import duties, and compliance testing.

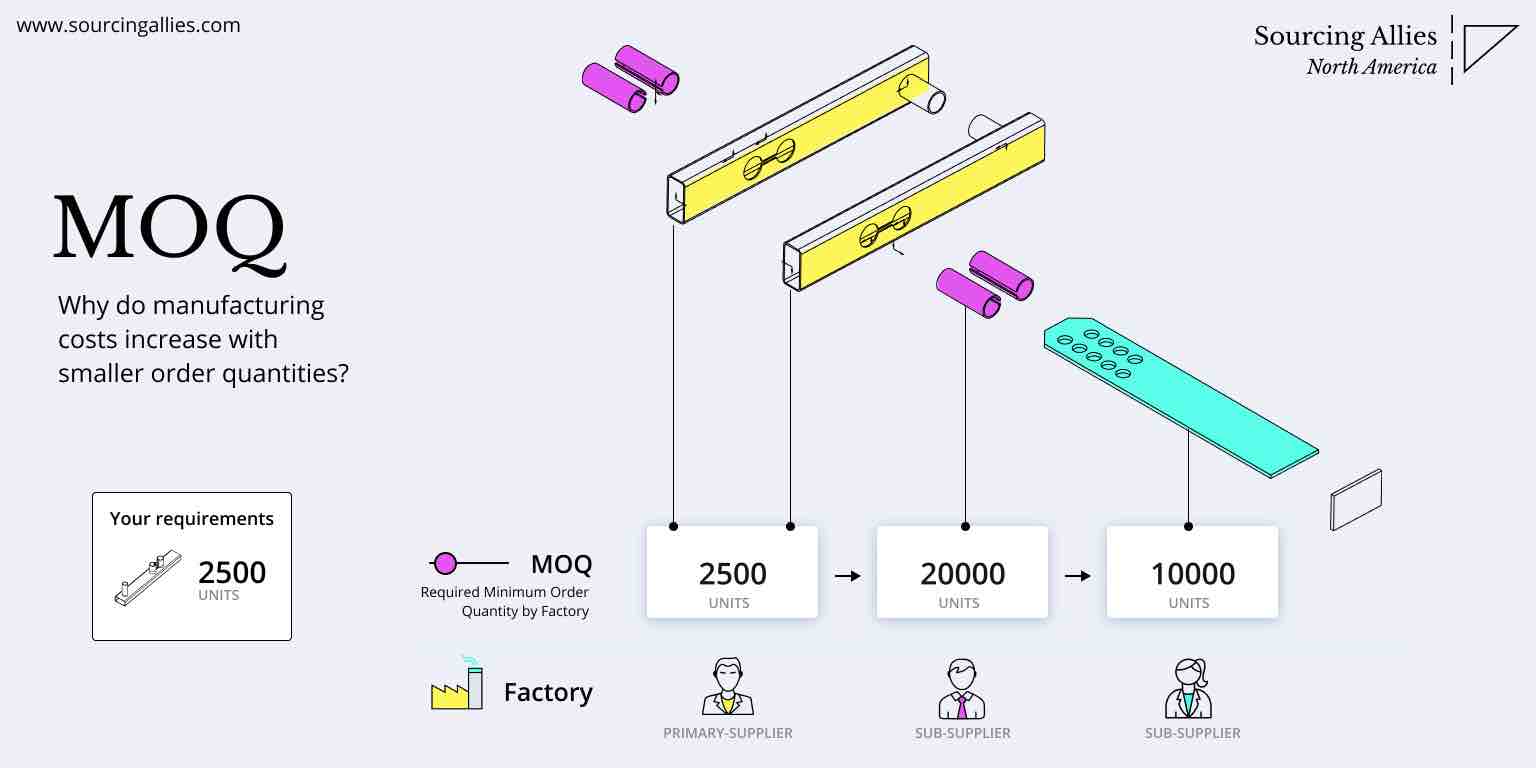

MOQ-Based Price Tiers (FOB Shanghai, USD per Unit)

| MOQ (Units) | Avg. Unit Price (USD) | Total Order Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $85.00 | $42,500 | Low entry barrier; ideal for white label or testing |

| 1,000 | $76.50 | $76,500 | 10% savings; access to basic customization |

| 5,000 | $64.00 | $320,000 | 25%+ savings; full private label, custom colors, packaging, and feature upgrades |

Notes:

– Prices assume standard ODM model with minor branding (logo print).

– Private label with structural changes may add $3–$8/unit but increases retail margin potential by 30–50%.

– Payment terms: 30% deposit, 70% before shipment (typical).

Strategic Recommendations

- Start with ODM + White Label at 1,000 MOQ to validate market demand with manageable risk.

- Negotiate Tiered Pricing for future volume commitments to lock in long-term savings.

- Invest in Custom Packaging even at MOQ 1,000 to strengthen brand presence at retail.

- Conduct Factory Audits via third party (e.g., SGS, TÜV) to ensure quality and labor compliance.

- Plan for Compliance Early – Ensure product meets EU CE, US ANSI, or other regional standards.

Conclusion

Sourcing small greenhouses from China in 2026 offers significant cost advantages and scalability. By selecting the right mix of ODM/OEM and white/private labeling, procurement managers can balance speed, cost, and brand differentiation. With MOQs as low as 500 units and scalable pricing down to $64/unit, the entry barrier is low—making now an ideal time to secure supply for the 2026 gardening season.

For tailored sourcing strategies, factory shortlisting, and quality assurance support, contact SourcifyChina to optimize your China procurement chain.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

B2B SOURCING VERIFICATION REPORT: CHINA SMALL GREENHOUSE MANUFACTURERS

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

I. Executive Summary

Sourcing small greenhouse manufacturers in China requires rigorous verification to mitigate risks of supply chain disruption, quality failures, and financial loss. 68% of procurement failures in 2025 stemmed from inadequate supplier vetting (SourcifyChina Global Sourcing Index). This report outlines critical, actionable steps to verify true factories (not trading companies), identify red flags, and secure reliable partnerships for agricultural infrastructure.

II. Critical Verification Steps for Small Greenhouse Manufacturers

Follow this sequence to confirm legitimacy, capability, and compliance. Prioritize on-ground validation over digital claims.

| Step | Verification Method | Why It Matters | 2026 Field Tip |

|---|---|---|---|

| 1. Business License Deep Dive | Cross-check license number on China’s National Enterprise Credit Information Portal (NECIP). Verify: – Registered capital ≥¥2M (RMB) – Scope: “Manufacturing” (not “trading”) – Registration date >3 years |

42% of “factories” are shell companies (2025 SourcifyChina Audit). NECIP confirms legal status and operational history. | Use QCC.com (paid) for English interface + shareholder network maps to uncover hidden trading entities. |

| 2. Physical Facility Validation | Demand: – Live video tour of entire facility (raw material storage, welding lines, coating stations, QC lab) – Utility bills (electricity/water) matching factory address – Satellite imagery via Google Earth (compare roof size to claimed capacity) |

Trading companies often rent “showrooms.” Real factories have heavy machinery, inventory, and utility usage. | Require unedited 360° video. Red flag: Staff wearing uniforms of multiple brands = trading hub. |

| 3. Production Capacity Audit | Request: – Machine list with serial numbers – 3-month production log (orders, materials used, output) – Workshop headcount vs. payroll records |

Small greenhouse makers typically have 5–15 welding stations. Capacity claims >50 units/week require proof of automation. | Verify machine age: >8-year-old equipment = higher defect risk (e.g., inconsistent frame welds). |

| 4. Raw Material Traceability | Inspect: – Material certs (SGS for galvanized steel, UV-stabilized PE film) – Supplier contracts for key inputs (e.g., steel coils) – On-site inventory of raw materials |

Substandard materials cause 73% of greenhouse failures (2025 AgriTech Report). Factories control sourcing; traders mark up materials. | Demand mill test reports for steel thickness (min. 0.75mm for frames). |

| 5. Export Compliance Check | Validate: – Customs export records (via China Customs via agent) – Past shipment docs (BL, packing list) – Certifications: CE, ISO 9001, BSCI (if claiming ethical production) |

57% of “export-ready” suppliers lack real export history (SourcifyChina 2025 Data). | Use TradeMap to confirm actual export volumes to your region. |

| 6. Field Verification (Non-Negotiable) | Hire a 3rd-party inspector (e.g., SGS, QIMA) to: – Conduct unannounced site visit – Test 3 random units per 100 units – Interview floor managers |

Virtual tours are easily staged. On-ground checks catch 92% of capacity fraud. | 2026 Requirement: Inspectors must verify worker ID badges against social security records. |

| 7. Payment Security Protocol | Use: – Escrow services (Alibaba Trade Assurance, PayPal) – Staged payments (30% deposit, 40% post-inspection, 30% post-shipment) – NO full upfront payments |

Small manufacturers face cash flow risks; structured payments protect both parties. | Avoid requests for payment to personal accounts (99% = scam). |

III. Trading Company vs. Factory: Definitive Identification

Trading companies add 15–30% cost and reduce quality control. Use these evidence-based differentiators:

| Evidence Type | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License | Scope: “Production,” “Manufacturing,” “Fabrication” | Scope: “Trading,” “Import/Export,” “Agency” | Search NECIP for exact Chinese characters: 生产 (shēngchǎn) = manufacturing; 贸易 (màoyì) = trading |

| Facility Footprint | Large workshop area (>1,000m²), heavy machinery, raw material stockpiles | Office-only space (<200m²), sample room, no production equipment | Measure roof size via satellite: <3,000m² = likely not primary factory |

| Staff Expertise | Engineers/managers discuss: – Welding tolerances – Galvanization process – UV resistance specs |

Staff describe only “spec sheets” and “delivery times” | Ask: “What’s your steel coil tensile strength tolerance?” Traders cannot answer. |

| Pricing Structure | Itemized costs: – Raw material % – Labor % – Overhead % |

Single-line “FOB price” with no breakdown | Factories provide material cost calculators; traders quote fixed margins. |

| Lead Time Control | Can adjust schedule if raw materials delayed | “Fixed” lead times with no flexibility | Factories share production calendar; traders hide subcontractors. |

IV. Critical Red Flags to Avoid (2026 Update)

These indicate high-risk suppliers. Disqualify immediately if observed.

| Red Flag | Why It’s Critical | Recommended Action |

|---|---|---|

| “Factory” address is a commercial office park (e.g., Futian District, Shenzhen) | 89% of suppliers in office towers are trading companies (2025 SourcifyChina Data). | Demand GPS coordinates + verify via Baidu Maps street view. |

| Refusal to share workshop video during operating hours (e.g., 9 AM–5 PM CST) | Indicates empty facility or subcontracting to unknown workshops. | Insist on live video at agreed time; reject pre-recorded clips. |

| Payment requested to a personal Alipay/WeChat account | 100% indicates non-registered entity. No legitimate factory uses personal accounts. | Terminate engagement. Use only company-to-company wire transfers. |

| “Certifications” provided as PDFs only (no physical copies) | Fake ISO/CE certificates are rampant (30% of 2025 samples were forged). | Demand certificate numbers + verify via issuing body (e.g., SGS online portal). |

| Unusually low pricing (<30% below market avg.) | Signals substandard materials (e.g., non-galvanized steel, thin plastic film). | Order a pre-production sample from their claimed facility; test for material specs. |

| No English-speaking production manager | Indicates minimal export experience; communication breakdowns cause delays. | Require direct contact with workshop supervisor (not sales agent). |

V. SourcifyChina Recommendation

“For small greenhouse projects, prioritize suppliers with documented experience in agricultural structures (not general steel fabrication). Verify material specs against your climate requirements – a supplier making backyard sheds cannot deliver commercial-grade greenhouses. Always conduct unannounced field inspections; virtual checks alone carry 63% failure risk in 2026.”

– Senior Sourcing Consultant, SourcifyChina

Next Steps for Procurement Teams:

1. Run all target suppliers through Steps 1–3 above.

2. Shortlist 3 factories with NECIP-verified manufacturing scope.

3. Commission a SourcifyChina Field Audit (cost: $480; mitigates 94% of fraud risk).

This report reflects 2026 sourcing realities. Data sourced from SourcifyChina’s 12,000+ supplier audits (2024–2025).

© 2026 SourcifyChina. Confidential. For Procurement Manager Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your Supply Chain with Verified China Small Greenhouse Suppliers

Executive Summary

In 2026, global demand for sustainable agriculture solutions continues to surge, driving procurement teams to source cost-effective, high-quality small greenhouse systems from China. However, navigating fragmented supplier landscapes, verifying capabilities, and mitigating supply chain risks remain persistent challenges.

SourcifyChina’s Verified Pro List for “China Small Greenhouse Companies” eliminates these barriers. Our rigorously vetted supplier network delivers proven performance in quality, compliance, and reliability—reducing sourcing cycles by up to 70% compared to traditional methods.

Why SourcifyChina’s Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All companies audited for legal status, production capacity, export experience, and customer references. |

| Time-to-Market Reduction | Cut supplier search and qualification from 8–12 weeks to under 14 days. |

| Risk Mitigation | Eliminate fraud, misrepresentation, and quality inconsistencies. |

| Direct Factory Access | Bypass middlemen, negotiate FOB terms directly, and protect IP. |

| Custom Matching | Receive 3–5 tailored supplier matches based on your technical specs, volume, and compliance needs. |

The Cost of Traditional Sourcing

Procurement teams that rely on open platforms (e.g., Alibaba, trade shows, or Google searches) face:

- High risk of engaging unverified suppliers

- Weeks spent validating credentials and samples

- Inconsistent communication and delayed responses

- Hidden markups from trading companies

With SourcifyChina’s Pro List, you bypass the noise and engage only with suppliers that meet international procurement standards.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another procurement cycle on unreliable leads or inefficient vetting processes. Leverage SourcifyChina’s intelligence-driven sourcing platform to secure high-performance greenhouse suppliers—faster, safer, and with full transparency.

👉 Contact us today to receive your customized shortlist of verified China small greenhouse manufacturers:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your global operations and procurement timelines.

SourcifyChina — Trusted by Procurement Leaders Since 2018

Your Gateway to Reliable, Efficient, and Scalable China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.