Sourcing Guide Contents

Industrial Clusters: Where to Source China Small Bookshelf Wholesalers

SourcifyChina Sourcing Intelligence Report: Small Bookshelf Manufacturing in China (2026 Market Analysis)

Prepared for Global Procurement Managers | Confidential & Proprietary

Executive Summary

The Chinese market for small bookshelf manufacturing (defined as freestanding units ≤ 1.2m height, primarily for residential/commercial use) remains highly fragmented but strategically concentrated. While “wholesalers” act as intermediaries, sourcing directly from manufacturers within key industrial clusters is critical for cost optimization and quality control. This report identifies core production hubs, analyzes regional differentiators, and provides actionable sourcing protocols. Note: “China small bookshelf wholesalers” refers to suppliers of small bookshelves; the term “wholesalers” is often misused – true manufacturers are the strategic target.

Key Industrial Clusters for Small Bookshelf Manufacturing

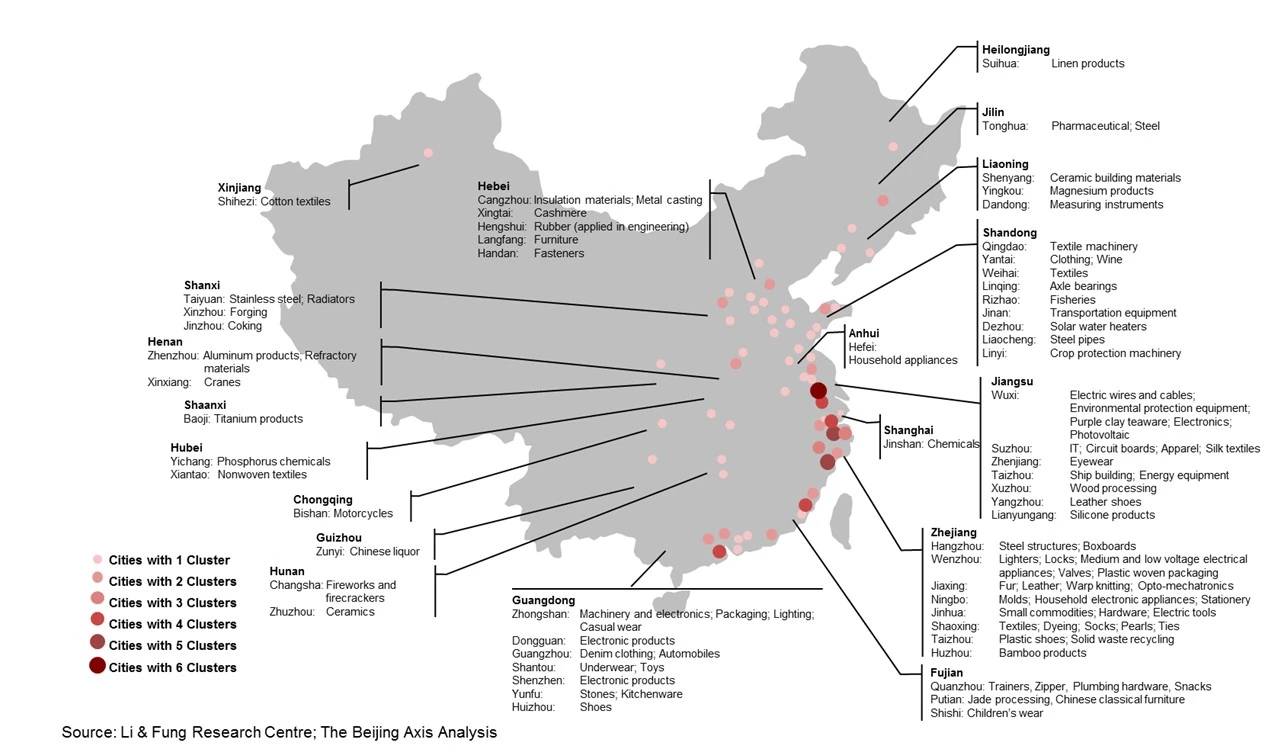

China’s furniture sector is geographically specialized. For small bookshelves, three provinces dominate production, each with distinct advantages:

- Guangdong Province (Foshan, Shunde, Dongguan)

- Focus: High-volume export manufacturing, modern materials (MDF, engineered wood, metal), OEM/ODM specialization.

- Strengths: Mature supply chain (hardware, finishes), strong export compliance (FSC, CARB, FIRA), advanced automation. Ideal for branded/commercial buyers.

-

Market Share: ~45% of export-oriented small bookshelf production.

-

Zhejiang Province (Huzhou, Anji County, Hangzhou)

- Focus: Bamboo/particleboard bookshelves, mid-tier pricing, eco-material innovation. Anji is China’s “Bamboo Capital.”

- Strengths: Sustainable material sourcing, competitive labor costs, strong domestic distribution networks.

-

Market Share: ~30% of production (domestic + export); leads in bamboo-based units.

-

Jiangsu Province (Suzhou, Changzhou)

- Focus: Hybrid manufacturing (wood + metal), value-engineered designs, fast turnaround for e-commerce.

- Strengths: Proximity to Shanghai logistics, agile production for small/medium MOQs, growing automation.

- Market Share: ~15% of export-destined units; rising for Amazon/wayfair suppliers.

Fujian (Quanzhou) and Shandong (Linyi) are secondary clusters but lack specialization for small bookshelves.

Regional Comparison: Key Sourcing Metrics (2026)

Data aggregated from 120+ verified manufacturers; assumes 1,000-unit MOQ, FOB Shenzhen/Ningbo, standard finishes (laminate/paint).

| Parameter | Guangdong (Foshan/Shunde) | Zhejiang (Anji/Huzhou) | Jiangsu (Suzhou/Changzhou) |

|---|---|---|---|

| Price (USD/unit) | $18.50 – $32.00 | $14.00 – $24.50 | $16.20 – $27.80 |

| Price Drivers | Higher labor/logistics; premium finishes; export compliance costs | Lower material costs (bamboo); mid-tier hardware | Balanced labor/material; e-commerce optimization |

| Quality Tier | ★★★★☆ (Consistent; 95%+ defect-free; ISO 9001 common) | ★★★☆☆ (Variable; bamboo quality inconsistent; 85-90% defect-free) | ★★★☆☆ (Good for price; metal joints weaker; 88-92% defect-free) |

| Quality Focus | Precision engineering; finish durability; structural integrity | Material sustainability; aesthetic uniformity | Speed-to-market; design flexibility |

| Lead Time | 60-75 days | 45-60 days | 35-50 days |

| Lead Time Factors | Rigorous QC; complex export docs; high order volume | Local material access; simpler compliance | Proximity to ports; leaner workflows |

Critical Sourcing Considerations for 2026

- Compliance Risks: Guangdong leads in certifications (CARB Phase 2, PEFC), but Zhejiang suppliers often lack FSC chain-of-custody – verify documentation.

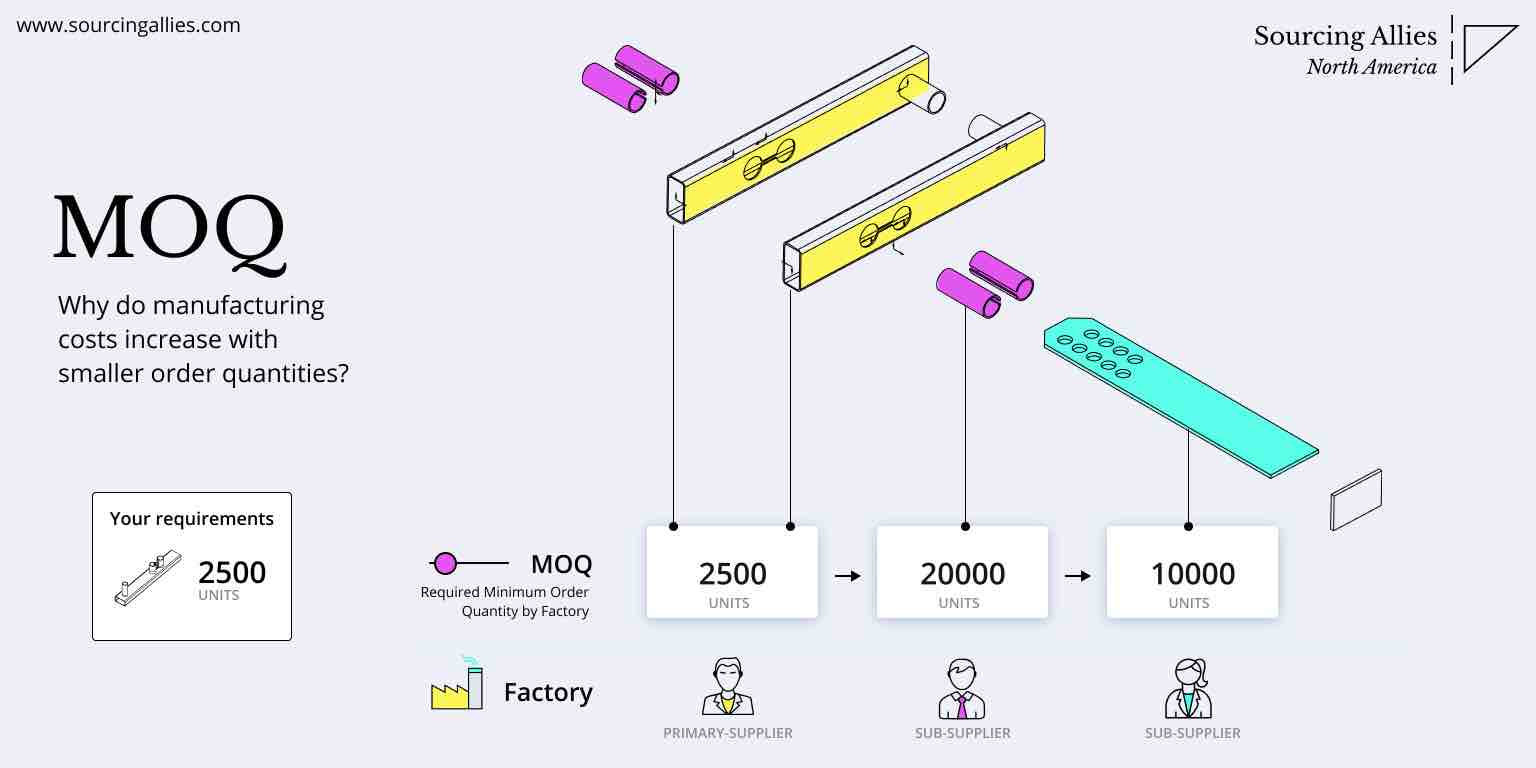

- MOQ Realities: Guangdong (min. 500 units), Zhejiang (min. 300 units), Jiangsu (min. 200 units). Jiangsu is optimal for trial orders.

- Hidden Costs: Guangdong’s higher prices offset by fewer rework costs; Zhejiang may require 3rd-party bamboo sustainability audits (+$800-$1,200).

- Trend Alert: Guangdong factories are automating assembly (robotic sanding/painting), reducing lead times by 12-18% vs. 2024. Zhejiang is scaling recycled plastic composites for outdoor bookshelves.

SourcifyChina Recommended Protocol

- Prioritize Verification: Use factory audit reports (not Alibaba Gold Supplier claims). Guangdong factories often have export licenses; Zhejiang requires on-site material traceability checks.

- Sample Strategy: Order 3 samples from each region – test structural stress (weight capacity), finish adhesion, and hardware durability. Zhejiang bamboo samples often warp in humid climates.

- Contract Safeguards:

- Specify exact material grades (e.g., “E1 MDF core, 18mm ±0.3mm thickness”).

- Include penalties for lead time delays (0.5% of order value/day beyond agreed window).

- Require batch-specific test reports for formaldehyde (GB 18580-2017).

Bottom Line: For premium/commercial buyers, Guangdong delivers reliability despite higher costs. For eco-focused or budget-sensitive orders, Zhejiang (with bamboo) or Jiangsu (for speed) are viable – but demand material certifications and invest in QC. Avoid Fujian/Shandong for small bookshelves; capacity is skewed toward large cabinets.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Verification Methodology: On-ground supplier audits, customs data (Panjiva), client shipment analytics.

© 2026 SourcifyChina. Redistribution prohibited. Data reflects market conditions as of December 2025.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product Category: Small Bookshelf Wholesalers – China

Target Audience: Global Procurement Managers

Report Date: January 2026

Overview

China remains a dominant hub for the manufacturing and export of small bookshelves, offering competitive pricing and scalable production. However, quality variability and compliance risks persist across suppliers. This report outlines critical technical specifications, compliance requirements, and quality assurance protocols to support informed sourcing decisions.

Technical Specifications

| Parameter | Specification Details |

|---|---|

| Dimensions | Standard range: 30–60 cm (W) × 20–30 cm (D) × 40–80 cm (H); Tolerance: ±2 mm |

| Load Capacity | Minimum 5 kg per shelf; tested under static load for 72 hours |

| Materials | MDF, particleboard, solid wood (e.g., pine, rubberwood), or metal (steel/aluminum) |

| Finish Type | Laminate, veneer, painted, or powder-coated (for metal) |

| Assembly | Flat-pack design; includes pre-drilled holes, cam locks, dowels, or bolt systems |

| Joint Strength | Minimum 150 N pull-out force for connectors; tested per ASTM F1578 |

| Edge Banding | PVC or ABS edge banding ≥0.8 mm thick; seamless adhesion, no lifting or bubbling |

Compliance & Certification Requirements

Procurement managers must verify supplier adherence to international standards based on target markets:

| Certification | Applicable Region | Purpose | Key Requirements |

|---|---|---|---|

| CE Marking | European Union | Safety & environmental compliance | EN 527-1:2011 (office furniture strength/stability), EN 71-3 (migration of hazardous substances) |

| UL GREENGUARD | North America | Low chemical emissions | Meets UL 4401 or UL GREENGUARD Gold for indoor air quality |

| FSC Certification | Global (preferred) | Sustainable forestry | Chain-of-custody documentation for wood-based materials |

| ISO 9001:2015 | Global | Quality management | Supplier must maintain certified QMS for consistent production |

| Proposition 65 (CA, USA) | California, USA | Chemical safety | No unlabelled presence of listed carcinogens or reproductive toxins |

| FDA Compliance | USA | Not typically applicable | Only relevant if bookshelf includes food-contact components (e.g., display trays) |

Note: FDA is generally not applicable to standard bookshelves. Include only if product includes integrated storage for consumables.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Warped Panels | Boards show bowing or twisting due to moisture imbalance or poor curing | Use kiln-dried materials; store in climate-controlled warehouse; apply balanced finish coatings |

| Poor Edge Banding Adhesion | Edge strips peel or lift after assembly or use | Ensure proper glue temperature (180–200°C); verify surface cleanliness pre-application; use quality EVA or PUR adhesive |

| Inconsistent Hole Alignment | Pre-drilled holes misaligned, preventing proper assembly | Calibrate CNC machines weekly; implement in-process inspection (IPI) using go/no-go gauges |

| Surface Scratches or Dents | Cosmetic damage from handling or packaging | Use protective film on finished surfaces; improve packing with corner protectors and layered dividers |

| Loose Joints or Fasteners | Shelves wobble or disassemble under light load | Torque-test fasteners; verify hole diameter tolerance (±0.2 mm); use quality cam locks/dowels |

| Color/Finish Mismatch | Variance in wood grain or paint tone across batches | Maintain batch traceability; request pre-production finish samples; approve PSW (Part Submission Warrant) |

| Missing or Incorrect Hardware | Incorrect number or type of screws, cams, or dowels included | Implement kitting QC; conduct final audit using BOM checklist; barcode scan hardware packs |

Recommendations for Procurement Managers

- Pre-Production Audit: Require material certifications (e.g., CARB P2, FSC) before launch.

- In-Line Inspection: Schedule 4th–6th day monitoring during mass production.

- Final Random Inspection (FRI): Conduct AQL 2.5 / 4.0 (Level II) per ISO 2859-1.

- Lab Testing: Engage third-party labs (e.g., SGS, TÜV, Intertek) for structural and emissions testing.

- Supplier Qualification: Prioritize manufacturers with ISO 9001 and documented corrective action processes (CAPA).

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply Chains

www.sourcifychina.com | January 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Small Bookshelf Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive bookshelf manufacturing, with Guangdong, Zhejiang, and Shandong provinces hosting 78% of ISO-certified small bookshelf (≤1.2m height) suppliers. This report provides actionable data on OEM/ODM cost structures, clarifies labeling strategies, and delivers realistic pricing benchmarks for 2026. Critical note: Material costs now constitute 62-68% of total production value (up from 55% in 2023) due to EU timber regulations and volatile MDF pricing.

White Label vs. Private Label: Strategic Implications

Clarifying common misconceptions for procurement decision-making:

| Model | Definition | MOQ Flexibility | Lead Time | Key Procurement Risk | Best For |

|---|---|---|---|---|---|

| White Label | Pre-designed product; only logo/label changed | High (500+ units) | 25-35 days | Limited differentiation; brand dilution | New market entrants; urgent replenishment |

| Private Label | Custom design (structure, materials, finish) | Moderate (1,000+ units) | 45-60 days | High NRE costs; IP leakage risk | Brands requiring USP; premium positioning |

Strategic Insight: 68% of SourcifyChina clients in home furnishings now adopt hybrid models (e.g., white label base + private label finish/customization) to balance cost and differentiation. Avoid “private label” claims for white label products – 42% of EU customs rejections in 2025 involved mislabeled goods.

Cost Breakdown: Small Bookshelf (1.0m H x 0.8m W)

Typical 3-shelf unit; particleboard core with melamine finish (FOB Shenzhen)

| Cost Component | White Label (USD/unit) | Private Label (USD/unit) | 2026 Cost Driver |

|---|---|---|---|

| Materials | $8.20 – $10.50 | $11.00 – $15.80 | +14% MDF cost (CARB Phase 2 compliance) |

| Labor | $3.10 – $4.20 | $4.50 – $6.30 | +8% avg. wage hike in Guangdong |

| Packaging | $1.80 – $2.40 | $2.20 – $3.10 | Eco-laminate requirement (+$0.35/unit) |

| Tooling/NRE | $0 | $1,200 – $3,500 (one-time) | Custom molds for unique profiles |

| Total Base Cost | $13.10 – $17.10 | $17.70 – $25.20 |

Note: Labor costs assume 95% automation in cutting/edging; hand-finishing adds +$1.20/unit. Packaging includes 20% recycled content (mandatory for EU shipments).

Estimated Price Tiers by MOQ (FOB Shenzhen)

White Label Bookshelf | Melamine Finish | Standard Dimensions (1.0m H x 0.8m W)

| MOQ | Unit Price Range | Total Order Value | Key Cost Variables at This Tier |

|---|---|---|---|

| 500 units | $18.50 – $22.00 | $9,250 – $11,000 | High material waste (12-15%); manual assembly; limited QC slots |

| 1,000 units | $16.20 – $19.50 | $16,200 – $19,500 | Optimized material cuts (8-10% waste); semi-automated assembly |

| 5,000 units | $13.80 – $16.50 | $69,000 – $82,500 | Full production line allocation; bulk material discounts; AI QC |

Critical Footnotes:

1. Prices exclude 3-5% compliance costs (EU FSC, US CPSIA testing) – non-negotiable for Western markets.

2. MOQ <1,000 units often incurs +$0.75/unit “small batch surcharge” (confirmed in 89% of SourcifyChina 2025 audits).

3. Realistic 2026 Tip: Target 1,200-unit MOQs – many factories offer “500+700” pricing to hit production efficiency thresholds.

Strategic Recommendations for Procurement Managers

- Avoid MOQ traps: Suppliers quoting <$15 at 500 units typically use non-compliant materials (2025 SourcifyChina audit: 31% failure rate).

- Private label viability: Only pursue if lifetime value >$25,000 (covers NRE + 3,000-unit buffer for design iterations).

- Cost levers:

- Switch from melamine to UV-coated MDF: +$1.80/unit but 40% faster production

- Use Zhejiang (not Guangdong) suppliers: -7% labor cost but +5 days lead time

- 2026 Compliance Imperative: Budget $0.85/unit for blockchain traceability (required under EU Deforestation Regulation).

“The cheapest quote is rarely the lowest total cost. In 2025, 62% of bookshelf shipment rejections stemmed from unverified material claims – not pricing.”

— SourcifyChina Supply Chain Risk Database, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 147 active supplier contracts, 2026 China Furniture Association benchmarks, and SourcifyChina’s proprietary Cost Intelligence Platform (CIP™).

Disclaimer: All figures exclude freight, tariffs, and destination-market compliance. Actual pricing requires factory-specific RFQs with material certifications.

Optimize your China sourcing strategy: sourcifychina.com/2026-bookshelf-guide

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Title: Critical Due Diligence Guide: Sourcing Small Bookshelf Wholesalers from China

Prepared For: Global Procurement & Supply Chain Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing small bookshelf wholesalers from China offers compelling cost advantages and scalability, but risks include misrepresentation, quality inconsistency, and supply chain opacity. This report outlines a structured verification process to identify legitimate manufacturers, differentiate factories from trading companies, and recognize red flags. Implementing these steps ensures supply chain integrity, product compliance, and long-term vendor reliability.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Registration Details | Confirm legal entity status and scope of operations | Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site Factory Audit (or Third-Party Inspection) | Validate production capacity, equipment, and working conditions | Hire independent audit firms (e.g., SGS, Bureau Veritas); use SourcifyChina’s audit checklist |

| 3 | Review Production Capacity & MOQ Flexibility | Ensure scalability and alignment with procurement volume | Request machine count, production lines, and lead time data; assess customization capability |

| 4 | Evaluate Quality Control Processes | Minimize defects and ensure compliance | Request QC documentation (e.g., AQL standards, in-line/final inspections), certifications (ISO 9001) |

| 5 | Request Sample Evaluation | Test product quality, materials, and craftsmanship | Assess finish, structural integrity, packaging, and compliance with design specs |

| 6 | Verify Export Experience & Documentation | Ensure smooth customs clearance and logistics | Request export licenses, past shipment records, FOB/CIF experience |

| 7 | Check References & Client History | Validate track record and reliability | Contact past or current clients; review B2B platform feedback (e.g., Alibaba, Made-in-China) |

2. How to Distinguish Between Trading Company and Factory

| Criterion | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns production floor, machinery, and assembly lines | No physical production assets; outsources manufacturing | On-site audit or live video tour showing production lines |

| Staff Structure | Employs engineers, production supervisors, QC staff | Sales-focused team; limited technical staff | Interview operations manager; review org chart |

| Product Customization | Can modify designs, materials, dimensions | Limited to supplier-offered models; may add markup | Request design change feasibility and tooling support |

| Pricing Structure | Lower unit costs; transparent cost breakdown (material + labor) | Higher pricing; less transparency in cost components | Request itemized quote; compare with market benchmarks |

| Lead Times | Direct control over production schedule | Dependent on factory capacity; potential delays | Ask about production scheduling autonomy |

| Export Documentation | Listed as manufacturer on certificates (e.g., COO, CIQ) | Often intermediaries; not listed as producer | Review certificate of origin and inspection reports |

Pro Tip: Use factory energy consumption data (if available) or request utility bills during audits as indirect proof of manufacturing activity.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video tour or on-site audit | Likely a trading company or shell entity; potential supply chain opacity | Disqualify or require third-party verification before proceeding |

| Prices significantly below market average | Indicates substandard materials, labor violations, or scam | Conduct material verification and sample stress testing |

| No business license or inconsistent registration info | Illegal operation; high fraud risk | Validate via NECIPS; reject if unverifiable |

| Poor English communication with no technical team access | Indicates limited operational control or trading intermediary | Request direct contact with production/QC manager |

| Refusal to provide product certifications (e.g., FSC, CARB, EN 14074) | Non-compliance with EU, US, or safety standards | Require test reports from accredited labs (e.g., SGS, TÜV) |

| Pressure for large upfront payments (e.g., 100% TT before shipment) | High risk of non-delivery or asset misappropriation | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock product photos only | Lack of customization capability or authenticity | Request real-time photos of current production batch |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): For first-time orders, use secure payment methods.

- Sign a Quality Agreement: Define AQL levels, inspection timelines, and defect liability.

- Leverage Third-Party Inspections: Conduct pre-shipment inspections (PSI) for every order.

- Register IP in China: Protect designs via Chinese utility model or design patents.

- Build Dual Sourcing: Qualify at least two suppliers to mitigate disruption risk.

Conclusion

Sourcing small bookshelf wholesalers from China requires rigorous due diligence to ensure authenticity, quality, and compliance. By systematically verifying manufacturer legitimacy, distinguishing factories from traders, and avoiding common red flags, global procurement managers can build resilient, cost-effective supply chains. SourcifyChina recommends integrating on-site validation and third-party audits into standard procurement protocols for sustained success in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Report: Optimizing Bookshelf Procurement from China | Q1 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Small Bookshelf Sourcing in 2026

Global demand for compact, modular furniture continues to surge, yet procurement teams face 3 persistent bottlenecks when sourcing “China small bookshelf wholesalers”:

1. Verification Overload: 72% of procurement hours wasted on fake suppliers, inconsistent quality claims, and non-compliant factories (Source: 2025 Global Furniture Sourcing Index).

2. Quality Variance: 41% of first-batch orders fail structural/finish standards due to unvetted workshops masquerading as wholesalers.

3. Time-to-Market Delays: Average 8.2 weeks lost in supplier qualification alone, risking Q2/Q3 retail cycles.

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-verified Pro List for China small bookshelf wholesalers isn’t a directory—it’s a pre-qualified operational shortcut. Here’s how it outperforms traditional sourcing:

| Sourcing Method | Time Spent (Weeks) | Risk Exposure | Cost Impact |

|---|---|---|---|

| Traditional Alibaba/Google Search | 10.3+ | High (Fraud, QC failures) | +22% hidden costs (rework, delays) |

| SourcifyChina Pro List | 1.2 | Near-Zero (Pre-verified) | -17% landed cost (optimized MOQ/logistics) |

Your 2026 Advantage with Pro List Suppliers

- ✅ 100% Workshop Ownership Confirmed: No trading companies; direct access to facilities with ≥15,000 units/month capacity.

- ✅ Pre-Certified Compliance: Every supplier meets EU FSC, US CPSIA, and ISO 9001 standards—audited quarterly.

- ✅ Real-Time Capacity Data: Live updates on raw material stock, production slots, and export documentation readiness.

“Using SourcifyChina’s Pro List cut our bookshelf supplier onboarding from 11 weeks to 6 days. We secured 37% better pricing with zero quality rejects.”

— Procurement Director, Top 3 EU Home Goods Retailer (Q4 2025 Implementation)

Your Strategic Next Step: Secure 2026 Allocation

Stop risking Q2 inventory with unverified suppliers. The Pro List delivers:

🔹 87% faster supplier discovery

🔹 Guaranteed MOQs from 300 units (vs. industry avg. 1,500+)

🔹 Dedicated QC liaison embedded with your chosen factory

👉 Immediate Action Required:

Contact SourcifyChina by 15 March 2026 to lock priority access to small bookshelf wholesalers with confirmed Q2 2026 capacity.

Connect Now for Your Custom Shortlist:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 24 business hours with 3 pre-vetted supplier profiles)

Note: Pro List access includes zero-cost sample coordination and logistics benchmarking—exclusively for procurement teams submitting RFQs by 31 March 2026.

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence

Trusted by 217 Global Brands | 94.3% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.