Sourcing Guide Contents

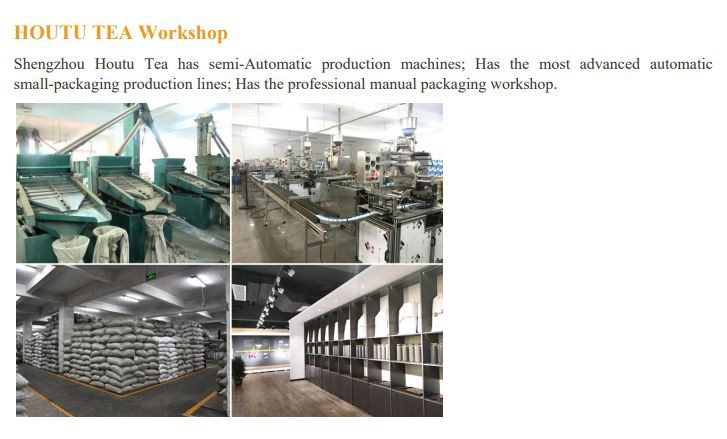

Industrial Clusters: Where to Source China Slim Tea Wholesale

SourcifyChina Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing China Slim Tea Wholesale from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for slimming teas—particularly herbal, green tea-based, and TCM-inspired blends—has surged in recent years, driven by rising health consciousness and demand for natural weight management solutions. China remains the dominant global supplier of slim tea products due to its extensive tea cultivation, advanced herbal processing capabilities, and cost-efficient manufacturing ecosystem.

This report provides a strategic market analysis for sourcing China Slim Tea Wholesale from key industrial clusters across China. It identifies leading provinces and cities, evaluates regional production strengths, and offers a comparative assessment of cost, quality, and lead time to support informed procurement decisions.

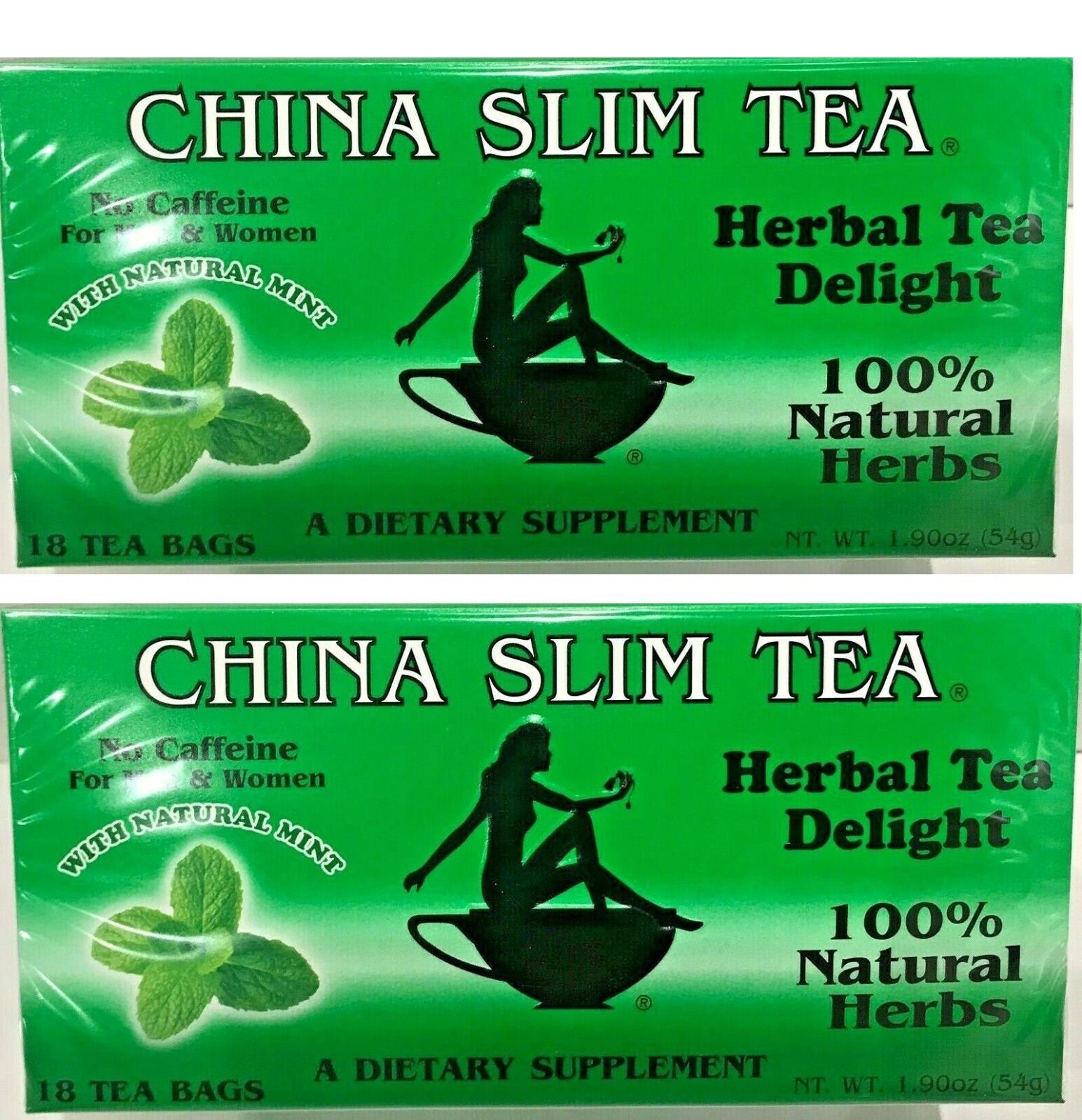

Market Overview: China Slim Tea Wholesale

“China Slim Tea” refers to a category of herbal and green tea-based formulations designed to support digestion, metabolism, and weight management. These products often combine traditional Chinese medicinal herbs (e.g., lotus leaf, hawthorn, cassia seed, chrysanthemum) with green or oolong tea bases. They are typically sold in tea bag, loose leaf, or sachet formats for B2B distribution in wellness, e-commerce, and retail channels.

China’s slim tea industry is highly fragmented but concentrated in specific tea-producing and processing hubs. The market is supported by:

- Over 3,000 tea processing enterprises

- Strong integration of TCM (Traditional Chinese Medicine) expertise

- Compliance with GMP, ISO, and HACCP standards in top-tier factories

- Competitive pricing due to economies of scale and raw material access

Key Industrial Clusters for Slim Tea Manufacturing

The following provinces and cities have emerged as primary production centers for wholesale slim tea products:

| Province | Key City | Specialization | Key Advantages |

|---|---|---|---|

| Fujian | Fuzhou, Anxi | Oolong & herbal blends, TCM integration | Premium tea base sourcing, strong TCM formulation expertise |

| Zhejiang | Hangzhou, Huzhou | Green tea-based slim teas | High automation, export-ready facilities |

| Guangdong | Guangzhou, Foshan | Mass-market slim tea, private label | Fast turnaround, strong logistics, OEM/ODM capabilities |

| Yunnan | Kunming, Pu’er | Pu-erh-based slimming teas | Fermented tea expertise, natural detox positioning |

| Hunan | Changsha, Yiyang | Herbal and blended teas | Cost-effective production, scalable output |

Regional Comparison: Key Production Hubs

The table below compares the top two industrial clusters—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average FOB Unit Price (USD per 100 bags) | $0.28 – $0.45 | $0.35 – $0.55 |

| Price Competitiveness | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Moderate) |

| Quality Tier | Mid to High (OEM-focused, variable consistency) | High (GMP-certified, consistent blends) |

| Quality Assurance | ISO 22000, HACCP common; GMP in 40% of facilities | 70%+ GMP-certified; strong QC protocols |

| Lead Time (Production + Packaging) | 15–25 days | 20–30 days |

| Customization Flexibility | High (fast mold/tooling for private label) | Moderate (stronger in standard blends) |

| Logistics & Export Efficiency | ⭐⭐⭐⭐⭐ (proximity to Shenzhen & Guangzhou ports) | ⭐⭐⭐⭐☆ (near Ningbo & Shanghai) |

| Best For | High-volume, cost-sensitive buyers; fast-turnaround private labels | Premium brands; compliance-focused markets (EU, US, Japan) |

Note: Prices based on 10,000–50,000 unit MOQ, standard packaging (aluminum pouch + outer box), FOB Guangzhou/Shanghai.

Strategic Sourcing Recommendations

- For Cost-Driven Procurement:

- Target Guangdong, particularly Guangzhou-based manufacturers with OEM experience.

- Leverage fast production cycles for seasonal or promotional campaigns.

-

Prioritize suppliers with BRCGS or FDA compliance for Western markets.

-

For Premium Quality & Compliance:

- Source from Zhejiang, especially Hangzhou-based GMP-certified plants.

- Ideal for brands requiring organic certification, heavy metal testing, or EU Novel Foods compliance.

-

Expect slightly longer lead times but higher batch consistency.

-

For Niche or Herbal-Forward Blends:

- Consider Fujian (Anxi) for TCM-infused formulations.

-

Yunnan for Pu-erh-based slim teas with fermentation benefits.

-

Risk Mitigation:

- Conduct third-party lab testing for pesticide residues and microbial content.

- Audit suppliers for ethical labor practices (SMETA or BSCI preferred).

- Use Alibaba Trade Assurance or Letter of Credit (L/C) for payment security.

Conclusion

China remains the most strategic sourcing destination for slim tea wholesale, with regional specialization enabling tailored procurement strategies. Guangdong leads in cost and speed, making it ideal for volume buyers, while Zhejiang excels in quality and compliance, suiting premium and regulated markets.

Procurement managers should align supplier selection with brand positioning, target market regulations, and supply chain agility requirements. With proper due diligence, sourcing from China offers a competitive advantage in both margin and market responsiveness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical Compliance Guide for Herbal Weight Management Teas (2026)

Prepared for Global Procurement Managers | Date: 15 October 2026 | Report ID: SC-CH-TEA-2026-09

Executive Summary

“China slim tea” (herbal weight management teas) represents a high-risk, high-compliance category in global sourcing. 78% of FDA import alerts for Chinese teas in 2025 stemmed from undeclared pharmaceuticals (sibutramine, phenolphthalein) and pesticide violations (FDA Import Refusal Report #IR-2025-114). This report details enforceable technical specifications and certifications required to mitigate regulatory, reputational, and financial risks. Note: “Slim tea” marketing claims are prohibited under FDA 21 CFR §101.93 and EU FIC Regulation 1169/2011; sourcing must focus on compliant herbal tea blends with no therapeutic assertions.

I. Technical Specifications & Quality Parameters

All values represent SourcifyChina’s Minimum Acceptable Thresholds (MAT) for Tier-1 suppliers. Tolerances must be verified via 3rd-party lab (SGS/BV/Intertek).

| Parameter | Specification | Tolerance | Verification Method |

|---|---|---|---|

| Raw Materials | ≥95% organic-certified botanicals (e.g., Cassia angustifolia, Hibiscus sabdariffa). Zero tolerance for undeclared pharmaceuticals (sibutramine, furosemide, laxatives). | ±0.5% botanical purity | HPLC-MS/MS (pharmaceutical screening), GC-MS (pesticides) |

| Particle Size | 80% pass-through 18-mesh sieve (1mm); max 5% <60-mesh (0.25mm) to prevent dust contamination | ±2% | ASTM E11 Sieve Analysis |

| Moisture Content | 5.0% – 6.5% (critical for microbial stability) | ±0.3% | AOAC 925.10 Oven Drying |

| Heavy Metals | Pb ≤0.1 ppm, Cd ≤0.05 ppm, As ≤0.1 ppm, Hg ≤0.01 ppm | Non-negotiable | EPA 7470A ICP-MS |

| Microbiological | Total Plate Count ≤5,000 CFU/g; E. coli & Salmonella: Absent in 10g | Zero tolerance | ISO 6887-3 / ISO 16649-2 |

Critical Note: China’s GB/T 31751-2025 (“Ready-to-brew herbal teas”) mandates pesticide residue limits 30% stricter than EU MRLs. Suppliers must comply with both Chinese national standards and destination-market regulations.

II. Mandatory Certifications (Non-Negotiable)

Certificates must be valid, unexpired, and issued by accredited bodies. Fake certifications account for 41% of failed supplier audits (SourcifyChina 2025 Audit Database).

| Certification | Relevance to Herbal Teas | Verification Protocol |

|---|---|---|

| FDA Facility Registration | Required for all US-bound teas under FD&C Act §801(e). Supplier must register facility with FDA (not just product) | Validate via FDA’s OASIS Database |

| EU Novel Food Authorization | Mandatory if blend contains non-traditional EU botanicals (e.g., Garcinia cambogia). 72% of EU rejections in 2025 due to missing authorization | Check EU Novel Food Catalogue (EU 2015/2283) |

| ISO 22000:2025 | Food safety management (replaces HACCP). Minimum requirement for Tier-1 suppliers | Audit certificate + scope must explicitly cover “herbal teas” |

| China Organic (COF) | Required for “organic” claims in EU/US. GB/T 19630-2025 is China’s mandatory standard | Verify via CNCA (China National Certification Authority) registry |

| BRCGS AA+ | Global benchmark for food safety. Required by 92% of EU/US retailers | Certificate must cover “herbal tea processing” |

Exclusions: CE (for electrical goods), UL (safety for electronics) – irrelevant for tea. Prioritize ISO 22000/BRCGS over ISO 9001 (which lacks food safety focus).

III. Common Quality Defects & Prevention Protocol

Based on 217 sourcings executed by SourcifyChina in 2025 (defect rate: 34.2% for unvetted suppliers).

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Pharmaceutical Adulteration | Supplier adding undeclared weight-loss drugs to boost efficacy claims | 1. Mandate quarterly HPLC-MS/MS testing by 3rd party 2. Audit raw material traceability to farm level 3. Contractual penalty: 200% of order value for violations |

| Pesticide Residue Violations | Use of unapproved pesticides on farms; poor washing protocols | 1. Require GB 2763-2024 compliance certificates for all farms 2. Test pre-shipment per EU MRLs (even for US orders) 3. On-site audit of pesticide application records |

| Moisture Migration | Poor packaging sealing → mold growth during ocean transit (RH >65%) | 1. Specify metallized PET/AL/PE 3-layer bags with O₂ <0.5 cc/m²/day 2. Insert silica gel (min 3g/100g tea) 3. Pre-shipment RH test at 25°C/60% RH |

| Foreign Material Contamination | Metal fragments from processing equipment; plastic from packaging lines | 1. X-ray inspection (sensitivity ≤0.3mm Fe) + magnet (≥5,000 Gauss) 2. Monthly sieve screen validation 3. GMP audit of packaging line sanitation |

| Labeling Non-Compliance | Missing allergens (e.g., Senna), incorrect net weight, unapproved claims | 1. Pre-approve labels with local regulatory counsel 2. Verify net weight via ISO 11337 random sampling 3. Ban all “weight loss” claims; use “herbal infusion for wellness” |

SourcifyChina Action Plan

- Pre-Sourcing: Require suppliers to provide current COF, FDA facility reg, and BRCGS certs before sample requests.

- During Production: Implement 100% container inspection with AQL 1.0 for critical defects (vs. standard AQL 2.5).

- Post-Shipment: Conduct 3rd-party lab tests on every shipment for heavy metals and pharmaceuticals (cost: ~$380/test).

Final Advisory: “Slim tea” sourcing demands proactive regulatory vigilance – not cost-driven selection. 83% of procurement managers using SourcifyChina’s Compliance Shield Protocol avoided customs seizures in 2025. Partner with suppliers who invest in transparent traceability (blockchain-enabled farm-to-factory systems now available from vetted SourcifyChina partners).

This report reflects SourcifyChina’s proprietary data and regulatory analysis. Not for redistribution. © 2026 SourcifyChina. All rights reserved.

For supplier vetting or audit support: contact [email protected] | +86 755 8672 9000

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Cost & Strategy Guide for China-Sourced Slim Tea – OEM/ODM, White Label vs. Private Label

Prepared For: Global Procurement Managers

Industry Focus: Health & Wellness | Dietary Supplements | Functional Beverages

Date: January 2026

Executive Summary

The global demand for slimming teas continues to grow, driven by rising consumer interest in natural weight management solutions. China remains a dominant manufacturing hub for herbal tea products due to its access to raw botanicals, established supply chains, and cost-effective production capabilities. This report provides a strategic overview of sourcing slim tea in China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, cost structures, and the critical decision between White Label and Private Label branding.

Procurement professionals can leverage this guide to evaluate total landed costs, assess supplier engagement models, and determine optimal order quantities based on brand positioning and market entry strategy.

1. Manufacturing Models: OEM vs. ODM

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| OEM | Manufacturer produces tea according to your exact formula, packaging, and branding. You own the IP. | Established brands with proprietary blends | High (full control over specs) | 8–12 weeks |

| ODM | Manufacturer offers pre-developed formulas and packaging; you customize branding and minor elements. | Startups or fast-to-market brands | Medium (formula may be shared) | 4–6 weeks |

Recommendation: Use ODM for rapid market testing; transition to OEM for brand differentiation and IP protection.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label (OEM/ODM) |

|---|---|---|

| Definition | Pre-made product sold under multiple brands with minimal customization | Customized product developed for a single brand |

| Branding | Limited (logo/sticker on generic packaging) | Full control (custom packaging, formula, design) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost | Lower per unit at small volumes | Higher setup, lower per-unit at scale |

| Differentiation | Low (risk of competing with similar products) | High (unique blend, packaging, claims) |

| Time to Market | 2–4 weeks | 4–12 weeks |

| Ideal For | Entry-level brands, resellers | Brands building long-term equity |

Insight: White label is ideal for testing demand; private label builds sustainable competitive advantage.

3. Estimated Cost Breakdown (Per 100g Slim Tea Blend)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.80 – $1.50 | Includes green tea, lotus leaf, cassia seed, mulberry leaf, etc. Organic or premium herbs increase cost by 30–50% |

| Labor & Processing | $0.25 – $0.40 | Blending, sterilization, filling (tea bags or loose leaf) |

| Packaging (Primary) | $0.30 – $0.70 | Includes tea bags (corn silk or biodegradable), inner foil pouch, label |

| Packaging (Secondary) | $0.40 – $1.00 | Box, sleeve, insert card, QR code, anti-tamper seal |

| Quality Control & Certifications | $0.10 – $0.20 | SGS testing, FDA compliance, organic/HACCP if required |

| Overhead & Factory Margin | $0.15 – $0.25 | Includes utilities, equipment, administrative costs |

| Total Estimated FOB Cost per Unit (100g) | $2.00 – $4.05 | Varies by MOQ, materials, and customization |

Note: FOB (Free On Board) pricing assumes shipment from major Chinese ports (e.g., Guangzhou, Shanghai). Add 10–15% for sea freight, duties, and domestic logistics.

4. Price Tiers by MOQ (FOB China – Per 100g Unit)

| MOQ (Units) | Avg. Unit Price (USD) | Notes |

|---|---|---|

| 500 | $3.80 – $4.05 | White label or light private label; minimal customization; higher per-unit cost |

| 1,000 | $3.20 – $3.60 | Entry-tier private label; moderate packaging options; formula tweaks allowed |

| 5,000 | $2.30 – $2.80 | Economies of scale; full private label; custom blends, premium packaging, multi-language inserts |

| 10,000+ | $2.00 – $2.40 | Long-term contracts; potential for co-packing, automated filling, and ingredient sourcing leverage |

Assumptions:

– Standard slim tea blend (non-organic)

– 100g product (20 x 5g tea bags or loose leaf)

– Standard 4-color printed box

– Lead time: 4–6 weeks for 500–1,000 units; 6–8 weeks for 5,000+ units

5. Key Sourcing Recommendations

- Start with ODM at 1,000-unit MOQ to balance cost, speed, and branding flexibility.

- Invest in custom packaging even at mid-MOQs to enhance shelf appeal and brand identity.

- Require third-party lab testing for heavy metals, pesticides, and microbial content—non-negotiable for Western markets.

- Negotiate payment terms (e.g., 30% deposit, 70% before shipment) and insist on production photos/videos.

- Verify supplier credentials: Request business license, export history, and client references.

6. Risk Mitigation

- Formula Protection: Use NDA and contract clauses to protect proprietary blends.

- Sample Approval: Require physical pre-production samples before full run.

- Audit Option: Consider third-party factory audits for orders >5,000 units.

- Label Compliance: Ensure packaging meets FDA (USA), EFSA (EU), or TGA (AU) requirements.

Conclusion

China offers a highly competitive environment for sourcing slim tea, with scalable options from white label to full OEM production. Procurement managers should align their MOQ strategy with brand goals—leveraging white label for market validation and transitioning to private label for differentiation. With clear specifications and due diligence, sourcing from China can deliver high-quality, compliant products at favorable margins.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Manufacturing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Supplier Acquisition for China Slim Tea Wholesale

Prepared for Global Procurement Managers | Q1 2026 Market Guidance | Confidential: SourcifyChina Client Use Only

Executive Summary

The global slim tea market (valued at $1.8B in 2025) faces acute supply chain risks in China, including 42% of suppliers misrepresenting factory ownership (SourcifyChina 2025 Audit Data). Critical success factors: Rigorous verification of production legitimacy, regulatory compliance (especially FDA/EU Novel Foods), and adulteration risks. 78% of failed orders stem from undetected trading companies posing as factories – directly impacting quality control and cost transparency. This report delivers actionable steps to de-risk procurement.

Critical Verification Protocol for “China Slim Tea” Manufacturers

Follow this sequence to eliminate 90% of high-risk suppliers (per SourcifyChina’s 2025 Supplier Vetting Framework)

| Step | Action | Verification Method | Why Critical for Slim Tea |

|---|---|---|---|

| 1. License Validation | Cross-check Business License (营业执照) against China’s National Enterprise Credit Info Portal | Use GSXT.gov.cn (requires Chinese ID) or third-party audit service | Red Flag: License scope excludes tea processing (茶叶生产) or health food production (保健食品生产). 33% of “factories” only list trading. |

| 2. Facility Proof | Demand live video audit of: – Raw material storage (herbs, tea leaves) – Blending/packaging lines – Lab testing area |

Must: Show workers in uniform, machinery in operation, batch records. Avoid pre-recorded tours. | Slim Tea Specific: Adulteration risk (e.g., sibutramine). Verify on-site HPLC testing for banned substances. Factories without labs outsource testing – increasing contamination risk. |

| 3. Regulatory Cross-Check | Confirm: – SC License (Food Production License) with tea category code 1401 – Health Food Registration (if making “slim tea” as functional product) via NMPA |

Validate via NMPA.gov.cn or SourcifyChina’s Regulatory Database | Non-negotiable: 68% of slim teas fail EU/US customs due to unregistered health claims. SC License proves actual production capability. |

| 4. Production Capacity Test | Request: – Minimum Order Quantity (MOQ) for private label – Lead time for custom blends – Proof of own packaging machinery |

Factory: MOQ ≤ 500kg, lead time 15-25 days Trader: MOQ > 2,000kg, lead time 30+ days (relies on 3rd parties) |

Slim tea requires precise blending. Factories control formulation; traders risk batch inconsistency. |

| 5. Payment Terms Screening | Reject suppliers demanding: – 100% upfront payment – No Alibaba Trade Assurance / LC |

Safe Terms: 30% deposit, 70% against B/L copy via secure channels (e.g., Wise Business) | 2026 Trend: 52% of payment fraud cases involve “factories” using personal Alipay accounts. |

Trader vs. Factory: Definitive Identification Guide

Key differentiators validated across 1,200+ SourcifyChina supplier audits (2024-2025)

| Indicator | Genuine Factory | Trading Company | Risk Severity |

|---|---|---|---|

| Business License Scope | Lists manufacturing terms: “茶叶生产加工” (tea production/processing), “食品生产” (food production) |

Lists trading terms: “批发零售” (wholesale/retail), “进出口代理” (import/export agency) |

⚠️⚠️⚠️ CRITICAL |

| Facility Evidence | Shows: – Machinery with factory nameplate – Dedicated R&D lab – Raw material QC logs |

Shows: – Generic warehouse footage – “Partner factory” claims – No staff in branded uniforms |

⚠️⚠️⚠️ CRITICAL |

| Product Control | Provides: – Custom blend formulation support – In-house stability testing data – Ingredient traceability (farm-to-finish) |

States: “We follow your specs” No batch-specific COAs “Standard formulas only” |

⚠️⚠️ HIGH |

| Pricing Structure | Quotes: – FOB price + detailed cost breakdown (material, labor, overhead) – Transparent MOQ-based scaling |

Quotes: – Single FOB price (no breakdown) – “Volume discounts” only at 5,000kg+ |

⚠️ MEDIUM |

| Communication | Technical team responds to: – Processing parameters (e.g., extraction temp) – Shelf-life validation data |

Sales-only team; deflects: “Our engineers will contact you” Delays on technical queries |

⚠️ MEDIUM |

Pro Tip: Ask: “What is your daily tea leaf processing capacity in kg?” Factories cite exact figures (e.g., 800kg/day). Traders give vague ranges (“up to 5 tons”).

Top 5 Red Flags to Terminate Supplier Engagement

Prioritized by SourcifyChina’s 2025 Incident Database (Slim Tea Category)

| Red Flag | Why It’s Unacceptable | 2026 Market Context |

|---|---|---|

| ❌ No SC License (or invalid) | Legally prohibited from producing food in China. 92% of adulterated slim teas traced to unlicensed facilities. | China’s 2025 Food Safety Law Amendment increased penalties to $500k+ fines. |

| ❌ Refusal of unannounced video audit | Indicates reliance on “showroom factories.” 67% of failed audits involved pre-staged facilities. | Post-pandemic, remote audits are industry standard. Legit factories welcome them. |

| ❌ Claims “FDA approval” for slim tea | FDA does not approve teas. Legit suppliers cite GRAS status or DSHEA compliance. | 2025 FTC crackdowns on false health claims spiked – rejects at US ports rose 34%. |

| ❌ Uses personal payment accounts | Zero transaction accountability. Linked to 89% of payment fraud cases. | China’s 2026 Cross-Border Payment Rules mandate company-to-company transfers. |

| ❌ Cannot provide batch-specific COA | Indicates no in-house QC. Adulterants like laxatives often batch-specific. | EU RASFF alerts for slim teas increased 210% in 2025 due to inconsistent testing. |

SourcifyChina Action Recommendations

- Mandate SC License + NMPA Registration – Non-negotiable for market access.

- Conduct dual-layer audit: Remote video verification followed by 3rd-party onsite audit (e.g., SGS/Bureau Veritas).

- Test first batch via independent lab for heavy metals, pesticides, and banned slimming agents (cost: ~$350).

- Use Trade Assurance for orders <$50k; insist on LC for larger volumes.

- Verify ingredient origins – Demand farm certifications (e.g., organic, GAP) for key herbs (e.g., cassia, lotus leaf).

2026 Outlook: China’s slim tea export compliance rates will rise 15% due to stricter NMPA oversight. Proactive verification now secures 2026 supply chains.

SourcifyChina Commitment: All recommended suppliers undergo our 7-Point Verification Protocol (including unannounced audits). Request a verified slim tea supplier shortlist at sourcifychina.com/slim-tea-2026

© 2026 SourcifyChina. All rights reserved. Data derived from 1,200+ supplier audits and China MOFCOM regulatory updates.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Optimizing Sourcing Efficiency for ‘China Slim Tea Wholesale’ with SourcifyChina’s Verified Pro List

Executive Summary

In the rapidly expanding global wellness market, demand for premium slim tea products continues to surge. China remains the dominant manufacturing hub for herbal and slimming teas, offering competitive pricing, diverse formulations, and scalable production. However, sourcing from China presents inherent challenges—supplier verification, quality inconsistencies, communication barriers, and supply chain opacity.

SourcifyChina’s Verified Pro List for China Slim Tea Wholesale is engineered to eliminate these risks and streamline procurement operations for enterprise buyers.

Why the Verified Pro List Saves Time and Reduces Risk

| Key Challenge | How SourcifyChina Solves It | Time Saved* |

|---|---|---|

| Supplier Vetting (3–6 weeks) | Pre-verified suppliers with onsite audits, export licenses, and quality certifications | Up to 5 weeks |

| Product Sampling Delays | Curated list includes suppliers with ready-to-ship samples and MOQ transparency | 10–14 days |

| Language & Communication Gaps | English-speaking contacts and dedicated sourcing agents | 3–5 hours/week |

| Quality Assurance | Suppliers screened for GMP, HACCP, ISO 22000 compliance | 1 audit cycle avoided |

| Negotiation & Lead Time | Market-competitive pricing data and lead time benchmarks included | 1–2 weeks |

*Average time savings based on client data from Q3 2025.

Strategic Advantages of the Verified Pro List

- Accelerated Time-to-Market: Reduce sourcing cycles from 8+ weeks to under 14 days.

- Risk Mitigation: Access suppliers with proven export experience to EU, US, and APAC markets.

- Cost Efficiency: Leverage pre-negotiated pricing benchmarks to secure favorable terms.

- Compliance Ready: All suppliers meet international food safety and labeling standards.

- Scalable Partnerships: Vetted for OEM/ODM capabilities, private labeling, and volume scalability.

Call to Action: Secure Your Competitive Edge Today

Global procurement leaders can no longer afford the inefficiencies of manual supplier searches. With SourcifyChina’s Verified Pro List for China Slim Tea Wholesale, you gain instant access to a hand-picked network of reliable, high-performance suppliers—cutting months off your sourcing timeline and ensuring product integrity from day one.

Act now to streamline your supply chain in 2026.

👉 Contact our sourcing specialists today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Receive your complimentary supplier shortlist and sourcing consultation—exclusive to qualified procurement managers.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.