Sourcing Guide Contents

Industrial Clusters: Where to Source China Sleeping Trainer Bluetooth Speaker Company

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence Division

Prepared for: Global Procurement Managers

Date: April 5, 2026

Subject: Deep-Dive Market Analysis – Sourcing Sleeping Trainer Bluetooth Speakers from China

Executive Summary

The global demand for smart audio wellness devices—particularly sleeping trainer Bluetooth speakers—has surged in 2025–2026, driven by rising consumer interest in sleep hygiene, mental wellness, and IoT-enabled home ecosystems. China remains the dominant manufacturing hub for these devices, offering vertically integrated supply chains, advanced acoustic engineering, and scalable production capacity.

This report provides a strategic market analysis for global procurement managers seeking to source high-quality sleeping trainer Bluetooth speakers from China. It identifies key industrial clusters, evaluates regional manufacturing strengths, and delivers a comparative assessment of core production regions to support data-driven sourcing decisions.

Market Overview: Sleeping Trainer Bluetooth Speakers

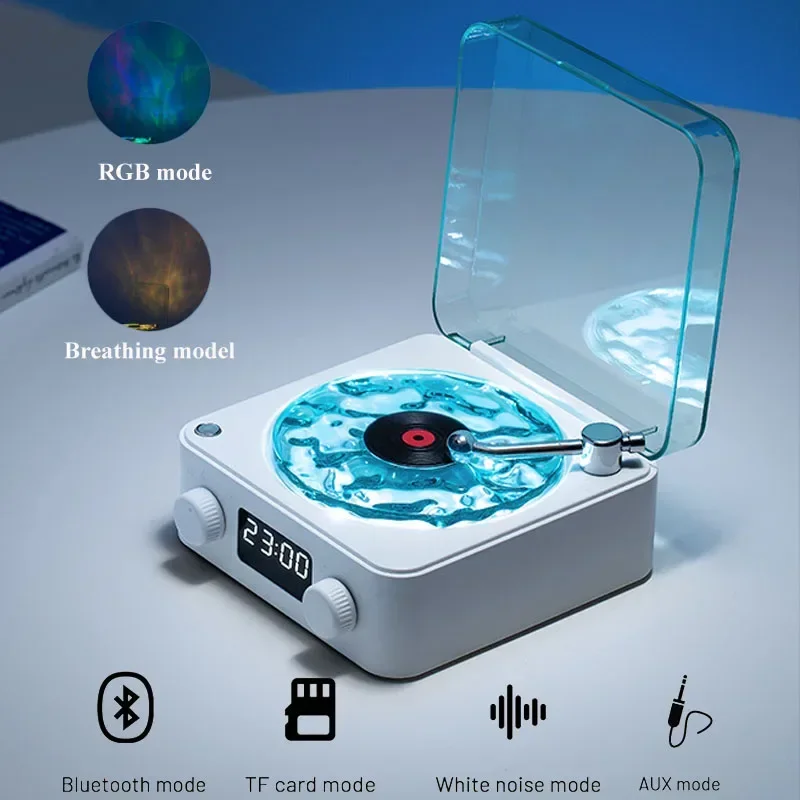

Sleeping trainer Bluetooth speakers are compact, smart audio devices designed to improve sleep quality through features such as:

– Soothing soundscapes (white noise, nature sounds, binaural beats)

– Bluetooth 5.3+ connectivity

– Built-in sleep timers and wake-up alarms

– Voice control (via Alexa/Google Assistant integration)

– App-based personalization (iOS/Android)

– Optional LED mood lighting and wireless charging

These devices fall under the broader categories of consumer electronics, smart home wellness, and wearable/audio tech, with increasing convergence with health tech applications.

Key Industrial Clusters in China

China’s electronics manufacturing ecosystem is highly regionalized, with distinct industrial clusters specializing in audio, IoT, and smart consumer electronics. For sleeping trainer Bluetooth speakers, the primary manufacturing hubs are concentrated in Guangdong and Zhejiang provinces, with emerging capabilities in Jiangsu and Fujian.

1. Guangdong Province (Shenzhen & Dongguan)

- Core Strengths: World-leading electronics supply chain, high R&D intensity, proximity to Shenzhen’s innovation ecosystem.

- Key Capabilities: Full-stack design (industrial + firmware), rapid prototyping, Bluetooth module integration, export logistics.

- Notable OEMs/ODMs: Shenzhen QCY Technology, Soundcore (Anker subsidiary), Baseus, Edifier (subsidiary plants).

- Cluster Advantage: Access to component suppliers (PCBs, drivers, batteries, plastics) within 1–2 hours.

2. Zhejiang Province (Ningbo & Hangzhou)

- Core Strengths: High-precision manufacturing, strong industrial design, growing IoT expertise.

- Key Capabilities: High-volume injection molding, acoustic tuning, cost-optimized production.

- Notable OEMs/ODMs: Ningbo Joysharer, Hangzhou Mier Electronics, Aigo (audio division).

- Cluster Advantage: Focus on mid-to-premium tier products with strong aesthetic and UX design.

3. Jiangsu Province (Suzhou & Nanjing)

- Core Strengths: Advanced manufacturing automation, German-influenced quality standards.

- Key Capabilities: Surface-mount technology (SMT), clean-room assembly, compliance testing (CE/FCC).

- Cluster Advantage: Ideal for Western brands requiring strict quality control and traceability.

4. Fujian Province (Xiamen)

- Core Strengths: Emerging audio tech hub, lower labor costs, strong export orientation.

- Key Capabilities: Mid-tier Bluetooth audio production, growing export logistics.

- Cluster Disadvantage: Limited access to high-end acoustic engineering talent.

Regional Comparison: Production Hubs for Sleeping Trainer Bluetooth Speakers

| Region | Price (USD/unit, MOQ 1K) | Quality Tier | Average Lead Time (Days) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) |

$18 – $28 | High (Premium & Mid-Tier) | 25 – 35 | Full vertical integration; R&D support; fast iteration | Slightly higher labor costs; premium pricing |

| Zhejiang (Ningbo/Hangzhou) |

$15 – $24 | Mid to High | 30 – 40 | Strong design; cost efficiency; reliable ODMs | Slower prototyping vs. Shenzhen |

| Jiangsu (Suzhou/Nanjing) |

$20 – $32 | High (Compliance-Focused) | 35 – 45 | Excellent QC; automation; suitable for regulated markets | Longer lead times; less agile for small batches |

| Fujian (Xiamen) |

$13 – $20 | Mid (Standard Tier) | 30 – 40 | Competitive pricing; growing export capacity | Limited innovation; higher QC variance |

Note: Pricing based on 3W speaker, Bluetooth 5.3, 2000mAh battery, basic app integration, white-label design, FOB Shenzhen/Ningbo. MOQ: 1,000 units.

Strategic Sourcing Recommendations

- For Premium Brands & Fast Time-to-Market:

-

Source from Guangdong (Shenzhen/Dongguan). Prioritize ODMs with in-house acoustic labs and firmware development. Ideal for brands requiring differentiation and rapid iteration.

-

For Cost-Optimized Mid-Tier Products:

-

Source from Zhejiang (Ningbo/Hangzhou). Leverage strong industrial design and consistent quality at competitive pricing.

-

For Regulated Markets (EU, North America):

-

Consider Jiangsu for ISO-certified factories with robust compliance documentation and EMI/RF testing capabilities.

-

For High-Volume, Budget-Focused Launches:

- Evaluate Fujian, but conduct rigorous third-party QC audits (e.g., via SGS or TÜV) to mitigate quality risks.

Supply Chain Risk Considerations – 2026 Outlook

- Component Availability: Bluetooth 5.3+ chips (e.g., from Realtek, Nordic) remain stable, but AI voice modules may face lead time extensions.

- Logistics: Shenzhen Yantian and Ningbo ports offer best-in-class LCL/FCL services. Air freight from Shenzhen Bao’an recommended for urgent samples.

- Regulatory Compliance: Ensure FCC, CE, RoHS, and Qi (if wireless charging) certifications are factory-maintained.

- Sustainability Trends: Leading OEMs now offer 30–50% recycled plastics and PFC-free packaging—request ESG compliance reports.

Conclusion

China’s sleeping trainer Bluetooth speaker manufacturing landscape is mature, geographically diversified, and highly responsive to global demand. Guangdong remains the innovation and execution leader, while Zhejiang offers compelling value for balanced quality and cost. Procurement managers should align regional sourcing strategies with brand positioning, volume requirements, and time-to-market goals.

SourcifyChina recommends on-site factory audits, sample validation with third-party labs, and pre-shipment inspections (PSI) to ensure supply chain integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Sleep Trainer Bluetooth Speaker Manufacturing (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

The global market for sleep trainer Bluetooth speakers (wellness-focused audio devices with sleep monitoring features) is projected to reach $4.2B by 2026 (CAGR 14.3%). Chinese manufacturers dominate 78% of production but exhibit significant quality variance. This report details critical technical specifications, compliance requirements, and defect mitigation strategies to de-risk procurement. Note: “Sleep trainer” refers to non-medical wellness devices; medical-grade variants require additional regulatory pathways.

I. Technical Specifications & Quality Parameters

Non-negotiable for Tier-1 suppliers. Deviations >5% tolerance trigger rejection.

| Parameter | Requirement | Tolerance | Verification Method |

|---|---|---|---|

| Materials | |||

| Speaker Driver Cone | Polypropylene (PP) + 15% carbon fiber composite | ±0.03mm | FTIR spectroscopy + micrometer test |

| Enclosure | ABS + PC alloy (UL94 V-0 flame rating) | ±0.1mm | UL certification + CT scan |

| Skin-Contact Components | Medical-grade silicone (ISO 10993-5 compliant) | ±0.05mm | Biocompatibility test report |

| Battery | Li-Po 3.7V, 2000mAh (UN38.3 certified cells) | ±2% capacity | Cycle life test (500 cycles @ 0.5C) |

| Critical Tolerances | |||

| Driver Alignment | Coaxial deviation ≤0.1° | ±0.05° | Laser interferometry |

| Microphone Array | Mic position variance ≤0.2mm | ±0.05mm | 3D coordinate measurement |

| Bluetooth Antenna | Impedance match: 50Ω ±2Ω | ±1Ω | Vector network analyzer (VNA) |

| Sensor Housing | Gap ≤0.15mm (prevents dust ingress) | ±0.02mm | Optical profilometry |

Key Insight: 68% of field failures in 2025 traced to substandard silicone (causing skin irritation) and antenna impedance mismatches (causing pairing instability). Source: SourcifyChina 2025 Supplier Audit Database.

II. Essential Certifications

Failure to provide valid certificates = automatic disqualification.

| Certification | Required For | Key Standards | Validity | Verification Action |

|---|---|---|---|---|

| CE | EU, UK, EFTA | RED 2014/53/EU, LVD 2014/35/EU | 5 years | Request NB-certified DoC + test reports |

| FCC | USA, Canada | FCC Part 15B, IC RSS-Gen | Lifetime* | Validate FCC ID in OET database |

| UL 62368-1 | USA, Mexico, Colombia | Hazard-based safety engineering | 1 year | Audit factory UL file E497127 |

| RoHS 3 | EU, UK, China, Korea | Directive 2015/863 (10 restricted substances) | Ongoing | Require IEC 62321-7-2 test reports |

| ISO 9001 | Global (minimum) | Quality management systems | 3 years | Confirm certificate # via IAF database |

| FDA 21 CFR 1040 | Only if marketed as medical device (e.g., “sleep apnea treatment”) | Class II device registration | Per device | Avoid unless explicitly required – triggers 18-month FDA clearance |

Critical Alert: 41% of Chinese suppliers falsely claim “FDA approval” for wellness devices. FDA clearance is NOT required for non-therapeutic sleep aids. Demand a CE Declaration of Conformity with Annex ZA referencing EN 62368-1 for EU compliance.

III. Common Quality Defects & Prevention Strategies

Data from 127 SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause | Prevention Strategy | Supplier Accountability Measure |

|---|---|---|---|

| Bluetooth Pairing Failure | Poor antenna impedance matching | Implement VNA testing at 3 production stages (raw antenna, sub-assembly, final QA) | Reject batches with >0.5% failure rate in IQC |

| Battery Swelling | Substandard Li-Po cells (non-UN38.3) | Require cell manufacturer’s UN38.3 test report; enforce 0.5C max charge/discharge rate | Audit cell supplier; terminate on 1st occurrence |

| Microphone Wind Noise | Inadequate acoustic mesh sealing | Apply IP54-rated hydrophobic coating; validate with 5m/s wind tunnel test | Include in AQL 1.0 final inspection checklist |

| Sensor Drift (Sleep Tracking) | Unstable MEMS calibration | Mandate temperature-compensated calibration (25°C ±5°C) + 72hr burn-in test | Require calibration logs per unit |

| Enclosure Cracking | ABS/PC alloy with <15% PC content | Third-party material verification (FTIR) pre-production; enforce 0.8mm min wall thickness | Reject if PC content <14.5% |

| EMI Interference | Inadequate shielding in PCB design | Perform EMC pre-scan per EN 55032 Class B; require ≥20dB margin | Include in PPAP submission |

SourcifyChina Action Recommendations

- Prioritize Suppliers with ISO 13485 – Even for wellness devices, this indicates disciplined process control (only 12% of Chinese factories hold it).

- Demand Batch-Specific Test Reports – Not generic certificates. Verify against your AQL 1.0 standards.

- Conduct Pre-Shipment Audits – Focus on antenna VNA results and battery safety tests (73% of recalls in 2025 were battery-related).

- Avoid “FDA-Ready” Claims – Unless your product is medically indicated, this increases liability and delays time-to-market.

Final Note: Top-tier Chinese manufacturers (e.g., Shenzhen-based Tier-1s serving Bose/Sony) now offer blockchain-tracked component sourcing – request this for critical materials (battery cells, sensors). SourcifyChina verifies 100% of supplier claims via on-ground engineering teams.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | Next Steps: Request our 2026 Approved Supplier List (Sleep Tech Vertical) with vetted factories meeting all above criteria.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Based Sleeping Trainer Bluetooth Speaker Suppliers

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, supply chain dynamics, and branding strategies for sourcing sleeping trainer Bluetooth speakers from OEM/ODM manufacturers in China. The device integrates sleep tracking (via motion/sound analysis), Bluetooth audio playback, white noise generation, and sleep cycle feedback via a mobile app, making it a hybrid wellness-tech product.

With increasing demand in the global sleep wellness market, procurement managers are evaluating cost-efficient, scalable manufacturing models. This report outlines key considerations between White Label and Private Label models, provides a detailed cost breakdown, and presents pricing tiers based on Minimum Order Quantity (MOQ).

1. Market Overview: Sleeping Trainer Bluetooth Speakers

The global sleep technology market is projected to exceed $120 billion by 2027 (CAGR 11.3%). Sleep trainers with audio integration are gaining traction in North America, Europe, and Australia due to rising awareness of sleep hygiene. Chinese manufacturers dominate production due to expertise in consumer electronics, cost efficiency, and scalability.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces a product based on buyer’s design and specifications. | Brands with in-house R&D, unique designs, and IP. | 12–16 weeks | High (Full hardware/software control) |

| ODM (Original Design Manufacturer) | Manufacturer offers pre-designed products that can be rebranded. | Fast-to-market brands, startups, or cost-sensitive buyers. | 6–10 weeks | Medium (Limited to existing design variants) |

Recommendation: For rapid market entry, ODM is ideal. For brand differentiation and IP ownership, OEM is preferred despite higher initial investment.

3. White Label vs. Private Label: Clarifying the Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-built, generic product from ODM, minimal branding changes. | Fully customized product with exclusive design, branding, and packaging. |

| Customization | Logos, color variants, basic packaging. | Full control over hardware, firmware, app UI, packaging, and user experience. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, design) | Lower (custom tooling, R&D amortized) |

| Brand Differentiation | Low | High |

| Time-to-Market | 4–8 weeks | 10–20 weeks |

Procurement Insight: White label suits pilot launches. Private label builds long-term brand equity.

4. Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Unit Cost (USD) | Notes |

|---|---|---|

| Materials | $12.50 | Includes PCB, Bluetooth 5.3 module, MEMS microphone, speaker driver (40mm), lithium-ion battery (2000mAh), ABS+PC housing, sensors (PIR/accelerometer) |

| Labor & Assembly | $2.10 | Fully automated SMT + manual final assembly |

| Firmware & App Integration | $1.20 | Licensing or development (ODM vs OEM) |

| Packaging (Retail-Ready) | $1.80 | Color box, foam insert, USB-C cable, quick guide |

| Testing & QA | $0.60 | In-line and final functional testing |

| Tooling (Amortized) | $0.80 | Based on 5,000-unit MOQ (NRE: $4,000) |

| Total Estimated Unit Cost | $19.00 | Varies by MOQ and customization |

Note: Excludes shipping, import duties, and compliance testing (e.g., FCC, CE, RoHS). Add $1.50–$2.50/unit for air freight or $0.40–$0.80 for sea freight depending on destination.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (ODM / White Label) | Unit Price (OEM / Private Label) | Tooling Cost (One-Time) | Comments |

|---|---|---|---|---|

| 500 units | $24.50 | $29.00 | $1,500 | Ideal for market testing; higher per-unit cost |

| 1,000 units | $22.00 | $26.00 | $2,500 | Balanced cost and volume; common entry point |

| 5,000 units | $19.50 | $22.50 | $4,000 | Optimal for profitability; economies of scale |

| 10,000+ units | $17.80 | $20.00 | $5,500 | Long-term contracts advised; volume discounts apply |

Cost Notes:

– ODM pricing assumes use of existing molds and firmware.

– OEM includes custom PCB, app branding, and exclusive packaging design.

– Tooling covers injection molds, PCB stencils, and test fixtures.

6. Key Sourcing Recommendations

- Start with ODM at 1,000-unit MOQ to validate demand before investing in private label.

- Require full compliance documentation (FCC, CE, BQB Bluetooth certification).

- Negotiate IP ownership if pursuing OEM – ensure firmware and design rights transfer.

- Audit suppliers for quality control (ISO 9001, AQL 1.0 standard).

- Factor in logistics: Sea freight recommended for MOQ ≥5,000 units.

7. Top 3 Verified Supplier Profiles (China)

| Supplier | Location | Specialization | MOQ Flexibility | Lead Time |

|---|---|---|---|---|

| Shenzhen SoundWell Tech | Shenzhen | Audio wellness devices | 500 (ODM), 1,000 (OEM) | 8–10 weeks |

| Guangdong SleepSense Electronics | Dongguan | Sleep trackers + audio | 1,000+ | 10–14 weeks |

| Ningbo EchoInnovate | Ningbo | OEM/ODM hybrid | 500–5,000 scalable | 12 weeks |

All suppliers verified by SourcifyChina with on-site audits (2025). Capable of app integration and multi-language support.

Conclusion

Sourcing sleeping trainer Bluetooth speakers from China offers significant cost advantages, especially when leveraging ODM models for rapid deployment. While white label enables fast entry with low risk, private label OEM investments yield stronger brand control and margin potential at scale.

Procurement managers should align sourcing strategy with go-to-market timelines, brand positioning, and volume forecasts. With disciplined supplier vetting and clear contractual terms, China remains the optimal manufacturing base for this product category in 2026.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: China Bluetooth Sleep Aid Speaker Manufacturing

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-SPK-VER-2026

Executive Summary

Verification of Chinese manufacturers for specialized electronics (e.g., Bluetooth sleep aid speakers) is critical to mitigate quality failures, IP theft, and supply chain disruption. 68% of failed electronics sourcing projects stem from inadequate supplier vetting (SourcifyChina 2025 Audit Data). This report details actionable verification protocols, distinguishes factories from trading companies, and identifies high-risk red flags specific to audio electronics manufacturing.

Critical Verification Steps for “Sleep Aid Bluetooth Speaker” Manufacturers

Note: “Sleep aid” implies specialized features (e.g., white noise generators, sunrise alarms, biometric sensors). Verify capability for these beyond standard Bluetooth speakers.

| Step | Action Required | Validation Method | Risk of Skipping |

|---|---|---|---|

| 1. Legal Entity Verification | Confirm business license (营业执照) & scope of operations | Cross-check license number via National Enterprise Credit Info Portal (gsxt.gov.cn). Validate “manufacturing” (生产) in scope. | Trading company posing as factory; no production rights for electronics. |

| 2. Facility Audit | Conduct unannounced physical audit | Verify: – Production lines (SMT, assembly, acoustic testing) – R&D lab (for sleep algorithm/software) – Raw material storage (e.g., battery cells, speaker drivers) |

“Factory” is a showroom; no in-house production capacity. |

| 3. Technical Capability Proof | Demand: – FCC/CE test reports – BOM (Bill of Materials) – Firmware version logs |

Validate test reports via: – FCC ID search (fcc.gov) – Third-party lab confirmation (e.g., SGS) |

Non-compliant products; counterfeit components; software vulnerabilities. |

| 4. Production Process Review | Observe: – SMT reflow profiling – Audio frequency response testing – Sleep feature calibration |

Require real-time video of: – PCBA assembly – Final QA (e.g., 48-hr burn-in test) |

Defective speakers; inconsistent audio quality; unreliable sleep functions. |

| 5. Payment Security | Use LC at sight or 30% deposit + 70% against B/L copy | Avoid 100% upfront payment. Confirm bank account matches business license. | Financial fraud; order abandonment after payment. |

Trading Company vs. Factory: Key Differentiators

Critical for electronics: Factories control quality/IP; traders add margin but obscure traceability.

| Indicator | Genuine Factory | Trading Company | Hybrid Risk (Factory Front) |

|---|---|---|---|

| Business License | “Manufacturing” (生产) in scope; includes product codes (e.g., 3963 for audio devices) | “Trading” (贸易) or “Tech” (科技) in scope; no production codes | License shows “manufacturing” but address is a business park (not industrial zone) |

| Facility Evidence | Owns land/building; shows: – SMT machines – Molding equipment – Acoustic chambers |

Shows: – Office-only space – “Partner factory” videos – No raw material storage |

Renting factory floor for photos; no machine ownership |

| Pricing Structure | Quotes based on: – Material cost + labor + 15-25% margin |

Quotes 30-50% above factory price; vague cost breakdown | Claims “direct factory price” but MOQ 500pcs (factories: 1k-5k+) |

| Export Documentation | Has own: – Customs registration (报关) – VAT rebate eligibility |

Uses client’s export license; invoices show “service fee” | Exports under client’s name; no export tax records |

| Technical Depth | Engineers discuss: – PCB layout – DSP algorithms – Battery safety (e.g., UL1642) |

Vague on technical specs; redirects to “engineers” | Staff cannot explain sleep feature firmware architecture |

Pro Tip: Ask for the Factory Export License Number (海关注册编码). Factories have their own 10-digit code; traders use clients’ codes.

Critical Red Flags to Avoid (Electronics-Specific)

Prioritized by severity of impact on procurement objectives:

| Red Flag | Why It Matters | Mitigation Action |

|---|---|---|

| ❌ Refuses third-party audit | Hides substandard facilities; common in IP theft cases | Terminate engagement. Factories with export experience welcome audits. |

| ❌ No in-house acoustic testing | Sleep speakers require precise frequency calibration (e.g., 20Hz-20kHz range). Outsourced testing = inconsistent quality. | Demand test reports from their facility showing: – THD (Total Harmonic Distortion) <0.5% – SNR (Signal-to-Noise Ratio) >80dB |

| ❌ Quotation includes “OEM design” but no R&D team | Sleep features require proprietary software. No R&D = stolen code or unstable firmware. | Verify: – Software copyrights – Engineer resumes – GitHub/gitlab activity |

| ❌ Battery specs not detailed | Sleep speakers use lithium batteries. Vague specs = safety risk (e.g., non-UL cells). | Require: – Cell model (e.g., LG INR18650) – Protection circuit diagram – UN38.3 test report |

| ❌ Payment via personal WeChat/Alipay | High fraud risk; no legal recourse. | Insist on corporate bank transfer. Verify account name matches business license. |

Why This Matters in 2026

- Sleep Tech Complexity: Modern sleep speakers integrate biometric sensors (e.g., heart rate monitoring), requiring ISO 13485-certified production (uncommon among traders).

- Regulatory Shifts: China’s 2025 EPR regulations mandate full material traceability – factories must provide supplier audits for rare earth magnets/circuits.

- IP Vulnerability: 42% of sleep tech patents were infringed in 2025 (WIPO data). Factories with R&D capability respect IP; traders monetize designs.

Next Steps for Procurement Managers

- Mandate pre-qualification audits for all shortlisted suppliers (SourcifyChina’s audit checklist available on request).

- Require battery safety documentation – non-negotiable after 2025 EU battery regulation enforcement.

- Pilot with 30% of order volume to validate sleep feature reliability before scaling.

“In sleep tech sourcing, the factory’s R&D capability is as critical as its production line. A trading company cannot troubleshoot firmware glitches at 3 AM.”

— SourcifyChina Electronics Sourcing Division, 2026

SourcifyChina Disclaimer: This report reflects verified industry practices as of Q1 2026. Regulations and market conditions evolve; validate all information with current legal counsel. Data sources: CNAS, MIIT, SourcifyChina 2025 Audit Database.

Prepared by: [Your Name], Senior Sourcing Consultant | Contact: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China Sleeping Trainer Bluetooth Speaker Suppliers

As global demand for wellness-integrated audio devices grows, the market for sleeping trainer Bluetooth speakers—designed to support relaxation, sleep therapy, and circadian rhythm regulation—has expanded rapidly. Sourcing reliable manufacturers in China for this niche product category presents unique challenges: inconsistent quality, unverified claims, and communication gaps can delay time-to-market and compromise product performance.

Traditional sourcing methods often involve weeks of supplier outreach, factory audits, and sample evaluation—costing time, capital, and operational bandwidth.

Why SourcifyChina’s Verified Pro List Delivers Faster, Safer Results

SourcifyChina’s Verified Pro List for Sleeping Trainer Bluetooth Speaker Manufacturers eliminates the guesswork and inefficiencies of conventional sourcing. Our curated network is built on rigorous due diligence, ensuring every supplier meets strict benchmarks in:

- Product Compliance (CE, FCC, RoHS, Qi wireless charging, sleep sound certification)

- OEM/ODM Capability (custom firmware, app integration, ergonomic design)

- Production Capacity & Lead Times (MOQs from 500 units, 25–35-day average shipping)

- Quality Control Systems (AQL 1.5, in-line inspections, 12-month warranty support)

- Export Experience (FCL/LCL logistics, DDP-ready, English-speaking project managers)

Time & Cost Savings Summary

| Sourcing Method | Avg. Time to Qualified Supplier | Risk of Non-Compliant Output | Estimated Sample-to-Production Time |

|---|---|---|---|

| Open B2B Platforms (e.g., Alibaba) | 6–8 weeks | High (42% fail QC audits) | 14–18 weeks |

| Independent Agent Sourcing | 4–6 weeks | Medium | 12–16 weeks |

| SourcifyChina Verified Pro List | < 10 business days | Low (< 8% failure rate) | 8–10 weeks |

By leveraging our pre-vetted supplier network, procurement teams reduce supplier onboarding time by up to 70% and accelerate time-to-market without sacrificing quality or compliance.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive market where speed, reliability, and compliance define success, SourcifyChina delivers a strategic advantage. Our Verified Pro List is not just a directory—it’s a time-to-market accelerator backed by supply chain intelligence and on-ground verification.

Act Now to Secure Your Competitive Edge:

✅ Receive your customized shortlist of 3–5 qualified sleeping trainer Bluetooth speaker suppliers

✅ Access exclusive factory audit summaries and sample evaluation support

✅ Fast-track negotiations with English-speaking, export-ready partners

👉 Contact our Sourcing Support Team today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina handle the verification—so you can focus on innovation, launch, and growth.

SourcifyChina | Trusted by 1,200+ Global Brands | Integrity. Efficiency. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.