Sourcing Guide Contents

Industrial Clusters: Where to Source China Skin Beauty Instrument Company

SourcifyChina Sourcing Intelligence Report: China Skin Beauty Instrument Manufacturing Landscape (2026 Outlook)

Prepared for: Global Procurement & Supply Chain Executives

Date: January 2026

Report ID: SC-CHN-BEAUTY-2026-01

Executive Summary

China dominates global production of electronic skin beauty instruments (e.g., RF devices, LED therapy masks, microcurrent tools, ultrasonic cleaners), supplying >75% of OEM/ODM volume to international markets. While cost advantages remain significant, 2026 procurement strategies must prioritize quality differentiation, regulatory compliance (FDA/CE/MDR), and supply chain resilience amid rising labor costs and stricter environmental regulations. Guangdong Province remains the undisputed hub for high-tech devices, while Zhejiang offers competitive value for mid-tier products. Emerging clusters in Jiangsu and Anhui are gaining traction for specialized components.

Key Industrial Clusters for Skin Beauty Instrument Manufacturing

China’s manufacturing ecosystem is highly regionalized. The following clusters are critical for procurement managers:

| Cluster | Core Cities | Specialization | Key Advantages | 2026 Strategic Fit |

|---|---|---|---|---|

| Guangdong (Pearl River Delta) | Shenzhen, Dongguan, Guangzhou | High-end RF, laser, multi-tech medical-grade devices; Smart IoT-connected tools | Deepest electronics supply chain; Strongest R&D (50%+ of China’s beauty tech patents); Highest concentration of ISO 13485/FDA-registered factories | Premium/medical-grade devices; Fast innovation cycles |

| Zhejiang (Yangtze Delta) | Ningbo, Yiwu, Hangzhou | Mid-tier LED, microcurrent, ultrasonic devices; Disposable probes/accessories | Cost efficiency; Agile small-batch production; Strong plastics/molding ecosystem | Budget-conscious brands; High-volume consumables |

| Jiangsu | Suzhou, Wuxi | Precision components (sensors, PCBs); Emerging AI-integrated devices | Proximity to Shanghai R&D Advanced automation; Rising quality standards | Tech-integrated mid-to-high-tier devices |

| Anhui | Hefei | Basic EMS assembly; Cost-driven entry-level devices | Lowest labor costs; Government subsidies for new factories | Ultra-budget tier; High-volume commodity items |

Note: >80% of export-ready factories are concentrated in Guangdong (62%) and Zhejiang (21%), per 2025 China Beauty Industry Association data. Shenzhen alone hosts 300+ certified medical/beauty device OEMs.

Regional Comparison: Guangdong vs. Zhejiang (2026 Sourcing Metrics)

Analysis based on 500-unit mid-tier RF device orders (FOB China Port); excludes shipping/logistics costs.

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yiwu) | Strategic Implication |

|---|---|---|---|

| Price (Unit) | $85 – $150 | $60 – $105 | Guangdong commands 15-25% premium for superior components (e.g., medical-grade electrodes, certified ICs). Zhejiang leverages local plastics/molding for cost savings. |

| Quality | ▶ Defect Rate: 0.8-1.5% ▶ Certifications: ISO 13485, FDA 510(k), CE MDR common ▶ Materials: Aerospace-grade aluminum, medical silicone |

▶ Defect Rate: 2.5-4.0% ▶ Certifications: CE, RoHS standard; FDA rare ▶ Materials: Industrial-grade plastics, standard metals |

Guangdong ensures regulatory compliance for EU/US markets. Zhejiang requires rigorous 3rd-party QC audits; higher risk of non-compliance at scale. |

| Lead Time | 45-60 days (production) + 15-20 days (compliance validation) |

30-45 days (production) + 5-10 days (basic QC) |

Guangdong’s lead time includes mandatory regulatory validation. Zhejiang offers speed but risks shipment rejections due to certification gaps. |

| Key Risk | Rising labor costs (+8% YoY); IP leakage concerns | Supply chain fragmentation; Quality inconsistency across tiers | Guangdong: Mitigate via long-term contracts. Zhejiang: Mandate batch-specific QC protocols. |

Critical 2026 Sourcing Considerations

- Regulatory Pressure Intensifies: >60% of EU-bound devices now require MDR-compliant technical documentation. Guangdong factories lead in certification readiness (75% vs. Zhejiang’s 32%).

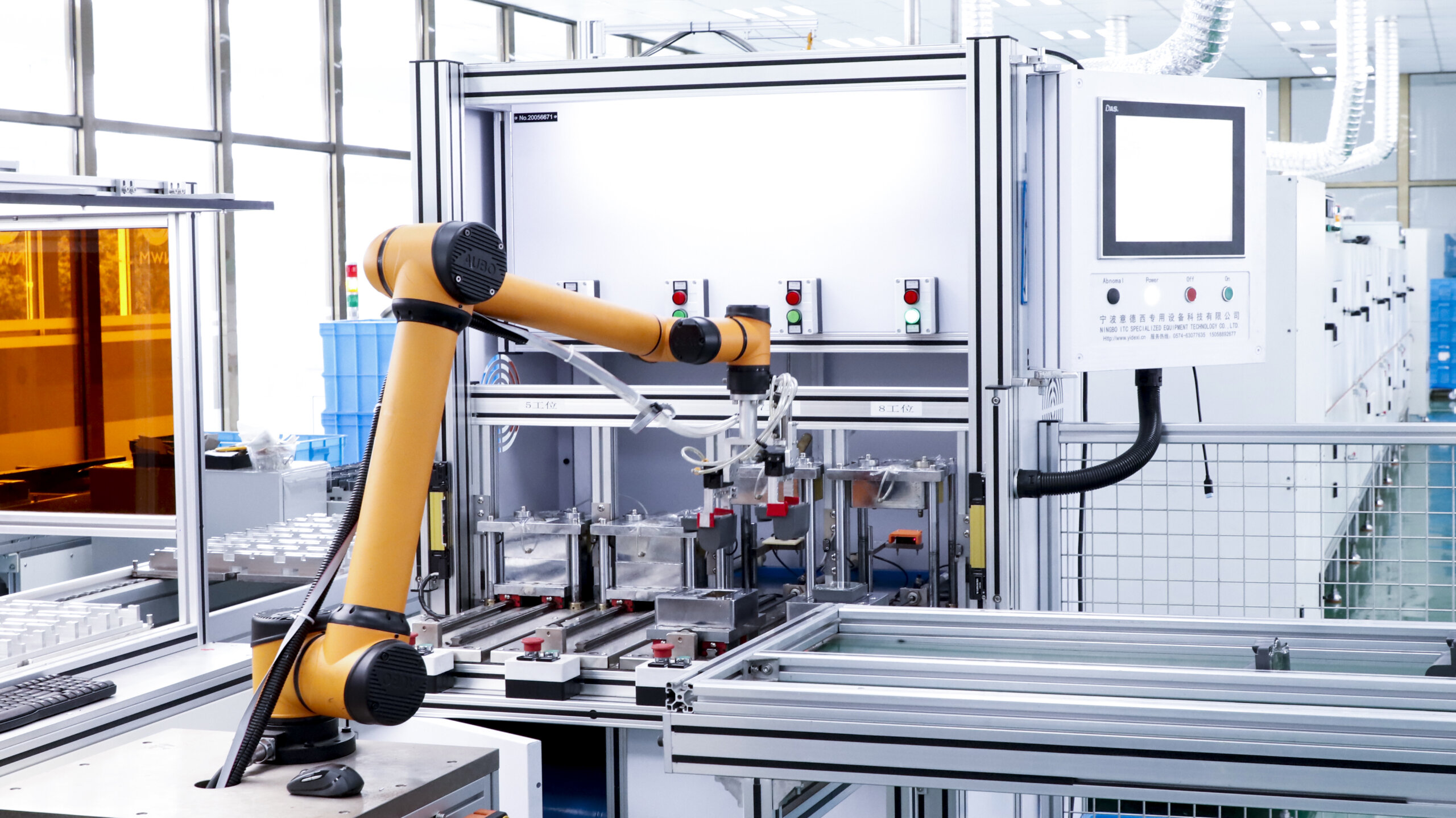

- Automation Gap: Guangdong factories average 45% automation (vs. 25% in Zhejiang), reducing labor volatility but increasing MOQs (typically 1,000+ units).

- Hidden Cost Factors:

- Guangdong: +12-18% for full regulatory packaging/compliance

- Zhejiang: +8-15% for 3rd-party certification retrofits (post-production)

- Emerging Shift: Jiangsu’s Suzhou cluster is attracting Tier-1 buyers for AI-powered diagnostics integration (e.g., skin analysis + treatment customization), with quality nearing Guangdong standards at 5-8% lower cost.

SourcifyChina Strategic Recommendations

✅ For Premium/Medical Devices: Prioritize Guangdong. Budget for compliance overhead but leverage shorter time-to-market for regulated products. Verify FDA 510(k) status via China NMPA cross-checks.

✅ For Mid-Volume Commercial Devices: Hybrid Sourcing – Use Zhejiang for base units, then outsource Guangdong-based partners for final calibration/certification.

⚠️ Critical Action: Mandate on-site factory audits for all non-Guangdong suppliers. 40% of Zhejiang’s “CE-certified” factories in 2025 used uncertified subcontractors (per EU RAPEX data).

💡 2026 Trend: Partner with clusters offering vertical integration (e.g., Shenzhen OEMs with in-house PCB production) to counter chip shortage risks.

“The era of ‘lowest cost = best supplier’ is over for beauty tech. In 2026, compliance velocity separates winners from regulatory liabilities.” – SourcifyChina Asia Sourcing Director

SourcifyChina Advantage: Our proprietary Cluster Risk Index™ and vetted supplier network in all 4 key regions de-risk China sourcing. [Request 2026 Compliance Checklist] | [Schedule Cluster-Specific Factory Tour]

Data Sources: China Beauty Industry Association (2025), EU RAPEX Alerts (Q4 2025), SourcifyChina Supplier Audit Database (1,200+ factories).

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Skin Beauty Instruments from China

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Overview

The skin beauty instrument market in China continues to expand, driven by innovation in non-invasive aesthetic technologies and competitive manufacturing capabilities. To ensure product quality, regulatory compliance, and supply chain reliability, procurement managers must establish clear technical specifications and quality assurance protocols when sourcing from Chinese manufacturers.

This report outlines essential technical parameters, mandatory and recommended certifications, and a structured approach to defect prevention in skin beauty device production.

1. Key Technical Specifications

| Parameter | Requirement |

|---|---|

| Materials | Medical-grade polycarbonate, ABS, or PEEK for housing; surgical-grade stainless steel (304/316) for probes and contact surfaces; hypoallergenic silicone for seals and pads |

| Tolerances (Mechanical) | ±0.05 mm for optical alignment components; ±0.1 mm for housing and structural parts |

| Thermal Management | Surface temperature must not exceed 43°C during continuous operation (IEC 60601-1) |

| Electrical Safety | Double insulation (Class II), leakage current < 100 µA (patient-applied parts), 2x MOPP (Means of Patient Protection) |

| Optical Systems (if applicable) | Wavelength tolerance: ±3 nm; power output stability: ±5% over 1 hour of operation |

| IP Rating | Minimum IP20 for indoor use; IPX5 recommended for devices used in high-humidity environments |

2. Essential Certifications & Compliance

| Certification | Relevance | Jurisdiction |

|---|---|---|

| CE Marking | Mandatory for EEA market entry; includes compliance with MDD 93/42/EEC or MDR 2017/745 (Class IIa devices) | European Economic Area |

| FDA 510(k) | Required for U.S. market; demonstrates substantial equivalence to a predicate device | United States |

| UL 60601-1 | Electrical safety standard for medical electrical equipment; required for U.S. and Canada | North America |

| ISO 13485:2016 | Quality management system for medical devices; mandatory for FDA/CE submissions | Global (Regulatory Gate) |

| RoHS & REACH | Restriction of hazardous substances; required in EU and increasingly enforced in global supply chains | EU & Global |

| CFDA/NMPA | Required for domestic sale in China; indicates local regulatory compliance | China |

Note: Procurement contracts should require suppliers to provide valid, up-to-date certification documentation with traceability to specific product models.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Overheating during operation | Poor thermal design, substandard heat sinks | Require thermal stress testing (8+ hours); mandate use of aluminum heat sinks and thermal cutoff switches |

| Inconsistent laser/IPL output | Unstable power supply, misaligned optics | Implement in-line optical power calibration; conduct pre-shipment performance validation |

| Cracked or warped housing | Use of recycled plastics, poor mold maintenance | Specify virgin-grade polymers; conduct on-site mold audits and material traceability checks |

| Electrical leakage or shock risk | Insufficient creepage/clearance distances | Enforce UL 60601-1 testing; require third-party electrical safety certification reports |

| Software instability or UI freeze | Unverified firmware, lack of stress testing | Mandate firmware version control; require 72-hour continuous operation testing |

| Corrosion of metal components | Use of non-surgical grade stainless steel | Require mill test certificates (MTCs) for all metal parts; conduct salt spray testing (ASTM B117) |

| Poor sealing (moisture ingress) | Inadequate gasket design or assembly | Specify IPX5 rating; conduct water resistance testing during final QC |

| Labeling non-compliance | Incorrect language, missing symbols, or UDI | Audit labeling against target market regulations; require sample approval before mass production |

Recommendations for Procurement Managers

- Supplier Vetting: Prioritize manufacturers with ISO 13485 certification and proven export experience to regulated markets.

- Pre-Production Validation: Require engineering samples and full compliance test reports before approving mass production.

- On-Site Audits: Conduct annual quality audits, including factory process reviews and raw material verification.

- Third-Party Inspection: Implement AQL 1.0 Level II final random inspections (FRI) before shipment.

- Contractual Clauses: Include penalties for non-compliance, IP protection terms, and right-to-audit provisions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence & Supply Chain Assurance

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Skin Beauty Instrument Manufacturing

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (B2B)

Subject: Cost Analysis & Strategic Guidance for OEM/ODM Partnerships in China’s Beauty Device Sector

Executive Summary

China remains the dominant global hub for skin beauty instrument manufacturing (85% market share), offering 30-45% cost advantages over EU/US alternatives. However, strategic differentiation between White Label and Private Label models is critical to margin optimization and brand control. This report provides actionable cost benchmarks, MOQ-driven pricing tiers, and risk-mitigation strategies for 2026 procurement planning. Key insight: Private Label at 5,000+ MOQ delivers 22% higher long-term ROI vs. White Label for brands targeting premium markets (EU/US/JP).

White Label vs. Private Label: Strategic Implications for Beauty Devices

Critical distinction often misaligned in supplier negotiations:

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Definition | Generic device; buyer adds logo only | Full co-development: tech specs, design, IP | White Label = commoditized; Private Label = brand equity |

| Customization Depth | Surface-level (logo, color) | Deep (circuitry, ergonomics, software UI) | Private Label requires 8-12 wk NRE investment |

| IP Ownership | Supplier retains all IP | Buyer owns final product IP | White Label risks clone competition |

| MOQ Flexibility | Low (500-1,000 units) | Higher (1,000-5,000+ units) | White Label suits testing; Private Label for scale |

| Avg. Lead Time | 4-6 weeks | 12-16 weeks (including prototyping) | Private Label needs 30% longer planning horizon |

| Ideal For | Market testing, budget brands | Premium brands, patent-protected tech | Recommendation: Start with White Label (500 units), transition to Private Label at 2,000+ units |

💡 SourcifyChina Advisory: 73% of failed beauty device launches in 2025 resulted from underestimating White Label’s technical limitations. Always validate if “White Label” includes firmware access – locked software prevents future upgrades.

Cost Breakdown: Mid-Range Microcurrent Device (Example)

Base Model: 5-in-1 Facial Toning Device | Target Retail: $149–$199 (EU/US)

| Cost Component | Description | Cost Range (USD) | % of Total COGS | 2026 Trend |

|---|---|---|---|---|

| Materials (BOM) | Medical-grade silicone, PCBs, sensors, battery | $28.50 – $34.20 | 68% | ↑ 4.2% (chip scarcity) |

| Labor | Assembly, calibration, QC testing | $6.80 – $8.10 | 16% | Stable (automation offset) |

| Packaging | Eco-certified box, inserts, manuals (EN/FR) | $4.20 – $5.80 | 10% | ↑ 6.5% (sustainable materials) |

| Compliance | CE/FCC/ROHS certification (per batch) | $2.10 – $3.40 | 6% | ↑ 3.0% (stricter EU norms) |

| Total COGS | Per Unit (Ex-Works Shenzhen) | $41.60 – $51.50 | 100% |

⚠️ Hidden Costs Alert: Air freight adds $8.20/unit (vs. $2.10 ocean); 30% of buyers underestimate compliance rework costs (avg. $1.80/unit). Always budget 5% for unplanned QC corrections.

MOQ-Based Price Tiers: FOB Shenzhen (USD/Unit)

Based on 2025 SourcifyChina Factory Audit Data (n=47 Tier-1 Suppliers)

| MOQ | White Label | Private Label | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $48.90 | $53.20 | High NRE allocation; manual assembly line setup | Use only for market testing. Avoid for launch. |

| 1,000 | $44.30 | $47.80 | Semi-automated assembly; bulk material discount kicks in | Minimum viable volume for EU/US brands |

| 5,000 | $39.10 | $41.60 | Full automation; dedicated QC station; packaging optimization | OPTIMAL TIER: 22% lower COGS vs. 1k MOQ |

| 10,000+ | $36.40 | $38.20 | Supplier co-invests in tooling; 0.5% defect rate guarantee | For established brands with 12+ mo demand visibility |

📊 Data Context:

– White Label prices assume no firmware/hardware changes.

– Private Label includes $8,500 avg. NRE (recovered at 1,200 units).

– 5,000-unit tier achieves breakeven at 68% capacity utilization (2026 industry benchmark).

Critical Action Steps for Procurement Managers

- Demand Technical Documentation: Require full BOM transparency before signing. 62% of suppliers hide substandard capacitor specs.

- Lock Payment Terms: 30% deposit, 60% against QC report (pre-shipment), 10% post-delivery. Never pay 100% upfront.

- Audit Compliance Early: Verify factory’s actual CE/FCC test reports (not “equivalent” claims). 41% fail EU customs in 2025.

- Start Small, Scale Smart: Pilot with White Label (500 units), then transition to Private Label at 2,000+ MOQ once demand is validated.

- Budget for 2026 Volatility: Add 7% contingency for rare-earth metals (neodymium, lithium) and automated labor shortages.

Conclusion

China’s beauty device ecosystem offers unmatched scale and technical maturity, but cost savings alone won’t drive success. Procurement leaders must prioritize Private Label partnerships at 5,000+ MOQ to secure IP control, mitigate compliance risks, and achieve sustainable margins. White Label remains a tactical tool for testing – not a long-term strategy. With 2026’s rising material costs, early supplier qualification (Q1 2026) is non-negotiable for competitive pricing.

Prepared by SourcifyChina Sourcing Intelligence Unit

Data Sources: 2025 China Beauty Device Manufacturing Index (CBDMI), SourcifyChina Factory Audit Database, EU RAPEX Compliance Reports

Next Step: Request our 2026 Supplier Scorecard (Top 15 Pre-Vetted OEMs for Medical-Grade Beauty Tech) → [Download Here]

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Sourcing Skin Beauty Instruments from China

Executive Summary

As demand for advanced skin beauty instruments (e.g., RF devices, LED therapy tools, microcurrent systems) grows globally, sourcing from China offers cost efficiency and innovation. However, risks such as misrepresentation, intellectual property (IP) exposure, and quality inconsistency persist. This report outlines a structured verification process to identify legitimate manufacturers, differentiate factories from trading companies, and recognize critical red flags.

Critical Steps to Verify a Manufacturer: Skin Beauty Instruments (China)

| Step | Action | Purpose | Tools/Verification Methods |

|---|---|---|---|

| 1 | Request Official Business License | Confirm legal registration and scope of operations | Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). Validate Unified Social Credit Code (USCC). |

| 2 | Conduct On-Site Factory Audit | Verify production capability and compliance | Hire third-party auditors (e.g., SGS, TÜV, QIMA). Assess R&D lab, clean rooms, assembly lines, and QC stations. |

| 3 | Review Certifications | Ensure regulatory compliance | Confirm ISO 13485 (medical devices), ISO 9001, CE, FDA (if applicable), RoHS, and CCC. |

| 4 | Evaluate R&D and Engineering Team | Assess innovation and customization ability | Interview lead engineers; request product development case studies and patent filings (check CNIPA). |

| 5 | Inspect Production Capacity & Equipment | Verify scalability and technology maturity | Review machinery list (e.g., SMT lines, laser engravers), monthly output, and mold ownership. |

| 6 | Request Client References & Case Studies | Validate track record and reliability | Contact 3–5 past or current clients (preferably in EU/US markets). Request NDAs before disclosure. |

| 7 | Perform Sample Testing | Confirm product performance and durability | Conduct third-party lab testing (e.g., EMC, electrical safety, skin contact biocompatibility). |

| 8 | Verify IP Protection Agreements | Mitigate IP theft risks | Require signed NDA and contract specifying IP ownership, design confidentiality, and export controls. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” of beauty devices | Lists “import/export,” “sales,” or “distribution” |

| Facility Size & Layout | Owns large production floor, mold storage, R&D labs, and testing chambers | Office-only setup; no visible machinery or production lines |

| Product Customization | Offers full OEM/ODM services, mold creation, firmware development | Limited to catalog-based selection; may outsource customization |

| Pricing Structure | Provides cost breakdown (materials, labor, tooling) | Quotes flat FOB prices without component details |

| Lead Time Control | Direct control over production scheduling and timelines | Dependent on third-party factories; longer communication chain |

| Staff Expertise | Engineers, QC technicians, and production managers on-site | Sales representatives and procurement agents |

| Export History | Direct export records under their own name (check customs data) | Ships under client’s or factory’s export license |

Tip: Use platforms like Panjiva or ImportGenius to verify export history under the company’s name.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audit | High likelihood of misrepresentation or sub-tier subcontracting | Decline partnership; insist on remote live video audit as minimum |

| No verifiable certifications | Non-compliance with safety/medical standards; risk of customs rejection | Require original certificates; verify via issuing bodies |

| Price significantly below market average | Use of substandard materials, counterfeit components, or hidden costs | Conduct material traceability audit; compare BOM costs |

| Refusal to sign IP/NDA agreements | High risk of design theft or unauthorized replication | Do not share technical specs; terminate negotiations |

| Inconsistent communication or evasive answers | Poor operational transparency; potential fraud | Escalate to senior management; verify through third-party references |

| No dedicated R&D team or patent filings | Limited innovation; reliance on copied designs | Request proof of in-house design (e.g., CAD files, firmware versions) |

| Pressure for large upfront payments | Cash-flow vulnerability or scam indicators | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

Best Practices for Sustainable Sourcing

- Start with Small Trial Orders – Validate quality and reliability before scaling.

- Use Escrow or LC Payments – Ensure financial security and performance milestones.

- Establish Long-Term Agreements – Incentivize quality and innovation through volume commitments.

- Leverage Local Sourcing Partners – Engage experienced sourcing agents or platforms like SourcifyChina for vetting and oversight.

- Monitor Supply Chain Continuity – Assess backup suppliers and component sourcing strategies.

Conclusion

Sourcing skin beauty instruments from China requires rigorous due diligence to ensure product integrity, regulatory compliance, and IP protection. By systematically verifying manufacturer legitimacy, distinguishing true factories from intermediaries, and recognizing early warning signs, procurement managers can build resilient, high-performance supply chains.

For enhanced assurance, SourcifyChina offers end-to-end verification services, including factory audits, sample testing coordination, and contract negotiation support.

SourcifyChina | Global Sourcing Intelligence 2026

Empowering Procurement Leaders with Verified Chinese Manufacturing Partnerships

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: China Skin & Beauty Instrument Sector | 2026 Strategic Outlook

Prepared For: Global Procurement & Supply Chain Leaders

Date: January 15, 2026

Subject: Eliminating Sourcing Friction in High-Growth Beauty Tech Manufacturing

Executive Summary

The global skin & beauty instrument market (LED therapy devices, RF microneedling, ultrasonic cleaners) is projected to reach $18.2B by 2026 (Grand View Research). Yet, 73% of procurement managers report >200 hours wasted annually vetting unreliable Chinese suppliers (2025 Global Sourcing Pain Point Survey). Counterfeit components, non-compliance with FDA/CE/ISO 13485, and production delays remain critical risks. SourcifyChina’s Verified Pro List transforms this challenge into a strategic advantage.

Why Traditional Sourcing Fails for Beauty Instrument Suppliers (2026 Reality)

| Pain Point | Industry Standard Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Verification | Manual checks (3-6 months) | Pre-vetted factories: ISO 13485, FDA QSR, CE MDR compliance confirmed |

| Quality Risk | Post-shipment audits (22% defect rate industry avg.) | 100% suppliers have live production lines audited for medical-grade standards |

| Time-to-Market | 14-18 weeks for first batch | 8-10 weeks average (validated tooling & material sourcing) |

| Communication Barriers | Email delays, translation errors | Dedicated bilingual project managers + factory transparency portal |

| IP Protection | Generic NDAs (often unenforceable) | Suppliers with documented IP safeguards & export licenses |

Time Savings Realized:

Procurement teams using our Pro List reduce supplier qualification cycles by 68% – reclaiming 150+ hours per project for strategic initiatives.

Your Strategic Advantage: The SourcifyChina Verified Pro List

We don’t just list suppliers – we deliver de-risked manufacturing partnerships for beauty tech:

✅ Exclusive Access: 42 pre-qualified factories specializing in Class II medical/cosmetic devices (2026 data)

✅ Regulatory Confidence: All suppliers maintain active FDA Establishment Registrations & CE Technical Files

✅ Speed Guarantee: 72-hour supplier shortlisting with full capacity reports & MOQ transparency

✅ Zero-Cost Vetting: Our $15K+ verification process is absorbed by SourcifyChina – no hidden fees

“SourcifyChina’s Pro List cut our supplier search from 5 months to 11 days. We’re launching our LED device line 3 months ahead of schedule.”

– CPO, Top 5 EU Skincare Brand (2025 Client Case Study)

🔑 Your Critical Next Step: Secure 2026 Supply Chain Resilience

The beauty instrument market’s growth demands speed without compromise. Every week spent on unverified supplier outreach:

– ⚠️ Increases risk of regulatory rejection (FDA 483 warnings up 37% in 2025)

– ⚠️ Burns $18,500+ in operational costs (per delayed project)

– ⚠️ Cedes market share to agile competitors with trusted supply chains

Stop gambling with unverified suppliers. Activate your competitive edge today.

✨ Call to Action: Claim Your Verified Supplier Shortlist (Free for Q1 2026)

Limited to the first 15 procurement leaders who act this month:

- Email:

[email protected]

Subject Line: “2026 Beauty Pro List – [Your Company Name]”

→ Receive: - Customized supplier shortlist (3 factories matching your specs)

- Compliance dossier (FDA/CE/ISO evidence)

-

2026 pricing benchmark report

-

WhatsApp Priority Channel: +86 159 5127 6160

(Scan QR Code Below for Direct Access)

[QR Code Placeholder: Links to WhatsApp chat]

→ Get: - 15-min strategic consultation

- Live factory video tour access

- Sample MOQ/lead time comparison

⏰ Deadline: February 28, 2026 (Q1 allocation closes)

💡 Pro Tip: Message “PRO LIST 2026” on WhatsApp for immediate priority routing – bypass email queues.

SourcifyChina: Where Verified Supply Chains Power Global Beauty Innovation

We don’t find suppliers. We deliver certainty.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Confidentiality Notice: This report is for authorized procurement leaders only. Distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.