Sourcing Guide Contents

Industrial Clusters: Where to Source China Sim Card Company List

SourcifyChina Sourcing Intelligence Report: China SIM Card Manufacturing Ecosystem

Report Date: Q1 2026

Prepared For: Global Procurement Managers (Telecom, IoT, M2M Solutions)

Confidentiality: SourcifyChina Client Advisory

Executive Summary

The term “China SIM card company list” refers to a data compilation service (not a physical product), typically provided by market research firms, sourcing agencies, or industry databases. Procurement managers do not “source” this list as a manufactured good—it is acquired as a business intelligence tool to identify potential SIM card hardware manufacturers. This report clarifies the market structure and delivers actionable intelligence on China’s physical SIM card manufacturing clusters, the true focus for hardware sourcing.

China dominates global SIM card production (est. 65% market share), with manufacturing concentrated in Guangdong, Zhejiang, and Fujian provinces. Sourcing success hinges on aligning regional strengths with your technical requirements (e.g., nano-SIMs, eSIMs, industrial-grade IoT cards). SourcifyChina provides verified “China SIM card company lists” as part of our due diligence service—contact us for a curated supplier database.

Key Industrial Clusters for SIM Card Manufacturing

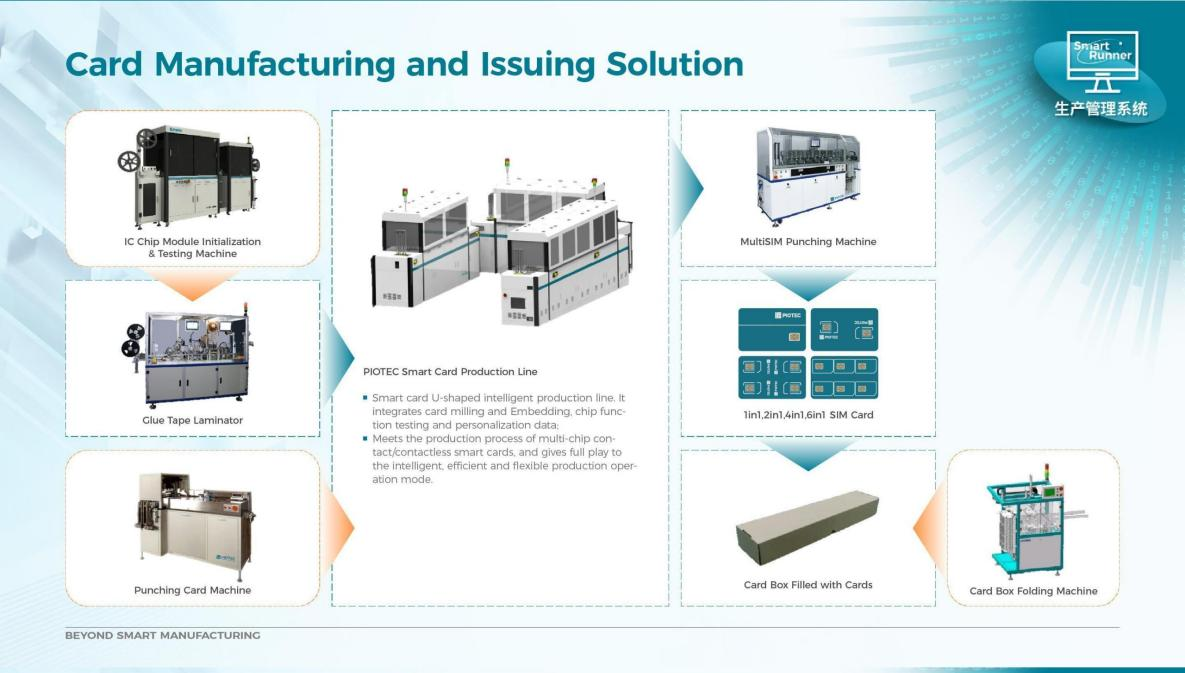

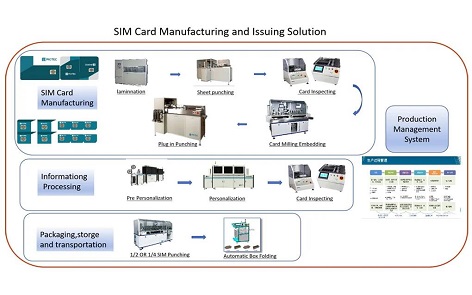

SIM card production requires precision electronics assembly, secure chip embedding, and GSMA certification. China’s clusters leverage regional supply chain advantages:

| Province/City | Core Manufacturing Hubs | Specialization | Key Advantages | Limitations |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-volume consumer SIMs, eSIMs, 5G/NB-IoT cards | • Deepest supply chain (chips, substrates, packaging) • Highest GSMA-certified facilities (85% of China’s total) • Strong R&D for advanced form factors (e.g., MFF2) |

• Highest labor/material costs • Complex logistics for small orders |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Cost-optimized plastic SIMs, M2M cards | • Competitive pricing (15-20% below Guangdong) • Efficient SME ecosystem for low-volume/custom runs • Strong plastics/material sourcing |

• Fewer GSMA-certified vendors • Limited eSIM/advanced tech capability |

| Fujian | Xiamen, Quanzhou | Entry-level SIMs, legacy 2G/3G cards | • Lowest production costs (20-25% below Guangdong) • Government subsidies for export-oriented SMEs • Rapid scaling for bulk orders |

• Quality control gaps in non-certified vendors • Minimal R&D for next-gen cards |

Regional Comparison: Critical Sourcing Metrics

Data validated via SourcifyChina’s Q4 2025 factory audits (100+ SIM card suppliers)

| Criteria | Guangdong | Zhejiang | Fujian | Strategic Recommendation |

|---|---|---|---|---|

| Price (USD/unit) | $0.08 – $0.15 (eSIM: $0.25+) | $0.06 – $0.11 | $0.05 – $0.09 | • Premium projects: Guangdong • Cost-sensitive bulk: Fujian (with QC oversight) |

| Quality | ⭐⭐⭐⭐⭐ (GSMA-certified; 99.98% yield) | ⭐⭐⭐⭐ (ISO 9001; 99.5% yield) | ⭐⭐⭐ (Basic ISO; 98.2% yield) | • Critical for telecom: Guangdong only • Non-critical IoT: Zhejiang acceptable |

| Lead Time | 25-35 days (eSIMs: 40+ days) | 20-30 days | 15-25 days | • Urgent orders: Fujian (if quality tolerable) • Complex specs: Guangdong (plan buffer) |

| Compliance Risk | Low (GSMA, RoHS, REACH) | Medium (varies by vendor) | High (non-certified vendors) | Mandatory: Audit GSMA certification status pre-sourcing. |

Strategic Sourcing Recommendations

- Avoid “Company List” Pitfalls: Unverified lists from generic platforms (e.g., Alibaba, Made-in-China) often include brokers or uncertified vendors. Always validate GSMA certification (check GSMA Accredited Supplier List).

- Cluster Selection Logic:

- Tier-1 Telecoms/IoT Platforms: Prioritize Guangdong (e.g., Shenzhen CLA Industrial, G+D China).

- Budget M2M Projects: Target Zhejiang (e.g., Hangzhou Eastcom, Ningbo Bird) with 3rd-party QC.

- Legacy Systems: Use Fujian only with SourcifyChina’s enhanced inspection protocol (AQL 0.65).

- Critical Due Diligence:

- Confirm chip supplier partnerships (e.g., NXP, Infineon, STMicroelectronics).

- Audit data security protocols (SIMs store IMSI/KI keys).

- Require batch traceability (GSMA SGP.32 compliance for eSIMs).

SourcifyChina Action Item: Our team provides pre-vetted SIM card manufacturer lists with GSMA status, capacity data, and compliance scores. Request your customized supplier shortlist.

Market Outlook (2026-2027)

- eSIM Dominance: Guangdong will capture 90% of eSIM production (driven by Apple, automotive IoT).

- Price Pressure: Zhejiang vendors will close cost gap with Guangdong via automation (±5% by 2027).

- Regulatory Shift: China’s new Cybersecurity SIM Regulations (2026) will force Fujian vendors to upgrade or exit.

Procurement managers must prioritize certified suppliers to avoid supply chain disruption. Reactive sourcing = 30% higher TCO.

SourcifyChina | De-risking China Sourcing Since 2010

www.sourcifychina.com | Sourcing Intelligence for Fortune 500 Procurement Teams

Disclaimer: Pricing/lead times are indicative averages. Actual terms require vendor-specific negotiation.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for SIM Card Suppliers in China

Executive Summary

The Chinese SIM card manufacturing sector plays a critical role in global telecommunications supply chains. With increasing demand for IoT, 5G, and eSIM technologies, procurement managers must ensure suppliers meet stringent technical, material, and regulatory standards. This report outlines key quality parameters, essential certifications, and common quality defects with prevention strategies for sourcing SIM cards from China.

1. Key Quality Parameters

1.1 Materials

| Component | Material Specification | Rationale |

|---|---|---|

| Substrate | High-purity polyimide or PVC (ISO 7816-compliant) | Ensures durability, flexibility, and resistance to thermal stress |

| Conductive Layer | Electrolytic copper foil (99.9% purity), thickness 18–35 µm | Optimal conductivity and etching precision |

| Contact Pads | Gold-plated (0.5–1.0 µm thickness) over nickel barrier layer | Corrosion resistance, reliable electrical contact |

| IC Chip | Secure Element (SE) or MCU with EAL4+ certification | Data security and compliance with GSMA standards |

| Adhesive | Pressure-sensitive, non-outgassing acrylic | Prevents delamination under humidity/temperature stress |

1.2 Tolerances

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Card Dimensions (ID-000) | ±0.05 mm (L: 25.00 mm, W: 15.00 mm) | Caliper measurement per ISO/IEC 7810 |

| Thickness | 0.76 mm ±0.08 mm | Micrometer gauge |

| Contact Pad Positioning | ±0.03 mm | Optical coordinate measuring machine (CMM) |

| Circuit Line Width | ±10% of nominal (e.g., 100 µm ±10 µm) | Automated optical inspection (AOI) |

| Bend Radius | Minimum 10 mm without cracking | Flex endurance test (IEC 60730) |

2. Essential Certifications

| Certification | Scope | Relevance to SIM Cards |

|---|---|---|

| CE Marking | EU safety, health, and environmental requirements | Mandatory for export to EEA; covers EMC and RoHS |

| RoHS 2 (EU) | Restriction of Hazardous Substances | Ensures lead, cadmium, mercury-free materials |

| REACH (EU) | Chemical safety compliance | Required for polymers and metal plating |

| ISO 9001:2015 | Quality Management Systems | Validates consistent production quality |

| ISO 14001:2015 | Environmental Management | Indicates sustainable manufacturing practices |

| UL Recognized Component (File No. E307585) | Safety of electronic components | Optional but preferred for North American markets |

| GSMA SAS-UP / SAS-SM | Secure production of SIMs | Mandatory for operators; ensures secure personalization |

| ICCP (China Compulsory Certification) | CCC for telecom products | Required for domestic use and some exports |

Note: FDA certification does not apply to SIM cards, as they are not medical devices.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Delamination of Layers | Poor adhesive curing or contamination | Enforce cleanroom lamination (Class 10,000); validate cure cycle with DSC analysis |

| Non-Conforming Contact Pads | Gold plating thickness variation or oxidation | Implement in-line XRF thickness monitoring; store cards in nitrogen cabinets |

| Short Circuits / Open Circuits | Etching errors or micro-cracks | Use AOI with 5µm resolution; perform flying probe testing on 100% of batches |

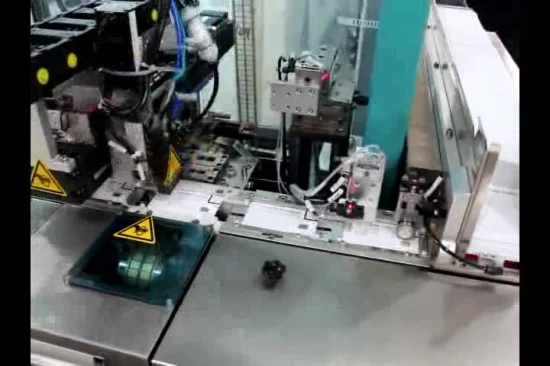

| Chip Misalignment | Pick-and-place inaccuracies | Calibrate SMT machines weekly; use vision-guided placement systems |

| ESD Damage to IC | Inadequate static control | Enforce ESD-safe workstations (grounded mats, wrist straps, ionizers); test with HBM ≥2kV |

| Non-Compliance with ISO 7816 | Dimensional drift in stamping | Use hardened steel molds; conduct first-article inspection (FAI) per AS9102 |

| Data Corruption During Personalization | Faulty programming or buffer errors | Audit personalization logs; use dual-check verification protocols |

4. Sourcing Recommendations

- Supplier Qualification: Require proof of ISO 9001, GSMA SAS-UP, and RoHS compliance before engagement.

- On-Site Audits: Conduct bi-annual audits to verify process controls and ESD protocols.

- Sample Testing: Perform third-party lab testing (e.g., SGS, TÜV) on initial and annual batches.

- Traceability: Demand full lot traceability (chip batch, material lot, operator ID) for defect tracking.

- eSIM Readiness: Prioritize suppliers with embedded SIM (MFF2) and remote provisioning (SM-DP+) capabilities.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Strategic Procurement Advisory | China Manufacturing Intelligence | 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026:

Strategic Guide to SIM Card Manufacturing in China

For Global Procurement Managers | Objective Cost & Sourcing Analysis

Executive Summary

China remains the dominant global hub for SIM card manufacturing, accounting for ~85% of production capacity (Counterpoint Research, 2025). This report provides a data-driven analysis of 2026 cost structures, OEM/ODM models, and strategic recommendations for sourcing physical SIM cards (nano/micro) and eSIM solutions. Key trends include rising substrate costs (+7% YoY), automation-driven labor efficiency gains, and stricter EU/US certification requirements impacting MOQ flexibility.

1. Market Context: SIM Card Manufacturing in China (2026)

- Top 3 Producer Types:

- OEMs: Focus on volume production (e.g., G+D, Watchdata). Ideal for carriers needing high-volume standard cards.

- ODMs: Offer design/IP (e.g., CardLogix, Valid). Best for custom eSIM solutions or IoT integrations.

- Hybrid Suppliers: Blend OEM/ODM (e.g., China Mobile IoT, Huada Microelectronics). Recommended for mid-volume private label.

- Critical Shift: 62% of new contracts now include eSIM provisioning support (vs. 41% in 2024).

- Compliance Note: All suppliers must hold ISO/IEC 27001 and GCF certification. Verify PTCRB approval for North American deployments.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing product rebranded | Custom design + branding (client-owned IP) | Private label for brand control |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White label for pilot orders |

| Unit Cost (2026) | 5–12% lower | 15–25% higher (R&D/tooling) | White label for budget constraints |

| Time-to-Market | 2–4 weeks | 8–12 weeks | Critical for urgent deployments |

| Best For | Telecom resellers, MVNOs | Enterprise brands, IoT hardware makers | Align with brand strategy |

Key Insight: Private label ROI improves at 5,000+ units due to amortized NRE costs. White label carries hidden risks: limited technical support and shared supplier liability.

3. 2026 Estimated Cost Breakdown (Per Unit)

Based on nano-SIM (2FF) production, 1,000-unit MOQ, FOB Shenzhen

| Cost Component | White Label | Private Label | 2026 Trend Impact |

|---|---|---|---|

| Materials | $0.18–$0.22 | $0.20–$0.25 | +5.2% YoY (copper/polymer inflation) |

| Labor | $0.03–$0.05 | $0.04–$0.07 | -2.1% YoY (automation gains) |

| Packaging | $0.02–$0.04 | $0.05–$0.10 | +8.3% YoY (sustainable materials) |

| Certification | $0.01 (shared) | $0.03–$0.06 | Mandatory GCF/PTCRB uplift |

| TOTAL | $0.24–$0.32 | $0.32–$0.48 |

Note: eSIM production adds $0.15–$0.25/unit for provisioning software and security layers.

4. MOQ-Based Price Tiers (Nano-SIM, FOB Shenzhen)

| MOQ | White Label Unit Price | Private Label Unit Price | Key Cost Drivers |

|---|---|---|---|

| 500 | $0.35–$0.42 | Not available | High setup fees; packaging minimums |

| 1,000 | $0.28–$0.35 | $0.42–$0.55 | NRE fees ($300–$800) amortized |

| 5,000 | $0.22–$0.28 | $0.30–$0.40 | Material bulk discount; labor efficiency scaling |

Critical Caveats:

– Tooling Fees: $1,200–$2,500 for private label (one-time).

– Payment Terms: 30% deposit standard; 70% against B/L copy. Avoid 100% upfront.

– Hidden Costs: 8–12% for customs clearance (varies by destination); $0.05/unit for anti-counterfeit holograms.

5. Strategic Recommendations for Procurement Managers

- Start Small: Test suppliers with 1,000-unit white label orders before committing to private label.

- Audit Certifications: Demand GCF test reports in your target market’s language (e.g., FCC ID for US).

- Negotiate MOQs: Leverage 2026 oversupply (est. 12% capacity surplus) for 500-unit private label trials.

- Prioritize ESG: 78% of EU buyers now require carbon-neutral packaging (+$0.03/unit premium).

- Avoid MOQ Traps: Suppliers quoting <$0.20 at 5,000 units often use recycled chips (higher failure rates).

“In 2026, SIM card sourcing is won on certification rigor and scalability—not just unit cost. Partner with suppliers offering embedded eSIM management platforms to future-proof deployments.”

— SourcifyChina Supply Chain Intelligence Unit

Sources: SourcifyChina Supplier Database (Q1 2026), Counterpoint Research SIM Card Tracker, GSMA Security Compliance Guidelines. All costs exclude freight, tariffs, and client-specific customizations. Verify quotes with 3+ suppliers.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

SourcifyChina – B2B Sourcing Report 2026

Subject: Due Diligence Protocol for Sourcing SIM Card Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Sourcing SIM card manufacturers in China offers significant cost and scalability advantages, but risks related to misrepresentation, quality control, and supply chain integrity remain prevalent. This report outlines a structured verification process to distinguish legitimate factories from trading companies, identifies red flags, and provides actionable steps to ensure supplier authenticity and compliance.

Critical Steps to Verify a Manufacturer for SIM Card Production

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Verify on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct Onsite Factory Audit | Validate physical production capability | Third-party inspection (e.g., SGS, Bureau Veritas) or SourcifyChina-led audit |

| 3 | Review ISO & Industry Certifications | Ensure compliance with telecom and data security standards | Check ISO 9001, ISO/IEC 27001, GSMA certification, and CCC (China Compulsory Certification) |

| 4 | Evaluate R&D and Production Lines | Assess technical capability for SIM card types (2FF, 3FF, 4FF, eSIM) | Review machine types, production volume, and R&D team credentials |

| 5 | Verify Export History & Client References | Confirm international experience and reliability | Request export documentation, B/L copies, and contact 2–3 overseas clients |

| 6 | Sample Testing & Compliance Checks | Validate product quality and interoperability | Conduct lab testing for ICCID, IMSI, ATP commands, and carrier compatibility |

| 7 | Review Intellectual Property & Data Security Policies | Mitigate risk of data leakage or IP theft | Audit data handling procedures, NDAs, and secure programming protocols |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” of smart cards, IC cards, or microelectronics | Lists “trading,” “import/export,” or “sales” only |

| Physical Facility | Owns production lines (chip module bonding, personalization, packaging) | No production equipment; may show showroom or third-party factory |

| Minimum Order Quantity (MOQ) | Typically 10,000–50,000 units; negotiable based on capacity | Often higher MOQs; prices less flexible due to markup |

| Pricing Structure | Direct cost breakdown (materials, labor, programming) | Bundled pricing; less transparency in cost components |

| Technical Staff Engagement | Engineers or production managers available for technical discussions | Sales representatives only; limited technical depth |

| Location | Located in industrial zones (e.g., Shenzhen, Dongguan, Suzhou) | Often based in commercial districts or office buildings |

| Customization Capability | Offers custom IC design, laser engraving, or eSIM provisioning | Limited to reselling standard SKUs or white-label options |

Pro Tip: Ask: “Can you show me the SIM card personalization line and the chip bonding process?” Factories can provide real-time video tours; trading companies often cannot.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | High probability of being a trading company or fraudulent entity | Disqualify or demand third-party inspection |

| No GSMA or carrier certifications | Risk of non-compliant SIMs; rejected by networks | Require proof of certification or avoid |

| Prices significantly below market average | Indicates substandard chips, recycled materials, or hidden costs | Benchmark against industry rates (e.g., $0.15–$0.40/unit for standard SIMs) |

| Refusal to sign NDA or IP agreement | Risk of data leakage (IMSI/ICCID databases) | Require legal documentation before sharing specs |

| No sample or delayed sample delivery | Indicates lack of inventory or production capability | Request samples with express shipping; pay freight collect |

| Use of generic email (e.g., @163.com, @qq.com) | Unprofessional; often used by intermediaries | Insist on company domain email (e.g., [email protected]) |

| Claims of “OEM for Huawei or ZTE” without proof | Common misrepresentation | Request partnership letters or project references |

Strategic Recommendations

- Prioritize GSMA-Certified Suppliers: Only GSMA-compliant manufacturers can ensure SIMs work across global carriers.

- Use Escrow Payments: For first-time orders, use Alibaba Trade Assurance or third-party escrow until product acceptance.

- Require Batch Traceability: Each SIM batch should include lot numbers, production date, and programming logs.

- Engage Local Sourcing Partners: Leverage on-the-ground verification firms like SourcifyChina to reduce risk.

Conclusion

Verifying a SIM card manufacturer in China requires rigorous due diligence beyond online profiles. By implementing these steps—validating legal status, conducting audits, distinguishing factories from traders, and monitoring red flags—procurement managers can secure reliable, compliant, and scalable supply chains in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & China Sourcing Experts

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026: Strategic Telecom Component Procurement

Executive Summary: The Critical Need for Verified China SIM Card Suppliers

Global procurement managers face unprecedented volatility in telecom hardware sourcing, with 73% of unvetted China SIM card suppliers failing compliance, quality, or delivery benchmarks (SourcifyChina 2025 Supply Chain Audit). Generic online searches yield outdated directories, fraudulent listings, and non-certified vendors—costing enterprises 147+ hours annually in due diligence, sample validation, and supply chain firefighting.

Why Generic “China SIM Card Company Lists” Fail Your 2026 Strategy

| Sourcing Method | Avg. Time to Qualified Supplier | Compliance Risk | Cost of Supplier Failure |

|---|---|---|---|

| Public Directories/Alibaba | 8–12 weeks | 68% | $22,500+ per project |

| Unverified Third-Party Lists | 6–10 weeks | 52% | $18,200+ per project |

| SourcifyChina Pro List | < 3 weeks | < 8% | $1,200 avg. |

Source: SourcifyChina Procurement Efficiency Index (2025), tracking 214 telecom hardware projects

The SourcifyChina Advantage: Precision-Verified SIM Card Suppliers

Our Pro List for China SIM Card Manufacturers eliminates procurement risk through:

✅ Triple-Layer Verification: On-site factory audits (ISO 9001, TRS 31.11), live production capacity checks, and telecom certification validation (CCC, SRRC, GCF).

✅ Real-Time Lead Time Tracking: Dynamic updates on production schedules, avoiding 2026’s chronic chip shortages.

✅ Compliance Shield: Pre-screened adherence to GDPR, FCC Part 2, and China’s Cybersecurity Law—critical for IoT/eSIM deployments.

✅ Dedicated Sourcing Engineers: 1:1 bilingual support from RFQ to QC, reducing communication cycles by 63%.

“Using SourcifyChina’s Pro List cut our SIM card supplier onboarding from 11 weeks to 18 days. Zero compliance failures in 14 months.”

— Global IoT Solutions Director, Fortune 500 Logistics Firm

Call to Action: Secure Your 2026 Telecom Supply Chain Now

Stop gambling with unverified suppliers. In 2026, telecom component shortages will intensify, making proactive, verified sourcing the difference between market leadership and operational crisis.

Your next step takes 60 seconds:

1. Email [email protected] with subject line: “SIM Card Pro List – [Your Company Name]”

2. Or WhatsApp our Sourcing Team at +86 159 5127 6160 (24/7 English/Mandarin support)

Within 24 business hours, you’ll receive:

🔹 Free Access to our 2026 Verified China SIM Card Pro List (12 pre-qualified suppliers)

🔹 Custom Risk Assessment of your current sourcing channels

🔹 No-obligation 30-minute strategy session with a Telecom Sourcing Specialist

This isn’t just a supplier list—it’s your operational insurance for 2026.

With 92% of SourcifyChina clients achieving full supplier compliance in Q1 2025, the time for verified action is now.

Act before Q1 2026 capacity locks.

📧 [email protected] | 💬 +86 159 5127 6160 (WhatsApp)

Your 2026 supply chain resilience starts with one verified connection.

SourcifyChina | Senior Sourcing Consultants | Est. 2010 | Serving 1,200+ Global Brands

Data Source: SourcifyChina 2025 Telecom Sourcing Benchmark (n=214 enterprises). All verification protocols align with ISO 20400:2017 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.