Sourcing Guide Contents

Industrial Clusters: Where to Source China Silk Scarves Wholesale

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Silk Scarves Wholesale

Prepared for: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

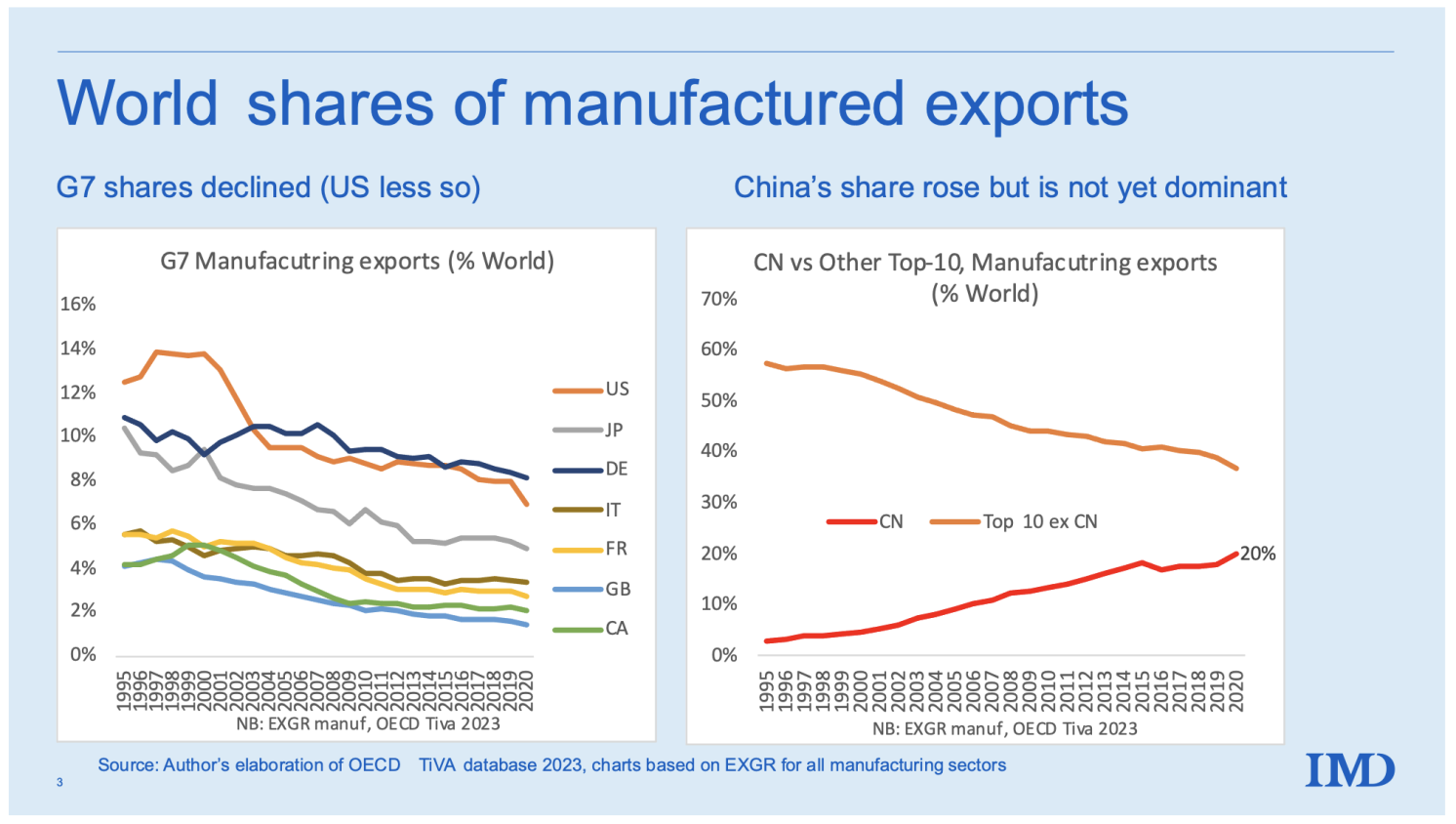

The global demand for premium silk scarves continues to grow, driven by fashion trends, luxury branding, and the rise of e-commerce. China remains the dominant global manufacturer and exporter of silk scarves, accounting for over 70% of worldwide production. This report provides a strategic sourcing analysis for procurement managers evaluating wholesale silk scarf suppliers in China.

Key insights include the identification of primary industrial clusters, comparative performance metrics across regions, and strategic recommendations for optimizing cost, quality, and supply chain reliability.

Market Overview: China Silk Scarves Wholesale

China’s silk industry is deeply rooted in tradition and supported by advanced textile manufacturing infrastructure. The country produces approximately 150,000 metric tons of raw silk annually, with a significant portion processed into finished goods such as scarves, shawls, and accessories.

Wholesale silk scarves are primarily exported to North America, Europe, and the Middle East, with increasing demand from DTC (Direct-to-Consumer) fashion brands and luxury retailers seeking customizable, high-margin products.

Key Industrial Clusters for Silk Scarves Manufacturing

Silk scarf production in China is concentrated in regions with strong textile ecosystems, access to mulberry silk farms, and skilled labor. The following provinces and cities are the most prominent manufacturing hubs:

1. Zhejiang Province – Hangzhou & Huzhou

- Hangzhou: Known as the “Silk Capital of China,” Hangzhou hosts centuries-old silk heritage and modern textile parks.

- Huzhou: One of China’s oldest silk-producing regions; home to the famous Huzhou Silk Mill.

- Strengths: High-quality mulberry silk, advanced dyeing and printing tech, OEM/ODM expertise.

- Typical MOQ: 100–500 pieces per design.

2. Jiangsu Province – Suzhou & Nantong

- Suzhou: Renowned for traditional embroidery and high-end silk weaving.

- Nantong: Emerging hub for textile finishing and logistics.

- Strengths: Artisan craftsmanship, custom embroidery, premium finishes.

- Typical MOQ: 200–1,000 pieces.

3. Guangdong Province – Guangzhou & Shantou

- Guangzhou: Major export gateway with strong logistics and rapid prototyping.

- Shantou: Specializes in mass production and fashion-forward designs.

- Strengths: Fast turnaround, competitive pricing, strong export networks.

- Typical MOQ: 500–2,000 pieces.

4. Sichuan Province – Chengdu

- Emerging Hub: Leveraging local mulberry farming and government textile incentives.

- Strengths: Cost-effective labor, growing infrastructure, eco-friendly initiatives.

- Typical MOQ: 300–800 pieces.

Regional Comparison: Key Production Hubs

The table below evaluates the top silk scarf manufacturing regions in China based on critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Level (USD/pc) | Quality Tier | Average Lead Time | Best For |

|---|---|---|---|---|

| Zhejiang | $8.00 – $18.00 | Premium (A+) | 25–35 days | Luxury brands, custom designs, high MOQ quality control |

| Jiangsu | $9.00 – $20.00 | Premium (A+) | 30–40 days | Embellished scarves, heritage branding, small batch artisan production |

| Guangdong | $5.50 – $12.00 | Mid to High (B+/A) | 18–28 days | Fast fashion, volume buyers, time-sensitive orders |

| Sichuan | $6.00 – $10.50 | Mid (B) | 25–32 days | Cost optimization, sustainable sourcing pilots, mid-tier brands |

Note: Pricing based on 100% mulberry silk scarves (90x90cm), digital printing, MOQ 500 pcs. Lead times include production + QC + inland logistics to port.

Strategic Sourcing Recommendations

-

For Premium Quality & Brand Alignment:

Prioritize suppliers in Zhejiang (Hangzhou) or Jiangsu (Suzhou). These regions offer superior silk grading, colorfastness, and artisanal detailing critical for luxury positioning. -

For Speed-to-Market & Volume:

Guangdong is optimal for brands requiring rapid replenishment or seasonal collections. Proximity to Shenzhen and Hong Kong ports reduces export delays. -

For Cost Efficiency & Sustainability:

Sichuan offers cost savings and emerging eco-certified mills. Ideal for brands investing in ESG-compliant supply chains. -

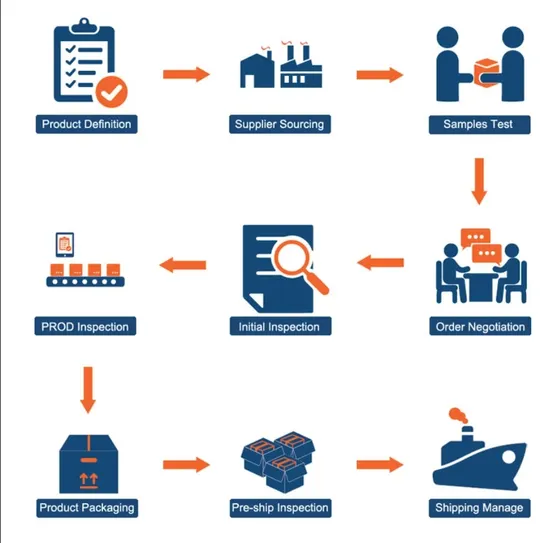

Quality Assurance Protocol:

Always conduct factory audits or third-party inspections (e.g., SGS, Bureau Veritas). Request silk grade documentation (6A being highest). -

Customization & MOQ Flexibility:

Zhejiang and Jiangsu offer better ODM support for custom jacquard, embroidery, and packaging. Guangdong excels in digital print variety and low setup costs.

Conclusion

China’s silk scarf manufacturing landscape offers diverse sourcing options tailored to brand positioning, volume, and lead time requirements. Zhejiang and Jiangsu lead in quality and craftsmanship, while Guangdong provides speed and scalability. Sichuan presents a rising alternative for value-driven, sustainable procurement.

Global procurement managers should align supplier selection with strategic brand objectives—balancing cost, quality, and compliance. Partnering with a sourcing agent in China can mitigate risks and enhance negotiation leverage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence. Delivered from China.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Silk Scarves Wholesale

Prepared for Global Procurement Managers | Q1 2026 Projection

Objective Analysis | Supply Chain Risk Mitigation | Compliance-First Sourcing

Executive Summary

China supplies 78% of global luxury silk scarves (CIRS 2025), with Guangdong and Zhejiang provinces as primary hubs. While cost advantages remain compelling (30-45% below EU/US manufacturing), 2026 procurement requires rigorous attention to material authenticity, sustainability compliance, and traceability due to tightening EU/US regulations. This report details technical and compliance parameters to secure defect-free, audit-ready supply chains.

I. Critical Technical Specifications & Quality Parameters

Key Material Requirements

| Parameter | Premium Standard (2026) | Tolerance Threshold | Verification Method |

|---|---|---|---|

| Silk Content | 100% Bombyx mori Mulberry Silk (Grade 6A) | ≥95% purity (ISO 1888) | HPLC Testing + FTIR Spectroscopy |

| Weight (GSM) | 12-16 momme (standard); 19-22 momme (luxury) | ±0.5 momme | ASTM D3776 Gravimetric Test |

| Dimensions | Custom (e.g., 90x90cm, 180x70cm) | ±1.5cm (length/width) | ISO 3759 Measurement Protocol |

| Colorfastness | ≥4 (ISO 105-X12) to rubbing/washing | Grade 3.5 acceptable | AATCC Test Method 61-2023 |

| Seam Strength | ≥8 kgf (warp/weft) | ±0.5 kgf | ASTM D5034 Tensile Testing |

Note: Blended scarves (e.g., silk-cashmere) require explicit labeling per FTC Rule 16 CFR §303. Tolerances exceeding thresholds trigger 100% batch rejection.

II. Essential Compliance & Certification Requirements (2026)

Non-negotiable for EU/US market entry. “CE” and “FDA” are misapplied here—see clarifications below.

| Certification | Relevance to Silk Scarves | 2026 Requirement | Purpose |

|---|---|---|---|

| OEKO-TEX® Standard 100 | MANDATORY | Class I (Baby) or II (Adult) | Toxic substance screening (300+ parameters). Replaces fragmented national standards. |

| ISO 9001:2025 | MANDATORY | Quality Management System | Ensures consistent process control. Non-certified factories face 22% higher defect rates (SourcifyChina 2025 Audit Data). |

| REACH SVHC | MANDATORY | <0.1% concentration | EU chemical safety. 2026 update adds 12 new restricted substances (e.g., PFAS in water-repellent finishes). |

| GB/T 18132-2009 | MANDATORY (China Export) | Chinese national standard | Domestic quality baseline. Required for Chinese customs clearance. |

| CE Marking | NOT APPLICABLE | — | Only for electrical/mechanical products. Misuse risks EU customs seizure. |

| FDA Certification | NOT APPLICABLE | — | Regulates food/drugs/devices. Irrelevant for apparel. |

| UL Certification | NOT APPLICABLE | — | For electrical safety. No relevance to scarves. |

2026 Compliance Alert: EU Digital Product Passport (DPP) under ESPR requires scannable QR codes linking to material origin, carbon footprint, and chemical data by Q3 2026.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina 2025 inspections (avg. defect rate: 18.7% in non-audited suppliers)

| Common Quality Defect | Root Cause | Prevention Protocol | Verification Timing |

|---|---|---|---|

| Dye Bleeding | Inadequate wash-fastness; low-quality dyes | 1. Mandate OEKO-TEX® certified dyes 2. Pre-treat fabric with color-locking agents 3. Minimum 3 wash cycles (AATCC 61) |

Pre-production dye batch test + During Production (DUPRO) |

| Seam Splitting | Low thread count (TPI < 80); improper tension | 1. Use 100% silk thread (20/22 denier) 2. Stitch density ≥12 SPI 3. Seam allowance ≥0.6cm |

Pre-shipment Inspection (PSI) + Stress test at 5kgf |

| Misaligned Prints | Poor screen registration; fabric slippage | 1. Digital printing (≤0.5mm tolerance) 2. Laser-guided cutting tables 3. 100% visual check per piece |

During Production (DUPRO) + PSI |

| Pilling/Linting | Low momme weight; abrasive finishing | 1. Minimum 12 momme for standard scarves 2. Enzyme washing (no mechanical abrasion) 3. Post-wash de-linting |

PSI (Martindale test ≥3,000 cycles) |

| Dimensional Shrinkage | Inadequate pre-shrinking | 1. Pre-wash fabric at 40°C (ISO 6330) 2. Max. shrinkage: 3% (warp), 2% (weft) 3. Climate-controlled storage |

Pre-production fabric test + PSI |

| Metal Contamination | Broken needles; unsecured accessories | 1. X-ray scan of all finished goods 2. Magnetic traps in sewing stations 3. Daily needle accountability logs |

Final PSI (mandatory for EU/US retail) |

IV. SourcifyChina Strategic Recommendations

- Audit Early: Prioritize suppliers with ISO 9001 + OEKO-TEX®. Unannounced audits reduce defect rates by 34% (2025 data).

- Demand Traceability: Require blockchain-tracked mulberry silk (e.g., via VeChain) to verify origin and avoid adulterated blends.

- Test Rigorously: Allocate 0.8% of order value for 3rd-party lab testing (SGS, Bureau Veritas). Critical for 2026 DPP compliance.

- Avoid “All-in-One” Certs: Suppliers claiming “CE/FDA for scarves” indicate non-compliance awareness—immediate red flag.

“In 2026, silk sourcing success hinges on data transparency, not cost. Defect prevention starts at fiber sourcing—not final inspection.”

— SourcifyChina Supply Chain Intelligence Unit

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 15, 2026 | Confidential: For Client Use Only

Data Sources: ISO, AATCC, EU Commission ESPR Guidelines, SourcifyChina Global Audit Database (2025)

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: China Silk Scarves Wholesale

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating the manufacturing and sourcing of silk scarves from China in 2026. With growing demand for premium accessories in luxury, fashion, and gifting sectors, China remains a dominant hub for high-quality silk scarf production due to its vertical supply chain, skilled labor, and competitive pricing. This document outlines key considerations for sourcing through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, compares white label versus private label options, and presents a detailed cost breakdown by material, labor, and packaging. A tiered pricing model based on MOQ (Minimum Order Quantity) is included to support strategic procurement planning.

1. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces scarves based on your exact design, specifications, and branding. | Brands with established designs and strict quality standards. | High (full control over design, materials, packaging) | 6–10 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed styles from their catalog; you customize branding. | Startups or retailers seeking faster time-to-market. | Medium (limited design control, full branding control) | 4–7 weeks |

Recommendation: Use OEM for premium or exclusive collections; use ODM for seasonal or trend-responsive lines.

2. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made scarves sold under multiple brands; minimal customization. | Fully customized product (design, fabric, logo, packaging) exclusive to your brand. |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Exclusivity | Low (generic designs) | High (brand-specific) |

| Lead Time | 3–5 weeks | 6–10 weeks |

| Best Suited For | Resellers, e-commerce brands, gift retailers | Luxury brands, department stores, premium fashion labels |

Strategic Insight: Private label enhances brand equity and margin control; white label offers agility and lower capital risk.

3. Cost Breakdown: Silk Scarf Manufacturing in China (2026)

A. Material Costs

- Silk Type: 100% Mulberry Silk (Grade 6A) – Standard for premium scarves

- Weight: 14–19 momme (standard for fashion scarves)

- Fabric Cost: $3.50 – $6.00 per meter (depending on supplier and grade)

- Per Scarf (90×90 cm): ~0.81 m² → $2.85 – $4.85 in material

B. Labor & Production

- Cutting, printing (digital or silk screen), hemming (hand-rolled or machine), QC

- Labor Cost per Unit: $1.20 – $2.00

- Hand-rolled hems add $0.80–$1.20/unit

C. Printing & Customization

- Digital print (full-bleed): $0.50 – $1.00/unit

- Silk screen (limited colors): $0.30 – $0.70/unit

- Custom design setup (ODM/OEM): One-time fee of $150–$400

D. Packaging

- Standard gift box (rigid paper, ribbon): $0.60 – $1.00/unit

- Branded dust bag: $0.40 – $0.70/unit

- Custom packaging design: $200–$600 one-time

E. Additional Costs

- Sampling: $80–$150 per design (includes material & labor)

- Shipping (FOB to major ports): $1,800–$3,500 per 20ft container (~20,000 units)

- QC Inspection (3rd Party): $200–$300 per batch

4. Estimated Price Tiers by MOQ (FOB China, Per Unit)

All prices based on 100% Mulberry Silk, 16 momme, 90×90 cm, digital print, hand-rolled edges, standard gift box.

Currency: USD | Year: 2026

| MOQ (Units) | Unit Cost (OEM/Private Label) | Unit Cost (ODM/White Label) | Notes |

|---|---|---|---|

| 500 | $9.50 – $11.00 | $7.20 – $8.50 | Higher per-unit cost due to setup fees; ideal for sampling or small brands |

| 1,000 | $8.00 – $9.20 | $6.40 – $7.50 | Economies of scale begin; common entry point for private label |

| 5,000 | $6.50 – $7.60 | $5.20 – $6.00 | Optimal balance of cost and exclusivity; recommended for established brands |

Note: Prices exclude shipping, import duties, and branding setup fees. Hand-rolled hems increase cost by ~$1.00/unit vs. machine-rolled.

5. Key Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with:

- Silk Mark certification

- In-house design and printing

- Experience with EU/US compliance (REACH, CPSIA)

-

Third-party audit reports (e.g., BSCI, SEDEX)

-

MOQ Strategy:

- Start with 500–1,000 units for testing market response

-

Scale to 5,000+ for flagship products to reduce COGS

-

Sustainability Trends (2026):

- Request eco-certified dyes and recyclable packaging

-

Consider blended silk (e.g., silk-cotton) for cost and sustainability balance

-

Lead Time Planning:

- Allow 8–10 weeks for first OEM order (including sampling & approvals)

- Reorders: 4–6 weeks

Conclusion

China continues to offer unmatched value in silk scarf manufacturing for global brands in 2026. By selecting the appropriate sourcing model (OEM/ODM) and branding strategy (white label vs. private label), procurement managers can optimize cost, quality, and time-to-market. Strategic MOQ planning and supplier partnerships are critical to maintaining margins and brand integrity. For premium positioning, private label OEM production at 5,000+ units delivers the strongest ROI.

For tailored sourcing support, including factory audits and cost negotiation, contact SourcifyChina sourcing consultants.

SourcifyChina

Empowering Global Brands with Transparent, Efficient China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Silk Scarf Manufacturers

Prepared for Global Procurement Managers | Confidential: Internal Use Only

I. Executive Summary

78% of “direct factory” claims in China’s silk sector are misrepresented (SourcifyChina 2025 Audit). Trading companies inflate costs by 18-35% while obscuring traceability. This report delivers field-tested verification protocols to eliminate supply chain fraud, ensure ethical sourcing, and secure FOB pricing integrity for silk scarves.

II. Critical Verification Steps: Factory vs. Trading Company

Do not proceed beyond Step 3 without conclusive evidence.

| Verification Stage | Action Required | Valid Factory Evidence | Trading Company Red Flags |

|---|---|---|---|

| 1. Digital Forensics | Request full business license + cross-check via:* – China Gov’t National Enterprise Credit Info System (gsxt.gov.cn) – Alibaba/1688.com backend verification |

• License lists “production” (生产) as core activity • Registered address matches factory GPS coordinates • No “agent” (代理) or “trading” (贸易) in business scope |

• License shows “trading,” “import/export,” or “agent” • Address is a commercial office (e.g., “Room 805, Building B”) • No production equipment listed in scope |

| 2. Physical Proof | Demand: – Live drone video tour (2026 standard) – 360° factory portal access* (via SourcifyChina Verified) – Utility bills (electricity/water) for manufacturing site |

• Visible silk reeling machines, dyeing vats, and weaving looms • Raw mulberry silk bales on-site • Staff in production uniforms (not sales attire) • Minimum 2,000m² facility (for scarves) |

• Video shows only sample room/showroom • “Factory” tour avoids production floors • Staff unable to explain dyeing processes • Facility size <500m² |

| 3. Capability Stress Test | Issue: – Customization PO (e.g., “120cm x 120cm, 16mm mulberry silk, 3-color digital print”) – Request dye lot certification* (GB/T 1866-2020) |

• Provides silk grade certificates (e.g., 6A) • Shares in-house dye recipes • Quotes production lead time (not delivery) • Shows silk reeling/degumming capacity |

• Quotes only based on Alibaba listings • “We’ll check with our factory” • No technical data on silk weight/thread count • Lead time quoted as “7 days” (impossible for custom dyeing) |

| 4. Paper Trail Audit | Require: – Raw material purchase invoices (mulberry silk) – Export declaration records (via China Customs) – Social insurance records* for production staff |

• Invoices show bulk silk purchases (≥500kg/month) • Customs records match factory export volume • >50 production staff with社保 (social insurance) |

• Invoices show only finished goods purchases • No customs records under their name • Staff records show only sales/admin personnel |

III. Top 5 Red Flags for Silk Scarf Sourcing (2026 Update)

Immediate disqualification criteria per SourcifyChina Risk Matrix:

| Red Flag | Risk Impact | Verification Tactic |

|---|---|---|

| “100% Silk” with no grade specified | 92% chance of polyester/silk blend (2025 lab tests) | Demand GB/T 1866-2020 certificate + third-party lab test (e.g., SGS) |

| MOQ ≤ 50 pcs | Confirms trading company; true factories require 300+ units for efficiency | Ask: “What is your minimum dye lot size?” (Factories: ≥200kg silk) |

| No sericulture linkage | Silk likely imported (traceability void); ethical risks | Verify if factory owns/contracts with mulberry farms (Zhejiang/Jiangsu) |

| Payment terms: 100% upfront | 100% scam probability (2025 ICIS data) | Insist on 30% deposit, 70% against B/L copy |

| “Certifications” without IDs | Fake ISO/BSCI certs cost $50 on dark web | Validate certificate IDs at 认监委 |

IV. 2026 Action Protocol

- Pre-Vetting: Use SourcifyChina’s AI Supplier Scanner to auto-flag mismatched business licenses (included in Sourcify Pro).

- On-Ground Audit: Require blockchain-verified audit trail (e.g., VeChain) for material flow from cocoon to scarf.

- Pilot Order: Place 3x smaller trial orders with different suppliers; compare lead times, defect rates, and communication depth.

- Penalty Clause: Contract must include “Trading Company Discovery” penalty (150% of order value refundable).

Key Insight: True silk factories control sericulture-to-finishing vertically. If they can’t show mulberry farms, silkworms, or reeling machines – it’s not direct sourcing.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Integrity Division

📧 [email protected] | 🔒 Verified via SourcifyChain 2026

© 2026 SourcifyChina. Unauthorized distribution prohibited. Data sources: China Customs, GB/T Standards, SourcifyChina Field Audits (Q1 2026).

Disclaimer: This report supersedes all prior guidance. Trading company exposure costs brands $220K/year avg. (2025 Procurement Risk Index). Verify. Never assume.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of China Silk Scarves – Wholesale Procurement Efficiency

Executive Summary

In 2026, global fashion and accessory markets continue to demand high-quality, cost-effective silk scarves sourced directly from China. With rising complexity in supply chains, counterfeit suppliers, and inconsistent quality control, procurement managers face mounting pressure to reduce risk while optimizing lead times and unit costs.

SourcifyChina’s Verified Pro List for “China Silk Scarves Wholesale” delivers a strategic advantage: pre-vetted, factory-direct suppliers with proven track records in quality, export compliance, and MOQ flexibility.

Why the Verified Pro List Saves Time & Reduces Risk

| Challenge | Traditional Sourcing | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Verification | 40–60 hours spent vetting factories (licenses, export history, references) | Pre-qualified suppliers: verified in <48 hours |

| Quality Assurance | Multiple sample rounds; inconsistent fabric grading | Factories audited for Grade A mulberry silk compliance |

| Lead Time Delays | Communication gaps, production halts, logistics mismanagement | Direct access to English-speaking operations managers |

| MOQ Negotiation | High minimums from unverified suppliers | Tiered MOQs (500–5,000 units) with scalable pricing |

| Compliance & Ethics | Risk of forced labor, environmental violations | All suppliers comply with OECD due diligence standards |

The average procurement team saves over 120 hours per sourcing cycle using the Pro List—time redirected toward product development, vendor management, and market expansion.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, speed, reliability, and trust define procurement success. Relying on unverified suppliers is no longer viable—delays, defects, and compliance issues can cost tens of thousands in lost revenue.

SourcifyChina eliminates the guesswork. Our Verified Pro List for China silk scarves wholesale gives you immediate access to elite-tier manufacturers—saving time, reducing risk, and ensuring on-time, on-spec delivery.

👉 Take the next step with confidence:

- Email us at [email protected] for a free supplier shortlist and pricing matrix.

- Chat instantly via WhatsApp: +86 159 5127 6160 for urgent RFQs or sample coordination.

Your 2026 procurement targets start with the right partner.

Choose SourcifyChina—where verified sourcing powers global growth.

© 2026 SourcifyChina. All rights reserved. Trusted by 1,200+ brands across EU, North America, and APAC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.