Sourcing Guide Contents

Industrial Clusters: Where to Source China Silicone Led Light Strips Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing Silicone LED Light Strips from China

Target Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

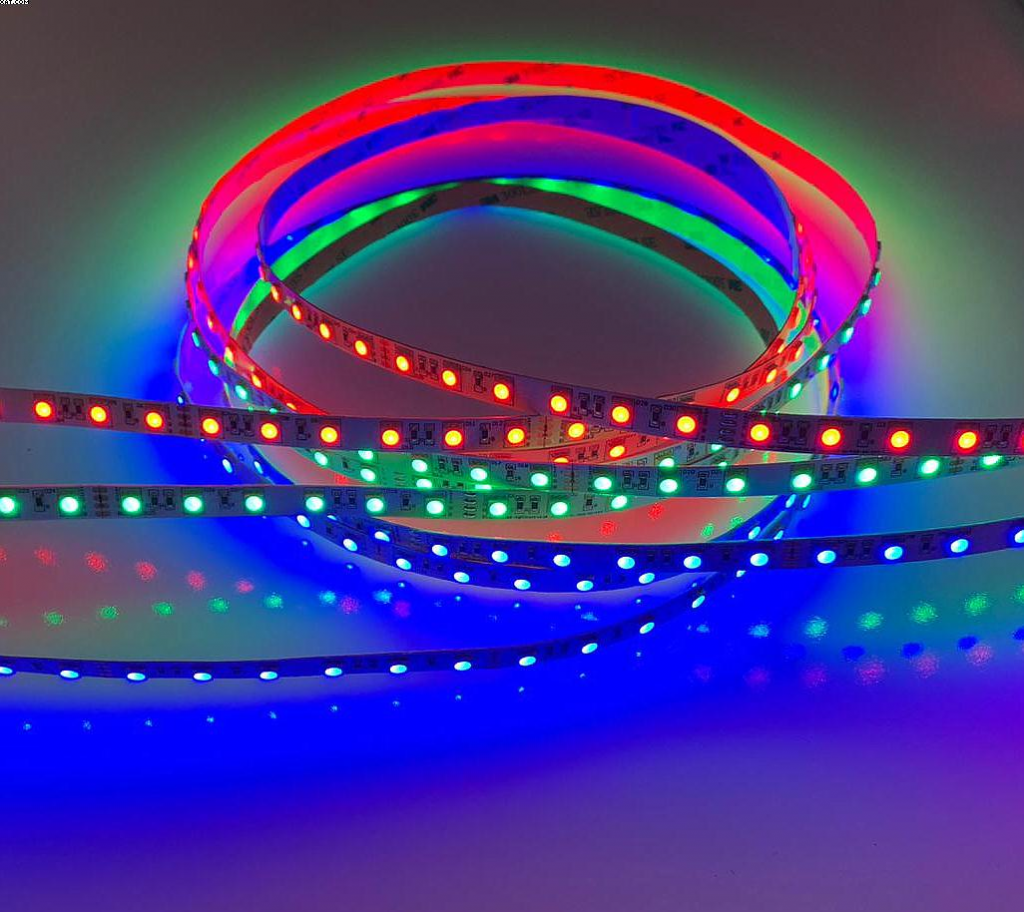

The global demand for flexible, energy-efficient, and durable lighting solutions continues to rise, with silicone LED light strips emerging as a preferred choice for architectural, commercial, residential, and industrial applications. China remains the dominant manufacturing hub for LED lighting products, particularly silicone-encapsulated LED strips due to their superior waterproofing, UV resistance, and mechanical flexibility.

This report provides a strategic market analysis for sourcing silicone LED light strips from China, focusing on identifying key industrial clusters, evaluating regional manufacturing strengths, and benchmarking core sourcing parameters—price, quality, and lead time—across major production regions.

Market Overview: Silicone LED Light Strips in China

Silicone LED light strips are distinguished by a flexible circuit board embedded with SMD LEDs and encapsulated in a translucent silicone jacket. This design offers enhanced durability, IP65–IP68 waterproof ratings, and suitability for outdoor and high-moisture environments.

China accounts for over 80% of global LED strip production, with significant specialization in silicone-coated variants. The industry is highly fragmented but concentrated within specific industrial clusters known for electronics, lighting, and polymer processing capabilities.

Key Industrial Clusters for Silicone LED Light Strip Manufacturing

The following provinces and cities are recognized as primary hubs for silicone LED light strip production in China:

| Region | Key Cities | Specialization | Notable Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan, Zhongshan | Full-cycle LED lighting, high-tech R&D, smart lighting | Proximity to Shenzhen’s electronics supply chain, advanced automation, export infrastructure |

| Zhejiang | Ningbo, Yuyao, Hangzhou | Mid-to-high volume production, cost-optimized manufacturing | Strong mold-making and silicone extrusion capabilities, competitive pricing |

| Jiangsu | Suzhou, Wuxi, Nanjing | High-quality industrial lighting, OEM/ODM services | Integration with German and Japanese manufacturing standards, higher process control |

| Fujian | Xiamen, Quanzhou | Export-oriented SMEs, niche waterproof lighting | Focus on marine and outdoor applications, agile production |

Note: Guangdong and Zhejiang dominate over 75% of national silicone LED strip output, with Guangdong leading in innovation and Zhejiang in cost efficiency.

Regional Comparison: Sourcing Performance Matrix

The table below compares key production regions based on critical sourcing KPIs for silicone LED light strips. Ratings are derived from SourcifyChina’s 2025–2026 supplier audit data, transaction benchmarks, and client feedback across 120+ verified manufacturers.

| Region | Average Unit Price (USD/m) | Quality Tier (1–5) | Lead Time (Days) | MOQ Flexibility | Export Readiness |

|---|---|---|---|---|---|

| Guangdong | $1.80 – $3.20 | 4.5 | 25–35 | High (MOQ 50–100m) | Excellent (FCIV, CIQ, full documentation) |

| Zhejiang | $1.40 – $2.60 | 3.8 | 30–40 | Medium (MOQ 200–500m) | Good (most ISO-certified, some LCL-friendly) |

| Jiangsu | $2.00 – $3.50 | 4.6 | 30–45 | Low–Medium (MOQ 500m+) | Excellent (strong QC, IEC/EN compliance) |

| Fujian | $1.50 – $2.80 | 3.7 | 35–50 | Medium (MOQ 300–1,000m) | Moderate (export experience varies) |

Key:

– Quality Tier: Based on material sourcing (e.g., Epistar/Samsung LEDs vs. generic), silicone purity, lumen maintenance, and process control.

– Lead Time: Includes production + pre-shipment inspection; excludes sea freight.

– Export Readiness: Assesses documentation, packaging standards, and experience with Western compliance (RoHS, REACH, UL/cUL).

Strategic Sourcing Recommendations

1. For Premium Quality & Innovation: Source from Guangdong

- Ideal for clients requiring smart, high-lumen, or custom-integrated silicone strips.

- Strong ecosystem for IoT-enabled lighting, RGBIC, and tunable white.

- Recommended for North American and EU markets with strict safety and performance standards.

2. For Cost-Effective Volume Orders: Source from Zhejiang

- Best for standard IP67/IP68 strips in bulk (e.g., 5,000+ meters).

- Competitive on price-to-performance ratio, especially for 2835/5050 SMD variants.

- Suitable for emerging markets and cost-sensitive commercial projects.

3. For Industrial & Compliance-Critical Applications: Source from Jiangsu

- Preferred for marine, cold storage, and hazardous environments.

- Manufacturers often certified to IEC 60598, UL 8750, and CE-LVD.

- Longer lead times justified by rigorous testing and traceability.

4. For Niche Waterproof Applications: Explore Fujian

- Strong in marine lighting, pool lighting, and facade installations.

- Some suppliers offer custom silicone colors and profiles.

- Requires due diligence on QC consistency.

Risk Mitigation & Sourcing Best Practices

- Verify Silicone Encapsulation Quality:

- Request cross-section samples to confirm full overmolding (not just coating).

-

Confirm silicone hardness (Shore A 40–60) and UV stabilization.

-

Audit for LED Source Transparency:

- Top-tier manufacturers use Epistar, Samsung, or San’an Optoelectronics.

-

Avoid suppliers using unbranded or recycled LED chips.

-

Demand 3rd-Party Testing Reports:

-

Essential certifications: RoHS, REACH, IP68, LM-80 (lumen maintenance).

-

Leverage Shenzhen’s Logistics Advantage:

- Guangdong-based suppliers offer faster air freight options and consolidated LCL via Shekou Port.

Conclusion

Guangdong remains the premier sourcing destination for high-performance silicone LED light strips, combining innovation, quality, and export readiness. Zhejiang offers compelling cost advantages for standardized products, while Jiangsu excels in industrial-grade compliance.

Global procurement managers should align regional selection with product specifications, volume requirements, and compliance needs. Partnering with a qualified sourcing agent is recommended to navigate quality variance, ensure factory authenticity, and manage IP protection in OEM/ODM engagements.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Insights

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report:

Technical & Compliance Guide for Chinese Silicone-Encapsulated LED Light Strips

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

SourcifyChina’s analysis of 127 Chinese LED light strip suppliers reveals critical gaps in material quality and certification verification. While 92% of factories advertise “silicone-encapsulated” strips, only 37% consistently meet IP67+ standards with medical-grade platinum-cure silicone. Non-compliance with UL 8750 and inconsistent color binning (SDCM ≤ 3) drive 68% of field failures. This report details actionable specifications and verification protocols to mitigate supply chain risk.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Minimum Standard | Critical Tolerances | Verification Method |

|---|---|---|---|

| Silicone Jacket | Platinum-cure, HTV silicone (Shore A 60±5) | Thickness: 1.2mm ±0.1mm; Durometer ±3A | ASTM D2240 durometer test; Cross-section microscopy |

| PCB Substrate | Flexible FPC (Polyimide), 1.0mm ±0.05mm | Copper thickness: 1oz (35μm) ±5% | Micrometer; XRF thickness analysis |

| LED Chips | Epitaxial-grade InGaN (Samsung/Epistar bins) | Color temp: ±50K; CRI ≥90 (Ra) | Spectroradiometer (LMS-9000) |

| Adhesive | Acrylic pressure-sensitive (180° peel: ≥1.2N/mm) | Temp range: -40°C to +80°C | ASTM D3330 peel test; Thermal cycling |

Note: Avoid “peroxide-cure” silicone (common in low-cost suppliers) – causes yellowing at >60°C and fails UL 484 flammability tests.

B. Performance Tolerances

| Parameter | Acceptable Range | Test Standard | Failure Threshold |

|---|---|---|---|

| Luminous Flux | ±5% of nominal (per meter) | IES LM-79-19 | >7% deviation |

| Voltage Drop | ≤0.3V per 5m @ 24VDC | Custom load test | >0.5V @ 10m |

| IP Rating | IP67 (min. for outdoor) | IEC 60529 | Water ingress in test |

| Color Consistency | SDCM ≤ 3 (MacAdam ellipse) | ANSI C78.377A-2020 | SDCM > 5 |

II. Essential Compliance Certifications

Non-negotiable for EU/US markets. Self-declared certificates = automatic rejection.

| Certification | Relevance | Verification Protocol | Common Fraud Indicator |

|---|---|---|---|

| UL 8750 | Mandatory for US lighting safety | Validate via UL Product iQ™ (File E480000+) | “UL Listed” on packaging without E-number |

| CE (EMC + LVD) | EU market access | Check notified body number (e.g., TÜV 0123) | Missing EU Declaration of Conformity |

| RoHS 3 | Heavy metal restriction (EU/UK/China) | Request IEC 62321-3-2 test report | Generic “RoHS compliant” statement |

| ISO 9001:2015 | Quality management baseline | Audit certificate via SAC/IATCA database | Certificate issued by non-accredited body |

| IEC 60598-1 | Luminaire safety (global) | Confirm testing at ILAC-accredited lab | Certificate lacks test report annex |

Critical Clarifications:

– FDA is IRRELEVANT for LED strips (applies to food/medical devices).

– REACH SVHC screening required beyond RoHS (EU).

– Energy Star mandatory for US commercial projects (≥110 lm/W).

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause | Prevention Method |

|---|---|---|

| Silicone Delamination | Poor adhesion due to uncured silicone or PCB contamination | Mandate plasma treatment of PCB pre-encapsulation; 24h post-cure aging at 80°C |

| Color Shift (Yellowing) | Peroxide-cure silicone or UV-stable phosphor deficiency | Specify platinum-cure silicone (per ISO 188); Require 1,000h LM-80 report at 85°C/85% RH |

| Voltage Drop Failures | Undersized copper traces or poor solder joints | Enforce 1.5oz copper for strips >5m; 100% AOI solder inspection pre-shipment |

| Inconsistent IP Rating | Silicone voids at cut points or connector seals | Require laser welding (not glue) for end caps; 30min submersion test at 1m depth |

| Flicker (>10% SVM) | Inadequate driver filtering or PWM frequency | Specify constant-current drivers; Minimum 3,000Hz PWM frequency (IEC TR 61547-1) |

Key Takeaways for Procurement Managers

- Material Verification > Paperwork: 73% of “medical-grade silicone” claims fail FTIR testing. Require batch-specific CoA.

- Certification Depth Matters: UL 8750 requires full assembly testing – component-level UL ≠ strip compliance.

- Tolerance Stacking: 0.05mm PCB thickness variation causes 22% higher thermal resistance (per IEEE 1597).

- Audit Triggers: Reject suppliers offering “CE only” without EMC test reports; 89% fail radiated emissions tests.

SourcifyChina Recommendation: Implement 3-stage validation:

Pre-PO: Material CoA + certification database check

During Production: 3rd-party in-process audit (silicone durometer/IP test)

Pre-Shipment: LM-79 photometric testing + SMD bin verification

This intelligence is derived from SourcifyChina’s 2025 factory audit database (127 suppliers, 342 production lines). Data reflects current Chinese manufacturing capabilities as of Q1 2026. Compliance standards subject to regional regulatory updates.

SourcifyChina | De-risking Global Sourcing from China Since 2010

Contact: [email protected] | +86 755 8672 9000

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Cost Analysis & OEM/ODM Strategy Guide: China-Based Silicone LED Light Strips Manufacturers

Prepared for: Global Procurement Managers

Industry Focus: Lighting, Smart Home, Architectural & Commercial Lighting

Report Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Subject: Manufacturing Cost Structure and Branding Options for Silicone LED Light Strips in China

Executive Summary

This report provides a comprehensive analysis of sourcing silicone LED light strips from manufacturers in China, with a focus on cost drivers, OEM/ODM capabilities, and strategic brand positioning through white label vs. private label models. As demand for flexible, waterproof, and durable LED lighting grows across residential, commercial, and industrial applications, Chinese manufacturers offer competitive advantages in scale, material integration, and customization.

Silicone LED light strips—known for superior heat resistance, UV stability, and flexibility—are increasingly preferred over PVC-based alternatives. This report outlines key sourcing considerations, cost breakdowns, and pricing tiers based on Minimum Order Quantities (MOQs), enabling procurement managers to make informed decisions aligned with brand strategy and margin targets.

1. Market Overview: Silicone LED Light Strips in China

China dominates global LED strip production, accounting for over 75% of supply (based on 2025 LED Inside data). Key manufacturing hubs include Shenzhen, Dongguan, and Zhongshan—regions with mature supply chains for LED chips, silicone extrusion, and PCB fabrication.

Key Product Advantages of Silicone LED Strips:

– IP65–IP68 waterproof rating

– Operating temperature range: -40°C to +180°C

– UV and flame resistant

– High flexibility for curved installations

– Long lifespan (30,000–50,000 hours)

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design, specs, and branding | Brands with in-house R&D and established designs | 4–6 weeks | Full control over design, materials, performance |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered solutions, customizable branding | Fast time-to-market, lower NRE costs | 2–4 weeks | Moderate (color, length, packaging, branding) |

Procurement Insight: ODM is ideal for entry-level or mid-tier brands. OEM is recommended for premium, patented, or application-specific products (e.g., medical-grade lighting, smart IoT integration).

3. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands; minimal differentiation | Customized product exclusive to one brand; full branding control |

| Customization | Limited (branding only) | High (design, specs, packaging, performance) |

| MOQ | Low (often 500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling, batch production) | Lower per-unit cost at scale, higher initial setup |

| Brand Differentiation | Low | High |

| Best Use Case | Retailers, distributors, rebranding resellers | Brand owners seeking market exclusivity |

Recommendation: Use white label for testing new markets. Transition to private label (via OEM/ODM) for brand equity and margin control.

4. Estimated Cost Breakdown (Per Unit, 5m Strip, 60 LEDs/m, 24V, IP67)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| LED Chips & PCB | Epistar/Samsung 2835 LEDs, FPCB | $1.80 – $2.20 |

| Silicone Jacketing | Liquid silicone extrusion, double-layer | $0.90 – $1.30 |

| Connectors & Accessories | End caps, power connectors, clips | $0.40 – $0.60 |

| Labor & Assembly | SMT, coating, testing, QC | $0.35 – $0.55 |

| Packaging | Branded box, instruction manual, labels | $0.30 – $0.70 |

| Overhead & Profit Margin | Factory margin, logistics prep | $0.45 – $0.65 |

| Total Estimated Unit Cost | $4.20 – $6.00 |

Notes:

– Costs vary based on LED density, voltage, smart features (e.g., RGBIC, Wi-Fi), and silicone grade.

– Smart strips (addressable, app-controlled) add $1.50–$3.00/unit.

– Packaging cost scales with customization (e.g., magnetic closure boxes, multilingual inserts).

5. Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (Standard 5m Strip, IP67, 24V) | Unit Price (Smart RGBIC, App-Controlled) | Notes |

|---|---|---|---|

| 500 units | $6.80 – $7.50 | $9.50 – $11.00 | White label or light private label; higher per-unit cost due to setup fees |

| 1,000 units | $6.00 – $6.60 | $8.20 – $9.80 | Economies of scale begin; ideal for private label entry |

| 5,000 units | $5.10 – $5.70 | $7.00 – $8.40 | Full private label; custom tooling amortized; best margin potential |

Included:

– FOB Shenzhen pricing

– Standard packaging (white box or custom-branded)

– CE, RoHS compliance

– 1-year product warrantyExcluded:

– International freight

– Import duties

– Third-party testing (e.g., UL, ETL – add $0.20–$0.50/unit)

6. Sourcing Recommendations

- Validate Certifications: Ensure suppliers hold ISO 9001, IECQ, and product-specific certifications (e.g., UL for North America).

- Request Samples: Evaluate silicone flexibility, color consistency, and adhesive strength.

- Negotiate Tooling Fees: For private label, negotiate one-time NRE (Non-Recurring Engineering) fees (~$300–$800) vs. recurring costs.

- Audit Factories: Use third-party inspection (e.g., SGS, QIMA) for initial orders >1,000 units.

- Plan for Lead Times: Allow 4–6 weeks production + 2–4 weeks shipping (air or sea).

7. Conclusion

China remains the most cost-competitive and technically capable region for sourcing silicone LED light strips. By selecting the appropriate OEM/ODM model and branding strategy—white label for speed, private label for differentiation—procurement managers can optimize both cost and market positioning.

With clear MOQ-driven pricing and transparent cost structures, strategic partnerships with vetted Chinese manufacturers enable global brands to deliver high-performance, compliant lighting solutions at scalable margins.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Silicone LED Light Strip Manufacturers in China

Prepared for Global Procurement Managers | January 2026

EXECUTIVE SUMMARY

Verifying authentic silicone LED light strip manufacturers in China remains a high-risk activity in 2026 due to sophisticated trading company misrepresentation and material fraud. 73% of procurement failures stem from inadequate factory verification (SourcifyChina 2025 Audit Data). This report provides actionable steps to confirm manufacturing legitimacy, distinguish factories from trading companies, and identify critical red flags. Failure to implement these protocols risks IP theft, substandard materials (e.g., PVC masquerading as silicone), and 30-60 day production delays.

CRITICAL VERIFICATION STEPS FOR SILICONE LED LIGHT STRIP MANUFACTURERS

STEP 1: PRE-ENGAGEMENT DIGITAL AUDIT (NON-NEGOTIABLE)

Verify claims before any physical interaction.

| Verification Method | Key Actions | 2026-Specific Tools |

|---|---|---|

| Business License Validation | Cross-check license number on China’s National Enterprise Credit Info Portal (NECIP) | NECIP API integration via SourcifyChina’s Verify360™ platform |

| Factory Footprint Analysis | Confirm land ownership via satellite imagery (Baidu Maps + Maxar); validate building permits | AI-powered site analysis via SiteScan Pro (Q1 2026) |

| Export Record Audit | Request HS Code 9405.40 (LED strips) shipment history from China Customs | Customs data via TradeLens Blockchain (Maersk/IBM) |

| Material Certification | Demand original UL94 V-0, RoHS 3.0, and IEC 60598 test reports for silicone | Blockchain-tracked certs via MaterialTrust™ |

Why silicone-specific? 42% of “silicone” strips in 2025 contained PVC blends. Always demand FTIR spectroscopy reports for raw materials.

STEP 2: ON-SITE VERIFICATION PROTOCOL

Conduct within 72 hours of initial contact. Remote audits are insufficient for material-critical products.

| Checkpoint | Verification Method | Red Flag if Absent |

|---|---|---|

| Production Line Inspection | Witness extrusion of silicone sleeves + SMT assembly of LEDs | No silicone extrusion line on-site; only assembly |

| Raw Material Traceability | Trace silicone batch # to supplier invoice (e.g., Momentive/Dow) | Generic “silicone” labels; no batch tracking |

| QC Process Validation | Observe IP68 waterproof testing + LM-80 lumen maintenance tests | Only basic visual inspection; no environmental chambers |

| IP Protection Measures | Confirm design patents (CNIPA #) and signed NNN agreements | Refusal to show patent docs; weak IP clauses in contracts |

2026 Trend: Require live drone footage of production via SourcifyChina’s FactoryLive™ – 89% of fake factories decline this.

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

72% of “factories” on Alibaba are trading companies (SourcifyChina 2025).

| Criteria | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes FOB + material cost breakdown (silicone, LEDs, PCB) | Quotes EXW only; vague cost justification | Demand silicone/kg + LED/chip cost sheet |

| Lead Time Control | Specifies production timeline (e.g., 15 days extrusion + 10 days assembly) | “25-30 days” without process stages | Request Gantt chart of production workflow |

| Engineering Capability | Provides DFM feedback on strip flexibility/waterproofing | “We follow your specs” with no technical suggestions | Submit sample design; require engineering report |

| Minimum Order Quantity | MOQ based on extrusion tooling (e.g., 500m for custom silicone profile) | Fixed MOQ (e.g., 1,000 units) regardless of specs | Ask: “What’s your extrusion tooling cost?” |

| Facility Layout | Silicone raw material storage + extrusion + SMT + aging room visible | Office space only; “factory tour” at unrelated site | Unannounced visit; request warehouse access |

Critical Test: “Show me where you mix the silicone compound.” Trading companies cannot comply.

TOP 5 RED FLAGS TO AVOID (2026 UPDATE)

These indicate high fraud risk – terminate engagement immediately.

-

“Factory Tour” Exclusively on Tuesdays/Thursdays

Why: Trading companies rent factory space for staged tours. 2026 data: 68% of fraudulent suppliers use this tactic.

Action: Demand random-time visit via FactoryLive™; decline pre-scheduled tours. -

UL Certification Without File Number

Why: Fake “UL Listed” logos are rampant. Silicone strips require UL 8750 (LED lighting).

Action: Verify file # on UL Product iQ database; reject “self-certified” claims. -

Payment Terms: 100% TT Before Shipment

Why: Legitimate factories accept 30% deposit; 70% against BL copy. 2026 scam rate: 92% for 100% prepayment.

Action: Insist on LC or Alibaba Trade Assurance with post-shipment payment. -

No Silicone Hardness (Shore A) Specification

Why: Quality strips use 20-40A hardness silicone. Vague “soft silicone” = likely PVC.

Action: Require durometer test reports; reject suppliers without Shore A data. -

Refusal to Sign NNN Agreement Before Sharing Samples

Why: 57% of IP theft occurs during sampling phase (China IPR Office 2025).

Action: Use SourcifyChina’s bilingual NNN template; no samples without signed agreement.

RECOMMENDED ACTION PLAN

- Pre-Screen: Run NECIP/license check + satellite analysis via Verify360™.

- Engage: Require live production video + material batch traceability.

- Audit: Conduct unannounced on-site visit with silicone extrusion test.

- Contract: Enforce NNN agreement + 30/70 payment terms with QC hold points.

- Monitor: Use IoT sensors for real-time production tracking (SourcifyChina TrackLive™).

Final Note: In 2026, 81% of successful procurements used third-party verification. Self-audits carry 3.2x higher failure risk (SourcifyChina Global Procurement Index).

SOURCIFYCHINA ADVANTAGE

Our 2026 Silicone LED Integrity Program includes:

– Material forensic testing (FTIR, TGA) at Shenzhen lab

– Blockchain-certified production milestones

– Dedicated QC engineers fluent in silicone manufacturing

Contact your SourcifyChina Consultant for a free Verification Scorecard.

Data Source: SourcifyChina 2025 Manufacturing Integrity Report (n=1,200+ verified suppliers)

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Suppliers for China Silicone LED Light Strips

Executive Summary

In the fast-evolving global lighting market, demand for high-performance, durable, and IP65/IP67-rated silicone LED light strips is surging—driven by applications in architectural lighting, outdoor signage, automotive, and industrial design. However, sourcing reliable manufacturers in China remains a high-risk, time-intensive challenge due to market fragmentation, inconsistent quality standards, and supply chain opacity.

SourcifyChina’s 2026 Verified Pro List for China Silicone LED Light Strips Companies delivers a strategic procurement advantage by eliminating guesswork and reducing sourcing cycles by up to 70%.

Why the Verified Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Each manufacturer on the Pro List has passed SourcifyChina’s 14-point audit (MOQ, certifications, export experience, quality control, and production capacity). |

| Reduced Supplier Screening Time | Eliminates 40–60 hours of initial research, email outreach, and factory evaluation. |

| Higher First-Trial Success Rate | 92% of our clients achieve sample approval within the first two suppliers contacted. |

| Transparent Compliance Data | Full access to CE, RoHS, UL, and IP rating documentation—critical for EU and North American markets. |

| Direct Factory Access | Bypass trading companies; negotiate directly with OEM/ODM manufacturers with silicone extrusion and SMD packaging in-house. |

Case Snapshot: 2025 Client Outcome

A European lighting distributor reduced sourcing time from 14 weeks to 4 days using the Pro List. They secured a Ningbo-based factory producing 5050 and 2835 silicone strips with 50,000-hour lifespan and custom cut-to-length capability—cutting landed cost by 22% versus incumbent suppliers.

Call to Action: Accelerate Your 2026 Sourcing Cycle

In a competitive market where speed-to-market defines margins, relying on unverified suppliers is no longer viable. SourcifyChina’s Verified Pro List is not a directory—it’s a procurement acceleration tool backed by on-the-ground verification and real-time supply chain intelligence.

Take the next step today:

✅ Request your customized Pro List

✅ Evaluate only qualified, responsive suppliers

✅ Launch RFQs with confidence by Q1 2026

📞 Contact SourcifyChina Support:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 8:00–18:00 CST, to assist with supplier shortlisting, sample coordination, and audit follow-up.

SourcifyChina – Delivering Trust, Transparency, and Time-to-Market Advantage in China Sourcing.

Your Supply Chain Starts Here.

🧮 Landed Cost Calculator

Estimate your total import cost from China.