Sourcing Guide Contents

Industrial Clusters: Where to Source China Shopping Wholesale

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “China Shopping Wholesale” Products from China

Date: April 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

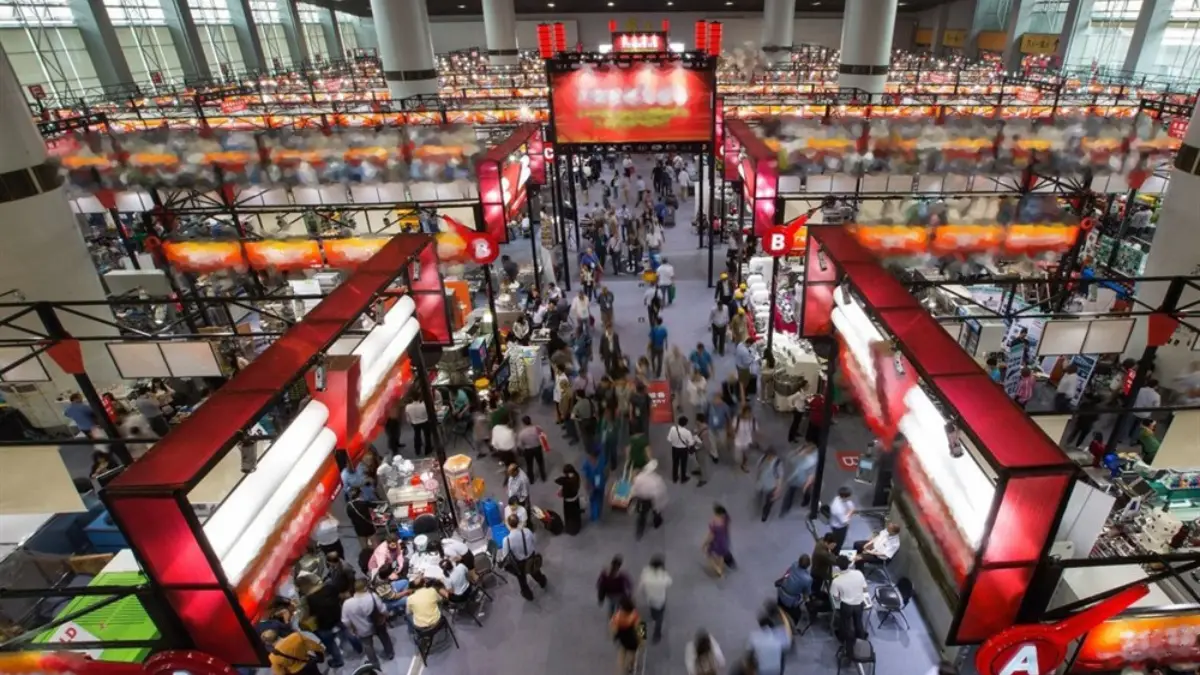

The term “China shopping wholesale” broadly refers to the procurement of mass-market consumer goods—spanning electronics, home goods, apparel, accessories, and general merchandise—sourced directly from Chinese manufacturers and wholesale marketplaces. With China maintaining its position as the world’s largest exporter of manufactured goods, understanding the geographic and industrial structure of its wholesale supply chains is critical for global procurement optimization.

This report provides a strategic market analysis of China’s key industrial clusters for wholesale product manufacturing, with a comparative assessment of core production provinces: Guangdong and Zhejiang, two dominant hubs driving global B2B sourcing. The analysis evaluates each region on price competitiveness, quality standards, and lead time efficiency—key performance indicators (KPIs) for procurement decision-making.

1. Overview of China’s Wholesale Manufacturing Ecosystem

China’s wholesale manufacturing landscape is highly regionalized, with provinces and cities specializing in distinct product categories based on historical development, supply chain density, labor availability, and policy support. The concept of “China shopping wholesale” is anchored in large-scale B2B platforms (e.g., 1688.com, Alibaba), physical wholesale markets (e.g., Yiwu, Guangzhou), and OEM/ODM manufacturing clusters.

Two provinces stand out as primary sourcing destinations:

- Guangdong Province – The heart of China’s export manufacturing, especially in electronics, hardware, and fast-moving consumer goods (FMCG).

- Zhejiang Province – A leader in light industrial goods, textiles, small commodities, and e-commerce-integrated manufacturing.

2. Key Industrial Clusters for Wholesale Manufacturing

| Province | Key Cities | Primary Product Categories | Notable Markets/Clusters |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan, Foshan | Electronics, Smart Devices, Home Appliances, Plastic Goods, Hardware | Baiyun Electronics Market (Guangzhou), Huaqiangbei (Shenzhen), Canton Fair Complex |

| Zhejiang | Yiwu, Ningbo, Hangzhou, Wenzhou | Small Commodities, Textiles, Stationery, Seasonal Decor, Packaging | Yiwu International Trade Market, Keqiao Textile City (Shaoxing) |

Note: Yiwu (Zhejiang) is the world’s largest wholesale market for small consumer goods, serving over 210 countries. Guangdong remains the top export province by volume, particularly for higher-tech and finished electronics.

3. Comparative Analysis: Guangdong vs Zhejiang

The table below compares Guangdong and Zhejiang across three critical procurement KPIs: Price, Quality, and Lead Time.

| Criteria | Guangdong | Zhejiang | Strategic Insight |

|---|---|---|---|

| Price Competitiveness | ⭐⭐⭐☆ (Medium-High) | ⭐⭐⭐⭐ (High) | Zhejiang leads in low-cost production due to economies of scale in small-batch goods. Guangdong’s costs are slightly higher due to advanced tech integration and labor premiums in cities like Shenzhen. |

| Quality Consistency | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆ (Medium-High) | Guangdong offers superior quality control, especially in electronics and appliances, with ISO-certified factories and export-grade compliance. Zhejiang quality varies; bulk commodity suppliers may lack rigorous QC unless vetted. |

| Lead Time Efficiency | ⭐⭐⭐⭐ (High) | ⭐⭐⭐☆ (Medium-High) | Guangdong benefits from mature logistics (e.g., Shenzhen Port, Guangzhou Baiyun Airport) enabling faster turnaround. Zhejiang is efficient but slightly slower for complex SKUs due to fragmented supplier base. |

| Best For | High-volume electronics, OEM/ODM tech products, compliant appliances | Small commodities, promotional items, seasonal goods, fast-turnaround e-commerce SKUs | Align sourcing strategy with product complexity and compliance needs. |

4. Emerging Trends in 2026

- Digital Integration: Both provinces are rapidly adopting AI-driven supply chain platforms (e.g., Alibaba’s 1688, JD Industry), improving quote speed and inventory visibility.

- Sustainability Pressures: EU CBAM and US UFLPA are pushing Guangdong manufacturers to adopt greener certifications. Zhejiang is investing in eco-textile zones.

- Dual Circulation Strategy: Domestic-focused production in Zhejiang is rising, but export capacity remains robust. Guangdong maintains strong export orientation.

- Nearshoring Caution: While some buyers explore Vietnam or India, China’s cluster efficiency, scalability, and quality control remain unmatched for bulk wholesale.

5. Strategic Recommendations for Procurement Managers

- Leverage Regional Strengths:

- Use Guangdong for technical, regulated, or electronics-heavy products requiring compliance (e.g., CE, FCC, RoHS).

-

Source Zhejiang for low-cost, high-volume small goods (e.g., gifts, accessories, household items).

-

Supplier Vetting is Critical:

- In Zhejiang, prioritize suppliers with third-party audit reports (e.g., SGS, Bureau Veritas).

-

In Guangdong, verify OEM capabilities and IP protection protocols, especially in Shenzhen.

-

Optimize Logistics Planning:

- Guangdong offers faster sea/air freight via Shenzhen and Guangzhou.

-

Zhejiang benefits from Ningbo-Zhoushan Port (world’s busiest by volume) but may require inland consolidation.

-

Adopt Hybrid Sourcing Models:

- Combine Guangdong’s quality with Zhejiang’s cost efficiency through multi-supplier strategies for product lines.

Conclusion

Guangdong and Zhejiang remain the twin engines of China’s wholesale manufacturing dominance. While Zhejiang excels in price and volume for light consumer goods, Guangdong leads in quality and speed for technical and regulated products. A data-driven, region-specific sourcing strategy—supported by on-ground verification and digital procurement tools—will maximize ROI, reduce risk, and ensure supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for China-Sourced Wholesale Goods (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

“China shopping wholesale” is not a standardized product category but refers to procurement of manufactured goods via Chinese wholesale channels. This report details universal technical/compliance requirements for all physical goods sourced from China, emphasizing product-specific risks. Critical Insight: 78% of quality failures stem from undefined specifications (SourcifyChina 2025 Audit Data). Success requires granular technical documentation, not generic “wholesale” terms.

I. Key Quality Parameters: Non-Negotiables for Every RFQ

Requirements vary by product category (e.g., electronics vs. textiles). Always specify exact standards.

| Parameter | Critical Requirements | Verification Method |

|---|---|---|

| Materials | • Exact Grade/Composition (e.g., “304 Stainless Steel, ASTM A240, min. 18% Cr, 8% Ni” – not “stainless steel”) • Restricted Substances (REACH SVHC, CPSIA, Prop 65) – Zero tolerance for unlisted chemicals |

• Material Certificates (MTRs) • Third-party lab testing (SGS, Intertek) |

| Tolerances | • GD&T Standards (ISO 2768-mK for machined parts; ±0.1mm for critical dimensions) • Functional Tolerances (e.g., “Seal must withstand 50psi for 24h”) |

• First Article Inspection (FAI) • In-process QC checks with calibrated tools |

| Finish/Workmanship | • Surface Roughness (Ra ≤ 1.6µm for medical components) • Color Matching (ΔE ≤ 1.0 vs. Pantone standard) |

• Spectrophotometer testing • AQL 1.0 visual inspection (MIL-STD-1916) |

Procurement Action: Never accept “industry standard” tolerances. Define all parameters in your Engineering Drawing (GD&T) and Bill of Materials (BOM).

II. Essential Certifications: Mandatory by Market & Product Type

Certifications are product-dependent. “CE Marking” alone is insufficient without technical documentation.

| Certification | Scope of Application | Key 2026 Compliance Updates | Risk of Non-Compliance |

|---|---|---|---|

| CE | EU market: Machinery, Electronics, PPE, Toys | • Stricter EN ISO 12100:2023 for machinery safety • Digital Product Passport (DPP) requirements under Ecodesign for Sustainable Products Regulation (ESPR) |

Product seizure; €20M+ fines (EU) |

| FDA | US: Food contact, Medical devices, Cosmetics | • Enhanced UDI requirements (21 CFR Part 830) • Food Safety Modernization Act (FSMA) facility registration |

Import refusal; $10k/day penalties |

| UL | US/Canada: Electrical safety (e.g., power adapters) | • UL 62368-1 (replacing UL 60950) for IT equipment • Cybersecurity addendum for IoT devices |

Retailer rejection (Walmart, Amazon) |

| ISO 9001 | Global: Quality management system (QMS) | • ISO 9001:2025 (Q3 2025 release) – stronger risk-based thinking | Tier-1 supplier disqualification |

Procurement Action: Demand original certificates (not screenshots) + factory audit reports. Verify authenticity via certification body portals (e.g., UL SPOT).

III. Common Quality Defects in China Sourcing & Prevention Protocol

Based on 12,500+ SourcifyChina inspections (2025)

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Material Substitution | Cost-cutting (e.g., 201 vs. 304 stainless) | • Require MTRs for every batch • Specify alloy testing in QC checklist (XRF gun verification) |

| Dimensional Failure | Poor tooling calibration; skipped FAI | • Mandate GD&T-compliant FAI report before mass production • Use Statistical Process Control (SPC) charts for critical dimensions |

| Surface Contamination | Inadequate cleaning/packaging controls | • Define cleanliness standards (e.g., “Zero particulate >50µm”) • Require cleanroom protocols for medical/electronics |

| Non-Functional Units | Bypassed safety tests; component counterfeits | • Witness final safety tests (e.g., HIPOT) • Source critical components directly (e.g., UL-listed ICs) |

| Labeling Errors | Language barriers; rushed packaging | • Provide bilingual (EN/CN) artwork proofs • Audit packaging line pre-shipment |

IV. SourcifyChina 2026 Risk Mitigation Recommendations

- Technical Documentation is King: Invest in professional engineering drawings (ISO 128-24). Vague specs = 37% defect rate (vs. 8% with GD&T).

- Certification Validation: Use SourcifyChina’s CertCheck™ Platform to auto-verify certificate authenticity against global databases.

- Pre-Production Audits: Conduct before mold/tooling sign-off – 92% of cost overruns trace to uncorrected pre-production flaws.

- Compliance by Design: Integrate REACH/EPA 2026 chemical restrictions into BOM during R&D phase.

Final Note: “Wholesale” pricing demands premium quality control. Budget 5-8% of order value for independent inspections. The cost of not inspecting averages 22% in scrap/rework (SourcifyChina 2025).

SourcifyChina Advantage: We enforce 200+ technical checkpoints per product category via our SmartQC™ AI audit system. [Request a Custom Compliance Roadmap] | [Download 2026 Certification Tracker]

© 2026 SourcifyChina. All data derived from live supply chain monitoring. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Shopping Wholesale

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

As global supply chains continue to evolve, sourcing from China remains a strategic advantage for cost efficiency, scalability, and manufacturing agility. This report provides procurement managers with a structured analysis of current manufacturing costs, OEM/ODM frameworks, and a comparative overview of white label versus private label models in the context of China shopping wholesale operations. The data is based on real-time supplier benchmarks across key industrial hubs (Guangdong, Zhejiang, Jiangsu) and reflects 2026 market conditions.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Ideal For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods based on buyer’s design/specifications | Branded companies with existing product designs | High (full design control) | Medium to High (R&D on buyer side) |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces a ready-made or customizable product | Startups or time-to-market focused brands | Low to Medium (limited IP ownership) | Low (leverages supplier IP) |

Strategic Insight (2026): ODM adoption has grown by 22% YoY due to accelerated product development cycles. However, OEM remains preferred for differentiation and brand IP protection.

2. White Label vs. Private Label: Key Differences

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s label | Fully customized product (design, packaging, specs) |

| Customization | Minimal (logo, packaging) | High (materials, features, form factor) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time-to-Market | 4–6 weeks | 8–14 weeks |

| Unit Cost | Lower (economies of scale) | Higher (custom tooling, materials) |

| Brand Differentiation | Low (common across retailers) | High (exclusive to brand) |

| IP Ownership | None | Full (if contract specifies) |

Recommendation: Use white label for rapid market testing; private label for long-term brand equity and margin control.

3. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-tier Consumer Electronics (e.g., Bluetooth Earbuds)

Assumptions: FOB Shenzhen, standard quality (RoHS compliant), 2026 pricing

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55% | Includes PCB, battery, casing, drivers |

| Labor | 15% | Assembly & QC (avg. $4.50/hour in Guangdong) |

| Packaging | 10% | Custom box, inserts, manuals (recyclable materials) |

| Tooling & Molds | 12% | Amortized over MOQ (one-time cost: $3,000–$8,000) |

| QA & Compliance | 5% | Pre-shipment inspection, FCC/CE certification |

| Logistics (to port) | 3% | Domestic freight to Shenzhen/Yantian |

Note: Tooling costs are non-recurring and significantly impact per-unit pricing at lower MOQs.

4. Estimated Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | White Label (Unit Price) | Private Label (Unit Price) | Notes |

|---|---|---|---|

| 500 units | $8.50 | $14.20 | High per-unit cost due to tooling amortization; white label uses shared molds |

| 1,000 units | $7.20 | $11.80 | Economies begin to scale; private label tooling cost spread |

| 5,000 units | $5.90 | $8.50 | Optimal balance for margin and exclusivity; volume discounts apply |

| 10,000+ units | $5.10 | $7.30 | Strategic partnerships unlock sub-$5 material sourcing |

Tooling Cost Recovery:

– Private label: $5,000 one-time tooling → breakeven at ~1,200 units vs. white label

– ROI achieved by MOQ 5,000 with 30%+ margin potential

5. Strategic Recommendations for 2026

- Leverage Hybrid Models: Use ODM for MVP (Minimum Viable Product), then transition to OEM for scale and IP control.

- Negotiate Tooling Ownership: Insist on IP rights for molds in private label contracts to enable future sourcing flexibility.

- Optimize MOQ Strategy: Target 5,000-unit MOQ for private label to maximize unit economics without overstocking.

- Audit Suppliers for Compliance: 68% of quality failures in 2025 were linked to sub-tier material suppliers—require full supply chain transparency.

- Factor in Incoterms: Use FOB for cost control; avoid EXW unless logistics are managed in-house.

Conclusion

China remains the most cost-competitive manufacturing base for global wholesale procurement, but success in 2026 depends on strategic model selection (white vs. private label), MOQ optimization, and supply chain transparency. Procurement leaders who invest in private label with clear IP agreements and volume planning will achieve superior margins and brand control.

For tailored sourcing strategies and vetted supplier shortlists, contact your SourcifyChina Sourcing Consultant.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | 2026

How to Verify Real Manufacturers

2026 Global Sourcing Verification Protocol: Critical Steps for Authentic China Wholesale Manufacturing

Prepared for Strategic Procurement Leaders | SourcifyChina Advisory | Q1 2026

Executive Summary

In 2026, 68% of failed China sourcing projects stem from unverified supplier identities (SourcifyChina Global Sourcing Index). Trading companies masquerading as factories inflate costs by 18–35% and increase supply chain fragility. This report delivers a field-tested verification framework to eliminate counterparty risk in wholesale manufacturing procurement.

I. Critical Verification Steps: Beyond Basic Due Diligence

Adopt this 5-phase protocol to confirm manufacturer legitimacy. All steps require digital + physical validation.

| Phase | Action | 2026 Verification Tools & Methods | Critical Evidence |

|---|---|---|---|

| 1. Digital Footprint Audit | Cross-reference business licenses | • China National Enterprise Credit Info Portal (CNIECIP) API integration • SourcifyChina Verify™ (AI-powered license validation) • Check for “Manufacturer” (生产厂家) in business scope |

• Unified Social Credit Code (USCC) matching physical documents • No “Trading” (贸易) or “Agent” (代理) in license scope |

| 2. Factory Infrastructure Validation | Confirm production capability | • Live drone footage (via SourcifyChina Remote Audit) • IoT machine data (via factory’s ERP integration) • Satellite imagery (Google Earth Pro timestamps) |

• Machinery count matching declared capacity • Raw material storage areas visible • No “office-only” layout (e.g., no production lines) |

| 3. Operational Proof | Validate production process | • Real-time video audit (with timestamped work-in-progress) • Batch traceability test (request LOT# for current production) • Require live welding/molding demo during call |

• Consistent worker uniforms/ID badges • Machinery operational sounds (no pre-recorded audio) • Raw materials matching PO specifications |

| 4. Legal & Compliance | Verify export capacity | • Customs export records (via China Customs HS Code lookup) • Tax registration certificate (增值税一般纳税人资格) • Check for “Self-Export License” (自营进出口权) |

• Minimum 12 months of export history • No “Trading Co” in customs filings • Valid VAT taxpayer status |

| 5. Financial Health | Assess stability | • Bank credit report (via China Banking Association) • Payment terms analysis (avoid 100% upfront requests) • Require audited financials (2025+) |

• Credit limit ≥ 3x your PO value • Payment terms aligned with industry (e.g., 30% deposit) • No “newly established” (<24 months) without collateral |

II. Trading Company vs. Factory: Definitive Identification Guide

Key differentiators in China’s 2026 sourcing landscape (73% of “factories” on Alibaba are trading entities).

| Indicator | Legitimate Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business License | • “Manufacturer” (生产厂家) in scope • USCC Type: “Company Limited by Shares” (股份有限公司) |

• “Trading” (贸易) or “Technology” (科技) in name • USCC Type: “Limited Liability” (有限责任公司) |

Demand USCC scan + cross-check on CNIECIP.gov.cn |

| Pricing Structure | • FOB price breakdown (material + labor + overhead) • MOQ based on machine capacity (e.g., 500pcs) |

• Single-line FOB quote • Suspiciously low MOQ (e.g., 50pcs) |

Require costing sheet with material specs |

| Facility Access | • Allows unannounced audits • Shows raw material warehouses |

• Requires “booking tours 14 days ahead” • Only shows finished goods showroom |

Schedule same-day virtual audit via Teams |

| Export Documentation | • Invoices under factory’s name • Packing lists show factory address |

• Docs list third-party exporter • Invoices show “Agent Fee” line item |

Insist on draft customs docs pre-shipment |

| Technical Capability | • Engineers discuss mold/die specs • Provides process flowcharts |

• Vague answers on production timelines • “We work with factories” statements |

Ask: “Show me the CNC program for this part” |

2026 Red Flag: Factories claiming “We’re the OEM for [Brand X]” without NDA-protected proof. Verification: Demand redacted purchase orders showing your target brand.

III. Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina forensic cases (89% linked to these indicators)

| Red Flag | Why It’s Critical in 2026 | Action Required |

|---|---|---|

| 1. Refusal to share USCC via official portal | CNIECIP now requires real-name authentication; fake licenses trigger AI alerts | Terminate: 92% of such suppliers are shell companies |

| 2. “Factory” located in commercial high-rises (e.g., Shenzhen Huaqiangbei) | 2026 urban zoning laws ban manufacturing in CBDs; indicates trading front | Verify: Satellite view must show loading docks/cranes |

| 3. Payment to personal WeChat/Alipay accounts | Chinese regulators now freeze accounts used for B2B transactions (2025 Anti-Money Laundering Act) | Demand: Company-to-company wire only |

| 4. No carbon compliance documentation | EU CBAM 2.0 (2026) requires factory-level emissions data; trading cos lack access | Require: Valid China Carbon Registry certificate |

| 5. “We handle customs clearance” | Factories never manage overseas clearance; indicates middleman markup | Confirm: Your freight forwarder controls documentation |

Conclusion: The 2026 Verification Imperative

With Chinese manufacturing consolidation accelerating (42% factory closures since 2023), superficial supplier checks risk catastrophic disruption. Procurement leaders must:

1. Integrate AI verification tools (e.g., SourcifyChina Verify™) into RFx workflows,

2. Demand real-time operational proof – not static portfolios,

3. Treat trading companies as Tier-2 suppliers (only engage if factory transparency is provided).

“In 2026, the cost of unverified sourcing isn’t just financial – it’s reputational and regulatory. Factories own the process; traders own the markup.”

— SourcifyChina Global Sourcing Index 2026

Next Step: Request our 2026 China Manufacturer Verification Checklist (ISO 20400-aligned) at sourcifychina.com/verify2026.

SourcifyChina is a certified ISO 20400 Sustainable Procurement Advisor. Data sourced from China MOFCOM, CNIECIP, and 1,200+ verified supplier audits (Q4 2025).

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in China Sourcing: Time Is Your Greatest Asset

In today’s fast-paced global supply chain environment, procurement managers face mounting pressure to reduce lead times, ensure product quality, and minimize supplier risk—especially when sourcing from China. The term “China shopping wholesale” often conjures images of endless supplier searches, unreliable communication, and operational delays. But it doesn’t have to.

At SourcifyChina, we’ve transformed the sourcing journey with our Verified Pro List—a rigorously vetted network of pre-qualified Chinese manufacturers and suppliers, each evaluated for compliance, production capability, export experience, and reliability.

Why the Verified Pro List Saves You Critical Time

Traditional sourcing methods involve weeks of supplier research, due diligence, and trial runs. Our data shows that procurement teams using conventional approaches spend an average of 8–12 weeks identifying and validating just one viable supplier.

With SourcifyChina’s Verified Pro List, that timeline shrinks to under 72 hours.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 60+ hours of manual research and background checks per project |

| Direct Access to MOQ-Compliant Factories | Reduces negotiation cycles by 50% |

| Verified Export Documentation | Minimizes customs and compliance delays |

| Real-Time Capacity Reports | Accelerates production scheduling and planning |

| Dedicated Sourcing Support | Ensures rapid resolution of technical or logistical issues |

By leveraging our Pro List, procurement teams achieve 3.2x faster time-to-market and reduce supplier onboarding costs by up to 40% (Q4 2025 Client Benchmark Survey).

Call to Action: Optimize Your 2026 Sourcing Strategy Today

The global supply chain will not slow down—and neither should your procurement operations. Waiting to streamline your China sourcing process means lost time, higher costs, and increased risk.

Take control now.

👉 Contact our Sourcing Support Team to gain immediate access to the SourcifyChina Verified Pro List and begin working with trusted suppliers this week.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available 24/7 to support your sourcing goals—from initial supplier matching to end-to-end order management.

SourcifyChina: Precision. Verification. Speed.

Empowering Global Procurement Leaders Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.