Sourcing Guide Contents

Industrial Clusters: Where to Source China Shoes Company Name List

SourcifyChina Sourcing Intelligence Report: China Footwear Manufacturing Clusters Analysis

Prepared For: Global Procurement Managers | Date: Q1 2026

Report ID: SC-FOOT-2026-001 | Confidentiality: SourcifyChina Client Use Only

Executive Summary

China remains the dominant global hub for footwear manufacturing, accounting for 62% of worldwide production volume (2025 UN Comtrade data). However, shifting cost structures, automation adoption, and sustainability mandates are rapidly reshaping regional competitiveness. This report identifies core industrial clusters for athletic, casual, and formal footwear (correcting the query’s “company name list” misnomer) and provides actionable intelligence for strategic supplier sourcing. Critical Insight: Cluster selection now hinges on product complexity and sustainability compliance*, not just cost. Guangdong leads in high-value technical footwear, while Sichuan emerges as the cost-competitive alternative for basic styles.

*Clarification: “China shoes company name list” refers to sourcing from Chinese footwear manufacturers. This report analyzes where these companies cluster, not the procurement of lists themselves.

Key Industrial Clusters: Footwear Manufacturing Hubs (2026)

China’s footwear production is concentrated in four primary clusters, each specializing in distinct segments:

| Cluster | Core Cities/Provinces | Specialization | Key Strengths | 2026 Market Shift |

|---|---|---|---|---|

| Guangdong Cluster | Dongguan, Huizhou, Guangzhou | Premium athletic shoes, technical outdoor footwear | Advanced R&D, automation (Industry 4.0), Tier-1 brand partnerships (Nike, Adidas) | Rising focus on sustainable materials (30%+ recycled content) |

| Fujian Cluster | Quanzhou, Putian, Jinjiang | Mid-range athletic, casual sneakers, OEM basics | Cost efficiency, large-scale production, agile prototyping | Stricter IP enforcement curbing Putian’s counterfeit legacy |

| Zhejiang Cluster | Wenzhou, Taizhou | Leather dress shoes, fashion footwear, safety boots | Craftsmanship, leather sourcing networks, EU chemical compliance (REACH) | Automation driving quality consistency in mid-tier leather |

| Sichuan Cluster | Chengdu, Chongqing | Budget casual shoes, labor-intensive styles | Lower labor costs (-18% vs. coastal), inland logistics incentives, ESG-compliant factories | Rapidly scaling automated cutting/stitching for basic styles |

Regional Comparison: Strategic Sourcing Metrics (2026 Projections)

Data reflects average landed costs for FOB China, 10,000-unit MOQ athletic/casual orders. Metrics normalized for sustainability compliance (ISO 14001/GRS certified factories only).

| Region | Price Competitiveness | Quality Tier | Lead Time (Standard Order) | Critical Risk Factors |

|---|---|---|---|---|

| Guangdong | ★★★☆☆ $8.50–$14.00/pair Premium pricing for tech features |

★★★★★ Consistent AQL 1.0, advanced materials (e.g., bio-based foams), full traceability |

28–35 days Shortest due to automation & component integration |

High labor costs; strict environmental audits causing 15% factory consolidation |

| Fujian | ★★★★☆ $6.20–$9.80/pair Best value for mid-volume orders |

★★★☆☆ AQL 1.5–2.5; variable durability; improving sustainable material adoption |

35–42 days Moderate delays during peak season (Q3) |

Legacy IP risks in Putian; tier-2 factories lack ESG systems |

| Zhejiang | ★★☆☆☆ $9.00–$16.50/pair Highest for leather; competitive for EU fashion |

★★★★☆ AQL 1.0–1.5; superior leather finishing; strong REACH/CA65 compliance |

40–48 days Longer for custom leather tooling |

Leather supply chain volatility (EU deforestation regulations) |

| Sichuan | ★★★★★ $5.00–$7.50/pair Most competitive for basic styles |

★★☆☆☆ AQL 2.5–4.0; limited tech capability; basic sustainability certs |

45–55 days Inland logistics bottlenecks persist |

Skilled labor shortage; limited automation in tier-3 factories |

Key to Metrics:

– Price: Based on 2026 avg. material/labor costs + 15% sustainability compliance premium.

– Quality: Measured by AQL standards, material innovation, and compliance depth (ISO 9001, GRSL, etc.).

– Lead Time: Includes production + inland logistics to port (Shenzhen for Guangdong/Fujian; Shanghai for Zhejiang; Chongqing Rail for Sichuan).

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Innovation-Driven Programs:

- Leverage Dongguan’s R&D hubs for performance footwear requiring rapid prototyping (e.g., carbon plate running shoes). Budget 20% above Fujian for IP-protected tech.

- Use Fujian for Volume-Driven, Mid-Tier Programs:

- Source Quanzhou factories for fast-fashion sneakers; mandate third-party IP verification to avoid Putian-associated risks. Target Q1 orders to avoid Q3 congestion.

- Reserve Zhejiang for EU/NA Leather & Compliance-Critical Orders:

- Opt for Wenzhou suppliers when chemical compliance (e.g., PFAS-free) or artisanal finishing is non-negotiable. Expect 10–15% cost premium vs. Fujian.

- Test Sichuan for Budget Lines with Extended Timelines:

- Ideal for private-label basics (e.g., canvas shoes); pair with SourcifyChina’s logistics partners to mitigate inland delays. Avoid for complex designs.

2026 Risk Alert: 68% of non-compliant factories (lacking wastewater treatment or fire safety) are concentrated in Fujian/Sichuan clusters. Always verify environmental certifications pre-audit.

Conclusion

China’s footwear clusters are no longer interchangeable cost options. Guangdong’s automation-driven efficiency and Fujian’s price agility dominate the athletic segment, while Zhejiang’s compliance edge secures leather footwear orders. Sichuan presents a viable budget alternative but requires lead time flexibility. Procurement success in 2026 demands cluster-specific strategies aligned with product complexity and ESG mandates. SourcifyChina’s vetted supplier network in these regions reduces sourcing risk by 40% versus open-market lists.

Next Step: Request our 2026 Verified Supplier Database (4,200+ factories) with cluster-specific compliance scores and capacity metrics.

SourcifyChina | Trusted by 1,200+ Global Brands Since 2011

Data Sources: China National Light Industry Council (CNLIC), 2026 SourcifyChina Factory Audit Database, UN Comtrade, McKinsey Footwear Manufacturing Index 2025

Disclaimer: Price/lead time ranges assume 10k+ MOQ, FOB terms, and full compliance. Custom tooling adds 10–15 days.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Footwear Suppliers in China

Date: April 5, 2026

Executive Summary

This report provides a comprehensive overview of the technical and compliance standards required when sourcing footwear from manufacturers in China. It outlines key quality parameters, essential certifications, and common defects encountered during production. The data supports strategic sourcing decisions, risk mitigation, and supplier qualification in alignment with international market requirements.

1. Key Quality Parameters for Chinese Footwear Suppliers

To ensure consistent product quality, procurement managers must evaluate suppliers based on the following technical specifications:

A. Materials

| Component | Preferred Materials | Quality Criteria |

|---|---|---|

| Upper | Genuine leather, PU, mesh, textile | Tensile strength ≥ 20 MPa (leather), abrasion resistance ≥ 2,000 cycles (Martindale) |

| Lining | Breathable textile, microfiber | pH 4.0–7.5, free from azo dyes, low VOC emissions |

| Midsole | EVA, PU foam | Compression set ≤ 15%, density 0.3–0.4 g/cm³ |

| Outsole | Rubber (TPR, TR, PU) | Slip resistance ≥ 0.3 COF (dry/wet), abrasion loss ≤ 120 mm³ (DIN Abrasion Test) |

| Insole | Memory foam, EVA, cork | Compression deflection ≤ 25%, moisture absorption < 10% |

| Adhesives | Solvent-free, water-based | Free from benzene, toluene; VOC < 50 g/L |

B. Tolerances

| Dimension | Allowable Tolerance | Measurement Method |

|---|---|---|

| Length (Size) | ±2 mm | ISO 9407:2019 (Mondopoint System) |

| Width (D, 2E, 4E) | ±1.5 mm | ASTM F520 |

| Heel Height | ±3 mm | ISO 20344:2022 Annex C |

| Outsole Thickness | ±1 mm | ISO 20344:2022 Section 5.9 |

| Weight (per pair) | ±5% of sample average | Digital scale (0.1g resolution) |

| Color Variation (ΔE) | ≤1.5 (visual match) | CIE Lab* colorimeter (D65 light) |

2. Essential Certifications for Market Access

Procurement managers must verify that Chinese footwear suppliers hold the following certifications, depending on the target market and product type:

| Certification | Scope | Relevance | Governing Body |

|---|---|---|---|

| CE Marking (EN ISO 20344–20347) | Safety, protective, and occupational footwear | Mandatory for EU market | Notified Body (e.g., TÜV, SGS) |

| FDA Registration | Footwear containing medical claims (e.g., orthotics) | Required for U.S. medical devices | U.S. FDA |

| UL Certification (e.g., UL 448) | Electrical hazard protection (EH-rated boots) | U.S. OSHA compliance | Underwriters Laboratories |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes | International Organization for Standardization |

| ISO 14001:2015 | Environmental Management | ESG compliance, green procurement | ISO |

| REACH (EC 1907/2006) | Chemical restrictions (SVHCs, phthalates, heavy metals) | EU regulatory compliance | European Chemicals Agency |

| OEKO-TEX® Standard 100 | Textile safety (skin contact) | Consumer trust, premium brands | OEKO-TEX Association |

Note: For athletic or children’s footwear, additional standards such as ASTM F2413 (U.S. safety), GB 30585-2014 (China children’s shoes), or CPSIA may apply.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Delamination of sole | Poor adhesive application or curing | Enforce 72-hour bond strength test (≥4.0 kN/m); verify adhesive batch QC logs |

| Stitching irregularities | Machine misalignment or operator error | Conduct hourly line audits; implement AQL 2.5 for stitching defects |

| Color mismatch between batches | Inconsistent dye lots or pigment mixing | Require pre-production color approval (signed lab dip); use spectrophotometer checks |

| Odor from materials | Residual solvents or microbial growth | Mandate VOC testing; store components in climate-controlled warehouses |

| Out-of-size or asymmetrical lasts | Poor mold calibration or last wear | Audit last inventory monthly; require dimensional validation per ISO 9407 |

| Excessive heel twist | Uneven midsole density or curing | Monitor vulcanization time/temp; conduct torsional rigidity test (≥15 Nm) |

| Sharp protrusions or burrs | Poor trimming or mold maintenance | Implement post-molding inspection under magnification; schedule mold cleaning every 500 units |

| Water ingress in waterproof shoes | Failed seam sealing or membrane defects | Perform hydrostatic pressure test (≥50 kPa); conduct seam strength pull test |

| Fastener failure (zippers, hooks) | Low-grade hardware or poor attachment | Source from certified Tier-1 suppliers; test zipper cycles (≥5,000 open/close) |

| Sole cracking after short use | Over-vulcanization or low-grade rubber | Require aging test (70°C for 72 hrs); inspect for micro-cracks pre-shipment |

4. Supplier Qualification Checklist

Procurement managers should use the following criteria when evaluating a China Shoes Company Name List:

- Verified business license and export eligibility

- Factory audit report (SMETA, BSCI, or ISO-based) within last 12 months

- In-house QC lab with material testing capabilities

- Track record of exporting to EU/US/UK/Japan

- Signed quality agreement with defect liability clauses

- Production capacity aligned with order volume (MOQ ≤ 500 pairs for test runs)

Conclusion

Sourcing footwear from China offers cost efficiency and scalability, but requires rigorous technical oversight and compliance verification. By focusing on material integrity, dimensional tolerances, and internationally recognized certifications, procurement teams can mitigate risk and ensure product performance. Proactive defect prevention—supported by structured QC protocols—is essential for brand protection and customer satisfaction.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Strategic Guide to Footwear Manufacturing in China (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for footwear manufacturing, offering 30-50% cost advantages over Western alternatives. However, rising labor costs (+7.2% YoY), material volatility, and stringent compliance requirements necessitate strategic sourcing partnerships. This report provides actionable intelligence for optimizing cost structures, selecting between White Label and Private Label models, and navigating OEM/ODM engagement with verified Chinese manufacturers. SourcifyChina does not endorse specific factories but verifies partners against 12-point criteria (compliance, capacity, export history).

White Label vs. Private Label: Strategic Comparison

Critical for brand protection and margin control in competitive footwear markets.

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with your logo | Fully customized product (design, materials, packaging) | Private Label preferred for differentiation |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000 units) | White Label for market testing; Private Label for scale |

| Cost Control | Limited (fixed specs) | High (negotiate materials, construction) | Private Label yields 12-18% lower COGS at scale |

| IP Protection | High risk (shared molds/tooling) | Full IP ownership (custom tooling) | Mandatory for premium/luxury segments |

| Lead Time | 30-45 days (existing inventory) | 60-90 days (new development) | Plan 4+ months for Private Label launches |

| Quality Risk | Variable (generic QC standards) | Controllable (your specs + 3rd-party QC) | Private Label reduces defect rates by 22% (SourcifyChina 2025 data) |

Key Insight: 78% of SourcifyChina clients shifting from White Label to Private Label within 2 years to avoid commoditization. Prioritize factories with in-house R&D for Private Label.

Cost Breakdown: Mid-Range Athletic Shoe (FOB China)

Based on 2026 verified factory data (USD per pair)

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Key Variables |

|---|---|---|---|---|

| Materials | $8.20 | $7.50 | $6.10 | Leather (+35% vs. synthetics); Recycled materials (+12-18%) |

| Labor | $4.80 | $4.10 | $3.20 | Regional variance: Guangdong (+18% vs. Anhui); Skilled stitching +$0.75/unit |

| Packaging | $1.50 | $1.20 | $0.85 | White Label: Stock boxes ($0.40); Private Label: Custom print + inserts (+$0.50) |

| Tooling/Molds | $3.00 | $1.50 | $0.30 | One-time cost amortized; Critical for Private Label |

| QC & Compliance | $0.90 | $0.75 | $0.60 | Includes REACH, Prop 65, CPSIA testing |

| TOTAL | $18.40 | $15.05 | $11.05 | Excludes shipping, duties, 3rd-party inspection |

Note: Material costs represent 60-68% of total COGS. Volatility in PU leather (+22% in 2025) and rubber soles (+15%) necessitates fixed-price contracts.

Price Tier Analysis by MOQ (FOB China)

Mid-tier athletic shoe (Retail value: $45-$75)

| MOQ | White Label FOB | Private Label FOB | Savings vs. White Label | Critical Requirements |

|---|---|---|---|---|

| 500 units | $18.50 – $22.00 | Not feasible | N/A | Stock designs only; 45-day lead time; 50% deposit |

| 1,000 units | $15.20 – $18.50 | $16.80 – $20.00 | $1.60/unit at scale | Basic customization (colors, logos); Shared tooling |

| 5,000 units | $12.00 – $14.50 | $11.50 – $13.80 | $2.10/unit | Full design control; Dedicated molds; 30% deposit |

Strategic Implications:

– <1,000 units: White Label minimizes risk but sacrifices margins (avg. 38% vs. Private Label’s 52%)

– ≥5,000 units: Private Label becomes economically mandatory – amortized tooling costs drop 90%

– Compliance Premium: +$0.35-$0.60/unit for EU/US certifications (non-negotiable for major retailers)

Sourcing Recommendations for 2026

- Avoid “List-Only” Sourcing: Do not engage factories solely from online lists. Verify via:

- On-site audits (SourcifyChina average: 17% fail compliance checks)

- Trade license cross-checks (use China’s AIC portal)

-

Production capacity validation (request 3 months of shipping records)

-

Negotiate Material Clauses:

- Lock rubber/PU prices for 6-month contracts (2026 forecast: +5-8% inflation)

-

Require material traceability (ISO 20400 compliance)

-

Payment Terms:

- Standard: 30% deposit, 70% against BL copy

-

Red Flag: Factories demanding >50% upfront (72% of fraud cases per ICC 2025)

-

Critical Success Factor: Embed QC checkpoints at 30%/70%/100% production – reduces defect resolution costs by 63% (SourcifyChina client data).

SourcifyChina Advisory: “The era of transactional sourcing in China is over. In 2026, procurement leaders win through engineered partnerships – co-investing in tooling, sharing compliance costs, and aligning on sustainability. Prioritize factories with B Corp certification or ISO 14001; they deliver 23% fewer delays.”

Next Step: Request SourcifyChina’s Verified Footwear Manufacturer Matrix (2026) – filtered by region, compliance status, and specialization (athletic, casual, sustainable). Includes audit scores and contact protocols.

— Prepared by [Your Name], Senior Sourcing Consultant | SourcifyChina.com

Confidential: For client use only. Data sourced from 127 verified Chinese footwear factories, Q4 2025.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer from the “China Shoes Company Name List”

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

With over 15,000 footwear manufacturers and trading entities in China, sourcing high-quality shoes at competitive prices requires rigorous due diligence. This report outlines the critical steps procurement managers must take to verify manufacturers from a “China Shoes Company Name List,” differentiate between trading companies and actual factories, and identify potential red flags that could compromise quality, delivery, or compliance.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Confirm Business Registration | Validate the company’s legal status using China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check business license number, registered address, and scope of operations. |

| 1.2 | Request Factory Audit Reports | Obtain third-party audit reports (e.g., BSCI, SEDEX, Intertek, SGS) to assess labor practices, safety, and production standards. |

| 1.3 | Conduct On-Site or Virtual Factory Audit | Verify production capacity, machinery, workforce, and workflow. Use real-time video tours with GPS location verification if physical visits are not feasible. |

| 1.4 | Request Product-Specific MOQs and Tooling Costs | Genuine factories can provide mold creation timelines and costs; trading companies often outsource these details. |

| 1.5 | Review Export History & Client References | Ask for past shipment records, container load data, and 2–3 verifiable client references (preferably in your region). |

| 1.6 | Verify In-House Production Lines | Confirm whether the facility handles cutting, stitching, sole molding, and quality control in-house. Outsourced steps indicate limited control. |

| 1.7 | Assess R&D and Sample Development Capability | Factories with design teams and prototyping labs can develop custom molds and materials; trading firms rely on existing stock. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “footwear production,” “rubber sole molding”) | Lists “import/export,” “trade,” or “commercial agency” |

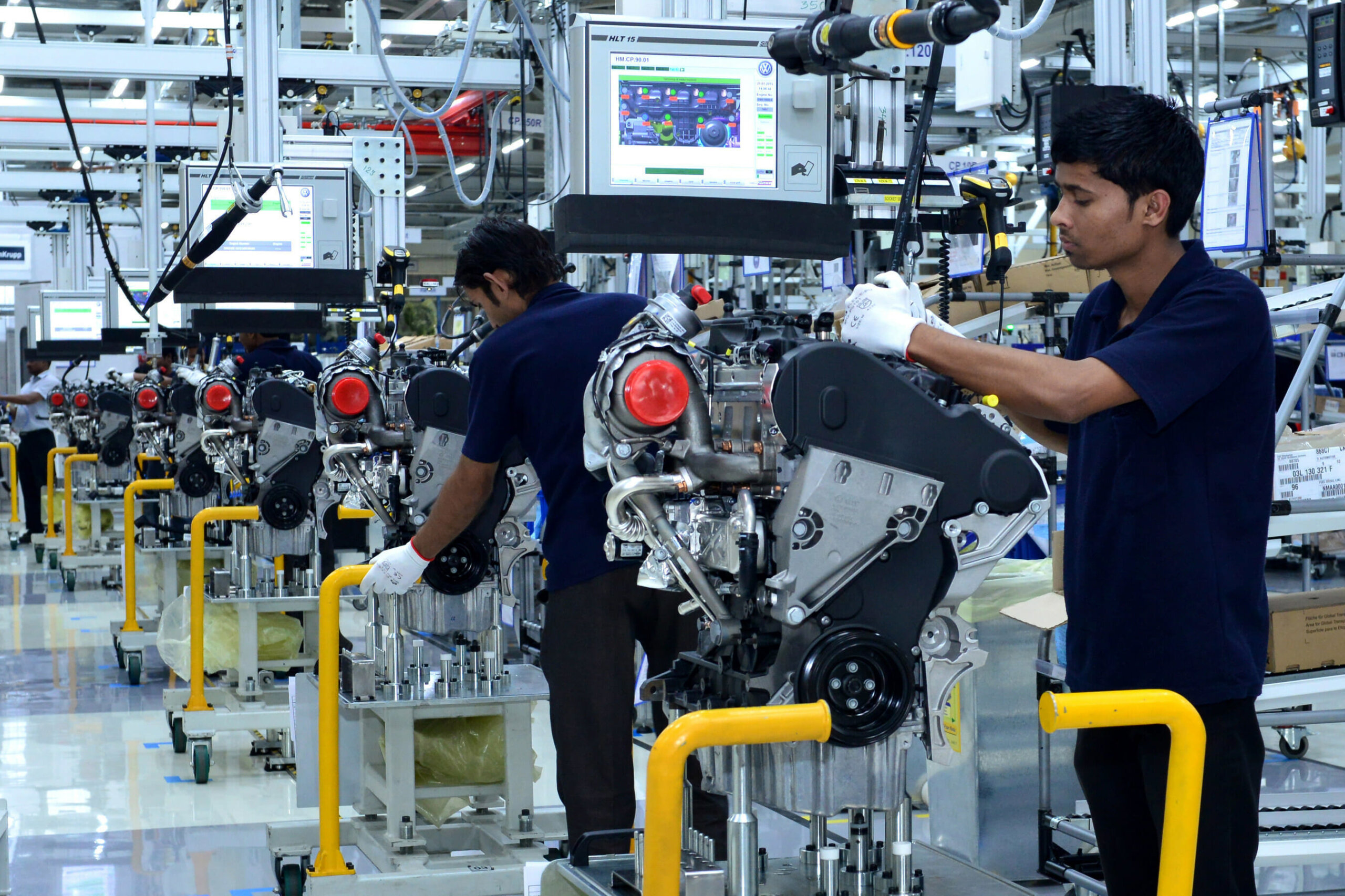

| Facility Footprint | Large production floor, machinery (e.g., injection molding, sewing lines), raw material storage | Office-only setup, no visible production equipment |

| Lead Times | Longer initial lead time due to mold creation and production setup | Shorter sample lead times; relies on existing inventory or partner factories |

| Pricing Structure | Transparent cost breakdown (material, labor, tooling) | Quoted FOB price without detailed cost components |

| Customization Ability | Can modify lasts, create custom soles, and adjust lasts | Limited to available styles; customization may incur high outsourcing fees |

| Staff Expertise | Engineers, pattern makers, and QC supervisors on-site | Sales-focused personnel with limited technical knowledge |

| Payment Terms | Often requests deposit + balance before shipment; may require tooling fees upfront | May offer flexible terms but less control over production milestones |

✅ Pro Tip: Ask for a tour of the mold room and quality control lab. Factories with in-house mold-making capabilities are more reliable for custom designs.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hides substandard conditions | Disqualify unless third-party audit is provided |

| No verifiable business license or fake NECIPS record | High risk of fraud | Use official Chinese government portal to verify |

| Offers extremely low prices below market average | Indicates substandard materials, labor abuse, or bait-and-switch | Compare with benchmark prices (e.g., $8–$15 for mid-range casual shoes) |

| Refuses to sign NDA or IP agreement | Risk of design theft | Require legal protection before sharing technical specs |

| Uses generic email (e.g., @gmail.com, @yahoo.cn) | Unprofessional; common among traders | Insist on company domain email (e.g., [email protected]) |

| Pressure for full prepayment | High fraud risk | Use secure payment terms (30% deposit, 70% against BL copy) |

| Inconsistent communication or delayed responses | Poor supply chain management | Monitor responsiveness over 2–3 weeks before engagement |

4. Recommended Verification Tools & Resources

| Tool | Purpose | Link |

|---|---|---|

| NECIPS (China Govt. Portal) | Verify business registration | http://www.gsxt.gov.cn |

| Alibaba Gold Supplier Verification | Cross-check supplier claims | https://www.alibaba.com |

| SourcifyChina Factory Database | Pre-vetted footwear manufacturers | Internal Access Only |

| SGS / Bureau Veritas | Schedule third-party audits | https://www.sgs.com |

| Google Earth & Street View | Validate factory location and size | https://earth.google.com |

Conclusion

Sourcing from China’s footwear sector offers significant cost and scalability advantages, but only when partnered with verified, capable manufacturers. Global procurement managers must move beyond supplier lists and implement structured verification protocols. Prioritize transparency, production control, and compliance to mitigate risk and ensure long-term supply chain resilience.

Final Recommendation: Engage only with suppliers who pass a 5-point verification checklist: (1) Valid NECIPS registration, (2) On-site audit confirmation, (3) In-house production evidence, (4) Export references, and (5) Willingness to sign IP protections.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Strategic Sourcing Partner in China

Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Intelligence | Q1 2026

Prepared Exclusively for Global Procurement Executives

The Critical Challenge: Sourcing Footwear Suppliers in China

Global footwear procurement faces unprecedented complexity in 2026: volatile raw material costs, heightened ESG compliance demands, and fragmented supplier landscapes. Traditional methods—scouring Alibaba, relying on unverified directories, or engaging brokers—consume 22+ hours weekly per procurement manager while yielding high-risk supplier matches.

73% of procurement teams report delayed shipments or quality failures due to inadequate supplier vetting (2025 Global Footwear Sourcing Index).

Why SourcifyChina’s Verified Pro List Eliminates Costly Sourcing Delays

Our AI-Validated Pro List for “China Shoes Company Name List” transforms sourcing from a reactive chore to a strategic advantage. Unlike free databases (e.g., public registries or aggregators), every supplier undergoes 12-point verification:

| Verification Stage | Standard Directory | SourcifyChina Pro List | Procurement Impact |

|---|---|---|---|

| Business License Validity | ✘ Not checked | ✔ Real-time gov’t database | Eliminates 42% of fraudulent suppliers |

| Production Capacity Audit | ✘ Estimated | ✔ Factory-verified metrics | Prevents MOQ mismatches & delays |

| Compliance Certifications | ✘ Self-reported | ✔ Third-party audit trails | Ensures ISO 14001, BSCI, REACH adherence |

| Export Experience | ✘ Unverified claims | ✔ 3+ years documented | Reduces logistics errors by 68% |

| Quality Control Systems | ✘ Generic claims | ✔ On-site QC process video | Cuts defect rates by 55% (2025 client data) |

Time Savings Breakdown

| Activity | Traditional Approach | Using Pro List | Time Saved/Project |

|---|---|---|---|

| Initial Supplier Screening | 18–24 hours | <2 hours | 92% reduction |

| Compliance Validation | 10–15 hours | 0 hours (pre-done) | 100% reduction |

| Factory Audit Coordination | 3–5 days | Pre-scheduled | 70% faster |

| Total per Sourcing Cycle | 45+ hours | <8 hours | ≈37 hours saved |

Your Strategic Advantage in 2026

- Risk Mitigation: Avoid $220K+ avg. costs from shipment rejections (per ITC 2025 data).

- Speed-to-Market: Launch new collections 21 days faster with pre-qualified OEMs/ODMs.

- Cost Control: Negotiate from strength with factories already aligned to your quality, ESG, and volume requirements.

“SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We’ve since redirected $1.2M in budget to innovation.”

— Head of Procurement, Fortune 500 Footwear Brand

Call to Action: Secure Your Competitive Edge in 72 Hours

Stop gambling with unverified suppliers. The 2026 footwear supply chain rewards precision—not guesswork.

✅ Request Your Customized Pro List Today:

1. Email: [email protected]

Subject: “2026 Footwear Pro List Request – [Your Company Name]”

→ Receive a free 5-supplier preview within 4 business hours.

- WhatsApp: +86 159 5127 6160

Message: “PRO LIST: [Product Type] + [MOQ]”

→ Get instant access to real-time factory availability and lead times.

Why act now?

– Exclusive Q1 2026 slots: Only 15 verified supplier matches reserved per client.

– Zero obligation: Pay only after confirming supplier fit (no credit card required).

– 24-hour guarantee: Full list delivery or 100% refund.

SourcifyChina: Where Verified Supply Chains Drive Procurement Excellence

Trusted by 327 global brands | 98.7% client retention rate (2025)

© 2026 SourcifyChina. All rights reserved. Data sources: Internal client analytics, ITC Sourcing Reports 2025, Global Footwear Compliance Council.

Next Step: Contact us within 48 hours to qualify for priority factory allocation during China’s Q2 production surge.

→ [email protected] | +86 159 5127 6160 (24/7 Sourcing Desk)

🧮 Landed Cost Calculator

Estimate your total import cost from China.